Resources

About Us

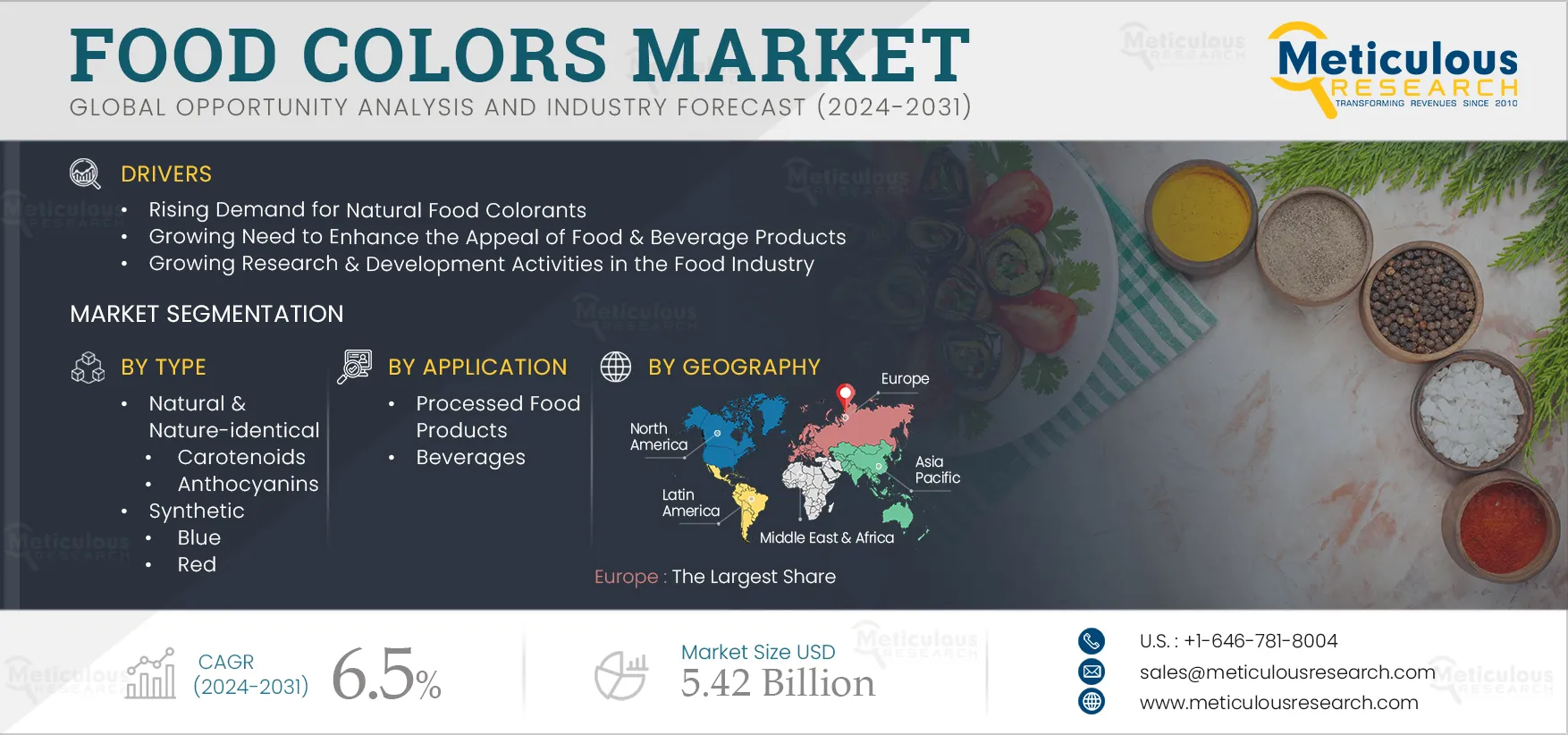

Food Colors Market Size, Share, Forecast, & Trends Analysis by Type (Natural & Nature-identical {Carotenoids, Anthocyanin}), Source (Plants), Form (Liquid), Solubility (Water, Oil), Application (Processed Food Products, Beverages)—Global Forecast to 2032

Report ID: MRFB - 104134 Pages: 425 Jan-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the food colors market is driven by the rising demand for natural food colorants, the growing need to enhance the appeal of food & beverage products, and growing research & development activities in the food industry. However, stringent government regulations and the high prices of natural food colors restrain the growth of this market. The growing demand for food colors in emerging economies and the rising demand for natural, organic & clean-label foods are expected to create market growth opportunities. Moreover, the growing demand for plant-based foods is a prominent trend in the food colors market.

Click here to: Get Free Sample Pages of this Report

The demand for natural ingredients, particularly natural food colorants, is rising in the food & beverage industry, driven by a growing consumer preference for natural and organic products and increased awareness regarding the health risks associated with synthetic additives. The widespread use of chemicals and artificial ingredients in food production has raised concerns about adverse health effects. As consumers have become increasingly health-conscious with a shift toward environmentally sustainable products, the demand for naturally grown food products has surged globally. For instance, according to FiBL, in 2022, sales of organic foods reached $142.3 billion (€135 billion). Hence, food manufacturers are increasingly utilizing natural food colorants to enhance the appeal of processed food & beverage products.

Color is one of the most significant organoleptic attributes of food & beverage products that directly influence consumer choice. Colors are added to food to make it more appealing, to mitigate the loss of color due to processing, extreme temperature, light, air, moisture, and storage conditions, to improve product quality, and to influence consumers to buy a product. The visual appearance of food products plays an important role in consumers’ perception of taste and overall satisfaction. Food colors make food more attractive and informative, helping consumers identify their desired food products. Natural food colors appeal to consumers seeking organic and minimally processed foods. Synthetic food colors offer a wider range of bright, consistent shades preferred for processed foods such as candies, beverages, and icings. Thus, incorporating food colors, natural or synthetic, can elevate the appearance of foods and make them more enjoyable.

Emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East & Africa, hold huge potential for market growth. This growth is mainly attributed to the abundant availability of food color production sources and increasing health & wellness trends. In addition, increasing health awareness and the rising demand for natural food colors in the food, beverage, bakery, and confectionery industries are supporting the growth of the food colors market in these regions.

Moreover, governments in Asia-Pacific and the Middle East & Africa are creating a favorable environment to attract foreign investments in the food & beverage sector. For instance, the Indian government has declared major tax breaks to attract multinational investors. Also, according to the USDA FAS GAIN report, by 2032, investments in Sudi Arabia’s food & beverage sector are expected to reach $71 billion, an increase of 59% compared to 2016. Therefore, government support to increase foreign investments in the food sector is expected to boost the demand for food colors in these regions.

Consumers are increasingly prioritizing natural, organic, and clean-label products, driven by a growing focus on health, transparency, and sustainability in their food choices. Clean-label products are characterized by the inclusion of natural, recognizable, and simple ingredients. Additionally, consumers are becoming more aware of the potential negative effects of artificial ingredients commonly used in the production of various food & beverage products. As a result, there is a rising demand for natural ingredients, including natural food colorants. According to Ingredion’s 2024 ATLAS survey, approximately 78% of respondents indicated a willingness to pay a premium for clean-label and natural-claimed products. This shift toward clean-label products is encouraging food manufacturers to reformulate their products to meet this demand. Companies are now focusing on replacing synthetic dyes with natural food colorants. Therefore, the increasing consumer preference for natural, organic, and clean-label products is expected to create growth opportunities for the companies operating in this market.

Natural food colors, which originate from sources such as fruits, vegetables, spices, and algae, are used to impart color to plant-based food & beverage products. Plant-based foods are often chosen for their sustainability benefits, and the use of natural food colors aligns with this environmental objective. Natural food colors are often perceived as a safer and healthier alternative to synthetic food colors. With more people adopting plant-based diets due to the health benefits and growth in vegan and vegetarian populations, there is a growing demand for natural food colors that align with these healthier eating habits. Therefore, the growing demand for plant-based foods has led to an increased interest in the development of innovative natural products, generating opportunities for the players operating in the natural food colors market.

Based on type, the food colors market is segmented into natural & nature-identical and synthetic food colors. In 2025, the natural & nature-identical segment is expected to account for the larger share of 67.8% of the food colors market. This segment’s large market share is primarily attributed to the large number of companies offering natural and nature-identical food colors, the increasing consumer demand for organic food products, the growing preference for clean-label food products, and advancements in microencapsulation technology for natural colors.

Moreover, this segment is projected to register the higher CAGR of 6.8% during the forecast period 2025–2032. The growth of this segment is driven by the rising demand for food & beverage products free from artificial additives and the implementation of bans and stringent regulatory restrictions on synthetic food colors. Additionally, increasing awareness regarding the health benefits of natural food colors is anticipated to further support the growth of this segment.

Furthermore, natural & nature-identical food colors are further segmented into carotenoids, anthocyanins, caramel, chlorophyll, curcumin, betanin, carmine, spirulina, and other natural & nature-identical food colors. In 2025, the carotenoids segment is expected to account for the largest share of the natural & nature-identical food colors market. However, the phycocyanin segment is slated to record the highest CAGR during the forecast period 2025–2032.

Based on source, the food colors market is segmented into plants, minerals, chemicals, microorganisms, and animals. In 2025, the plants segment is expected to account for the largest share of the food colors market. This segment’s large market share is primarily attributed to the increasing demand for natural and organic food ingredients, the wide availability of various plant sources for food color extraction, and advancements in food color extraction and processing technologies. Additionally, the rising clean-label trend and strict regulations regarding the use of chemical additives in food products are encouraging manufacturers to adopt natural plant-based colors to comply with consumer safety standards, contributing to the segment’s large market share.

However, the microorganisms segment is expected to record the highest CAGR during the forecast period 2025–2032. This segment's high growth is driven by the growing interest in sustainable and environmentally friendly production methods, and advancements in fermentation technologies, allowing for the efficient production of vibrant and stable colorants from microorganisms. Moreover, the increasing demand for unique and innovative colors in food and beverage applications is further creating opportunities for food color manufacturers to explore microbial sources, which offer a diverse range of color options and reduce reliance on traditional sources. Microbial pigments impart various color shades, such as red, pink-red, orange, yellow, blue, green, golden, purple, black, and brown-black.

Based on form, the food colors market is segmented into liquid, powder, and other forms. In 2025, the liquid segment is expected to account for the largest share of the food colors market. This segment’s large share can be attributed to the benefits offered by liquid food colors, such as better shelf life & visual appeal, improved viscosity, and enhanced mouthfeel & texture. Moreover, liquid food colors have a higher water content compared to other forms, driving their use in the preparation of hard candy and lollipops, frostings, cakes, cookies, ice cream, and syrups.

Moreover, the liquid segment is expected to record the highest CAGR during the forecast period 2025–2032. The growth of this segment is driven by the increasing demand for convenience and ready-to-use products in the food & beverage industry, which aligns with the ease of incorporation and blending of liquid colors. Additionally, the trend toward customization and personalization in food products is encouraging manufacturers to utilize liquid colors for more versatile applications, enabling them to create unique and vibrant formulations that meet evolving consumer preferences. Furthermore, advancements in formulation technologies are improving the stability and performance of liquid food colors, making them an attractive option in various applications. All these factors are expected to support the growth of this segment during the forecast period.

Based on solubility, the food colors market is segmented into water, oil, and dye. In 2025, the water-soluble segment is expected to account for the largest share of the food colors market. The major share of this segment is mainly attributed to the high adoption of water-soluble food colors due to their high stability and concentration.

Moreover, the water-soluble segment is projected to record the highest CAGR during the forecast period 2025–2032. This segment's high growth is driven by the widening application areas of water-soluble food colors and innovations in formulation technologies that enhance the performance and stability of water-soluble food colors. Additionally, the rapidly growing global beverages industry, including soft drinks, juices, and sports drinks, is further expected to support the growth of this segment during the forecast period.

Based on application, the food colors market is segmented into processed food products and beverages. In 2025, the processed food products segment is expected to account for the larger share of the food colors market. The large market share of this segment is primarily attributed to the growing processed foods industry, the increasing demand for convenience foods, and the extensive use of food colors to mitigate color loss during food processing to enhance the appeal, minimize variations, and color uncolored food.

Furthermore, the processed food products segment is further segmented into bakery & confectionery, dairy, snacks & cereals, meat, poultry, and seafood, oils & fats, and other processed food products. In 2025, the bakery & confectionery segment is expected to account for the largest share of the food colors market for processed food products. This significant share can be attributed to changing food consumption patterns, the growing global population, rising disposable incomes, and the proliferation of specialized e-commerce platforms selling bakery & confectionery products.

However, the beverages segment is projected to record the higher growth rate during the forecast period 2025–2032. This growth is driven by the increasing consumer preference for unique and diverse flavors and the growing demand for clean-label ingredients in the functional and wellness beverages sector, leading to increased adoption of natural food colors among beverage manufacturers.

Based on geography, the food colors market is segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Europe is expected to account for the largest share of 33.8% of the food colors market, followed by North America and Asia-Pacific. Europe's food colors market is estimated to reach $1.18 billion in 2025. Europe's significant market share can be attributed to the presence of key established players, growing R&D activities in the food industry, and the increasing adoption of natural food colors due to stringent regulations on synthetic food colors and a focus on sustainability.

However, Asia-Pacific is expected to record the highest CAGR of 7.5% during the forecast period 2025–2032. The high growth of this regional market is attributed to the growing awareness regarding the benefits of natural food products, increasing urbanization, growing population, health awareness, rising disposable incomes, and the rising demand for clean-label products and healthier, minimally processed foods.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the food colors market are Oterra A/S (Denmark), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), Givaudan SA (Switzerland), DSM-Firmenich AG (Switzerland), BASF SE (Germany), International Flavors & Fragrances Inc. (U.S.), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Mane Kancor Ingredients Private Limited (India), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), and Allied Biotech Corporation (Taiwan).

In January 2025, Oterra A/S (Denmark) partnered with Vaxa Technologies Ltd. (Israel), a food and climate tech company, to cultivate and produce microalgae in Iceland. This microalga is expected to be used as a raw material for natural color production.

In October 2024, Oterra A/S (Denmark) launched the Simply Brown range, a clean-label caramel replacement, as a part of the FruitMax coloring food range. This product is made from apples and is ideally suited for bakery, cereal, snack, dairy, and savory applications.

In May 2024, GNT Group B.V. (Netherlands) launched EXBERRY Shade Vivid Orange – OS, an oil-based food color made from paprika seed oil and paprika pulp for snacks, decorative coatings, and sauces.

|

Particulars |

Details |

|

Number of Pages |

425 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2025 |

|

CAGR (Value) |

6.5% |

|

Market Size (Value) |

$5.42 Billion by 2032 |

|

Segments Covered |

By Type

By Source

By Form

By Solubility

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Denmark, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, Singapore, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (United Arab Emirates, South Africa, Saudi Arabia, and Rest of Middle East & Africa) |

|

Key Companies Profiled |

Oterra A/S (Denmark), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), Givaudan SA (Switzerland), DSM-Firmenich AG (Switzerland), BASF SE (Germany), International Flavors & Fragrances Inc. (U.S.), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Mane Kancor Ingredients Private Limited (India), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), and Allied Biotech Corporation (Taiwan) |

The food colors market study provides valuable insights, market sizes, and forecasts in terms of value and volume by type, and geography. Also, the study provides insights, market sizes, and forecasts only in terms of value based on source, form, solubility, and application.

The food colors market is projected to reach $5.42 billion by 2032, at a CAGR of 6.5% during the forecast period.

In 2025, the natural & nature-identical segment is expected to hold the major share of the food colors market.

The beverages segment is expected to witness the fastest growth during the forecast period 2025–2032.

The rising demand for natural food colorants, the growing need to enhance the appeal of food & beverage products, and growing research and development activities in the food industry are the key factors supporting the growth of this market. Moreover, the growing demand for food colors in emerging economies and the rising demand for natural, organic, and clean-label foods are expected to create market growth opportunities during the forecast period.

The key players operating in the food colors market are Oterra A/S (Denmark), Sensient Technologies Corporation (U.S.), Archer-Daniels-Midland Company (U.S.), Givaudan SA (Switzerland), DSM-Firmenich AG (Switzerland), BASF SE (Germany), International Flavors & Fragrances Inc. (U.S.), Lycored, Ltd (A Part of ADAMA Agricultural Solutions Ltd.) (Israel), Döhler Group (Germany), GNT Group B.V. (Netherlands), San-Ei Gen F.F.I., Inc. (Japan), Kalsec, Inc. (U.S.), Mane Kancor Ingredients Private Limited (India), Innovation Colour Technology S.L. (Spain), IFC Solutions (U.S.), and Allied Biotech Corporation (Taiwan).

The food colors market in Asia-Pacific is expected to witness significant growth during the forecast period 2025–2032.

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Aug-2024

Published Date: Jun-2024

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates