Resources

About Us

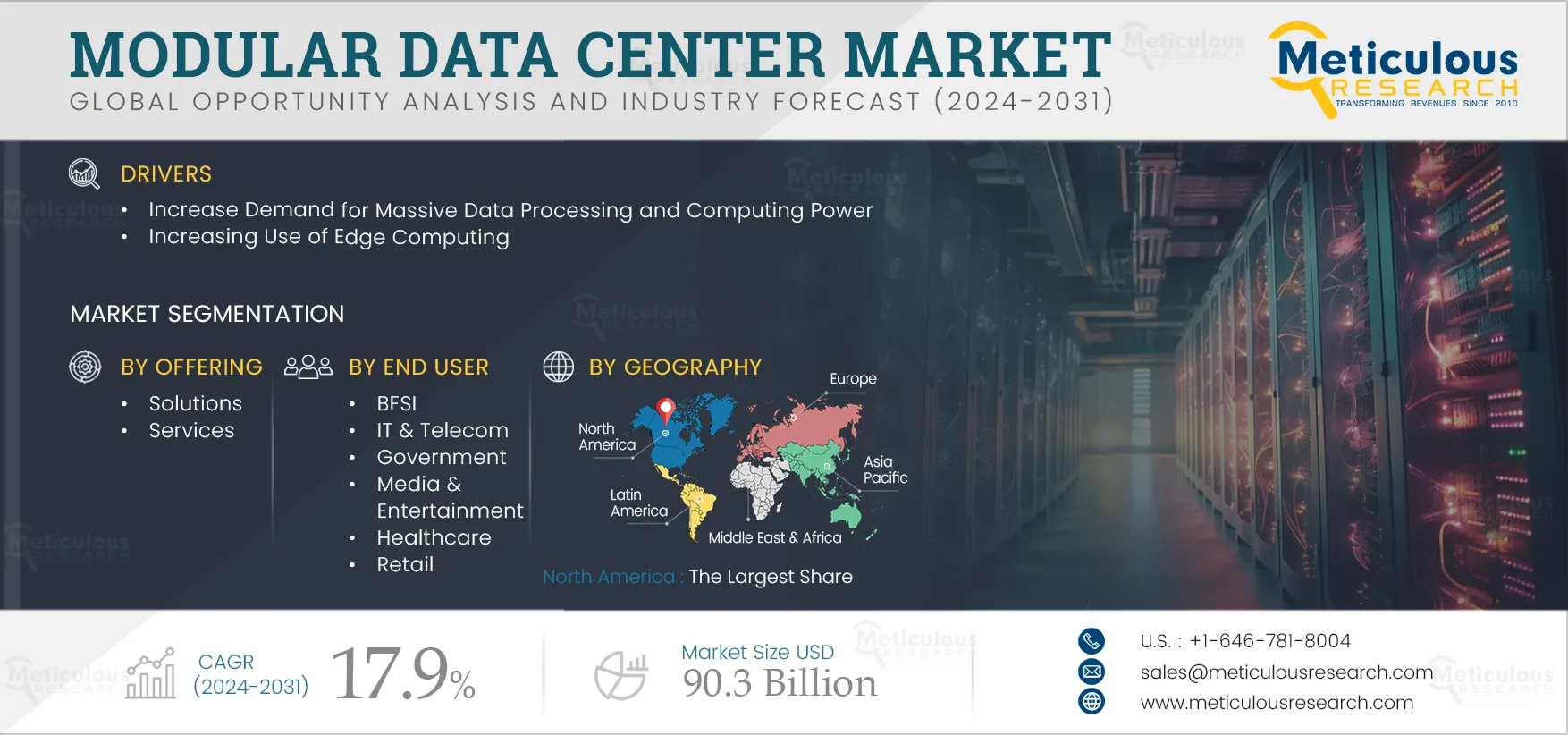

Modular Data Center Market Size, Share, Forecast, & Trends Analysis by Offering (Solution, Services), Organization Size (Large Enterprises, Small and Medium-sized Enterprises), End User (BFSI, IT & Telecom, Healthcare, Retail, Government, Others) & Geography -Global Forecast to 2032

Report ID: MRICT - 1041192 Pages: 250 May-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe Modular Data Center Market is expected to reach $90.3 billion by 2032, at a CAGR of 17.9% from 2025 to 2032. The growth of the modular data center market is driven by increasing demand for massive data processing and computing power and increasing use of edge computing. However, data privacy & security concerns are a factor restraining the growth of this market.

Furthermore, the rapid growth in artificial intelligence applications and the increased adoption of micro data centers are expected to generate growth opportunities for the stakeholders in this market. However, integration with existing infrastructure is a major challenge impacting market growth. Additionally, the increasing use of green energy sources for powering modular data centers, hybrid cloud adoption, and integration of advanced cooling systems in modular data centers are prominent trends in the modular data center market.

Agility has become vital for companies to accelerate innovation and future-proof their businesses. Recently, the volume of data generated has reached unprecedented levels, primarily due to the proliferation of IoT devices, big data applications, and digitization. This development is creating flexibility and extendibility challenges for traditional data centers due to their solid state. Traditional data center takes a long duration for planning, design, and installation of the systems in the data center and its operation. However, the modular data center requires a shorter planning and designing period. Modular data centers enable high expandability and easy deployment and provide multiple construction phases depending on the requirements. Hence, ongoing technological advancements are creating demand for data processing and computing power, which is expected to drive the adoption of modular data centers.

The growing use of edge computing is one of the most significant trends in data centers. Computing at the edge brings computational capacity and storage closer to the source of data generation. One key factor driving the momentum toward Edge computing is the surge in IoT devices and the need for real-time processing. Healthcare, energy, agriculture, and telecommunications are other sectors significantly benefiting from edge computing’s capabilities.

Modular data centers play a central role in empowering edge computing and meet the growing demand for greater data center capacity. In addition, several key players are focusing on the development of modular data centers to increase the use of edge computing. For instance, in March 2025, Eaton Corporation plc (Ireland) launched a new modular data center solution for organizations seeking to rapidly meet the growing requirements for edge computing, machine learning, and AI. These evolving needs of modern businesses are driving the demand for compact, modular data center units designed to meet specific site requirements.

Click here to: Get Free Sample Pages of this Report

Data centers are high-powered infrastructures supporting the growth of business across sectors for smooth data operations. The data center industry accounts for nearly 1% of global energy consumption. Integration of green energy alternatives is an essential part of efforts to enhance data center sustainability. Solar, wind, geothermal, and hydroelectric are among the key renewable energy sources that data center operators are investing in globally. Several players are focusing on the development of modular renewable energy modules for data centers. For instance, in April 2025, Exowatt (U.S.) launched Exowatt P3, a modular energy module designed to power energy-intensive data centers. Hence, such development of modular renewable energy modules escalates both the demand and the energy costs for data centers, which are expected to generate opportunities for market stakeholders.

AI and machine learning algorithms excel at identifying patterns within vast datasets. AI models are being trusted by a majority of businesses to make operational decisions, leading to significant efficiency improvements and cost reductions. The global adoption of artificial intelligence (AI) skyrocketed the demand for data processing, driving a surge in demand for data center capacity. Modular data centers can meet the demand created by AI applications as they can maximize energy efficiency, enable rapid deployment, and increase computing density. Modular data centers are helping organizations upgrade existing data center infrastructure with IT, electrical, and mechanical units. Hence, the widespread use of AI applications creates demand for data processing, which is expected to generate growth opportunities for modular data center market players.

A micro data center is a compact, modular computing facility that provides the same essential functionalities as a traditional data center but in a smaller, more agile form. Micro data centers are typically designed to fit in a standard rack and can be deployed in diverse environments, from office spaces to factory floors. They include the infrastructure required for data storage, processing, and networking, as well as integrated cooling and power management systems. Micro data centers are experiencing rising demand across a wide array of industries, including healthcare, retail, manufacturing, BFSI, and telecom. With the development of more efficient cooling and power management technologies, as well as enhanced remote monitoring and management tools, the adoption of micro data centers is expected to grow.

Based on offering, the modular data center market is broadly segmented into solutions and services. In 2025, the solutions segment is expected to account for the larger share of above 70.0% of the modular data center market. The solutions segment is further segmented into all-in-one modules and individual modules. The segment’s large market share is mainly attributed to factors such as the excellent performance of modular data centers in energy consumption, advantages of modular data centers in the construction, planning, and required space, increasing data consumption, and digital transformation.

However, the services segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the increasing demand for modular data centers for processing data generated by IoT devices and AI applications, the growing need for integrating and deploying modular data centers in traditional data centers to enhance operations scalability, and businesses' growing concern to streamline and enhance data center performance.

Based on organization size, the modular data center market is segmented into large enterprises, and small and medium-sized enterprises (SMEs). In 2025, the small and medium-sized enterprises (SMEs) segment is expected to account for the larger share of above 55.0% of the modular data center market. The segment’s large share is mainly attributed to factors such as increased adoption of scalable IT infrastructure to facilitate growth, manage costs, and swiftly adapt to growing market needs; increased operational integration of AI and ML in SMEs; and lower upfront investment.

Moreover, the small and medium-sized enterprises (SMEs) segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the rising demand for real-time data processing and localized data management and the increasing need to leverage localized computing resources without significant infrastructure investments.

Based on end user, the modular data center market is segmented into BFSI, IT & telecom, government, media & entertainment, healthcare, retail, education institutes, manufacturing, and other end users. In 2025, the IT & telecom segment is expected to account for the largest share of above 30.0% of the modular data center market. The segment’s large share is mainly attributed to factors such as increased use of edge computing and AI applications in the IT & telecom sector, growing data loads in the telecom sector, increased reliance on data, the crucial need for data storage for business operations, and increasing investment of companies on IT infrastructure.

Moreover, the healthcare segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the growing digitalization of the healthcare sector, the increased need to store electronic health records (EHR), medical imagery, and patient information, the increasing spending of the healthcare sector on IT infrastructure to optimize functioning, and the growing use of medical IoT devices for collecting and analyzing patient information.

In 2025, North America is expected to account for the largest share of above 35.0% of the modular data center market. The large market share of this segment is attributed to the increased adoption of modular data centers in the region’s IT & telecom industry, the presence of leading IT companies, the rising need for efficient data collection and management in the region, data storage compliance and regulations, and increased adoption of edge computing in the region.

However, Asia-Pacific is projected to register the highest CAGR of 20.0% during the forecast period. This region's growth is due to increasing digitalization, government initiatives promoting digitalization across various industries, substantial investments in IoT and AI technologies, and government and private enterprise investments in IT infrastructure.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the modular data center market are Dell Technologies Inc. (U.S.), Schneider Electric SE (France), IBM Corporation (U.S.), Vertiv Group Corporation (U.S.), Huawei Technologies Co., Ltd. (China), Rittal GmbH & Co. KG (Germany), Eaton Corporation plc (Ireland), Hewlett Packard Enterprise Company (U.S.), Silent-Aire (Canada), PCX Holding LLC (U.S.), Cannon Technologies Ltd (U.K.), BladeRoom Group Limited (U.K.), Baselayer Technology, LLC (U.S.), Yondr Group (Netherlands), and Altron a.s. (Czech Republic).

In April 2025, Vertiv Group Corporation (U.S.) launched the Vertiv SmartAisle 3, a micro modular data center system that utilizes the power of Artificial Intelligence (AI), providing enhanced intelligence and enabling efficient operations within the data center environment.

In November 2024, Schneider Electric SE (France) expanded its partnership with Compass Datacenters (U.S.). The partnership extends the companies’ existing relationship that integrates their respective supply chains to manufacture and deliver prefabricated modular data center solutions.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

17.9% |

|

Market Size (Value) |

USD 90.3 Billion by 2032 |

|

Segments Covered |

By Offering

By Organization Size

By End User

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Sweden, Switzerland, Netherlands, Norway, Austria, Denmark, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Australia, Malaysia, Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa (Israel, UAE, Rest of Middle East & Africa) |

|

Key Companies |

Dell Technologies Inc. (U.S.), Schneider Electric SE (France), IBM Corporation (U.S.), Vertiv Group Corporation (U.S.), Huawei Technologies Co., Ltd. (China), Rittal GmbH & Co. KG (Germany), Eaton Corporation plc (Ireland), Hewlett Packard Enterprise Company (U.S.), Silent-Aire (Canada), PCX Holding LLC (U.S.), Cannon Technologies Ltd (U.K.), BladeRoom Group Limited (U.K.), Baselayer Technology, LLC (U.S.), Yondr Group (Netherlands), and Altron a.s. (Czech Republic). |

The Modular Data Center Market consists of prefabricated, scalable data centers designed for rapid deployment and flexibility in data processing and computing.

The Modular Data Center Market is projected to reach a substantial $90.3 billion by 2032, reflecting its significant growth and adoption.

The market is forecast to grow at a robust CAGR of 17.9% from 2025 to 2032, highlighting strong future expansion and investment opportunities.

The Modular Data Center Market size is set to hit $90.3 Billion by 2032, indicating a substantial increase in market value over the forecast period.

Key players in the Modular Data Center Market include Dell Technologies, Schneider Electric, IBM, Vertiv, Huawei, Eaton, and several other leading firms.

Current trends include the increased use of green energy, the rise of AI and machine learning applications, and the growing adoption of micro data centers.

Drivers include rising data processing demands, the surge in edge computing, AI advancements, and the need for scalable and efficient data center solutions.

Segments include offerings (solutions and services), organization size (SMEs and large enterprises), and end-users (IT & telecom, healthcare, BFSI, etc.).

The global outlook is optimistic, with North America leading in market share, and Asia-Pacific expected to experience the highest growth due to tech investments.

The market is experiencing significant growth, with projections showing an increase at a CAGR of 17.9% through the year 2032, reflecting dynamic expansion.

The Modular Data Center Market is projected to grow at a robust CAGR of 17.9% from 2025 to 2032, indicating strong and sustained growth.

North America holds the largest market share in the Modular Data Center Market, driven by advanced IT infrastructure and high adoption rates in the region.

Published Date: Oct-2024

Published Date: Jul-2024

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates