What is the Air Compressor Market Size?

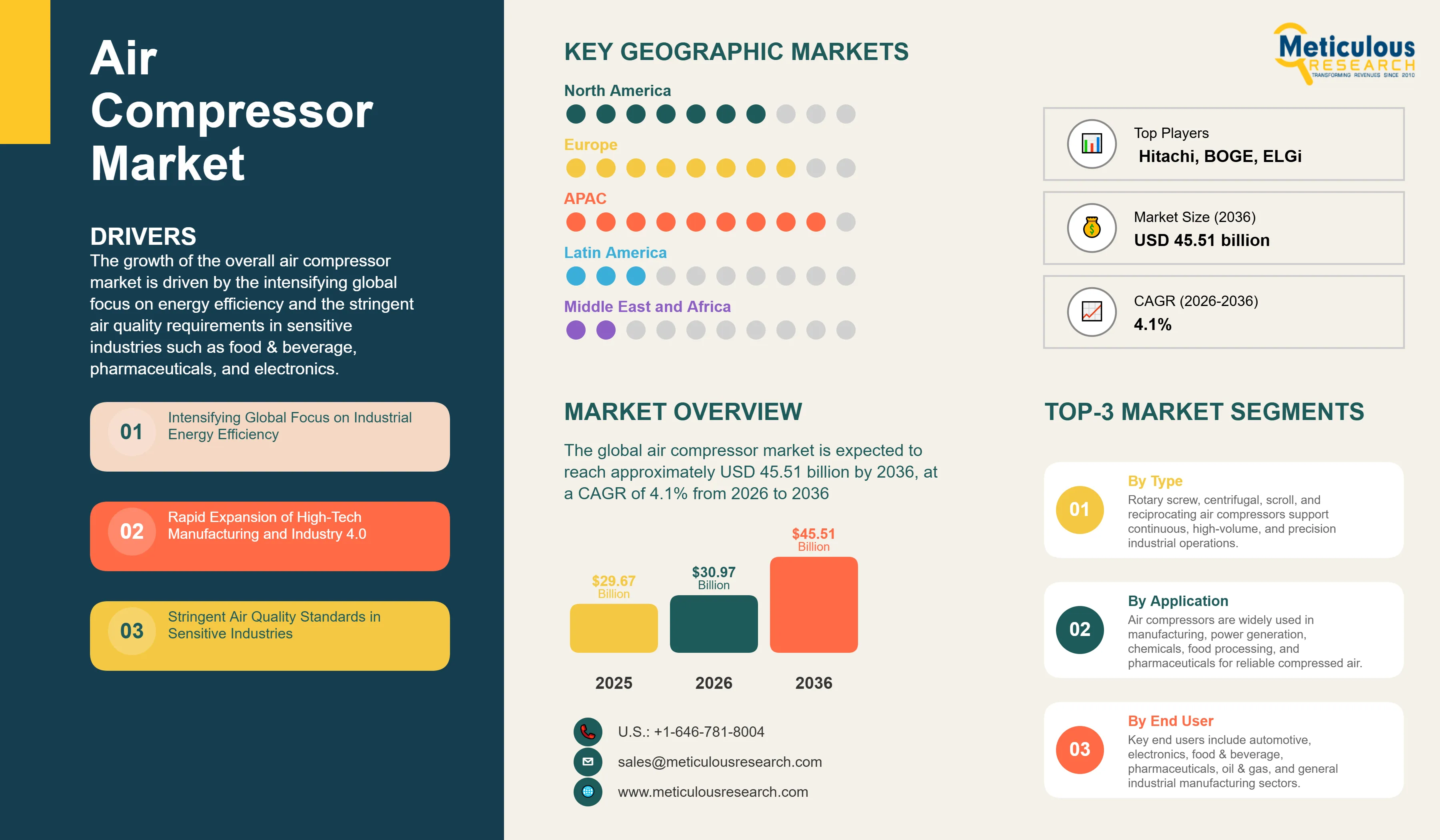

The global air compressor market was valued at USD 29.67 billion in 2025. This market is expected to reach approximately USD 45.51 billion by 2036 from USD 30.97 billion in 2026, at a CAGR of 4.1% from 2026 to 2036. The growth of the overall air compressor market is driven by the intensifying global focus on energy efficiency and the stringent air quality requirements in sensitive industries such as food & beverage, pharmaceuticals, and electronics. As industrial facilities seek to reduce their carbon footprint and operational costs, Variable Speed Drive (VSD) technology and Oil-Free compression systems have become essential for modern manufacturing. The rapid expansion of high-tech manufacturing, coupled with the increasing adoption of Industry 4.0 and smart factory initiatives, continues to fuel significant growth of this market across all major geographic regions.

Market Highlights: Air Compressor (Oil-Free/Variable Speed)

- In terms of revenue, the global air compressor market is projected to reach USD 45.51 billion by 2036.

- The market is expected to grow at a CAGR of 4.1% from 2026 to 2036.

- Asia Pacific dominates the global air compressor market with the largest market share in 2026, driven by massive industrialization and the presence of leading manufacturing hubs in China and India.

- Europe is expected to witness significant growth during the forecast period, supported by aggressive energy efficiency regulations and the transition toward sustainable industrial practices.

- By technology, the rotary screw compressors segment holds the largest market share in 2026, particularly in continuous-duty industrial applications.

- By technology, the centrifugal compressors segment is expected to witness the fastest growth during the forecast period, driven by large-scale utility and process industry requirements.

- By lubrication type, the oil-free segment is expected to witness the fastest CAGR during the forecast period due to the rising demand for contaminant-free air in sensitive processes.

- By application, the manufacturing segment holds the largest share of the overall market in 2026.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Air compressors are critical industrial assets that convert power into potential energy stored in pressurized air. The modern market is increasingly defined by two high-performance categories: oil-free compressors, which ensure 100% contaminant-free air by eliminating oil from the compression chamber, and variable speed drive (VSD) compressors, which automatically adjust their motor speed to match real-time air demand. Unlike traditional fixed-speed units, VSD systems offer energy savings of up to 35-50%, making them indispensable for facilities seeking to optimize their total cost of ownership (TCO) and meet corporate sustainability targets.

The market includes a diverse range of configurations, ranging from compact scroll units for medical laboratories to massive centrifugal systems for chemical plants and power generation. These systems are increasingly integrated with advanced digital monitoring platforms and heat recovery units to provide a comprehensive "Quality Air" solution. The ability to provide stable, high-purity air while minimizing energy waste has made oil-free VSD compressors the technology of choice for industries where product safety and operational efficiency are paramount.

The overall air compressor market is expected to witness robust growth during the forecast period, driven by several factors. The global industrial sector is pushing hard to modernize aging infrastructure, aiming to meet net-zero emission targets. This drive has increased the adoption of high-efficiency units, with advanced VSD+ designs helping to stabilize plant energy consumption. At the same time, the rapid growth in the pharmaceutical and food processing markets is increasing the need for Class 0 certified air.

What are the Key Trends in the Air Compressor Market?

Proliferation of VSD+ Technology and Permanent Magnet Motors

A major trend reshaping the air compressor market is the shift toward VSD+ technology integrated with interior permanent magnet (iPM) motors. Manufacturers are increasingly moving beyond standard variable speed units to premium designs that offer even higher efficiency across the entire speed range. Leading companies are deploying systems that feature oil-cooled motors and direct-drive mechanisms, eliminating transmission losses. The recent introduction of "smart" VSD+ ranges marks a key milestone in this transition. These advanced designs allow for superior performance even in harsh environments, making high-efficiency compressors increasingly attractive for a wider range of industrial users.

Integration of AI-Driven Monitoring and Heat Recovery

Another major trend is the development of AI-driven compressor monitoring systems and integrated heat recovery units. As the industry moves toward "Compressor 4.0," manufacturers are creating units that feature advanced sensors and cloud-based analytics platforms. This approach allows for real-time optimization of air systems and predictive alerts, significantly reducing unplanned downtime. Furthermore, manufacturers are investing in energy recovery modules that can capture up to 90% of the heat generated during compression for use in space heating or industrial processes, further enhancing the environmental profile of the technology.

Market Summary:

|

Parameters

|

Details

|

|

Market Size by 2036

|

USD 45.51 Billion

|

|

Market Size in 2026

|

USD 30.97 Billion

|

|

Market Size in 2025

|

USD 29.67 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 4.1%

|

|

Dominating Region

|

Asia Pacific

|

|

Fastest Growing Region

|

Asia Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Technology, Lubrication Type, Application, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Energy Efficiency Regulations and Industrial Modernization

A key driver of the air compressor market is the rapid movement of the global industry toward energy efficiency and infrastructure modernization. Global regulations requiring the reduction of industrial energy consumption have created significant incentives for the adoption of VSD technology. The EU Ecodesign Directive, the U.S. Department of Energy (DOE) standards, and various national energy efficiency grants drive manufacturers toward high-performance solutions that conventional fixed-speed units cannot match. It is estimated that as energy prices remain volatile through 2036, the return on investment (ROI) for high-efficiency compressors becomes increasingly compelling; therefore, VSD compressors, with their ability to match demand precisely, are considered a crucial enabler of modern industrial strategies.

Opportunity: Rising Demand for High-Purity Air in Sensitive Industries

The rapid growth of the pharmaceutical, food & beverage, and semiconductor industries provides great opportunities for the oil-free air compressor market. Indeed, the global surge in consumer safety standards has created a compelling demand for Class 0 certified air. These applications require 100% oil-free air to prevent product contamination and ensure compliance with international safety standards (ISO 8573-1). The sensitive manufacturing market is set to expand significantly through 2036, with oil-free units poised for an expanding share as operators seek to eliminate the risk of oil carryover. Furthermore, the increasing demand for clean air in medical and laboratory environments is stimulating demand for modular scroll and tooth compressors that provide quiet, reliable performance.

Technology Insights

Why Do Rotary Screw Compressors Dominate the Market?

The rotary screw compressors segment accounts for around 45-50% of the overall air compressor market in 2026. This dominant position reflects the primary use of this technology in continuous-duty industrial applications. These systems, ranging from small workshop units to large industrial packages, offer a reliable and efficient way to provide a steady flow of compressed air. The manufacturing sector alone consumes the vast majority of rotary screw production, with major projects in Asia Pacific and North America demonstrating the technology's capability to provide 24/7 operational support.

However, the centrifugal compressors segment is expected to grow at the fastest CAGR during the forecast period, driven by the requirement for high-volume bulk air in large-scale process industries and power plants. The high efficiency and low maintenance of new centrifugal designs make them highly attractive for utility-scale users.

Lubrication Type Insights

How Does the Oil-Free Segment Lead Growth?

Based on lubrication type, the oil-injected segment currently holds the largest share of the overall market in 2026, accounting for around 60-65% of total consumption due to its lower initial cost and suitability for general industrial use. However, the oil-free segment is expected to witness the fastest growth during the forecast period. From pharmaceutical cleanrooms to food packaging lines, the use of oil-free compressors is central to ensuring product integrity. Current high-tech projects are increasingly specifying oil-free units for their safety and long-term maintenance advantages over oil-injected systems in sensitive environments.

Regional Insights

How is Asia Pacific Maintaining Dominance in the Global Air Compressor Market?

Asia Pacific holds the largest share of the global air compressor market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world's largest manufacturing hubs, particularly in China and India. China alone accounts for a significant portion of global compressor consumption, with its position as a leading hub for electronics and automotive manufacturing driving sustained growth. The presence of leading manufacturers and a well-developed industrial supply chain provides a robust market for both standard and high-efficiency compressor solutions.

Which Factors Support North America and Europe Air Compressor Market Growth?

North America and Europe together account for around 30 to 40% of the global air compressor market. The growth of these markets is mainly driven by the need for energy-efficient modernization and the implementation of stringent environmental mandates. The demand for VSD compressors in North America is mainly due to its large-scale industrial automation projects and the presence of innovators like Ingersoll Rand and Sullair.

In Europe, the leadership in sustainable industrial policies and the push for energy independence are driving the adoption of high-efficiency compressors. Countries like Germany, Italy, and the UK are at the forefront, with significant focus on integrating smart compressors into digital factory environments.

Key players

The companies such as Atlas Copco, Ingersoll Rand, Kaeser Compressors, and Sullair (Hitachi Group) lead the global air compressor market with a comprehensive range of oil-free and variable speed solutions, particularly for large-scale industrial and process applications. Meanwhile, players including Gardner Denver, Hitachi Industrial Equipment, BOGE Compressors, and ELGi Equipments focus on specialized rotary screw and centrifugal systems targeting the manufacturing, automotive, and textile sectors. Emerging manufacturers and integrated players such as Fusheng, Anest Iwata, and Kobe Steel (Kobelco) are strengthening the market through innovations in scroll technology and smart monitoring systems. Overall, competition in the market is driven by energy efficiency ratings (VSD+), air purity certifications (Class 0), system reliability, and the ability to support diverse applications ranging from food & beverage and pharmaceuticals to electronics and power generation.

Key Questions Answered in the Report: