Resources

About Us

High-Performance Polymer 3D Printing Materials Market by Type (PEEK & PEKK, PEI, Reinforced HPPs, Others), Form (Filament & Pellet, Powder), Technology (FDM/FFF, SLS/HSS, Others), and End-use Industry (Aerospace & Defense, Medical & Healthcare, Automotive, Oil & Gas) – Global Forecast to 2036

Report ID: MRCHM - 1041695 Pages: 294 Jan-2026 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the High-Performance Polymer 3D Printing Materials Market Size?

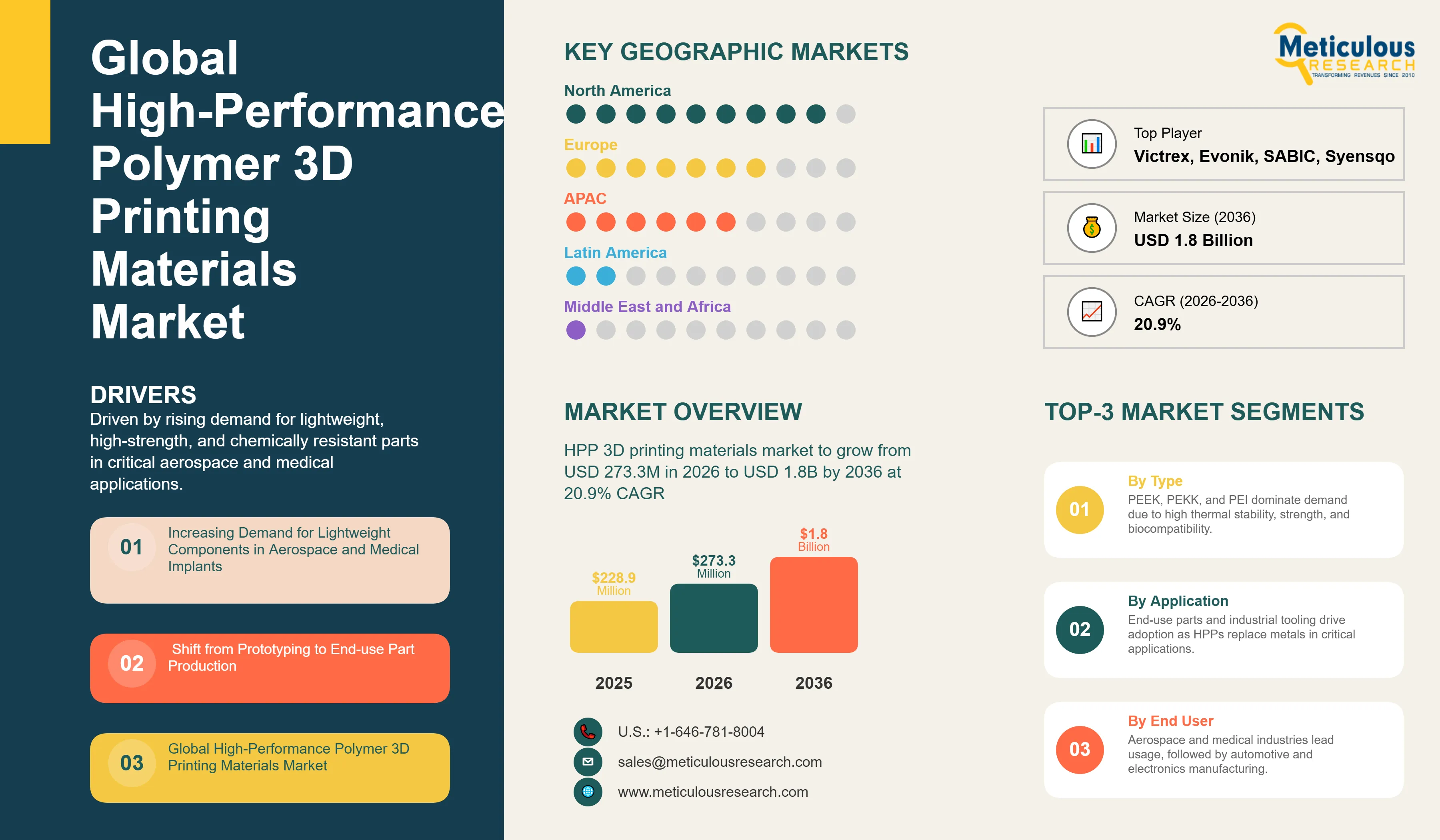

The global high-performance polymer (HPP) 3D printing materials market was valued at approximately USD 228.9 million in 2025. The market is expected to reach USD 1.8 billion by 2036 from USD 273.3 million in 2026, growing at a robust Compound Annual Growth Rate (CAGR) of 20.9% from 2026 to 2036. The growth of the overall HPP 3D printing materials market is fundamentally driven by the escalating demand for lightweight, high-strength, and chemically resistant components in mission-critical applications, particularly within the aerospace and medical sectors. As additive manufacturing technologies mature and the cost-efficiency of production-grade HPPs improves, these materials are increasingly replacing traditional metals and low-performance plastics. The shift toward decentralized, on-demand manufacturing and the necessity for rapid prototyping with end-use materials further fuel the significant expansion of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

High-Performance Polymers (HPPs) for 3D printing, such as Polyetheretherketone (PEEK), Polyetherketoneketone (PEKK), and Polyetherimide (PEI/ULTEM), are a class of advanced materials characterized by exceptional mechanical strength, high thermal resistance (often exceeding 200°C), and superior chemical inertness. These materials are critical enablers for the transition of additive manufacturing from prototyping to full-scale, end-use part production. The market is defined by the necessity for materials that can withstand extreme operating environments, including high-pressure, high-temperature (HPHT) conditions in the oil and gas sector, and stringent sterilization requirements in the medical field.

The market includes a diverse range of material forms, from fine powders used in Selective Laser Sintering (SLS) and High-Speed Sintering (HSS) to filaments and pellets optimized for high-temperature FDM/FFF and large-format additive manufacturing (LFAM). Leading material manufacturers, including Syensqo (formerly Solvay), Arkema, Evonik, and Victrex, are continuously innovating, offering specialized grades like carbon-fiber reinforced PEEK and flame-retardant PEI to meet evolving industry standards. The ability of these materials to produce complex, lightweight geometries with properties rivaling metals has positioned them as the technology of choice for industries seeking to optimize supply chains, reduce weight, and enhance component performance.

1. Shift to Production-Scale, Open-Source Material Systems

The HPP 3D printing market is rapidly moving beyond proprietary, closed-material systems toward open-source platforms that facilitate industrial-scale production. This trend is driven by end-users demanding greater material flexibility and lower costs. For instance, the adoption of large-format pellet extrusion systems, which utilize lower-cost, standard-grade HPP pellets instead of expensive filaments, is becoming widespread. This shift, supported by advancements in high-temperature FDM/FFF hardware, allows manufacturers to use materials like Syensqo’s KetaSpire® PEEK or Arkema’s Kepstan® PEKK in a more cost-effective, high-throughput manner, accelerating the replacement of machined metal parts.

2. Proliferation of Carbon Fiber and Glass Fiber Reinforced HPPs

The demand for composite HPPs is surging as industries require materials with even higher stiffness-to-weight ratios. Carbon fiber-reinforced PEEK and PEKK materials are now standard offerings, providing mechanical properties that can compete directly with aluminum alloys. This trend is particularly evident in the aerospace sector, where parts printed with materials like Victrex’s VICTREX™ AM™ 200 or specialized Evonik VESTAKEEP® PEEK grades are used for structural components, brackets, and interior parts, leading to significant fuel savings and enhanced performance. The ability to tailor the fiber orientation during the printing process further optimizes the final part’s strength and durability.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 1.8 Billion |

|

Market Size in 2026 |

USD 273.3 Million |

|

Market Size in 2025 |

USD 228.9 Million |

|

Market Growth Rate (2026-2036) |

CAGR of 20.9% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Form, Technology, End-use Industry, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Increasing Demand for Lightweight Components in Aerospace and Medical Implants

A key driver of the HPP 3D printing materials market is the relentless pursuit of weight reduction in the aerospace and automotive industries, coupled with the growing need for custom, biocompatible implants in healthcare. HPPs offer a superior strength-to-weight ratio compared to many metals, directly translating to lower fuel consumption in aircraft and improved performance in high-speed vehicles. In the medical field, materials like PEEK are used for patient-specific cranial, spinal, and orthopedic implants due to their radiolucency, biocompatibility, and mechanical properties that closely mimic human bone.

Opportunity: Advancements in High-Temperature Additive Manufacturing Hardware

The rapid development and commercialization of high-temperature 3D printers capable of reliably processing materials with high melting points (e.g., PEEK, PEKK) represent a significant market opportunity. Companies like Stratasys, EOS, and specialized hardware manufacturers are introducing systems with advanced thermal management, heated build chambers, and improved extrusion technologies. This hardware innovation lowers the barrier to entry for manufacturers, enabling wider adoption of HPPs for production applications.

Restraints: High Material Cost and Processing Complexity

The primary restraint for market growth remains the high cost of HPP materials compared to standard engineering plastics and traditional manufacturing feedstocks. Furthermore, the processing of HPPs, particularly PEEK and PEKK, requires specialized, high-temperature equipment and precise control over the thermal environment to prevent warping and ensure optimal layer adhesion, adding complexity and cost to the manufacturing process.

Challenges: Material Standardization and Regulatory Hurdles

A significant challenge is the lack of universal material standardization across different 3D printing platforms and material suppliers. This fragmentation complicates material qualification for highly regulated industries like aerospace and medical devices. Additionally, navigating the regulatory approval process for 3D-printed HPP components, especially for long-term implantable devices, requires extensive testing and documentation, which can slow down market adoption.

Why Do PEEK & PEKK Materials Lead the Market?

The PEEK & PEKK segment accounts for the largest share of the overall HPP 3D printing materials market in 2026. This dominance is attributed to their membership in the Polyaryletherketone (PAEK) family, offering the highest performance characteristics, including continuous use temperatures up to 260°C, excellent chemical resistance, and inherent flame retardancy. These properties are non-negotiable for applications such as aircraft interior components, downhole tools in oil and gas, and load-bearing medical implants. The key material suppliers in this segment are Victrex, Syensqo (KetaSpire® PEEK, AvaSpire® PAEK), and Arkema (Kepstan® PEKK).

How is North America Maintaining Dominance in the Global HPP 3D Printing Materials Market?

North America holds the largest share of the global HPP 3D printing materials market in 2026. The region’s leadership is primarily attributed to the massive R&D spending and rapid adoption of additive manufacturing by the U.S. Department of Defense and major aerospace companies (e.g., Boeing, Lockheed Martin). Furthermore, the presence of a highly mature medical device industry, which is a major consumer of biocompatible PEEK and PEI materials, solidifies the region’s market position.

Which Factors Support Asia Pacific Market Growth?

Asia Pacific is the fastest-growing region, driven by the aggressive expansion of the automotive and electronics manufacturing sectors, particularly in China, Japan, and South Korea. The region is rapidly adopting 3D printing for tooling, jigs, and fixtures, utilizing HPPs to withstand the rigors of high-volume production environments. Government initiatives promoting advanced manufacturing and the emergence of local material suppliers are accelerating the market’s growth trajectory.

The High-Performance Polymer 3D Printing Materials is expected to grow from USD 273.3 million in 2026 to USD 1.8 billion by 2036.

The market is segmented by:

PEEK & PEKK materials are typically dominant due to their exceptional thermal resistance, mechanical strength, and biocompatibility, making them ideal for aerospace and medical applications.

Both FDM/FFF and SLS/HSS are major technologies, with dominance depending on application requirements—FDM/FFF for ease of use and SLS/HSS for production-scale manufacturing and superior mechanical properties.

Aerospace & Defense and Medical & Healthcare are typically high-growth sectors due to stringent performance requirements, regulatory acceptance of 3D-printed parts, and the need for customized, lightweight components.

Published Date: Apr-2024

Published Date: Jan-2024

Published Date: Jun-2021

Published Date: Dec-2025

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates