Resources

About Us

Bioprocessing Equipment Market by Product Type (Bioreactors, Fermenters, Filtration Systems, Control & Monitoring Systems, Support Equipment), Application, End User, & Geography - Global Forecast to 2035

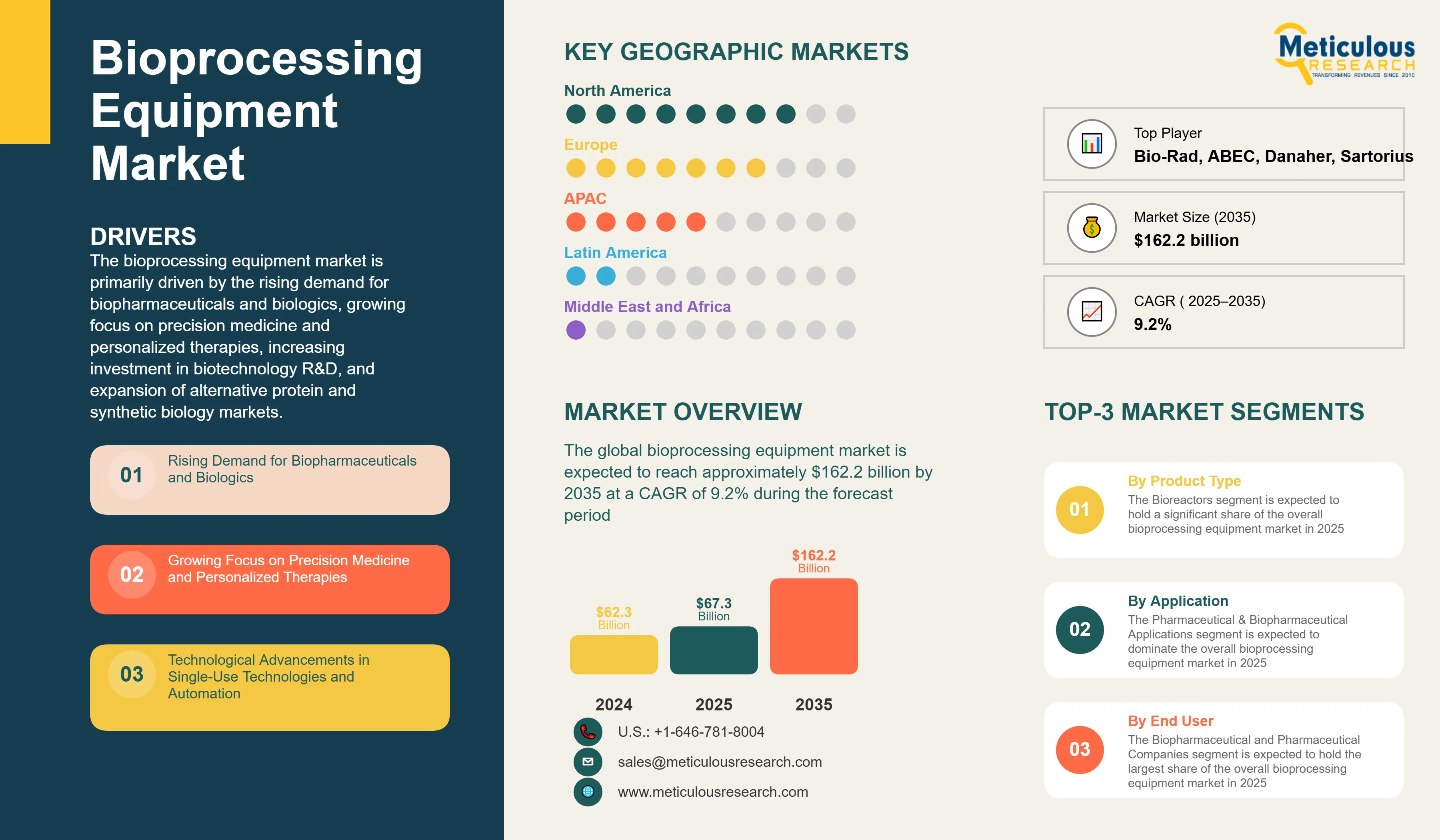

Report ID: MRHC - 1041507 Pages: 285 May-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe global bioprocessing equipment market was valued at $62.3 billion in 2024. This market is expected to reach approximately $162.2 billion by 2035, growing from an estimated $67.3 billion in 2025, at a CAGR of 9.2% during the forecast period of 2025–2035.

Report Overview

This report analyzes the global bioprocessing equipment market, highlighting how bioprocessing equipment providers are addressing the growing demand for biopharmaceuticals and biologics, precision medicine and personalized therapies, as well as the surge in biotechnology R&D investments across emerging markets. It provides a strategic assessment of market dynamics, forecasts through 2035, and evaluates the competitive landscape at global, regional, and country levels.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The bioprocessing equipment market is primarily driven by the rising demand for biopharmaceuticals and biologics, growing focus on precision medicine and personalized therapies, increasing investment in biotechnology R&D, and expansion of alternative protein and synthetic biology markets. The shift towards continuous bioprocessing and perfusion systems, single-use and disposable technologies are reshaping the industry, while modular and flexible manufacturing platforms and AI and machine learning integration technologies are gaining significant traction. Additionally, integration with Industry 4.0 and digital technologies and technological advancements in automation are further driving market growth, especially in developed markets with advanced biotechnology infrastructure.

Key Challenges

Although the bioprocessing equipment market holds substantial growth potential, it encounters several challenges such as high capital investment and operational costs, complex regulatory approval processes, and technical challenges in scale-up and process optimization. Furthermore, hurdles like regulatory compliance across different regions, quality standards and validation requirements, and supply chain disruptions and material shortages pose significant barriers that could hinder market adoption in different parts of the world.

Growth Opportunities

The bioprocessing equipment market presents numerous avenues for high growth. Emerging markets offer substantial expansion opportunities for market players looking to reach new customer bases. Integration with Industry 4.0 and digital technologies provides another key opportunity, enhancing the accessibility of advanced bioprocessing control systems. Moreover, the growing demand for contract manufacturing services and environmental applications and sustainable manufacturing are generating new revenue streams for solution providers as organizations seek efficient alternatives to traditional manufacturing methods.

Market Segmentation Highlights

By Product Type

The Bioreactors segment is expected to hold a significant share of the overall bioprocessing equipment market in 2025, due to their critical role in cell culture and fermentation processes across pharmaceutical and biotechnology applications. The segment includes stirred-tank bioreactors, single-use bioreactors, wave/rocking bioreactors, air-lift bioreactors, and perfusion bioreactors. However, the Filtration Systems segment continues to maintain strong market presence, driven by increasing demand for downstream processing and purification technologies.

By Application

The Pharmaceutical & Biopharmaceutical Applications segment is expected to dominate the overall bioprocessing equipment market in 2025, primarily due to the increasing development of monoclonal antibodies, vaccines, cell and gene therapy, and recombinant proteins. However, the Food & Beverage Applications segment is expected to grow significantly during the forecast period, driven by the growing focus on alternative proteins, probiotics, and fermented products.

By End User

The Biopharmaceutical and Pharmaceutical Companies segment is expected to hold the largest share of the overall bioprocessing equipment market in 2025, due to the growing pipeline of biologics and increasing manufacturing capacity investments. However, the Contract Development and Manufacturing Organizations (CDMOs/CMOs) segment is expected to experience notable growth during the forecast period, driven by the increasing outsourcing trend in pharmaceutical manufacturing.

By Geography

North America is expected to hold the largest share of the global bioprocessing equipment market in 2025, driven by advanced biotechnology infrastructure, strong focus on biopharmaceutical development, well-established pharmaceutical industry, and favorable regulatory environment for biologics. Additionally, high R&D investments and mature market infrastructure contribute significantly to market dominance. Europe follows as a significant market, bolstered by growing biotechnology sector and increasing adoption of advanced bioprocessing technologies. However, Asia-Pacific is witnessing the fastest growth rate during the forecast period, primarily driven by expanding pharmaceutical manufacturing, growing biotechnology investments, increasing healthcare expenditure, and rising demand for biologics.

Competitive Landscape

The global bioprocessing equipment market is characterized by a diverse competitive environment, comprising established biotechnology equipment manufacturers, pharmaceutical technology providers, automation solution providers, and innovative technology companies, each adopting unique approaches to advancing bioprocessing technologies.

Within this landscape, equipment providers are segmented into industry leaders, market differentiators, vanguards, and contemporary stalwarts, with each group implementing distinct strategies to sustain their competitive edge. Leading companies are prioritizing integrated solutions that merge cutting-edge bioprocessing technologies with comprehensive manufacturing automation systems, while also addressing scalability and regulatory compliance challenges specific to various regions.

The key players operating in the global bioprocessing equipment market are Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, Eppendorf SE, Getinge AB, Applikon Biotechnology B.V., ABEC, Inc., Solaris Biotech Solutions S.r.l., Pierre Guerin Technologies, Bioengineering AG, Infors HT, CerCell ApS, Pall Corporation (Cytiva - GE Healthcare), and Bio-Rad Laboratories, Inc. among others.

Bioprocessing Equipment Market Report Summary

|

Particulars |

Details |

|

Number of Pages |

285 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value) in 2025 |

USD 67.3 Billion |

|

Market Size (Value) in 2035 |

USD 162.2 Billion |

|

Segments Covered |

Market Assessment, by Product Type

Market Assessment, by Application

Market Assessment, by End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Switzerland, Denmark, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

|

Key Companies |

Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, Eppendorf SE, Getinge AB, Applikon Biotechnology B.V., ABEC, Inc., Solaris Biotech Solutions S.r.l., Pierre Guerin Technologies, Bioengineering AG, Infors HT, CerCell ApS, Pall Corporation (Cytiva - GE Healthcare), Bio-Rad Laboratories, Inc. |

Key Questions Answered in the Report:

The global bioprocessing equipment market was valued at $62.3 billion in 2024. This market is expected to reach approximately $162.2 billion by 2035, growing from an estimated $67.3 billion in 2025, at a CAGR of 9.2% during the forecast period of 2025–2035.

The global bioprocessing equipment market is expected to grow at a CAGR of 9.2% during the forecast period of 2025–2035.

The global bioprocessing equipment market is expected to reach approximately $162.2 billion by 2035, growing from an estimated $67.5 billion in 2025, at a CAGR of 9.2% during the forecast period of 2025–2035.

The key companies operating in this market include Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, Eppendorf SE, Getinge AB, Applikon Biotechnology B.V., ABEC, Inc., Solaris Biotech Solutions S.r.l., Pierre Guerin Technologies, and others.

Major trends shaping the market include continuous bioprocessing and perfusion systems, single-use and disposable technologies, modular and flexible manufacturing platforms, and AI and machine learning integration.

Which Segments Will Hold Large Market Shares in the Bioprocessing Equipment Market during 2025-2035?

• In 2025, the Bioreactors segment is expected to hold a significant share of the overall bioprocessing equipment market by product type

• Based on application, the Pharmaceutical & Biopharmaceutical Applications segment is expected to hold the largest share of the overall market in 2025

• Based on end user, the Biopharmaceutical and Pharmaceutical Companies segment is expected to hold the largest share of the overall market in 2025

North America is expected to hold the largest share of the global bioprocessing equipment market in 2025, driven by advanced biotechnology infrastructure, strong focus on biopharmaceutical development, and favorable regulatory environment for biologics. Asia-Pacific is witnessing the fastest growth rate during the forecast period.

The growth of this market is driven by rising demand for biopharmaceuticals and biologics, growing focus on precision medicine and personalized therapies, increasing investment in biotechnology R&D, and expansion of alternative protein and synthetic biology markets.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates