Resources

About Us

Greywater Recycling Units Market by System Type (Simple, Biological, Mechanical), Capacity (Below 500 GPD, 500-5000 GPD, Above 5000 GPD), Technology (Physical, Chemical, Biological), Application, End User, and Geography—Global Forecast to 2035

Report ID: MRSE - 1041600 Pages: 215 Sep-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Greywater Recycling Units Market Size?

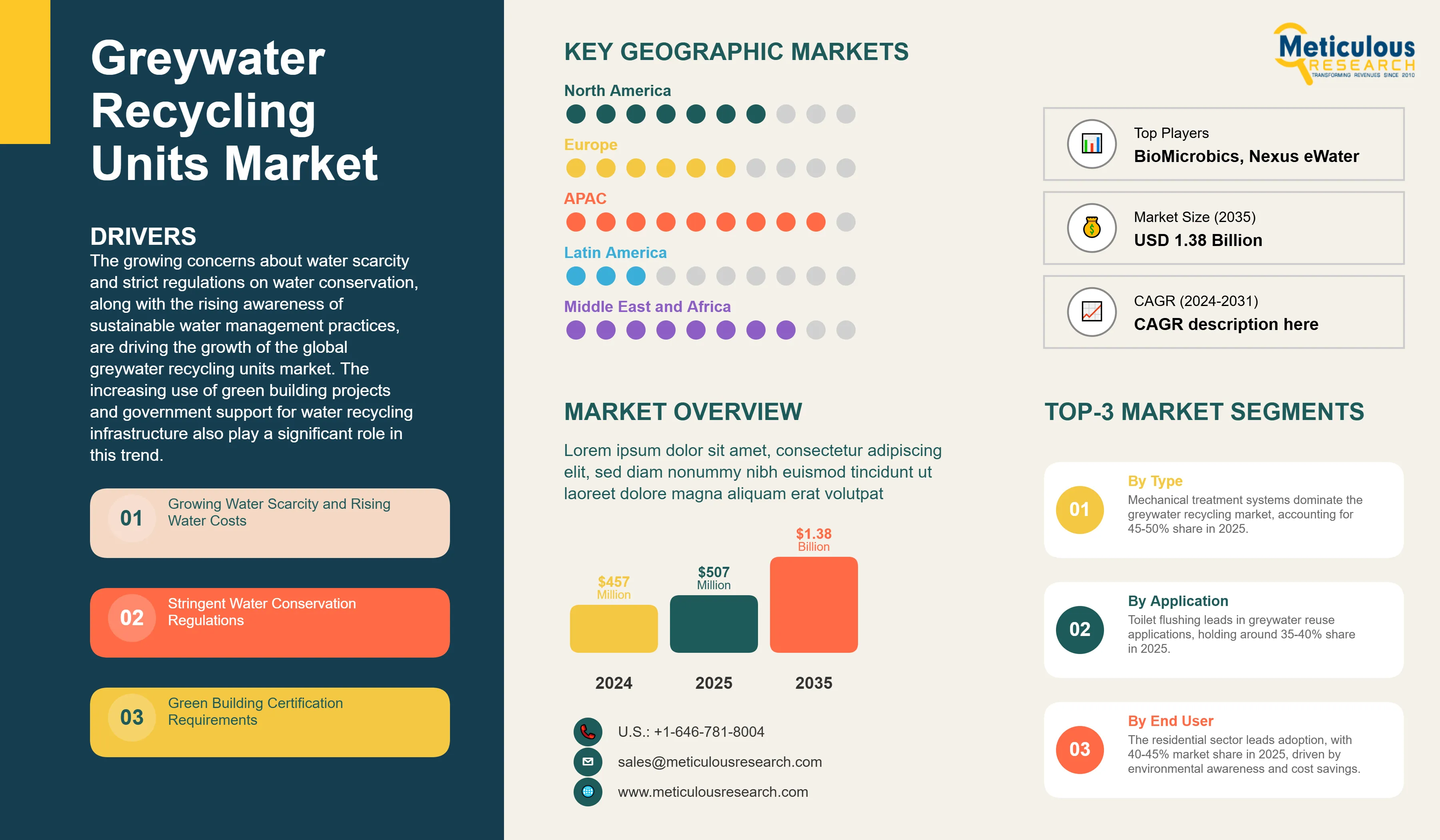

The global greywater recycling units market size was valued at USD 457 million in 2024 and is expected to increase from USD 507 million in 2025 to approximately USD 1.38 billion by 2035, expanding at a CAGR of 10.5% from 2025 to 2035.

The growing concerns about water scarcity and strict regulations on water conservation, along with the rising awareness of sustainable water management practices, are driving the growth of the global greywater recycling units market. The increasing use of green building projects and government support for water recycling infrastructure also play a significant role in this trend.

Greywater Recycling Units Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The greywater recycling units market involves designing, manufacturing, installing, and maintaining systems that collect, treat, and redistribute wastewater from showers, bathtubs, washing machines, and bathroom sinks for non-drinking reuse applications. These systems filter and disinfect greywater to remove soap, hair, lint, and other contaminants, making it suitable for toilet flushing, irrigation, cooling towers, and other secondary uses.

Unlike blackwater, which contains sewage, greywater accounts for 50-80% of household wastewater and can be safely recycled with proper treatment. The market is driven by rising global water stress impacting over 2 billion people.

Increased water tariffs make recycling more economically appealing. Green building certification requirements, like LEED and BREEAM, demand water conservation measures. Technological improvements are reducing system costs and complexity. There is also a growing awareness among consumers and businesses about reducing their water usage.

How is AI Transforming the Greywater Recycling Units Market?

AI solutions help monitor water quality in real time by analyzing sensor data like turbidity, pH, biological oxygen demand (BOD), and microbial content. This ongoing analysis allows for automatic improvements in treatment processes. It ensures consistent output quality while cutting down on chemical use and energy consumption.

Machine learning algorithms predict when maintenance is needed. They can detect early signs of pump wear, filter clogging, and membrane fouling. This helps prevent expensive system failures and lowers operational costs by about 25-30%. AI controllers also improve water distribution based on demand forecasts, weather conditions, and storage levels. This maximizes water reuse efficiency for irrigation and other non-potable uses.

Moreover, smart systems learn how households or commercial buildings use greywater. They can predict water availability and consumption accurately. This proactive approach significantly reduces the demand for freshwater, with potential savings of up to 40% through smart recycling methods.

By using AI, greywater recycling units are becoming more independent, efficient, and cost-effective. They play an important role in sustainable water management and conservation efforts.

What are the Key Trends in the Greywater Recycling Units Market?

IoT-Enabled Smart Monitoring and Control

One major trend transforming the greywater recycling units market is the growing use of Internet of Things (IoT) technology. Smart sensors in these systems gather real-time data on water quality parameters like turbidity, pH, and microbial content, as well as flow rates, storage levels, and overall system performance. This data goes to cloud-based platforms, which users and service providers can access through mobile apps. This setup allows for remote monitoring of system health and efficiency.

IoT connectivity supports proactive management through predictive maintenance. Systems can automatically send alerts for filter replacements and other servicing needs before failures happen. This strategy reduces downtime and lowers operational costs. Also, IoT systems help with compliance reporting by generating regulatory documentation automatically. This ensures that water safety standards are met with less manual work.

Modular and Scalable System Designs

Another important market driver is innovation in modular, plug-and-play greywater recycling units that are easy to scale and adapt. Prefabricated units made from standard components simplify installation. They significantly lower setup time and costs while allowing for easy capacity expansion by adding modules as water demand increases.

This modular approach is especially useful for retrofitting existing residential and commercial buildings, as well as for phased development projects. It makes greywater recycling more widely available. Whether for a single-family home or a large commercial building, these scalable systems can be customized to meet specific water conservation needs. This effectively encourages broader adoption of sustainable water reuse practices.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 1.38 Billion |

|

Market Size in 2025 |

USD 507 Million |

|

Market Size in 2024 |

USD 457 Million |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 10.5% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Middle East & Africa |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

System Type, Capacity, Technology, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Water Scarcity and Rising Water Costs

A major factor driving the growth of the greywater recycling units market is the worsening global water crisis. The United Nations predicts that by 2025, nearly two-thirds of the world's population will face water stress, with over 2 billion people unable to access safely managed drinking water. This crisis is made worse by droughts caused by climate change, decreasing groundwater supplies, and rapid urban growth. These issues place an unprecedented strain on existing water resources.

Rising water and sewage rates, with some cities seeing increases of 40-50% over the past decade, have created strong economic reasons to invest in greywater recycling. Typical payback periods for these systems range from 3 to 5 years, making them financially appealing to both residential and commercial users. Moreover, government rules requiring water conservation in stressed areas, such as California’s greywater standards and Australia’s BASIX requirements, are pushing for the mandatory use of these systems in new construction projects.

Frequent water restrictions and supply interruptions in urban areas highlight the need for on-site greywater recycling. A reliable supply of recycled water is key for ensuring business continuity and maintaining quality of life, particularly in sensitive sectors such as hospitality, healthcare, and residential complexes, where having constant water access is crucial.

Together, these environmental, economic, and regulatory factors drive strong growth in the greywater recycling units market. This underscores the important role these systems play in sustainable water management.

Restraint

High Initial Investment and Maintenance Requirements

Despite the growing demand, the greywater recycling units market faces several challenges due to high upfront costs. Simple residential systems can start at $5,000, while large commercial installations can exceed $500,000. This pricing deters many cost-conscious consumers and businesses from adopting the technology. The installation often requires complex setups, including dual plumbing systems, storage tanks, and treatment equipment. These factors can raise construction costs by 5 to 10% for new buildings and cause even higher increases in retrofits.

Regular maintenance is also necessary. Users need to clean filters, service pumps, and test water quality, which requires technical skills and ongoing expenses that many underestimate. There are also public health concerns regarding potential pathogen exposure and cross-contamination risks, even when treatment is done correctly. These issues create regulatory hurdles and make consumers hesitant. Additionally, the lack of standardized building codes and inconsistent local regulations across different areas makes system design and approval processes more complicated, leading to longer project timelines and higher costs.

Opportunity

Green Building Movement and Sustainable Development

The rapidly growing green building sector offers great opportunities for greywater recycling units. Sustainability certifications like LEED, BREEAM, and WELL focus more on water conservation strategies. Corporate commitments to sustainability and ESG reporting requirements encourage businesses to adopt these systems as they try to lower water use and show their environmental responsibility.

Combining greywater recycling with other sustainable technologies such as rainwater harvesting, solar power, and smart building systems leads to effective water management solutions that attract environmentally aware developers and owners. Government incentives, including tax credits, rebates, and faster permitting for water conservation projects, help make these projects more financially viable.

The rising trend of net-zero water buildings and living building challenges that require on-site water recycling creates premium market segments for greywater treatment systems that can produce water close to potable quality.

System Type Insights

Why do Mechanical Treatment Systems Lead the Market?

The mechanical treatment systems segment commands the largest share of around 45-50% of the overall greywater recycling units market in 2025. Mechanical systems that use physical filtration, sedimentation, and disinfection deliver reliable and consistent treatment. They are suitable for commercial and multi-family residential applications that require high-volume processing. These systems operate automatically, need minimal manual intervention, and provide predictable performance that meets regulatory standards for water reuse.

Mechanical systems that include membrane filtration and UV disinfection produce high-quality effluent. This effluent can be reused for various applications like toilet flushing and cooling tower makeup. Their ability to manage variable flow rates and different water qualities makes mechanical systems adaptable for various building types and usage patterns. Compact and packaged mechanical units make installation and maintenance easier while offering real-time monitoring capabilities.

However, the biological treatment systems segment is expected to grow the fastest in the near future. Increased interest in nature-based solutions and energy-efficient treatment options boosts the use of biological systems that rely on beneficial bacteria and plants for treating greywater. These systems have lower operational costs and provide chemical-free treatment, appealing to environmentally conscious users.

Technology Insights

How do Membrane Bioreactors Dominate Treatment Technology?

The membrane bioreactor (MBR) segment commands the largest market share, nearly 30-35%, in 2025. MBR technology combines biological treatment and membrane filtration. This results in high-quality effluent that meets strict reuse standards while taking up little space. The technology can handle high organic loads and varying influent quality, making it ideal for commercial buildings and multi-residential complexes with different greywater sources.

However, the constructed wetland systems segment is expected to grow at the fastest CAGR through 2035. More people are adopting green infrastructure and nature-based solutions. This increases the demand for constructed wetlands, which provide both aesthetic appeal and water treatment. These systems use little energy and have minimal mechanical parts, making them attractive for sustainable development projects.

Capacity Insights

How does the 500-5000 GPD Range Serve Most Applications?

The 500-5000 GPD (gallons per day) segment accounts for nearly 45% of the market share in 2025. This range fits small to medium commercial buildings, multi-family homes, and institutional facilities, making it the largest segment for greywater recycling.

The 500-5000 GPD capacity allows for future expansion without sacrificing efficiency. Standard equipment sizes and established design guidelines help lower engineering costs and simplify the permitting process.

On the other hand, the segment above 5000 GPD is likely to see the fastest growth rate in the coming years. Large projects, including mixed-use complexes, industrial facilities, and district-level water recycling initiatives, are driving the demand for high-capacity systems.

Application Insights

Why does Toilet Flushing Represent the Primary Application?

The toilet flushing segment holds the largest share of around 40% in 2025. Toilet flushing accounts for 30% of indoor water use in commercial buildings and 24% in homes. This makes it the biggest application for recycled greywater. The steady demand for toilet flushing water throughout the year ensures maximum use of greywater recycling systems, which improves economic returns.

However, the irrigation segment is expected to grow at the fastest CAGR through 2035. Increased focus on sustainable landscaping and urban farming is driving the demand for greywater irrigation systems. Droughts and water restrictions caused by climate change make recycled water vital for keeping green spaces in areas facing water shortages.

End User Insights

Why does the Residential Sector Lead Adoption?

On the basis of end user, the residential segment commands the largest share of 40-45% of the overall greywater recycling market in 2025. Single-family homes and multi-family residences produce consistent greywater volumes that match on-site reuse needs. This consistency makes recycling systems financially feasible.

Growing environmental awareness among homeowners and the desire for water independence encourage people to adopt these systems, often beyond what regulations require. Residential systems benefit from simpler designs and lower treatment standards for garden irrigation. There are also packaged solutions available for DIY installation. Government rebates and incentives aimed at reducing residential water use make these systems more affordable for homeowners. The shift towards sustainable living and off-grid options attracts environmentally aware consumers.

The commercial segment is likely to see the fastest growth rate in the coming years. Commercial buildings, such as hotels, offices, and shopping centers, which use a lot of water, are quickly adopting greywater recycling to meet corporate sustainability goals. Cost savings from lower water and sewer bills, along with the push for green building certifications, speed up the adoption of these systems in the commercial sector.

U.S. Greywater Recycling Units Market Size and Growth 2025 to 2035

The U.S. greywater recycling units market is valued at USD 161 million in 2025 and is expected to reach USD 439 million by 2035, at a CAGR of 10.5% from 2025 to 2035.

How is the Asia Pacific Greywater Recycling Units Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of 35-40% of the global greywater recycling units market in 2025. This is due to significant water stress in countries like India and China, where per capita water availability has dropped by 70% since 1950. As a result, water recycling has become essential for sustainable development.

Rapid urbanization in megacities has led to water supply challenges, pushing the use of decentralized greywater treatment solutions. Government initiatives, such as Singapore's Four National Taps strategy, India's Jal Shakti Abhiyan, and China's sponge city program, require water recycling in urban development. The large population of the region and the expanding middle class create significant market potential for both residential and commercial uses.

Manufacturing capabilities in China and India lower system costs through local production and competitive pricing. The growth of green buildings in markets like Singapore, Hong Kong, and Australia, along with mandatory water efficiency standards, further drives the adoption.

Which Factors Support the Middle East & Africa Greywater Recycling Units Market Growth?

The Middle East and Africa greywater recycling units market is expected to grow at the fastest growth rate from 2025 to 2035. This growth is mainly driven by severe water scarcity, with many countries facing less than 500 cubic meters of water per person each year. Relying on costly desalination and shrinking groundwater supplies makes greywater recycling an appealing option for reducing the need for freshwater.

Large projects and smart city initiatives in Gulf countries now include water recycling as standard infrastructure. Regulations like Abu Dhabi's Pearl Rating System and Saudi Arabia's Vision 2030 require water conservation in buildings. The growth of the hospitality industry, particularly with resorts and hotels that use a lot of water, boosts commercial use. Agricultural growth in dry areas leads to a demand for systems that use treated greywater for irrigation.

Recent Developments

Segments Covered in the Report

By System Type

By Capacity

By Technology

By Application

By End User

By Region

The greywater recycling units market is expected to increase from USD 507 million in 2025 to USD 1.38 billion by 2035.

The greywater recycling units market is expected to grow at a CAGR of around 10.5% from 2025 to 2035.

The major players in the greywater recycling units market include BioMicrobics Inc., Aquaco Water Recycling Ltd., Genesis Water Technologies Inc., Flotender (Ecologix Environmental Systems), INTEWA GmbH, Greyter Water Systems Inc., WhiteWater Concepts Ltd., Nexus eWater, AWWS (Advanced Wastewater Systems), Hydraloop Systems B.V., Water Solutions Aust Pty Ltd., Salher (Salvador Herrero S.A.), BIOROCK S.à.r.l., Aquality Trading & Consulting Ltd., Envicare Systems Pvt. Ltd., Nubian Water Systems, Aquartis, Epic Cleantec, Membrane Systems Australia, and Get Water Solutions.

The driving factors of the greywater recycling units market are increasing water scarcity concerns and stringent regulations on water conservation, growing awareness about sustainable water management practices, rising adoption in green building projects, and government incentives for water recycling infrastructure.

Asia Pacific region will lead the global greywater recycling units market during the forecast period 2025 to 2035.

Published Date: Jun-2025

Published Date: Oct-2024

Published Date: Oct-2024

Published Date: Jan-2024

Published Date: Apr-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates