1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Estimation Approach

2.4. Assumptions for the Study

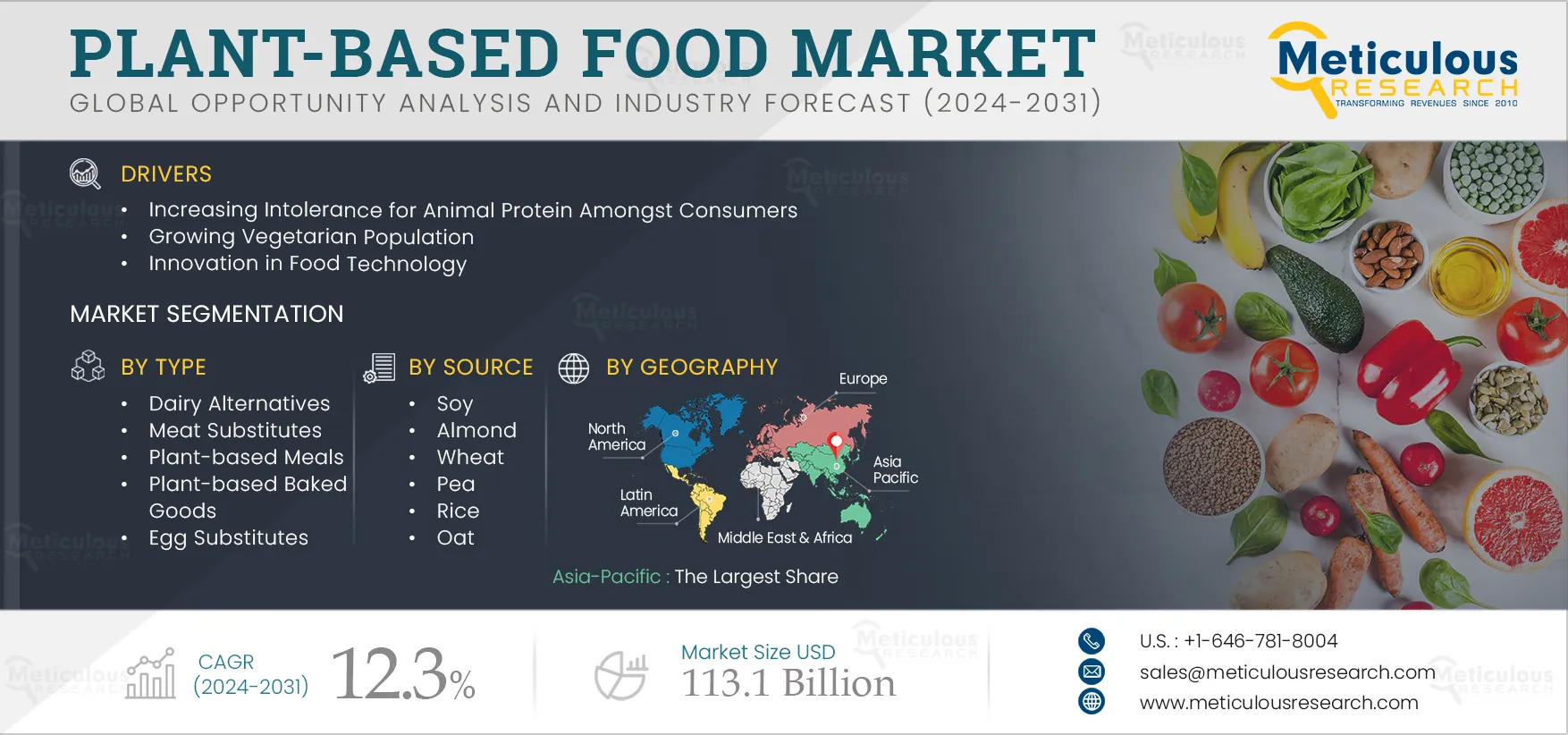

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Plant-based Food Market, by Type

3.2.2. Plant-based Food Market, by Source

3.2.3. Plant-based Food Market, by Distribution Channel

3.3. Plant-based Food Market: by Region

3.4. Market Competitors

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Increasing Intolerance for Animal Protein Amongst Consumers

4.2.2. Growing Vegetarian Population

4.2.3. Rising Number of Venture Investments in Plant-based Food Companies

4.2.4. Innovation in Food Technology

4.2.5. Growing Focus on Animal Welfare and Sustainability

4.3. Restraints

4.3.1. Comparatively Higher Price Range of Meat Substitutes

4.3.2. Significant Preference for Animal-based Products

4.3.3. Consumer Preference for Soy and Gluten-Free Products

4.4. Opportunities

4.4.1. Product Launches by Plant-based Food and Alternative Protein Manufacturers

4.4.2. Emerging Economies

4.5. Trends

4.5.1. Rising Industry Concentration with Growth in Mergers and Acquisitions in the Plant-based Food Space

4.6. Porters Five Forces Analysis

4.6.1. Bargaining Power of Suppliers

4.6.2. Bargaining Power of Buyers

4.6.3. Threat of Substitutes

4.6.4. Threat of New Entrants

4.6.5. Degree of Competition

4.7. Value Chain Analysis

5. Global Plant-based Food Market Assessment—by Type

5.1. Overview

5.2. Dairy Alternatives

5.2.1. Milk

5.2.2. Cheese

5.2.3. Yogurt

5.2.4. Butter

5.2.5. Ice Cream

5.2.6. Creamer

5.2.7. Other Dairy Alternatives

5.3. Meat Substitutes

5.3.1. Tofu

5.3.2. Textured Vegetable Protein (TVP)

5.3.3. Burger Patties

5.3.4. Tempeh

5.3.5. Hot Dogs & Sausages

5.3.6. Seitan

5.3.7. Meatballs

5.3.8. Ground Meat

5.3.9. Nuggets

5.3.10. Crumbles

5.3.11. Shreds

5.3.12. Other Meat Substitutes

5.4. Plant-based Meals

5.5. Plant-based Baked Goods

5.6. Plant-based Confectionery

5.7. Plant-based Beverages

5.8. Egg Substitute

5.9. Fish and Seafood Alternatives

5.10. Others Plant-based Food

6. Global Plant-based Food Market Assessment—by Source

6.1. Overview

6.2. Soy

6.3. Almond

6.4. Wheat

6.5. Pea

6.6. Rice

6.7. Oat

6.8. Other Sources

7. Global Plant-based Food Market Assessment—by Distribution Channel

7.1. Overview

7.2. Business-to-Business

7.3. Business-to-Consumer

7.3.1. Modern Groceries

7.3.2. Convenience Stores

7.3.3. Specialty Stores

7.3.4. Online Retail Stores

7.3.5. Other B2C Distribution Channels

8. Plant-based Food Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. U.K.

8.3.3. Spain

8.3.4. Italy

8.3.5. France

8.3.6. Netherlands

8.3.7. Belgium

8.3.8. Austria

8.3.9. Poland

8.3.10. Portugal

8.3.11. Netherlands

8.3.12. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. Australia

8.4.5. Thailand

8.4.6. South Korea

8.4.7. Rest of Asia-Pacific

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Argentina

8.5.4. Rest of Latin America

8.6. Middle East & Africa

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Share/Ranking Analysis of Key Players

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Beyond Meat Inc.

10.2. Impossible Foods Inc.

10.3. Danone S.A.

10.4. Garden Protein International, Inc.

10.5. Amy's Kitchen Inc.

10.6. Plamil Foods Ltd.

10.7. The Hain Celestial Group, Inc.

10.8. Sahmyook Foods

10.9. Sanitarium Health and Wellbeing Company

10.10. Daiya Foods Inc.

10.11. Earth's Own Food Company Inc.

10.12. Lightlife Foods, Inc.

10.13. Taifun –Tofu GmbH

10.14. Atlantic Natural Foods LLC

10.15. VBIte Food Ltd

10.16. Nutrisoy Pty Ltd.

10.17. Nestlé S.A.

10.18. Unilever PLC

10.19. Sophie’s Kitchen

10.20. Eat Just, Inc.

10.21. Other Companies

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Price Comparison Between Meat and Meatless Items at Fast-Food Chains (2021)

Table 2 Global Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 3 Global Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 4 Plant-based Dairy Alternatives Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Plant-based Milk Market, by Country/Region, 2022–2031 (USD Million)

Table 6 Plant-based Cheese Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Plant-based Yogurts Market, by Country/Region, 2022–2031 (USD Million)

Table 8 Plant-based Butter Market, by Country/Region, 2022–2031 (USD Million)

Table 9 Plant-based Ice Cream Market, by Country/Region, 2022–2031 (USD Million)

Table 10 Plant-based Creamer Market, by Country/Region, 2022–2031 (USD Million)

Table 11 Other Plant-based Dairy Alternatives Market, by Country/Region, 2022–2031 (USD Million)

Table 12 Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 13 Plant-based Meat Substitutes Market, by Country/Region, 2022–2031 (USD Million)

Table 14 Plant-based Tofu Market, by Country/Region, 2022–2031 (USD Million)

Table 15 Plant-based TVP Market, by Country/Region, 2022–2031 (USD Million)

Table 16 Plant-based Burger Patties Market, by Country/Region, 2022–2031 (USD Million)

Table 17 Plant-based Tempeh Market, by Country/Region, 2022–2031 (USD Million)

Table 18 Plant-based Hot Dogs and Sausages Market, by Country/Region, 2022–2031 (USD Million)

Table 19 Plant-based Seitan Market, by Country/Region, 2022–2031 (USD Million)

Table 20 Plant-based Meatballs Market, by Country/Region, 2022–2031 (USD Million)

Table 21 Plant-based Ground Meat Market, by Country/Region, 2022–2031 (USD Million)

Table 22 Plant-based Nuggets Market, by Country/Region, 2022–2031 (USD Million)

Table 23 Plant-based Crumbles Market, by Country/Region, 2022–2031 (USD Million)

Table 24 Plant-based Shreds Market, by Country/Region, 2022–2031 (USD Million)

Table 25 Other Plant-based Meat Substitutes Market, by Country/Region, 2022–2031 (USD Million)

Table 26 Plant-based Meals Market, by Country/Region, 2022–2031 (USD Million)

Table 27 Plant-based Baked Goods Market, by Country/Region, 2022–2031 (USD Million)

Table 28 Plant-based Confectionery Market, by Country/Region, 2022–2031 (USD Million)

Table 29 Plant-based Beverages Market, by Country/Region, 2022–2031 (USD Million)

Table 30 Plant-based Egg Substitutes Market, by Country/Region, 2022–2031 (USD Million)

Table 31 Plant-based Fish and Seafood Alternatives Market, by Country/Region, 2022–2031 (USD Million)

Table 32 Other Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 33 Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 34 Soy Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 35 Almond-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 36 Wheat-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 37 Pea-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 38 Rice-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 39 Oat-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 40 Other Source-Derived Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 41 Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 42 B2B Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 43 B2C Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 44 B2C Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 45 Plant-based Food Market Size for Modern Groceries, by Country/Region, 2022–2031 (USD Million)

Table 46 Plant-based Food Market Size for Convenience Stores, by Country/Region, 2022–2031 (USD Million)

Table 47 Plant-based Food Market Size for Specialty Stores, by Country/Region, 2022–2031 (USD Million)

Table 48 Plant-based Food Market Size for Online Retail Stores, by Country/Region, 2022–2031 (USD Million)

Table 49 Plant-based Food Market Size for Other B2C Distribution Channels, by Country/Region, 2022–2031 (USD Million)

Table 50 Plant-based Food Market, by Country/Region, 2022–2031 (USD Million)

Table 51 North America: Plant-based Food Market, by Country, 2022–2031 (USD Million)

Table 52 North America: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 53 North America: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 54 North America: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 55 North America: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 56 North America: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 57 North America: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 58 U.S.: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 59 U.S.: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 60 U.S.: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 61 U.S.: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 62 U.S.: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 63 U.S.: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 64 Canada: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 65 Canada: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 66 Canada: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 67 Canada: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 68 Canada: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 69 Canada: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 70 Europe: Plant-based Food Market, by Country, 2022–2031 (USD Million)

Table 71 Europe: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 72 Europe: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 73 Europe: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 74 Europe: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 75 Europe: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 76 Europe: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 77 Germany: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 78 Germany: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 79 Germany: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 80 Germany: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 81 Germany: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 82 Germany: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 83 U.K.: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 84 U.K.: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 85 U.K.: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 86 U.K.: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 87 U.K.: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 88 U.K.: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 89 Spain: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 90 Spain: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 91 Spain: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 92 Spain: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 93 Spain: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 94 Spain: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 95 Italy: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 96 Italy: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 97 Italy: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 98 Italy: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 99 Italy: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 100 Italy: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 101 France: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 102 France: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 103 France: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 104 France: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 105 France: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 106 France: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 107 Netherlands: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 108 Netherlands: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 109 Netherlands: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 110 Netherlands: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 111 Netherlands: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 112 Netherlands: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 113 Belgium: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 114 Belgium: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 115 Belgium: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 116 Belgium: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 117 Belgium: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 118 Belgium: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 119 Austria: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 120 Austria: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 121 Austria: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 122 Austria: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 123 Austria: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 124 Austria: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 125 Poland: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 126 Poland: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 127 Poland: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 128 Poland: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 129 Poland: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 130 Poland: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 131 Portugal: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 132 Portugal: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 133 Portugal: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 134 Portugal: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 135 Portugal: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 136 Portugal: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 137 Rest of Europe: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 138 Rest of Europe: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 139 Rest of Europe: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 140 Rest of Europe: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 141 Rest of Europe: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 142 Rest of Europe: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 143 Asia-Pacific: Plant-based Food Market, by Country, 2022–2031 (USD Million)

Table 144 Asia-Pacific: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 145 Asia-Pacific: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 146 Asia-Pacific: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 147 Asia-Pacific: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 148 Asia-Pacific: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 149 Asia-Pacific: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 150 China: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 151 China: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 152 China: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 153 China: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 154 China: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 155 China: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 156 India: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 157 India: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 158 India: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 159 India: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 160 India: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 161 India: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 162 Japan: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 163 Japan: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 164 Japan: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 165 Japan: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 166 Japan: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 167 Japan: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 168 Australia: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 169 Australia: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 170 Australia: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 171 Australia: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 172 Australia: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 173 Australia: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 174 Thailand: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 175 Thailand: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 176 Thailand: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 177 Thailand: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 178 Thailand: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 179 Thailand: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 180 South Korea: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 181 South Korea: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 182 South Korea: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 183 South Korea: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 184 South Korea: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 185 South Korea: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 186 Rest of Asia-Pacific: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 187 Rest of Asia-Pacific: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 188 Rest of Asia-Pacific: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 189 Rest of Asia-Pacific: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 190 Rest of Asia-Pacific: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 191 Rest of Asia-Pacific: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 192 Latin America: Plant-based Food Market, by Country, 2022–2031 (USD Million)

Table 193 Latin America: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 194 Latin America: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 195 Latin America: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 196 Latin America: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 197 Latin America: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 198 Latin America: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 199 Brazil: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 200 Brazil: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 201 Brazil: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 202 Brazil: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 203 Brazil: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 204 Brazil: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 205 Mexico: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 206 Mexico: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 207 Mexico: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 208 Mexico: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 209 Mexico: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 210 Mexico: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 211 Argentina: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 212 Argentina: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 213 Argentina: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 214 Argentina: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 215 Argentina: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 216 Argentina: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 217 Rest of Latin America: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 218 Rest of Latin America: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 219 Rest of Latin America: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 220 Rest of Latin America: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 221 Rest of Latin America: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 222 Rest of Latin America: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 223 Middle East & Africa: Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 224 Middle East & Africa: Plant-based Dairy Alternatives Market, by Type, 2022–2031 (USD Million)

Table 225 Middle East & Africa: Plant-based Meat Substitutes Market, by Type, 2022–2031 (USD Million)

Table 226 Middle East & Africa: Plant-based Food Market, by Source, 2022–2031 (USD Million)

Table 227 Middle East & Africa: Plant-based Food Market, by Distribution Channel, 2022–2031 (USD Million)

Table 228 Middle East & Africa: Business-to-Consumer Plant-based Food Market, by Type, 2022–2031 (USD Million)

Table 229 Total Number of Recent Developments, by Company (2021–2024)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Size Estimation

Figure 7 In 2024, the Dairy Alternatives Segment is Expected to Account for the Largest Share of the Plant-based Food Market

Figure 8 Pea Segment is Projected to Witness Significant Growth in the Market During 2024–2031

Figure 9 In 2024, the Business-to-Consumer Segment is Expected to Account for the Larger Share of the Plant-based Food Market

Figure 10 Asia-Pacific to be the Fastest-growing Regional Market

Figure 11 Factors Affecting Market Growth

Figure 12 A Lighthouse for Future Food Consumption

Figure 13 Investments in the Global Alternative Products Industry (2019-2020)

Figure 14 Global Plant-based Food Market: Porter's Five Forces Analysis

Figure 15 Global Plant-based Food Market Value Chain

Figure 16 Global Plant-based Food Market, by Type, 2024 Vs. 2031 (USD Million)

Figure 17 Global Plant-based Food Market, by Source, 2024 Vs. 2031 (USD Million)

Figure 18 Global Plant-based Food Market, by Distribution Channel, 2024 Vs. 2031 (USD Million)

Figure 19 Global Plant-based Food Market, by Region, 2024 Vs. 2031 (USD Million)

Figure 20 North America: Plant-based Food Market Snapshot (2024)

Figure 21 Europe: Plant-based Food Market Snapshot (2024)

Figure 22 Asia-Pacific: Plant-based Food Market Snapshot (2024)

Figure 23 Latin America: Plant-based Food Market Snapshot (2024)

Figure 24 Middle East & Africa: Plant-based Food Market Snapshot (2024)

Figure 25 Key Growth Strategies Adopted by Leading Players, 2021–2024

Figure 26 Plant-based Food Market: Competitive Benchmarking of Key Players, by Type

Figure 27 Global Plant-based Food Market Competitive Dashboard

Figure 28 Global Plant-based Food Market Share/Ranking, by Key Player, 2023 (%)

Figure 29 Beyond Meat Inc.: Financial Overview (2022)

Figure 30 Danone S.A.: Financial Overview (2023)

Figure 31 Conagra Brands, Inc.: Financial Overview (2022)

Figure 32 The Hain Celestial Group, Inc.: Financial Overview (2022)

Figure 33 Nestlé S.A.: Financial Overview (2023)

Figure 34 Unilever Plc: Financial Overview (2023)