Resources

About Us

High-Efficiency Transformer Market Size, Share, & Forecast by Product Type (Distribution, Power, Specialty), Core Material (Amorphous, Silicon Steel, Emerging), Cooling Method, and Application – Global Forecast to 2036

Report ID: MREP - 1041674 Pages: 248 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the High-Efficiency Transformer Market Size?

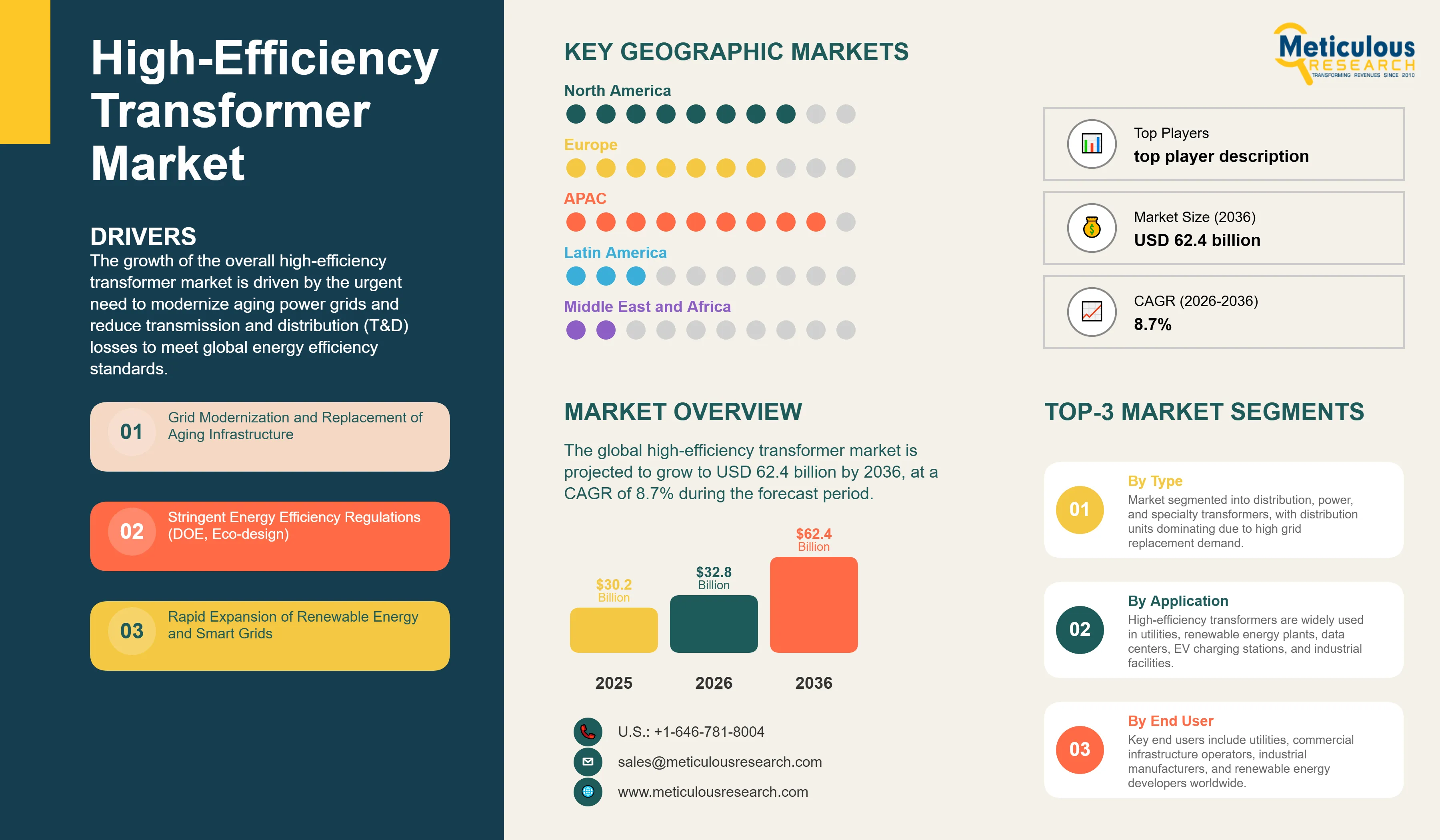

The global high-efficiency transformer market was valued at USD 30.2 billion in 2025. The market is estimated to reach USD 32.8 billion in 2026 and is projected to grow to USD 62.4 billion by 2036, at a CAGR of 8.7% during the forecast period. The growth of the overall high-efficiency transformer market is driven by the urgent need to modernize aging power grids and reduce transmission and distribution (T&D) losses to meet global energy efficiency standards. As nations transition toward decentralized renewable energy and smart grid architectures, high-efficiency transformers, including those utilizing amorphous metal cores and advanced silicon steel, have become essential for minimizing "no-load" losses and enhancing grid reliability. The rapid expansion of data centers, EV charging infrastructure, and industrial automation continues to fuel significant growth of this market across all major geographic regions.

|

Metric |

Value |

Strategic Insight |

|

Market Size (2025) |

USD 30.2 Billion |

Represents high-efficiency distribution, power, and specialty transformers meeting advanced loss-reduction standards across utility, industrial, renewable, and commercial applications. |

|

Market Size (2026) |

USD 32.8 Billion |

Growth supported by utility replacement cycles, renewable energy grid integration, and rising demand from EV charging and data center infrastructure. |

|

Projected Market Size (2036) |

USD 62.4 Billion |

Driven by mandatory efficiency regulations, net-zero grid targets, and widespread adoption of low-loss transformer technologies globally. |

|

CAGR (2026–2036) |

8.7% |

Reflects faster-than-market growth as high-efficiency designs transition from premium offerings to baseline procurement standards. |

|

Largest Product Type |

Distribution Transformers (55–60% share) |

High replacement rates, regulatory mandates, and grid expansion programs make distribution transformers the primary revenue contributor. |

|

Fastest Growing Product Type |

Power Transformers (Medium & Large, >100 MVA) |

Expansion of renewable energy capacity, cross-border transmission, and high-voltage grid upgrades drive demand for high-efficiency power transformers. |

|

Largest Core Material Segment |

Grain-Oriented (GO) Silicon Steel |

Widely adopted due to balanced performance, cost efficiency, and compatibility with existing transformer designs. |

|

Fastest Growing Core Material |

Amorphous Metal & Emerging Nanocrystalline Cores |

Ultra-low core losses and tightening efficiency regulations accelerate adoption despite higher upfront costs. |

|

Largest Cooling Method |

Liquid-Immersed Transformers |

Preferred for utility and large-scale industrial applications due to superior thermal performance and long service life. |

|

Fastest Growing Cooling Method |

Dry-Type Transformers (Cast Resin & VPI) |

Growth driven by indoor installations, urban substations, data centers, and safety-critical commercial environments. |

|

Largest Application Segment |

Utility Facilities (Transmission & Distribution) |

Aging grid infrastructure and loss-reduction mandates make utilities the dominant end users of high-efficiency transformers. |

|

Fastest Growing Application |

Commercial (Data Centers & EV Charging) |

High power density, continuous load profiles, and energy-efficiency requirements fuel rapid adoption. |

|

Leading Region |

Asia-Pacific |

Large-scale grid expansion, renewable energy deployment, and urbanization in China and India drive high-volume demand. |

|

Fastest Growing Region |

Europe |

Stringent Ecodesign regulations and accelerated energy transition policies support rapid penetration of high-efficiency transformers. |

|

Key Market Drivers |

Grid Modernization, Energy Efficiency Regulations, Renewable Integration |

Governments and utilities prioritize loss reduction and lifecycle efficiency to meet decarbonization targets. |

|

Key Market Restraints |

High Initial Cost, Volatile Raw Material Prices |

Premium core materials and copper price volatility impact procurement decisions. |

|

Key Opportunities |

Smart Grids, HVDC Expansion, Sustainable Core Materials |

Digital grids and next-generation materials unlock long-term efficiency gains and differentiation. |

|

Competitive Landscape |

Moderately Consolidated |

Global OEMs dominate utilities and large projects, while regional players compete in distribution and specialty segments. |

Click here to: Get Free Sample Pages of this Report

High-efficiency transformers are advanced electrical devices designed to transfer energy between circuits with minimal power loss. Unlike conventional transformers, these systems utilize high-permeability core materials, such as amorphous metal or high-grade grain-oriented silicon steel (HGO), and optimized winding designs to significantly reduce both core (no-load) and copper (load) losses. These transformers are critical components of modern energy infrastructure, enabling utilities and industrial users to comply with evolving "Eco-design" regulations and reduce their carbon footprint.

These systems are increasingly integrated with digital monitoring and diagnostic tools to provide real-time data on load patterns, temperature, and health status. The ability to provide stable, high-efficiency power conversion has made these transformers the technology of choice for grid operators and renewable energy developers seeking to maximize the throughput of wind and solar farms.

The global energy sector is pushing hard to integrate higher proportions of renewable energy, aiming to meet net-zero emission targets. This drive has increased the adoption of high-efficiency units, with advanced transformers helping to stabilize grids by managing the bidirectional power flows of distributed energy resources (DERs). At the same time, the rapid growth in the data center and AI market is increasing the need for high-reliability, low-loss power solutions.

What are the Key Trends in the High-Efficiency Transformer Market?

Proliferation of Amorphous Core Technology for Distribution Grids

Manufacturers are increasingly moving beyond traditional grain-oriented silicon steel toward amorphous metal core technology, which can deliver 70–80% lower no-load losses compared to conventional designs. This shift is increasingly being witnessed in distribution transformers, where core losses dominate lifetime energy consumption and regulatory scrutiny is highest.

In Asia, utilities in India and China have implemented large-scale amorphous transformer replacement programs as part of national grid loss-reduction initiatives. Government-backed procurement programs in India’s power distribution sector have actively promoted amorphous core distribution transformers to curb technical losses in residential and commercial networks, while Chinese utilities have deployed amorphous units across urban and rural grids to meet efficiency and carbon reduction targets.

In Europe, leading manufacturers such as Hitachi Energy and ABB have commercialized amorphous core distribution transformers for utility applications, particularly in regions subject to EU Ecodesign loss regulations. These transformers are increasingly favored in public grid upgrades and smart distribution projects, where lifecycle efficiency and compliance outweigh higher upfront material costs.

As utilities place greater emphasis on total cost of ownership (TCO) and carbon intensity reduction, the adoption of amorphous core technology is expected to grow significantly during the forecast period.

Integration of Digital Twins and Smart Monitoring Systems

The integration of digital twins and smart monitoring systems is increasingly transforming the high-efficiency transformer market as utilities and large power users move toward condition-based and autonomous grid management. Modern high-efficiency transformers are now being equipped with embedded sensors and communication modules that continuously monitor critical parameters such as dissolved gas levels (DGA), moisture content, load conditions, and winding temperatures. These data streams are used to create digital replicas (digital twins) of physical assets, enabling real-time performance tracking and predictive maintenance.

Leading manufacturers such as Hitachi Energy and Siemens Energy have commercialized transformer platforms that integrate online condition monitoring with analytics software to detect early signs of insulation degradation, thermal stress, or incipient faults. Utilities deploying these systems are able to extend transformer service life, reduce unplanned outages, and optimize maintenance schedules, improving lifecycle economics despite higher upfront equipment costs.

|

Parameters |

Details |

|

Market Size by 2036 |

USD 62.4 Billion |

|

Market Size in 2026 |

USD 32.8 Billion |

|

Market Size in 2025 |

USD 30.2 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 8.7% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Product Type, Core Material, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Grid Modernization and Stringent Energy Efficiency Regulations

Global regulations requiring the reduction of T&D losses have created significant incentives for the adoption of high-efficiency units. The U.S. Department of Energy (DOE) efficiency standards, the EU Eco-design Directive (Tier 2 and beyond), and China’s Green Transformer standards drive manufacturers toward advanced core materials that conventional designs cannot match. It is estimated that as global electricity demand grows by 3-4% annually through 2036, the need for efficient power conversion increases exponentially; therefore, high-efficiency transformers, with their ability to reduce waste, are considered a crucial enabler of modern energy strategies.

Opportunity: Expansion of Data Centers and EV Charging Infrastructure

The rapid growth of AI-driven data centers and EV fast-charging networks provides great opportunities for the high-efficiency transformer market. The global surge in data center capacity has created a compelling demand for high-efficiency, low-noise power systems. These applications require high reliability, low heat dissipation, and the ability to handle non-linear loads, all attributes that are met with advanced high-efficiency transformers. The data center power infrastructure market is set to expand significantly through 2036, with high-efficiency units poised for an expanding share as operators seek to lower their Power Usage Effectiveness (PUE). Furthermore, the increasing demand for high-power EV charging hubs is stimulating demand for specialized transformers that provide energy independence and resilience.

Product Type Insights

Why Do Distribution Transformers Dominate the Market?

The distribution transformers segment accounts for around 55-60% of the overall high-efficiency transformer market in 2026. This is mainly attributed to the sheer volume of units required at the edge of the grid to serve residential and commercial customers. These systems, typically ranging from 10 kVA to 2,500 kVA, offer the most immediate opportunity for energy savings through the adoption of amorphous cores. The utility sector alone consumes the vast majority of distribution transformer production, with major replacement programs in North America and Asia demonstrating the technology's capability to reduce regional energy waste.

However, the power transformers segment is expected to grow at a steady CAGR during the forecast period, driven by the requirement for high-efficiency bulk power transfer in renewable energy hubs and high-voltage DC (HVDC) links. The ease of integration and high reliability of new power transformer designs make them highly attractive for grid operators.

Core Material Insights

How Does Amorphous Core Technology Lead Growth?

Based on core material, the amorphous core segment is expected to witness the fastest growth during the forecast period, accounting for an increasing share of the distribution market. From reducing no-load losses by up to 80% to providing superior performance under low-load conditions, the use of amorphous metal is central to modern energy-saving strategies. Current grid-scale projects are increasingly specifying amorphous units for their long-term cost advantages and environmental benefits.

The silicon steel (HGO) segment remains dominant in the power transformer market owing to its high saturation induction and proven performance in high-voltage applications. Manufacturers are continuing to innovate in silicon steel grades to provide "Super-Premium" efficiency levels for large-scale utility projects.

Regional Insights

How is Asia Pacific Maintaining Dominance in the Global High-Efficiency Transformer Market?

Asia Pacific holds the largest share of the global high-efficiency transformer market in 2026. The largest share of this region is primarily attributed to the massive government-led investments in power infrastructure, particularly in China and India. China alone accounts for a significant portion of global transformer production, with its position as a leading hub for amorphous metal manufacturing driving sustained growth. The presence of leading manufacturers including Hitachi Energy, TBEA Co., Ltd., and specialized core producers provides a well-developed supply chain serving regional and global customers.

Which Factors Support North America and Europe High-Efficiency Transformer Market Growth?

The growth of North America and Europe high-efficiency transformer market is mainly driven by the need to replace aging grid assets and the implementation of stringent efficiency mandates. The demand for high-efficiency units in North America is mainly due to its large-scale utility modernization projects and the presence of innovators like GE Vernova and Eaton.

In Europe, the push for energy independence is driving the adoption of eco-design transformers. Countries like Germany, France, and the UK are at the forefront, with significant projects aimed at integrating offshore wind and providing smart grid services.

Recent Developments in the Global High-Efficiency Transformer Market

June 2025: Hitachi Energy successfully tested the world's first 765 kV natural ester-filled oil transformer, the largest at this voltage class. This biodegradable solution uses advanced ester insulation for ultra-high-voltage AC grids, reducing environmental impact while delivering high efficiency for utility transmission.

September 2025: Siemens Energy announced €220 million investment to expand its Nuremberg, Germany transformer factory by 50% capacity. The project targets large power transformers for grid expansion, creating 350 jobs with new production areas operational by 2028 to meet surging global demand.

April 2025: ABB launched its EconiQ™ transformer line with vegetable oil cooling and amorphous metal cores for renewable energy applications. Deployed in European wind farms, the liquid-immersed units achieve 20% lower no-load losses compared to mineral oil designs, supporting utility-scale solar and offshore integration.

The high-efficiency transformer market is expected to grow from USD 32.8 billion in 2026 to USD 62.4 billion by 2036.

The high-efficiency transformer market is expected to grow at a CAGR of 8.7% from 2026 to 2036.

The major players include Hitachi Energy, Siemens Energy, Schneider Electric, GE Vernova, and Eaton, among others.

The main factors include grid modernization, stringent energy efficiency regulations, and the rapid expansion of renewable energy and smart grids.

Asia Pacific will lead the global high-efficiency transformer market in terms of market share, while also witnessing the fastest growth during the forecast period 2026 to 2036.

Published Date: Jul-2025

Published Date: Sep-2025

Published Date: Jan-2026

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates