Resources

About Us

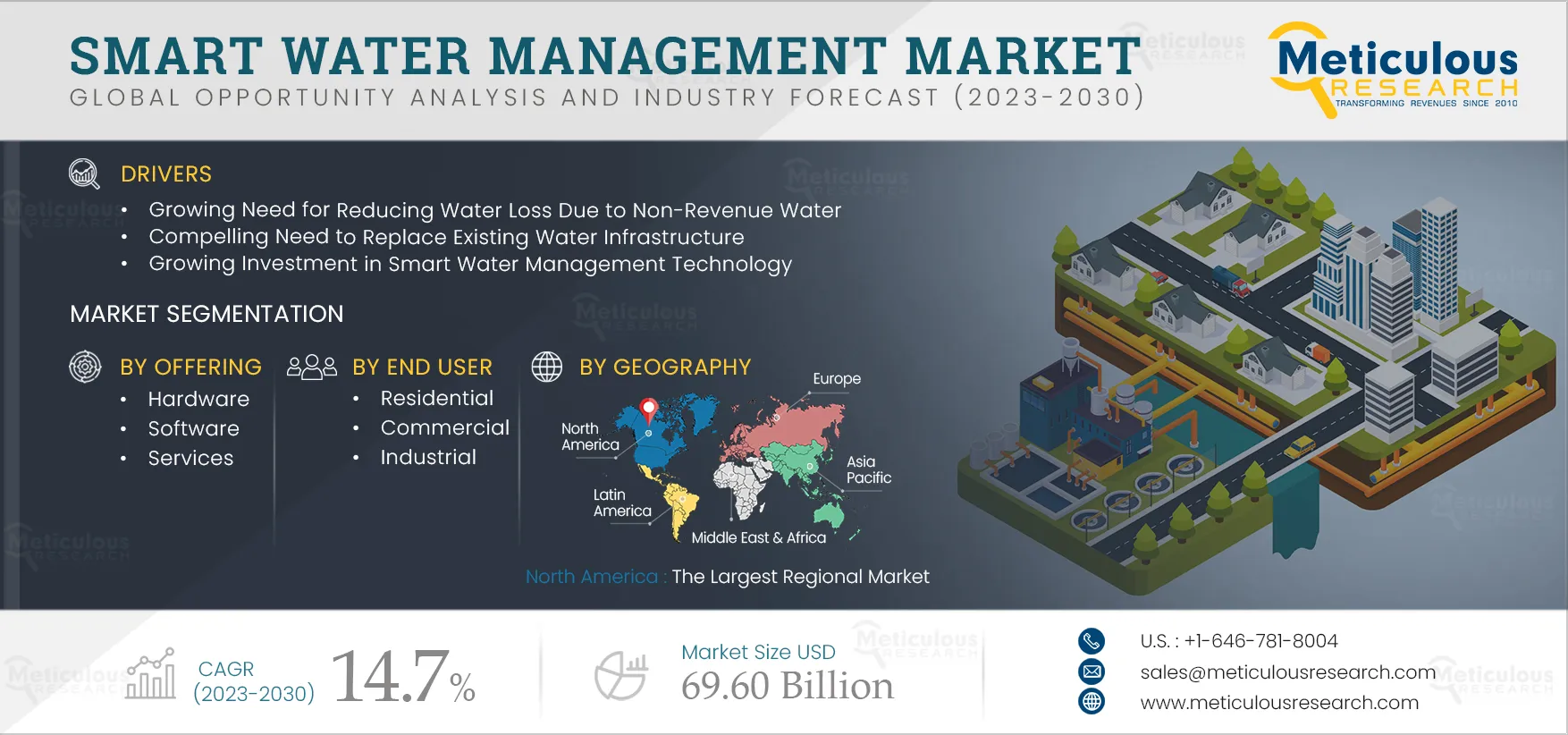

Smart Water Management Market by Offering (Hardware, Software, Services), Application (Water Management, Leak Detection, Water Quality & Quantity Monitoring, Others), End User (Residential, Commercial, Industrial), & Geography - Global Forecast to 2030

Report ID: MRICT - 104505 Pages: 250 Dec-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Smart Water Management Market is projected to reach $69.60 billion by 2030, at a CAGR of 14.7% during the forecast period of 2023–2030. The growth of this market is driven by the increasing demand to minimize water loss attributed to non-revenue water, a compelling necessity for the replacement of current water infrastructure, and a surge in investments in smart water management technology. Moreover, the rising governmental initiatives to integrate smart water management and the growth of smart city projects are anticipated to present substantial growth opportunities for stakeholders in the smart water management industry.

Investing in smart water management technology has become increasingly crucial due to the pressing need for efficient and sustainable water resource management. This investment is driven by various factors, including the demand for advanced solutions to reduce water loss, replace aging infrastructure, and improve overall water distribution systems. Additionally, the integration of technology enables real-time monitoring, data analytics, and remote management, contributing to better decision-making and resource optimization. Approximately two billion individuals globally are projected to lack access to safe drinking water in 2022, with nearly half of the world's population facing significant water scarcity for at least a portion of the year, according to information from the United Nations.

Smart water management is a potential solution to optimize water consumption and tackle water scarcity issues in numerous regions. The imperative to efficiently utilize existing water resources, coupled with challenges related to water scarcity, is driving the advancement and adoption of smart water management solutions.

Additionally, water authorities are investing in smart water management technologies to address the water scarcity problem. For instance, in April 2023, Ofwat (U.K.), the Water Services Regulation Authority, proposed an acceleration on the delivery of 31 investment schemes, among which included the installation of 462,000 smart water meters to improve drought resilience. The total investment will be around EUR 1.6 billion (USD 2 billion).

Moreover, private investors are actively funding companies within the smart water management market to expand their operations and enhance water management practices. A case in point is the investment made by HCAP Partners (U.S.), a California-based private equity firm and a nationally recognized impact investor, in Flume, Inc., in June 2023. Flume, Inc. specializes in bringing connectivity and intelligence to residential water use, and this investment aims to provide the Flume team with the necessary capital and resources to cultivate a valuable business while positively impacting water conservation efforts. Such investments from stakeholders like water authorities and investors are expected to propel the growth of the smart water management industry throughout the forecast period.

Click here to: Get Free Sample Pages of this Report

Based on Offering, in 2023, the Hardware Segment is Expected to Account for the Largest Share of the Smart Water Management Market

Based on offering, the global smart water management market is segmented into hardware, software, and services. In 2023, the hardware segment is expected to account for the largest share of the global smart water management market. The significant market share of this segment can be credited to factors like the increasing demand for automated readings for billing and analytical purposes, as well as the widespread use of wireless communication technology for transmitting water usage data to a central server.

Based on Application, in 2023, the Water Quality and Quantity Monitoring Segment is Expected to Account for the Largest Share of the Smart Water Management Market

Based on application, the global smart water management market is broadly segmented into water quality & quantity monitoring, water management, asset management, leak detection, analytics & data management, rain & stormwater management, and other applications. In 2023, the water quality & quantity monitoring segment is expected to account for the largest share of the global smart water management market. The substantial market share of this segment is linked to the increasing utilization of sensors for monitoring water quality and measuring essential metrics such as physical, chemical, and microbial properties. Additionally, the growing adoption of smart water management for continuous remote monitoring and diagnosis of water-related issues contributes to its prominence.

Based on End User, the Industrial Segment is Expected to Account for the Largest Share of the Smart Water Management Industry

Based on end user, the global smart water management market is broadly segmented into residential, commercial, and industrial. In 2023, the industrial segment is expected to account for the largest share of the global smart water management market. The large market share of this segment is attributed to the increasing adoption of smart water management solutions across diverse industries enabling the effective measurement and real-time monitoring of water consumption patterns at respective sites. This proactive approach aids in reducing operational costs, ensuring statutory compliance, identifying potential inefficiencies in water consumption, and triggering alerts when necessary.

North America: The Largest Regional Market

Based on geography, the global smart water management market is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest share of the global smart water management market. The large market share of the region is attributed to the increasing adoption of smart water management solutions for identifying water leakages, technological advancements in smart water metering, increasing need for water conservation, coupled with the necessity for improved water management systems. For instance, in August 2023, Oldcastle Infrastructure, Inc. (U.S.), an infrastructure solutions provider, partnered with FIDO Tech, a UK-based artificial intelligence (AI) and technology solutions provider, to deliver leak detection and broader water management and conservation solutions in the U.S.

Key Players:

Some of the key players operating in the global smart water management market are IBM Corporation (U.S.), ABB Ltd. (Switzerland), Honeywell International Inc. (U.S.), Schneider Electric SE (France), Cisco Systems, Inc. (U.S.), Sensus (U.S.), Mueller Water Products, Inc. (U.S.), Trimble Inc. (U.S.), Arad Group (Israel), Oracle Corporation (U.S.), Badger Meter, Inc. (U.S.), Landis+Gyr Group AG (Switzerland), Kamstrup A/S (Denmark), SUEZ SA (France), HydroPoint (U.S.), Siemens AG (Germany), Itron, Inc. (U.S.), Endress+Hauser AG (Switzerland) and Neptune Technology Group Inc. (U.S.).

Report Summary:

|

Particular |

Details |

|

|

Page No |

250 |

|

|

Format |

|

|

|

Forecast Period |

2023-2030 |

|

|

Base Year |

2022 |

|

|

CAGR |

14.7% |

|

|

Market Size (Value) |

$69.60 Billion in 2030 |

|

|

Segments Covered |

offering [hardware (meters [AMR meters, AMI meters, water flow meters], smart water sensors, water controllers, smart pumps and drives, smart valves, and other hardware), software (cloud-based deployments, on-premises deployments), services (consulting services, integration and deployment services, support and maintenance services)], application (water quality and quantity monitoring, water management, asset management, leak detection, analytics and data management, rain and stormwater management, and other applications), and end user (residential, commercial, industrial [manufacturing, agriculture, utilities, energy, mining, oil & gas, food & beverage, automotive, pulp & paper, chemical, textile, construction)] |

|

|

Region Covered |

|

|

|

Key Companies |

IBM Corporation (U.S.), ABB Ltd. (Switzerland), Honeywell International Inc. (U.S.), Schneider Electric SE (France), Cisco Systems, Inc. (U.S.), Sensus (U.S.), Mueller Water Products, Inc. (U.S.), Trimble Inc. (U.S.), Arad Group (Israel), Oracle Corporation (U.S.), Badger Meter, Inc. (U.S.), Landis+Gyr Group AG (Switzerland), Kamstrup A/S (Denmark), SUEZ SA (France), HydroPoint (U.S.), Siemens AG (Germany), Itron, Inc. (U.S.), Endress+Hauser AG (Switzerland) and Neptune Technology Group Inc. (U.S.). |

|

Scope of the Report:

Smart Water Management Market Assessment, by Offering

Smart Water Management Market Assessment, by Application

Smart Water Management Market Assessment, by End User

Smart Water Management Market Assessment, by Country/Region

Key questions answered in the report:

The smart water management market is projected to reach $69.60 billion by 2030, at a CAGR of 14.7% during the forecast period.

In 2023, the hardware segment is expected to account for the largest share of the global smart water management market.

The industrial segment is expected to account for the largest share of the global smart water management market.

The expansion of this market is fueled by an increasing imperative to minimize water loss attributed to non-revenue water, the urgent need for replacing existing water infrastructure, and a rising investment trend in smart water management technology.

The key players operating in the smart water management market are IBM Corporation (U.S.), ABB Ltd. (Switzerland), Honeywell International Inc. (U.S.), Schneider Electric SE (France), Cisco Systems, Inc. (U.S.), Sensus (U.S.), Mueller Water Products, Inc. (U.S.), Trimble Inc. (U.S.), Arad Group (Israel), Oracle Corporation (U.S.), Badger Meter, Inc. (U.S.), Landis+Gyr Group AG (Switzerland), Kamstrup A/S (Denmark), SUEZ SA (France), HydroPoint (U.S.), Siemens AG (Germany), Itron, Inc. (U.S.), Endress+Hauser AG (Switzerland) and Neptune Technology Group Inc. (U.S.).

Asia-Pacific is projected to register the highest CAGR during the forecast period and offer significant growth opportunities for market players.

Published Date: Aug-2024

Published Date: Mar-2024

Published Date: Jun-2024

Published Date: Aug-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates