Resources

About Us

Recyclable Packaging Market by Material (Paper, Plastic, Bio-Based), End User (Food, Cosmetics, E-commerce, Pharma), and Region – Global Forecast to 2035

Report ID: MRCHM - 1041505 Pages: 248 May-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThis in-depth market research report examines the fast-changing Recyclable Packaging market, assessing the impact of sustainable packaging solutions and circular economy principles on the packaging industry across different applications and regions. It offers a strategic analysis of market dynamics, growth forecasts through 2035, and competitive positioning at both global and regional/country levels.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

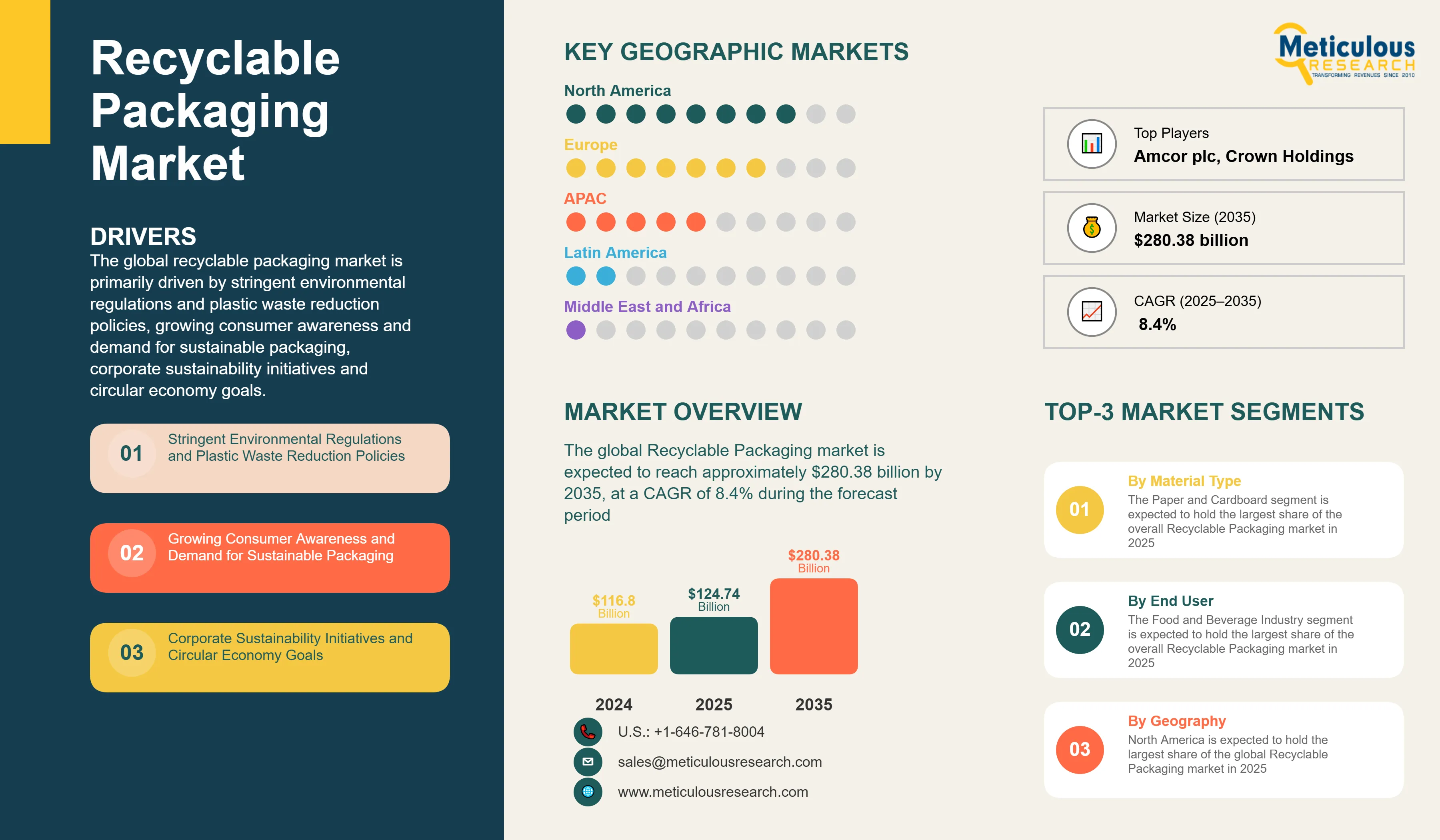

The global recyclable packaging market is primarily driven by stringent environmental regulations and plastic waste reduction policies, growing consumer awareness and demand for sustainable packaging, corporate sustainability initiatives and circular economy goals, government incentives for sustainable packaging solutions, and rising costs of raw materials and waste management. The increasing strategic partnerships between brand owners and packaging manufacturers are accelerating innovation, while the development of packaging-as-a-service business models is creating new operational efficiencies. Additionally, the integration of blockchain for supply chain transparency, focus on design for recyclability principles, and growth in advanced recycling technologies are further driving market growth, especially in North America and Europe.

Key Challenges

Despite its strong growth potential, the Recyclable Packaging market faces several challenges, including the high upfront costs of advanced recycling equipment, limited recycling infrastructure and collection systems, and technical difficulties associated with recycling multi-layer packaging. Consumer behaviour and compliance with recycling practices also pose significant hurdles. Contamination in recycling streams remains a major barrier to widespread adoption. Additionally, complexities related to standardization and certification, along with the economic feasibility of advanced recycling processes, need to be addressed. Maintaining cost competitiveness with traditional packaging solutions and ensuring access to specialized recycling technologies further challenge market expansion, potentially slowing adoption across various regions worldwide.

Growth Opportunities

The Recyclable Packaging market offers several high-growth opportunities. Development of chemical recycling processes presents a significant opportunity to handle complex packaging materials that cannot be mechanically recycled. The integration of digital marking and smart packaging can solve traceability concerns in recycling operations. Expansion in emerging markets provides new growth avenues, while innovation in bio-based and compostable materials improves sustainability profiles and reduces environmental impact. Additionally, the emergence of extended producer responsibility frameworks and specialized applications in sustainable packaging present untapped market potential, as organizations increasingly seek innovative solutions to meet environmental commitments.

Market Segmentation Highlights

By Material Type

The Paper and Cardboard segment is expected to hold the largest share of the overall Recyclable Packaging market in 2025, due to its established recycling infrastructure, consumer acceptance, and proven recyclability in existing systems. However, Bio-Based Materials are projected to grow at the fastest CAGR through 2035 as this technology offers biodegradability and compostability features, making them increasingly attractive for sustainable packaging applications.

By End User

The Food and Beverage Industry segment is expected to hold the largest share of the overall Recyclable Packaging market in 2025, driven by stringent food safety regulations and consumer demand for sustainable packaging. However, E-commerce and Logistics is projected to grow at the highest CAGR during the forecast period as online retail growth increases packaging demand and sustainability requirements. Pharmaceuticals also show strong growth potential as the sector seeks compliant recyclable packaging solutions for regulatory requirements.

By Geography

North America is expected to hold the largest share of the global Recyclable Packaging market in 2025, followed by Europe. Supportive policy frameworks, including extended producer responsibility programs, substantial government incentives for sustainable packaging, and strong corporate commitment to sustainability targets, drive this leadership position. The U.S. represents the largest market in North America, while Germany leads in Europe due to advanced recycling infrastructure and comprehensive packaging regulations. However, the Asia-Pacific region, particularly China, India, and Japan, is projected to witness the highest CAGR during the forecast period 2025-2035, driven by increasing environmental awareness, growing regulatory pressures, and significant investments in recycling infrastructure. The Latin America region shows promising growth potential as countries like Brazil and Mexico implement stricter packaging regulations and develop circular economy frameworks.

Competitive Landscape

The global Recyclable Packaging market presents a diverse competitive landscape, where established packaging manufacturers compete alongside specialized recycling technology firms and innovators in sustainable materials.

The broader ecosystem of solution providers can be divided into traditional packaging leaders driving sustainable transformation and cutting-edge technology developers creating advanced recycling solutions. Each segment employs unique strategies to sustain their competitive edge. Leading companies are prioritizing integrated solutions that combine recyclable materials with advanced processing technologies, while also developing specialized applications and adapting to evolving regulatory requirements.

The key players operating in the global Recyclable Packaging market are Amcor plc, International Paper Company, WestRock Company, Sealed Air Corporation, Sonoco Products Company, Berry Global Group, Inc., CCL Industries Inc., Crown Holdings, Inc., Ball Corporation, Smurfit Kappa Group plc, Mondi plc, Huhtamaki Oyj, Stora Enso Oyj, Tetra Pak International S.A., and Krones AG, among others.

|

Particulars |

Details |

|

Number of Pages |

248 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.4% |

|

Market Size (Value)in 2025 |

$124.74 billion |

|

Market Size (Value) in 2035 |

$280.38 billion |

|

Segments Covered |

By Material Type

By End User

|

|

Countries Covered |

North America: U.S., Canada |

|

Key Companies |

Industry Leaders: Amcor plc, International Paper Company, WestRock Company, Sealed Air Corporation, Sonoco Products Company Technology Innovators: Berry Global Group, Inc., CCL Industries Inc., Crown Holdings, Inc., Ball Corporation, Smurfit Kappa Group plc Emerging Players: Mondi plc, Huhtamaki Oyj, Stora Enso Oyj, Tetra Pak International S.A., Krones AG |

The global Recyclable Packaging market was valued at $116.8 billion in 2024 and is expected to reach approximately $280.38 billion by 2035, growing from an estimated $124.74 billion in 2025, at a CAGR of 8.4% during the forecast period of 2025–2035.

The global Recyclable Packaging market is expected to grow at a CAGR of 8.4% during the forecast period of 2025–2035.

The global Recyclable Packaging market is expected to reach approximately $280.38 billion by 2035, growing from an estimated $124.74 billion in 2025, at a CAGR of 8.4% during the forecast period of 2025–2035.

The key companies operating in this market include Amcor plc, International Paper Company, WestRock Company, Sealed Air Corporation, Sonoco Products Company, Berry Global Group, Inc., CCL Industries Inc., Crown Holdings, Inc., Ball Corporation, Smurfit Kappa Group plc, Mondi plc, Huhtamaki Oyj, Stora Enso Oyj, Tetra Pak International S.A., and Krones AG, among others.

Major trends shaping the market include strategic partnerships between brand owners and packaging manufacturers, development of packaging-as-a-service business models, integration of blockchain for supply chain transparency, and focus on design for recyclability principles.

• In 2025, the Paper and Cardboard segment is expected to dominate the overall Recyclable Packaging market by material type.

• Based on end user, the Food and Beverage segment is expected to hold the largest share of the global Recyclable Packaging market in 2025.

• Personal Care and Cosmetics is expected to be the second-largest end-user segment in 2025.

• Bio-Based Materials are projected to grow at the highest CAGR in the material type segment through 2035.

• E-commerce and Logistics applications are projected to grow at the highest CAGR during the forecast period.

North America is expected to hold the largest share of the global Recyclable Packaging market in 2025, followed by Europe. This is driven by supportive policy frameworks including extended producer responsibility programs, substantial government incentives for sustainable packaging, and strong corporate commitment to sustainability targets. However, the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period.

The growth of this market is driven by stringent environmental regulations and plastic waste reduction policies, growing consumer awareness and demand for sustainable packaging, corporate sustainability initiatives and circular economy goals, government incentives for sustainable packaging solutions, and rising costs of raw materials and waste management.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency & Pricing

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Segmental Analysis

3.2.1. Recyclable Packaging Market, by Material Type

3.2.2. Recyclable Packaging Market, by End User

3.2.3. Recyclable Packaging Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Market Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Stringent Environmental Regulations and Plastic Waste Reduction Policies

4.2.1.2. Growing Consumer Awareness and Demand for Sustainable Packaging

4.2.1.3. Corporate Sustainability Initiatives and Circular Economy Goals

4.2.1.4. Government Incentives for Sustainable Packaging Solutions

4.2.1.5. Rising Costs of Raw Materials and Waste Management

4.2.2. Restraints

4.2.2.1. High Initial Investment in Advanced Recycling Equipment

4.2.2.2. Limited Recycling Infrastructure and Collection Systems

4.2.2.3. Technical Challenges in Multi-Layer Packaging Recycling

4.2.2.4. Consumer Behaviour and Recycling Compliance Issues

4.2.3. Opportunities

4.2.3.1. Development of Chemical Recycling Processes

4.2.3.2. Integration of Digital Marking and Smart Packaging

4.2.3.3. Expansion in Emerging Markets

4.2.3.4. Innovation in Bio-Based and Compostable Materials

4.2.4. Trends

4.2.4.1. Strategic Partnerships Between Brand Owners and Packaging Manufacturers

4.2.4.2. Development of Packaging-as-a-Service Business Models

4.2.4.3. Integration of Blockchain for Supply Chain Transparency

4.2.4.4. Focus on Design for Recyclability Principles

4.2.5. Challenges

4.2.5.1. Contamination Issues in Recycling Streams

4.2.5.2. Standardization and Certification Complexities

4.2.5.3. Economic Viability of Advanced Recycling Processes

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Impact of Sustainability on the Recyclable Packaging Market

4.4.1. Carbon Footprint Reduction Targets

4.4.2. Sustainable Manufacturing Practices

4.4.3. Life Cycle Assessment of Recyclable Packaging Materials

4.4.4. Circular Economy and Extended Producer Responsibility

4.5. ESG and Regulatory Compliance Landscape

4.6. Innovation Roadmap and Technology Trends

4.7. Customer Insights and Buyer Personas

4.8. Value Chain and Ecosystem Analysis

4.9. Scenario Analysis and Market Disruptions

4.10. Case Studies of Recyclable Packaging Implementation

5. Recyclable Packaging Market Assessment—by Material Type

5.1. Paper and Cardboard

5.2. Plastic Polymers

5.3. Glass

5.4. Metal

5.5. Bio-Based Materials

5.6. Multi-Layer Materials

6. Recyclable Packaging Market Assessment—by End User

6.1. Food and Beverage

6.2. Personal Care and Cosmetics

6.3. Pharmaceuticals

6.4. E-commerce and Logistics

6.5. Consumer Electronics

6.6. Automotive

6.7. Other End Users

7. Recyclable Packaging Market Assessment—by Geography

7.1. Overview

7.2. North America

7.2.1. U.S.

7.2.2. Canada

7.3. Europe

7.3.1. Germany

7.3.2. United Kingdom

7.3.3. France

7.3.4. Netherlands

7.3.5. Sweden

7.3.6. Italy

7.3.7. Rest of Europe (RoE)

7.4. Asia-Pacific

7.4.1. China

7.4.2. Japan

7.4.3. South Korea

7.4.4. Australia

7.4.5. India

7.4.6. Singapore

7.4.7. Rest of Asia-Pacific (RoAPAC)

7.5. Latin America

7.5.1. Brazil

7.5.2. Mexico

7.5.3. Chile

7.5.4. Rest of Latin America (RoLATAM)

7.6. Middle East & Africa

7.6.1. United Arab Emirates (UAE)

7.6.2. Saudi Arabia

7.6.3. South Africa

7.6.4. Qatar

7.6.5. Rest of Middle East & Africa (RoMEA)

8. Competitive Landscape

8.1. Overview

8.2. Key Growth Strategies

8.3. Competitive Benchmarking

8.4. Competitive Dashboard

8.4.1. Industry Leaders

8.4.2. Market Differentiators

8.4.3. Vanguards

8.4.4. Emerging Players

8.5. Market Share/Ranking Analysis, by Key Players, 2024

9. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

9.1. Amcor plc

9.2. International Paper Company

9.3. WestRock Company

9.4. Sealed Air Corporation

9.5. Sonoco Products Company

9.6. Berry Global Group, Inc.

9.7. CCL Industries Inc.

9.8. Crown Holdings, Inc.

9.9. Ball Corporation

9.10. Smurfit Kappa Group plc

9.11. Mondi plc

9.12. Huhtamaki Oyj

9.13. Stora Enso Oyj

9.14. Tetra Pak International S.A.

9.15. Krones AG

10. Appendix

10.1. Available Customizations

10.2. Related Reports

List of Tables

Global Market Overview

Table 1: Global Recyclable Packaging Market, 2023–2035 (USD Million)

Table 2: Global Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 3: Global Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 4: Global Recyclable Packaging Market, by Region/Country, 2023–2035 (USD Million)

Material Type Segment

Table 5: Global Paper and Cardboard Packaging Market, by Region/Country, 2023–2035 (USD Million)

Table 6: Global Plastic Polymers Packaging Market, by Region/Country, 2023–2035 (USD Million)

Table 7: Global Glass Packaging Market, by Region/Country, 2023–2035 (USD Million)

Table 8: Global Metal Packaging Market, by Region/Country, 2023–2035 (USD Million)

Table 9: Global Bio-Based Materials Packaging Market, by Region/Country, 2023–2035 (USD Million)

Table 10: Global Multi-Layer Materials Packaging Market, by Region/Country, 2023–2035 (USD Million)

End User Segment

Table 11: Global Recyclable Packaging Market for Food and Beverage, by Region/Country, 2023–2035 (USD Million)

Table 12: Global Recyclable Packaging Market for Personal Care and Cosmetics, by Region/Country, 2023–2035 (USD Million)

Table 13: Global Recyclable Packaging Market for Pharmaceuticals, by Region/Country, 2023–2035 (USD Million)

Table 14: Global Recyclable Packaging Market for E-commerce and Logistics, by Region/Country, 2023–2035 (USD Million)

Table 15: Global Recyclable Packaging Market for Consumer Electronics, by Region/Country, 2023–2035 (USD Million)

Table 16: Global Recyclable Packaging Market for Automotive, by Region/Country, 2023–2035 (USD Million)

Table 17: Global Recyclable Packaging Market for Other End Users, by Region/Country, 2023–2035 (USD Million)

North America Market

Table 18: North America Recyclable Packaging Market, 2023–2035 (USD Million)

Table 19: North America Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 20: North America Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 21: North America Recyclable Packaging Market, by Country, 2023–2035 (USD Million)

U.S. Market

Table 22: U.S. Recyclable Packaging Market, 2023–2035 (USD Million)

Table 23: U.S. Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 24: U.S. Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Canada Market

Table 25: Canada Recyclable Packaging Market, 2023–2035 (USD Million)

Table 26: Canada Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 27: Canada Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Europe Market

Table 28: Europe Recyclable Packaging Market, 2023–2035 (USD Million)

Table 29: Europe Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 30: Europe Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 31: Europe Recyclable Packaging Market, by Country, 2023–2035 (USD Million)

Germany Market

Table 32: Germany Recyclable Packaging Market, 2023–2035 (USD Million)

Table 33: Germany Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 34: Germany Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

United Kingdom Market

Table 35: United Kingdom Recyclable Packaging Market, 2023–2035 (USD Million)

Table 36: United Kingdom Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 37: United Kingdom Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

France Market

Table 38: France Recyclable Packaging Market, 2023–2035 (USD Million)

Table 39: France Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 40: France Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Netherlands Market

Table 41: Netherlands Recyclable Packaging Market, 2023–2035 (USD Million)

Table 42: Netherlands Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 43: Netherlands Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Sweden Market

Table 44: Sweden Recyclable Packaging Market, 2023–2035 (USD Million)

Table 45: Sweden Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 46: Sweden Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Italy Market

Table 47: Italy Recyclable Packaging Market, 2023–2035 (USD Million)

Table 48: Italy Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 49: Italy Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Rest of Europe Market

Table 50: Rest of Europe Recyclable Packaging Market, 2023–2035 (USD Million)

Table 51: Rest of Europe Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 52: Rest of Europe Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Asia-Pacific Market

Table 53: Asia-Pacific Recyclable Packaging Market, 2023–2035 (USD Million)

Table 54: Asia-Pacific Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 55: Asia-Pacific Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 56: Asia-Pacific Recyclable Packaging Market, by Country, 2023–2035 (USD Million)

China Market

Table 57: China Recyclable Packaging Market, 2023–2035 (USD Million)

Table 58: China Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 59: China Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Japan Market

Table 60: Japan Recyclable Packaging Market, 2023–2035 (USD Million)

Table 61: Japan Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 62: Japan Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

South Korea Market

Table 63: South Korea Recyclable Packaging Market, 2023–2035 (USD Million)

Table 64: South Korea Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 65: South Korea Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Australia Market

Table 66: Australia Recyclable Packaging Market, 2023–2035 (USD Million)

Table 67: Australia Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 68: Australia Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

India Market

Table 69: India Recyclable Packaging Market, 2023–2035 (USD Million)

Table 70: India Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 71: India Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Singapore Market

Table 72: Singapore Recyclable Packaging Market, 2023–2035 (USD Million)

Table 73: Singapore Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 74: Singapore Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Rest of Asia-Pacific Market

Table 75: Rest of Asia-Pacific Recyclable Packaging Market, 2023–2035 (USD Million)

Table 76: Rest of Asia-Pacific Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 77: Rest of Asia-Pacific Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Latin America Market

Table 78: Latin America Recyclable Packaging Market, 2023–2035 (USD Million)

Table 79: Latin America Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 80: Latin America Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 81: Latin America Recyclable Packaging Market, by Country, 2023–2035 (USD Million)

Brazil Market

Table 82: Brazil Recyclable Packaging Market, 2023–2035 (USD Million)

Table 83: Brazil Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 84: Brazil Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Mexico Market

Table 85: Mexico Recyclable Packaging Market, 2023–2035 (USD Million)

Table 86: Mexico Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 87: Mexico Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Chile Market

Table 88: Chile Recyclable Packaging Market, 2023–2035 (USD Million)

Table 89: Chile Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 90: Chile Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Rest of Latin America Market

Table 91: Rest of Latin America Recyclable Packaging Market, 2023–2035 (USD Million)

Table 92: Rest of Latin America Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 93: Rest of Latin America Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Middle East & Africa Market

Table 94: Middle East & Africa Recyclable Packaging Market, 2023–2035 (USD Million)

Table 95: Middle East & Africa Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 96: Middle East & Africa Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Table 97: Middle East & Africa Recyclable Packaging Market, by Country, 2023–2035 (USD Million)

United Arab Emirates (UAE) Market

Table 98: UAE Recyclable Packaging Market, 2023–2035 (USD Million)

Table 99: UAE Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 100: UAE Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Saudi Arabia Market

Table 101: Saudi Arabia Recyclable Packaging Market, 2023–2035 (USD Million)

Table 102: Saudi Arabia Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 103: Saudi Arabia Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

South Africa Market

Table 104: South Africa Recyclable Packaging Market, 2023–2035 (USD Million)

Table 105: South Africa Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 106: South Africa Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Qatar Market

Table 107: Qatar Recyclable Packaging Market, 2023–2035 (USD Million)

Table 108: Qatar Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 109: Qatar Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

Rest of Middle East & Africa Market

Table 110: Rest of Middle East & Africa Recyclable Packaging Market, 2023–2035 (USD Million)

Table 111: Rest of Middle East & Africa Recyclable Packaging Market, by Material Type, 2023–2035 (USD Million)

Table 112: Rest of Middle East & Africa Recyclable Packaging Market, by End User, 2023–2035 (USD Million)

List of Figures

Figure 1: Global Recyclable Packaging Market Size, 2023–2035 (USD Million)

Figure 2: Global Recyclable Packaging Market Growth, Y-o-Y % Growth, 2025-2035

Figure 3: Global Recyclable Packaging Market, by Material Type, 2025 vs. 2035 (%)

Figure 4: Global Recyclable Packaging Market, by End User, 2025 vs. 2035 (%)

Figure 5: Global Recyclable Packaging Market, by Region/Country, 2025 vs. 2035 (%)

Figure 6: Impact Assessment of Market Drivers on Global Recyclable Packaging Market (2025-2032)

Figure 7: Impact Assessment of Market Restraints on Global Recyclable Packaging Market (2025-2035)

Figure 8: Impact Assessment of Market Opportunities on Global Recyclable Packaging Market (2025-2035)

Figure 9: Porter's Five Forces Analysis: Global Recyclable Packaging Market

Figure 10: Recyclable Packaging Adoption Rate by Material Type, 2024

Figure 11: Key Environmental Regulations for Packaging Materials by Region

Figure 12: Investment Trends in Advanced Recycling Technology, 2022-2025

Figure 13: Circular Economy Framework for Packaging Materials, 2020-2030

Figure 14: Total Cost of Ownership Comparison: Recyclable vs. Conventional Packaging

Figure 15: Recycling Infrastructure Development Timeline by Material Type, 2023–2035

Figure 16: Carbon Emission Reduction Potential: Recyclable vs. Non-Recyclable Packaging

Figure 17: Global Packaging Sustainability Timeline by End-User Industry, 2023–2035

Figure 18: Extended Producer Responsibility Implementation in Recyclable Packaging Market

Figure 19: Chemical vs. Mechanical Recycling Technology Comparison

Figure 20: Smart Packaging and Digital Watermarking Technology Adoption Trends

Figure 21: Contamination Rate Analysis in Recycling Streams by Material Type

Figure 22: Design for Recyclability Index by Packaging Category

Figure 23: Packaging-as-a-Service Model Adoption in Recyclable Packaging Market

Figure 24: North America Recyclable Packaging Market Snapshot, 2025-2035 (USD Million)

Figure 25: North America Recyclable Packaging Market Share, by Country, 2025 vs. 2035 (%)

Figure 26: Europe Recyclable Packaging Market Snapshot, 2025-2035 (USD Million)

Figure 27: Europe Recyclable Packaging Market Share, by Country, 2025 vs. 2035 (%)

Figure 28: Asia-Pacific Recyclable Packaging Market Snapshot, 2025-2035 (USD Million)

Figure 29: Asia-Pacific Recyclable Packaging Market Share, by Country, 2025 vs. 2035 (%)

Figure 30: Latin America Recyclable Packaging Market Snapshot, 2025-2035 (USD Million)

Figure 31: Latin America Recyclable Packaging Market Share, by Country, 2025 vs. 2035 (%)

Figure 32: Middle East & Africa Recyclable Packaging Market Snapshot, 2025-2035 (USD Million)

Figure 33: Middle East & Africa Recyclable Packaging Market Share, by Country, 2025 vs. 2035 (%)

Published Date: Sep-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates