Resources

About Us

Instant Water Heater Market Size, Share & Forecast 2025-2035 | Growth Analysis by Product Type, Application Type, Power Source, End-Use Sector & Geography

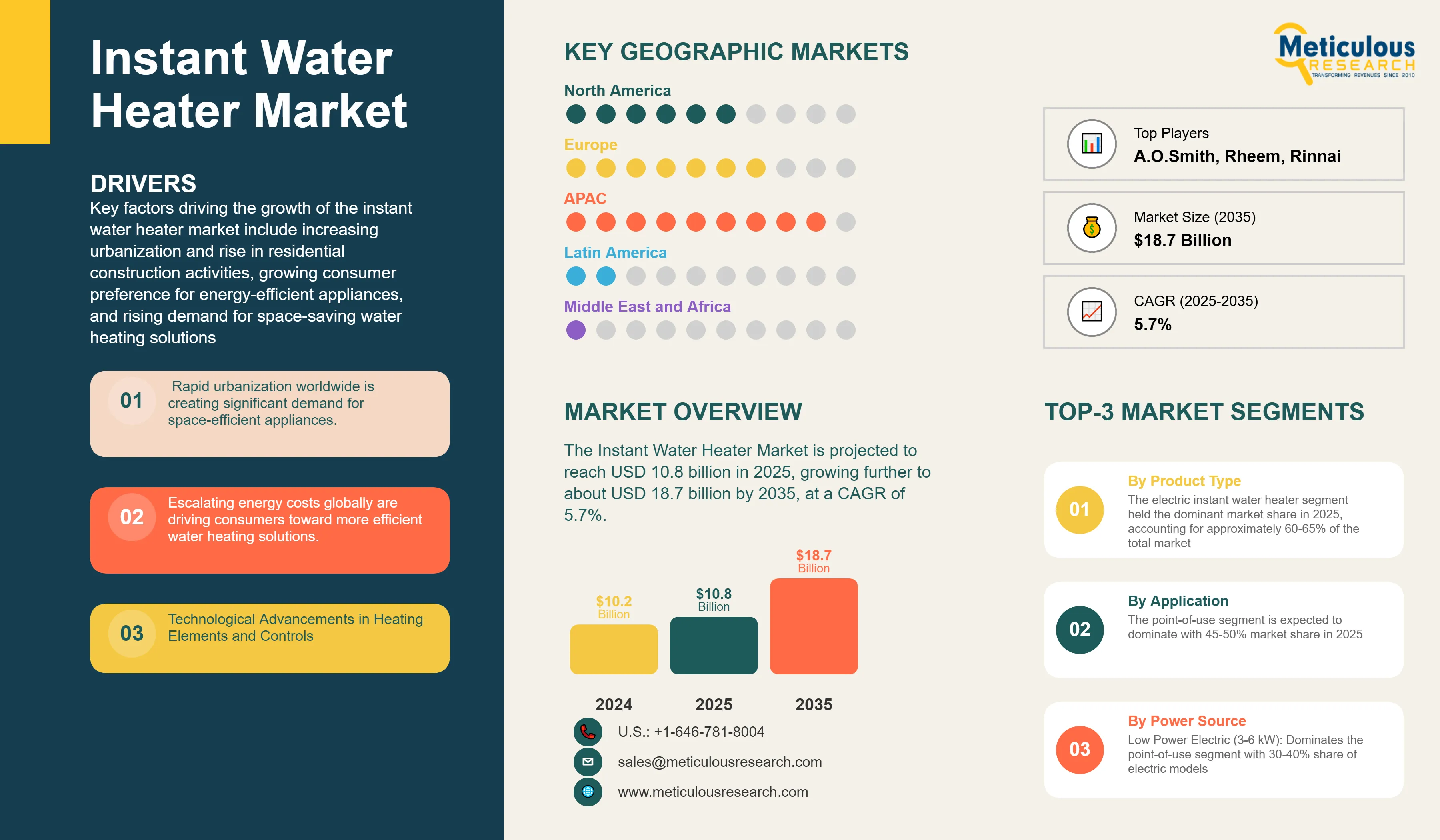

Report ID: MREP - 1041522 Pages: 170 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the instant water heater market include increasing urbanization and rise in residential construction activities, growing consumer preference for energy-efficient appliances, rising demand for space-saving water heating solutions, government initiatives promoting energy conservation and green building standards, technological advancements in heating elements and smart connectivity features, and increasing disposable income in emerging economies. However, this growth is restrained by high initial installation costs compared to storage water heaters, electrical infrastructure limitations in developing regions, consumer concerns about water flow rates and temperature consistency, competition from solar water heating systems in certain regions, and maintenance complexity requiring skilled technicians.

Additionally, emerging opportunities in IoT-enabled smart water heaters with remote control capabilities, development of hybrid systems combining instant and storage technologies, expansion in commercial and hospitality sectors, integration with renewable energy sources like solar panels, growing demand for point-of-use water heaters in multi-story buildings, and advancement in heat pump technology for instant water heating are poised to offer significant growth opportunities for market players. The adoption of voice-controlled smart home integration and development of ultra-compact designs for small living spaces are emerging as notable trends in this market.

Growing Urbanization and Space Constraints in Residential Buildings

Rapid urbanization worldwide is creating significant demand for space-efficient appliances. Instant water heaters, with their compact design and wall-mounted installation, are increasingly preferred in urban apartments where space is at a premium. According to the United Nations, 68% of the global population is expected to live in urban areas by 2050, up from 55% in 2018.

In densely populated cities like Tokyo, Singapore, and Hong Kong, where average apartment sizes range from 400-600 square feet, instant water heaters have become the standard choice. The space saved by eliminating bulky storage tanks allows for better utilization of limited bathroom and kitchen areas. Real estate developers in major metropolitan areas are increasingly specifying instant water heaters as standard fixtures in new residential projects.

Rising Energy Costs and Environmental Consciousness

Escalating energy costs globally are driving consumers toward more efficient water heating solutions. Instant water heaters consume energy only when hot water is needed, eliminating standby heat losses associated with storage water heaters. The U.S. Department of Energy reports that instant water heaters can be 24-34% more energy efficient than conventional storage tank water heaters for homes using 41 gallons or less of hot water daily.

The growing awareness about carbon footprint reduction has led to increased adoption of energy-efficient appliances. European Union's Ecodesign Directive and Energy Labeling Regulation have set stringent efficiency standards for water heaters, favoring instant models. Many countries offer rebates and tax incentives for installing energy-efficient instant water heaters, further accelerating market growth.

Technological Advancements in Heating Elements and Controls

Innovation in heating technology has significantly improved the performance of instant water heaters. Advanced materials like titanium and Incoloy heating elements offer superior durability and efficiency. Digital temperature controls with precision sensors ensure consistent water temperature, addressing a traditional concern with instant water heaters.

The integration of smart technology has revolutionized user experience. Wi-Fi enabled models allow remote control through smartphone apps, voice assistants, and integration with home automation systems. Features like usage tracking, maintenance alerts, and energy consumption monitoring appeal to tech-savvy consumers. Self-modulating technology automatically adjusts power consumption based on water flow and incoming water temperature, optimizing energy efficiency.

Market Segmentation Analysis

By Product Type

Based on product type, the instant water heater market is segmented into electric instant water heaters, gas instant water heaters, and solar-powered instant water heaters. The electric instant water heater segment held the dominant market share in 2025, accounting for approximately 60-65% of the total market.

By Application Type

Based on application type, the market is segmented into point-of-use water heaters, multi-point water heaters, and whole house/central water heaters. The point-of-use segment is expected to dominate with 45-50% market share in 2025.

By Power Source

The market is segmented by power specifications, with electric models categorized by power rating (3-6 kW, 7-12 kW, 13-18 kW, 19-27 kW) and gas models by heat output (up to 140,000 BTU, 140,001-180,000 BTU, 180,001-199,000 BTU, above 199,000 BTU).

Regional Analysis

Asia-Pacific: Largest and Fastest Growing Market

Asia-Pacific dominates the global instant water heater market with approximately 40-45% share in 2025. China alone accounts for over 50% of the regional market, driven by massive urbanization, rising living standards, and government energy efficiency initiatives. India represents the fastest-growing market with a CAGR of 8.5% during the forecast period.

Europe: Mature Market with Innovation Focus

Europe holds the second-largest market share, led by Germany, UK, and France. Stringent EU energy regulations and high energy costs drive demand for efficient instant water heaters. The region leads in smart water heater adoption and integration with renewable energy systems.

North America: Steady Growth Market

The U.S. market is driven by replacement demand and growing awareness of energy savings. Tankless water heaters are gaining popularity in new construction, particularly in southern states with milder climates.

Latin America: Emerging Market with High Potential

Latin America represents 5-8% of the global market, with Brazil and Mexico as key markets. Growing middle class, urbanization, and increasing access to natural gas infrastructure drive market growth.

Middle East & Africa: Developing Market

GCC countries show strong demand for premium instant water heaters in luxury residential and hospitality projects. Africa presents long-term growth potential with improving electricity infrastructure.

Competitive Landscape

The instant water heater market is moderately consolidated with several global players and numerous regional manufacturers. Companies compete on product innovation, energy efficiency, pricing, and after-sales service networks.

Leading Companies Include:

Global Technology Leaders:

Regional Market Leaders:

Specialized Manufacturers:

Emerging Players:

|

Particulars |

Details |

|

Market Size 2024 |

USD 10.2 billion |

|

Market Size 2025 |

USD 10.8 billion |

|

Market Size 2035 |

USD 18.7 billion |

|

CAGR (2025-2035) |

5.7% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2035 |

|

Segments Covered |

By Product Type, Application Type, Power Source, End-Use Sector |

|

Leading Product Type |

Electric Instant Water Heaters (60-65% share) |

|

Leading Application Type |

Point-of-Use Water Heaters (45-50% share) |

|

Leading End-Use Sector |

Residential (55-60% share) |

|

Leading Region |

Asia-Pacific (40-45% share) |

|

Fastest Growing Application |

Multi-Point Water Heaters (6.8% CAGR) |

The instant water heater market is projected to reach USD 18.7 billion by 2035 from USD 10.8 billion in 2025, at a CAGR of 5.7% during the forecast period.

The point-of-use water heater segment is anticipated to maintain the dominant position with approximately 45-50% market share throughout the forecast period due to growing demand for localized hot water solutions in urban apartments and commercial buildings.

The medium power electric models (7-12 kW) are projected to record the highest growth rate with a CAGR of 7.2% during the forecast period, driven by increasing adoption in multi-point residential applications.

Key factors driving growth include urbanization and space constraints, rising energy costs, technological advancements in heating elements and smart controls, government energy efficiency incentives, and growing demand for point-of-use solutions in multi-story buildings.

Major opportunities include IoT-enabled smart water heater development, hybrid instant-storage systems, expanding commercial and hospitality applications, integration with renewable energy sources, and emerging market expansion in Asia-Pacific and Africa.

Asia-Pacific leads with the highest growth potential at 6.5% CAGR, driven by rapid urbanization in China and India. North America maintains the largest market value share at 40-45%, while emerging markets in Latin America and Africa present significant expansion opportunities due to improving infrastructure and rising living standards.

Published Date: Sep-2025

Published Date: Oct-2025

Published Date: Oct-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates