Resources

About Us

Self Storage Software Market Size, Share, Forecast & Trends Size - By Component (Solution, Services), Deployment Mode (Cloud-based, On-premises), Organization Size - Global Forecast to 2035

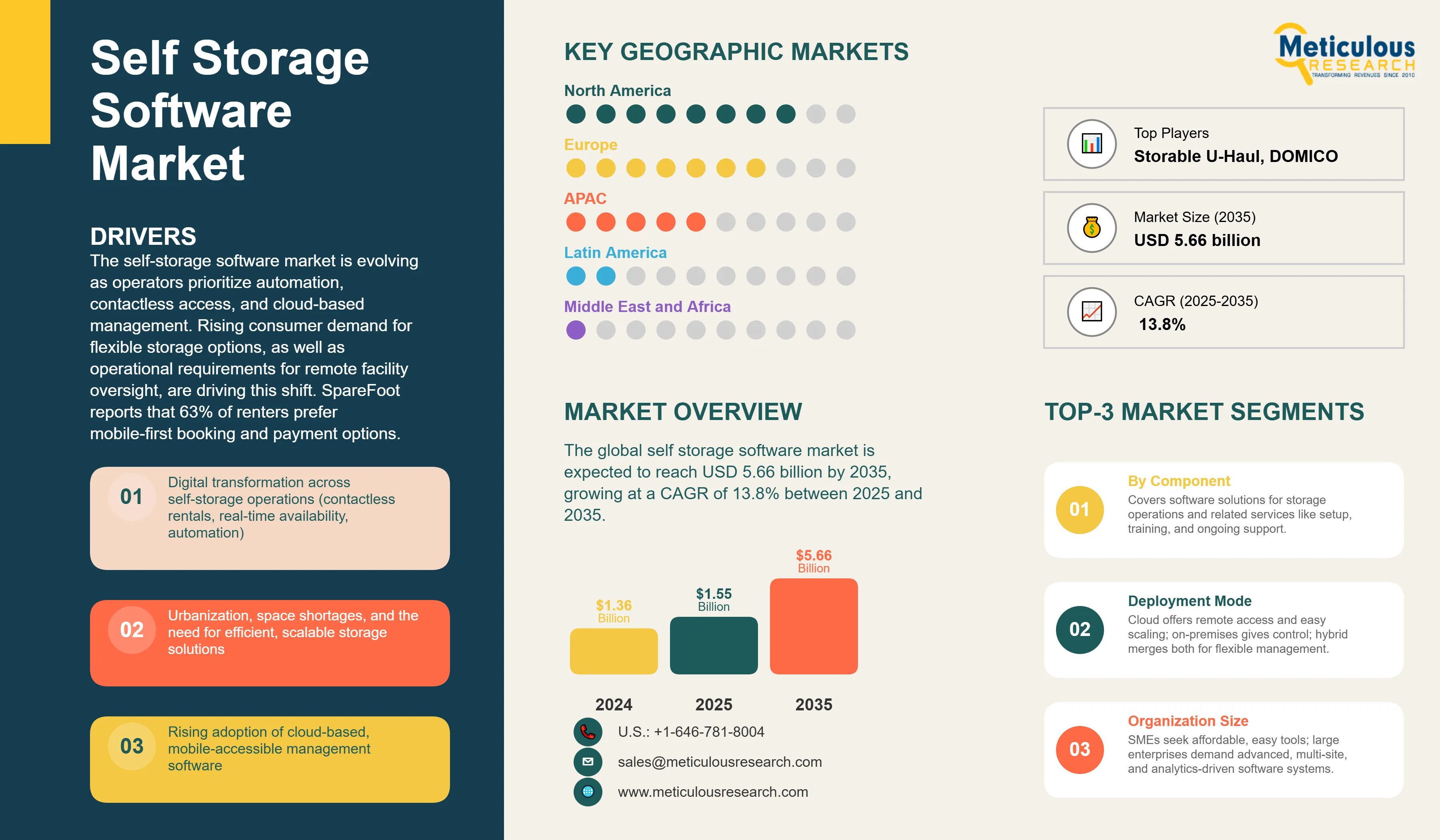

Report ID: MRICT - 1041558 Pages: 210 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global self storage software market is estimated to be USD 1.55 billion in 2025 and is expected to reach USD 5.66 billion by 2035, growing at a CAGR of 13.8% between 2025 and 2035.

The self-storage software market is evolving as operators prioritize automation, contactless access, and cloud-based management. Rising consumer demand for flexible storage options, as well as operational requirements for remote facility oversight, are driving this shift. SpareFoot reports that 63% of renters prefer mobile-first booking and payment options. As urbanization and e-commerce logistics grow, so does the demand for scalable, automated software solutions in North America, Europe, and Asia Pacific. The market outlook remains positive, with operators investing in AI-powered analytics, IoT integrations, and customer self-service portals to improve efficiency and user experience.

Click here to: Get Free Sample Pages of this Report

Yardi, Storable, Sitelink, and Tenant Inc. are among the market leaders, offering cloud-based platforms tailored for facility management, tenant communication, and payment processing, respectively. In 2024, Storable expanded its API ecosystem to support third-party integrations with CRM, accounting, and smart lock systems. Yardi introduced AI-powered analytics for occupancy forecasting and dynamic pricing, which assisted operators in optimizing revenue. Tenant Inc. has launched a white-label mobile app builder, allowing operators to provide branded digital experiences. Vendors compete on automation, scalability, and integration with IoT devices and access control systems.

Recent Developments

Storable Launches Unified API Platform Enabling Seamless Integration and Workflow Automation in Self-Storage Operations

Yardi Enhances Software Suite with AI-Powered Pricing Engine Optimizing Rental Rates and Occupancy Forecasting

Key Market Drivers

Key Market Restraints

Base CAGR: 13.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Cloud-Based Platforms Drive Remote Facility Management and Multi-Site Control in Expanding Self-Storage Industry |

Improved centralized operations |

Standardized multi-site management |

▲ +3.5% |

|

2. Consumer Preference for Mobile Booking and Access Fuels Demand for Responsive and App-Enabled Storage Solutions |

Increased app usage |

Mobile-first industry norm |

▲ +3.0% |

|

|

Restraints |

1. Initial Expenses and Training Challenges Limit Self-Storage Software Adoption Among Small and Independent Facility Operators |

Slow SME software uptake |

Expanded training and cost reduction programs |

▼ −2.5% |

|

2. Privacy Regulations and Data Security Worries Constrain Cloud Software Uptake, particularly in Europe and Asia |

Compliance-related hesitation |

Mature data privacy frameworks established |

▼ −2.2% |

|

|

Opportunities |

1. Growth of cloud-based and hybrid deployment, reducing costs and enabling scale |

Faster cloud migration |

Scalable hybrid models dominate |

▲ +3.8% |

|

2. AI-driven analytics and digital twin integration for predictive demand forecasting |

Enhanced forecasting and planning |

Fully predictive, automated demand management |

▲ +3.1% |

|

|

Trends |

1. Surge in mobile-first and subscription-based management solutions |

Increasing subscription-based adoption |

Continuous auditing and automation integration |

▲ +2.2% |

|

2. IoT-enabled automation (smart locks, sensors, real-time tracking) |

Growing feature deployments |

Industry standard in new facility installations |

▲ +2.5% |

|

|

Challenges |

1. Competition from non-specialized business software and legacy systems |

Fragmented adoption |

Enhanced legacy system integrations |

▼ −1.8% |

|

2. Real-time integration with IoT, access control, and third-party CRM platforms |

Integration complexity |

Standardized seamless integrations |

▼ −1.5% |

North America Leads with Advanced Automation, Mobile Access, and AI Analytics in Dense, Competitive Self-Storage Market

North America remains the largest and dominant market for self-storage software, growing at a CAGR of 11.8%, owing to high facility density, consumer demand for convenience, and operator emphasis on automation. Operators are investing in mobile-first platforms, smart access systems, and AI-powered analytics to enhance efficiency and customer experience. Canada is also expanding, with urban areas such as Toronto and Vancouver implementing cloud-based platforms to manage rising demand and limited space. The region has strong internet infrastructure, high smartphone penetration, and a competitive vendor landscape.

Urbanization and Digital Infrastructure Propel Rapid Growth of Cloud-Based Self-Storage Software in Asia-Pacific Region

The self-storage software market is accelerating at a rapid rate with a CAGR of 14.9% from 2025 to 2035. The factors such as growing urbanization, rising disposable income, and digital transformation are propelling the growth of Asia-Pacific self-storage software market. In 2025, Australia and Japan will lead adoption, with Sydney and Tokyo operators integrating cloud-based platforms to manage multi-site operations and mobile bookings. The self-storage market in India is still in its early stages, but startups in Bengaluru and Mumbai are using SaaS-based software to manage inventory and automated billing. According to The Hindu BusinessLine's 2024 report, there has been a 28% increase in self-storage startups in India, many of which are tech-enabled. The region's increasing smartphone usage and 5G rollout are enabling mobile-first solutions, while government funding for digital infrastructure is hastening adoption.

U.S. Market Drives Innovation with AI, Smart Access Integration, and Mature Vendor Ecosystem in Self-Storage Software

The U.S. is the global leader in self-storage software adoption and innovation. Operators are utilizing AI for dynamic pricing, occupancy forecasting, and customer segmentation. Companies such as Extra Space Storage and Public Storage are investing in proprietary platforms to streamline operations and improve customer experience. The U.S. market benefits from a mature vendor ecosystem, high consumer digital literacy, and strong demand for contactless services.

China’s Expanding Urban Logistics Sector Embraces Mobile-First Self-Storage Solutions Supported by Local Startups

China's self-storage software market is in its early stages but expanding rapidly, particularly in tier-one cities. According to China Daily, self-storage facility openings in Beijing and Shanghai increased by 22% in 2024, with many of them using mobile-first software for booking and access. Operators are targeting urban professionals and e-commerce sellers who require flexible storage. The government's support for smart city initiatives encourages digital adoption, while local startups create Mandarin-language platforms tailored to domestic needs.

Germany Emphasizes Data Privacy and Hybrid Deployments, Leading to Slower but Compliance-Focused Software Adoption

Germany is taking a cautious approach to self-storage software, emphasizing data privacy and compliance. According to Heise Online's report, 61% of operators preferred hybrid or on premises solutions in 2024 due to GDPR concerns. Facilities in Berlin, Munich, and Hamburg are implementing software for access control, billing, and customer communication, but cloud adoption is slower than in North America. Vendors are responding by providing localized data hosting and compliance capabilities. Germany's emphasis on security and operational efficiency is influencing software design and deployment approaches.

Cloud-Native Self-Storage Software Dominates Globally Due to Scalability, Remote Access, and Rapid Feature Deployment

Cloud-based solutions are expected to lead the overall self-storage market, growing at a CAGR of 14.7% from 2025 to 2035. Demand for scalability, remote access, and real-time updates has propelled cloud-based self-storage software to the top of the industry. According to Inside Self-Storage, more than 78% of new facilities worldwide will use cloud-native platforms this year. These platforms offer multi-site management, automated billing, and mobile access, making them ideal for expanding operators. Cloud solutions also allow for faster update deployment and integration with third-party tools. Vendors provide tiered pricing and modular features to serve both large chains and independent operators.

Integration of IoT and Keyless Entry Systems with Software Solutions Enhances Security, Convenience, and Operational Efficiency

On the basis of component, the solutions segment is expected to grow at a CAGR of 12.8% from 2025 to 2035. The combination of smart access systems and self-storage software is a rapidly expanding segment. Real-time access logs, remote lock control, and automated alerts are among the features being added to software platforms. This integration improves security, reduces staffing requirements, and enables 24-hour access. Operators use access data to analyze customer behavior and optimize facility layout. The segment is expected to further expand as consumers seek greater convenience and operators seek operational efficiencies.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.55 billion |

|

Revenue forecast in 2035 |

USD 5.66 billion |

|

CAGR (2025-2035) |

13.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Solution, Services), Deployment Mode (Cloud-based, On-premises), Organization Size, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Storable Group, U-Haul International, DOMICO Software, RADical Systems (UK) Ltd., Corrigo Incorporated (Jones Lang LaSalle), QuikStor Security & Software, OpenTech Alliance, Syrasoft Management Software, E-SoftSys LLC, Easy Storage Solutions, Storage Commander, Empower Software Technologies, Madwire, Unit Trac, Trackum Software, Storage Group Inc., AndraTech Software, Primeur, Sentinel Systems LLC, Storeganise Ltd., Yardi Systems Inc., and StorTrack |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The self-storage software market is estimated to be USD 1.55 billion in 2025 and grow at a CAGR of 13.8% to reach USD 5.66 billion by 2035.

In 2024, the Self-Storage Software Market was valued at USD 1.35 billion, with projections to reach USD 1.55 billion in 2025.

Storable Group, U-Haul International, DOMICO Software, RADical Systems (UK) Ltd., Corrigo Incorporated (Jones Lang LaSalle), QuikStor Security & Software, OpenTech Alliance, Syrasoft Management Software, E-SoftSys LLC, Easy Storage Solutions, Storage Commander, Empower Software Technologies, among others are the major companies operating in the Self-Storage Software Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

Cloud-based solutions are expected to hold the largest share of the overall self-storage software market.

1. Market Definition & Scope

1.1 Market Definition

1.2 Market Ecosystem

1.3 Currency

1.4 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Process of Data Collection and Validation

2.2.1 Secondary Research

2.2.2 Primary Research / Interviews with Key Opinion Leaders from the Industry

2.3 Market Sizing and Forecast

2.3.1 Market Size Estimation Approach

2.3.1.1 Bottom-up Approach

2.3.1.2 Top-down Approach

2.3.2 Growth Forecast Approach

2.3.3 Assumptions for the Study

3. Executive Summary

3.1 Overview

3.2 Segmental Analysis

3.2.1 Self-Storage Software Market, by Component

3.2.2 Self-Storage Software Market, by Deployment Mode

3.2.3 Self-Storage Software Market, by Organization Size

3.2.4 Self-Storage Software Market, by Region

3.3 Competitive Landscape (high-level)

3.4 Strategic Recommendations

4. Market Insights

4.1 Overview

4.2 Factors Affecting Market Growth

4.2.1 Drivers

4.2.1.1 Digital transformation across self-storage operations (contactless rentals, real-time availability, automation)

4.2.1.2 Urbanization, space shortages, and the need for efficient, scalable storage solutions

4.2.1.3 Rising adoption of cloud-based, mobile-accessible management software

4.2.1.4 Increasing data security, compliance, and remote monitoring requirements

4.2.2 Restraints

4.2.2.1 High initial investment and integration costs, especially for SMEs

4.2.2.2 Technical complexity and ongoing training demands of staff

4.2.3 Opportunities

4.2.3.1 Growth of cloud-based and hybrid deployment, reducing costs and enabling scale

4.2.3.2 AI-driven analytics and digital twin integration for predictive demand forecasting

4.2.4 Trends

4.2.4.1 Surge in mobile-first and subscription-based management solutions

4.2.4.2 IoT-enabled automation (smart locks, sensors, real-time tracking)

4.2.5 Challenges

4.2.5.1 Competition from non-specialized business software and legacy systems

4.2.5.2 Real-time integration with IoT, access control, and third-party CRM platforms

4.3 Porter’s Five Forces Analysis

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Buyers

4.3.3 Threat of Substitutes

4.3.4 Threat of New Entrants

4.3.5 Degree of Competition

4.4 Technology Impact on Self-Storage Software Market

4.4.1 Cloud and SaaS-based deployments

4.4.1.1 Real-time access and automation across locations

4.4.1.2 Simplified updates, scaling, and vendor support

4.4.2 IoT, Automation & AI

4.4.2.1 Smart locks, sensors, and predictive analytics for security and demand management

4.4.2.2 Automated payment, notifications, and operational workflows

5. Impact of Sustainability on Self Storage Software Market

5.1 Reduction in physical paperwork and travel, driving lower emissions

5.2 Cloud-native deployments optimize energy and resource usage across facilities

5.3 Supports remote management and flexible workforce models (reducing commuting)

5.4 Enables more efficient use of space and site resources at the facility level

5.5 Challenges include e-waste from hardware upgrades and ensuring digital inclusion for all facility sizes

6. Competitive Landscape

6.1 Overview

6.2 Key Growth Strategies

6.3 Competitive Benchmarking

6.4 Competitive Dashboard

6.4.1 Industry Leaders

6.4.2 Market Differentiators

6.4.3 Vanguards

6.4.4 Contemporary Stalwarts

6.5 Market Share/Ranking Analysis, by Key Players, 2024

7. Self Storage Software Market Assessment — By Component

7.1 Overview

7.2 Solutions

7.3 Services

8. Self Storage Software Market Assessment — By Deployment Mode

8.1 Overview

8.2 Cloud-based Deployments

8.2.1 Public Cloud

8.2.2 Private Cloud

8.2.3 Hybrid Cloud

8.3 On-premises Deployment

8.4 Hybrid Deployment

9. Self Storage Software Market Assessment — By Organization Size

9.1 Overview

9.2 Small-Medium Enterprises

9.3 Large Enterprises

10. Self Storage Software Market Assessment — By End-User

10.1 Overview

10.2 Individual Renters

10.3 Small Business Users

10.4 Enterprise-Level Storage Operators

11. Self Storage Software Market Assessment — By Business Model

11.1 Overview

11.2 Subscription-Based

11.3 Perpetual License-Based

12. Self Storage Software Market Assessment — By Software Function

12.1 Overview

12.2 Unit Management

12.3 Tenant Management

12.4 Access & Security Controls

12.5 Billing & Invoicing

12.6 Reporting & Analytics

12.7 IoT & Automation Integration

13. Self Storage Software Market Assessment — By Geography

13.1 Overview

13.2 North America

13.2.1 U.S.

13.2.2 Canada

13.3 Europe

13.3.1 Germany

13.3.2 U.K.

13.3.3 France

13.3.4 Netherlands

13.3.5 Switzerland

13.3.4 Spain

13.3.5 Italy

13.3.6 Rest of Europe

13.4 Asia-Pacific

13.4.1 China

13.4.2 Japan

13.4.3 South Korea

13.4.4 Taiwan

13.4.5 India

13.4.6 Singapore

13.4.7 Australia

13.4.8 Rest of Asia-Pacific

13.5 Latin America

13.5.1 Brazil

13.5.2 Mexico

13.5.3 Argentina

13.5.4 Rest of Latin America

13.6 Middle East & Africa

13.6.1 UAE

13.6.2 Saudi Arabia

13.6.3 Israel

13.6.4 South Africa

13.6.5 Rest of Middle East & Africa

14. Company Profiles

14.1 Storable Group

14.2 U-Haul International, Inc.

14.3 DOMICO Software

14.4 RADical Systems (UK) Ltd.

14.5 Corrigo Incorporated

14.6 QuikStor Security & Software

14.7 OpenTech Alliance, Inc.

14.8 Syrasoft Management Software

14.9 E-SoftSys LLC

14.10 Easy Storage Solutions

14.11 Storage Commander

14.12 Empower Software Technologies

14.13 Madwire, LLC

14.14 Unit Trac

14.15 Trackum Software

14.16 Storage Group Inc.

14.17 AndraTech Software

14.18 Primeur

14.19 Sentinel Systems LLC

14.20 Storeganise Ltd.

14.21 Yardi Systems Inc.

14.22 StorTrack

14.23 Others

15. Appendix

15.1 Available Customization

15.2 Related Reports

Published Date: Aug-2025

Published Date: Aug-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates