Resources

About Us

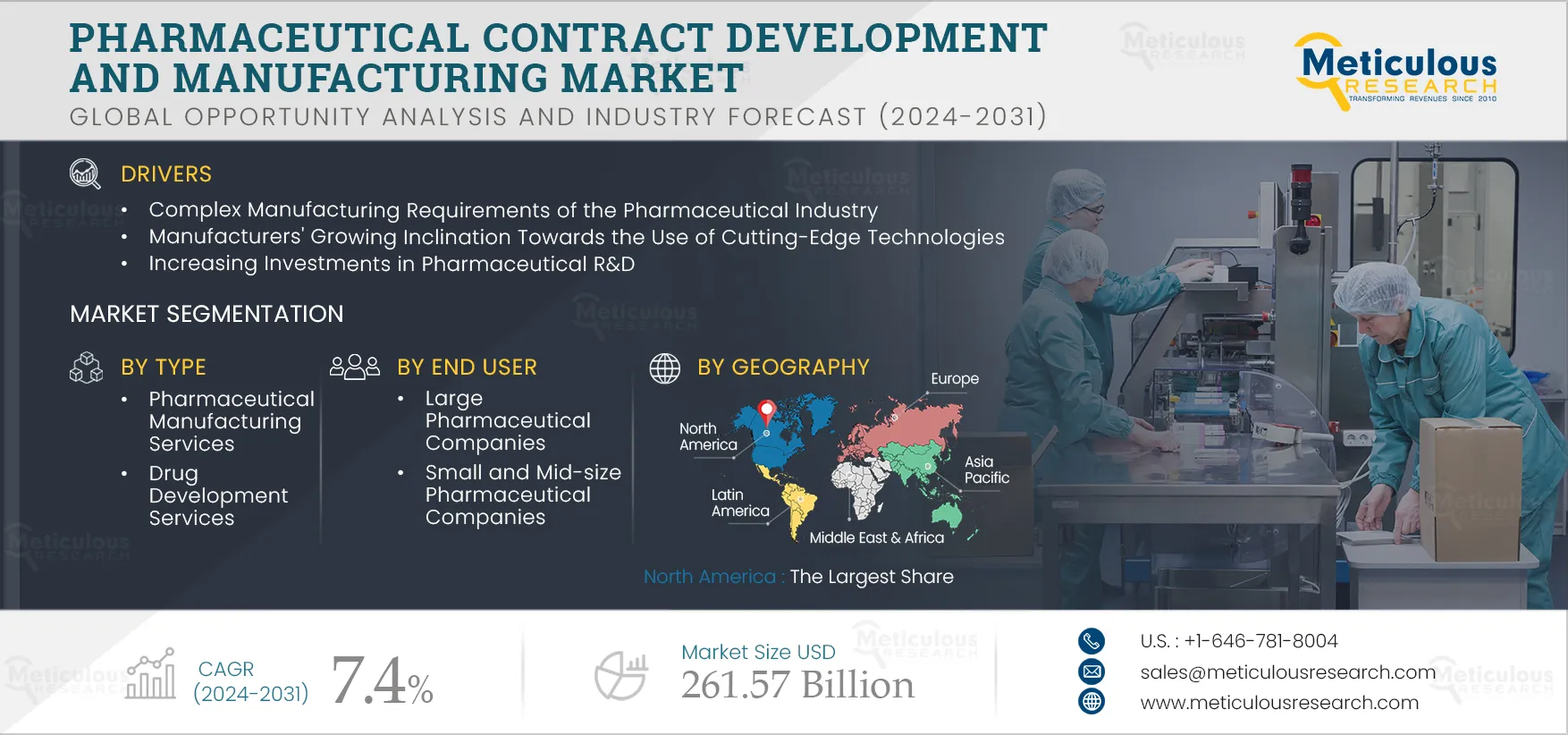

Pharmaceutical Contract Development & Manufacturing Market Size, Share, Forecast, & Trends Analysis by Service (Manufacturing [API, FDF {Parenteral, Injectable, Tablet, Capsule, Oral Liquid, Biologics}], Drug Development) End User - Global Forecast to 2031

Report ID: MRHC - 104477 Pages: 250 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market can be attributed to various factors, such as complex manufacturing requirements of the pharmaceutical industry, manufacturers growing inclination towards the use of cutting-edge technologies, increasing investments in pharmaceutical R&D, patent expiration, and rising demand for generic medicines and biologics. Furthermore, growing demand for cell therapies, gene therapies, and personalized medicines and growth in high potency active pharmaceutical ingredients (HPAPI) and antibody-drug conjugates (ADC) markets are expected to offer growth opportunities.

Pharmaceutical companies are allocating significant resources for R&D purposes. This funding is mainly driven by the rising prevalence of chronic diseases due to the growing geriatric population, complexities in clinical trials, and higher failure of drugs in early-phase studies. The increasing funding for R&D purposes is leading to accelerated drug discovery and manufacturing, thereby driving the need for contract manufacturing and development organizations. According to the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA), pharmaceutical R&D expenditure is expected to reach USD 213 billion by 2026 from USD 189 billion in 2022. Additionally, governments around the world are ramping up their investments in pharmaceutical and biopharmaceutical research. Various national governments have also launched initiatives to enhance pharmaceutical R&D.

For instance, in March 2023, the Canadian government allocated USD 59 million to the Canadian Critical Drug Initiative to advance drug research and commercialization. Such initiatives are anticipated to drive higher demand for pharmaceutical CDMOs to support efficient manufacturing processes.

Click here to: Get Free Sample Pages of this Report

The pharmaceutical industry is driven mainly by scientific advancements and discoveries in conjunction with clinical and toxicological expertise. In addition to the complex nature of the pharmaceutical manufacturing process, multiple countries offer distinct legal safeguards for exclusive medications and production techniques, commonly referred to as intellectual property rights. Extensive government rules are in place in many countries that impact the development and approval of medications intended for commercial sale. To protect the integrity of drug manufacturing processes and the efficacy, safety, and quality of pharmaceutical goods, these countries have stringent regulations for good manufacturing practices. Due to these difficulties, pharmaceutical companies are now developing and producing medicines and biologics in collaboration with contract manufacturing and development firms.

Process automation involves utilizing software and technologies to streamline business processes and functions, ensuring a consistent workflow and achieving specific tasks. In Contract Development and Manufacturing Organizations (CDMOs), process automation is essential for managing, controlling, and optimizing manufacturing activities. This automation leverages sensors, software, and programmable logic controllers (PLCs) to enhance operations. By integrating these technologies, organizations can centralize and analyze data from sensors, monitor production lines in real time, and improve quality. During the manufacturing process, automated systems look for inconsistencies. If any are found, production is halted to protect workers and preserve product quality.

Additionally, process automation helps eliminate bottlenecks, boost efficiency, and reduce time and costs. These benefits are driving the industry's growing adoption of process automation technology.

Capacity expansion is a strategic move of an organization that involves decisions like increasing production capabilities, investment in new units, and adoption or implementation of new technology and equipment. The increase in the number of acquisitions, collaborations, and mergers among CDMOs is a response to some of the major challenges the pharmaceutical industry faces in the development process of drugs, such as the growing number of expiring patents, increasing R&D costs, and increasing prevalence of chronic diseases. Some of the recent strategic developments are as follows:

Next-generation medicines, such as cell and gene therapy, provide significant opportunities for growth in the CDMO market. Cell therapies can benefit patients with neurological disorders, cancer, autoimmune diseases, infectious diseases, urinary tract issues, and compromised immune systems. The need for CDMOs is rising as the number of gene therapy approvals is steadily rising.

The U.S. FDA reports that as of March 2024, 36 gene treatments had received FDA approval, compared to 34 in 2023. A significant barrier to the growth of the cell and gene therapy market is a lack of manufacturing capacity, so large companies outsource the development of their cell or gene therapy processes, creating profitable opportunities for the expansion of the pharmaceutical contract development and manufacturing market.

Based on type, the pharmaceutical contract development and manufacturing market is segmented into pharmaceutical manufacturing services, drug development services, and biologics manufacturing services. In 2024, the pharmaceutical manufacturing services segment is expected to account for the largest share of 75.6% of the pharmaceutical contract development and manufacturing market. The complex requirements of the manufacturing process, in addition to the high cost associated with drug manufacturing, are increasing the outsourcing of manufacturing services. Small and medium-sized pharmaceutical companies need more manufacturing infrastructure and require technical expertise. Small and medium-sized pharmaceutical companies can lower production costs and uphold medical quality standards by outsourcing to CDMOs. Pharmaceutical firms can focus on their core capabilities by using CDMOs to streamline their manufacturing process, from manufacture to secondary packaging.

However, the biologics manufacturing services segment is estimated to register the highest CAGR of 11.1% during the forecast period. Biologics are becoming progressively more in demand due to their advantages, which include high activity and specificity, few side effects, and the capacity to target particular molecules. The need for manufacturing biologics is growing as these are used in treating infectious, autoimmune, and cardiovascular diseases, and different types of cancers.

The U.S. Food and Drug Administration (FDA) reports that over the last five years, the approval of biologics has increased and now makes up over 25% of all drug approvals; in 2022, 15 biologics were approved out of a total of medicines, up from 13 in 2020. Moreover, the intricacy involved in producing biologics is leading to a rise in outsourcing to CDMOs. CDMO successfully handles issues including scaling up, potential for contamination, and stringent analytical testing. Therefore, it is anticipated that the growth of biologics manufacturing services will be aided by an increase in the percentage of approved biologics, an increase in the complexity of production, and government funding in biologics R&D.

Based on end user, the pharmaceutical contract development and manufacturing market is segmented into large pharmaceutical companies, small & mid-size pharmaceutical companies, and generic pharmaceutical companies. In 2024, the large pharmaceutical companies segment is expected to account for the largest share of 42.3% of the pharmaceutical contract development and manufacturing market. The primary drivers accounting for the largest market share of this segment are the increasing demand for modern technology and the emphasis on expanding worldwide in business. Since CDMOs have facilities spread across multiple regions, they are a major source of manufacturing support for large pharmaceutical businesses looking to expand geographically. Due to the increasing complexity of drug research and the rising expenses of building and maintaining those facilities, large biotech and pharmaceutical companies are finding it increasingly necessary to rely on outside contract manufacturers for help running their intricate operations.

In 2024, North America is expected to account for the largest share of 44.3% of the pharmaceutical contract development and manufacturing market. This region’s large market share is attributed to factors such as the presence of large pharmaceutical and biotechnology manufacturers, biopharmaceutical R&D funding, and rising demand for cell and gene therapies. The region's biopharmaceutical production facilities have grown as a result of the growing demand for biopharmaceuticals and supportive activities for their adoption. Drug shortages are an important concern for consumers in the United States. Drug shortages can be caused by a variety of factors, including delays, discontinuations, and issues with manufacturing and quality.

The U.S. FDA reports that in 2023 there were 98 medicine shortages as opposed to 79 in 2021. Many pharmaceutical companies in the United States are depending on CDMOs to prevent medicine shortages.

Moreover, Asia-Pacific is poised to register the highest CAGR of 8.8% during the forecast period. The region's rapid growth can be attributed to increased awareness of overall health and treatment availability, improved healthcare infrastructure, a growing geriatric population, low-cost manufacturing advantages, rising pharmaceutical R&D expenditure, increased government funding for drug development and research, and rising healthcare spending in the region. The governments of this region are focusing on improving healthcare infrastructure in order to improve patient safety.

In 2022–2023, the Government of India approved 13 foreign direct investment (FDI) proposals, which led to USD 281,400 in foreign investment in the pharmaceutical sector for brownfield projects. These government initiatives and other factors are expected to drive growth in pharmaceutical CDMOs in the Asia-Pacific region.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years. The key players operating in the pharmaceutical contract development and manufacturing market are Lonza Group Ltd. (Switzerland), Catalent Inc. (U.S.), Patheon (Subsidiary of Thermo Fisher Scientific Inc. (U.S.), Recipharm AB (Sweden), C.H. Boehringer Sohn AG & CO. KG. (Germany), Aurobindo Pharma ltd (India), Jubilant Pharmova Limited (India), Fareva SA (Luxembourg), Vetter Pharma International GmbH (Germany), Aenova Group (Germany), WuXi Biologics Inc. (China), Piramal Enterprises Limited (India), Almac Group (U.K.), Fabbrica Italiana Sintetici S.p.A. (F.I.S.) (Italy), Samsung Biologics Co., Ltd (South Korea), Cambrex Corporation (U.S.), Siegfried Holdings AG (Switzerland), FUJIFILM Diosynth Biotechnologies (Japan), and Curia Global, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

~250 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

7.4% |

|

Estimated Market Size (Value) |

$261.57 billion by 2031 |

|

Segments Covered |

By Type

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa. |

|

Key Companies |

are Lonza Group Ltd. (Switzerland), Catalent Inc. (U.S.), Patheon (Subsidiary of Thermo Fisher Scientific Inc. (U.S.), Recipharm AB (Sweden), C.H. Boehringer Sohn AG & CO. KG. (Germany), Aurobindo Pharma ltd (India), Jubilant Pharmova Limited (India), Fareva SA (Luxembourg), Vetter Pharma International GmbH (Germany), Aenova Group (Germany), WuXi Biologics Inc. (China), Piramal Enterprises Limited (India), Almac Group (U.K.), Fabbrica Italiana Sintetici S.p.A. (F.I.S.) (Italy), Samsung Biologics Co., Ltd (South Korea), Cambrex Corporation (U.S.), Siegfried Holdings AG (Switzerland), FULJIFILM Diosynth Biotechnologies (Japan), and Curia Global, Inc. (U.S.), WuXi Biologics Inc. (China), Piramal Enterprises Limited (India), Almac Group (U.K.), Fabbrica Italiana Sintetici S.p.A. (F.I.S.) (Italy), Samsung Biologics Co., Ltd (South Korea), Cambrex Corporation (U.S.), Siegfried Holdings AG (Switzerland), FULJIFILM Diosynth Biotechnologies (Japan), and Curia Global, Inc. (U.S.). |

The pharmaceutical contract development and manufacturing market report covers the qualitative and quantitative analysis of the market. This report involves analyzing various segments of pharmaceutical contract development and manufacturing, such as type, end user, and regional and country-level studies. The report also provides insights on factors impacting market growth, regulatory analysis, factor analysis, and Porter’s five forces analysis.

The pharmaceutical contract development and manufacturing market is projected to reach $261.57 billion by 2031 at a CAGR of 7.4% from 2024 to 2031.

Among all the types studied in this report, in 2024, the pharmaceutical manufacturing services segment is expected to account for the largest share, 75.6%, of the pharmaceutical contract development and manufacturing market. The largest share of the segment is attributed to increasing investment in R&D, the need to reduce manufacturing costs, and the increase in demand for high-volume drug manufacturing.

The growth of this market can be attributed to various factors, such as complex manufacturing requirements of the pharmaceutical industry, manufacturers' growing inclination towards the use of innovative technologies, increasing investments in pharmaceutical R&D, patent expiration, and rising demand for generic medicines and biologics are expected to drive the growth of the market. Furthermore, growing demand for cell therapies, gene therapies, and personalized medicines growth in high potency active pharmaceutical ingredients (HPAPI) and antibody-drug conjugates (ADC) markets are expected to offer growth opportunities.

The key players operating in the pharmaceutical contract development and manufacturing market are Lonza Group Ltd. (Switzerland), Catalent Inc. (U.S.), Patheon (Subsidiary of Thermo Fisher Scientific Inc. (U.S.), Recipharm AB (Sweden), C.H. Boehringer Sohn AG & CO. KG. (Germany), Aurobindo Pharma ltd (India), Jubilant Pharmova Limited (India), Fareva SA (Luxembourg), Vetter Pharma International GmbH (Germany), Aenova Group (Germany), WuXi Biologics Inc. (China), Piramal Enterprises Limited (India), Almac Group (U.K.), Fabbrica Italiana Sintetici S.p.A. (F.I.S.) (Italy), Samsung Biologics Co., Ltd (South Korea), Cambrex Corporation (U.S.), Siegfried Holdings AG (Switzerland), FUJIFILM Diosynth Biotechnologies (Japan), and Curia Global, Inc. (U.S.).

Among all the geographies studied in this report, Asia-Pacific is expected to register the highest CAGR of 8.8% during the forecast period. This region’s growth is attributed to its growing geriatric population, rising awareness of overall health and treatment availability, growing healthcare spending, improving healthcare infrastructure, low-cost manufacturing advantages, rising pharmaceutical R&D expenditure, and increasing government funding for drug development and research.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates