Resources

About Us

Anti-wrinkle Products Market by Product Type (Creams & Moisturizers, Serums & Concentrates, Eye Creams, Cleansers), Active Ingredient (Retinoids, Peptides, Antioxidants, Hyaluronic Acid), Nature (Synthetic, Natural, Organic), and Distribution Channel (Specialty Stores, Pharmacies, Online Retail) – Global Forecast to 2036

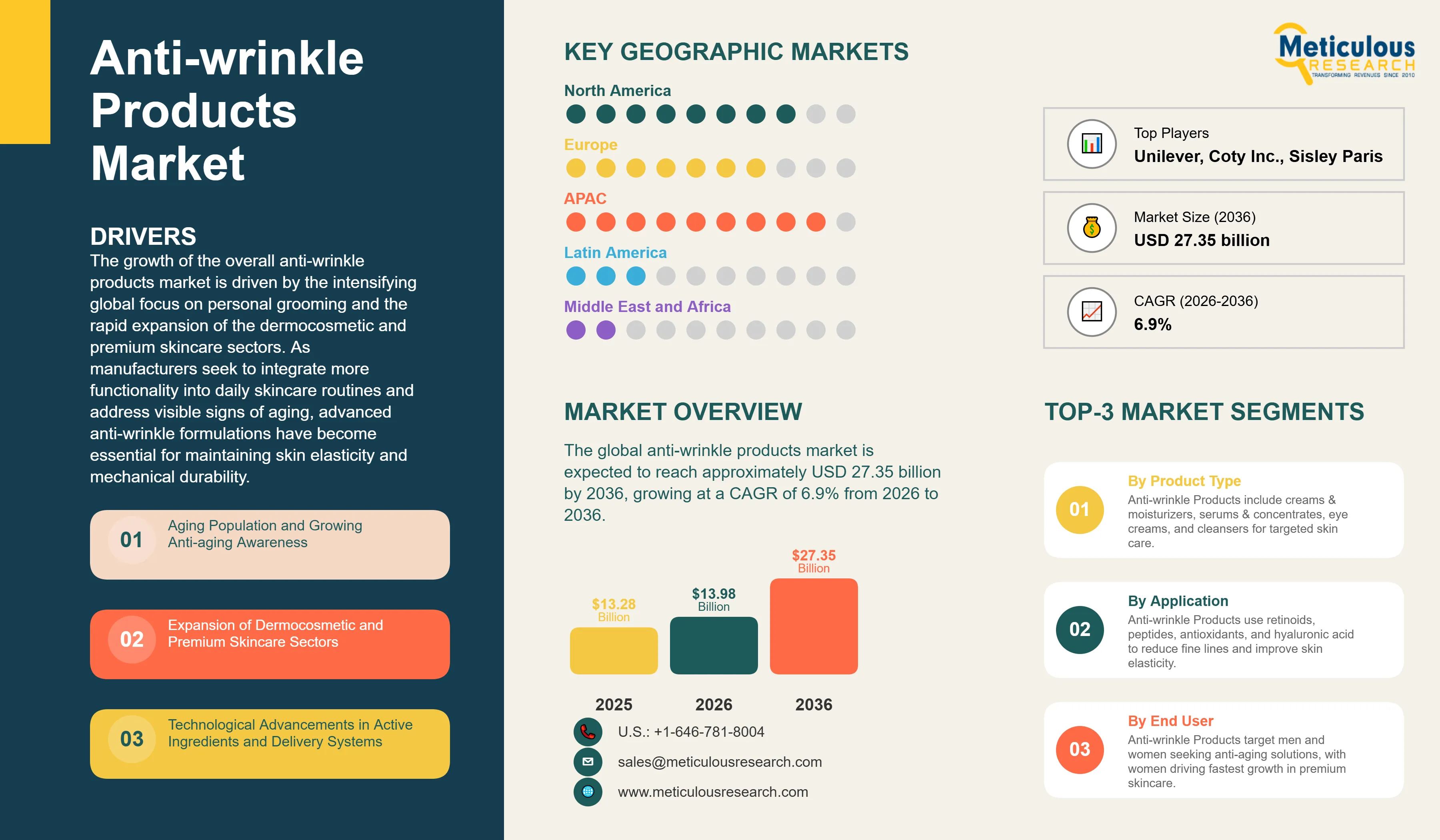

Report ID: MRCHM - 1041713 Pages: 152 Feb-2026 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe global anti-wrinkle products market was valued at USD 13.28 billion in 2025. The market is expected to reach approximately USD 27.35 billion by 2036 from USD 13.98 billion in 2026, growing at a CAGR of 6.9% from 2026 to 2036. The growth of the overall anti-wrinkle products market is driven by the intensifying global focus on personal grooming and the rapid expansion of the dermocosmetic and premium skincare sectors. As manufacturers seek to integrate more functionality into daily skincare routines and address visible signs of aging, advanced anti-wrinkle formulations have become essential for maintaining skin elasticity and mechanical durability. The rapid expansion of the e-commerce infrastructure and the increasing need for high-performance active ingredients like retinoids and peptides continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Anti-wrinkle products are critical skincare systems used to provide topical treatment while allowing for cellular regeneration and moisture retention throughout the skin’s aging process. These systems include creams, serums, and targeted treatments, which are designed to withstand environmental stressors and fit into diverse skincare regimens. The market is defined by high-efficiency ingredients such as hyaluronic acid and epigenetic peptides, which significantly enhance skin firmness and signal performance in anti-aging applications. These systems are indispensable for manufacturers seeking to optimize their internal product architecture and meet aggressive skin rejuvenation targets.

The market includes a diverse range of formulations, ranging from simple moisturizing creams for basic hydration to complex multilayer serum systems for high-performance repair and epigenetic defense. These systems are increasingly integrated with advanced components such as encapsulated actives and ultra-fine delivery systems to provide services such as deep-layer penetration and improved ingredient stability. The ability to provide stable, high-precision results while minimizing irritation has made advanced anti-wrinkle products the technology of choice for industries where aesthetic efficiency and reliability are paramount.

The global beauty sector is pushing hard to modernize production capabilities, aiming to meet AI-driven formulation and personalized skincare targets. This drive has increased the adoption of high-density active concentrations, with advanced molecular defense techniques helping to stabilize production yields for ultra-fine skincare textures. At the same time, the rapid growth in the dermocosmetic and professional skincare markets is increasing the need for high-reliability, clinically-proven anti-aging solutions.

What are the Key Trends in the Anti-wrinkle Products Market?

Proliferation of Epigenetic Skincare and Molecular Defense

Manufacturers across the beauty industry are rapidly shifting to science-optimized formulations, moving well beyond traditional cream designs toward high-speed, low-irritation active setups. Beiersdorf’s latest epigenetic serums deliver significantly higher skin rejuvenation for aging skin, while L’Oréal’s recent installations have slashed visible fine lines in clinical trials. The real game-changer comes with “smart” skincare featuring integrated molecular defense capabilities that maintain peak performance even in environmentally noisy urban environments. These advancements make high-precision anti-aging practical and cost-effective for everyone from skincare startups to global beauty giants chasing aesthetic excellence and lower system weight.

Innovation in Personalized and Ultra-Thin Delivery Systems

Innovation in personalized and ultra-thin delivery systems is rapidly driving the anti-wrinkle products market, as skincare devices become more compact and multi-functional. Equipment suppliers are now designing units that combine the structural integrity of traditional creams with the versatility of targeted serums in a single assembly, saving valuable shelf space and simplifying consumer logistics. These systems often involve advanced encapsulation and time-release technology capable of handling ultra-fine active particles without compromising ingredient strength or clinical reliability.

At the same time, growing focus on sustainable beauty is pushing manufacturers to develop anti-wrinkle solutions tailored to circular economy principles. These systems help reduce material waste through refillable packaging processes and the use of biodegradable substrates. By combining high-density active delivery with robust environmental performance, these new designs support both technological advancement and corporate sustainability, strengthening the resilience of the broader beauty value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 27.35 Billion |

|

Market Size in 2026 |

USD 13.98 Billion |

|

Market Size in 2025 |

USD 13.28 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 6.9% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Product Type, Active Ingredient, Nature, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Aging Population and Rise of Dermocosmetics

A key driver of the anti-wrinkle products market is the rapid movement of the global beauty industry toward science-backed, highly functional skincare. Global consumer demand for sleek packaging, effective results, and health-monitoring skincare has created significant incentives for the adoption of anti-aging products. The trend toward “clean” technology and the integration of skincare into daily wellness patches drive manufacturers toward scalable solutions that anti-wrinkle products can uniquely provide. It is estimated that as consumer adoption of dermatologist-recommended routines rises and diagnostic tools become more decentralized through 2036, the need for robust, effective formulations increases significantly; therefore, serums and targeted treatments, with their ability to ensure high-density active delivery, are considered a crucial enabler of modern skincare design strategies.

Opportunity: E-commerce Expansion and Personalized Beauty

The rapid growth of the e-commerce market and personalized beauty technologies provides great opportunities for the anti-wrinkle products market. Indeed, the global surge in online retail has created a compelling demand for systems that can replace traditional brick-and-mortar consultations and integrate seamlessly into digital subscription models. These applications require high reliability, ingredient transparency, and the ability to handle high-volume shipping environments, all attributes that are met with advanced skincare solutions. The personalized beauty market is set to expand significantly through 2036, with anti-wrinkle products poised for an expanding share as manufacturers seek to maximize consumer loyalty and minimize product waste. Furthermore, the increasing demand for AI-driven skin analysis and virtual try-on tools is stimulating demand for modular skincare solutions that provide high-speed results and design flexibility.

Why Do Creams & Moisturizers Lead the Market?

The creams and moisturizers segment accounts for a significant portion of the overall anti-wrinkle products market in 2026. This is mainly attributed to the versatile use of this technology in supporting daily hydration and complex barrier protection within extremely diverse environments, such as in urban centers and high-altitude regions. These systems offer the most comprehensive way to ensure skin integrity across diverse high-frequency applications. The mass market and premium sectors alone consume a large share of anti-wrinkle cream production, with major projects in Asia Pacific and North America demonstrating the technology’s capability to handle high-density active requirements. However, the serums and concentrates segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for robust active delivery in targeted treatments, clinical procedures, and luxury skincare systems.

How Does the Retinoids Segment Dominate?

Based on active ingredient, the retinoids segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of clinical evidence and the rigorous performance standards required for modern anti-aging products. Current large-scale manufacturing plants are increasingly specifying high-density retinoid concentrations to ensure compliance with global performance standards and consumer expectations for faster, visible results.

The peptides segment is expected to witness the fastest growth during the forecast period. The shift toward epigenetic skincare and the complexity of biomimetic ingredient suites are pushing the requirement for advanced active systems that can handle varied skin types and mechanical stresses while ensuring absolute reliability for safety-critical skincare systems.

Why Does Synthetic Lead the Market?

The synthetic segment commands the largest share of the global anti-wrinkle products market in 2026. This dominance stems from its superior ingredient stability, chemical consistency, and excellent mechanical properties, making it the formulation of choice for high-performance anti-aging products. Large-scale operations in dermocosmetics, professional skincare, and high-end beauty drive demand, with advanced molecules from suppliers like L’Oréal and Beiersdorf enabling reliable performance in extreme environments.

However, the natural and organic segment is poised for steady growth through 2036, fueled by expanding applications in clean beauty and simple botanical formulations. Manufacturers face mounting pressure to optimize costs for high-volume, less demanding applications, where natural extracts provide a cost-effective alternative for basic anti-aging connectivity.

How is Asia Pacific Maintaining Dominance in the Global Anti-wrinkle Products Market?

Asia Pacific holds the largest share of the global anti-wrinkle products market in 2026. The largest share of this region is primarily attributed to the massive urbanization and the presence of the world’s largest beauty manufacturing hubs, particularly in China, South Korea, and Japan. South Korea alone accounts for a significant portion of global anti-wrinkle production, with its position as a leading exporter of high-end skincare driving sustained growth. The presence of leading manufacturers like Shiseido and a well-developed beauty supply chain provides a robust market for both standard and high-density anti-aging solutions.

Which Factors Support North America and Europe Market Growth?

North America and Europe together account for a substantial share of the global anti-wrinkle products market. The growth of these markets is mainly driven by the need for technological modernization in the dermocosmetic, professional, and luxury beauty sectors. The demand for advanced skincare systems in North America is mainly due to its large-scale R&D projects and the presence of innovators like Estée Lauder and Procter & Gamble.

In Europe, the leadership in dermatological engineering and the push for ingredient safety innovation are driving the adoption of high-reliability anti-aging products. Countries like France, Germany, and the UK are at the forefront, with significant focus on integrating smart skincare solutions into daily routines and advanced beauty treatments to ensure the highest levels of performance and reliability.

The companies such as L’Oréal S.A., The Estée Lauder Companies Inc., Beiersdorf AG, and Shiseido Company, Limited lead the global anti-wrinkle products market with a comprehensive range of cream and serum solutions, particularly for large-scale consumer beauty and high-speed anti-aging applications. Meanwhile, players including Procter & Gamble (Olay), Johnson & Johnson (Neutrogena), Unilever, and Kao Corporation focus on specialized mass-market and high-density formulations targeting the dermocosmetic and professional sectors. Emerging manufacturers and integrated players such as Coty Inc., Clarins Group, and Sisley Paris are strengthening the market through innovations in epigenetic technology and modular skincare platforms.

The global anti-wrinkle products market is expected to grow from USD 13.98 billion in 2026 to USD 27.35 billion by 2036.

The global anti-wrinkle products market is projected to grow at a CAGR of 6.9% from 2026 to 2036.

Creams and moisturizers are expected to dominate the market in 2026 due to their superior ability to support daily hydration and barrier protection. However, serums and concentrates are projected to be the fastest-growing segment owing to their increasing adoption in targeted treatments, clinical procedures, and luxury skincare where high active delivery is required.

AI and Epigenetics are transforming the anti-wrinkle landscape by demanding higher ingredient integrity, lower irritation, and improved cellular repair. These technologies drive the adoption of advanced materials like encapsulated actives and biomimetic peptides, enabling skincare manufacturers to support the complex formulations and high-frequency requirements of next-generation anti-aging products.

Asia Pacific holds the largest share of the global anti-wrinkle products market in 2026. The largest share of this region is primarily attributed to the massive urbanization and the presence of the world’s largest beauty manufacturing hubs in China, South Korea, and Japan. North America and Europe together account for a substantial share, driven by high-end applications in dermocosmetics and luxury skincare.

The leading companies include L’Oréal S.A., The Estée Lauder Companies Inc., Beiersdorf AG, Shiseido Company, Limited, and Procter & Gamble.

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Research Methodology

1.4. Assumptions & Limitations

2. Executive Summary

3. Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Impact of AI and Epigenetics on Anti-wrinkle Products

3.4. Regulatory Landscape (EU Cosmetics Regulation, FDA)

3.5. Porter’s Five Forces Analysis

4. Global Anti-wrinkle Products Market, by Product Type

4.1. Introduction

4.2. Creams & Moisturizers

4.2.1. Day Creams

4.2.2. Night Creams

4.3. Serums & Concentrates

4.4. Eye Creams & Targeted Treatments

4.5. Cleansers & Washes

4.6. Others (Masks, Peels)

5. Global Anti-wrinkle Products Market, by Active Ingredient

5.1. Introduction

5.2. Retinoids (Retinol, Tretinoin)

5.3. Peptides (Biomimetic, Epigenetic)

5.4. Antioxidants (Vitamin C, Vitamin E, Niacinamide)

5.5. Alpha Hydroxy Acids (AHAs) & Beta Hydroxy Acids (BHAs)

5.6. Hyaluronic Acid

5.7. Others

6. Global Anti-wrinkle Products Market, by Nature

6.1. Introduction

6.2. Synthetic

6.3. Natural/Herbal

6.4. Organic

7. Global Anti-wrinkle Products Market, by Distribution Channel

7.1. Introduction

7.2. Supermarkets/Hypermarkets

7.3. Specialty Stores (Sephora, Ulta)

7.4. Pharmacies & Drugstores

7.5. Online Retail (E-commerce)

7.6. Others

8. Global Anti-wrinkle Products Market, by Region

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherlands

8.3.7. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. South Korea

8.4.4. India

8.4.5. Australia

8.4.6. Rest of Asia-Pacific

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America

8.6. Middle East & Africa

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Ranking/Positioning Analysis of Key Players, 2024

10. Company Profiles (Manufacturers & Providers)

10.1. L’Oréal S.A.

10.2. The Estée Lauder Companies Inc.

10.3. Beiersdorf AG

10.4. Shiseido Company, Limited

10.5. Procter & Gamble (Olay)

10.6. Johnson & Johnson (Neutrogena)

10.7. Unilever

10.8. Kao Corporation

10.9. Coty Inc.

10.10. Clarins Group

10.11. Sisley Paris

10.12. Revlon, Inc.

11. Appendix

11.1. Questionnaire

11.2. Related Reports

Published Date: Dec-2024

Published Date: Sep-2024

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates