Resources

About Us

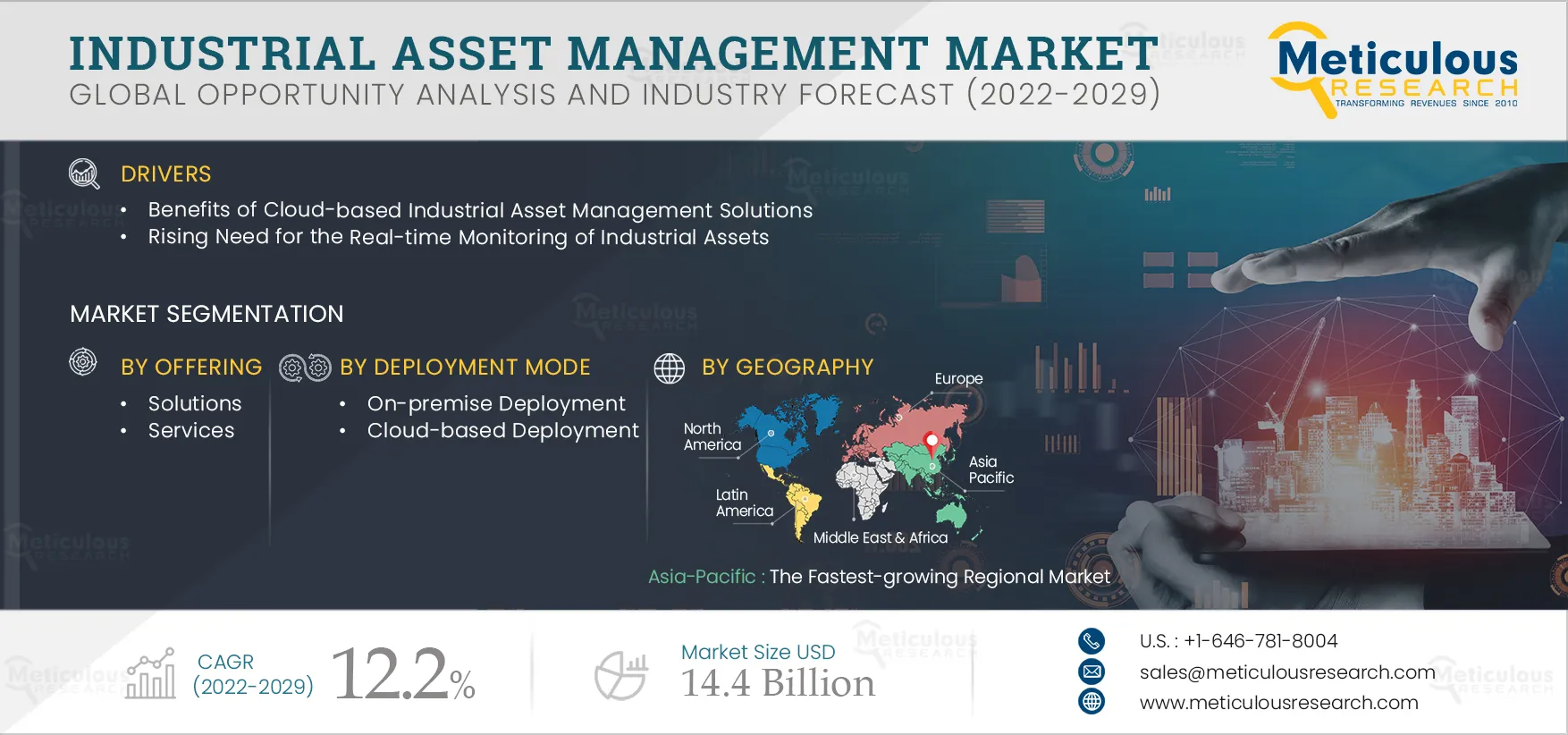

Industrial Asset Management Market by Offering, Deployment Mode, Asset Type, and End-use Industry (Food & Beverage, Pharmaceuticals, Biotechnology, Medical Devices, and Other Industries), and Geography - Global Forecast to 2029

Report ID: MRICT - 104754 Pages: 220 Jan-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Industrial Asset Management Market is projected to reach $14.4 billion by 2029, at a CAGR of 12.2% from 2022 to 2029. The growth of this market is driven by the benefits of cloud-based industrial asset management solutions and the rising need for the real-time monitoring of industrial assets. The integration of Artificial Intelligence, Machine Learning, and 5G technologies and the growing adoption of industrial asset management solutions in the pharmaceutical sector are expected to create growth opportunities for the players operating in this market. The lack of infrastructure & IT capabilities is a challenge for market growth. However, concerns regarding data security & confidentiality restrain the growth of this market. Additionally, the increasing integration of predictive analytics is a major trend in the industrial asset management market.

The COVID-19 pandemic created several obstacles for market players due to the lockdowns imposed during the second & third quarters of 2020. The pandemic lowered customers’ financial potential, impacting the sales of industrial asset management solutions & services. However, in 2021, industries that are major end users of industrial asset management solutions & services started recovering from the economic setbacks suffered during the pandemic.

The COVID-19 pandemic moderately impacted the industrial asset management market due to delayed and postponed orders; however, the market started recovering rapidly from the last quarter of 2020. Leading industrial asset management solutions & services providers are now focused on launching IAM offerings with enhanced capabilities to increase their revenues & market shares and support the recovery of the industrial asset management market. For instance:

The industrial asset management market is projected to transform drastically over the coming years. Several leading companies are growing rapidly through strategies such as product launches & enhancements, partnerships, and collaborations. Companies are developing predictive analytics solutions to enhance process optimization, asset condition/health monitoring, and prevent asset failure. The growing need for real-time asset data & monitoring, the integration of advanced technologies, and the rising adoption of industrial asset management solutions in the pharmaceutical sector are expected to create growth opportunities for the players operating in the industrial asset management market in the coming years

Click here to: Get Free Sample Copy of this report

Rising Need for the Real-time Monitoring of Industrial Assets to Fuel the Market Growth

The industrial asset management market is undergoing a significant transformation with the advent of new and innovative technologies. Industrial IoT technology is a key component of modern manufacturing processes. IoT-enabled smart connected devices help manufacturers increase productivity, reduce maintenance costs, and ensure optimal product quality. These devices also provide manufacturers with the data to manage complex production cycles. Industrial IoT technology enables the real-time monitoring of assets for safety, reliability, and compliance. The integration of IIoT with industrial asset management platforms helps maximize the utilization of production assets. IoT-enabled industrial asset management systems have sensors that provide real-time information, which is crucial for planning maintenance schedules and taking actionable decisions to ensure employee & asset safety and enhance operational performance. Besides, IIoT technology allows manufacturers to send their operations data to the cloud, which is thoroughly analyzed and provides the framework to monitor, service, and audit the connected assets. This framework enables the precise evaluation of the designs & operating conditions of assets and inventory levels, optimizing cash flow and warehousing operations. Thus, the need for the real-time monitoring of production assets is boosting the demand for industrial asset management solutions, driving the growth of this market

Some of the recent key developments in this space are as follows:

Based on offering, in 2022, the Solutions Segment Accounted for the Largest Share of the Market

Based on offering, in 2022, the solutions segment accounted for the largest share of the global industrial asset management market. The large market share of this segment is attributed to the surge in demand for cloud-based industrial asset management solutions, the growing need to reduce maintenance costs and procurement expenses among companies, and the need to gain a 360-degree view of assets.

Based on Deployment Mode, the Cloud-based Deployment Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on deployment mode, the cloud-based deployment segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing need to reduce IT infrastructure costs, the benefits offered by cloud-based IAM solutions & services such as better accessibility, reduced IT costs, and automatic updates, and the rising efforts by leading IAM players to launch cloud-based asset monitoring services for industrial plants. Furthermore, the growing demand for predictive maintenance solutions & asset lifecycle management solutions in smart factories and the increasing need to monitor, manage, and report different states of all critical assets in the manufacturing industry is promoting the growth of this market.

Based on End-use Industry, the Pharmaceuticals Segment is Projected to Register the Higher CAGR During the Forecast Period

Based on end-use industry, the pharmaceuticals segment is projected to register the highest CAGR during the forecast period. The high growth of this segment is attributed to pharmaceutical companies’ increasing need to monitor purchase orders (PO) & requisitions, handle tickets, optimize equipment maintenance, gain real-time visibility into assets’ operation, and ensure FDA compliance for drug development.

Asia-Pacific: The Fastest-growing Regional Market

Asia-Pacific is projected to register the highest CAGR during the forecast period. The rapid growth of industrial asset management in the Asia-Pacific region is attributed to the heavy investments by private and public industries to manage essential resources & machinery, the presence of a large number of industrial manufacturing industries, the surge in demand for cost-effective IAM solutions, and the increasing emphasis by leading providers to launch industrial asset management solutions & services. Furthermore, the growing demand for IAM solutions for the tracking and monitoring of manufacturing assets and extending asset life cycles with preventive maintenance, the high adoption of cloud-based IAM solutions across emerging economies, and government initiatives to increase the adoption and expansion of smart factory technologies among small and medium-sized enterprises is promoting the growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2022. The key players operating in the global industrial asset management market are ABB Ltd (Switzerland), Siemens AG (Germany), Schneider Electric SE (France), Emerson Electric Co. (U.S.), Endress+Hauser Group Services AG (Switzerland), General Electric (U.S.), Honeywell International Inc. (U.S.), Rockwell Automation, Inc. (U.S.), SKF Group (Sweden), and Yokogawa Electric Corporation (Japan).

Scope of the Report:

Industrial asset management Market, by Offering

Industrial asset management Market, by Deployment Mode

Industrial asset management Market, by Asset Type

Industrial asset management Market, by End-use Industry

Industrial asset management Market, by Geography

Key questions answered in the report:

The global industrial asset management market is projected to reach $14.4 billion by 2029, at a CAGR of 12.2% during the forecast period.

Based on end-use industry, in 2022, the energy & power segment accounted for the largest share of the global industrial asset management market. The large market share of this segment is mainly attributed to the growing need to upgrade aging infrastructure, accurately control inventories, and prioritize & schedule work orders and the rising demand for clean & renewable energy sources.

The automation assets segment is projected to register the highest CAGR during the forecast period due to the growing demand for efficient inventory tracking, better accountability and preventing theft and misuse of IT assets, a rise in demand for centralized vendor management and improved data accuracy, and a surge in demand to reduce the maintenance cost and ease the burden of audits.

The growth of this market is driven by the benefits of cloud-based industrial asset management solutions and the rising need for the real-time monitoring of industrial assets. The integration of Artificial Intelligence, Machine Learning, and 5G technologies and the growing adoption of industrial asset management solutions in the pharmaceutical sector are expected to create growth opportunities for the players operating in this market.

The key players operating in the global industrial asset management market are ABB Ltd (Switzerland), Siemens AG (Germany), Schneider Electric SE (France), Emerson Electric Co. (U.S.), Endress+Hauser Group Services AG (Switzerland), General Electric (U.S.), Honeywell International Inc. (U.S.), Rockwell Automation, Inc. (U.S.), SKF Group (Sweden), and Yokogawa Electric Corporation (Japan).

At present, Asia-Pacific dominates the global industrial asset management market. However, Germany, Japan, China, India, South Korea, and the U.K. are expected to witness strong growth in demand for industrial asset management in the coming years.

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates