Resources

About Us

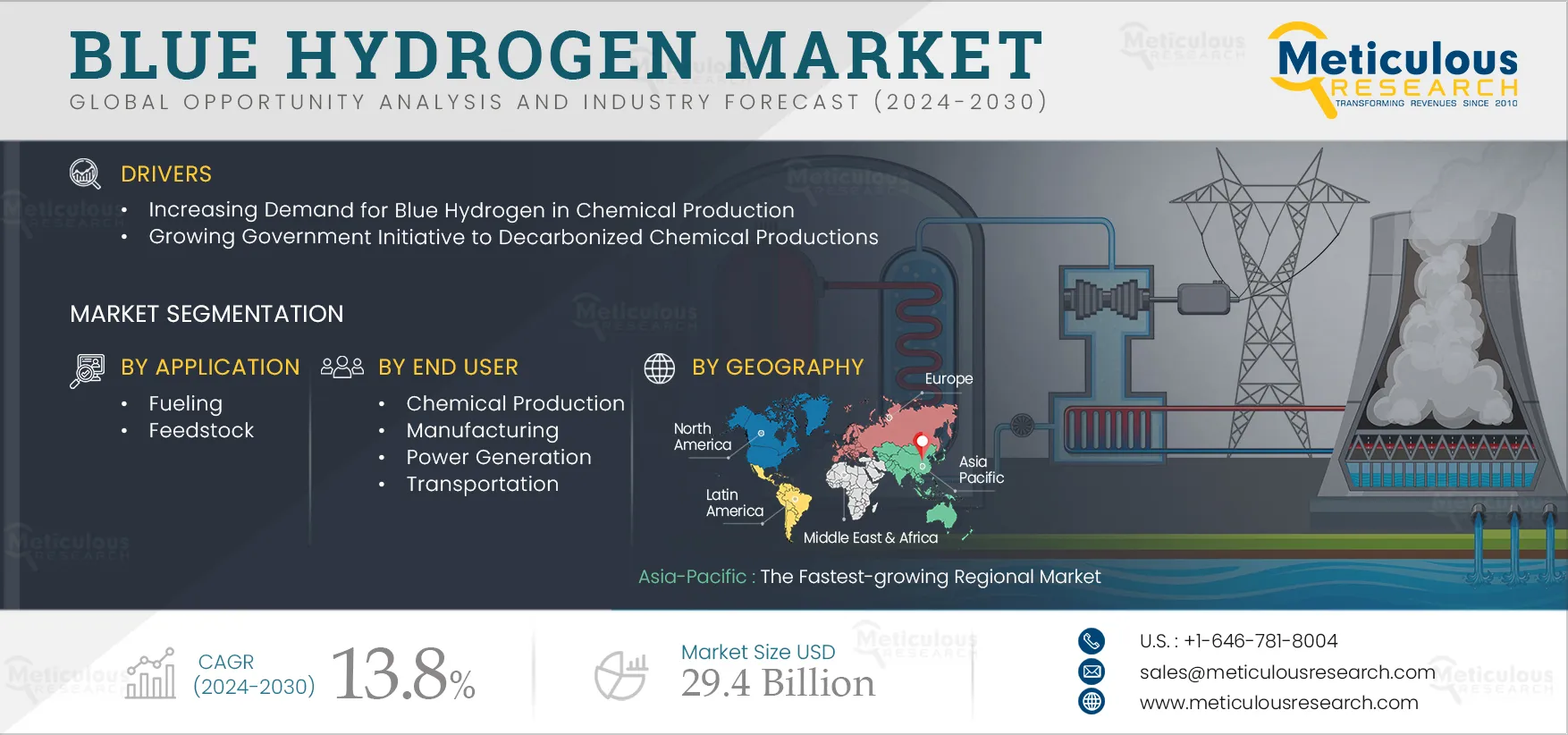

Blue Hydrogen Market by Generation Process (Steam Methane Reforming, Autothermal Reforming), Energy Source (Coal, Methane), Application (Fueling, Feedstock), End User (Transportation, Chemical Production), and Geography - Global Forecast to 2032

Report ID: MRCHM - 1041012 Pages: 230 Jan-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe Blue Hydrogen Market is projected to reach $29.4 billion by 2032, at a CAGR of 13.8% during the forecast period of 2025 to 2032. The growth of this market is driven by the increasing demand for blue hydrogen in chemical production and the growing government initiative to decarbonize chemical production. However, the energy loss during the blue hydrogen production restrains the growth of this market. Furthermore, a growing development of blue hydrogen production technologies is expected to create market growth opportunities. However, the integration of blue hydrogen into natural gas networks is a major challenge for the players operating in this market. The latest trends in the blue hydrogen market are increasing adoption of carbon capture utilization and storage (CCUS) technology.

The increasing demand for blue hydrogen in chemical production is due to it being produced from natural gases with carbon capture storage (CCS), which gives several benefits in chemical production. In chemical production, there are several environmental regulations and emissions targets. Using blue hydrogen helps chemical manufacturers to meet these requirements and reduce their environmental footprint. Blue hydrogen is widely used in several chemical productions, such as synfuel production, ammonia production, petroleum refinery, and methanol production. The use of blue hydrogen in chemical production helps to reduce carbon emissions, improve energy efficiency, and support the chemical industry's transition toward more sustainable and environmentally friendly practices.

Click here to: Get Free Sample Pages of this Report

The Gasification Segment to Register the Highest CAGR During the Forecast Period

Based on generation process, the gasification is projected to register the highest CAGR during the forecast period. The rising use of gasification to convert organic or carbon-based materials, including coal and biomass, into blue hydrogen, the increasing demand for low-carbon hydrogen as a fuel source for industrial applications, and the growing use of a cost-effective method for producing blue hydrogen are expected to support the growth of this segment.

The Methane Segment to Register the Highest CAGR During the Forecast Period

Based on energy source, the methane segment is projected to register the highest CAGR during the forecast period. The rising use of methane to produce blue hydrogen using CCS technology to capture and store the carbon dioxide (CO2), the rising use of methane in steam methane reforming and auto thermal reforming for blue hydrogen production, and the growing availability of abundant feedstock for blue hydrogen production are expected to support the growth of this segment.

The Fueling Segment to Register the Highest CAGR During the Forecast Period

Based on application, the fueling segment is projected to register the highest CAGR during the forecast period. The increasing adoption of blue hydrogen during combustion due to producing less smoke or any unpleasant fumes, the increasing government initiative for clean and flexible energy sources to support zero-carbon energy, and the increasing adoption of blue hydrogen due to more powerful and energy efficient than fossil fuels are expected to support the growth of this segment.

The Transportation Segment to Register the Highest CAGR During the Forecast Period

Based on end user, the transportation segment is projected to register the highest CAGR during the forecast period. The increasing adoption of blue hydrogen to produce fewer carbon emissions, reduced oil dependence, and fewer air pollutants, the growing fueling solutions for a range of transportation and motive power applications, and the rising demand for blue hydrogen to reduce carbon emission are expected to support the growth of this segment.

Asia-Pacific to be the Fastest-growing Regional Market

In 2025, Asia-Pacific is expected to account for the largest share of the blue hydrogen market, followed by Europe, North America, Latin America, and the Middle East & Africa. However, Asia-Pacific is slated to record the highest growth rate during the forecast period. The growing strategic alliances and large-scale investment in the clean hydrogen economy, the rising government initiative and investment for blue hydrogen production to reduce emission, ongoing investment, funding program, grants for clean fuel adoption, the growing ability to build large infrastructures for storing blue hydrogen, and the increasing adoption of clean energy solutions for sectors such as power generation and transportation contribute to the rapid growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market participants in the blue hydrogen market in the last three to four years. The key players profiled in the blue hydrogen market report are Matheson Tri-Gas, Inc. (U.S.), Shell plc (U.K.), Linde GmbH (Germany), L’AIR LIQUIDE S.A. (France), Air Products and Chemicals Inc. (U.S.), Uniper SE (Germany), ATCO Ltd. (Canada), Suncor Energy Inc. (Canada), Equinor ASA (Norway), Saudi Arabian Oil Company (Saudi Arabia), Aker Solutions ASA (Norway), Topsoe A/S (Denmark), Technip Energies N.V (France), Ivys Adsorption Inc. (U.S.), and Woodside Energy Group Limited (Australia).

Scope of the report:

Blue Hydrogen Market Assessment, by Generation Process

Blue Hydrogen Market Assessment, by Energy Source

Blue Hydrogen Market Assessment, by Application

Blue Hydrogen Market Assessment, by End User

Blue Hydrogen Market Assessment, by Geography

Key questions answered in the report:

The blue hydrogen market is projected to reach $29.4 billion by 2032 at a CAGR of 13.8% during the forecast period.

In 2025, the chemical production segment is expected to account for the largest share of the blue hydrogen market. The growth of this segment is attributed to the increasing adoption of blue hydrogen to reduce net-zero emissions, the growing use of blue hydrogen to produce sustainable methanol and ammonia, and the increasing demand for highly efficient energy sources for refineries.

The growth of this market is driven by the increasing demand for blue hydrogen in chemical production and the growing government initiative to decarbonize chemical production. Furthermore, a growing development of blue hydrogen production technologies is expected to create market growth opportunities.

The key players operating in the blue hydrogen market are Matheson Tri-Gas, Inc. (U.S.), Shell plc (U.K.), Linde GmbH (Germany), L’AIR LIQUIDE S.A. (France), Air Products and Chemicals Inc. (U.S.), Uniper SE (Germany), ATCO Ltd. (Canada), Suncor Energy Inc. (Canada), Equinor ASA (Norway), Saudi Arabian Oil Company (Saudi Arabia), Aker Solutions ASA (Norway), Topsoe A/S (Denmark), Technip Energies N.V (France), Ivys Adsorption Inc. (U.S.), and Woodside Energy Group Limited (Australia).

1. Introduction

1.1 Market Definition & Scope

1.2 Market Ecosystem

1.3 Currency & Limitations

2. Research Methodology

2.1 Research Approach

2.2 Process of Data Collection and Validation

2.2.1 Secondary Research

2.2.2 Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3 Market Sizing and Forecast

2.3.1 Market Size Estimation Approach

2.3.2 Growth Forecast Approach

2.4 Assumptions for the Study

3. Executive Summary

3.1 Market Overview

3.2 Market Analysis, by Generation Process

3.3 Market Analysis, by Energy Source

3.4 Market Analysis, by Application

3.5 Market Analysis, by End User

3.6 Market Analysis, by Geography

3.7 Competitive Analysis

4. Market Insights

4.1. Overview

4.2 Factors Affecting Market Growth

4.2.1 Drivers

4.2.1.1 Increasing Demand for Blue Hydrogen in Chemical Production

4.2.1.2. Growing Government Initiative to Decarbonized Chemical Productions

4.2.2 Restraints

4.2.2.1 Energy Loss During the Blue Hydrogen Production

4.2.3 Opportunities

4.2.3.1 Growing Development of Blue Hydrogen Production Technologies

4.2.4 Challenges

4.2.4.1 Integration of Blue Hydrogen into Natural Gas Networks

4.3 Market Trend

4.3.1 Increasing Adoption of Carbon Capture Utilization and Storage (CCUS) Technology

4.4 Case Studies

4.4.1 Case Study A

4.4.2 Case Study B

4.4.3 Case Study C

5. Blue Hydrogen Market Assessment, by Generation Process

5.1 Overview

5.2 Steam Methane Reforming

5.3 Autothermal Reforming

5.4 Gasification

5.5 Partial Oxidation

6. Blue Hydrogen Market Assessment, by Energy Source

6.1 Overview

6.2 Coal

6.3 Methane

6.4 Water

7. Blue Hydrogen Market Assessment, by Application

7.1 Overview

7.2 Fueling

7.3 Feedstock

7.4 Other Applications

8. Blue Hydrogen Market Assessment, by End User

8.1 Overview

8.2 Chemical Production

8.2.1 Synfuel Production

8.2.2 Ammonia Production

8.2.3 Petroleum Refinery

8.2.4 Methanol Production

8.3 Manufacturing

8.4 Power Generation

8.5 Transportation

8.6 Other End Users

9. Blue Hydrogen Market Assessment, by Geography

9.1 North America

9.1.1 U.S.

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 U.K.

9.2.3 France

9.2.4 Italy

9.2.5 Spain

9.2.6 Netherlands

9.2.7 Poland

9.2.8 Rest of Europe

9.3 Asia-Pacific

9.3.1 Japan

9.3.2 China

9.3.3 India

9.3.4 South Korea

9.3.5 Singapore

9.3.6 Rest of Asia-Pacific

9.4 Latin America

9.5 Middle East & Africa

10. Competition Analysis

10.1 Overview

10.2 Key Growth Strategies

10.3 Competitive Benchmarking

10.4 Competitive Dashboard

10.4.1 Industry Leader

10.4.1.1 Market Ranking, By Key Player

10.4.2 Market Differentiators

10.4.3 Vanguards

10.4.4 Emerging Companies

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Development)

11.1 Matheson Tri-Gas, Inc. (U.S.) (A Subsidiary of Nippon Sanso Holdings Corporation)

11.2 Shell plc (U.K.)

11.3 Linde GmbH (Germany)

11.4 L’AIR LIQUIDE S.A. (France)

11.5 Air Products and Chemicals Inc. (U.S.)

11.6 Uniper SE (Germany)

11.7 ATCO Ltd. (Canada)

11.8 Suncor Energy Inc. (Canada)

11.9 Equinor ASA (Norway)

11.10 Saudi Arabian Oil Company (Saudi Arabia)

11.11 Aker Solutions ASA (Norway)

11.12 Topsoe A/S (Denmark)

11.13 Technip Energies N.V (France)

11.14 Ivys Adsorption Inc. (U.S.)

11.15 Woodside Energy Group Limited (Australia)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Currency Conversion Rates (2019–2022)

Table 2 Global Blue Hydrogen Market, by Generation Process, 2021–2032 (USD Million)

Table 3 Global Steam Methane Reforming Market, by Country/Region, 2021–2032 (USD Million)

Table 4 Global Autothermal Reforming Market, by Country/Region, 2021–2032 (USD Million)

Table 5 Global Gasification Market, by Country/Region, 2021–2032 (USD Million)

Table 6 Global Partial Oxidation Market, by Country/Region, 2021–2032 (USD Million)

Table 7 Global Blue Hydrogen Market, by Energy Source, 2021–2032 (USD Million)

Table 8 Global Blue Hydrogen Market, by Coal, by Country/Region, 2021–2032 (USD Million)

Table 9 Global Blue Hydrogen Market, by Methane, by Country/Region, 2021–2032 (USD Million)

Table 10 Global Blue Hydrogen Market, by Water, by Country/Region, 2021–2032 (USD Million)

Table 11 Global Blue Hydrogen Market, by Application, 2021–2032 (USD Million)

Table 12 Global Blue Hydrogen Market for Fueling, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Blue Hydrogen Market for Feedstock, by Country/Region, 2021–2032 (USD Million)

Table 14 Global Blue Hydrogen Market for Other Applications, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Blue Hydrogen Market, by End User, 2021–2032 (USD Million)

Table 18 Global Blue Hydrogen Market for Chemical Production, by Type, 2021–2032 (USD Million)

Table 19 Global Blue Hydrogen Market for Chemical Production, by Country/Region, 2021–2032 (USD Million)

Table 20 Global Blue Hydrogen Market for Synfuel Production, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Blue Hydrogen Market for Ammonia Production, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Blue Hydrogen Market for Petroleum Refinery, by Country/Region, 2021–2032 (USD Million)

Table 23 Global Blue Hydrogen Market for Methanol Production, by Country/Region, 2021–2032 (USD Million)

Table 24 Global Blue Hydrogen Market for Manufacturing, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Blue Hydrogen Market for Power Generation, by Country/Region, 2021–2032 (USD Million)

Table 26 Global Blue Hydrogen Market for Transportation, by Country/Region, 2021–2032 (USD Million)

Table 27 Global Blue Hydrogen Market for Other End Users, by Country/Region, 2021–2032 (USD Million)

Table 28 North America: Blue Hydrogen Market, by Country, 2021-2032 (USD Million)

Table 29 North America: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 30 North America: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 31 North America: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 32 North America: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 33 North America: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 34 U.S.: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 35 U.S.: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 36 U.S.: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 37 U.S.: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 38 U.S.: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 39 Canada: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 40 Canada: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 41 Canada: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 42 Canada: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 43 Canada: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 44 Europe: Blue Hydrogen Market, by Country/Region, 2021-2032 (USD Million)

Table 45 Europe: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 46 Europe: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 47 Europe: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 48 Europe: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 49 Europe: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 50 Germany: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 51 Germany: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 52 Germany: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 53 Germany: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 54 Germany: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 55 U.K.: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 56 U.K.: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 57 U.K.: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 58 U.K.: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 59 U.K.: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 60 France: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 61 France: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 62 France: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 63 France: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 64 France: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 65 Italy: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 66 Italy: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 67 Italy: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 68 Italy: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 69 Italy: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 70 Spain: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 71 Spain: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 72 Spain: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 73 Spain: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 74 Spain: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 75 Netherlands: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 76 Netherlands: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 77 Netherlands: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 78 Netherlands: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 79 Netherlands: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 80 Poland: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 81 Poland: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 82 Poland: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 83 Poland: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 84 Poland: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 85 Rest of Europe: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 86 Rest of Europe: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 87 Rest of Europe: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 88 Rest of Europe: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 89 Rest of Europe: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 90 Asia-Pacific: Blue Hydrogen Market, by Country/Region, 2021-2032 (USD Million)

Table 91 Asia-Pacific: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 92 Asia-Pacific: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 93 Asia-Pacific: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 94 Asia-Pacific: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 95 Asia-Pacific: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 96 Japan: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 97 Japan: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 98 Japan: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 99 Japan: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 100 Japan: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 101 China: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 102 China: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 103 China: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 104 China: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 105 China: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 106 India: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 107 India: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 108 India: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 109 India: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 110 India: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 111 South Korea: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 112 South Korea: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 113 South Korea: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 114 South Korea: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 115 South Korea: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 116 Singapore: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 117 Singapore: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 118 Singapore: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 119 Singapore: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 120 Singapore: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 121 Rest of Asia-Pacific: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 122 Rest of Asia-Pacific: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 123 Rest of Asia-Pacific: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 124 Rest of Asia-Pacific: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 125 Rest of Asia-Pacific: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 126 Latin America: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 127 Latin America: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 128 Latin America: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 129 Latin America: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 130 Latin America: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

Table 131 Middle East & Africa: Blue Hydrogen Market, by Generation Process, 2021-2032 (USD Million)

Table 132 Middle East & Africa: Blue Hydrogen Market, by Energy Source, 2021-2032 (USD Million)

Table 133 Middle East & Africa: Blue Hydrogen Market, by Applications, 2021-2032 (USD Million)

Table 134 Middle East & Africa: Blue Hydrogen Market, by End User, 2021-2032 (USD Million)

Table 135 Middle East & Africa: Blue Hydrogen Market for Chemical Production, by Type, 2021-2032 (USD Million)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholder

Figure 3 Research Process

Figure 4 Key Secondary Source

Figure 5 Primary Research Technique

Figure 6 Key Executive Interview

Figure 7 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 In 2025, the Steam Methane Reforming Segment Is Expected to Dominate the Global Blue Hydrogen Market

Figure 11 In 2025, the Methane Segment Is Expected to Dominate the Global Blue Hydrogen Market

Figure 12 In 2025, the Feedstock Segment Is Expected to Dominate the Global Blue Hydrogen Market

Figure 13 In 2025, the Chemical Production Segment Is Expected to Dominate the Global Blue Hydrogen Market

Figure 14 Global Blue Hydrogen Market, by Region (2025 vs. 2032)

Figure 15 Impact Analysis of Market Dynamics

Figure 16 Global Blue Hydrogen Market, By Generation Process, 2025 Vs. 2032 (USD Million)

Figure 17 Global Blue Hydrogen Market, By Energy Source, 2025 Vs. 2032 (USD Million)

Figure 18 Global Blue Hydrogen Market, By Application, 2025 Vs. 2032 (USD Million)

Figure 19 Global Blue Hydrogen Market, By End User, 2025 Vs. 2032 (USD Million)

Figure 20 Global Blue Hydrogen Market, By Country/Region, 2025 Vs. 2032 (USD Million)

Figure 21 Geographic Snapshot: Blue Hydrogen Market in North America

Figure 22 Geographic Snapshot: Blue Hydrogen Market in Europe

Figure 23 Geographic Snapshot: Blue Hydrogen Market in Asia-Pacific

Figure 24 Growth Strategies Adopted by the Key Players (2020–2025)

Figure 25 Competitive Dashboard: Blue Hydrogen Market

Figure 26 Competitive Benchmarking Analysis (2020–2025)

Figure 27 Nippon Sanso Holdings Corporation: Financial Overview (2022)

Figure 28 Shell plc: Financial Overview (2022)

Figure 29 Linde GmbH: Financial Overview (2022)

Figure 30 Air Products and Chemicals, Inc.: Financial Overview (2022)

Figure 31 Uniper SE: Financial Overview (2022)

Figure 32 L’AIR LIQUIDE S.A.: Financial Overview (2022)

Figure 33 ATCO Ltd.: Financial Overview (2022)

Figure 34 Suncor Energy Inc.: Financial Overview (2022)

Figure 35 Equinor ASA: Financial Overview (2022)

Figure 36 Saudi Arabian Oil Company: Financial Overview (2022)

Figure 37 Aker Solutions ASA: Financial Overview (2022)

Figure 38 Topsoe A/S: Financial Overview (2022)

Figure 39 Technip Energies N.V: Financial Overview (2022)

Figure 40 Ivys Adsorption Inc.: Financial Overview (2022)

Figure 41 Woodside Energy Group Limited: Financial Overview (2022)

Published Date: Apr-2025

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Aug-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates