Resources

About Us

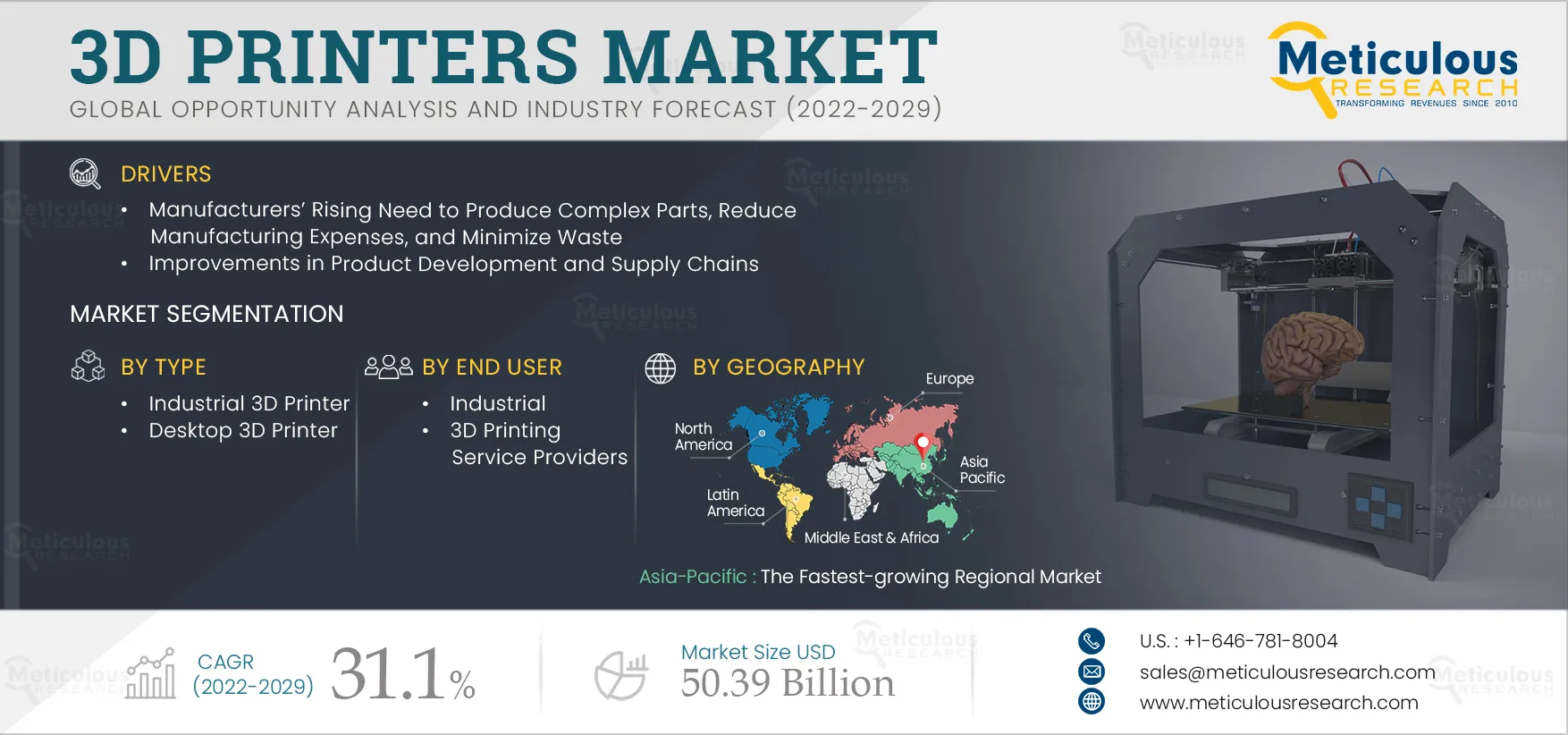

3D Printers Market by Type (Industrial, Desktop), Technology (FDM, SLS, SLA, EBM), Printing Material (Metal, Polymer, Ceramics), End User (Industrial End User, 3D Printing Service Providers) and Geography—Global Forecasts to 2029

Report ID: MRSE - 104541 Pages: 200 Jul-2022 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportManufacturers’ rising need to produce complex parts, reduce manufacturing expenses, and minimize waste, and improvement in product development and supply chain are factors driving the growth of this market. Additionally, growing use of 3D printers to produce functional end-use parts and composite 3D printing offer lucrative opportunities for the growth of this market. Some of the major trends that may support the growth of this market are on-demand spare parts production, increased customized products, and the use of AI in 3D printing.

The COVID-19 pandemic emerged towards the end of December 2019 in Wuhan, China. By March 2020, it had already spread worldwide, resulting in huge casualties and heavy economic losses. The pandemic severely impacted several sectors, including the industrial sector, with major manufacturers either shutting down their operations completely or operating at reduced capacities following the directives issued by their respective governments. Uncertainty regarding the duration of the lockdown and supply-chain disruptions made it more difficult for industry players to anticipate the recovery. This crisis caused structural shifts that had significant implications on the market.

The outbreak of the COVID-19 pandemic in 2020 resulted in a mixed impact on the usage of 3D printers across different applications. The 3D printer market was highly affected in terms of professional 3D printing and enterprise 3D printing, including several industrial manufacturers and verticals such as aerospace, automotive, energy, power, and semiconductor and electronics.

However, some of the industries, including research & development and medical, flourished during the period as these industries were able to boost their production using 3D printers to meet the emergency demand. On the other hand, low-cost 3D printers for designers, hobbyists, and desktop printers recorded higher sales than in 2019.

In addition, since numerous executives shifted to a work-from-home model, setting up a desktop 3D printer was easier and more convenient to conduct research operations. Also, there were several instances where hobbyists helped print PPE kits and masks to help the local community. Although the manufacturing of 3D printers was slowed down during the first three months of the pandemic, it caused a widespread economic breakdown across several countries, trade routes, and global supply chains.

Major end-use industries of 3D printers, such as manufacturing, aerospace, defense, electronics, and consumer goods, were severely affected due to disruptions in the supply chain. However, numerous companies took this as an opportunity and utilized 3D printing service providers to print spare parts, fixtures, joints, and jigs at or near the actual site, which helped these companies reduce the cost of transportation, import, and other taxes.

Click here to: Get Free Sample Pages of this Report

3D printing methods create parts by adding material layer by layer, enabling engineers and designers to produce parts with geometric complexities and in a single piece which is impossible for traditional methods to produce. Such geometries include hollow cavities within solid parts and parts within parts. 3D printing allows the inclusion of multiple materials into a single object, enabling an array of colors, textures, and mechanical properties to be mixed and matched.

Also, the production of parts only requires the materials needed for the part itself, with little or no wastage compared to alternative methods that are cut from large chunks of non-recyclable materials, thus resulting in high costs and waste. This process eliminates the wastage of resources and also reduces the cost of the materials being used. For instance, a respirator manufacturer that used injection molding to produce tubes for ventilation products previously used additive manufacturing to print tubes. 3D printing tubes with particular geometries were found to be not only cheaper but faster as well. Using an Origin 3D printer in combination with Henkel LOCTITE silicone resin, the company cut production costs by approximately ten times.

Additionally, the U.S. Air Force in 2019 used 3D printing to cut down turnaround time and cost of manufacturing spare parts. Many of the planes were out of production, and spare part delivery could have taken more than a year. With 3D printing, the acquisition time for these parts was reduced from a year to two days. As this technology reduces the amount of material wastage, this process is inherently environmentally friendly.

However, the environmental benefits are extended when factors such as improved fuel efficiency from using lightweight 3D printed parts are considered. 3D printing creates parts from scratch, and less material is wasted when manufacturing a complex geometry, resulting in lower production costs.

The desktop 3D printers segment is projected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the rising adoption of compact and advanced desktop printers after the emergence of the COVID-19 pandemic. Several 3D printing enthusiasts, hobbyists, and small manufacturers have utilized desktop 3D printers, contributing to the high market growth of this segment.

The electron-beam melting (EBM) segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to its advanced 3D printing method to produce low-cost and efficient metal parts for high-end prototyping and small series production. EBM is used for precisely cutting or boring metals to allow for a better surface finish.

The resins segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is due to the potential to offer highly detailed prototypes requiring tight tolerances and smooth surfaces, such as molds, patterns, and functional parts. Moreover, compared to other 3D printing materials, resins offer limited flexibility and strength.

The 3D printing service provider segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is mainly attributed to the reduction in manufacturing cost and process downtime. 3D printing service providers fit into two main categories - application-agnostic service providers and application-specific service providers. The first are firms with deep knowledge of different 3D printing technology types. They provide services to a variety of adopting industries.

Asia-Pacific is expected to witness the fastest growth during the forecast period. The high market growth rate of this region is attributed to the rapid developments in the manufacturing sector in Asia-Pacific with growing interests in new technologies for efficient production. Additionally, increased digitization has fueled the growth and adoption of 3D printers for end-use industries such as consumer goods, construction, medical, electronics and semiconductor, and research and education.

Countries such as China, India, Japan, Malaysia, South Korea, Thailand, and Singapore are some of the largest economies in this region and have huge potential for the 3D printers market due to the rapid increase in industrialization. China is among the leading nations with high production capacities of 3D printers and higher usage as well. The COVID-19 pandemic resulted in the higher adoption of 3D printers in the medical industry, which accelerated the utilization of 3D printers in the region.

The key players profiled in the 3D printers market are 3D Systems Corporation (U.S.), GE Additive (U.S.), DMG Mori Company Limited (Japan), Renishaw plc (U.K), TRUMPF GmbH & CO. KG (Germany), HP Inc. (U.S.), XYZprinting, Inc. (U.S.), Carbon, Inc. (U.S.), Stratasys Ltd. (Israel), Formlabs Inc. (U.S.), Markforged Holding Corporation (U.S.), Voxeljet AG (Germany), Desktop Metal, Inc. (U.S.), Fusion3 design LLC (U.S.), DWS s.r.l (Italy), and EOS GmbH (Germany).

Key Questions Answered in the Report:

The 3D printers market report covers the market size & forecasts for the 3D printers by type, technology, printing material, end user, and geography. The 3D printers market study in this report involves the value analysis of various segments and subsegments of the 3D printers market at regional and country levels.

The 3D printers market is projected to reach a value of $ 50.39 billion by 2029, at a CAGR of 31.1% during the forecast period.

Based on the type, the industrial 3D printers segment is expected to account for the largest share of the 3D printers market in 2022.

Based on end user, the 3D printing service provider segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is mainly attributed to the reduction in manufacturing cost and process downtime. 3D printing service providers fit into two main categories - application-agnostic service providers and application-specific service providers. The first are firms with deep knowledge of different 3D printing technology types. They provide services to a variety of adopting industries.

Manufacturers’ rising need to produce complex parts, reduce manufacturing expenses, and minimize waste, and improvement in product development and supply chain are factors driving the growth of this market. Additionally, growing use of 3D printers to produce functional end-use parts and composite 3D printing offer lucrative opportunities for the growth of this market. Some of the major trends that may support the growth of this market are on-demand spare parts production, increased customized products, and the use of AI in 3D printing.

The key players profiled in the 3D printers market are 3D Systems Corporation (U.S.), GE Additive (U.S.), DMG Mori Company Limited (Japan), Renishaw plc (U.K), TRUMPF GmbH & CO. KG (Germany), HP Inc. (U.S.), XYZprinting, Inc. (U.S.), Carbon, Inc. (U.S.), Stratasys Ltd. (Israel), Formlabs Inc. (U.S.), Markforged Holding Corporation (U.S.), Voxeljet AG (Germany), Desktop Metal, Inc. (U.S.), Fusion3 design LLC (U.S.), DWS S.r.l (Italy), and EOS GmbH (Germany).

Emerging countries from Asia-Pacific are projected to offer significant growth opportunities for vendors in this market due to rapid development in the manufacturing sector in the region with growing interests in new technologies for efficient production.

Published Date: Oct-2024

Published Date: May-2023

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates