Resources

About Us

Mental Health Apps Market Size, Share, Forecast, & Trends Analysis by Platform (Android, iOS) Application (Depression, Anxiety, CBT, DBT, Meditation, Stress) Patient (Adult, Children, Geriatric) End User (Home, Clinic, Hospital) - Global Forecast to 2032

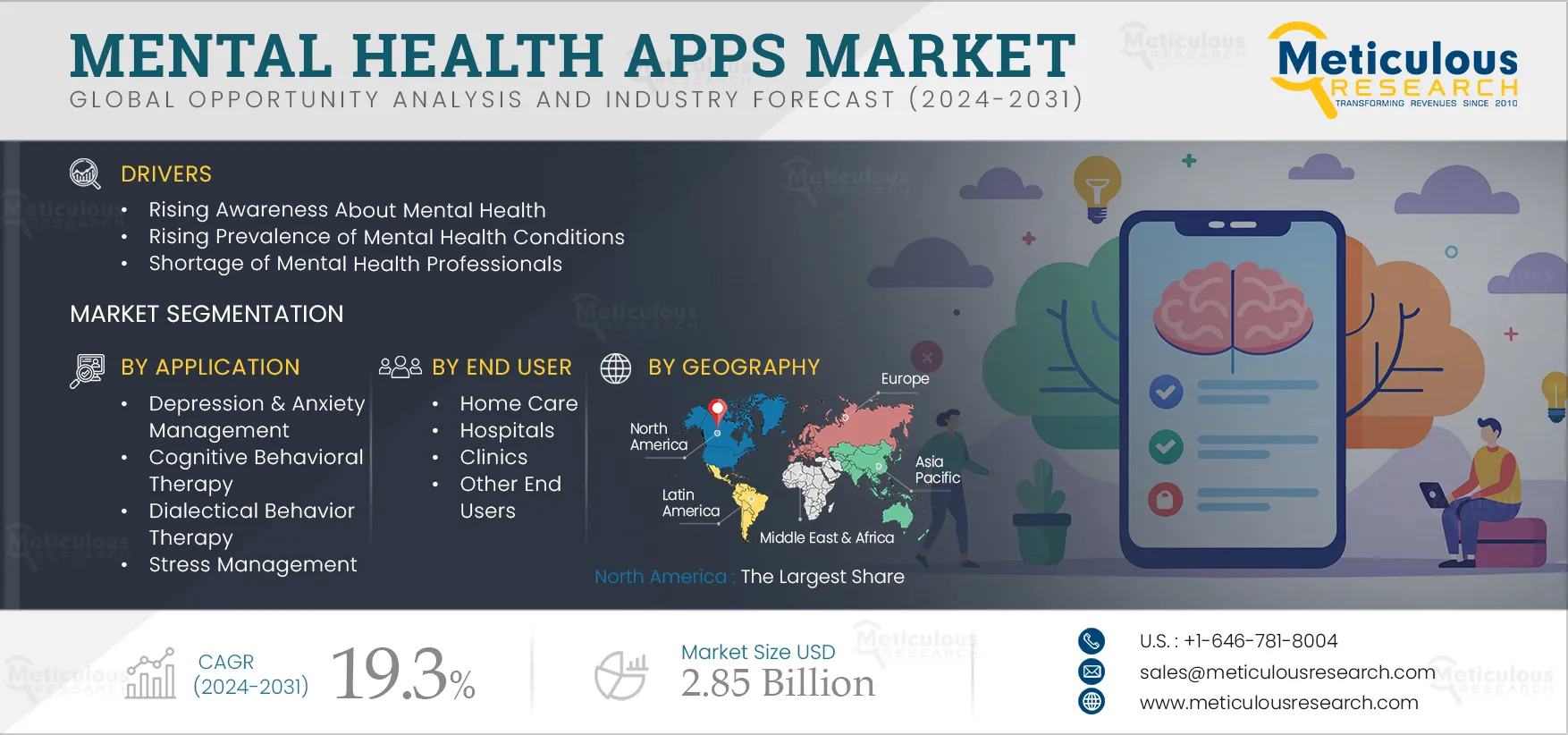

Report ID: MRHC - 1041170 Pages: 260 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by factors such as the increasing prevalence of mental illnesses, rising accessibility to the Internet, the growing number of smartphone users, a shortage of mental health professionals, and the rising awareness about mental health, driven by favorable public & private initiatives. Furthermore, the increasing popularity of digital therapeutics and the high level of personalization offered by mental health apps are expected to create market growth opportunities.

According to the World Health Organization, mental health illnesses are on the rise globally, with common conditions including anxiety, clinical depression, and bipolar disorder. These issues can stem from various factors, including individual, family, community, and structural influences. Risk factors may include adverse childhood experiences, biological predispositions, stressful life events, and the presence of long-term physical conditions.

Moreover, the COVID-19 pandemic has exacerbated the prevalence of mental illness. Measures such as social distancing, isolation, and disruptions to daily life, including school and workplace closures, have led to feelings of purposelessness and heightened anxiety about the state of the world. Many individuals, even those with previously robust mental health, have experienced challenges such as depression, stress, and anxiety during the pandemic, with lingering effects continuing to affect individuals today.

According to the WHO, approximately 1 billion people globally are living with mental, neurological, and substance use disorders. Additionally, in 2022, 23.1% of people in the U.S. experienced a mental health condition (Source: Substance Abuse and Mental Health Services Administration, U.S.). Furthermore, in India, an estimated 60-70 million people suffer from common and severe mental disorders (source: WHO).

Furthermore, a study published in The Lancet Psychiatry suggests that nearly half of the world's population may develop at least one type of mental disorder by the age of 75. This growing prevalence of mental disorders, coupled with increasing awareness of treatment and management options, is expected to drive the adoption of mental health apps for treatment and management purposes.

Click here to: Get Free Sample Pages of this Report

Global initiatives are underway to raise awareness of mental health issues and improve access to mental health care and treatment. Governments and public organizations around the world are implementing various efforts to enhance access to mental health services. Some of these initiatives include:

In October 2022, the government of India Launched the National Tele Mental Health Programme to improve access to quality mental health counseling and care services in the country.

Such initiatives are expected to raise awareness and access to mental health care. This growing awareness is expected to ultimately drive the growth of the mental health apps market.

AI-powered chatbots are increasingly being integrated into mental wellness apps to provide users with personalized support, immediate responses, and 24/7 availability. These chatbots can offer a range of services, including mood tracking, mindfulness exercises, cognitive behavioral therapy techniques, and even crisis intervention. The use of AI allows for scalability and cost-effectiveness, making mental health support more accessible to a wider audience. Additionally, AI-driven analytics enable app developers to gather valuable insights into user behavior and preferences, further enhancing the effectiveness of these mental health apps. Government institutions are taking steps to launch AI-based chatbots for mental health support. For instance, in March 2025, the U.K.'s National Health Service launched a chatbot called Wysa to assist with stress, anxiety, and depression management for both adults and teenagers.

Gamification involves integrating game-like elements, mechanics, and design principles into mental health apps to enhance user engagement and motivation. In mental health apps, gamification techniques can include:

Challenges and Goals: Users are presented with challenges or goals related to their mental health, such as completing a certain number of mindfulness exercises or achieving specific mood-tracking targets.

Progress Tracking: Apps may use progress bars, levels, or badges to visually represent users' progress and accomplishments, providing a sense of achievement and motivation to continue engaging with the app.

Rewards and Incentives: Users may earn virtual rewards, points, or virtual currency for completing tasks or reaching milestones within the app. These rewards can be used to unlock additional features, content, or customization options.

By integrating gamification elements, mental health applications aim to make the process of managing mental well-being more enjoyable, engaging, and sustainable for users. Gamification can help increase user retention, adherence to treatment plans, and the overall effectiveness of mental health interventions.

Digital therapeutics (DTx) utilize wearable sensors, mobile applications, virtual reality (VR), and artificial intelligence (AI) to assist patients dealing with mental health issues. The increasing prevalence of diseases, the need to reduce healthcare expenditure, and the shortage of healthcare professionals have propelled the adoption of digital therapeutics. Digital therapeutics, which leverage software solutions and connected devices, are increasingly being used for disease management and treatment.

Furthermore, the increasing focus on self-testing for enhanced disease management contributes to the rising adoption of digital therapeutics. Additionally, the COVID-19 pandemic accelerated the number of digital therapeutic platforms as patients sought alternatives to traditional healthcare settings. Digital therapeutics offer affordability, accessibility, convenience, and personalization while maintaining patient confidentiality, which is driving the demand for digital therapeutic applications for mental health issues. The growing demand for digital therapeutics and initiatives by companies to launch and obtain approvals for DTx solutions for mental health present opportunities for players in the mental health apps market. For instance, in July 2022, GAIA AG's (Germany) deprexis, an app for depression symptoms, was approved as a medical device by The Federal Institute for Drugs and Medical Devices (BfArM) and can be reimbursed by statutory health insurance companies.

Based on platform, the market is segmented into Android, iOS, and other platforms. In 2025, the Android segment is expected to account for the largest share of 64.0% of the mental health apps market. This segment’s large market share can be attributed to the significantly larger number of Android users globally compared to iOS users. Additionally, the faster approval process of apps on Google Play Store compared to Apple’s App Store and the comparatively lower subscription rates for Android apps contribute to the growth of this segment.

However, the iOS segment is projected to witness the highest growth rate of 22.6% during the forecast period of 2025–2032. The growth of this segment is driven by the increasing number of iPhone users worldwide. For instance, in the first quarter of 2025, Apple Inc. (U.S.) reported a revenue increase from iPhone sales, reaching USD 69.7 billion, compared to USD 61.57 billion in the first quarter of 2018 (Source: Business of Apps).

Based on application, the mental health apps market is segmented into depression & anxiety management, cognitive behavioral therapy, dialectical behavior therapy, meditation management, stress management, and other applications. In 2025, the depression & anxiety management segment is expected to account for the largest share of 44.7% of the mental health apps market. This segment's large market share is attributed to the high prevalence of depression and anxiety worldwide. There has been an increase in depression and anxiety, with approximately 280 million people affected globally (Source: WHO). This rise can be attributed to various factors, including social, psychological, and biological influences.

However, the meditation management segment is projected to register the highest CAGR of 20.4% during the forecast period of 2025-2032. This growth can be attributed to the increasing popularity of meditation apps, driven by the growing need to prevent and manage mental illnesses at early stages. Moreover, the rising scientific research conducted to support the importance of meditation for mental well-being is expected to further propel the growth of this segment.

Based on patient type, the mental health apps market is segmented into adults, children, and Older Adults. In 2025, the adults segment is expected to account for the largest share of the mental health apps market. This segment’s large market share can be attributed to the high incidence of mental illness in adults, which can stem from various factors, including social, psychological, and biological influences. Furthermore, the increasing awareness of mental health issues and the decreasing stigma surrounding mental health in developed countries contribute to the large market share of this segment.

Moreover, the adults segment is projected to register the highest CAGR during the forecast period.

Based on end user, the mental health apps market is segmented into home care, hospitals, clinics, and other end users. In 2025, the home care segment is expected to account for the largest share of the market. This segment’s large market share can be attributed to the growing awareness of mental health issues and the benefits offered by mental health apps. These apps offer therapeutic tasks and therapies that can be completed at home, providing comfort and familiarity to individuals with mental illnesses.

Moreover, the home care segment is projected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to the confidentiality provided by health apps and the sense of safety and security provided by home environments in managing mental illness.

In 2025, North America is expected to account for the largest share of 37.2% of the mental health apps market. Moreover, in 2025, the U.S. is expected to account for the larger share of the mental health apps market in North America. This significant market share can be attributed to the widespread adoption of mental health apps in the U.S., driven by the high prevalence of mental health issues, high awareness regarding mental health conditions, and the increased adoption of digital health technologies.

However, the market in Asia-Pacific is projected to register the highest CAGR of 20.5% during the forecast period. The growth of this regional market can be attributed to supportive government initiatives aimed at promoting mental well-being, a gradual increase in awareness of mental health issues, and rising disposable incomes in the region. Several mental health apps are being launched in Asia-Pacific countries. For instance, in 2022, the Maharashtra University of Health Sciences (India) launched the Mental Health and Normalcy Augmentation System (MANAS) app for its medical students across 469 colleges. Despite these developments, the stigma surrounding mental disorders remains a challenge to market growth in Asia-Pacific.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. The key players operating in the mental health apps market are Talkspace, Inc. (U.S.), BetterHelp (U.S.), Headspace Inc. (U.S.), Sanvello Health, Inc. (U.S.), ReachOut Australia (Australia), Calm.com, Inc. (U.S.), Twill Inc. (U.S.), Worry Watch (U.S.), Jade Lizard Software LLC (U.S.), Insight Network Inc. (U.S.), Aura Health (U.S.), MoodMission Pty Ltd (Australia), and Youper Inc. (U.S.).

In 2024, Big Health Inc. (U.S.), a digital therapeutics company that offers apps for mental health, acquired Limbix (U.S.), a creator of evidence-based digital therapeutic (apps) for teens and young adults with symptoms of depression.

In 2021, Cognitive Apps Software (U.S.), a subsidiary of Life Clips, Inc. (U.S.), launched the Yuru 3-in-1 tool. This solution is designed to aid users in understanding and managing mental health.

|

Particulars |

Details |

|

Page No |

260 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

19.3% |

|

Market Size (Value) |

$2.85 billion by 2032 |

|

Segments Covered |

By Platform

By Application

By Patient Type

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Sweden, Denmark, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Talkspace, Inc. (U.S.), BetterHelp (U.S.), Headspace Inc. (U.S.), Sanvello Health, Inc. (U.S.), ReachOut Australia (Australia), Calm.com, Inc. (U.S.), Twill Inc. (U.S.), Worry Watch (U.S.), Jade Lizard Software LLC (U.S.), Insight Network Inc. (U.S.), Aura Health (U.S.), MoodMission Pty Ltd (Australia), and Youper Inc. (U.S.). |

The mental health apps market covers the market sizes & forecasts of the mental health apps market based on platform, application, patient type, and end user. This report also offers the value analysis of various segments and sub-segments of the mental health apps market at the regional and country levels.

The mental health apps market is projected to reach $2.85 billion by 2032, at a CAGR of 19.3% during the forecast period.

In 2025, the Android segment is expected to account for the largest share of the mental health apps market.

The growth of this market is driven by factors such as the increasing prevalence of mental illnesses, rising accessibility to the Internet, the growing number of smartphone users, a shortage of mental health professionals, and the rising awareness about mental health, driven by favorable public & private initiatives. Furthermore, the increasing popularity of digital therapeutics and the high level of personalization offered by mental health apps are expected to create market growth opportunities.

The key players operating in the mental health apps market are Talkspace, Inc. (U.S.), BetterHelp (U.S.), Headspace Inc. (U.S.), Sanvello Health, Inc. (U.S.), ReachOut Australia (Australia), Calm.com, Inc. (U.S.), Twill Inc. (U.S.), Worry Watch (U.S.), Jade Lizard Software LLC (U.S.), Insight Network Inc. (U.S.), Aura Health (U.S.), MoodMission Pty Ltd (Australia), and Youper Inc. (U.S.).

India and China are expected to offer significant growth opportunities for vendors in this market due to the increasing awareness of mental health conditions, a growing prevalence of mental illnesses, rising disposable incomes, and the growing adoption of wellness practices such as yoga and meditation.

1. Overview

1.1. Market Definition and Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of The Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions For the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Market Dynamics

4.2.1.1. Drivers

4.2.1.1.1. Rising Awareness About Mental Health

4.2.1.1.2. Rising Prevalence of Mental Health Conditions

4.2.1.1.3. Shortage of Mental Health Professionals

4.2.1.2. Restraints

4.2.1.2.1. Not a Comprehensive Solution for Mental Health Treatment/Can Be Replaced by Therapy from Healthcare Professionals

4.2.1.3. Opportunities

4.2.1.3.1. Growing Popularity for Digital Therapeutics

4.2.1.3.2. High Level of Personalization Offered by Mental Health Apps

4.2.1.4. Challenges

4.2.1.4.1. Privacy & Security Concerns

4.2.1.4.2. Low Awareness Regarding Mental Apps and Mental Health Wellbeing in Middle-Low Income Countries

4.2.1.3. Stigma Around Mental Illness

4.3. Trends

4.3.1. Integration of Artificial Intelligence (AI) in Mental Health Chatbots

4.3.2. Gamification of Mental Health Apps

4.3.3. Utilization of Virtual Reality (VR) and Predictive Analysis in Mental Health Apps

4.3.4. Pricing Analysis

4.4. Case Studies

5. Mental Health Apps Market Assessment—by Platform

5.1. Overview

5.2. Android

5.3. iOS

5.4. Other Platforms

6. Mental Health Apps Market Assessment—by Application

6.1. Overview

6.2. Depression & Anxiety Management

6.3. Cognitive Behavioral Therapy

6.4. Dialectical Behavioral Therapy

6.5. Meditation Management

6.6. Stress Management

6.7. Other Applications

7. Mental Health Apps Market Assessment—by Patient Type

7.1. Overview

7.2. Adults (Age 19-59)

7.3. Children (Age till 18)

7.4. Older Adults (Age 60 & Above)

8. Mental Health Apps Market Assessment—by End User

8.1. Overview

8.2. Home Care

8.3. Hospitals

8.4. Clinics

8.5. Other End Users

9. Mental Health Apps Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Denmark

9.3.7. Sweden

9.3.8. Belgium

9.3.9. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. Australia

9.4.5. New Zealand

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/ Market Ranking, by Key Players (2024)

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

11.1. Talkspace, Inc. (U.S.)

11.2. BetterHelp (U.S.)

11.3. Headspace Inc. (U.S.)

11.4. Sanvello Health, Inc. (U.S.)

11.5. ReachOut Australia (Australia)

11.6. Calm.com, Inc. (U.S.)

11.7. Twill Inc. (U.S.)

11.8. Worry Watch (U.S.)

11.9. Jade Lizard Software LLC (U.S.)

11.10. Insight Network Inc. (U.S.)

11.11. Aura Health (U.S.)

11.12. MoodMission Pty Ltd (Australia)

11.13. Youper Inc. (U.S.)

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 2 Global Android-based Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 3 Global iOS-based Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Mental Health Apps Market for Other Platforms, by Country/Region, 2022–2032 (USD Million)

Table 5 Global Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 6 Global Mental Health Apps Market for Depression & Anxiety Management, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Mental Health Apps Market for Cognitive Behavioral Therapy, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Mental Health Apps Market for Dialectical Behavior Therapy, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Mental Health Apps Market for Meditation Management, by Country/Region, 2022–2032 (USD Million)

Table 10 Global Mental Health Apps Market for Stress Management, by Country/Region, 2022–2032 (USD Million)

Table 11 Global Mental Health Apps Market for Other Applications, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 13 Global Mental Health Apps Market for Adults, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Mental Health Apps Market for Children, by Country/Region, 2022–2032 (USD Million)

Table 15 Global Mental Health Apps Market for Older Adults, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 17 Global Mental Health Apps Market for Home Care, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Mental Health Apps Market for Hospitals, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Mental Health Apps Market for Clinics, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Contract Manufacturing Market for Other End Users, by Country/Region, 2022–2032 (USD Million)

Table 21 Global Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 22 North America: Mental Health Apps Market, by Country, 2022–2032 (USD Million)

Table 23 North America: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 24 North America: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 25 North America: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 26 North America: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 27 U.S.: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 28 U.S.: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 29 U.S.: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 30 U.S.: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 31 Canada: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 32 Canada: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 33 Canada: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 34 Canada: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 35 Europe: Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 36 Europe: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 37 Europe: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 38 Europe: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 39 Europe: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 40 Germany: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 41 Germany: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 42 Germany: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 43 Germany: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 44 France: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 45 France: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 46 France: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 47 France: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 48 U.K.: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 49 U.K.: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 50 U.K.: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 51 U.K.: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 52 Spain: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 53 Spain: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 54 Spain: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 55 Spain: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 56 Italy: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 57 Italy: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 58 Italy: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 59 Italy: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 60 Sweden: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 61 Sweden: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 62 Sweden: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 63 Sweden: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 64 Belgium: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 65 Belgium: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 66 Belgium: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 67 Belgium: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 68 Denmark: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 69 Denmark: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 70 Denmark: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 71 Denmark: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 72 Rest of Europe: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 73 Rest of Europe: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 74 Rest of Europe: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 75 Rest of Europe: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 76 Asia-Pacific: Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 77 Asia-Pacific: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 78 Asia-Pacific: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 79 Asia-Pacific: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 80 Asia-Pacific: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 81 Japan: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 82 Japan: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 83 Japan: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 84 Japan: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 85 China: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 86 China: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 87 China: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 88 China: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 89 India: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 90 India: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 91 India: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 92 India: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 93 Australia: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 94 Australia: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 95 Australia: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 96 Australia: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 97 New Zealand: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 98 New Zealand: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 99 New Zealand: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 100 New Zealand: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 101 Rest of Asia-Pacific: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 102 Rest of Asia-Pacific: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 103 Rest of Asia-Pacific: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 104 Rest of Asia-Pacific: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 105 Latin America: Mental Health Apps Market, by Country/Region, 2022–2032 (USD Million)

Table 106 Latin America: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 107 Latin America: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 108 Latin America: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 109 Latin America: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 110 Brazil: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 111 Brazil: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 112 Brazil: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 113 Brazil: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 114 Mexico: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 115 Mexico: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 116 Mexico: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 117 Mexico: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 118 Rest of Latin America: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 119 Rest of Latin America: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 120 Rest of Latin America: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 121 Rest of Latin America: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 122 Middle East & Africa: Mental Health Apps Market, by Platform, 2022–2032 (USD Million)

Table 123 Middle East & Africa: Mental Health Apps Market, by Application, 2022–2032 (USD Million)

Table 124 Middle East & Africa: Mental Health Apps Market, by Patient Type, 2022–2032 (USD Million)

Table 125 Middle East & Africa: Mental Health Apps Market, by End User, 2022–2032 (USD Million)

Table 126 Recent Developments, by Company, 2021-2024

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Mental Health Apps Market, by Platform, 2025 Vs.2032 (USD Million)

Figure 8 Global Mental Health Apps Market, by Application, 2025 Vs.2032 (USD Million)

Figure 9 Global Mental Health Apps Market, by Patient Type, 2025 Vs.2032 (USD Million)

Figure 10 Global Mental Health Apps Market, by End User, 2025 Vs.2032 (USD Million)

Figure 11 Global Mental Health Apps Market, by Geography

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Global Mental Health Apps Market, by Platform, 2025 Vs.2032 (USD Million)

Figure 14 Global Mental Health Apps Market, by Application, 2025 Vs.2032 (USD Million)

Figure 15 Global Mental Health Apps Market, by Patient Type, 2025 Vs.2032 (USD Million)

Figure 16 Global Mental Health Apps Market, by End User, 2025 Vs.2032 (USD Million)

Figure 17 North America: Mental Health Apps Market Snapshot

Figure 18 Europe: Mental Health Apps Market Snapshot

Figure 19 Asia-Pacific: Mental Health Apps Market Snapshot

Figure 20 Latin America: Mental Health Apps Market Snapshot

Figure 21 Key Growth Strategies Adopted by Leading Players (2021–2025)

Figure 22 Mental Health Apps Market: Competitive Benchmarking, by Application

Figure 23 Mental Health Apps Market: Competitive Benchmarking, by Region

Figure 24 Competitive Dashboard Mental Health Apps Market

Figure 25 Global Mental Health Apps Market Share/Market Ranking Analysis, by Key Players (2024)

Figure 26 Talkspace, Inc.: Financial Overview (2024)

Published Date: Nov-2024

Published Date: May-2024

Published Date: May-2024

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates