Resources

About Us

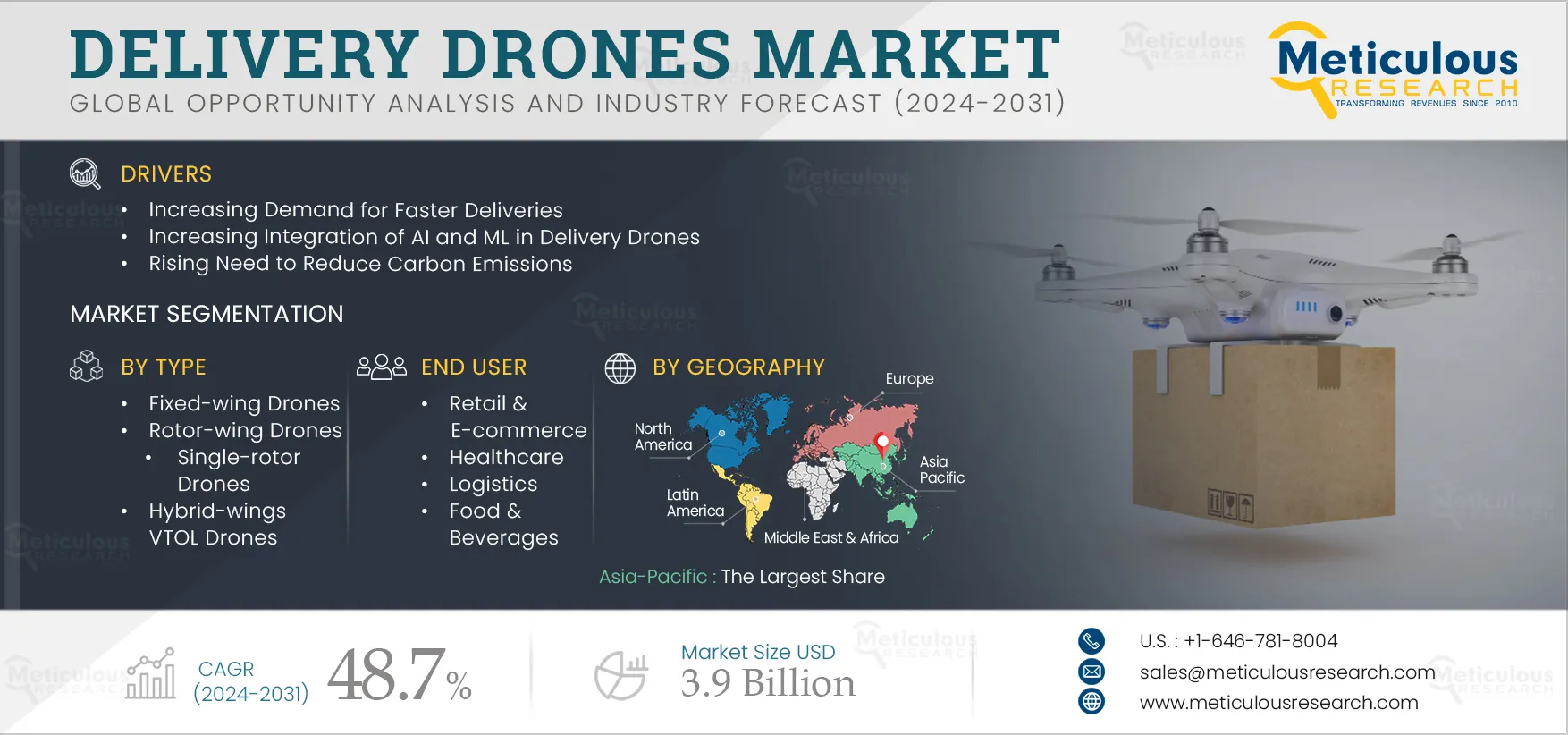

Delivery Drones Market Size, Share, Forecast, & Trends Analysis by Type (Fixed-wing Drones, Rotor-wing Drones), Payload (> 10 KG, 10-100 KG, < 100 KG), Range (Visual Line of Sight, Extended Visual Line of Sight), End User (Healthcare, Logistics) - Global Forecast to 2031

Report ID: MRSE - 104500 Pages: 250 Aug-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe delivery drones’ market is seeing growth due to rising demand for faster deliveries, increased integration of AI and ML in delivery drones, and the growing need to minimize carbon emissions. Furthermore, increased private investment in the drone industry is expected to provide significant growth opportunities for players operating in the delivery drone’s market.

The demand for delivery drones has surged as they are being used in e-commerce to deliver goods to customers in less time. In addition, technological advancements such as route optimization algorithms, real-time tracking, and automated warehouses have helped to streamline logistics processes. These technologies allow for speedier order processing and more efficient delivery routes. As a result, there is a growing trend toward online purchasing, as well as increased demand for rapid and dependable delivery services. Many consumers have become reliant on e-commerce for their daily necessities, which increases the demand for faster deliveries.

Furthermore, as the need for speedier deliveries grows, numerous organizations are considering a variety of tactics, including expanding their distribution center network, collaborating with third-party logistics providers, employing local couriers, and investing in innovative technological solutions.

For instance, in October 2023, Amazon.com, Inc. (U.S.) launched ultra-fast drone deliveries in Italy, the UK, and a third site in the U.S. The additional areas complement the company's existing drone delivery operations in the U.S., employing drones to safely carry products weighing up to five pounds in one hour or less. This expanding development contributes to a rise in demand for delivery drones over the anticipated period.

Click here to: Get Free Sample Pages of this Report

The growing use of artificial intelligence (AI) in delivery drones analyzes a range of data, including traffic patterns, weather, and delivery schedules, to optimize drone routes. Additionally, machine learning models assist in predicting the most effective routes, which lowers energy usage and delivery times, by learning from previous delivery data. AI-enabled drones employ computer vision and sensors to recognize and avoid obstacles instantly. Further, by using machine learning techniques, drones can learn from past encounters and gradually enhance their obstacle-avoidance capabilities.

AI and ML systems continuously monitor drone performance and estimate maintenance requirements based on usage patterns and environmental conditions. This strategy reduces downtime and ensures the operational efficiency of delivery drones. As a result, various delivery drones are progressively incorporating AI and ML to provide faster and more dependable deliveries, enhancing overall customer satisfaction and repeat business. Such advancements and benefits aid in boosting demand for AI-powered delivery drones during the forecast period.

The growing utilization of collaborative drones and swarm technology is a cutting-edge breakthrough in the field of unmanned aerial vehicles (UAVs) and robotics for delivery operations in a variety of industries, including retail and e-commerce, logistics, and healthcare. Recently, there has been a surge in the use of collaborative drones for complicated activities such as search and rescue operations, agricultural monitoring, infrastructure inspection, and disaster response. These drones can share information in real-time, allowing them to coordinate operations and improve overall performance. Thus, some delivery drone suppliers are rapidly offering collaborative drones that incorporate advanced algorithms and AI to help coordinate their motions and operations. This autonomy makes them more adaptable to changing settings and tasks.

Furthermore, some organizations are increasingly using Swarm technology for large-scale operations, which allows a huge number of drones to work together in a coordinated manner. They can do tasks on a far larger scale than individual drones or small groups. The swarm system uses distributed intelligence, with each drone operating based on local information and communicating with surrounding drones to deliver items. Thus, collaborative drones and swarm technology extend UAV capabilities beyond individual restrictions, allowing for more extensive data collecting, faster response times, and higher delivery rates.

Based on type, the delivery drones market is segmented into fixed-wing drones, rotor-wing drones, and hybrid-wings VTOL drones. In 2024, the rotor-wing drones segment is expected to account for the largest share of over 61.0% of the delivery drones market. This segment's growth is attributed to the increasing usage of rotor-wing drones due to their capacity to drift in a fixed position with vertical take-off and landing, as well as the rising adoption of rotor drones for longer flight periods, greater endurance, and heavier payload capability. Additionally, rotor-wing drones are becoming increasingly popular due to their low power consumption and longer flying duration.

However, the hybrid-wings VTOL drones segment is estimated to register the highest CAGR during the forecast period. This market is anticipated to grow as a result of the rising demand for hybrid-wing vertical takeoff and landing (VTOL) drones, which can fly vertically without a runway or special platform. These drones are also growing in popularity because of their endurance and capacity to cover greater distances faster. Moreover, the growing popularity of hybrid-wing VTOL drones allows them to fly at higher altitudes and lowers the possibility of airframe damage during landings.

Based on payload, the delivery drones market is segmented into > 10 Kg, 10-100 Kg, and < 100 Kg. In 2024, the 10-100 Kg segment is expected to account for the largest share of over 40.0% of the delivery drones market. This segment's growth is attributed to the growing demand for faster package delivery services in the retail and e-commerce industries, the logistics industry's need for 10-100 kg payload drones to ship packages of commercial goods, and the healthcare industry's growing need for larger payload drones to provide emergency services in remote or inaccessible areas. Furthermore, this segment is also anticipated to register the highest CAGR during the forecast period.

Based on range, the delivery drones market is segmented into visual line of sight (VLOS), extended visual line of sight (EVLOS), and beyond line of sight (BLOS). In 2024, the visual line of sight (VLOS) segment is expected to account for the largest share of over 65.0% of the delivery drones market. The increasing need for quicker deliveries of necessities like groceries and food in neighboring locations, as well as the requirement for VLOS drones to retain a direct visual connection with the drones in order to monitor the drone's flight path and surroundings, are contributing factors to the segment's growth.

However, the extended visual line of sight (EVLOS) segment is poised to register the highest CAGR during the forecast period. This segment is growing for spontaneous operation and to reduce gaps between facilities and rural communities. Drones are being used more frequently for EVLOS to make time-sensitive deliveries over long distances in minimal time duration. Furthermore, EVLOS drones are more capable than VLOS drones of delivering emergency medicines, vaccines, and essential supplies.

Based on end user, the delivery drones market is segmented into retail and e-commerce, healthcare, logistics, food & beverages, agriculture, oil & gas, and other end users. In 2024, the retail and e-commerce segment is expected to account for the largest share of over 31.0% of the delivery drones market. This segment's growth is attributed to the increasing adoption of delivery drones in online retailing to maximize revenues and conversion rates by reducing delivery time, the increasing demand for door-to-door delivery in less time, and the growing need for drones in retail to reduce manpower, cost-effectiveness, and contactless deliveries.

However, the logistics segment is expected to register the highest CAGR during the forecast period. The increasing requirement for drones for last-mile delivery, as well as the growing need for speedy delivery of commercial goods packages, are driving this segment's growth. Furthermore, delivery drones eliminate the need for road transit, traffic jams, and delivery delays in the logistics industry.

Based on geography, the delivery drones market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of over 45.0% of the delivery drones market. The growing demand for online shopping in various developing countries such as China, India, and Japan, the rapid growth in parcel fraud, missing items, or fake courier scams in traditional deliveries, and the region's increasing investment in delivery drones for various industries such as retail and e-commerce, healthcare, and logistics have all contributed to the market's growth.

Additionally, various countries in the region are increasing their investment in delivery drones as they become more widely used for logistics in the military and defense sectors. For example, in January 2024, the Indian government invested USD 38.5 million (INR 320 crore) in 563 logistics drones. Autonomous devices can transport cargo at elevations of more than 12,000 feet (3,657 meters). These drones provide last-mile delivery to troops stationed around borders.

However, North America is estimated to register the highest CAGR of 50.0% during the forecast period. The increasing growth of e-commerce and demand for quick delivery in the region, the growing technological advancement in the region for delivery drones, the rising investment by commercial operators to provide fully automatic delivery drones, and the growing drone delivery pilot programs for healthcare supplies, retail orders, and food delivery in the region all contribute to the market's growth.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. Some of the key players operating in the delivery drones market are Amazon.com Inc. (U.S.), The Boeing Company (U.S.), Airbus SE (Netherlands), Drone Delivery Canada Corp. (Canada), Wing Aviation (U.S.), Zipline International Inc. (U.S.), A Wingcopter GmbH (Germany), Flytrex Inc. (Israel), Deutsche Post AG (Germany), United Parcel Service, Inc. (U.S.), S.F. Express Co., Ltd. (China), Rakuten Group, Inc. (Japan), SZ DJI Technology Co., Ltd. (China), Matternet, Inc. (U.S.), and DroneUp, LLC (U.S.).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

48.7% |

|

Market Size |

USD 3.9 Billion by 2031 |

|

Segments Covered |

By Type

By Payload

By Range

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Netherlands, Switzerland, Sweden, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, Indonesia, Thailand, Vietnam, Malaysia, Singapore, and Rest of Asia- Pacific), Latin America (Mexico, Brazil, and Rest of Latin America), and Middle East & Africa (UAE, Israel, and Rest of Middle East & Africa) |

|

Key Companies |

Amazon.com Inc. (U.S.), The Boeing Company (U.S.), Airbus SE (Netherlands), Drone Delivery Canada Corp. (Canada), Wing Aviation (U.S.), Zipline International Inc. (U.S.), A Wingcopter GmbH (Germany), Flytrex Inc. (Israel), Deutsche Post AG (Germany), United Parcel Service, Inc. (U.S.), S.F. Express Co., Ltd. (China), Rakuten Group, Inc. (Japan), SZ DJI Technology Co., Ltd. (China), Matternet, Inc. (U.S.), and DroneUp, LLC (U.S.) |

The delivery drones market is expected to reach $3.9 billion by 2031, at a CAGR of 48.7% from 2024 to 2031.

The delivery drones market study focuses on market assessment and opportunity analysis based on the sales of delivery drones across different regions and countries and market segmentations. This study is also focused on competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

In 2024, the rotor-wing drones segment is expected to account for the largest share of over 61.0% of the delivery drones market. The growth of this segment is attributed to the increasing adoption of rotor-wing drones due to their ability to drift in a fixed position with vertical take-off & landing and the rising adoption of rotor drones for higher flying times, long-endurance, and heavier payload capability. Moreover, the growing adoption of rotor-wing drones due to its low power consumption and longer flight duration.

The logistics segment is projected to register the highest CAGR during the forecast period. This segment's growth is attributed to the increasing need for drones for last-mile delivery and the increasing demand for the fast delivery of packages of commercial goods. Additionally, delivery drones eliminate the need for road transportation, traffic issues, and delivery delays in the logistics industry.

The growth of the delivery drones market is driven by the increasing demand for faster deliveries, increasing integration of AI and ML in delivery drones, and rising need to reduce carbon emissions. Furthermore, the rising private investments in the drones industry are expected to offer significant growth opportunities for players operating in the delivery drones market.

The key players operating in the delivery drones market include Amazon.com Inc. (U.S.), The Boeing Company (U.S.), Airbus SE (Netherlands), Drone Delivery Canada Corp. (Canada), Wing Aviation (U.S.), Zipline International Inc. (U.S.), A Wingcopter GmbH (Germany), Flytrex Inc. (Israel), Deutsche Post AG (Germany), United Parcel Service, Inc. (U.S.), S.F. Express Co., Ltd. (China), Rakuten Group, Inc. (Japan), SZ DJI Technology Co., Ltd. (China), Matternet, Inc. (U.S.), and DroneUp, LLC (U.S.).

North America is projected to register the highest CAGR of 50.0% during the forecast period. The increasing growth of e-commerce and demand for quick delivery in the region, the growing technological advancement in the region for delivery drones, the rising investment by commercial operators to provide fully automatic delivery drones, and the growing drone delivery pilot programs for healthcare supplies, retail orders, and food delivery in the region.

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates