Resources

About Us

Low Code Development Platform Market Size, Share, Forecast & Trends by Deployment Mode (Cloud-based, On-premises), Application (Web-based, Mobile-based), Industry (Retail & E-commerce, Information Technology & Telecom) - Global Forecast to 2035

Report ID: MRICT - 1041544 Pages: 190 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportLow Code Development Platform Market is set to Expedite as the Integration of AI Increases Significantly

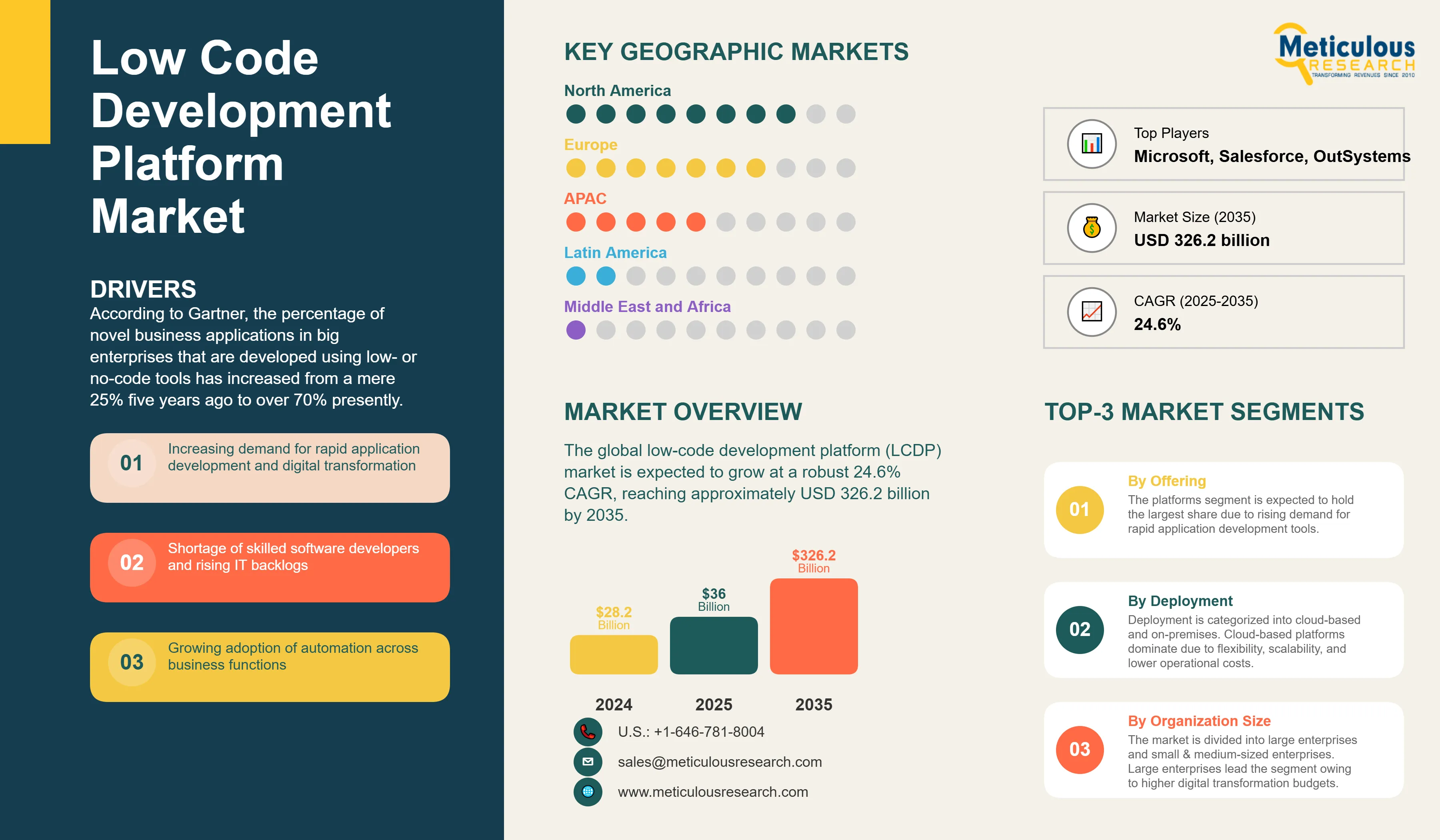

The global low-code development platform (LCDP) market was valued at USD 28.2 billion in 2024. This market is expected to grow at a robust 24.6% CAGR, reaching approximately USD 326.2 billion by 2035 from USD 36.0 billion in 2025.

According to Gartner, the percentage of novel business applications in big enterprises that are developed using low- or no-code tools has increased from a mere 25% five years ago to over 70% presently. The United States government is rapidly transitioning to the use of platforms such as Salesforce, ServiceNow, and Appian to modernise outdated systems and offer web-based public services. Leading consulting companies, including McKinsey and Deloitte, both say that low-code will be one of the main factors that affects the return on investment (ROI) and digital agility for businesses. The strategic policy that supports empowering "citizen developers," the widening digital skills gap, and the pressing demand for speedier software delivery by corporations are all factors fuelling the sector's expansion.

Click here to: Get Free Sample Pages of this Report

Competition among major enterprise technology vendors is intense as they strive to establish standards. Microsoft Power Platform is the most comprehensive, offering strong integration and security for both business users and IT. OutSystems, Mendix, and Oracle are aimed at regulated financial and industrial use, while Salesforce, Appian, and ServiceNow are dominating work in the public sector, including government and state deployments in the U.S. The market is currently experiencing ‘verticalization,’ indicating that solution stacks are being made for sectors like healthcare, finance, and logistics.

U.S. Federal Modernization Accelerates via Low Code

Major VC Funding for AI-integrated Low Code

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Digital Transformation Initiatives |

Boosts adoption across industries for modernization. |

Becomes a core element of digital infrastructure. |

▲ +5.8% |

|

2. Developer Shortage |

Enables citizen development and non-technical users. |

Reduces reliance on skilled developers. |

▲ +4.5% |

|

|

3. AI & Automation Integration |

Improves capabilities through AI features. |

Intelligent platforms for autonomous development. |

▲ +4.1% |

|

|

Restraints |

1. Security & Compliance Concerns |

Hesitancy due to data security risks. |

Development of security solutions to address concerns. |

▼ −2.3% |

|

2. Limited Customization for Complex Apps |

Challenges with highly customized solutions. |

Platforms evolve to support complex apps. |

▼ −1.9% |

|

|

Opportunities |

1. Growth in SMEs |

Cost-effective and rapid development. |

SMEs as key contributors in the app development space. |

▲ +6.2% |

|

2. Industry-Specific Solutions |

Tailored platforms for sectors like healthcare and finance. |

Rise of niche, industry-specific low-code platforms. |

▲ +5.5% |

|

|

Trends |

1. Hybrid & Multi-Cloud Deployment Models |

More flexible deployment options. |

Standardized hybrid and multi-cloud environments. |

▲ +3.8% |

|

|

2. Citizen Development Growth |

Empowering non-technical users in app development. |

Citizen development becomes a common practice. |

▲ +3.2% |

|

Challenges |

1. Speed vs. Quality & Security |

Balancing rapid development with quality and security. |

Maintaining high standards with fast delivery. |

▼ −2.0% |

Regional Analysis

SME Digitalization and Cloud Leadership Drive North America’s Low-Code Dominance

North America dominates the global low code development platform market, accounting for more than 40% market share in 2025. Private businesses, as well as federal and state agencies in the US, are quickly adopting owing to cloud-first procurement strategies and a constant focus on digital transformation efforts. According to the U.S. General Services Administration, more than 60% of government deployments now use low code as their standard way to build web applications. State and local governments often recommend Microsoft's Power Platforms like ServiceNow are viable options due to their strong security certifications. security certifications. They offer numerous features for automating compliance. Although with numerous startups and SMEs entering the market, the regional growth is still being driven by regulatory backing and a lack of developers.

Enterprise Modernization and Government Digitization Fuel APAC’s Rapid Growth

The Asia-Pacific market is the fastest-growing region in the low code development platform market, with projected growth rate exceeding 28% by 2035, as more people are using the cloud and starting their businesses. China and India are implementing cloud in the areas of banking, schooling, public health, and logistics. According to the World Bank and IMF assessments of digital modernization, “mobile-first” approaches to public service delivery are being used by many governments in the APAC region. They are still looking for tools that work with local languages and follow the rules in the area. Start-ups from Singapore to Sydney are making it easier for businesses to use B2B solutions. At the same time, Japanese and Korean companies are starting citizen developer programs to improve the skills of their workers.

Country-level Analysis

Cloud-First Strategies and Citizen Developers Cement U.S. Low-Code Leadership

The U.S. is expected to maintain a leading position and dominate the global low code development platform market, bolstered by cloud-native government modernization efforts and broad-based enterprise digitalization. The federal adoption curve is especially steep, with agencies deploying ServiceNow, Salesforce, or Appian to streamline areas spanning benefits processing to internal HR and procurement workflows. The Department of Defense and GSA have both cited low code’s ability to support secure, scalable apps “days, not months” for pilot or citizen-facing projects. The U.S. digital policy increasingly views low code as innovative and essential for closing the tech skills gap.

National Digitalization and Industrial IoT Drive China’s Low-Code Uptake

China dominates the Asia-Pacific low code development platform market and is also estimated to account for highest market size in 2025. According to regional industry news and a 2025 IMF technical review, Chinese banks, provincial governments, and logistics firms are rapidly deploying homegrown and global low code stacks, aiming for large-scale application delivery and mobile citizen engagement in record time. Additionally, China finances hyperscale data centers in Gulf states, offering sovereign clouds that host Western-compatible runtimes. These initiatives are collectively expected to drive the business growth in the country.

Modernization and Regulatory Compliance Accelerate Germany’s Growth

Germany is a leading geography in Europe’s low code development platform market. A 2025 survey reported that over 60% of German enterprises in banking, automotive, and manufacturing now use low code tools for customer portal rollouts, ERP extensions, and B2B integration. The Federal Ministry of the Interior has referenced platform adoption in efforts to digitize citizen-facing government services, emphasizing “explainable configuration” and full GDPR compliance. These factors are anticipated to drive the market growth in Germany.

Segmental Analysis

Platforms Lead, but Services Growth Accelerates with Complex Deployments

Platforms dominate the market with share of more than 65%, driven by the increasing demand for rapid application development with minimal hand-coding, enabling businesses to streamline workflows, automate processes, and enhance operational efficiency. These platforms offer drag-and-drop interfaces, pre-built templates, and AI-assisted development tools, significantly reducing time-to-market for applications. The growing adoption of mobile-based low-code platforms is challenging the traditional dominance of web-based solutions, as enterprises prioritize seamless cross-device functionality and offline capabilities.

While platforms account for the largest revenue share due to their scalability and ease of use, the services segment is projected to expand at a higher CAGR, driven by enterprises seeking end-to-end low-code solutions. The shift toward composable architectures and API-driven integrations further amplifies the need for specialized services, ensuring seamless connectivity with legacy systems and emerging technologies like AI and IoT. Vendors offering low-code platforms with embedded analytics, DevOps automation, and multi-cloud support are poised to capture greater market share, particularly as demand grows for industry-specific solutions in regulated sectors. The competitive landscape is evolving, with pure-play low-code providers and enterprise software giants like Microsoft, Salesforce, and Oracle expanding their offerings to cater to diverse development needs.

Rising uptake for Mobile-based platforms challenges the Web-based section’s Dominance

Web-apps platform is set to expand at 22% CAGR, during the forecast timeline. Native plug-ins for biometrics, augmented reality, and the camera enhance the contextuality and richness of mobile experiences. The market size of low-code development platforms for mobile applications is expected to expand rapidly, particularly in the areas of utility maintenance and insurance inspections. Composable-banking and open-data directives are in alignment with API-centric designs, which also extend to mobile and web applications. Microsoft's intention to transition from monolithic Dynamics 365 screens to task-oriented AI agents emphasizes the process by which interfaces will transform into contextual micro-interactions. Organizations that are striving for multi-channel parity will acquire incremental market share in the low-code development platform market from vendors that offer secure offline sync, one-click PWA generation, and responsive design.

Cloud-based deployment is helping shape hybrid strategies in the industry

Based on deployment mode, cloud-based deployment is estimated to account for the largest share of 72% of the overall low code development platform market, assisted by a decreased infrastructure burden and elastic scaling. However, numerous banks and ministries are compelled to implement hybrid or dedicated-region models as a result of the ECB's cloud-outsourcing guidance and the emergence of data-embassy constructs. In response, providers provide single-tenant regions, air-gapped installations, and Bring-Your-Own-Key encryption. This flexible continuum is helping sustain rapid growth for the low-code development platform market.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 36.0 billion |

|

Revenue forecast in 2035 |

USD 326.2 billion |

|

CAGR (2025-2035) |

24.6% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Platform, Services), Deployment Mode (Could-based, On-premises), Application (Web-based, Mobile-based), Organization Size, End-User Industry, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Microsoft Corporation; Salesforce; OutSystems; Mendix (Siemens); Appian Corporation; Pega Systems; Betty Blocks; Zoho Corporation; Kintone; Quick Base |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The low code development platform market size is estimated to be USD 36.0 billion in 2025 and grow at a CAGR of 24.6% to reach USD 326.2 billion by 2035.

In 2024, the low code development platform market size was estimated at USD 28.2 billion, with projections to reach USD 36.0 billion in 2025.

Microsoft Corporation, Salesforce, OutSystems; Mendix (Siemens), Appian Corporation, Pega Systems, Betty Blocks, Zoho Corporation, Kintone, and Quick Base among others are the major companies operating in the Low Code Development Platform Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, cloud-based deployment held highest market share, accounting for 72%.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Low Code Development Platform Market, by Deployment

3.2.2. Low Code Development Platform Market, by Application

3.2.3. Low Code Development Platform Market, by Organization Type

3.2.4. Low Code Development Platform Market, by End-Use Industry

3.2.5. Low Code Development Platform Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing demand for rapid application development and digital transformation

4.2.1.2. Shortage of skilled software developers and rising IT backlogs

4.2.1.3. Growing adoption of automation across business functions

4.2.1.4. Cost reduction and efficiency benefits for enterprises

4.2.1.5. Enhanced agility and flexibility for customizing workflows

4.2.2. Restraints

4.2.2.1. Security, compliance, and governance concerns

4.2.2.2. Limited scalability for complex or mission-critical solutions

4.2.2.3. Vendor lock-in and integration challenges

4.2.3. Opportunities

4.2.3.1. Expansion of low code in legacy system modernization

4.2.3.2. Increasing use of AI and automation in platform features

4.2.4. Trends

4.2.4.1. Rise of citizen development with business users building apps

4.2.4.2. Integration capabilities with third-party systems and cloud ecosystems

4.2.5. Challenges

4.2.5.1. Managing platform sprawl and shadow IT

4.2.5.2. Ensuring platform interoperability within large organizations

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Low Code Development Platform Market

4.4.1. Integration of Artificial Intelligence

4.4.1.1. AI-based development assistants and automation of repetitive tasks

4.4.1.2. Natural language processing for application generation

4.4.1.3. Intelligent recommendations for workflows and app logic design

4.4.2. Enhanced Drag-and-Drop Interfaces

4.4.2.1. Advanced visual modeling tools improving usability

4.4.2.2. Custom UI component libraries to accelerate development

4.4.3. Cloud-Native Architecture Adoption

4.4.3.1. Seamless deployment across hybrid and multi-cloud environments

4.4.3.2. Microservices orchestration for better scalability

4.4.3.3. Continuous integration and deployment pipelines

5. Impact of Sustainability on Low Code Development Platform Market

5.1. Reduction of resource consumption through faster development cycles

5.2. Support for remote and distributed workforces

5.3. Platforms enabling green IT (lower code base, less computational demand)

5.4. Enabling digital transformation for sustainable business models

5.5. Vendor emphasis on ethical software and inclusive design

5.6. Democratization of development promoting diverse participation

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Low Code Development Platform Market Assessment—By Component

7.1. Overview

7.2. Platforms

7.3. Services

8. Low Code Development Platform Market Assessment—By Deployment

8.1. Overview

8.2. Could-based

8.3. On-premises

9. Low Code Development Platform Market Assessment—By Application

9.1. Overview

9.2. Web-based

9.3. Mobile-based

9.4. Desktop-based

10. Low Code Development Platform Market Assessment—By Organization Type

10.1. Overview

10.2. Large Enterprises

10.3. Small and Medium Enterprises

11. Low Code Development Platform Market Assessment—By End-Use Industry

11.1. Overview

11.2. Banking Financial Services and Insurance

11.3. Retail and E-commerce

11.4. Information Technology and Telecom

11.5. Healthcare and Life Sciences

11.6. Manufacturing

11.7. Government and Defense

11.8. Others

12. Low Code Development Platform Market Assessment—By Geography

12.1. Overview

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Netherlands

12.3.5. Switzerland

12.3.6. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. Japan

12.4.3. South Korea

12.4.4. Taiwan

12.4.5. India

12.4.6. Singapore

12.4.7. Australia

12.4.8. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. Israel

12.6.4. South Africa

12.6.5. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

13.1. Microsoft

13.2. Salesforce

13.3. OutSystems

13.4. Mendix

13.5. Appian

13.6. Pegasystems

13.7. Oracle

13.8. ServiceNow

13.9. Zoho

13.10. Quick Base

13.11. Kissflow

13.12. Creatio

13.13. TrackVia

13.14. Betty Blocks

13.15. Nintex

13.16. Kintone

13.17. AgilePoint

13.18. ProntoForms

13.19. Newgen Software

13.20. LANSA

13.21. Others

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: May-2025

Published Date: May-2023

Published Date: Sep-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates