Resources

About Us

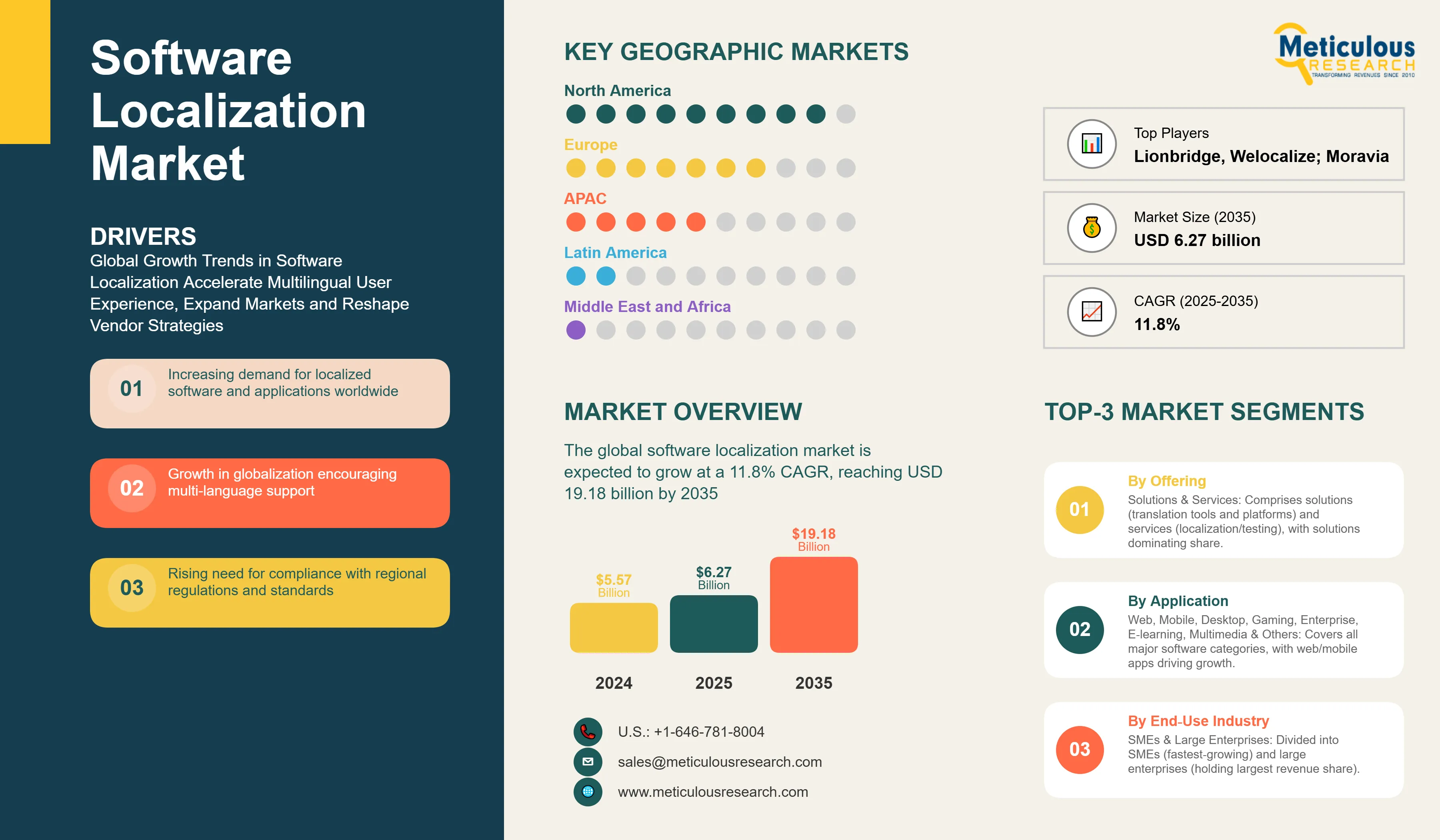

Software Localization Market Size, Share, Forecast & Trends by Component (Solutions, Services) Technology (Machine Learning, Deep Learning) Industry (Retail & E-commerce, Media & Advertising) - Global Forecast to 2035

Report ID: MRICT - 1041543 Pages: 210 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportGlobal Growth Trends in Software Localization Accelerate Multilingual User Experience, Expand Markets and Reshape Vendor Strategies

The global software localization market was valued at USD 5.57 billion in 2024. This market is expected to grow at a 11.8% CAGR, reaching USD 19.18 billion by 2035 from USD 6.27 billion in 2025. Numerous factors such as the global digital transformation, demand for multicultural user experiences, and the proliferation of SaaS, and mobile applications spanning diverse linguistic and regulatory landscapes are driving the industry growth.

Microservices and cloud-native architectures, now integral to software delivery, are reshaping localization, enabling companies to localize at the component level, respond rapidly to local trends, and launch features tuned for specific markets. Adding to the expansion are factors such as accelerated globalization of digital services with cross-border e-commerce sales reaching USD 4.8 trillion in 2025 and mandatory multilingual compliance under regulations such as the EU Digital Services Act (2024). The shift to microservices architectures facilitates component-level localization and continuous delivery, shortening global release cycles by 30% on average. Enhanced UX practices, locale-specific formatting, right-to-left script support, and cultural adaptation are now standard in product roadmaps to boost customer retention across diverse markets.

Click here to: Get Free Sample Pages of this Report

The software localization market landscape is intensely competitive and rapidly evolving. The sector is led by established players such as Smartling, Phrase, and TransPerfect that differentiate themselves with AI, automation, and deep platform integration. These companies invest in embedding localization directly into developer environments and CMS pipelines. Emerging vendors like Lokalise, Transifex, and Crowdin target developer-first, low-code solutions with robust APIs for SMEs. Competitive intensity is also heightened by niche, industry-specific providers focusing on regulated verticals such as healthcare, financial services, and legal, along with innovators pushing multimedia and AI-aided translation boundaries.

Launch of AI voice-over platform Acolad drives multilingual video adaption

SDL Trados Studio AI memory update to enhance precision

Base CAGR: 11.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Driver |

1. E-commerce & SaaS Globalization |

Expanded global content demand |

Mature cross-border software reach |

▲ +2.2% |

|

|

2. Advancements in AI & Automation |

Faster translation workflows |

Fully automated localization cycles |

▲ +1.8% |

|

|

3. Regulatory & Accessibility Mandates |

Mandatory compliance updates |

Standardized global accessibility |

▲ +1.2% |

|

Restraint |

1. High Upfront Investment & Integration Costs |

Slow vendor onboarding |

Economies of scale reduce costs |

▼ −1.8% |

|

2. Security & Data Privacy Risks |

Heightened client data concerns |

Robust encryption standards |

▼ −1.2% |

|

|

Opportunity |

1. Growing adoption of AI and machine translation in localization |

Improved translation quality |

AI-native localization platforms |

▲ +1.5% |

|

2. Increasing demand from emerging markets and SMEs |

New regional project growth |

Localization as standard practice |

▲ +1.1% |

|

|

Trend |

1. Integration of AI-powered translation and real-time localization capabilities |

Real-time content updates |

Instantaneous live localization |

▲ +1.3% |

|

Challenge |

1. Managing cultural nuances and contextual relevance |

Quality inconsistencies |

Deep cultural adaptation frameworks |

▼ −1.9% |

Cloud-Native Platforms and Enterprise Policies Cement North America’s Localization Lead

North America leads the global software localization market with around 35% share of the market. This dominance is sustained by a high level of digitalization, the ubiquity of multinational enterprises, and substantial spending on IT. According to the World Intellectual Property Organization (WIPO), in 2024, the United States maintains a firm lead in software investment, with associated spendings reaching USD 368.5 billion on software in, equating to over 50% of the global spending. Additionally, strict ADA compliance and multilingual mandates, notably in the U.S. and Canada compel companies to deliver accessible software in English, French, and Spanish, while more organizations in fintech, health, and legal sectors are prioritizing localization to comply with domain-specific regulations. Moreover, the startup sector is dynamic , with small-scale firms such as Lokalise and Crowdin have gained ground among SMEs and fast-growth app developers. Overall, North America’s competitive ecosystem, emphasis on accessibility, and regulatory leadership continue to set the pace for innovation and best practices in software localization.

National Digitalization Initiatives and Mobile-First Populations Drive APAC’s Localization Surge

Asia-Pacific is the fastest-growing region, expanding at a CAGR of 12.9% through 2035. Growth is powered by rapid digitization, booming e-commerce, a highly diverse linguistic landscape, and significant number of internet users in the region. The proliferation of mobile apps and digital services means software providers must localize for dozens of scripts, payment gateways, and regulatory frameworks to capture market share and user engagement. Regional governments have issued stronger multilingual digital content policies, making localization a critical precondition for public and private sector software procurement. APAC countries are also introducing governmental digital inclusion projects that facilitate expanding localized software within national websites, education as well as other public services. Southeast Asian governments mandate local-language digital services, Thailand’s Digital Government Roadmap launched in 2024, and Indonesia’s ‘100 Smart Cities’ initiative has the potential to spur regional TMS deployments to address surge in use of local digitization.

Federal Accessibility Laws and Hyperscale Investments Reinforce U.S. Localization Dominance

The U.S. holds approximately 85% share of the North America software localization market. The country’s market dominance is owing to the sheer volume of enterprise SaaS, fintech, healthcare, and e-commerce businesses prioritizing user experience and regulatory adherence. ADA and Section 508 compliance drive demand for accessible multilingual software, while federal contracts increasingly specify localized user interfaces and documentation. Major investments from tech giants and hyper-growth startups have increased the adoption of cloud-based, developer-first localization platforms tool adoption rates. Moreover, the U.S. ranks among top internet users, and the language translation services, a key component of localization industry, employs more than 56,000 interpreters and translators. Thus, U.S.-based localization vendors lead global innovation, introducing AI-powered quality assurance and workflow automation, reinforcing the country’s continued leadership in market value, technology innovation, and standard setting.

Tech Self-Reliance and Gaming Sector Propel China’s Localization Market

China commands the largest share of Asia-Pacific’s localization market, with a double-digit growth forecast through 2035. The nation’s immense mobile-first user base over 1.02 billion internet-connected users creates complex localization requirements for super-apps, payment solutions, and cross-border e-commerce. Regulatory pushes, including the 2024 “Multi-Language Internet Services Initiative” from MIIT, mandate that critical digital platforms provide content in Mandarin and minority languages. Moreover, the country’s eCommerce market has been expanding at a rapid pace reaching a market size of USD 1.8 trillion, supported by over one billion mobile devices in China, driving revenues generated through app stores, in-app ads, and mobile commerce. And over 95% of Chinese eCommerce users express a higher comfort with websites offering support for native language. These statistics highlight China’s immense growth potential in software localization market.

Regulatory Compliance Fuel Germany’s Localization Growth

Germany remains Europe’s largest software localization market, driven by its advanced manufacturing, automotive, and industrial SaaS adoption. Regulatory rigor under GDPR and new national digital accessibility laws (BITV 2.0) pushes both domestic and international software providers to deliver not just German-language versions but also robust, compliant localizations of interfaces, documentation, and transactional content for B2B and B2C products. Also, the German Digital Strategy 2025 includes a mandate for multilingual support in public-sector software, leading to significant municipal localization contracts. In 2024 alone, these contracts are projected to reach EUR 120 million. This initiative is part of a broader effort to enhance the digital capabilities and infrastructure of Germany, aiming to maintain its competitive edge in the digital age.

Cloud-Native Platforms Surge Ahead as On-Premises Remain Essential for Regulated Sectors

Cloud-based platforms capture around 60-70% market share in 2025, driven by their lower total cost of ownership (TCO), elastic scalability, and seamless integration into DevOps pipelines. The integration of localization to AWS Marketplace with additional languages has expanded its global accessibility. This enhancement enables customers to identify, validate, procure, and employ solutions in their preferred language, reducing friction for customers from different geographies, enhancing their purchasing experience.

Large Enterprises Dominates the Overall Software Localization Market

Large enterprises represented nearly two-thirds of the global software localization. As organizations scale global operations, complexity and demand for real-time, multi-market releases intensify. Enterprise users invest in advanced localization automation (AI-aided translation, continuous integration/deployment), content quality assurance, and regulatory compliance. Key enterprise verticals e-commerce, SaaS, financial services, and healthcare necessitate localization of not only UIs and websites but also transactional workflows, technical documentation, and customer service platforms. As digital accessibility and compliance pressures rise, large enterprises will remain market-shaping forces in technology adoption and localization best practices.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 6.27 billion |

|

Revenue forecast in 2035 |

USD 19.18 billion |

|

CAGR (2025-2035) |

11.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Offering (Solutions, Services), Deployment, Application (Web Application, Mobile Applications), End-User Industry, Industry Vertical, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Lionbridge; SDL (RWS); TransPerfect; Keywords Studios; Welocalize; Moravia (RWS); Pactera EDGE; Alconost; Smartling; Memsource; Gengo; TextMaster; Translated |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Software Localization Market size is estimated to be USD 6.27 billion in 2025 and grow at a CAGR of 11.8% to reach USD 19.18 billion by 2035.

In 2024, the Software Localization Market size was estimated at USD 5.57 billion, with projections to reach USD 6.27 billion in 2025.

Lionbridge; SDL (RWS); TransPerfect; Keywords Studios; Welocalize; Moravia (RWS); Pactera EDGE; Alconost; Smartling; Memsource; Gengo; TextMaster; and Translated among others are the major companies operating in the Software Localization Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

Large enterprises represented nearly two-thirds of the global software localization market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Software Localization Market, by Offering

3.2.2. Software Localization Market, by Deployment

3.2.3. Software Localization Market, by Application

3.2.4. Software Localization Market, by End-user

3.2.5. Software Localization Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing demand for localized software and applications worldwide

4.2.1.2. Growth in globalization encouraging multi-language support

4.2.1.3. Rising need for compliance with regional regulations and standards

4.2.1.4. Technological advances in translation management and automation

4.2.2. Restraints

4.2.2.1. Complexity and high cost of localization for multiple languages

4.2.2.2. Challenges in maintaining quality and consistency across languages

4.2.3. Opportunities

4.2.3.1. Growing adoption of AI and machine translation in localization

4.2.3.2. Increasing demand from emerging markets and SMEs

4.2.4. Trends

4.2.4.1. Integration of AI-powered translation and real-time localization capabilities

4.2.4.2. Shift toward cloud-based and collaborative localization platforms

4.2.5. Challenges

4.2.5.1. Managing cultural nuances and contextual relevance

4.2.5.2. Integrating localization process efficiently within development cycles

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Software Localization Market

4.4.1. Translation Management Systems

4.4.1.1. Automation of workflows and project management efficiency

4.4.1.2. Collaboration tools enhancing translator and developer interaction

4.4.1.3. Real-time translation updates and version control

4.4.2. Machine Translation

4.4.2.1. Improvement in quality with neural machine translation technologies

4.4.2.2. Cost and time reduction in handling large volumes of translation

4.4.2.3. Integration with post-editing to ensure accuracy

4.4.3. Computer-Assisted Translation Tools

4.4.3.1. Enhanced productivity through translation memory and glossary management

4.4.3.2. Support for consistency and reuse of translated content

4.4.3.3. Streamlining multi-language project handling and quality assurance

5. Impact of Sustainability on Software Localization Market

5.1. Reduction in physical localization needs leading to lower carbon footprint

5.2. Promotion of inclusive digital content across diverse demographics

5.3. Energy efficiency improvements through cloud-based localization platforms

5.4. Support for linguistic diversity as part of cultural sustainability

5.5. Ethical considerations in AI-driven translation outputs

5.6. Encouraging remote work and distributed localization teams

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Software Localization Market Assessment—By Offering

7.1. Overview

7.2. Solutions

7.2.1. Translation Management Software

7.2.2. Computer-Assisted Translation Tools

7.2.3. Machine Translation Software

7.2.4. Continuous Localization Platforms

7.2.5. Localization Testing Software

7.3. Services

8. Software Localization Market Assessment—By Deployment Model

8.1. Overview

8.2. Cloud-based

8.3. On-premises

9. Software Localization Market Assessment—By Application

9.1. Overview

9.2. Web Applications

9.3. Mobile Applications

9.4. Desktop Software

9.5. Gaming Software

9.6. Enterprise Software

9.7. E-learning & Training

9.8. Multimedia and Audio-Visual Content

9.9. Others

10. Software Localization Market Assessment—By End-user

10.1. Overview

10.2. Small and Medium Enterprises

10.3. Large Enterprises

11. Software Localization Market Assessment — By Industry Vertical

11.1. Overview

11.2. IT & Telecommunication

11.3. Healthcare & Life Sciences

11.4. Finance & Banking

11.5. Gaming & Entertainment

11.6. E-learning & Education

11.7. Retail & E-commerce

11.8. Manufacturing

11.9. Travel & Hospitality

11.10. Others

12. Software Localization Market Assessment—By Geography

12.1. Overview

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Netherlands

12.3.5. Switzerland

12.3.6. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. Japan

12.4.3. South Korea

12.4.4. Taiwan

12.4.5. India

12.4.6. Singapore

12.4.7. Australia

12.4.8. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. Israel

12.6.4. South Africa

12.6.5. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

13.1. Lionbridge Technologies, Inc.

13.2. RWS Group plc

13.3. TransPerfect Translations International, Inc.

13.4. Keywords Studios plc

13.5. Welocalize, Inc.

13.6. Pactera EDGE Limited

13.7. Alconost Inc.

13.8. Smartling, Inc.

13.9. Phrase GmbH

13.10. TextMaster SAS

13.11. Translated Srl

13.12. Acolad Group

13.13. Lingo24 Ltd

13.14. Tolingo GmbH

13.15. LanguageLine Solutions, Inc.

13.16. LanguageWire A/S

13.17. SYSTRAN SA

13.18. Others

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: Aug-2025

Published Date: Aug-2025

Published Date: May-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates