Resources

About Us

Biogas Cleaning/Upgrading Equipment Market Size, Share, Forecast & Trends by Technology (Water Scrubbing, PSA, Membrane) Application (Desulfurization, CO2 Removal) End-Use Industry (Agriculture, Municipal, Industrial) - Global Forecast to 2035

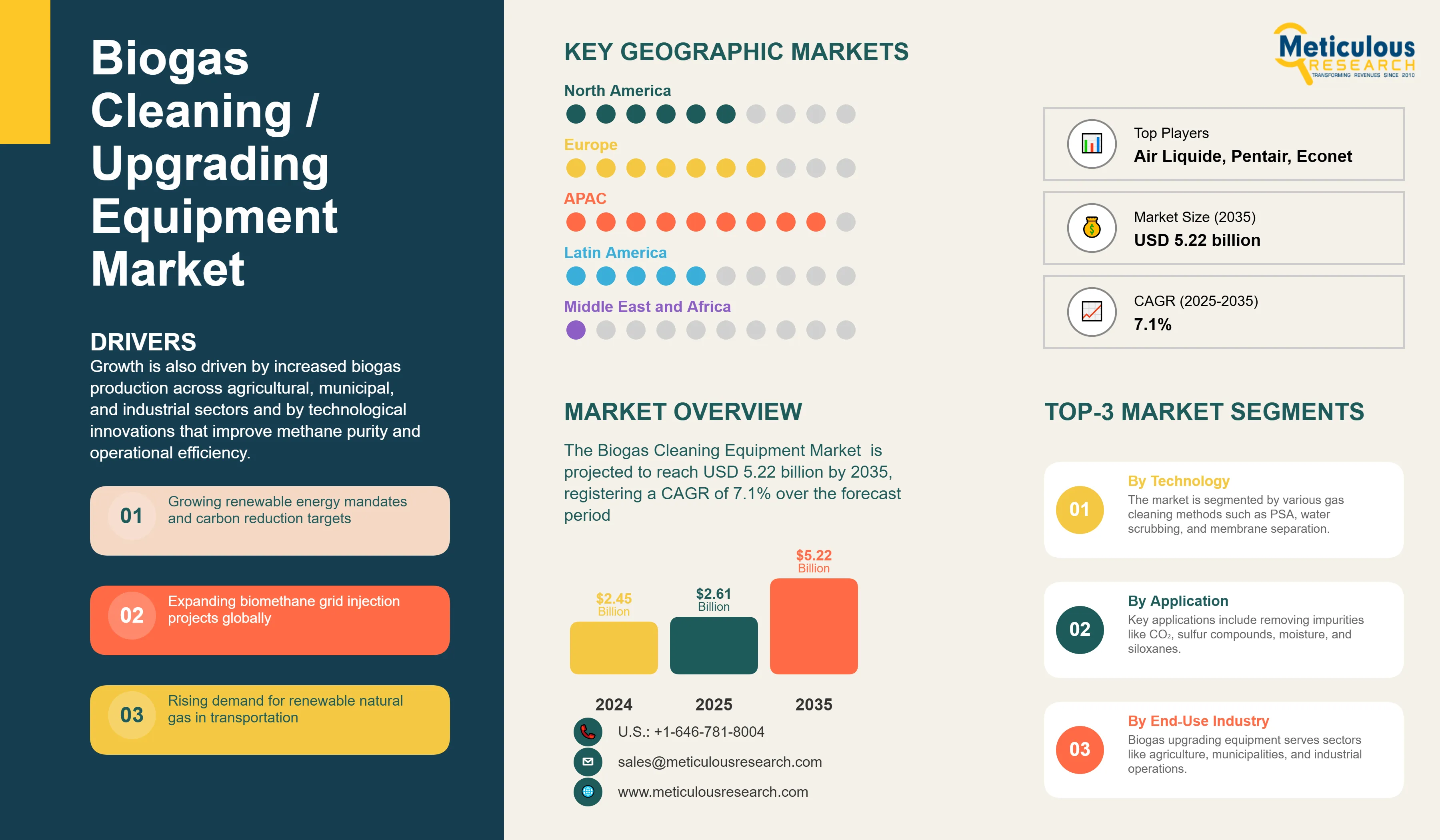

Report ID: MREP - 1041550 Pages: 215 Aug-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe Biogas Cleaning Equipment Market was worth USD 2.45 billion in 2024. The market is estimated to be valued at USD 2.61 billion in 2025 and is projected to reach USD 5.22 billion by 2035, registering a CAGR of 7.1% over the forecast period.

Biogas Cleaning Equipment Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 2.61 billion |

|

Market Value (2035) |

USD 5.22 billion |

|

CAGR (2025-2035) |

7.1% |

|

Largest Technology Segment |

Membrane Separation (30-35% share) |

|

Fastest Growing Technology |

Biological Desulfurization (8.3% CAGR) |

|

Leading Application |

CO2 Removal (40-45% share) |

|

Dominant End-Use Industry |

Agricultural Sector (30-40% share) |

|

Fastest Growth Region |

Asia-Pacific (8.5% CAGR) |

|

Top Country by CAGR |

China (8.8%) |

|

Market Concentration |

Top 5 players hold 30-40% share |

The biogas cleaning equipment market is growing because of the increased global focus on renewable energy transition and new environmental regulations with strict requirements. The demand is being driven by growing biogas production capacities in agricultural, municipal waste, and industrial applications with an increased focus on upgrading biogas to biomethane quality suitable for grid injection and possible use as vehicle fuel.

Market growth has been further driven by government incentives, feed-in tariffs, and renewable energy procurement legislation that encourages sustainable waste management practices and encourages a circular economy. Technological innovations in biogas purification systems are of importance as they allow for increased methane purity levels along with operational efficiency for end-users choosing among technologies.

Favorable regulatory frameworks enforcing carbon neutrality objectives whilst creating additional infrastructure for the distribution of renewable natural gas (RNG) also benefits the biogas cleaning/recycling market. In the future, increased investments in anaerobic digestion facilities and an increased acceptance of biomethane as a clean fuel alternative will continue to drive the growth and development in advanced biogas cleaning technologies.

Biogas Cleaning Equipment Market Size and Forecast and Insights

Click here to: Get Free Sample Pages of this Report

|

Metric |

Value |

|

Biogas Cleaning Equipment Market Value in (2025 E) |

USD 2,847.3 million |

|

Biogas Cleaning Equipment Market Forecast Value in (2035 F) |

USD 6,892.5 million |

|

Forecast CAGR (2025 to 2035) |

9.2% |

Market Segmentation

The biogas cleaning equipment market is segmented by technology type, application, end-use industry, and geography. The market is divided by technology into Water Scrubbing Systems, Pressure Swing Adsorption (PSA), Chemical Absorption Systems, Membrane Separation Technology, Cryogenic Separation, and Biological Desulfurization Systems. By application, the market is segmented into Desulfurization, CO2 Removal, Moisture Removal, Siloxane Removal, and Trace Contaminant Removal. By region, the global biogas cleaning equipment market is segmented into North America, Latin America, Europe, Latin America, and the Middle East & Africa.

Membrane Separation Leads Biogas Cleaning Technology Market with 30-35% Share

In the technology category, membrane separation technology dominates the overall biogas cleaning equipment market with a significant 30-35% market share, owing to its relatively high operating efficiency and small footprint for biogas upgrading processes. This technology achieves high methane recovery at over 99% and has low energy use compared to conventional technologies.

The membrane separation technology has broad adoption across small to medium-sized biogas plants owing to its modular design capabilities, and minimal requirements for chemicals or other solution consumptions. The process could operate independently of membranes at times, and gives a desirable operational flexibility since it performs well in reaching pipeline-quality biomethane specifications, in which it can inject into the grid.

This increasing adoption of this technology segment is also supported by greater investment in advanced membrane materials and declining technology costs. As biomethane standards become more prescriptive and demand for decentralized upgrading systems increases, membrane separation will remain the technology of choice for the next generation of biogas cleaning installations.

CO₂ Removal Dominates Biogas Cleaning/Upgrading Applications in 2025

On the basis of application, the CO2 removal segment dominates the overall biogas cleaning equipment market at 40-45% share with a significant contribution to upgrading raw biogas to biomethane to meet natural gas grid injection and vehicle fuel expectations. The CO2 removal is critical because methane concentration needs exceed 95% and the natural gas specifications are variable depending on regional standards for natural gas applications.

In addition to increasing grid injection projects and CBM development, which provides more capacity for compressed biomethane (CBM) as transportation fuel, work is continuously conducted on CO2 removal systems that optimize methane production while driving recent energetic, biomass-specific applications.

Along with the typical injection strategies, captured carbon dioxide streams are often used for industrial applications providing additional revenue streams. Forecasts for the CO2 removal segment are very much in-line with the growing biomethane market propelling carbon utilization strategies, as this will drive the demand for biomethane and high-performance CO2 separation technology needed for biogas upgrade purposes.

What are the Drivers, Restraints, and Key Trends of the Biogas Cleaning Equipment Market?

The biogas cleaning equipment market is expanding due to strong policies for renewable energy, increasing waste-to-energy initiatives, expanding biomethane infrastructure, and enhancing cost-effectiveness through technological improvements. Additionally, partnerships, modular solutions, and integrated systems improve their competitiveness in this industry.

Base CAGR: 7.1%

|

Driver |

CAGR Impact |

Key Factors |

|

Regulatory Push |

+2.7% |

|

|

Infrastructure & Market Development |

+1.3% |

|

|

Waste-to-Energy Expansion |

+1.2% |

|

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

Economic Barriers |

-1.6% |

→ Easing through modular solutions & financing |

|

Technical Challenges |

-1.2% |

→ Improving with technology maturation |

Policy Mandates and Carbon Targets Fuel Biogas Cleaning Equipment Demand

The biogas cleaning equipment market is booming due to ambitious renewable energy objectives and net-zero commitments by developed economies. In the European Union, the REPowerEU scheme aiming to achieve production of 35 bcm biomethane by 2030 has rapidly accelerated the rollout of upgrading facility installations. National renewable gas standards and green gas certificates for biomethane are creating incentives for biogas producers looking to invest in cleaning equipment to produce grid-quality biomethane. Gaining momentum from carbon pricing mechanisms and emissions trading schemes, biomethane is becoming increasingly competitive compared to fossil natural gas. The policy driven demand and long-term purchase contracts with utilities give investors certainty there will be long-term demand for large-scale biogas upgrading facilities across agricultural co-ops, wastewater treatment facilities and organic waste processing facilities around the world.

Agricultural Biogas and Circular Economy Drive Demand for Biogas Cleaning Equipment

The agricultural biogas plants are adopting cleaning equipment to turn waste from farming into biomethane, and benefit financially from selling an agricultural product independent of the traditional farm-based income streams. Dairy farms, livestock farms, crop residue processors, all are installing upgrading systems to obtain vehicle fuel, and pipeline quality gas. With increasing fertilizer prices, digestate by-product/s have become valuable and provide justification for the investment in an integrated biogas cleaning installation. Reporting on government support for agricultural biogas projects in Germany, France and the USA indicate the impact of these funding programs to increase and support the uptake of biomethane from agricultural sources. The circular economy model combining waste management, energy production, and nutrient recycling associated with agricultural biogas cleaning equipment is becoming a necessary component and basic infrastructure for an environmentally sustainable agricultural operation, now and in the future!

Municipal Waste Diversion and Biogas Infrastructure Fuel Cleaning Equipment Demand

Biogas cleaning equipment is also essential for municipal solid waste management and diversions of organic waste from landfills. Cities pursuing zero waste strategies are installing anaerobic digestion facilities, many with built-in gas cleaning systems. Wastewater treatment plants are upgrading existing anaerobic digesters with modern, cleaned-up equipment to generate revenue from biomethane. Food waste collection programs are predictable and require biogas cleaning infrastructure to address anticipated volumes of organic waste. Growing landfill taxes and disposal fees make biogas production with cleaning equipment enticing for municipalities. The multi-functional ability of biogas cleaning systems affords equipment manufacturers many market opportunities across the globe involving public utilities, waste management companies, and environmental service organizations.

Competitive Landscape

As the biogas cleaning equipment market grows, the competitive landscape will be dominated by technological advancements, integration ability, and services. Key companies in the global biogas cleaning/upgrading equipment market have allocated considerable R&D investments to develop more efficient, energy-saving solutions with higher recovery rates, while at the same time keeping operational costs minimized. Additionally, collaborations with engineering procurement construction (EPC) contractors and developing companies in the biogas plant space, are enhancing execution and production capacity for these projects. Key companies in the biogas cleaning equipment market are also implementing and utilizing digitalization and remote monitoring systems to better know how equipment can be optimized for maintenance. A strong focus on modular and container manufacturing and scalable units for fast implementation requires key participants to employ unique product development strategies. A full service after-sale support network will be paired with performance guarantees to help companies in the biogas cleaning market in taking advantage of more opportunities across different feedstock and different scopes.

|

Country |

CAGR |

|

China |

9.5% |

|

India |

9.1% |

|

Brazil |

8.8% |

|

Germany |

8.5% |

|

U.S. |

7.8% |

|

UK |

7.5% |

Globally, the biogas cleaning equipment market is expected to surge at a CAGR of 7.1% from 2025-2035, with the highest growth in Europe and Asia. China leads the way at 9.5% with its massive investments in biogas projects in agriculture and urban organic waste processing infrastructure. India marks a 9.1% growth, especially encouraging rural biogas and compressed biogas development, while Brazil demonstrates a 8.8% CAGR mainly driven by biogas recovery operations on sugarcane ethanol plants and new business endeavors exploiting agricultural residue.

The US has solid 7.8% growth, in part because of renewable fuel standards requirements, and strong state-level low carbon fuel programs which favor RNG production programs. The UK follows close behind at 7.5%, largely due to their Green Gas Support Scheme and fuel decarbonization targets for the gas grid.

Overall, these regional differences in biogas cleaning and upgrading equipment market growth rates, reflect a strong global momentum for better biogas upgrading infrastructure development. The majority of the report elaborates on more than 25+ countries, detailing examples of investment hotspots and technology preferences that will shape the evolution of the market in the future.

Country-Specific Growth Analysis

China’s Biogas Cleaning Equipment Market Accelerates at a CAGR of 9.5% (2025–2035)

China's CAGR for the biogas cleaning equipment market grew from 8.1% for the period 2020-2024, to 9.5% in the 2025-2035 phase, as large rural revitalization programs accelerated agricultural biogas development. Large-scale centralized biogas plants that process crop residues require both biogas cleaning equipment that prepares gas for commercial distribution. With urban organic waste diversion programs, there is an abundance of crop residue feedstock feedstocks for municipal biogas facilities to either process or distribute. Industrial parks are also installing biogas cleaning solutions that produce products that comply with waste to energy circular economy systems. In addition to technology localization and domestic manufacturing capabilities that significantly reduce the cost of equipment, the costs for projects improve the feasibility for a variety of projects, for stages in a value chain from village-scale agricultural to industrial-scale installations.

SATAT Initiative and Crop Residue Regulations Fuel Biogas Cleaning Growth in India

India biogas cleaning equipment market is expected to grow at a CAGR of 9.1% from 2025 to 2035. This expansion is linked to the SATAT (Sustainable Alternative Towards Affordable Transportation) initiative for planned 5,000 compressed biogas plants. Agricultural residue management rules prohibiting crop burning have sped up proposals for biogas projects utilizing cleaning equipment. Urban local bodies are implementing integrated waste management while developing biogas recovery and purification facilities. The off-take agreements for compressed biogas by oil marketing companies create marketing certainty for investments in cleaning equipment. Technology collaborations between Swiss and European suppliers as well as local manufacturers are building capabilities of local manufacturing while reducing import dependency.

U.S. Biogas Cleaning Equipment Market Grows at a CAGR of 7.8% on Policy and RNG Expansion

The U.S. biogas cleaning equipment market is expected to grow at a CAGR of 7.8% from 2025 to 2035. Renewable natural gas projects are expanding due to federal renewable fuel mandates and state low carbon fuel programs. Several states, particularly California, Oregon, and Washington, have low carbon fuel standard programs that have created premium biogenic market pricing for biomethane as a transportation fuel. Large dairy operations have purchased cleaning equipment so manure digesters can produce RNG that meets pipeline quality specifications. Landfill gas to energy projects, tend to be upgrading their systems, as they are being challenged to access environmental credit markets that create value for RNG credit production. Investment tax credits, USDA rural energy programs, and other government infrastructure improvement programs continue to support agricultural biogas infrastructure development across the country.

Key Players in Biogas Cleaning Market Expand Global Reach with Advanced System Offerings

Leading firms within biogas cleaning equipment market are developing different strategies to capture increasing demand from the agricultural, municipal, and industrial markets. Companies such as Air Liquide and Pentair Haffmans have comprehensive gas processing solutions that offer complete biogas-to-biomethane upgrading systems. These companies rely on their supplied reliability and their experience where biomethane production forms part of major projects with operational references for installations on all continents.

Bright Biomethane and Greenlane Renewables are leading the way in small, containerized solutions that can be quickly deployed for distributed biogas projects. DMT Environmental Technology and Hitachi Zosen Inova are both actively working on membrane-based systems which maximize methane recovery with a ease of operation considerably less than other technologies. On the specialized equipment side, both Econet Group and ETW Energietechnik are enhancing their conditioning and desulfurization systems for challenging biogas compositions. Malmberg Water is applying its extensive knowledge in water scrubbing to also provide an inexpensive way to upgrade gas in conjunction with agricultural registrations.

Recent Developments in the Global Biogas Cleaning Equipment Market

In August 2025, Asahi Kasei announced that they had completed a successful demonstration trial of its new biogas purification system, achieving biomethane yields of 99.5% or higher with a purity value of 97% plus. The system uses a new process called pressure vacuum swing adsorption (PVSA) with new zeolite adsorbents. The commercial availability is set for 2027 and the company is pursuing licensing globally.

|

Item |

Value |

|

Market Size (2025) |

USD 2.61 Billion |

|

Technology Type |

Water Scrubbing, PSA, Chemical Absorption, Membrane Separation, Cryogenic, Biological Systems |

|

Application |

Desulfurization, CO2 Removal, Moisture Removal, Siloxane Removal, Trace Contaminant Removal |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air Liquide, Pentair Haffmans, Bright Biomethane, Greenlane Renewables, DMT Environmental Technology, Hitachi Zosen Inova, Econet Group, ETW Energietechnik, Malmberg Water, Xebec Adsorption, CarboTech Engineering |

|

Additional Attributes |

Porter's Five Forces Analysis, technology impact on biogas cleaning equipment market, impact of sustainability on biogas cleaning equipment market, competitive benchmarking, market share/ranking analysis of key players, company profiles, digitalization adoption, and growth forecasts across key biogas producing regions |

The global biogas cleaning equipment market is estimated to be valued at USD 2.61 billion in 2025.

The market size for biogas cleaning equipment is projected to reach USD 5.22 billion by 2035.

The biogas cleaning equipment market is expected to grow at a 7.1% CAGR between 2025 and 2035.

Membrane separation technology commands the largest share at 30-35% due to high efficiency and compact design.

CO2 removal represents 40-45% of applications, essential for upgrading biogas to biomethane standards for grid injection and vehicle fuel use.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Biogas Cleaning Equipment Market, by Technology

3.2.2. Biogas Cleaning Equipment Market, by Application

3.2.3. Biogas Cleaning Equipment Market, by End-Use Industry

3.2.4. Biogas Cleaning Equipment Market, by Capacity

3.2.5. Biogas Cleaning Equipment Market, by Feedstock Source

3.2.6. Biogas Cleaning Equipment Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing renewable energy mandates and carbon reduction targets

4.2.1.2. Expanding biomethane grid injection projects globally

4.2.1.3. Rising demand for renewable natural gas in transportation

4.2.1.4. Surge in agricultural and municipal waste-to-energy projects

4.2.1.5. Increased focus on circular economy and waste valorization

4.2.2. Restraints

4.2.2.1. High initial capital investment requirements

4.2.2.2. Technical challenges in achieving pipeline-quality standards

4.2.2.3. Feedstock availability and quality variations

4.2.3. Opportunities

4.2.3.1. Emergence of modular and containerized cleaning solutions

4.2.3.2. Integration with carbon capture and utilization technologies

4.2.3.3. Expansion into developing markets with untapped biogas potential

4.2.4. Trends

4.2.4.1. Adoption of membrane technology for small-scale applications

4.2.4.2. Integration of IoT and remote monitoring systems

4.2.5. Challenges

4.2.5.1. Meeting varying biomethane quality standards across regions

4.2.5.2. Competition from other renewable energy technologies

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Biogas Cleaning Equipment Market

4.4.1. Advanced Membrane Materials

4.4.1.1. High-selectivity polymeric membranes

4.4.1.2. Mixed-matrix and ceramic membranes

4.4.1.3. Multi-stage membrane configurations

4.4.2. Process Optimization Technologies

4.4.2.1. AI-powered operational optimization

4.4.2.2. Predictive maintenance systems

4.4.2.3. Real-time quality monitoring and control

5. Impact of Sustainability on Biogas Cleaning Equipment Market

5.1. Energy-efficient cleaning technologies reducing parasitic loads

5.2. Progress towards zero-emission biogas upgrading facilities

5.3. Integration with renewable electricity for process operations

5.4. Promoting rural development through distributed biogas systems

5.5. Facilitating organic waste diversion from landfills

5.6. Contributing to national renewable energy and climate targets

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Biogas Cleaning Equipment Market Assessment—By Technology

7.1. Overview

7.2. Water Scrubbing Systems

7.3. Pressure Swing Adsorption (PSA)

7.4. Chemical Absorption Systems

7.5. Membrane Separation Technology

7.6. Cryogenic Separation

7.7. Biological Desulfurization Systems

8. Biogas Cleaning Equipment Market Assessment—By Application

8.1. Overview

8.2. Desulfurization

8.3. CO2 Removal

8.4. Moisture Removal

8.5. Siloxane Removal

8.6. Trace Contaminant Removal

9. Biogas Cleaning Equipment Market Assessment—By End-Use Industry

9.1. Overview

9.2. Agricultural Sector

9.3. Municipal Wastewater Treatment

9.4. Industrial Waste Processing

9.5. Landfill Gas Recovery

9.6. Food & Beverage Industry

10. Biogas Cleaning Equipment Market Assessment—By Capacity

10.1. Overview

10.2. Small-scale (<500 Nm³/h)

10.3. Medium-scale (500–2,000 Nm³/h)

10.4. Large-scale (>2,000 Nm³/h)

11. Biogas Cleaning Equipment Market Assessment—By Feedstock Source

11.1. Overview

11.2. Agricultural Residues

11.3. Animal Manure

11.4. Municipal Solid Waste

11.5. Sewage Sludge

11.6. Industrial Organic Waste

12. Biogas Cleaning Equipment Market Assessment—By Geography

12.1. Overview

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Netherlands

12.3.5. Italy

12.3.6. Denmark

12.3.7. Sweden

12.3.8. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. South Korea

12.4.5. Thailand

12.4.6. Indonesia

12.4.7. Australia

12.4.8. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. South Africa

12.6.4. Kenya

12.6.5. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

13.1. Greenlane Renewables Inc.

13.2. Air Liquide S.A.

13.3. DMT Environmental Technology

13.4. Malmberg Water AB

13.5. EnviTec Biogas AG

13.6. Pentair plc

13.7. Bright Renewables B.V.

13.8. Prodeval S.A.

13.9. Wärtsilä Corporation

13.10. ETW Energietechnik GmbH

13.11. CarboTech AC GmbH

13.12. Hitachi Zosen Inova AG

13.13. Biogasclean A/S

13.14. Varec Biogas

13.15. Anaergia Inc.

13.16. Condorchem Envitech

13.17. Sysadvance S.A.

13.18. AB Holding S.p.A.

13.19. Evonik Industries AG

13.20. Praj Industries

13.21. Others

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates