Resources

About Us

Critical Minerals Market by Type (Lithium, Cobalt, Nickel, Copper, Rare Earth Elements, Graphite, Manganese, Others), Application (Electric Vehicles, Renewable Energy, Consumer Electronics, Defense & Aerospace, Industrial), and Region – Global Forecast to 2036

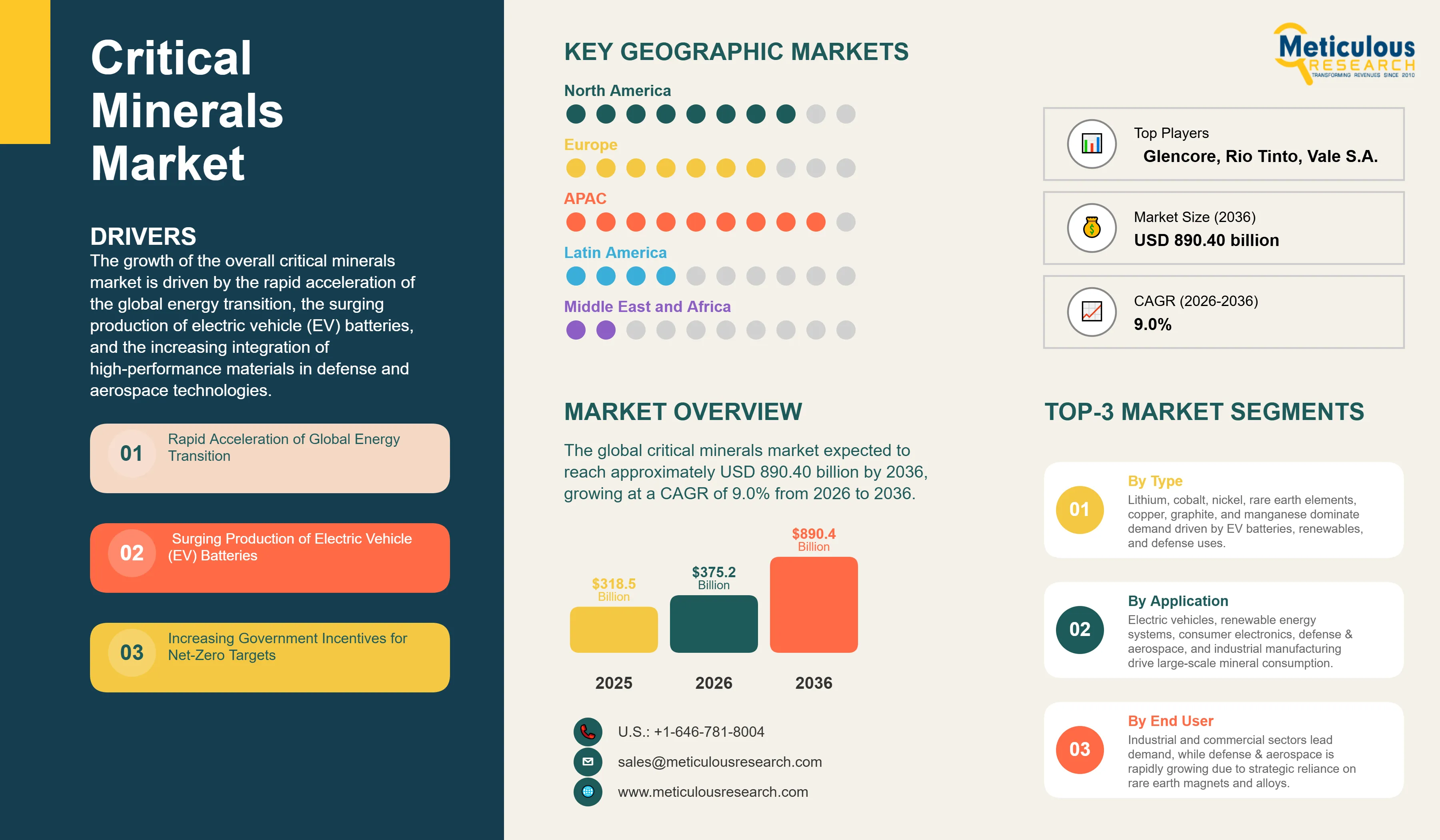

Report ID: MRCHM - 1041703 Pages: 291 Feb-2026 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe global critical minerals market was valued at USD 318.50 billion in 2025. The market is expected to reach approximately USD 890.40 billion by 2036 from USD 375.20 billion in 2026, growing at a CAGR of 9.0% from 2026 to 2036. The growth of the overall critical minerals market is driven by the rapid acceleration of the global energy transition, the surging production of electric vehicle (EV) batteries, and the increasing integration of high-performance materials in defense and aerospace technologies. As governments and private enterprises seek to achieve net-zero targets and secure sovereign supply chains, the demand for essential materials like lithium, copper, and rare earth elements has become a cornerstone of modern industrial policy. The rapid expansion of the “Green Economy” sector, coupled with the increasing need for high-capacity energy storage systems to stabilize renewable grids, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Critical minerals represent a sophisticated domain of the global materials industry that utilizes advanced extraction, refining, and processing technologies to produce high-purity elements essential for modern technology. Unlike traditional commodities, modern critical minerals leverage AI-driven geological mapping, autonomous mining fleets, and sustainable hydrometallurgical refining to ensure the supply of materials that are vital for national security and economic stability. The market is defined by high-reliability supply chains that enable “clean energy manufacturing,” optimizing product performance and reducing the total cost of ownership (TCO) for end-users in the high-tech and automotive sectors.

The market includes a diverse range of materials, from high-purity lithium chemicals for battery cathodes to permanent magnets designed for wind turbines and stealth aircraft. These systems are increasingly integrated with advanced circular economy practices for mineral recovery and blockchain-based traceability to ensure ethical sourcing and mission success in a ESG-conscious environment. The ability to operate in complex geopolitical landscapes while maintaining stable, high-volume production has made critical minerals the strategic priority of the next generation of global industrial competition and decarbonization.

The global energy sector is pushing hard to modernize supply capabilities, aiming to enhance resource resilience and reduce the carbon footprint of extraction. This drive has increased the adoption of sustainable mining practices and the recycling of end-of-life batteries, with modular refining platforms helping to stabilize operational costs. At the same time, the rapid growth in the hydrogen economy and the push for deep-sea mining exploration is increasing the need for high-performance, specialized mineral processing equipment. By combining high-efficiency refining with robust supply chain logistics, these new systems support both environmental discovery and the burgeoning green economy.

What are the Key Trends in the Global Critical Minerals Market?

Proliferation of Sovereign Supply Chains and Mineral Security Partnerships Governments are rapidly shifting toward localized and resilient supply chains, moving well beyond the traditional “globalized sourcing” model toward smarter regional logistics. The United States’ Inflation Reduction Act (IRA) and the EU’s Critical Raw Materials Act have already demonstrated successful incentives for domestic processing, while the Mineral Security Partnership (MSP) aims to deliver collective security and investment in LEO. The real game-changer comes with “smart” trade agreements featuring multi-lateral mineral alliances and AI-driven supply chain monitoring that can mitigate geopolitical risks in real-time. These advancements make high-efficiency mineral procurement practical and cost-effective for everyone from automotive giants to defense agencies chasing sustained technological dominance.

Innovation in Sustainable Extraction and Battery Recycling Innovation in mineral processing is rapidly driving the market as the global community scales up the circular economy. Technology suppliers are now designing autonomous recycling plants specifically for black mass processing, with tight control over chemical purity and waste mitigation to meet the challenges of environmental regulations. This often involves advanced solvent extraction and direct lithium extraction (DLE) stacks capable of processing low-grade ores without massive evaporation ponds. At the same time, growing focus on “In-Situ Recovery” (ISR) is pushing manufacturers to develop chemical solutions tailored to copper and uranium extraction. These systems help establish a sustainable mineral presence, extending the reach of resources instead of relying solely on traditional open-pit mines. By combining high-autonomy refining with robust environmental designs, these new systems support both economic discovery and the burgeoning recycling economy.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 890.40 Billion |

|

Market Size in 2026 |

USD 375.20 Billion |

|

Market Size in 2025 |

USD 318.50 Billion |

|

Market Growth Rate |

CAGR of 9.0% (2026-2036) |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Middle East & Africa |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Demand for Decarbonization and EV Proliferation A key driver of the critical minerals market is the rapid movement of the global economy toward decarbonization and the mitigation of carbon emissions. Global requirements for ensuring the long-term sustainability of the transport sector have created significant incentives for the adoption of electric vehicles (EVs) and energy storage technologies. The ability to manufacture high-density batteries and efficient electric motors drives operators toward scalable mineral solutions. It is estimated that as the number of electric vehicles triples through 2036, the need for lithium, cobalt, and nickel increases significantly; therefore, critical mineral systems, with their ability to enable high-performance green tech, are considered a crucial enabler of modern environmental strategies.

Opportunity: Expansion of the Green Hydrogen Economy and Renewable Grids The rapid growth of the green hydrogen economy provides great opportunities for the critical minerals market. Indeed, the global surge in renewable energy initiatives, such as the deployment of offshore wind and solar farms, has created a compelling demand for autonomous systems that can build and maintain resilient energy grids. These applications require high reliability, long operational life, and the ability to handle extreme environmental conditions, all attributes that are met with advanced platinum group metals (PGMs) and rare earth magnets. The energy storage market is set to expand significantly through 2036, with minerals poised for an expanding share as agencies seek to monetize resource extraction services. Furthermore, the transition from fossil fuels to commercial hydrogen platforms is stimulating demand for specialized catalysts that provide production flexibility and payload handling.

Why Do Battery Minerals Dominate the Market?

The battery minerals segment, comprising lithium, cobalt, and nickel, accounts for around 55-60% of the overall critical minerals market in 2026. This is mainly attributed to the primary use of these materials in mission-critical energy storage operations across the automotive and consumer electronics sectors. Lithium compounds, such as lithium hydroxide and carbonate, offer the most efficient way to manage high-energy density in battery packs. The government and commercial EV sectors alone consume the vast majority of these materials, with major projects in North America and Asia demonstrating the technology’s capability to handle high-value infrastructure management.

However, the rare earth elements segment (including neodymium and dysprosium) is expected to grow at a significant CAGR during the forecast period, driven by the growing number of offshore wind projects and the rising demand for high-performance defense systems. The ability to provide “High-Coercivity Magnets” makes these solutions highly attractive for modern industrial operators.

How Does Electric Vehicles Lead the Market?

Based on application, the electric vehicles segment holds the largest share of the overall market in 2026, accounting for around 45-50% of the overall market. From passenger cars to heavy-duty trucks, the use of critical minerals is central to modernizing global transport infrastructure. Current large-scale automotive projects are increasingly specifying high-nickel and low-cobalt chemistries for their ability to handle long-range travel with high efficiency and lower cost compared to traditional internal combustion engines.

The renewable energy and defense segments continue to find critical applications in missions where the construction of large wind turbines and the manufacturing of precision-guided munitions are essential. However, the shift toward autonomous green logistics is pushing the requirement for standardized mineral traceability that allow businesses to scale their procurement capacity while minimizing their environmental footprint.

How is Asia Pacific Maintaining Dominance in the Global Critical Minerals Market? Asia Pacific holds the largest share of the global critical minerals market in 2026. The largest share of this region is primarily attributed to the massive investments in refining infrastructure and the presence of the world’s leading battery manufacturing companies, particularly in China. China alone accounts for a significant portion of global mineral processing, with its position as a leading hub for EV production and industrial modernization driving sustained growth. The presence of leading manufacturers like Ganfeng Lithium, Tianqi Lithium, and China Rare Earth Group, along with a well-developed supply chain ecosystem, provides a robust market for both standard and high-purity mineral solutions.

Which Factors Support Middle East & Africa and Latin America Market Growth? Middle East & Africa is expected to witness the fastest growth, driven by the need for economic diversification and the expansion of the mining and refining sectors. Countries like Saudi Arabia and the DRC are at the forefront, with significant focus on integrating critical minerals into their national industrial strategies. In Latin America, the leadership in lithium and copper production is driving the adoption of high-efficiency extraction systems. Brazil, Chile, and Argentina are leading the way, with a strong focus on the “Lithium Triangle” and the integration of sustainable mining into the region’s economic roadmap through players like SQM and Vale.

The companies such as Glencore plc, BHP Group Limited, Rio Tinto, and Vale S.A. lead the global critical minerals market with a comprehensive range of extraction and refining solutions, particularly for large-scale industrial and energy applications. Meanwhile, players including Albemarle Corporation, Sociedad Química y Minera de Chile S.A. (SQM), Ganfeng Lithium Group Co., Ltd., and Tianqi Lithium Corporation focus on specialized lithium production and high-purity chemicals targeting the battery sector. Emerging manufacturers and integrated players such as MP Materials Corp., Lynas Rare Earths Ltd., Anglo American plc, and China Rare Earth Group Co., Ltd. are strengthening the market through innovations in rare earth magnets and sustainable mineral processing.

The global critical minerals market is projected to reach approximately USD 890.40 billion by 2036, growing at a CAGR of 9.0% from 2026 to 2036.

The lithium segment is expected to dominate the market in 2026, driven by its essential role in the production of high-density batteries for electric vehicles and energy storage systems.

Drivers:

• Rapid acceleration of the global energy transition

• Surging production of EV batteries

• Increasing government incentives for net-zero targets

Opportunities:

• Expansion of the circular economy through mineral recycling

• Development of deep-sea mining

• Growth in the green hydrogen sector

Asia Pacific holds the largest share of the global market in 2026, while the Middle East & Africa region is expected to witness the fastest growth during the forecast period.

Leading players include:

• Glencore plc

• BHP Group Limited

• Rio Tinto

• Vale S.A.

• Albemarle Corporation

• SQM

• Ganfeng Lithium

• Tianqi Lithium

• MP Materials

• Lynas Rare Earths

The proliferation of electric vehicles is significantly increasing the demand for:

• Battery-grade lithium, cobalt, nickel, and manganese

• Rare earth elements for high-efficiency electric motors

Key trends include:

• Adoption of autonomous mining fleets

• AI-driven exploration

• Direct lithium extraction (DLE) technologies

• Advanced hydrometallurgical recycling processes

These initiatives are driving:

• Diversification of supply chains away from single-source dominance

• Regional processing hubs development

• Reshoring of strategic mineral refining

Stringent ESG regulations are mandating:

• Higher transparency in sourcing

• Carbon footprint reduction in extraction

• Ethical labor practices

• Influencing investment flows and project timelines

Both sectors are major consumers of specialized minerals:

• Defense: Requires rare earth magnets and high-strength alloys

• Renewable Energy: Relies on copper for grids and PGMs for electrolyzers

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Currency and Pricing

1.4. Limitations

1.5. Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Secondary Research

2.3. Primary Research

2.4. Market Size Estimation

2.4.1. Bottom-Up Approach

2.4.2. Top-Down Approach

2.5. Market Forecasting

2.6. Data Triangulation

2.7. Assumptions

3. Executive Summary

3.1. Market Overview

3.2. Market Snapshot

3.3. Regional Snapshot

3.4. Segmental Snapshot

4. Market Insights

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.1.1. Rapid Acceleration of Global Energy Transition

4.2.1.2. Surging Production of Electric Vehicle (EV) Batteries

4.2.1.3. Increasing Government Incentives for Net-Zero Targets

4.2.2. Restraints

4.2.2.1. High Capital Expenditure for Mining and Refining Projects

4.2.2.2. Geopolitical Instability and Supply Chain Vulnerabilities

4.2.3. Opportunities

4.2.3.1. Expansion of Circular Economy and Mineral Recycling

4.2.3.2. Development of Deep-Sea Mining and Non-Traditional Resources

4.2.3.3. Growth in Green Hydrogen and Sustainable Industrialization

4.2.4. Challenges

4.2.4.1. Environmental and Social Governance (ESG) Compliance

4.2.4.2. Technical Difficulties in Processing Low-Grade Ores

4.3. Key Trends

4.4. Pricing Analysis

4.5. Value Chain Analysis

4.6. Porter’s Five Forces Analysis

5. Global Critical Minerals Market, by Type

5.1. Introduction

5.2. Lithium

5.2.1. Lithium Hydroxide

5.2.2. Lithium Carbonate

5.2.3. Spodumene Concentrate

5.3. Cobalt

5.3.1. Cobalt Metal

5.3.2. Cobalt Chemicals (Sulfates, Oxides)

5.4. Nickel

5.4.1. Class 1 Nickel

5.4.2. Nickel Sulfates

5.5. Copper

5.5.1. Refined Copper

5.5.2. Copper Concentrates

5.6. Rare Earth Elements (REE)

5.6.1. Neodymium (Nd)

5.6.2. Praseodymium (Pr)

5.6.3. Dysprosium (Dy)

5.6.4. Terbium (Tb)

5.7. Graphite

5.7.1. Natural Graphite

5.7.2. Synthetic Graphite

5.8. Manganese

5.9. Others (PGMs, Indium, Gallium, Germanium)

6. Global Critical Minerals Market, by Application

6.1. Introduction

6.2. Electric Vehicles (EVs)

6.2.1. Battery Cathodes

6.2.2. Electric Motors

6.3. Renewable Energy

6.3.1. Wind Turbines

6.3.2. Solar Photovoltaics (PV)

6.4. Consumer Electronics

6.5. Defense & Aerospace

6.6. Industrial & Manufacturing

6.7. Others (Medical, Energy Storage Systems)

7. Global Critical Minerals Market, by Geography

7.1. Introduction

7.2. North America

7.2.1. U.S.

7.2.2. Canada

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. U.K.

7.3.4. Italy

7.3.5. Spain

7.3.6. Norway

7.3.7. Finland

7.3.8. Rest of Europe

7.4. Asia-Pacific

7.4.1. China

7.4.2. India

7.4.3. Japan

7.4.4. South Korea

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Vietnam

7.4.8. Rest of Asia-Pacific

7.5. Latin America

7.5.1. Brazil

7.5.2. Chile

7.5.3. Argentina

7.5.4. Mexico

7.5.5. Peru

7.5.6. Colombia

7.5.7. Bolivia

7.5.8. Rest of Latin America

7.6. Middle East & Africa

7.6.1. Saudi Arabia

7.6.2. UAE

7.6.3. South Africa

7.6.4. Democratic Republic of the Congo (DRC)

7.6.5. Nigeria

7.6.6. Egypt

7.6.7. Namibia

7.6.8. Zimbabwe

7.6.9. Rest of Middle East & Africa

8. Competitive Landscape

8.1. Introduction

8.2. Key Strategic Developments

8.3. Competitive Dashboard

8.4. Market Share Analysis

9. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

9.1. Glencore plc

9.2. BHP Group Limited

9.3. Rio Tinto

9.4. Vale S.A.

9.5. Albemarle Corporation

9.6. Sociedad Química y Minera de Chile S.A. (SQM)

9.7. Ganfeng Lithium Group Co., Ltd.

9.8. Tianqi Lithium Corporation

9.9. MP Materials Corp.

9.10. Lynas Rare Earths Ltd.

9.11. Anglo American plc

9.12. China Rare Earth Group Co., Ltd.

9.13. Freeport-McMoRan Inc.

9.14. Antofagasta plc

9.15. First Quantum Minerals Ltd.

Published Date: Jan-2026

Published Date: Dec-2025

Published Date: Oct-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates