Resources

About Us

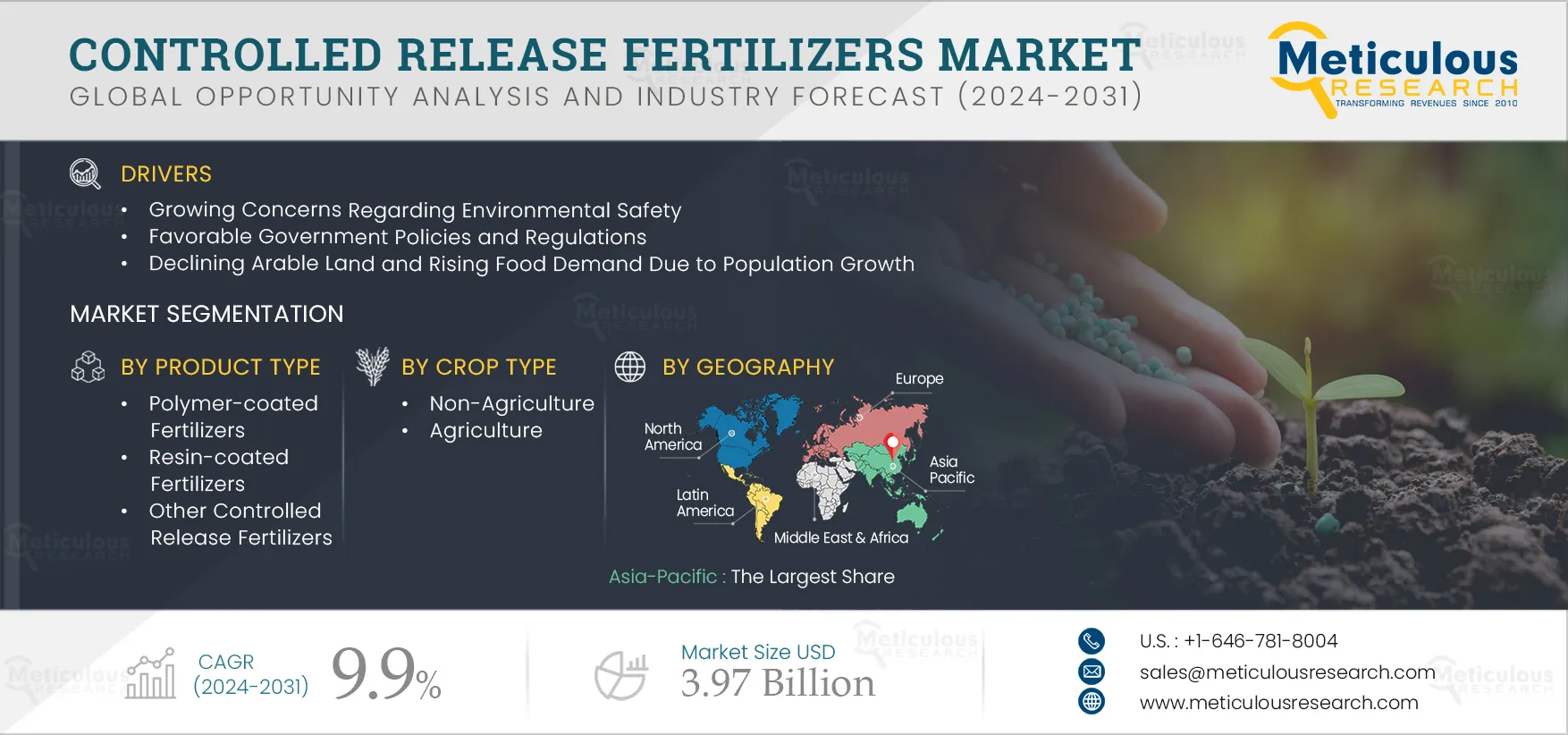

Controlled Release Fertilizers Market by Product Type (Polymer-coated, Resin-coated), Mode of Application (Top-dressing, Dibbling), Crop Type (Non-Agriculture {Turf, Nurseries}, Agriculture {Fruits & Vegetables, Cereals & Grains}) - Global Forecast to 2032

Report ID: MRAGR - 104793 Pages: 180 Jan-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe market's expansion is fueled by growing concerns regarding environmental safety, favorable government policies and regulations, declining arable land, and rising food demand due to population growth. However, challenges such as the high production costs, rapid growth of the organic fertilizer industry, and high cost of organic coating materials partially impede the market's growth to some extent.

The rising adoption of precision farming technology and increasing government initiatives for sustainable agriculture practices are further anticipated to generate opportunities for market growth. Nevertheless, the substantial challenge faced by stakeholders in this market is the lack of awareness among farmers.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 3 to 4 years. The key players profiled in the Controlled Release Fertilizers Market research report are Nutrien Ltd. (Canada), Yara International ASA (Norway), The Mosaic Company (U.S.), ICL Group Ltd. (Israel), Haifa Group (Israel), EuroChem Group AG (Switzerland), Kingenta Ecological Engineering Group Co., Ltd (China), Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) (India), Nufarm Ltd. (Australia), and Smart Fert Sdn Bhd. (Malaysia).

Click here to: Get Free Sample Pages of this Report

Arable land is one of the most important resources required to increase agricultural productivity. Numerous cultivation techniques and inputs, such as synthetic fertilizers and crop protection chemicals, have emerged during the last decade, resulting in the overutilization of land resources, soil pollution, and diminished agricultural productivity.

According to FAO projections, per capita arable land may decrease from 0.21 hectares per person in 2024 to 0.18 hectares per person in 2050. Further, according to the United Nations Food and Agriculture Organization’s (FAO) Global Assessment of Land Degradation and Improvement (GLADA), globally, around two billion hectares of agricultural land have been degraded since the 1950s. Land degradation is one of the world’s most critical environmental problems, which will continue to worsen without rapid remedial action. Globally, around 25% of the total land area had been degraded till 2022. Land degradation releases soil carbon and nitrous oxide into the atmosphere, making it a significant contributor to climate change. Scientists have warned that 24 billion tons of fertile soil are lost annually due to unsustainable agricultural practices (Source: Global Environment Facility). If this trend continues, 95% of the world’s land area is expected to be degraded by 2050.

Moreover, Africa and Latin America have the highest proportions of degraded agricultural land. Countries whose economies are largely dependent on agriculture have registered negative trends in land availability. The latest data published by India’s Ministry of Agriculture shows that as many as 20 states in India have reported a decrease of up to 790,000 hectares of cultivable land in the last 4–5 years. This decrease is mainly attributed to the diversion of cultivable land for non-agricultural purposes, including construction, industries, and other development.

On the other hand, the world population is growing rapidly. According to the Department of Economic and Social Affairs (UN), the global population is expected to reach 8.6 billion by 2032, 9.8 billion by 2050, and 11.2 billion by 2100. This growing global population has increased the pressure on the world’s agricultural resources to provide more and different types of food. The demand for nutrient-dense and residue-free food products has also increased due to consumers’ growing health awareness, socio-economic changes, increased incomes, and rapid urbanization. Thus, the growing population is driving the demand for crops for food, feed, and fuel, boosting the need to increase crop yield. Since crop yields are becoming increasingly important, the demand for cost-effective strategies to boost crop yields is also rising significantly. Also, reductions in agricultural land have compelled agricultural producers to become more efficient and productive.

According to the Food and Agriculture Organization (FAO), the demand for cereals for human consumption and animal feed is projected to reach 3 billion tonnes by 2050, an increase from 2.1 billion tonnes in 2018. In addition, the rising demand for biofuels will continue to exert upward pressure on commodity prices, affecting food security and poverty levels in developing countries. Thus, fertilizers and modern agricultural practices with advanced technologies are necessary for breaking yield barriers and enhancing crop productivity to meet the rising global demand for food while ensuring the safety of the environment.

Controlled release fertilizers increase agriculture productivity by providing a slow and steady release of nutrients to plants over an extended period. This ensures that the plants receive a continuous supply of essential elements, promoting healthy growth and development. Thus, the declining arable land and rising demand for food are expected to boost the adoption of controlled release fertilizers, driving the growth of this market.

Based on type, the controlled release fertilizers market is segmented into polymer-coated fertilizers, resin-coated fertilizers, and other controlled release fertilizers. In 2025, the polymer-coated fertilizers segment is expected to account for the largest share of the global controlled release fertilizers market. The significant market share of this segment is primarily attributed to the growing demand for polymer-coated fertilizers due to the advantages offered by polymer-coated fertilizers, such as prolonged nutrient release, reduced leaching, and improved nutrient absorption by plants. Additionally, the increasing adoption of precision farming technologies and rising technological advancements in fertilizer coating are further expected to support the growth of this market. Moreover, the government regulations and initiatives aimed at reducing the environmental impact of fertilizers are encouraging farmers to switch to controlled release fertilizers is further anticipated to boost the demand for controlled release fertilizers across the globe during the forecast period.

However, the resin-coated fertilizers segment is expected to register the highest CAGR during the forecast period of 2025–2032, owing to the increasing popularity of resin-coated fertilizers among farmers. Resin-coated fertilizers provide a more controlled and precise release of nutrients, ensuring that plants receive the right amount at the right time. Thus, factors such as high fertilizer use efficiency, high longevity compared to polymer-coated fertilizers, low leaching of nutrients, and lower environmental contamination are further expected to support the growth of this market during the forecast period.

Based on mode of application, the controlled release fertilizers market is segmented into top-dressing, dibbling, and incorporation. In 2025, the top-dressing segment is expected to account for the largest share of the global controlled release fertilizers market. The significant market share of this segment is primarily attributed to its high preference among farmers due to its ease of application and effectiveness in delivering nutrients directly to the plant's root zone. Moreover, this mode of application of controlled release fertilizers not only reduces the risk of nutrient leaching and runoff but also minimizes the need for frequent application, making it a preferred choice for farmers and gardeners, which is further anticipated to drive the growth of this market during the forecast period.

Based on crop type, the global controlled release fertilizers market is segmented into non-agriculture and agriculture. In 2025, the non-agriculture segment is expected to account for the larger share of the global controlled release fertilizers market. The large market share of this segment is mainly attributed to the increasing demand for controlled release fertilizers in landscaping, gardening, and turf management applications. Moreover, the growing trend of urbanization and the rising interest in aesthetically pleasing green spaces is also expected to drive the demand for controlled release fertilizers for non-agriculture use across the globe. Additionally, factors such as high purchasing power, increasing environmental issues, and large-scale turf production in lawns, greenhouses, nurseries, and gardens due to growing ecotourism are further anticipated to drive the growth of the controlled release fertilizers market for non-agriculture across the globe. Based on type, the global controlled release fertilizers market for non-agriculture is further segmented into turf & ornamental, nurseries & greenhouse, and other non-agriculture crops.

However, the agriculture segment is expected to register the highest CAGR during the forecast period of 2025–2032, owing to the increasing demand for sustainable farming practices and the need for high crop yields. Controlled release fertilizers offer several benefits to the agriculture sector, including reduced nutrient loss, improved nutrient availability, and enhanced crop quality. Thus, all these factors are further expected to drive the growth of the controlled release fertilizers market for agriculture across the globe.

Based on geography, the global controlled release fertilizers market is majorly segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of the global controlled release fertilizers market. The significant market share in this sector can be attributed to the presence of a large number of key controlled release fertilizer providers in the region, a huge area under agricultural production, and the growing support from various organizations & governments to enhance crop cultivation and rapidly increasing area under turf and landscaping activities. Additionally, the rising population and increasing food demand in countries like China and India are also driving the growth of the controlled release fertilizers market in the Asia-Pacific region. Moreover, the adoption of advanced farming techniques and the need for sustainable agriculture practices are further expected to contribute to the market's expansion in the upcoming years in this region.

|

Particular |

Details |

|

Number of Pages |

~180 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR |

9.9% |

|

Estimated Market Size (Value) |

$3.97 Billion by 2032 |

|

Estimated Market Size (Volume) |

NA |

|

Segments Covered |

By Product Type

By Mode of Application

By Crop Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, Spain, Italy, U.K., Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Nutrien Ltd. (Canada), Yara International ASA (Norway), The Mosaic Company (U.S.), ICL Group Ltd. (Israel), Haifa Group (Israel), EuroChem Group AG (Switzerland), Kingenta Ecological Engineering Group Co., Ltd (China), Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) (India), Nufarm Ltd. (Australia), and Smart Fert Sdn Bhd. (Malaysia). |

The Controlled Release Fertilizers Market focuses on fertilizers that release nutrients over an extended period, enhancing agricultural productivity by providing a consistent nutrient supply, promoting healthy plant growth while minimizing environmental impact.

Valued at $1.89 billion in 2024, the Controlled Release Fertilizers Market is projected to reach $3.97 billion by 2032, growing from an estimated $2.05 billion in 2025 at a CAGR of 9.9% during the forecast period.

The Controlled Release Fertilizers Market is anticipated to grow significantly, reaching $3.97 billion by 2032, driven by rising environmental concerns and the need for sustainable agricultural practices, alongside the pressures of declining arable land.

The Controlled Release Fertilizers Market is estimated to be valued at $2.05 billion in 2025 and projected to expand to $3.97 billion by 2032, demonstrating substantial growth potential driven by increased agricultural demands.

Key companies include Nutrien Ltd., Yara International ASA, The Mosaic Company, ICL Group Ltd., Haifa Group, EuroChem Group AG, Kingenta Ecological Engineering, Deepak Fertilisers, Nufarm Ltd., and Smart Fert Sdn Bhd, focusing on innovation and market expansion.

The market trend leans towards sustainable agricultural practices, with a growing adoption of precision farming and government initiatives aimed at enhancing crop yield and reducing environmental impact through controlled release fertilizers.

Key drivers include increasing food demand due to population growth, environmental concerns regarding soil health, government policies supporting sustainable agriculture, and the need for efficient nutrient delivery to improve crop yields.

Segments include product types (polymer-coated, resin-coated, and other controlled release fertilizers), modes of application (top-dressing, dibbling, incorporation), and crop types (agriculture and non-agriculture applications).

The global outlook is positive, with increasing adoption of controlled release fertilizers across regions, especially in Asia-Pacific, driven by population growth, urbanization, and a strong demand for sustainable agricultural practices.

The market is projected to grow at a CAGR of 9.9% from 2025 to 2032, driven by the rising need for effective and sustainable fertilizers, addressing challenges posed by declining arable land and increasing food production demands.

The Controlled Release Fertilizers Market is projected to grow at a CAGR of 9.9% from 2025 to 2032, reflecting the increasing demand for sustainable agricultural solutions and advanced fertilization technologies.

Asia-Pacific is expected to dominate the Controlled Release Fertilizers Market in 2025, attributed to a large agricultural area, numerous fertilizer providers, and rising food demand in countries like China and India.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jun-2022

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates