Resources

About Us

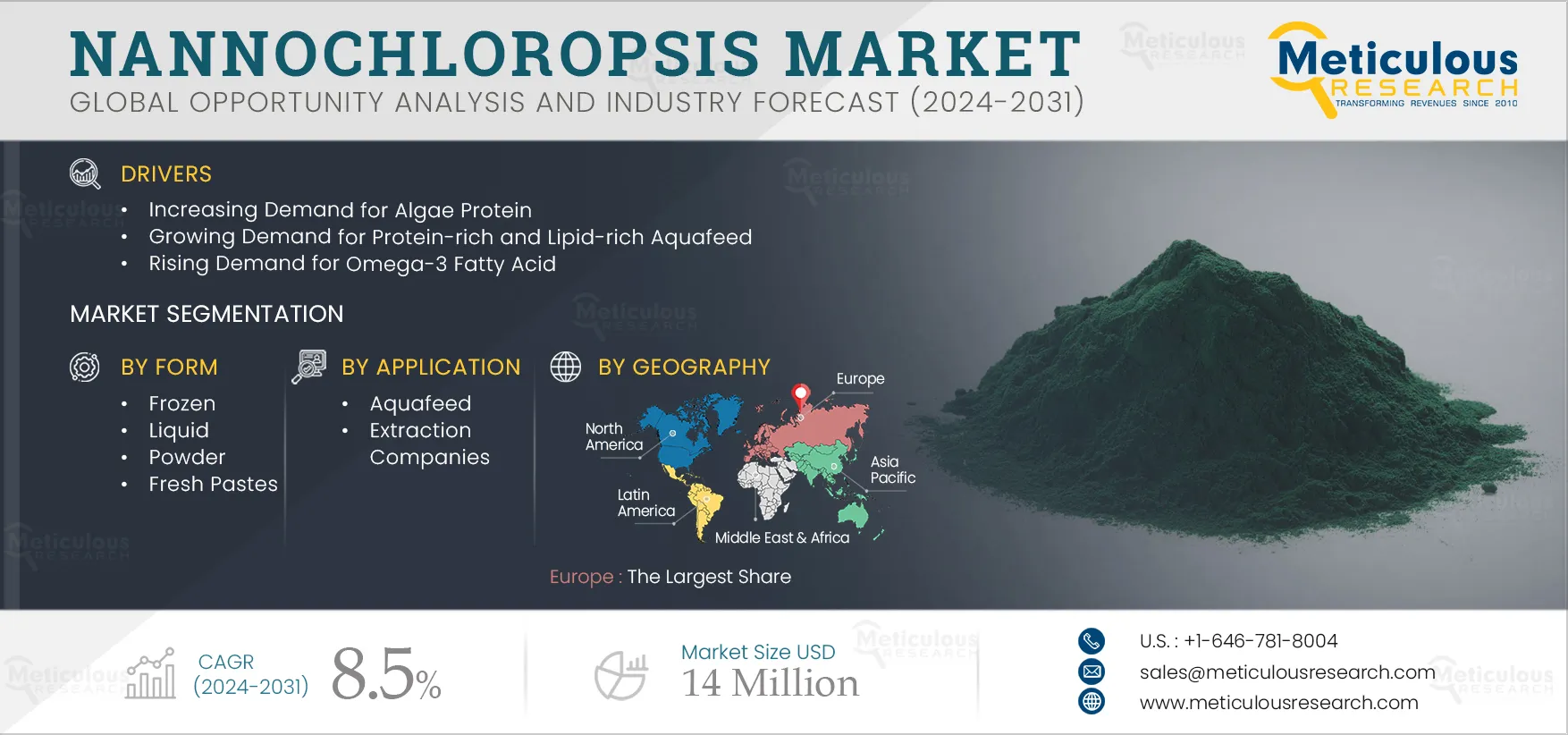

Nannochloropsis Market Size, Share, Forecast, & Trends Analysis by Form (Frozen, Liquid, Powder, Fresh Pastes), Application (Aquafeed, Extraction Companies)—Global Forecast to 2031

Report ID: MRFB - 104546 Pages: 152 May-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the Nannochloropsis market is driven by the increasing demand for algal protein, the growing demand for protein-rich and lipid-rich aquafeed, and the rising demand for omega-3 fatty acids. However, the complex production process of Nannochloropsis restrains the growth of this market.

The growing demand from the biodiesel industry is expected to generate growth opportunities for the players operating in this market. However, the risk of Nannochloropsis contamination is a major challenge impacting market growth.

Algae have demonstrated the potential to meet the population’s need for a more sustainable food supply, specifically with respect to proteins. It has become a strategic factor for the global food and beverage, aqua-farming, and animal nutrition industries. Several products can be made from algae due to the large variety of species whose composition can be influenced by changing the cultivation conditions. Algal protein is gaining prominence as an alternative plant protein owing to its balanced proportions of all the amino acids. It is a complete protein with essential amino acids involved in metabolic processes like enzyme production. Algal protein is now competing with other plant proteins, such as soy and wheat protein. As a result, high demand is observed for algae products from the food & feed industry.

Nannochloropsis is rich in protein, lipids, and essential fatty acids. Nannochloropsis proteins are highly demanded in the animal feed and human food sectors. The high protein content in Nannochloropsis makes it an excellent source of nutrition. Nannochloropsis cell mass comprises 50–55% crude protein. The growing demand for algal protein and the high protein content in Nannochloropsis is expected to drive the growth of the Nannochloropsis market.

Click here to: Get Free Sample Pages of this Report

Rising Need for Protein-rich and Lipid-rich Aquafeed Propelling the Demand for Nannochloropsis

Aquaculture is the fastest-growing food-producing sector in the world. According to the Food and Agriculture Organization of the United Nations (FAO), global fisheries and aquaculture production was 223.2 million tonnes in 2022, a 4.4% increase from 2020. Fish and fish products are some of the most traded food items in the world. In 2023, nearly 65 million tonnes of fish (live weight equivalent) were traded internationally for a total export value of USD 175.0 billion (Source: FAO). Thus, factors such as increasing seafood trade, growth in aquaculture production, and rising seafood consumption among consumers due to the increasing need for protein-rich diets are some of the factors driving the demand for aquafeed across the globe.

Nutrition and feeding influence the growth, reproduction, and health performances of fishes and their response to physiological and environmental stressors and pathogens. Fish are known to utilize protein preferentially to lipid or carbohydrate as an energy source. Dietary protein is the most important factor affecting the growth performance of fish and feed cost. Therefore, from a nutritional and economical point of view, it is important to improve protein utilization for tissue synthesis rather than for energy use. Moreover, dietary lipids play important roles as a source of energy and essential fatty acids necessary for fish growth and development.

Nannochloropsis is well appreciated in aquaculture due to its nutritional value and the ability to produce valuable chemical compounds, such as pigments (zeaxanthin, astaxanthin, and canthaxanthin.) and polyunsaturated fatty acids (EPA). Nannochloropsis is currently used in the production of microalgal concentrates for fish hatcheries. Nannochloropsis has potential as both a protein and lipid source for aquafeeds due to its favorable protein and lipid content, as well as its high availability. Nannochloropsis cell mass comprises 50–55% crude protein, which is a good value for a whole-cell ingredient in aquafeeds. Generally, salmonids require 36–38% digestible protein (dry-matter basis) in their diets, although this reduces to 29% for tilapia, an omnivorous fish. The growing aquaculture industry and the rising demand for protein and lipid-rich aquafeed are expected to drive the growth of the Nannochloropsis market across the globe.

Nannochloropsis Market Opportunity

Growing Demand from the Biodiesel Industry Expected to Generate Growth Opportunities for Market Players

Climate change, increased greenhouse gas emissions, and the depletion of conventional fuel reserves are becoming major global concerns. These factors have resulted in the growing demand for biofuels, as biofuels are secure, sustainable, and clean sources of energy.

The increasing pressure to lower carbon emissions and find an alternative energy source to conventional fuels has made biodiesel more appealing in recent years. Biodiesel is considered the future fuel of the transportation industry, which is contributing to its market growth worldwide. Biodiesel fuel is similar to diesel; however, it is an eco-friendly and clean-burning liquid fuel and does not produce harmful emissions during combustion, thus making it an environment-friendly alternative to conventional fuels.

Biofuel from microalgae is a suitable alternative to conventional fuels such as petrol and diesel. Moreover, logistics and aviation are the major contributors to GHG and CO2 emissions. For instance, the CEO of Compañía Española de Petróleos, S.A.U. (Cepsa) (Spain) has predicted that advanced biofuels will play a central role in the decarbonization of heavy transport and aviation. While the electrification of transport is a likely scenario for passenger cars, heavy transport, shipping, and aviation are expected to have a higher dependency on liquid fuels in the coming decades. Microalgal species such as Nannochloropsis oculata are a promising source of biodiesel due to their ease of growth, high oil content (28.7% of dry weight), and ability to produce cellular lipid, which is further converted to biodiesel through a transesterification reaction. Due to its high oil content and ability to produce cellular lipids, there has been an increased demand for Nannochloropsis microalgae from the biodiesel industry.

Nannochloropsis Market Analysis: Key Findings

By Form: In 2024, the Frozen Segment to Dominate the Nannochloropsis Market

Based on form, the Nannochloropsis market is segmented into frozen, liquid, powder, and fresh pastes. In terms of value, in 2024, the frozen segment is expected to account for the largest share of over 61.5% of the global Nannochloropsis market. The large market share of this segment is attributed to the higher adoption of frozen Nannochloropsis in aquafeed applications, especially in aquaculture hatcheries to establish the initial step of an artificial food chain considering its high nutritional value and rich source of fatty acids (EPA, ARA). Moreover, this segment is also projected to register the highest CAGR of 8.9% during the forecast period of 2024–2031 because frozen Nannochloropsis biomass promotes easier management in biomass production of lipid-enriched rotifers.

By Application: The Aquafeed Segment to Witness Highest Demand During the Forecast Period

Based on application, the global Nannochloropsis market is segmented into aquafeed, extraction companies, and other applications. In 2024, the aquafeed segment is expected to account for the largest share of over 72.9% of the global Nannochloropsis market. The segment’s large share is attributed to the extensive use of Nannochloropsis sp. in aquaculture due to its nutritional value and ability to produce valuable chemical compounds, such as pigments (zeaxanthin, astaxanthin, and canthaxanthin) and polyunsaturated fatty acids.

Geographical Analysis

Europe: The Dominating Regional Market for Nannochloropsis

Based on geography, the global Nannochloropsis market is segmented into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In terms of value, in 2024, Europe is expected to account for the largest share of over 35.7% of the global Nannochloropsis market. Europe’s large market share is attributed to the growing aquaculture industry and need for aquafeed, increasing health awareness, rising demand for omega-3 fatty acids, and increasing demand for algae protein. Additionally, the growing demand from the biodiesel industry is expected to create lucrative opportunities for Nannochloropsis manufacturers in the region.

Nannochloropsis Market: Key Companies

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the Nannochloropsis market are Proviron Industries NV (Belgium), Reed Mariculture Inc. (U.S.), Necton S.A. (Portugal), BlueBioTech Group (Germany), Allmicroalgae Natural Products S.A. (Portugal), Algatechnologies Ltd. (A Part of Solabia Group) (Israel), A4f Algae for Future (Portugal), Green Aqua Company SGPS S.A. (Portugal), AlgaSpring B.V. (Netherlands), Archimede Ricerche S.r.l (Italy), Astaxa GmbH (Germany), and Shaivaa Algaetech LLP (India).

Nannochloropsis Industry Overview: Latest Developments from Key Industry Players

Nannochloropsis Market Research Summary

|

Particulars |

Details |

|

Number of Pages |

152 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

8.5% |

|

Market Size (Value) |

$14 Million by 2031 |

|

CAGR (Volume) |

9.4% |

|

Market Size (Volume) |

122 Tons by 2031 |

|

Segments Covered |

By Form

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Spain, Portugal, Germany, Italy, France, U.K., Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (Egypt, Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

Proviron Industries NV (Belgium), Reed Mariculture Inc. (U.S.), Necton S.A. (Portugal), BlueBioTech Group (Germany), Allmicroalgae Natural Products S.A. (Portugal), Algatechnologies Ltd. (A Part of Solabia Group) (Israel), A4f Algae for Future (Portugal), Green Aqua Company SGPS S.A. (Portugal), AlgaSpring B.V. (Netherlands), Archimede Ricerche S.r.l (Italy), Astaxa GmbH (Germany), and Shaivaa Algaetech LLP (India). |

Key Questions Answered in the Nannochloropsis Market Report:

This report focuses on market analysis and opportunity assessment based on the sales of Nannochloropsis across various countries, regions, and market segments. The report also includes a competitive analysis based on leading market players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years.

The Nannochloropsis market study provides valuable insights, market sizes, and forecasts in terms of value & volume by form and country/region and only in terms of value by application.

The Nannochloropsis market is projected to reach $14 million by 2031, at a CAGR of 8.5% during the forecast period.

The frozen segment is expected to hold a major share during the forecast period of 2024–2031.

The aquafeed segment is expected to witness the fastest growth during the forecast period of 2024–2031.

The increasing demand for algal protein, the rising need for protein-rich and lipid-rich aquafeed, and the rising demand for omega-3 fatty acids are factors supporting the growth of this market. Moreover, growing demand from the biodiesel industry is expected to generate growth opportunities for the players operating in this market.

The key players operating in the Nannochloropsis market are Proviron Industries NV (Belgium), Reed Mariculture Inc. (U.S.), Necton S.A. (Portugal), BlueBioTech Group (Germany), Allmicroalgae Natural Products S.A. (Portugal), Algatechnologies Ltd. (A Part of Solabia Group) (Israel), A4f Algae for Future (Portugal), Green Aqua Company SGPS S.A. (Portugal), AlgaSpring B.V. (Netherlands), Archimede Ricerche S.r.l (Italy), Astaxa GmbH (Germany), and Shaivaa Algaetech LLP (India).

Europe is slated to register the highest CAGR of 9.0% during the forecast period of 2024–2031.

Published Date: Apr-2023

Published Date: Nov-2025

Published Date: Apr-2023

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates