Resources

About Us

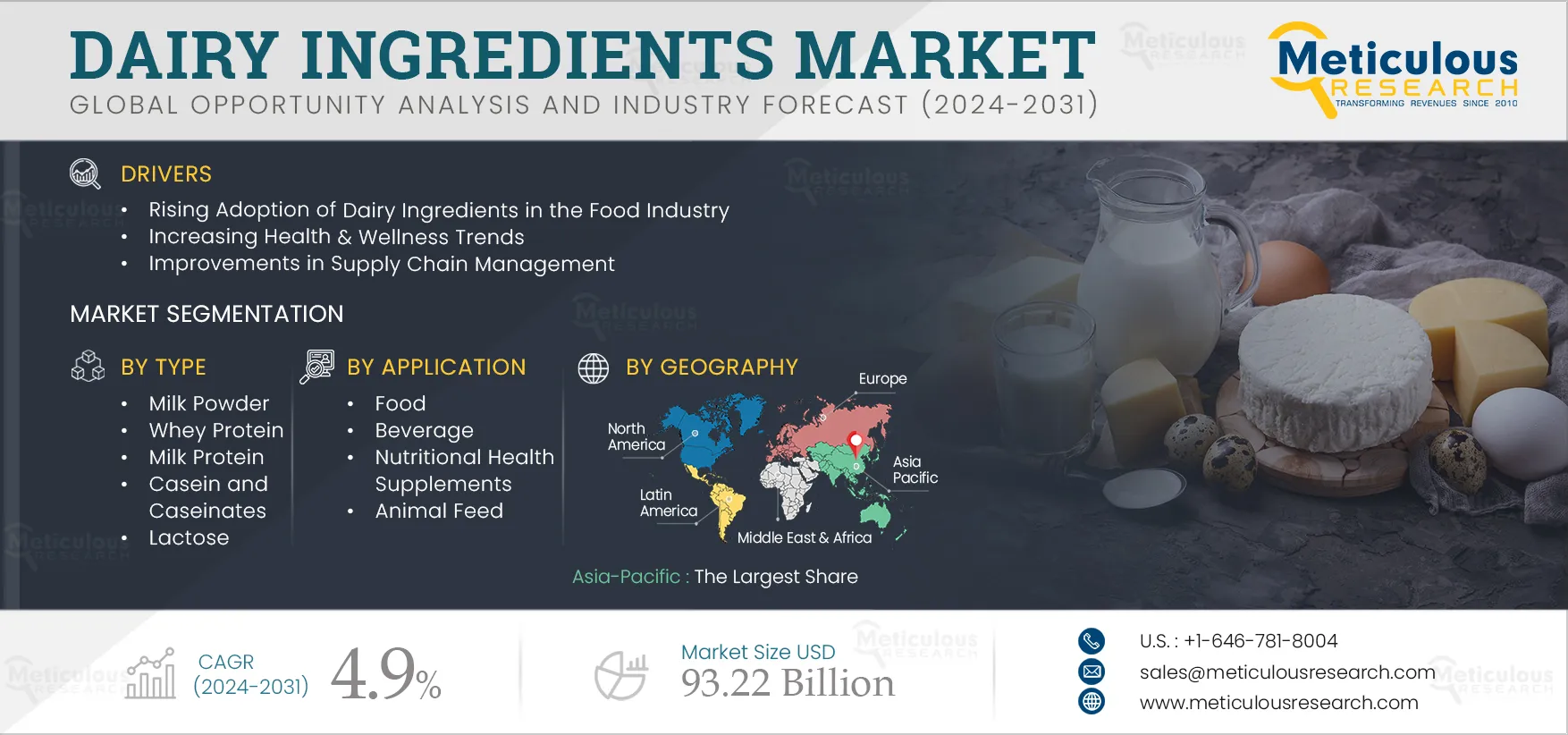

Dairy Ingredients Market Size, Share, Forecast, & Trends Analysis by Source (Milk, Whey), Type (Milk Powder, Whey Protein, Milk Protein, Lactose, Buttermilk Powder, Whey Permeate), Application (Food {Dairy Products}, Beverages) - Global Forecast to 2031

Report ID: MRFB - 104292 Pages: 426 Aug-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThis market's growth is driven by the growing adoption of dairy ingredients in the food industry, increasing health and wellness trends, improvements in supply chain management, rising consumer awareness regarding nutritional foods, and increasing milk production. However, the demand for plant-based dairy alternatives and the increasing incidence of lactose intolerance restrain market growth.

In addition, technological advances in the dairy industry and emerging economies are expected to generate growth opportunities for market stakeholders. On the other hand, rising consumer awareness about the benefits of a vegan diet is a major challenge for the players operating in the dairy ingredients market. Furthermore, healthy snacking is a prominent trend in the dairy ingredients market.

Dairy components have become increasingly popular in the food industry due to their useful qualities, health advantages, rising consumer awareness, and demand for natural and clean-label products. In the food industry, dairy ingredients are essential as they provide food products with their flavor, texture, and nutritional content. They are becoming more common in functional foods and beverages, bakery products, confectionery items, snacks, sauces, dressings, and processed meats.

The demand for dairy ingredients is primarily driven by the global shift toward diets high in protein, particularly in products for weight control, meal replacement, and sports nutrition. Additionally, there is a rising market for functional foods and drinks that go beyond simple dietary intake to promote health. According to the functional foods sector, demand for products with immune-boosting and other natural and nutritious components is rising.

For instance, according to the International Food Information Council's (IFIC) 2022 Food and Health Survey, 52% of Americans adhered to a specified diet in 2022, up from 39% in 2021, 43% in 2020, and 38% in 2019. The primary reasons for adopting new diets were to protect long-term health (35%) and to lose weight (34%).

The growing demand for functional foods is expected to drive the dairy ingredients market. Milk is considered a complete food given that it contains key elements such as proteins, essential fatty acids, minerals, and lactose in equal amounts. Milk and milk products are acknowledged as essential components of a well-balanced and nutritious diet. Consumers are increasingly seeking clean-label food products with simple, natural ingredients. Dairy ingredients, often perceived as natural and wholesome, fit well into this trend.

Thus, the nutritional and functional benefits of dairy ingredients are increasing their adoption in the food industry, driving the growth of the dairy ingredients market.

Click here to: Get Free Sample Pages of this Report

In many emerging nations, urbanization is causing a revolution in cattle production. A trend toward more livestock-intensive diets centered around dairy, meat, and eggs is being driven by urbanization, population increase, economic expansion, and changes in consumer eating preferences. The availability of milk proteins and other dairy products, which are essential components of many food products, has improved as a result of increased milk output.

According to the Organization for Economic Cooperation and Development and the United Nations Food and Agriculture Organization (OECD-FAO) Agricultural Outlook 2022-2031 report, global milk production is expected to rise by 1.19% per year between 2021 and 2031, reaching 1,059.9 million tons in 2031 from 875.8 million tons in 2021. India and Pakistan are expected to contribute to more than half of the increase in global milk output over the next decade.

Higher milk production increases the supply of raw milk, which is the major source for extracting milk proteins and other critical dairy constituents. This abundant supply allows dairy processors to manufacture more dairy products and diversify their offers to suit rising consumer demand. Furthermore, as milk production increases, economies of scale can result in lower per-unit costs for dairy ingredient extraction and processing. This factor may make dairy ingredients more affordable for both F&B manufacturers and consumers, potentially increasing their use in a variety of products.

Hence, increasing milk production is boosting the dairy industry’s ability to meet the growing consumer demand for high-quality, functional, and nutritious ingredients.

According to Glanbia Nutritional’s Healthy Snacking U&A Study (2022), around 60% of consumers have become more aware of mindful snacking (up 4% from the prior year), while 61% reported seeking healthier alternatives to snacks (up 7% from the prior year). This rising trend has increased the F&B industries’ focus on healthy snacks. Consumers are increasingly seeking snacks that offer nutritional benefits, such as high protein, calcium, and vitamin content. According to the U.S. Dairy Export Council (2022), 60% of consumers preferred ready-to-eat snacks as an immediate source of energy. Thus, health-aware consumers are significantly replacing conventional snacks with protein-enriched snacks.

Dairy ingredient manufacturers are responding to the demand for healthy snacks by developing new products that cater to health-conscious consumers. For instance, dairy ingredients such as milk powder, whey, casein, and caseinates are rich in essential nutrients, including protein, calcium, vitamins (such as Vitamin D and B12), and minerals. These nutrients provide various health benefits, such as muscle maintenance, bone health, and overall well-being. The addition of dairy ingredients to healthy snacks provides both nutritional and functional benefits, aligning with consumers’ preference for healthy and satisfying snack options.

Thus, the healthy snacking trend is driving innovation in snack products, boosting the demand for dairy ingredients in the production of dairy-based snacks.

The dairy industry has undergone transformational changes in recent years, owing mostly to technological advancements, increased nutritional awareness, and rising demand for next-generation products that necessitate new processing technology. The use of innovative technologies in the dairy industry has accelerated the growth of the dairy ingredients market by boosting production efficiency, product quality, and sustainability and opening up new market opportunities.

The use of technology in the dairy sector has evolved from precision feeding, automated/mechanized milk collection, and testing of milk composition to the evaluation of overall milk quality, automatic dairy plant operation, and ingredient processing. At the farm level, technology & automation have brought a wave of transformation to the management of dairy farms. From automated milking systems to data-driven decision-making, precision feeding, and sustainable practices, innovations are making dairy farming more efficient, sustainable, and profitable.

Furthermore, growing consumer awareness and changing lifestyles are encouraging processors to focus on product innovation and increasing the demand for high-quality dairy ingredients. Advances in food processing technology have enabled the development of innovative dairy ingredients with improved functionality, stability, solubility, and nutritional profiles.

For instance, techniques such as membrane filtration, spray drying, and enzymatic modification create dairy protein concentrates and isolates with enhanced functional properties. In addition, automation and robotics have streamlined dairy ingredient production, reduced labor costs, and increased output. Technologies such as automated blending, pasteurization, and packaging ensure consistent quality and efficiency.

Thus, technological advances are increasing productivity, profitability, and sustainability in the dairy industry, fostering innovation, and generating significant market growth opportunities.

Based on source, the dairy ingredients market is segmented into milk and whey. In 2024, the milk segment is expected to account for a larger share of 78.9% of the dairy ingredients market. The large market share of this segment can be attributed to the wide range of applications and versatile, functional properties of milk. In addition, milk is a staple food due to its high protein and micronutrient content, further driving market growth.

However, the whey segment is expected to record the highest CAGR of 5.4% during the forecast period. Its expanding use in sports nutrition products, functional foods, beverages, and dietary supplements, as well as advancements in dairy processing technology, is driving this segment’s growth.

Based on type, the dairy ingredients market is segmented into milk powder, whey protein, milk protein, casein and caseinates, third-generation dairy ingredients, lactose, lactose derivatives, buttermilk powder, and whey permeate. In 2024, the milk powder segment is expected to account for the largest share of 65.5%. This segment's large market share is attributed to its nutritional benefits, longer shelf life, wide application areas, and reduced transportation and storage costs.

However, the milk protein segment is also estimated to register the highest CAGR of 6.1% during the forecast period. This growth is due to the high protein content and versatile, functional properties; milk protein is being increasingly adopted for sports nutrition and dietary supplements.

Based on application, the dairy ingredients market is segmented into food, beverages, nutritional health supplements, animal feed, and other applications. In 2024, the food segment is expected to account for the largest share of 37.3% of the dairy ingredients market. This segment’s large market share is attributed to the rising consumption of functional food products, increasing awareness about the multi-functionality of dairy ingredients for processed food products, and growing demand for nutritional & fortifying food products.

However, the nutritional health supplements segment is anticipated to register the highest CAGR of 5.4% during the forecast period. The heightened awareness regarding health and wellness, increasing recognition of the functional and nutritional benefits of dairy ingredients in health products, and innovative product development within the health supplements sector are contributing to the growth of this segment.

Based on geography, the dairy ingredients market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of 36.9% of the dairy ingredients market, followed by Europe and North America. The Asia-Pacific dairy ingredients market is estimated to be worth USD 24.66 billion in 2024. This region’s substantial market share is mainly attributed to the increasing demand for sports nutrition, growing demand for milk & milk-based products in the diet, increasing focus on manufacturing functional food products, changing food consumption preferences, and government policies & programs to support dairy production & processing industries.

Moreover, Asia-Pacific is poised to register the highest CAGR of 5.3% during the forecast period. This regional market's growth is driven by the increasing demand for organic dairy ingredients and the rising infant population.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the dairy ingredients market are Lactalis Group (France), Dairy Farmers of America, Inc. (U.S.), Fonterra Co-Operative Group Limited (New Zealand), Arla Foods amba (Denmark), Saputo Inc. (Canada), Royal FrieslandCampina N.V. (Netherlands), Savencia SA (France), Sodiaal International (France), Glanbia PLC (Ireland), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Morinaga Milk Industry Co., Ltd. (Japan), AMCO Proteins (U.S.), KOMOS GROUP LLC (Russia), and Prolactal GmbH (Austria).

|

Particulars |

Details |

|

Number of Pages |

426 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

4.9% |

|

Market Size (Value) |

USD 93.22 Billion by 2031 |

|

Market Size (Volume) |

28,921,654 Tons by 2031 |

|

Segments Covered |

By Source

By Type

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, Russia, U.K., Spain, France, Italy, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, New Zealand, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Lactalis Group (France), Dairy Farmers of America, Inc. (U.S.), Fonterra Co-Operative Group Limited (New Zealand), Arla Foods amba (Denmark), Saputo Inc. (Canada), Royal FrieslandCampina N.V. (Netherlands), Savencia SA (France), Sodiaal International (France), Glanbia PLC (Ireland), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Morinaga Milk Industry Co., Ltd. (Japan), AMCO Proteins (U.S.), KOMOS GROUP LLC (Russia), and Prolactal GmbH (Austria) |

Dairy ingredients are defined as components derived from milk and whey. They are high in nutritional benefits, providing proteins, amino acids, vitamins, and minerals. Ingredients derived from milk and whey include milk powder, whey protein, milk protein, casein and caseinates, third-generation dairy ingredients, lactose, lactose derivatives, buttermilk powder, and whey permeate. These ingredients have applications in food, beverages, nutritional health supplements, animal feed, and other industries.

This dairy ingredient market report provides detailed market insights and market size & forecasts for dairy ingredients in terms of value & volume by type and geography and in terms of value by source & application. Each segment provides the market size & forecast for five key geographies (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa) along with the key countries.

The dairy ingredients market is expected to reach $93.22 billion by 2031, at a CAGR of 4.9% during the forecast period.

In 2024, the milk segment is expected to hold a major market share.

The nutritional health supplements segment is expected to witness the fastest growth from 2024 to 2031.

The growing adoption of dairy ingredients in the food industry, increasing health and wellness trends, improvements in supply chain management, rising consumer awareness regarding nutritional foods, and increasing milk production are factors supporting the growth of this market. Moreover, technological advances in the dairy industry and emerging economies create opportunities for players operating in this market.

The key players operating in the dairy ingredients market are Lactalis Group (France), Dairy Farmers of America, Inc. (U.S.), Fonterra Co-Operative Group Limited (New Zealand), Arla Foods amba (Denmark), Saputo Inc. (Canada), Royal FrieslandCampina N.V. (Netherlands), Savencia SA (France), Sodiaal International (France), Glanbia PLC (Ireland), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Morinaga Milk Industry Co., Ltd. (Japan), AMCO Proteins (U.S.), KOMOS GROUP LLC (Russia), and Prolactal GmbH (Austria).

Asia-Pacific is poised to register the highest CAGR of 5.3% during the forecast period of 2024–2031, mainly due to increasing demand for organic dairy ingredients and the rising infant population.

Published Date: May-2025

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates