Resources

About Us

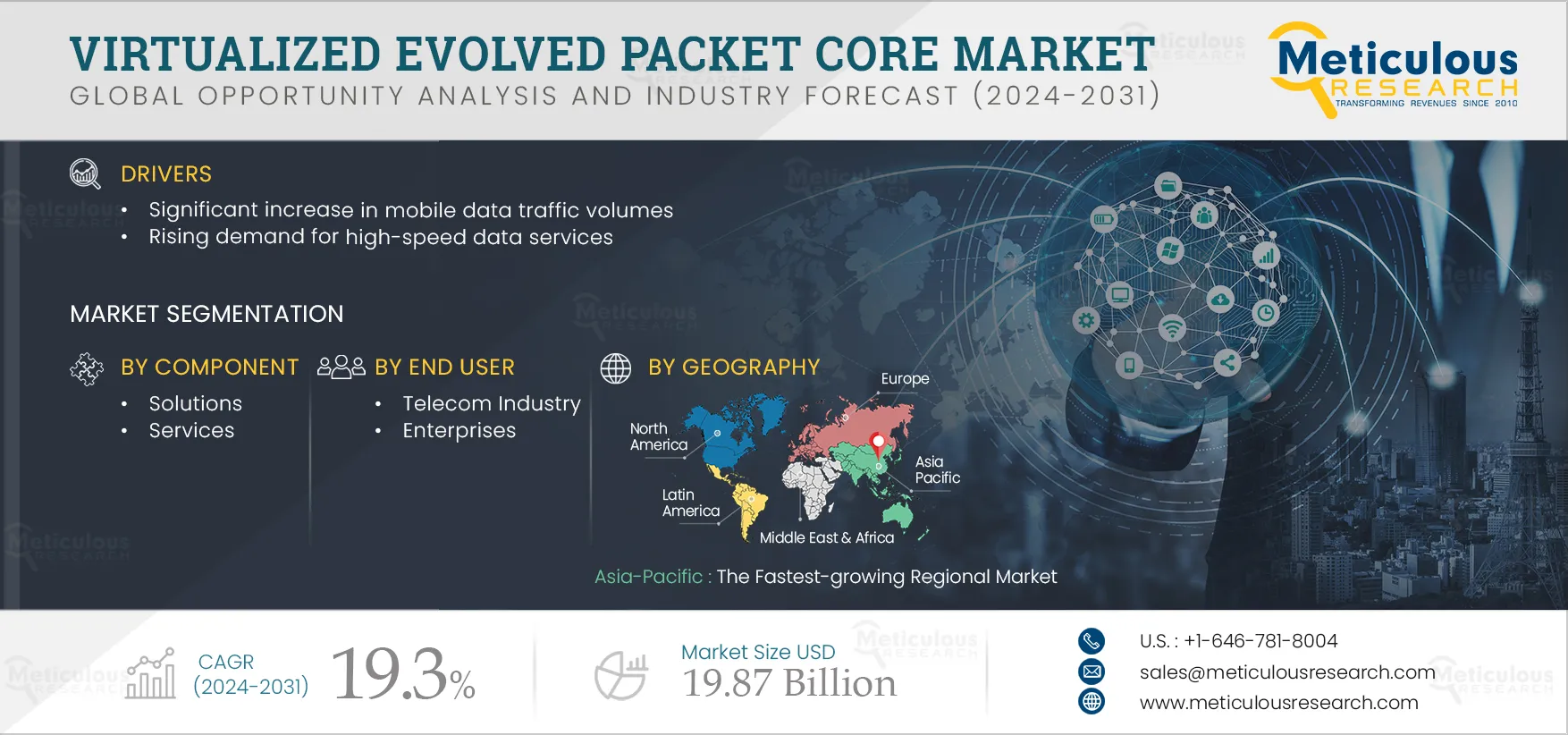

Virtualized Evolved Packet Core Market by Component (Solutions, Services), Application (LTE, VoLTE, IoT & M2M, MPN & MVNO), Deployment Mode (On-premise, Cloud), End User (Telecom, Enterprises), and Geography - Global Forecast to 2031

Report ID: MRICT - 104508 Pages: 270 Apr-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Virtualized Evolved Packet Core Market is expected to reach $19.87 billion by 2031 at a CAGR of 19.3% from 2024 to 2031. The growth of the virtualized evolved packet core market is driven by the significant increase in mobile data traffic volumes and the rising demand for high-speed data services. However, the data security risks associated with virtualized evolved packet core infrastructure restrain the growth of this market. Furthermore, increasing investments in 5G technology, the rising adoption of cloud-native 5G core solutions, and the growing adoption of IoT technology are expected to generate growth opportunities for the players operating in this market. However, the reliability of virtualized evolved packet core (vEPC) solutions and misconceptions and a lack of knowledge regarding vEPC solutions are major challenges impacting market growth. Additionally, the integration of edge computing with virtualized evolved packet core technology is a prominent trend in the vEPC market.

The trend of implementing cloud-native 5G core technology is on the rise and likely to continue in the coming years. Cloud-native architecture is at the heart of the new 5G core technology, which utilizes Cloud-native Network Functions (CNF). Cloud-native 5G core technology empowers organizations to build and run scalable applications in public, private, and hybrid clouds. Also, it delivers ultra-reliable connectivity and low-latency performance, which are critical to the success of the next phase of Industry 4.0. Also, the telecom industry is incorporating New Radio (NR) technology and the new standardized 5G core based on cloud-native Service-based Architecture (SBA). Market players are focusing on partnerships to offer advanced solutions in this market. For instance, in 2021, Google Cloud (U.S.) and Nokia Corporation (Finland) partnered to develop cloud-native 5G core solutions for communication service providers and enterprise customers. The cloud-native 5G core solution enhances voice services, automation & orchestration, operations & management, and security, improving the customer experience. The adoption of cloud-native 5G core solutions is expected to gain momentum over the forecast period as these solutions offer improved performance and help gain better business insights. These factors are expected to accelerate the growth of the vEPC market, generating opportunities for market stakeholders.

Click here to: Get a Free Sample Copy of this report

Based on component, the virtualized evolved packet core market is segmented into solutions and services. In 2024, the solutions segment is expected to account for the larger share of the virtualized evolved packet core market. However, the services segment is expected to register the higher CAGR during the forecast period. The growing need for vEPC consulting and vEPC solution development and maintenance, the wide adoption of vEPC services across telecom operators, and the growing demand for consulting, training & support, and integration services are expected to support the growth of this segment.

Based on application, the virtualized evolved packet core market is segmented into Mobile Private Network & Mobile Virtual Network Operators (MPN & MVNO), Long-term Evolution & Voice over Long-term Evolution (LTE & VoLTE), and Internet of Things & Machine to Machine (IoT & M2M). In 2024, the Mobile Private Network & Mobile Virtual Network Operators (MPN & MVNO) segment is expected to account for the largest share of the virtualized evolved packet core market. However, the Internet of Things & Machine to Machine (IoT & M2M) segment is expected to register the highest CAGR during the forecast period. The increasing need for remote monitoring of devices, the growing demand for autonomous decision-making and actions based on data analysis without human intervention, the increasing need to monitor and control real-world objects, such as industrial equipment, light switches, thermostats, sensors and actuators, and the rising adoption of IoT & M2M for remote access to industrial assets and their data streams are expected to support the growth of this segment.

Based on deployment mode, the virtualized evolved packet core market is segmented into cloud-based deployment and on-premise deployment. In 2024, the on-premise deployment segment is expected to account for the larger share of the virtualized evolved packet core market. However, the cloud-based deployment segment is expected to register a higher CAGR during the forecast period. The growing benefits of cloud-based deployment, including easy maintenance of customer data, cost-effectiveness, and scalability, the increasing demand for cloud-based vEPC for the use of cloud networks, and the superior flexibility offered by cloud deployments are expected to support the growth of this segment.

Based on end user, the virtualized evolved packet core market is segmented into telecom operators, enterprises, and other end users. In 2024, the telecom operators segment is expected to account for the largest share of the virtualized evolved packet core market. Also, this segment is expected to register the highest CAGR during the forecast period. The increasing adoption of vEPC solutions among telecom operators to improve latency issues and enhance IT agility, telecom operators’ rising need to offer better speeds and bandwidth connectivity and reliable application services, and the increasing need to reduce operational expenditure (OPEX) and capital expenditure (CAPEX) in the telecom sector are expected to support the growth of this segment.

Based on geography, the virtualized evolved packet core market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of the virtualized evolved packet core market. However, Asia-Pacific is expected to register the highest CAGR during the forecast period. The increasing number of mobile subscribers, the growing mobile data traffic, the rising adoption of network function virtualization solutions and cloud services, the high penetration of mobile devices and smartphones in developing countries, and the growing deployment of 5G-ready cloud core and Network Functions Virtualization Infrastructure (NFVI) solutions are expected to support the growth of this market.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants during the past 3 to 4 years. The key players operating in the virtualized evolved packet core market are Cisco Systems, Inc. (U.S.), Telefonaktiebolaget Lm Ericsson SE (Sweden), Huawei Technologies Co., Ltd. (China), Samsung Electronics Co., Ltd. (South Korea), Nokia Corporation (Finland), Affirmed Networks (a subsidiary of Microsoft Corporation) (U.S.), Mavenir Systems, Inc. (U.S.), ZTE Corporation (China), F5 Inc. (U.S.), NEC Corporation (Japan), IPLOOK Networks (Hong Kong) Co., Limited (Hong Kong), Parallel Wireless, Inc. (U.S.), Polaris Networks (a subsidiary of Motorola Solutions, Inc.) (U.S.), Athonet S.r.l. (a subsidiary of Hewlett Packard Enterprise) (Italy), Intel Corporation (U.S.), Tecore Networks (U.S.), Lemko Corporation (U.S.), and Metaswitch Networks Ltd (a subsidiary of Microsoft Corporation) (U.K.).

|

Particulars |

Details |

|

Number of Pages |

270 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2022 |

|

CAGR |

19.3% |

|

Estimated Market Size |

$19.87 Billion by 2031 |

|

Segments Covered |

By Component

By Application

By Deployment Mode

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (U.K., Germany, France, Italy, Spain, Netherlands, Norway, Sweden, RoE), Asia-Pacific (China, Japan, South Korea, India, Malaysia, Singapore, Australia & New Zealand, RoAPAC), Latin America (Mexico, Brazil, RoLATAM), and the Middle East & Africa (Saudi Arabia, UAE, Israel, RoMEA) |

|

Key Companies Profiled |

Cisco Systems, Inc. (U.S.), Telefonaktiebolaget Lm Ericsson SE (Sweden), Huawei Technologies Co., Ltd. (China), Samsung Electronics Co., Ltd. (South Korea), Nokia Corporation (Finland), Affirmed Networks (a subsidiary of Microsoft Corporation) (U.S.), Mavenir Systems, Inc. (U.S.), ZTE Corporation (China), F5 Inc. (U.S.), NEC Corporation (Japan), IPLOOK Networks (Hong Kong) Co., Limited (Hong Kong), Parallel Wireless, Inc. (U.S.), Polaris Networks (a subsidiary of Motorola Solutions, Inc.) (U.S.), Athonet S.r.l. (a subsidiary of Hewlett Packard Enterprise) (Italy), Intel Corporation (U.S.), Tecore Networks (U.S.), Lemko Corporation (U.S.), and Metaswitch Networks Ltd (a subsidiary of Microsoft Corporation) (U.K.) |

The virtualized evolved packet core market is projected to reach $19.87 billion by 2031, at a CAGR of 19.3% during the forecast period.

In 2024, the MPN & MVNO segment is expected to account for the largest share of the virtualized evolved packet core market. The segment's large market share is attributed to the increasing penetration of mobile devices and the rising demand for low-cost mobile services, the increasing demand for high-speed internet connectivity, and the rising demand for improved voice, video, and mobile internet.

The growth of the virtualized evolved packet core market is driven by the significant increase in mobile data traffic volumes and the rising demand for high-speed data services. Furthermore, increasing investments in 5G technology, the rising adoption of cloud-native 5G core solutions, and the growing adoption of IoT technology are expected to generate growth opportunities for the players operating in this market.

The key players operating in the virtualized evolved packet core market are Cisco Systems, Inc. (U.S.), Telefonaktiebolaget Lm Ericsson SE (Sweden), Huawei Technologies Co., Ltd. (China), Samsung Electronics Co., Ltd. (South Korea), Nokia Corporation (Finland), Affirmed Networks (a subsidiary of Microsoft Corporation) (U.S.), Mavenir Systems, Inc. (U.S.), ZTE Corporation (China), F5 Inc. (U.S.), NEC Corporation (Japan), IPLOOK Networks (Hong Kong) Co., Limited (Hong Kong), Parallel Wireless, Inc. (U.S.), Polaris Networks (a subsidiary of Motorola Solutions, Inc.) (U.S.), Athonet S.r.l. (a subsidiary of Hewlett Packard Enterprise) (Italy), Intel Corporation (U.S.), Tecore Networks (U.S.), Lemko Corporation (U.S.), and Metaswitch Networks Ltd (a subsidiary of Microsoft Corporation) (U.K.).

Published Date: Aug-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates