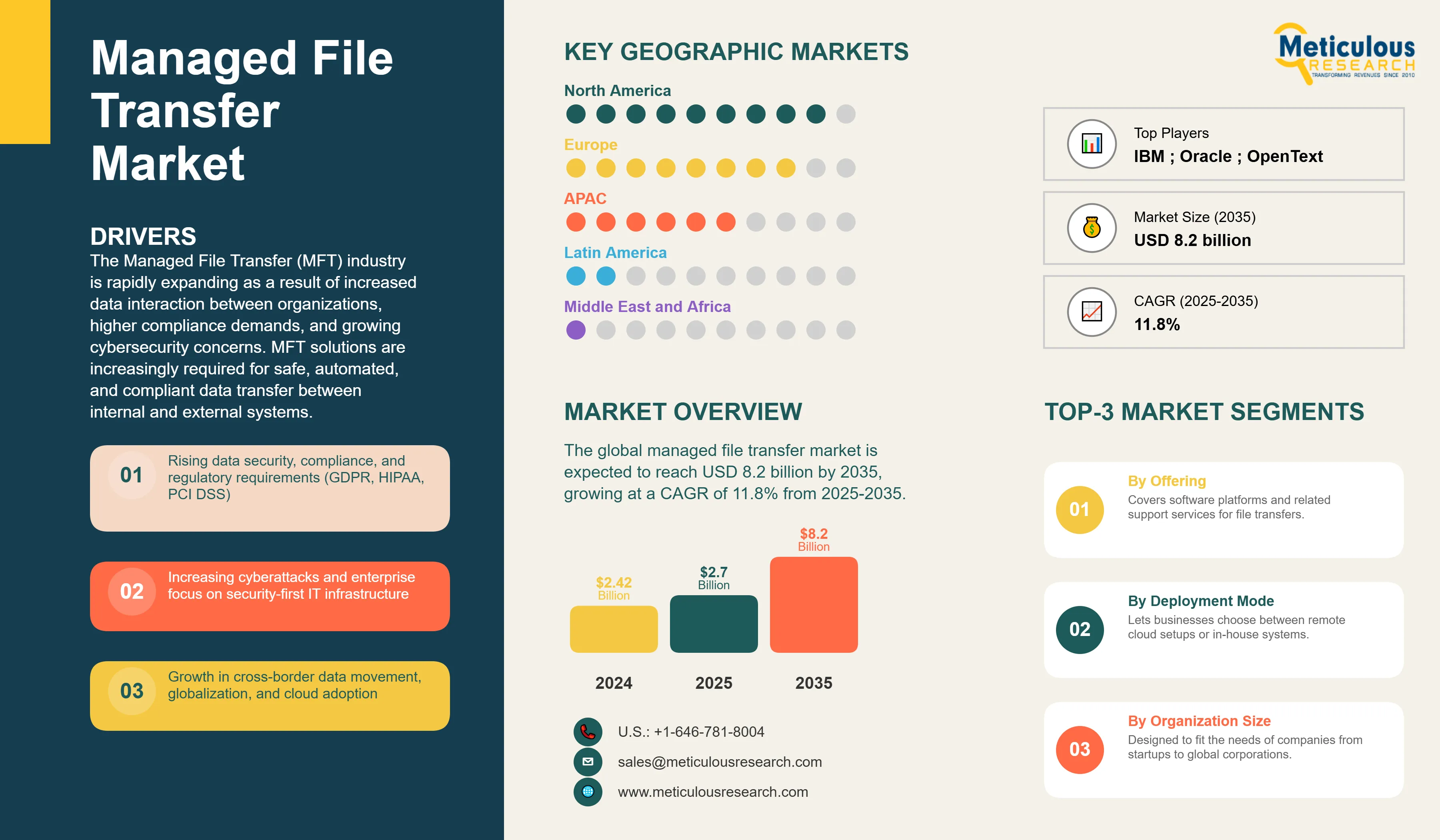

The global managed file transfer market was estimated to be USD 2.7 billion in 2025 and is expected to reach USD 8.2 billion by 2035, growing at a CAGR of 11.8% from 2025-2035.

The Managed File Transfer (MFT) industry is rapidly expanding as a result of increased data interaction between organizations, higher compliance demands, and growing cybersecurity concerns. MFT solutions are increasingly required for safe, automated, and compliant data transfer between internal and external systems. Ransomware assaults are on the rise, with IBM X-Force reporting an 18% increase globally in 2024. This has fuelled demand for encrypted and auditable information transfer platforms. Finance, healthcare, and government organizations are emphasizing MFT in order to comply with GDPR, HIPAA, and PCI-DSS regulations. The market is also seeing integration with AI-powered monitoring tools and cloud-native designs, which improve scalability and threat detection.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

IBM, Progress Software, Axway, and Globalscape are the leading participants in the MFT market, each of which provides unique capabilities. IBM Sterling and Axway SecureTransport are dominant in regulated industries because of their strong compliance features. Progress MOVEit gained traction in 2024 thanks to its cloud-native architecture and zero-trust security philosophy. Vendors are also getting into AI-powered anomaly detection and process orchestration. Strategic alliances with cloud providers and cybersecurity companies are influencing competitive positioning.

Recent Developments

Progress Software Introduces MOVEit Cloud Advanced with AI Anomaly Detection and Dynamic Routing for Hybrid Cloud

Progress Software introduced MOVEit Cloud Advanced in Q3 2024, aimed at organizations with hybrid cloud installations. The platform features AI-powered anomaly detection, dynamic routing, and improved compliance dashboards. Within six months, more than 1,000 businesses had selected the service, citing increased scalability and lower breach risks. Progress's launch establishes it as a leader in cloud-native MFT.

HelpSystems Expands Real-Time Transfer Portfolio with File Catalyst Acquisition Enhancing High-Speed Managed File Transfer

HelpSystems purchased FileCatalyst, a faster file transfer service provider, in early 2024. The acquisition expands HelpSystems' MFT portfolio with high-speed, low-latency capabilities for the media and telecom industries. FileCatalyst's UDP-based protocol allows for transfers that are up to ten times faster than regular FTP. The transaction shows the increasing need for performance-optimized MFT in bandwidth-intensive businesses.

Key Market Drivers

- Regulatory Pressure Drives Enterprise Adoption of Secure and Auditable Managed File Transfer Platforms: Regulatory pressure is a primary driver of MFT adoption across industries. According to the IAPP, GDPR enforcement actions in the EU will increase by 14%, while HIPAA violations will increase by 11% in the US. Enterprises are investing in MFT to ensure that data transfers are encrypted, traceable, and policy-compliant. Financial organizations are particularly active, with 67% were planning to boost spending on secure file exchange solutions in 2024, according to Deloitte. MFT technologies provide audit trails, role-based access, and automated procedures to match with changing compliance standards.

- Growing Hybrid Cloud Environments Accelerate Demand for Scalable and Integrated Managed File Transfer Solutions: Secure data movement becomes increasingly intricate as enterprises transition to hybrid cloud environments. Gartner reported that 72% of the global enterprises now use hybrid cloud configurations, up from 58% in 2022. MFT platforms are integrating with cloud-native services such as AWS Transfer Family and Azure Logic Apps to support dynamic workloads. This shift is driving demand for API-based, containerized MFT solutions that can scale in both on-premises and cloud environments. Vendors are also incorporating real-time monitoring and orchestration capabilities to manage multi-cloud transfers. According to Gartner, organizations are increasingly using encrypted file transfer systems due to cybersecurity threats.

- Automation of File Workflows Enhances Operational Efficiency and Drives Managed File Transfer Adoption Across Industries: Enterprises are automating data exchange to increase operational efficiency and reduce errors. According to a McKinsey report from 2024, 61% of digital transformation leaders have implemented automated file transfer systems to improve B2B and internal workflow efficiency. MFT platforms allow for scheduled transfers, conditional routing, and real-time alerts, which reduce the need for manual intervention. This is especially important in the supply chain, banking, and telecommunications industries, where latency and accuracy influence business outcomes. Integration with ERP and CRM systems broadens use cases.

Key Market Restraints

- High Integration Complexity and Costs Limit Managed File Transfer Adoption Among Small and Medium Enterprises: Despite its benefits, MFT implementation can be resource-intensive for small businesses. According to a TechRepublic survey from 2024, 39% of SMBs cited integration complexity and cost as barriers to MFT adoption. Customizing workflows, ensuring compliance, and training employees all require a significant initial investment. Many SMBs continue to use basic FTP or email-based transfers, which exposes them to security risks. Vendors are now providing SaaS-based MFT models to fill this gap.

- Challenges in Integrating Managed File Transfer with Legacy Infrastructure Hinder Seamless Deployment and Scalability: Many businesses use legacy systems that lack APIs or modern protocols. This causes friction when integrating MFT platforms into existing infrastructure. According to a Forrester study from 2024, 33% of IT leaders struggled to connect MFT tools with outdated ERP and mainframe systems. These compatibility issues cause delays in deployment and increase reliance on middleware, affecting performance and scalability.

Table: Key Factors Impacting Global Managed File Transfer Market (2025–2035)

Base CAGR: 11.8%

|

Category

|

Key Factor

|

Short-Term Impact (2025–2028)

|

Long-Term Impact (2029–2035)

|

Estimated CAGR Impact

|

|

Drivers

|

1. Regulatory Pressure Drives Enterprise Adoption of Secure and Auditable Managed File Transfer Platforms

|

Increased compliance-driven deployments

|

Standardized adoption across regulated industries

|

▲ +7.5%

|

| |

2. Growing Hybrid Cloud Environments Accelerate Demand for Scalable and Integrated Managed File Transfer Solutions

|

Rising cloud migrations and hybrid infrastructure use

|

Mature hybrid-cloud MFT ecosystems enabling seamless transfers

|

▲ +7.0%

|

| |

3. Increasing Cyberattacks Push Organizations Toward Encrypted Managed File Transfer Systems with Advanced Security Features

|

Heightened focus on encryption and threat detection

|

Advanced, AI-powered security and zero-trust implementations

|

▲ +6.8%

|

| |

4. Automation of File Workflows Enhances Operational Efficiency and Drives Managed File Transfer Adoption Across Industries

|

Workflow automation adoption accelerates

|

Fully automated and integrated file transfer ecosystems

|

▲ +6.5%

|

|

Restraints

|

1. High Integration Complexity and Costs Limit Managed File Transfer Adoption Among Small and Medium Enterprises

|

SME adoption slowed due to technical and financial barriers

|

Gradual reduction in integration costs improves SME uptake

|

▼ −2.8%

|

| |

2. Challenges in Integrating Managed File Transfer with Legacy Infrastructure Hinder Seamless Deployment and Scalability

|

Legacy system limitations create deployment delays

|

Integration frameworks mature enabling better scalability

|

▼ −2.5%

|

|

Opportunities

|

1. Expansion of cloud-based and hybrid MFT solutions for scalability

|

Increased cloud-based service offerings and enterprise interest

|

Cloud and hybrid solutions dominate MFT deployments

|

▲ +6.7%

|

| |

2. Industry-specific solutions in BFSI, healthcare, government, and retail

|

Tailored solution adoption grows in regulated sectors

|

Vertically optimized platforms become industry standard

|

▲ +6.3%

|

|

Trends

|

1. Increasing AI and automation in MFT workflows

|

Early AI-enhanced threat detection and workflow optimization

|

AI-driven MFT orchestration and predictive analytics

|

▲ +6.0%

|

| |

2. Blockchain and zero-trust architectures for secure transfer

|

Pilot adoption of blockchain and zero-trust frameworks

|

Broad adoption for enhanced trust and compliance

|

▲ +5.8%

|

|

Challenges

|

1. Managing security for multi-cloud and hybrid IT environments

|

Complex security governance and policy enforcement issues

|

Mature security protocols and automated compliance monitoring

|

▼ −2.3%

|

| |

2. Complexity of legacy system integrations and data migrations

|

Integration delays and data migration risks

|

Streamlined multi-platform integration solutions

|

▼ −2.0%

|

Regional Analysis

North America's Managed File Transfer Market Growth Driven by Regulatory Pressure Cloud Adoption and Cybersecurity Investments

North America continues to be the largest MFT market with around 35-40% share of the global market, driven by strict data privacy laws and rapid cloud migration. The region experienced a 16% increase in data breaches in 2024, prompting investment in secure file transfer platforms. The financial services, healthcare, and government sectors are early adopters, with MFT integrated into larger cybersecurity frameworks. The U.S. Department of Health and Human Services reported a 12% increase in HIPAA-related data transfer violations, highlighting the importance of compliant MFT solutions. Vendors are also working with AWS and Microsoft Azure to provide region-specific integrations.

Asia-Pacific Sees Rapid Managed File Transfer Adoption Fueled by Digitalization Mobile Penetration and Regulatory Compliance

Asia-pacific region is expected to experience significant and rapid growth, expanding at 13.4% CAGR from 2025 to 2035. MFT adoption is high in Asia-Pacific as a result of rapid digital transformation and mobile-first enterprise strategies. According to the GSMA, mobile penetration in the region reached 89% in 2024, with 27% growth in 5G adoption. Enterprises in India, China, and Southeast Asia are using MFT to enable secure data exchange across distributed teams and cloud platforms. Government-led initiatives such as India's Digital India and China's Cybersecurity Law encourage organizations to use compliant file transfer systems. The telecom and manufacturing industries are particularly active, with MFT being integrated into IoT and edge computing workflows.

Country-level Analysis

The U.S. Market Focuses on Compliance and Hybrid Cloud Strategies Driving Managed File Transfer Investment and Integration

In 2025, the U.S. MFT market is expected to maintain a dominant position, growing at a CAGR of 10.4% from 2025 to 2035. The U.S. market is shaped by regulatory enforcement and cloud-first approaches. According to PwC, 65% of enterprises plan to increase their spending on secure file transfer tools this year. HIPAA, SOX, and PCI-DSS compliance requirements are propelling adoption in healthcare, finance, and retail. Ransomware attacks have increased by 19% year on year, making encrypted and auditable transfers a top priority. Vendors are also integrating MFT into SIEM and IAM platforms to improve security posture.

China Advances Managed File Transfer Adoption Amid Cybersecurity Regulations and Expanding Digital Economy

The Chinese MFT market is expected to grow at 13.7% CAGR by 2035. China's MFT market is expanding due to cybersecurity regulations and enterprise digitalization. In 2024, China's Cyberspace Administration enforced stricter data localization rules, prompting businesses to use secure transfer platforms. The country's digital economy grew by 15%, with increased demand for cross-border and internal data exchange. Telecom and e-commerce companies are early adopters, combining MFT with cloud and AI systems.

Germany Emphasizes Data Sovereignty and Industry 4.0 Initiatives to Boost Managed File Transfer Deployment

Germany leads the European MFT market, expanding at a CAGR of 10.2% from 2025 to 2035. GDPR enforcement and industrial digitalization have shaped Germany's MFT market. Bitkom estimates that 48% of manufacturers will use MFT to support secure data exchange in IoT and automation workflows this year. The country's emphasis on data sovereignty and privacy is driving enterprises to use compliant, encrypted file transfer systems. Integration with SAP and Siemens platforms broadens use cases in manufacturing and logistics.

Segmental Analysis

Cloud-Based Managed File Transfer Solutions Gain Traction for Scalability While On-Premise Remain Key for Compliance

Cloud-based MFT solutions are gaining popularity due to their scalability & cost effectiveness and are projected to grow at 12.9% by 2035. In 2024, 62% of new MFT deployments were cloud-based, driven by hybrid work and remote collaboration requirements. Enterprises prefer SaaS models because they are faster to implement and require less infrastructure overhead. On-premise solutions remain relevant in heavily regulated industries such as government and banking, where data residency and control are critical. Vendors are offering hybrid models that strike a balance between flexibility and compliance. Integration with cloud storage and orchestration tools enhances cloud MFT capabilities.

BFSI Leads Managed File Transfer Adoption with Healthcare Following Closely Due to High Compliance and Data Sensitivity

The BFSI sector is the leader in the adoption of MFTs, accounting for over 25% revenue share in 2025, as it is characterized by a high level of compliance and data sensitivity. In 2024, 71% of financial institutions used MFT platforms to facilitate secure interbank transfers, customer data exchange, and regulatory compliance. Healthcare is the second-largest segment, with 58% of hospitals using MFT to meet HIPAA and HL7 standards. The rise of telemedicine and electronic health records is driving up demand for encrypted, automated file workflows.

Report Specifications:

|

Report Attribute

|

Details

|

|

Market size (2025)

|

USD 2.7 billion

|

|

Revenue forecast in 2035

|

USD 8.2 billion

|

|

CAGR (2025-2035)

|

11.8%

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 – 2035

|

|

Report coverage

|

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints

|

|

Segments covered

|

By Component (Solution, Services), Deployment Mode (Cloud-based, On-premise, Hybrid), Organization Size, Application (Banking, Financial Services, & Insurance (BFSI), Healthcare & Life Sciences, IT & Telecommunications), Geography

|

|

Regional scope

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

|

Key companies profiled

|

IBM Corporation; Oracle Corporation; OpenText Corporation; Broadcom Inc.; Axway Software SA; Software AG; Progress Software Corp. (Ipswitch, Inc.); GlobalScape, Inc. (Fortra LLC); Signiant, Inc.; Primeur; Kiteworks; Wipro Limited; SEEBURGER AG; Cloud Software Group, Inc.; SSH Communications Security; Data Expedition, Inc.; JSCAPE

|

|

Customization

|

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available

|

|

Pricing Details

|

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models

|

Market Segmentation

- By Component

- By Deployment Mode

- By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare & Life Sciences

- IT & Telecommunications

- Government & Public Sector

- Others

Key Questions Answered in the Report: