Resources

About Us

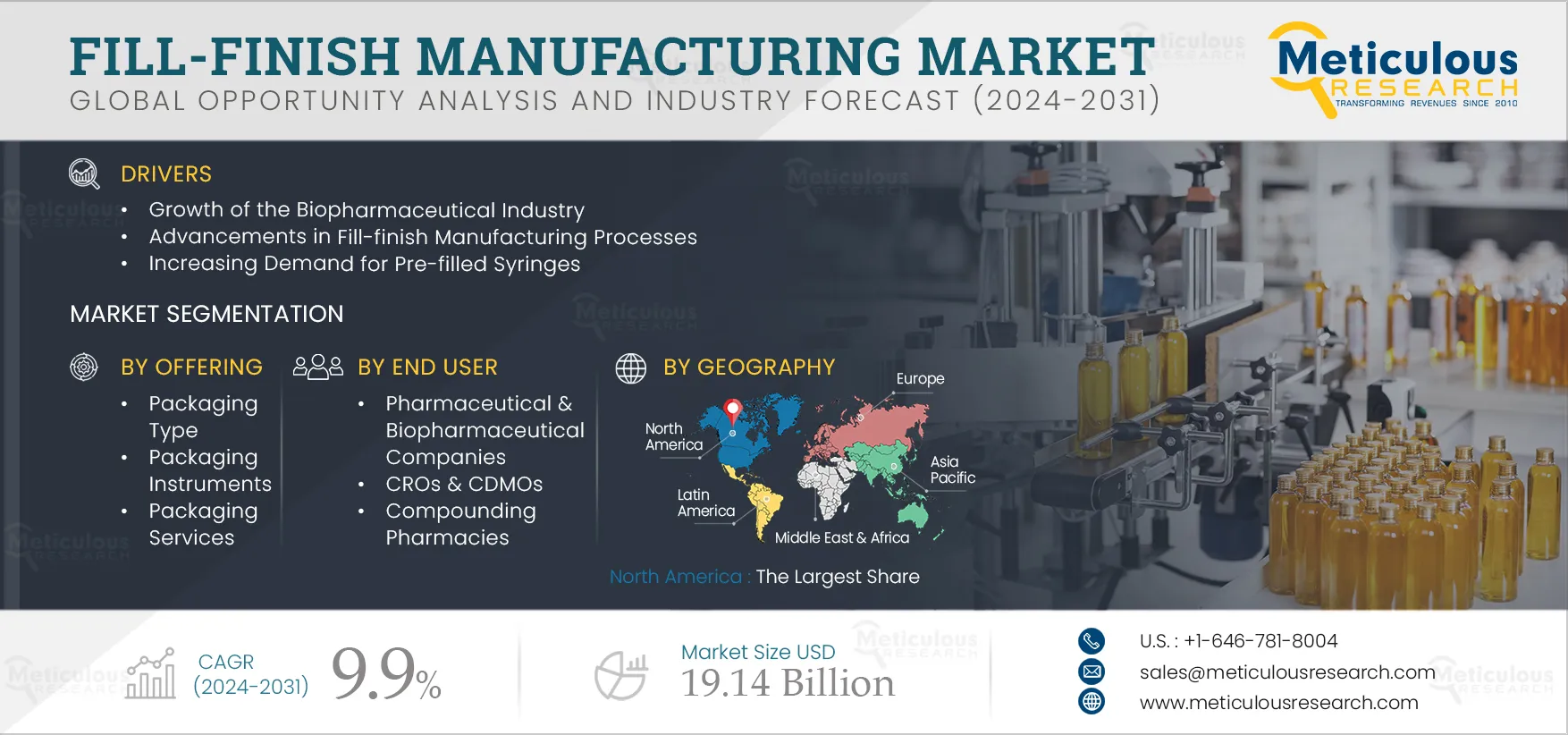

Fill-finish Manufacturing Market Size, Share, Forecast, & Trends Analysis by Offering (Packaging Type {Vial, Syringe, Cartridge} Equipment, Service) Formulation (Oral, Parenteral) Application (Biologics, Small Molecule) End User - Global Forecast to 2032

Report ID: MRHC - 1041247 Pages: 550 Jun-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Fill-finish Manufacturing Market is projected to reach $19.14 billion by 2032, at a CAGR of 9.9% from 2025 to 2032. The growth of this market is driven by the growth of the biopharmaceutical industry, initiatives by pharmaceutical & biopharmaceutical companies to expand their production capacities, advancements in fill-finish manufacturing processes, and the increasing demand for pre-filled syringes.

Moreover, initiatives aimed at increasing vaccination rates, increasing focus on biosimilar development, and rising investments in the development of new biologics are expected to create market growth opportunities.

The global biopharmaceutical market is witnessing significant growth, driven by the increase in biologics approvals, rising investments by vendors in expanding biomanufacturing capacities, and government initiatives aimed at boosting bioproduction. In 2021, the number of new planned clinical trials reached 5,500, an increase of 14% and 19% from 2020 and 2019, respectively. This increase in clinical trials and R&D activities is driving the growth of the fill-finish manufacturing market.

Governments worldwide are launching initiatives to support the biopharmaceutical market's growth. For instance, the government of China has implemented various measures to promote the development and commercialization of biosimilars. Similarly, countries such as Malaysia, Indonesia, Thailand, and Taiwan have established regulatory pathways for biosimilars, thereby enhancing access to biosimilar technologies. The production of biosimilars is expected to drive the demand for fill-finish manufacturing, thereby driving market growth.

There is an increased demand for fill-finish manufacturing services in the pharmaceutical industry, driven by increased drug approvals and growth in the biopharmaceutical sector. Recent advancements in fill-finish technology have improved bioprocessing capabilities, enhancing product quality & efficiency and reducing contamination risks. Key advancements include the adoption of single-use systems, advanced barrier technologies, and robotics, among others.

A significant innovation in aseptic fill-finish technologies involves the integration of data analytics and sensor technology for real-time process control and monitoring. Continuous monitoring of critical parameters such as airflow, temperature, and pressure enables swift detection of process deviations, thereby minimizing contamination risks and optimizing process efficiency.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Automation has revolutionized several aspects of the pharmaceutical industry, including fill-finish manufacturing. Robotic systems are now being used to perform tasks like inspection, container loading, capping, and filling. These robots are extremely precise and can work in a sterile environment without posing contamination risks. By integrating automation and robotics, pharmaceutical companies are improving the speed and consistency of fill-finish operations, resulting in reduced labor costs and higher production yields.

Robotic systems can operate around the clock without needing breaks or rest. This continuous operation capability enhances productivity & efficiency in manufacturing processes. Leading market players are increasingly launching robotic systems for fill-finish operations. For instance, in March 2024, 3P Innovation (U.K.) launched a Robotic Fill-Finish Cell at the ISPE Aseptic Conference in North Bethesda, Maryland, U.S. This robotic cell provides a compliant and autonomous solution for filling and finishing cartridges, ready-to-use (RTU) vials, and syringes.

The demand for biopharmaceuticals is rising, driven by their benefits, including their ability to target specific molecules, minimal side effects, and high activity & specificity. Biopharmaceuticals are increasingly being used for treating Immune-mediated Inflammatory Diseases (IMIDs), including Rheumatoid Arthritis (RA), Inflammatory Bowel Disease (IBD), and cancer. According to the U.S. FDA, out of the total drugs approved in 2022, 15 were biologics, an increase from 13 in 2020.

Furthermore, governments worldwide are providing funding for the R&D of biologics. For instance, in October 2022, the U.S. FDA provided funding of USD 1.3 million to the Biologics & Biosimilars Collective Intelligence Consortium (BBCIC) to advance biologics research. The increased share of biologics in total drug approval and investments by government bodies in the R&D of biologics is driving the demand for fill-finish manufacturing services.

Vaccination is recognized as an effective, simple, and safe method to protect against harmful diseases. In recent years, both private and government agencies have intensified their focus on vaccinations due to their role in preventing serious illnesses and reducing mortality rates. According to the WHO, vaccination and immunization prevent 3.5 to 5 million deaths annually from diseases such as measles, diphtheria, influenza, tetanus, and pertussis.

Governments worldwide are increasingly prioritizing vaccination efforts. For instance, the Canadian government has ramped up its vaccination initiatives, leading to heightened demand for fill and finish instruments. In June 2022, in alignment with global vaccination efforts, Canada launched the Global Initiative for Vaccine Equity (CanGIVE) with an investment of USD 317 million. This initiative aims to bolster COVID-19 vaccine distribution, strengthen healthcare systems, and enhance domestic vaccine manufacturing capacity. Such initiatives are expected to create opportunities for the growth of the fill-finish manufacturing market.

Based on offering, the fill-finish manufacturing market is segmented into packaging type, packaging instruments, and packaging services. In 2025, the packaging type segment is expected to account for the largest share of the fill-finish manufacturing market. This segment encompasses consumables like vials, pre-filled syringes, ampoules, and other containers used for drug filling. This segment's large market share can be attributed to the increasing utilization of vials and ampoules in vaccine packaging, the growing adoption of pre-fillable syringes and ampoules for single-dose packaging, and advancements in fill-finish technology.

Technological advancements, such as the integration of automation & robotics in filling instruments, are crucial in reducing drug wastage, optimizing production speed, and minimizing human interventions, thereby lowering the risk of contamination. The integration of these technologies in fill-finish packaging solutions is anticipated to drive the growth of this segment during the forecast period.

Based on formulation, the fill-finish manufacturing market is segmented into oral, parenteral, topical, and other formulations. In 2025, the parenteral segment is expected to account for the largest share of the fill-finish manufacturing market. Parenteral administration is the second most prevalent drug delivery method after oral solids and liquids. In recent years, parenteral drugs have constituted approximately 40% of new molecular entities approved annually by the U.S. Food and Drug Administration. The rising development of parenteral drugs is driving the demand for advanced drug delivery devices such as pre-filled syringes, thereby boosting the adoption of fill-finish manufacturing services.

Based on sterilization process, the fill-finish manufacturing market is segmented into aseptic processing and terminal sterilization. In 2025, the aseptic processing segment is expected to account for the larger share of 60.8% of the fill-finish manufacturing market. Aseptic processing ensures the sterility of pharmaceutical products. This method employs techniques such as dry heat, fumigation, gamma radiation, and others without subjecting the materials to high temperatures.

The increasing demand for aseptic processing is driven by the need to sterilize heat-sensitive drugs such as biologics, vaccines, and other parenteral medications. Additionally, the rising approvals and growing demand for vaccines and biologics are contributing to the increased demand for aseptic processing. According to data from the World Health Organization (WHO), global vaccine doses supplied increased from approximately 5.8 billion in 2019 to 16 billion in 2021.

Based on application, the fill-finish manufacturing market is segmented into biologics and small molecules. In 2025, the small molecules segment is expected to account for the larger share of 55.3% of the fill-finish manufacturing market. This segment’s large market share can be attributed to factors such as the cost-effectiveness of small molecules and their increasing efficacy in treating various diseases, the rising prevalence of conditions like cancer & diabetes, and the increasing number of small molecules in clinical development. According to Lonza Group (Switzerland), small molecules account for 52% of all molecules in clinical development. Furthermore, the increasing complexities associated with manufacturing small molecules have increased the reliance on fill-finish manufacturing services, thereby contributing to the segment's large market share.

However, the biologics segment is projected to register a higher CAGR of 11.1% during the forecast period. This growth is driven by increased funding for biologics development, rising approvals of biologic products, and investments by market players in expanding production capacities for biologics. Over the past five years, biologics manufacturing has grown significantly, with further growth anticipated with the advent of technologies like Bioprocessing 4.0. This approach harnesses the Internet of Things (IoT) for enhanced process control & efficiency.

Based on end user, the fill-finish manufacturing market is segmented into pharmaceutical & biopharmaceutical companies, CROs & CDMOs, and compounding pharmacies. In 2025, the CROs & CDMOs segment is expected to account for the largest share of the fill-finish manufacturing market. This segment’s large market share can be attributed to the increasing outsourcing of drug fill-finish operations to contract companies, driven by rising product development costs and limited in-house R&D infrastructure, particularly among small and medium-sized enterprises. The surge in clinical trials and rapid growth in the healthcare and life sciences sectors are accelerating the outsourcing trend to ensure efficient and cost-effective drug filling. According to a report published by the Association for Packaging and Processing Technologies (U.S.) in 2022, 60% of pharmaceutical manufacturers currently outsource at least a portion of their operations to third-party contractors.

In 2025, North America is expected to account for the largest share of 35.1% of the fill-finish manufacturing market. North America’s significant market share can be attributed to the presence of leading fill-finish manufacturers and major biopharmaceutical companies, substantial R&D investments, government & regulatory support promoting biopharmaceutical usage, and expansions of manufacturing capacities by pharmaceutical companies. For instance, in 2022, the U.S. accounted for approximately 45% of the global pharmaceutical market and 22% of global production. According to the International Trade Administration (ITA), the U.S. holds the largest share of the biopharmaceutical market globally, comprising about one-third of the market, and leads in biopharmaceutical manufacturing and R&D activities. The large biopharmaceutical market in North America is driving the demand for fill-finish manufacturing services, particularly for aseptic drug filling.

However, the market in Asia-Pacific is projected to register the highest growth rate of 11.3% during the forecast period. Countries such as China, India, and South Korea are expected to present significant growth opportunities for vendors in the fill-finish manufacturing market. The market growth in Asia-Pacific can be attributed to several factors, including the proliferation of pharmaceutical and biopharmaceutical companies, expanding patient populations, rising disposable incomes, and growing foreign direct investments (FDIs) in the pharmaceutical and biopharmaceutical sectors.

In 2015, the Government of China launched the Made in China (MIC) 2025 plan to strengthen domestic manufacturing capabilities, resulting in a significant increase in the emergence of new Chinese biopharmaceutical firms. Additionally, China has become an attractive destination for international pharmaceutical companies seeking to streamline product timelines and minimize production costs. These factors are driving the demand for fill-finish manufacturing across Asia-Pacific, thereby fueling the market’s growth.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years. The key players operating in the Fill-finish manufacturing market are Syntegon Technology GmbH (Germany), Becton, Dickinson and Company (U.S.), Industria Macchine Automatiche S.p.A. (Italy), West Pharmaceutical Services, Inc. (U.S.), Catalent, Inc. (U.S.), AbbVie Inc. (U.S.), Gerresheimer AG (Germany), AptarGroup, Inc. (U.S.), OPTIMA packaging group GmbH (Germany), Baxter International Inc. (U.S.), C.H. Boehringer Sohn AG & Co. KG (Germany), Schott Pharma AG & Co. KGaA (Germany), SGD Pharma (France), and Stevanato Group (Italy).

|

Particulars |

Details |

|

Number of Pages |

550 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

9.9% |

|

Estimated Market Size (Value) |

$19.14 billion by 2032 |

|

Segments Covered |

By Offering

By Formulation

By Sterilization Process

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Ireland, Belgium, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa. |

|

Key Companies |

The key players operating in the Fill-finish manufacturing market are Syntegon Technology GmbH (Germany), Becton, Dickinson and Company (U.S.), Industria Macchine Automatiche S.p.A. (Italy), West Pharmaceutical Services, Inc. (U.S.), Catalent, Inc. (U.S.), AbbVie Inc. (U.S.), Gerresheimer AG (Germany), AptarGroup, Inc. (U.S.), OPTIMA packaging group GmbH (Germany), Baxter International Inc. (U.S.), C.H. Boehringer Sohn AG & Co. KG (Germany), Schott Pharma AG & Co. KGaA (Germany), SGD Pharma (France), and Stevanato Group (Italy). |

The Fill-finish manufacturing market report covers the qualitative and quantitative analysis of the fill-finish manufacturing market. This report analyzes various segments of the fill-finish manufacturing market, such as offering, formulation, sterilization process, application, and end user at the regional and country levels. The report also provides insights on factors impacting market growth, regulatory analysis, pricing analysis, and Porter’s five forces analysis.

The fill-finish manufacturing market is projected to reach $19.14 billion by 2032 at a CAGR of 9.9% from 2025 to 2032.

Among the offerings covered in this report, in 2025, the packaging type segment is expected to account for the largest share of the fill-finish manufacturing market. This segment’s large market share can be attributed to the advancements in fill-finish technology, the increasing demand for injectable and parenteral formulations, the increasing approvals of biologics, the recurring demand for syringes, cartridges, and ampoules, as well as the rising initiatives aimed at increasing vaccination rates.

Among the applications covered in this report, the biologics segment is projected to register a higher CAGR of 11.1% during the forecast period. This segment’s large market share can be attributed to the rising demand for biologics, expansion of biologics manufacturing facilities, rising approvals for biologic products, and new product launches by key market players.

The growth of this market is driven by the growth of the biopharmaceutical industry, initiatives by pharmaceutical & biopharmaceutical companies to expand their production capacities, advancements in fill-finish manufacturing processes, and the growing adoption of pre-filled syringes for parenteral dosage.

Moreover, initiatives aimed at increasing vaccination rates, increasing focus on biosimilar development, and rising investments in the development of new biologics are expected to create market growth opportunities

The key players operating in the Fill-finish manufacturing market are Syntegon Technology GmbH (Germany), Becton, Dickinson and Company (U.S.), Industria Macchine Automatiche S.p.A. (Italy), West Pharmaceutical Services, Inc. (U.S.), Catalent, Inc. (U.S.), AbbVie Inc. (U.S.), Gerresheimer AG (Germany), AptarGroup, Inc. (U.S.), OPTIMA packaging group GmbH (Germany), Baxter International Inc. (U.S.), C.H. Boehringer Sohn AG & Co. KG (Germany), Schott Pharma AG & Co. KGaA (Germany), SGD Pharma (France), and Stevanato Group (Italy).

The market in Asia-Pacific is projected to register the highest growth rate of 11.3% during the forecast period. Countries such as China, India, and South Korea are expected to present significant growth opportunities for vendors in the fill-finish manufacturing market. The market growth in Asia-Pacific can be attributed to several factors, including the proliferation of pharmaceutical and biopharmaceutical companies, expanding patient populations, rising disposable incomes, and growing foreign direct investments (FDI) in the pharmaceutical and biopharmaceutical sectors.

Published Date: Sep-2013

Published Date: Oct-2013

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates