Resources

About Us

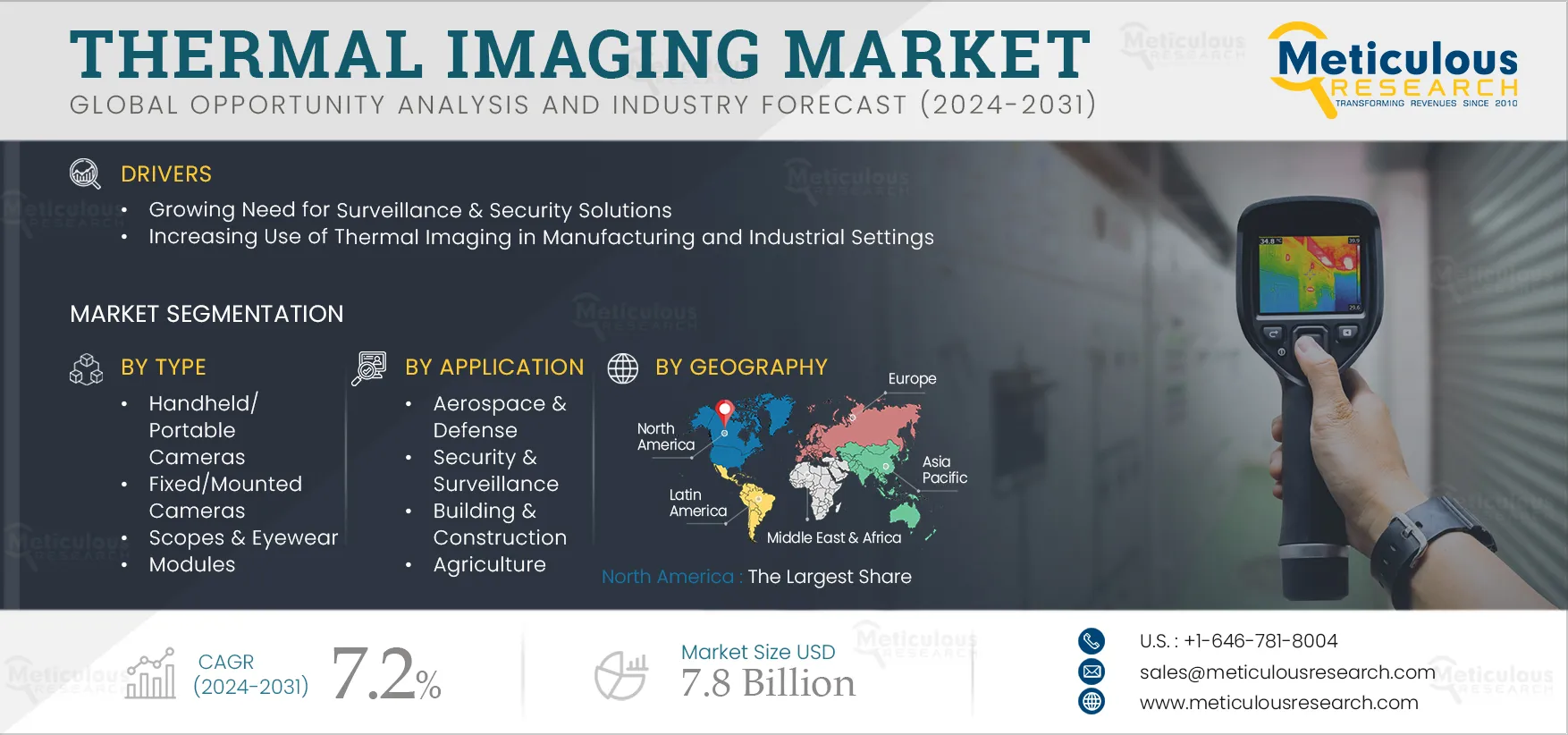

Thermal Imaging Market by Type (Handheld Cameras, Fixed Cameras, Scopes, Modules), Technology (Cooled, Uncooled), Wavelength (SWIR, MWIR, LWIR), Application (Security & Surveillance) - Global Forecast to 2032

Report ID: MRSE - 1041295 Pages: 240 Aug-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Thermal Imaging Market is expected to reach $7.8 billion by 2032, at a CAGR of 7.2% from 2025 to 2032. This market's growth is attributed to several factors, such as the increasing need for surveillance & security solutions and the increased use of thermal imaging in manufacturing & industrial settings. Furthermore, the surge in demand for thermal imaging in healthcare, increased military and defense spending on advanced surveillance technologies, and the rise of unmanned aerial vehicles (UAVs) are driving market growth. The availability of alternative imaging technologies, such as visible light cameras and radar systems, may limit the growth of this market.

However, the high cost of thermal imaging devices is a major challenge for the players operating in this market.

The increasing cases of theft, vandalism, and break-ins have amplified the need for robust surveillance & security solutions across various sectors, including residential, commercial, and industrial. Surveillance & security solutions act as a strong deterrent in keeping away such incidents. Installing surveillance solutions, such as cameras at home and office premises, prevents unauthorized entries. Thermal imaging is a compact method of identifying, measuring, and visualizing heat patterns, particularly in environments with little light or complete darkness. This ability allows the detection of intruders or suspicious activities, thereby offering continuous monitoring and helping reduce the chances of security breaches. It is mostly used in border security (monitor & detect illegal crossings), in critical infrastructure (safeguard sensitive areas), and in public events or large crowds (monitoring to ensure safety).

Companies in the market are emphasizing the importance of providing reliable and enhanced aerial imaging and surveillance systems to deliver comprehensive solutions.

For instance, in January 2025, Inspired Flight Technologies, Inc. (IFT) (U.S.) partnered with Gremsy (Vietnam) to launch a new thermal imaging payload for the IF800 Tomcat drone with enhanced capabilities in aerial imaging & surveillance. The partnership aims to deliver a comprehensive and powerful drone system that combines the strengths of IFT’s unmanned aerial vehicle (UAV) and the precision of Gremsy’s imaging payload.

In May 2024, 3S System Technology Inc. (Taiwan) launched a series of thermal IP cameras that deploy a unique thermal imaging detection technology with designed security mechanism enhancements. All such developments, along with the increasing need for enhanced security and the growing adoption of thermal imaging technology in surveillance and security applications, contribute to the market’s growth.

Click here to: Get Free Sample Pages of this Report

Industries face numerous challenges, such as equipment malfunctions, overheating, energy inefficiencies, and safety hazards, which can lead to costly downtime, reduced productivity, and potential accidents. Traditional inspection methods often fail to detect early signs of these issues, necessitating the adoption of advanced and effective inspection solutions. Thermal imaging cameras for industrial applications are powerful and non-invasive tools that help detect heat anomalies and temperature variations in electrical & mechanical installations and components. In manufacturing & industrial settings, thermal imaging is widely used for predictive maintenance, where it assists in monitoring the condition of machinery and electrical systems. This thermal image provides a temperature map of the area being visualized and highlights hotspots and heat anomalies that warrant further investigation. Hence, this proactive approach allows for timely maintenance and repairs, thereby minimizing downtime.

Companies in the market are focusing on thermal imaging technology to meet the growing need for efficient and reliable monitoring, inspection, and safety in industrial processes. For instance, in June 2024, AMETEK Land (U.K.) (Land Instruments International Limited) launched a new mid-wavelength thermal imager, the MWIR-640 390, to meet the demand for improved product quality and efficiency in industrial processes. Such developments, coupled with the increasing need for improved operational efficiency and reduced maintenance costs in manufacturing & industrial processes, are further boosting the market growth.

Traditional diagnostic methods involve invasive procedures and exposure to radiation that require significant time to produce results. Thermal imaging addresses these challenges by providing a safe, rapid, and efficient way to detect and monitor various medical conditions. Thermal imaging in the healthcare sector helps measure the infrared radiation emitted from the body to produce thermal images with corresponding temperature calculations. The process is non-invasive, so there is no pain or radiation. Thermal imaging systems are highly accurate tools to assist in diagnostics, including temperature scans (for instance, during the COVID-19 pandemic), breast imaging (cancer), and disease monitoring. It can be used on all types of inflammation that are close to the skin to be detected by a thermal sensor, such as in particular inflammatory arthritis or arthrosis. It allows the detection of muscle lesions such as contractions, tears, or strains. Thermal imaging, through its performance in terms of the detection of circulatory and metabolic problems, operates naturally in the detection of diabetes mellitus and especially the diabetic foot.

Furthermore, thermal imaging is used in veterinary medicine to diagnose injuries and illnesses in animals without causing stress or discomfort. Companies in the thermal imaging market are actively investing in R&D to enhance the capabilities and applications of thermal imaging in healthcare.

In September 2024, USATherm (U.S.) announced that the FDA granted a 510(k) for their 2nd generation thermal imaging device, ThermPix™. It provides high-resolution, real-time thermal images of the human body by utilizing state-of-the-art thermal imaging technology. The first installation of NIRAMAI Health Analytix (India)'s AI-based (artificial intelligence) Thermalytix, an automated breast health screening and diagnostic tool that blends thermal imaging with AI, was made possible in September 2022. Such advancements, in addition to growing technological developments aimed at enhancing resolution & accuracy, regulatory support for medical applications, and the increased significance of fever screening as a result of the COVID-19 pandemic, are generating growth opportunities for players in the market.

Unmanned Aerial Vehicles (UAVs), commonly known as drones, are aircraft that fly autonomously, under remote control, or both and can carry a variety of payloads, including thermal imaging cameras. The integration of thermal imaging technology with UAVs improves their functioning by allowing operators to notice temperature fluctuations and heat signatures that are invisible to the naked eye. It captures precise thermal photos of surrounding objects and environments, allowing it to detect even slight temperature differences with great precision. In agriculture, UAVs equipped with thermal cameras are used to monitor crop health, detect water stress, and locate pest infestations. Its purpose is to monitor borders and perimeters in real-time. It aids in the search and rescue of missing people in difficult terrain and adverse situations.

Companies are increasingly employing thermal imaging in UAVs to increase operational efficiency, safety, and precision. Major industry competitors are using thermal imaging technology to improve UAV capabilities for challenging and crucial missions. In April 2025, Red Cat Holdings, Inc. (U.S.) partnered with Sentien Robotics (U.S.) to deploy Teal Drones, a small unmanned system with high-resolution thermal imaging, as part of an autonomous drone swarming strategy for land, air, and sea defense and security operations. Such improvements, with the increasing advances in UAV technology, increased affordability of thermal imaging cameras, and the increasing requirement for enhanced monitoring and inspection solutions across many sectors, support the market's growth.

Based on type, the thermal imaging market is broadly segmented into handheld/portable cameras, fixed/mounted cameras, scopes & eyewear, and modules. In 2025, the handheld/portable cameras segment is expected to account for the largest share of over 55.0% of the thermal imaging market. This segment's large market share can be attributed to its ease of use and portability, as well as its growing use in a variety of industries such as electrical inspections, HVAC maintenance, building diagnostics, and emergency response, and the growing use of handheld/portable cameras for field inspection, maintenance, and emergency & rescue missions.

However, the fixed/mounted cameras segment is expected to register the highest CAGR during the forecast period. This growth is driven by its ability to provide continuous, high-precision, real-time monitoring of critical infrastructure without the need for manual intervention, its ability to withstand harsh environmental conditions, and the growing demand for fixed thermal cameras for integration with automated security and monitoring systems.

Based on technology, the thermal imaging market is broadly segmented into cooled thermal imaging and uncooled thermal imaging. In 2025, the cooled thermal imaging segment is expected to account for a larger share of over 64.0% of the thermal imaging market. This segment's large market share is attributed to its sensitivity, high level of accuracy, long-range detection, and image resolution, which allows for the detection of minute temperature differences and the capture of detailed thermal images, as well as the growing use of cooled thermal imaging for extreme environmental conditions such as high-temperature industrial environments or cold regions.

However, the uncooled thermal imaging segment is expected to register the highest CAGR during the forecast period. This growth is driven due to its features, including cost-effectiveness, compact and lightweight design, ease in maintenance and reduced operational costs, and growing demand for uncooled thermal imagers for applications, including building diagnostics, HVAC inspections, automotive safety, wildlife monitoring, emergency response, law enforcement, and temporary monitoring needs in various scenarios.

Based on wavelength, the thermal imaging market is broadly segmented into shortwave infrared (SWIR), mid-wave infrared (MWIR), and longwave infrared (LWIR). In 2025, the LWIR segment is expected to account for the largest share of over 49.0% of the thermal imaging market. This segment's significant market share can be attributed to the growing use of LWIR cameras in security and surveillance, advanced driver assistance systems (ADAS), environmental monitoring, the growing need to detect thermal radiation emitted by objects across various industries for building inspections and energy audits, and its ability to provide non-contact temperature measurement for monitoring high-temperature processes and equipment, and its cost-effectiveness.

However, the SWIR segment is expected to register the highest CAGR during the forecast period. This expansion is being driven by increased visual contrast and detail, as well as an enhanced ability to maintain clear vision in challenging environmental conditions such as smoke, fog, and haze. This is particularly beneficial for applications such as search and rescue, firefighting, and military operations, and there is an increasing need for SWIR technology in medical diagnostics for non-invasive imaging.

Based on application, the thermal imaging market is segmented into aerospace & defense, security & surveillance, building & construction, personal vision systems, healthcare & medical diagnostics, energy & utilities, agriculture, research & development, search & rescue operations, marine systems, and other applications. In 2025, the security & surveillance segment is expected to account for the largest share of over 41.0% of the thermal imaging market. This segment's large market share can be attributed to the growing security threats and criminal activities, the increasing need for enhanced surveillance capabilities, including visibility in low-light and obscured conditions for effective monitoring and threat detection, the increasing use of thermal imaging to improve perimeter security for securing sensitive facilities, military bases, and high-profile events, and the growing integration of thermal cameras into smart systems.

However, the healthcare & medical diagnostics segment is expected to register the highest CAGR during the forecast period. This growth is being driven by the increasing use of thermal imaging for fever screening in public places, the growing demand for using thermal imaging to monitor chronic conditions like diabetes, foot ulcers, and arthritis, and the growing use of thermal imaging in veterinary medicine to diagnose and track health issues in animals. Thermal imaging technology is becoming more and more popular due to its non-invasive nature and ability to identify abnormal heat patterns associated with conditions like inflammation, vascular disorders, and breast cancer.

Based on geography, the global thermal imaging market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of over 36.0% of the thermal imaging market. The substantial market share held by North America can be attributed to a number of important factors, such as the growing concerns about public safety, crime, and terrorism; the growing use of thermal imaging in large-scale surveillance applications, such as border control or citywide monitoring; the high investments made in advanced technologies for military and defense applications; and the growing emphasis on developing medical tools for non-invasive diagnostics and early disease detection.

Moreover, the market in Asia-Pacific is estimated to register the highest CAGR of over 8.5% during the forecast period. Growing security concerns, rising investments in border security, public safety, and surveillance systems, the region's expanding industrial sector and applications that fuel the need for thermal imaging to monitor equipment, improve safety, and carry out preventive maintenance, as well as the region's expanding healthcare infrastructure and emphasis on improving medical diagnostics, are all factors contributing to the growth of this regional market.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the thermal imaging market are Teledyne FLIR LLC (U.S.) (a subsidiary of Teledyne Technologies Incorporated (U.S.)), Fluke Corporation (U.S.), L3Harris Technologies, Inc. (U.S.), Leonardo S.p.A. (Italy), Axis Communications AB (Sweden), BAE Systems plc (U.K.), RTX Corporation (U.S.), Lockheed Martin Corporation (U.S.), Testo SE & Co. KGaA (Germany), Thales Group (France), Seek Thermal, Inc. (U.S.), Exosens (France), Honeywell International Inc. (U.S.), Trijicon, Inc. (U.S.), Cantronic Systems, Inc. (U.S.), Safran Group (France), Zhejiang Dali Technology Co., Ltd. (China), HT Italia S.r.l. (Italy), Thermoteknix Systems Ltd. (U.K.), and Bullard (U.S.).

|

Particulars |

Details |

|

Number of Pages |

240 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

7.2% |

|

Market Size (Value) |

$7.8 Billion by 2032 |

|

Segments Covered |

By Type

By Technology

By Wavelength

By Application

|

|

Countries Covered |

Europe (Germany, U.K., Italy, France, Spain, Russia, Netherlands, and Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Thailand, Singapore, and Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Argentina, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa) |

|

Key Companies |

Teledyne FLIR LLC (U.S.) (a subsidiary of Teledyne Technologies Incorporated (U.S.)), Fluke Corporation (U.S.), L3Harris Technologies, Inc. (U.S.), Leonardo S.p.A. (Italy), Axis Communications AB (Sweden), BAE Systems plc (U.K.), RTX Corporation (U.S.), Lockheed Martin Corporation (U.S.), Testo SE & Co. KGaA (Germany), Thales Group (France), Seek Thermal, Inc. (U.S.), Exosens (France), Honeywell International Inc. (U.S.), Trijicon, Inc. (U.S.), Cantronic Systems, Inc. (U.S.), Safran Group (France), Zhejiang Dali Technology Co., Ltd. (China), HT Italia S.r.l. (Italy), Thermoteknix Systems Ltd. (U.K.), and Bullard (U.S.) |

The market study focuses on the market assessment and opportunity analysis through the sales of various thermal imaging across different regions and countries across different market segmentations; this study is also focused on competitive analysis for thermal imaging technology based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global thermal imaging market is expected to reach $7.8 billion by 2032, at a CAGR of 7.2% during the forecast period.

In 2025, the handheld/portable cameras segment is expected to account for the largest share of over 55.0% of the thermal imaging market. The large market share of this segment can be attributed to its ease of use and portability, increasing use across multiple industries, including electrical inspections, HVAC maintenance, building diagnostics, and emergency response, growing use of handheld/portable cameras for field inspection, and maintenance, and emergency & rescue operations

The healthcare & medical diagnostics segment is projected to witness the highest growth rate during the forecast period of 2025–2032. This growth is driven by the growing demand for thermal imaging technology due to its non-invasive nature for early detection of diseases by identifying abnormal heat patterns associated with conditions such as breast cancer, vascular disorders, and inflammation, increasing use of thermal imaging for fever screening in public spaces, growing demand for monitoring chronic conditions including arthritis and diabetic foot ulcers with thermal imaging technology, and increasing use of thermal imaging in veterinary medicine to diagnose and monitor health conditions in animals.

The growth of this market can be attributed to several factors, including the growing need for surveillance & security solutions and the increasing use of thermal imaging in manufacturing and industrial settings. Additionally, the increasing demand for thermal imaging in healthcare, growing military & defense expenditure in advanced surveillance technologies, and rising unmanned aerial vehicles (UAVs) are expected to create market growth opportunities.

The key players operating in the thermal imaging market are Teledyne FLIR LLC (U.S.) (a subsidiary of Teledyne Technologies Incorporated (U.S.)), Fluke Corporation (U.S.), L3Harris Technologies, Inc. (U.S.), Leonardo S.p.A. (Italy), Axis Communications AB (Sweden), BAE Systems plc (U.K.), RTX Corporation (U.S.), Lockheed Martin Corporation (U.S.), Testo SE & Co. KGaA (Germany), Thales Group (France), Seek Thermal, Inc. (U.S.), Exosens (France), Honeywell International Inc. (U.S.), Trijicon, Inc. (U.S.), Cantronic Systems, Inc. (U.S.), Safran Group (France), Zhejiang Dali Technology Co., Ltd. (China), HT Italia S.r.l. (Italy), Thermoteknix Systems Ltd. (U.K.), and Bullard (U.S.).

Asia-Pacific region will offer significant growth opportunities for the vendors in the thermal imaging market during the analysis period due to rapid industrialization, increasing military & defense expenditures, expanding healthcare infrastructure, and the proliferation of smart city initiatives, particularly in emerging economies such as China, Japan, South Korea, and India.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Market Analysis, by Type

3.3. Market Analysis, by Technology

3.4. Market Analysis, by Wavelength

3.5. Market Analysis, by Application

3.7. Market Analysis, by Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Need for Surveillance & Security Solutions

4.2.1.2. Increasing Use of Thermal Imaging in Manufacturing and Industrial Settings

4.2.2. Restraints

4.2.2.1. Availability of Alternative Imaging Technologies such as Visible Light Cameras & Radar Systems

4.2.3. Opportunities

4.2.3.1. Increasing Demand for Thermal Imaging in Healthcare

4.2.3.2. Growing Military & Defense Expenditure in Advanced Surveillance Technologies

4.2.3.3. Rising Unmanned Aerial Vehicles (UAVs)

4.2.4. Challenges

4.2.4.1. High Cost of Thermal Imaging Devices

5. Global Thermal Imaging Market Assessment—by Type

5.1. Overview

5.2. Handheld/Portable Cameras

5.3. Fixed/Mounted Cameras

5.4. Scopes & Eyewear

5.5. Modules

6. Global Thermal Imaging Market Assessment—by Technology

6.1. Overview

6.2. Cooled Thermal Imaging

6.3. Uncooled Thermal Imaging

7. Global Thermal Imaging Market Assessment—by Wavelength

7.1. Overview

7.2. Shortwave Infrared (SWIR)

7.3. Mid-wave Infrared (MWIR)

7.4. Longwave Infrared (LWIR)

8. Global Thermal Imaging Market Assessment—by Application

8.1. Overview

8.2. Aerospace & Defense

8.2.1. Space Exploration Thermal Mapping

8.2.2. Military Targeting Systems

8.2.3. Counter-Unmanned Aircraft Systems (C-UAS)

8.4. Security & Surveillance

8.4.1. Border & Building Security

8.4.2. Perimeter Surveillance

8.4.3. Public Event Monitoring

8.5. Building & Construction

8.5.1. Monitoring & Inspection

8.5.2. Mechanical & Electrical Inspections

8.6. Personal Vision Systems

8.6.1. Night Vision

8.6.2. Security Patrols

8.7. Healthcare & Medical Diagnostics

8.7.1. Cancer Detection

8.7.2. Veterinary Diagnostics

8.7.3. Fever Detection

8.8. Energy & Utilities

8.8.1. Power Line Monitoring

8.8.2. Solar Panel Inspection

8.8.3. Pipeline Leak Detection

8.9. Agriculture

8.9.1. Pest Detection

8.9.2. Irrigation Management

8.10. Research & Development

8.10.1. Material Testing

8.10.2. Electronic Component Testing

8.10.3. Scientific Research

8.11. Search & Rescue Operations

8.11.1. Fire Fighting

8.11.2. Rescue & Reconnaissance

8.12. Marine Systems

8.12.1. Maritime & Coastal Surveillance

8.12.2. Maritime Navigation & Collision Avoidance

8.12.3. Fishing & Wildlife Observation

8.13. Other Applications

9. Thermal Imaging Market Assessment—By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Russia

9.3.7. Netherlands

9.3.8. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Thailand

9.4.6. Singapore

9.4.7. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Saudi Arabia

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa

10. Global Thermal Imaging Market Assessment—Competitive Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Recent Developments)

11.1. Teledyne FLIR LLC

11.2. Fluke Corporation

11.3. L3Harris Technologies, Inc.

11.4. Leonardo S.p.A.

11.5. Axis Communications AB

11.6. BAE Systems plc

11.7. RTX Corporation

11.8. Lockheed Martin Corporation

11.9. Testo SE & Co. KGaA

11.10. Thales Group

11.11. Seek Thermal, Inc.

11.12. Exosens

11.13. Honeywell International Inc.

11.14. Trijicon, Inc.

11.15. Cantronic Systems, Inc.

11.16. Safran Group

11.17. Zhejiang Dali Technology Co., Ltd.

11.18. HT Italia S.r.l.

11.19. Thermoteknix Systems Ltd.

11.20. Bullard

Note: SWOT Analysis of the Top 5 Companies will be Provided

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Currency Conversion Rate (2019–2024)

Table 2 Global Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 3 Global Handheld/Portable Cameras Market, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Fixed/Mounted Cameras Market, by Country/Region, 2022–2032 (USD Million)

Table 5 Global Thermal Imaging Scopes & Eyewear Market, by Country/Region, 2022–2032 (USD Million)

Table 6 Global Thermal Imaging Modules Market, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 8 Global Cooled Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Uncooled Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 10 Global Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 11 Global Shortwave Infrared Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Mid-wave Infrared Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Longwave Infrared Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 15 Global Thermal Imaging Market for Aerospace & Defense, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Thermal Imaging Market for Aerospace & Defense, by Application, 2022–2032 (USD Million)

Table 17 Global Thermal Imaging Market for Security & Surveillance, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Thermal Imaging Market for Security & Surveillance, by Application, 2022–2032 (USD Million)

Table 19 Global Thermal Imaging Market for Building & Construction, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Thermal Imaging Market for Building & Construction, by Application, 2022–2032 (USD Million)

Table 21 Global Thermal Imaging Market for Personal Vision Systems, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Thermal Imaging Market for Personal Vision Systems, by Application, 2022–2032 (USD Million)

Table 23 Global Thermal Imaging Market for Healthcare & Medical Diagnostics, by Country/Region, 2022–2032 (USD Million)

Table 24 Global Thermal Imaging Market for Healthcare & Medical Diagnostics, by Application, 2022–2032 (USD Million)

Table 25 Global Thermal Imaging Market for Energy & Utilities, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Thermal Imaging Market for Energy & Utilities, by Application, 2022–2032 (USD Million)

Table 27 Global Thermal Imaging Market for Agriculture, by Country/Region, 2022–2032 (USD Million)

Table 28 Global Thermal Imaging Market for Agriculture, by Application, 2022–2032 (USD Million)

Table 29 Global Thermal Imaging Market for Research & Development, by Country/Region, 2022–2032 (USD Million)

Table 30 Global Thermal Imaging Market for Research & Development, by Application, 2022–2032 (USD Million)

Table 31 Global Thermal Imaging Market for Search & Rescue Operations, by Country/Region, 2022–2032 (USD Million)

Table 32 Global Thermal Imaging Market for Search & Rescue Operations, by Application, 2022–2032 (USD Million)

Table 33 Global Thermal Imaging Market for Marine Systems, by Country/Region, 2022–2032 (USD Million)

Table 34 Global Thermal Imaging Market for Marine Systems, by Application, 2022–2032 (USD Million)

Table 35 Global Thermal Imaging Market for Other Applications, by Country/Region, 2022–2032 (USD Million)

Table 36 Global Thermal Imaging Market for Other Applications, by Application, 2022–2032 (USD Million)

Table 37 Global Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 38 North America: Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 39 North America: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 40 North America: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 41 North America: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 42 North America: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 43 U.S.: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 44 U.S.: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 45 U.S.: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 46 U.S.: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 47 Canada: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 48 Canada: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 49 Canada: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 50 Canada: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 51 Europe: Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 52 Europe: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 53 Europe: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 54 Europe: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 55 Europe: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 56 Germany: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 57 Germany: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 58 Germany: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 59 Germany: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 60 U.K.: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 61 U.K.: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 62 U.K.: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 63 U.K.: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 64 France: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 65 France: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 66 France: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 67 France: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 68 Italy: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 69 Italy: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 70 Italy: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 71 Italy: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 72 Spain: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 73 Spain: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 74 Spain: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 75 Spain: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 76 Russia: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 77 Russia: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 78 Russia: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 79 Russia: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 80 Netherlands: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 81 Netherlands: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 82 Netherlands: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 83 Netherlands: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 84 Rest of Europe: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 85 Rest of Europe: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 86 Rest of Europe: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 87 Rest of Europe: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 88 Asia-Pacific: Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 89 Asia-Pacific: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 90 Asia-Pacific: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 91 Asia-Pacific: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 92 Asia-Pacific: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 93 China: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 94 China: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 95 China: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 96 China: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 97 Japan: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 98 Japan: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 99 Japan: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 100 Japan: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 101 India: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 102 India: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 103 India: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 104 India: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 105 South Korea: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 106 South Korea: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 107 South Korea: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 108 South Korea: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 109 Thailand: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 110 Thailand: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 111 Thailand: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 112 Thailand: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 113 Singapore: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 114 Singapore: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 115 Singapore: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 116 Singapore: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 117 Rest of Asia-Pacific: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 118 Rest of Asia-Pacific: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 119 Rest of Asia-Pacific: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 120 Rest of Asia-Pacific: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 121 Latin America: Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 122 Latin America: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 123 Latin America: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 124 Latin America: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 125 Latin America: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 126 Brazil: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 127 Brazil: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 128 Brazil: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 129 Brazil: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 130 Mexico: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 131 Mexico: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 132 Mexico: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 133 Mexico: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 134 Argentina: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 135 Argentina: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 136 Argentina: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 137 Argentina: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 138 Rest of Latin America: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 139 Rest of Latin America: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 140 Rest of Latin America: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 141 Rest of Latin America: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 142 Middle East & Africa: Thermal Imaging Market, by Country/Region, 2022–2032 (USD Million)

Table 143 Middle East & Africa: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 144 Middle East & Africa: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 145 Middle East & Africa: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 146 Middle East & Africa: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 147 UAE: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 148 UAE: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 149 UAE: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 150 UAE: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 151 Saudi Arabia: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 152 Saudi Arabia: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 153 Saudi Arabia: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 154 Saudi Arabia: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 155 South Africa: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 156 South Africa: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 157 South Africa: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 158 South Africa: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 159 Rest of Middle East & Africa: Thermal Imaging Market, by Type, 2022–2032 (USD Million)

Table 160 Rest of Middle East & Africa: Thermal Imaging Market, by Technology, 2022–2032 (USD Million)

Table 161 Rest of Middle East & Africa: Thermal Imaging Market, by Wavelength, 2022–2032 (USD Million)

Table 162 Rest of Middle East & Africa: Thermal Imaging Market, by Application, 2022–2032 (USD Million)

Table 163 Recent Developments By Major Market Players (2021–2025)

List of Figures

Figure 1 Currency and Limitations

Figure 2 Research Process

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Key Insights

Figure 8 Thermal Imaging Market, by Type, 2025 vs. 2032 (USD Million)

Figure 9 Thermal Imaging Market, by Technology, 2025 vs. 2032 (USD Million)

Figure 10 Thermal Imaging Market, by Wavelength, 2025 vs. 2032 (USD Million)

Figure 11 Thermal Imaging Market, by Application, 2025 vs. 2032 (USD Million)

Figure 12 Geographic Snapshot: Global Thermal Imaging Market

Figure 13 Impact Analysis of Market Dynamics

Figure 14 Thermal Imaging Market, by Type, 2025 vs. 2032 (USD Million)

Figure 15 Thermal Imaging Market, by Technology, 2025 vs. 2032 (USD Million)

Figure 16 Thermal Imaging Market, by Wavelength, 2025 vs. 2032 (USD Million)

Figure 17 Thermal Imaging Market, by Application, 2025 vs. 2032 (USD Million)

Figure 18 Global Thermal Imaging Market, by Region, 2025 vs. 2032 (USD Million)

Figure 19 North America: Thermal Imaging Market Snapshot

Figure 20 Europe: Thermal Imaging Market Snapshot

Figure 21 Asia-Pacific: Thermal Imaging Market Snapshot

Figure 22 Latin America: Thermal Imaging Market Snapshot

Figure 23 Middle East & Africa: Thermal Imaging Market Snapshot

Figure 24 Growth Strategies Adopted by Leading Market Players (2021–2025)

Figure 25 Competitive Benchmarking Analysis (2021–2025)

Figure 26 Competitive Dashboard: Thermal Imaging Market

Figure 27 Teledyne FLIR LLC: Financial Overview (2024)

Figure 28 Fluke Corporation: Financial Overview (2024)

Figure 29 L3Harris Technologies, Inc.: Financial Overview (2024)

Figure 30 Leonardo S.p.A.: Financial Overview (2024)

Figure 31 BAE Systems plc: Financial Overview (2024)

Figure 32 RTX Corporation: Financial Overview (2024)

Figure 33 Lockheed Martin Corporation: Financial Overview (2024)

Figure 34 Thales Group: Financial Overview (2024)

Figure 35 Honeywell International Inc.: Financial Overview (2024)

Figure 36 Safran Group: Financial Overview (2024)

Published Date: Apr-2023

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates