Resources

About Us

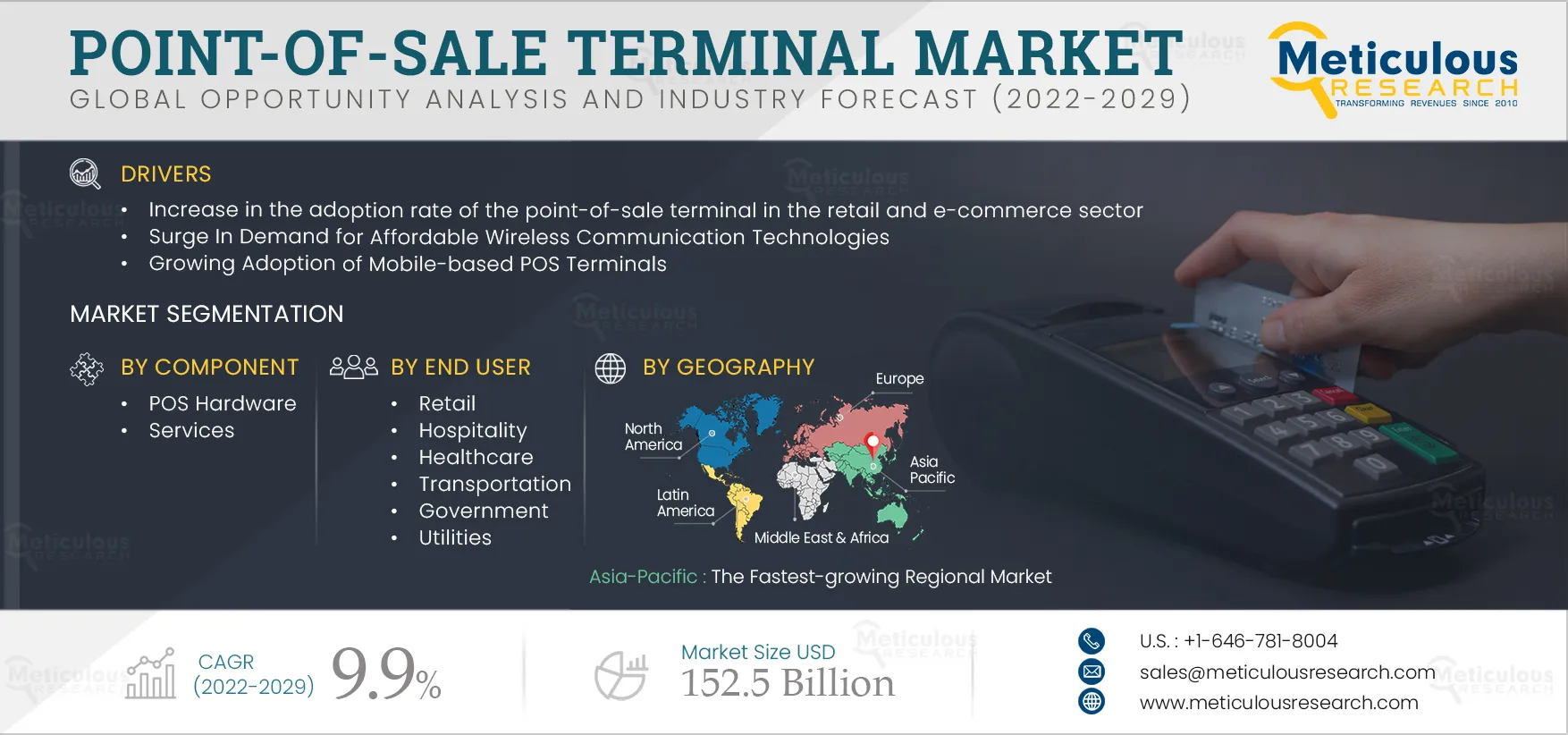

Point-of-Sale Terminal Market by Component (POS Hardware, Services), Operating System, (Android-based POS Terminal, Windows-based POS Terminal) End User (Retail, Hospitality, Healthcare, and Government) - Global Forecast to 2029

Report ID: MRICT - 104673 Pages: 230 Sep-2022 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe Point-of-Sale Terminal Market is projected to reach $152.5 billion by 2029, at a CAGR of 9.9% from 2022 to 2029. Based on volume, the global point-of-sale terminals market is projected to reach 687.4 million units by 2029, at a CAGR of 12.0% during the forecast period. The point-of-sale terminals market is majorly driven by the growing adoption of mobile-based POS terminals, growing use of Europay, Mastercard, and Visa (EMV) Cards, and rising adoption of POS terminals in the retail and e-commerce sector. Further, increasing demand for contactless and cashless payment is expected to offer significant growth opportunities for the point-of-sale terminals market. However, data security concerns and misconceptions and lack of standardization regarding POS terminal technology restrain the growth of the market to some extent.

The COVID-19 pandemic adversely impacted the global economy. Nationwide lockdowns and social distancing norms were imposed across several countries, negatively affecting multiple industries, including the point-of-sale terminal. Uncertainty regarding the duration of the lockdowns made it difficult for the key market players to anticipate the recovery of the point-of-sale terminals market. Numerous POS terminal providers were under immense pressure across various fronts due to the COVID-19 pandemic.

However, economies are shifting their focus from responding to the pandemic to economic recovery, and hence, various growth opportunities are expected to emerge for the point-of-sale terminals market players due to the growing demand for seamless shopping experiences and the increasing adoption of smart payment solutions.

However, several businesses are exerting extensively to move the point-of-sale terminals market in the right direction. Local governments are also undertaking several relief steps to mitigate the negative impacts of the COVID-19 pandemic. As a result, the point-of-sale terminals market is expected to recover to its original track after 2023.

Click here to: Get Free Sample Copy of this report

The increasing demand for contactless and cashless payment is expected to offer significant growth opportunities for the point-of-sale terminal market

Some key benefits of going cashless payment that attract more consumers include safety, growth in saved funds in accounts, better money management, and flexibility. The ability to make different digital payments through banking cards enables consumers to opt for cashless payment modes. Users can store their card information in digital payment apps or mobile wallets to mark cashless payments. With the rising concerns over the safety of handling cash transactions due to the COVID-19 pandemic, wholesalers and consumers are relying on contactless payment modes to avoid the risk of getting infected. Thus, major companies worldwide have started investing in POS terminals to improve customer experience, creating significant growth opportunities for the point-of-sale terminals market.

In 2022, the POS Hardware Segment is Expected to Dominate the Point-of-sale Terminals Market

Based on component, the POS hardware segment is expected to account for the largest share of the point-of-sale terminals market in 2022. The growing demand for wireless communication technologies, increasing data visibility through cloud POS systems, and increasing demand for contactless and cashless payments are some of the factors driving the growth of this segment.

In 2022, the Android-based POS Terminals Segment is Expected to Dominate the Point-of-sale terminal market

Based on operating system, the android-based POS terminals segment is expected to account for the largest share of the point-of-sale terminals market in 2022. The increasing adoption of cloud-based and android POS devices and the growing adoption of wireless technologies in mobile handsets are expected to support the growth of this segment.

The Retail Segment is Expected to Dominate the Point-of-sale terminals market

Based on end user, the retail segment is expected to account for the largest share of the point-of-sale terminals market in 2022. The large market share of this segment is attributed to the rising penetration of e-commerce platforms, growing focus on contactless payments, increased adoption of in-store mobile payments, and strong growth in the global retail industry.

Asia-Pacific: The Fastest-growing Regional Market

In 2022, Asia Pacific is expected to account for the largest share of the point-of-sale terminals market, followed by North America, Europe, Latin America, and the Middle East & Africa. However, Asia-Pacific is expected to witness rapid growth during the forecast period. The rapid growth of this region is mainly driven by the presence of prominent point-of-sale terminal key players. Besides, the growing modernization of the payment industry, rising e-commerce, virtual payment trends, and increasing prominence of SMEs are expected to help the region grow rapidly over the coming years.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by the leading market participants in the point-of-sale terminal industry over the last four years. The key players profiled in the global point-of-sale terminals market are NCR Corporation (U.S.), Ingenico Group S.A. (France), Hewlett Packard Enterprise (U.S.), VeriFone, Inc. (U.S.), Toshiba Corporation (Japan), PAX Global Technology Limited. (China), Elavon Inc. (U.S.), Castles Technology Co., Ltd. (Taiwan), BBPOS International Limited. (China), Block, Inc. (U.S.), Cegid Group (France), Diebold Nixdorf, Incorporated. (U.S.), Newland Payment Technology (China), NEC Corporation (Japan), and Oracle Corporation (U.S.).

Scope of the Report

Point-of-Sale Terminal Market, by Component

POS Hardware

Point-of-Sale Terminal Market, by Operating System

Android-based POS Terminals

Point-of-Sale Terminal Market, by End User

Point-of-Sale Terminal Market, by Region

North America

Key questions answered in the report:

The Point-of-Sale (POS) Terminal Market involves hardware and software systems used to process customer transactions in retail, hospitality, healthcare, and other industries. These systems support cashless, contactless, and digital payments.

The market is projected to reach $152.5 billion by 2029.

The market is forecasted to grow at a CAGR of 9.9% from 2022 to 2029, reaching $152.5 billion by 2029.

The market size in 2022 is significant, with an expected growth to $152.5 billion by 2029. In terms of volume, the market is projected to reach 687.4 million units by 2029.

Key companies include:

Major trends include the growing adoption of mobile-based POS terminals, rising use of contactless and cashless payments, increasing e-commerce, and the shift toward cloud-based and android-based POS systems.

Key drivers include:

The market is segmented by:

The global outlook is positive, with significant growth opportunities, particularly in Asia-Pacific, which is expected to grow rapidly due to modernization in payment systems and increasing e-commerce activity.

The market is projected to grow at a CAGR of 9.9% from 2022 to 2029, reaching $152.5 billion by 2029.

The market is projected to grow at a CAGR of 9.9% during the forecast period.

Asia-Pacific is expected to account for the largest share of the POS terminal market in 2022 and is projected to witness the fastest growth during the forecast period.

Published Date: Jul-2025

Published Date: Jun-2020

Published Date: Aug-2024

Published Date: Aug-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates