Resources

About Us

Europe Pelletized Fertilizer Market Size, Share, Forecast & Trends by Type (Organic, Inorganic, Biofertilizers) Nutrient Content (Nitrogen, Phosphorus, Potassium) Application Method (Broadcasting, Drilling) End-Use - Forecast to 2035

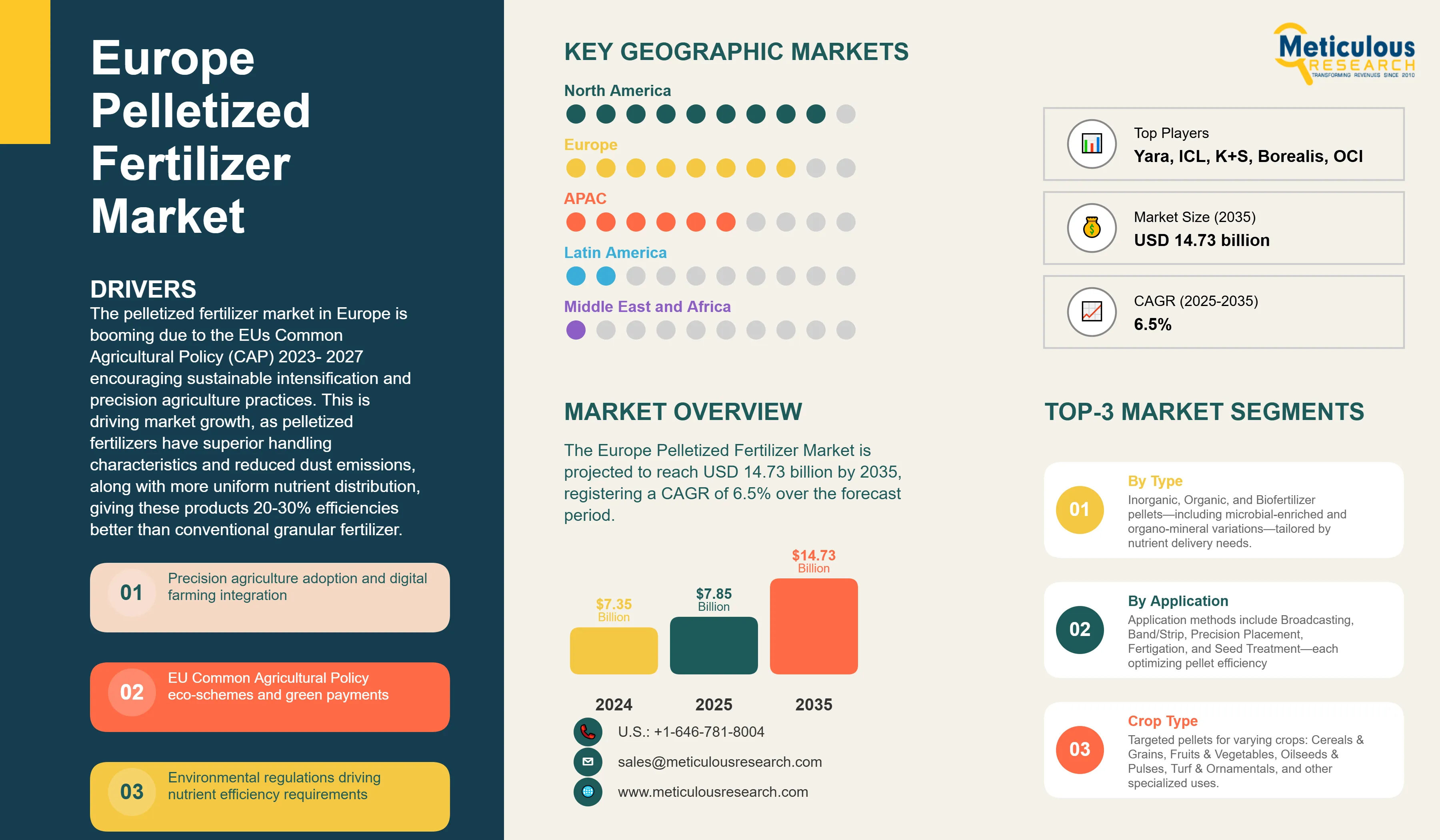

Report ID: MRAGR - 1041567 Pages: 175 Aug-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Pelletized Fertilizer Market was worth USD 7.35 billion in 2024. The market is estimated to be valued at USD 7.85 billion in 2025 and is projected to reach USD 14.73 billion by 2035, registering a CAGR of 6.5% over the forecast period.

Europe Pelletized Fertilizer Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 7.85 billion |

|

Market Value (2035) |

USD 14.73 billion |

|

CAGR (2025-2035) |

6.5% |

|

Largest Product Type |

Inorganic Pelletized Fertilizers (50-60% share) |

|

Fastest Growing Type |

Organic Pelletized Fertilizers (9.5% CAGR) |

|

Leading Nutrient Type |

NPK Complex (40-45% share) |

|

Dominant Application |

Cereals & Grains (30-35% share) |

|

Top Country by Market Size |

Germany |

|

Fastest Growth Country |

Poland |

|

Pelletization Adoption Rate |

40-45% of total fertilizer market |

|

Precision Agriculture Adoption |

30-35% of farms |

Europe Pelletized Fertilizer Market Overview

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Why the Europe Pelletized Fertilizer Market is Growing?

The pelletized fertilizer market in Europe is booming due to the EUs Common Agricultural Policy (CAP) 2023- 2027 encouraging sustainable intensification and precision agriculture practices. This is driving market growth, as pelletized fertilizers have superior handling characteristics and reduced dust emissions, along with more uniform nutrient distribution, giving these products 20-30% efficiencies better than conventional granular fertilizer and lowering application costs by 15-25%.

Growth in the market is also being accelerated by the European Green Deal's Farm to Fork Strategy which aims to reduce fertilizer use by 20% by 2030. Demand for high-efficiency pelletized products is increasing even as fertilizer use declines because, with lower application rates, farmers use less, achieve better yields while using less fertilizer. The introduction of mandatory nutrient management planning in nitrate vulnerable zones that affect 40% of the EU agricultural area creates the demand for precision-application pelletized fertilizers that limit the environmental footprint but allow production on Europe's 157 million hectares of agricultural area.

Europe Pelletized Fertilizer Market Size and Forecast

|

Metric |

Value |

|

Europe Pelletized Fertilizer Market Value (2025) |

USD 7.85 billion |

|

Europe Pelletized Fertilizer Market Forecast Value (2035 F) |

USD 14.73 billion |

|

Forecast CAGR (2025 to 2035) |

6.5% |

Market Segmentation

The Europe pelletized fertilizer market is segmented by product type, nutrient content, crop type, application method, distribution channel, and country. The market is divided by product type into Organic Pelletized Fertilizers, Inorganic Pelletized Fertilizers, and Biofertilizer Pellets. By nutrient content, the market includes Nitrogen-based, Phosphorus-based, Potassium-based, NPK Complex, and Micronutrient-enriched pellets. By crop type, the market encompasses Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals, and Others.

Inorganic Pelletized Fertilizers Lead European Market with 50-60% Share

NPK Complex Pellets Dominate Nutrient Segment with 42-45% Market Share

What are the Drivers, Restraints, and Key Trends of the Europe Pelletized Fertilizer Market?

The market for pelletized fertilizer in Europe is growing mainly due to the growing adoption of precision agriculture, environmental regulations on nutrient application, incentives from the CAP reform, and requirements for sustainable intensification. Furthermore, technological innovations, the growth of organic farming, and the increase of climate-smart agriculture also further enhance the competitiveness behind the market.

Impact of Key Growth Drivers and Restraints on Europe Pelletized Fertilizer Market

Base CAGR: 6.5%

|

Driver |

CAGR Impact |

Key Factors |

|

Precision Agriculture |

+1.8% |

|

|

Environmental Compliance |

+1.6% |

|

|

CAP Eco-Schemes |

+1.2% |

|

|

Efficiency Demands |

+1% |

|

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

Higher Product Costs |

-1.1% |

|

|

Infrastructure Requirements |

-0.7% |

|

|

Market Fragmentation |

-0.5% |

|

Precision Agriculture and Digital Farming Drive Pelletized Fertilizer Market in Europe

Benelux Region: Driving Growth and Innovation in the Pelletized Fertilizer Market

Competitive Landscape

Europe Pelletized Fertilizer Market Growth, By Key Countries

|

Country |

CAGR |

|

Poland |

8.8% |

|

Romania |

8.5% |

|

Spain |

7.8% |

|

Netherlands |

7% |

|

Italy |

6.5% |

|

France |

6.3% |

|

Germany |

6% |

|

Belgium |

5.5% |

|

United Kingdom |

5.1% |

The European pelletized fertilizer market is expected to grow at 6.5% CAGR from 2025-2035, with the fastest growth in Eastern European countries modernizing agricultural practices and Southern European nations adopting efficient water-nutrient management. Poland leads with 8.8% CAGR as 1.4 million farms transition from traditional to modern practices, requiring 2.5 million tonnes additional pelletized fertilizer capacity. Romania follows at 8.5%, leveraging EU funds for agricultural modernization across 8.2 million hectares arable land.

Country-Specific Growth Analysis

Germany's Technology Leadership Maintains 6% Growth Despite Market Maturity (2025-2035)

Netherlands Drives Innovation in the European Palletized Fertilizer Market

Key Players in Europe Pelletized Fertilizer Market Expand Through Innovation and Sustainability

The key companies operating in the palletized fertilizer market are Yara International ASA, ICL Group Ltd., K+S AG, Borealis AG, Grupa Azoty S.A., OCI N.V., EuroChem Group AG, Fertiberia S.A., Rosier SA, BASF SE, Van Iperen International B.V., Haifa Group, COMPO EXPERT GmbH, Frayssinet SAS, ILSA S.p.A., De Sangosse SAS, Koppert Biological Systems, Agrium Europe (Nutrien), and SKW Stickstoffwerke Piesteritz GmbH among others.

Recent Developments in the Europe Pelletized Fertilizer Market

|

Item |

Value |

|

Market Size (2025) |

USD 7.85 Billion |

|

Product Type |

Organic, Inorganic, Biofertilizer Pellets |

|

Nutrient Content |

Nitrogen, Phosphorus, Potassium, NPK Complex, Micronutrients |

|

Crop Application |

Cereals, Fruits & Vegetables, Oilseeds, Turf & Ornamentals |

|

Countries Covered |

Germany, France, United Kingdom, Austria, Switzerland, Netherlands, Belgium, Luxembourg, Italy, Spain, Portugal, Greece, Denmark, Sweden, Finland, Norway, Poland, Czech Republic, Hungary, Romania, Bulgaria. |

|

Key Companies Profiled |

Yara, ICL, K+S, Borealis, Grupa Azoty, OCI, Rosier, EuroChem, Fertiberia |

|

Additional Attributes |

Impact of sustainability, Porter’s Five Forces analysis, precision agriculture adoption, environmental compliance, circular economy integration, carbon footprint assessment, key trends and drivers, key market challenges, competitive dashboard and benchmarking, market ranking/share analysis, key strategic developments, Benelux innovation ecosystem |

he Europe pelletized fertilizer market is estimated to be valued at USD 7.85 billion in 2025.

The market size for Europe pelletized fertilizer is projected to reach USD 14.73 billion by 2035.

The Europe pelletized fertilizer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

Inorganic pelletized fertilizers command 50-60% market share driven by established infrastructure and immediate nutrient availability.

Benelux leads innovation with Netherlands achieving world's highest agricultural productivity using advanced pelletized fertilizers, Belgium showing 40% adoption rate, and Luxembourg demonstrating sustainable intensification models.

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jun-2022

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates