Resources

About Us

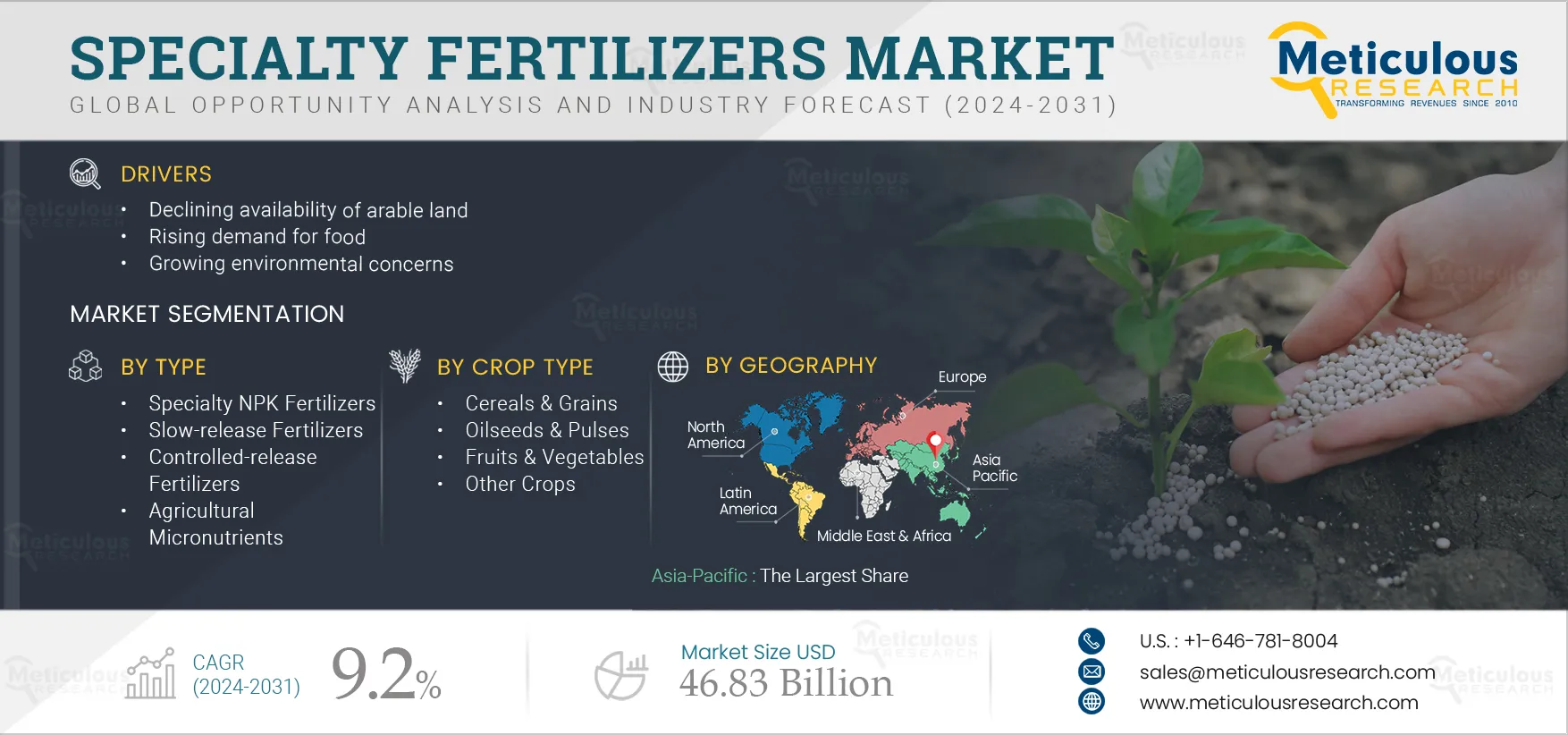

Specialty Fertilizers Market Size, Share, Forecast, & Trends Analysis by Type (Slow-release {Sulfur-coated Urea}, Controlled-release Fertilizer, Micronutrients), Form (Dry), Mode of Application (Fertigation), Crop Type (Cereals & Grains)- Forecast to 2031

Report ID: MRAGR - 104984 Pages: 280 Jan-2024 Formats*: PDF Category: Agriculture Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the declining availability of arable land and the rising demand for food, growing environmental concerns, and favorable government policies and regulations. Moreover, rising adoption of precision farming technologies is expected to offer growth opportunity for the players operating in this market.

Heavy use of synthetic agricultural inputs raises environmental concerns by causing serious damage to the fauna and flora of freshwater. Extensive use of these synthetic agriculture inputs directly affects the environment as residues of chemical fertilizers stay in the soil and cause soil pollution, contaminate surface or groundwater, or get released into the atmosphere through vitalization. These residues left in the soil emit ammonia, methane, nitrous oxide, and elemental nitrogen into the environment. Nowadays, growing awareness about the adverse effects of agrochemicals on plant physiology, soil quality, animals, and human beings calls for sustainable farming practices.

The increasing challenges of water and soil pollution caused by the heavy applications of commodity fertilizers, the global fertilizer industry shifted towards the development of specialty fertilizers (water-soluble fertilizers, liquid fertilizer), and some institutions and organizations are engaged in creating and encouraging farmers to use these fertilizers Specialty fertilizers are designed to provide targeted nutrients to specific crops, minimizing the risk of over-fertilization and reducing the potential for soil pollution. Thus, increasing concerns regarding environmental safety is expected to boost the demand for specialty fertilizers market.

Click here to: Get Free Sample Pages of this Report

Arable land is one of the most important resources required to increase agricultural productivity. Numerous cultivation techniques and inputs, such as synthetic fertilizers and crop protection chemicals, have emerged during the last decade, resulting in the overutilization of land resources, soil pollution, and diminished agricultural productivity. According to FAO projections, per capita arable land may decrease from 0.21 hectares per person in 2023 to 0.18 hectares per person in 2050.

On the other hand, the world population is growing rapidly. According to the Department of Economic and Social Affairs (UN), the global population is expected to reach 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100. This growing global population has increased the pressure on the world’s agricultural resources to provide more and different types of food. The demand for nutrient-dense and residue-free food products has also increased due to consumers’ growing health awareness, socio-economic changes, increased incomes, and rapid urbanization. Specialty fertilizers are used to provide essential nutrients to plants, enhance soil fertility, and ensure strong vegetative growth for increased crop output. Thus, the decreasing arable land and rising demand for food are expected to boost the adoption of specialty fertilizers, driving the growth of this market.

Global agricultural systems are facing numerous unprecedented challenges, including food security due to climate change. Advanced nanoengineering has emerged as a valuable tool for boosting crop yields and ensuring sustainability. The fertilizers industry is adopting nanotechnology to increase nutrient use efficiency. Nanofertilizers are nutrient carriers with nano-dimensions ranging from 30 to 40 nm. They can carry a multitude of nutrients and release them slowly and steadily as per crops’ requirements.

Nanostructured formulations reduce nutrient leaching. For example, nano urea liquid, which is cheaper and more effective than granular urea, reduces nutrient loss and environmental pollution. Thus, nanofertilizers have emerged as an important tool in improving crop growth, yield, and quality due to their increased nutrient use efficiency and reductions in fertilizer wastage and cost of cultivation. As a result, market players are increasing their focus on the development of nanofertilizers.

Precision farming utilizes advanced technologies, including Global Positioning Systems (GPS), Geographic Information Systems (GIS), sensors, drones, and data analytics tools to optimize agricultural practices and enhance crop productivity. Precision farming technologies, such as GPS-guided machinery and Variable Rate Technology (VRT), enable farmers to apply specialty fertilizers with high precision.

Specialty fertilizers play an important role in precision farming as they are capable of providing the right dosage of nutrients to crops at the right time. Also, specialty fertilizers supply necessary amounts of nutrients to crops and prevent soil toxification due to over-fertilization. Data on crop nutrient deficiencies can be used to control the delivery of nutrients to crops, maximizing fertilizer use efficiency and agricultural productivity. Thus, the rising adoption of precision farming technologies is expected to boost the utilization of specialty fertilizers, generating market growth opportunities during the forecast period.

Based on type, the specialty fertilizer market is mainly segmented into specialty NPK fertilizers, slow-release fertilizers (sulfur-coated urea and other slow-release fertilizers), controlled-release fertilizers, agricultural micronutrients, and other fertilizers. In 2024, the specialty NPK fertilizer segment is expected to account for the largest share of 60.9% of the global specialty fertilizer market. The large market share of this segment is mainly attributed to factors such as the growing population and the need to improve crop yields and soil fertility, the increasing demand for balanced nutrient solutions in agriculture, and the rising adoption of precision farming techniques. Moreover, the rising focus of governments in various countries to promote specialty urea fertilizers, advancements in fertilizer manufacturing techniques, and rising companies' focus on the development of customized formulations are further expected to support the growth of this market across the globe.

Moreover, slow-release fertilizer is further segmented into sulfur-coated urea and other slow-release fertilizers. In 2024, the sulfur-coated urea segment is expected to account for the larger share of the global slow-release fertilizer market owing to the rising need for improved crop yield and nutrient management in agriculture, increasing demand for high-efficiency fertilizers, and growing government support.

However, the agricultural micronutrients segment is projected to witness the highest growth rate of 10.4% during the forecast period of 2024–2031. due to rising micronutrient deficiency in the soil, increasing awareness of uses of micronutrients for crop production, rising government policies, and various organizations encouraging the use of micronutrients and increasing the production of fruits and vegetables which is heavy feeder of micronutrients.

Based on form, the global specialty fertilizer market is segmented into dry specialty fertilizers and liquid specialty fertilizers. In 2024, the dry specialty fertilizers segment is expected to account for the larger share of 85.9% of the global specialty fertilizers market. The large market share of this segment is mainly attributed to the increasing adoption of controlled-release and slow-release fertilizers and the high efficacy and easier applicability of dry specialty fertilizers. Moreover, its cost-effectiveness, longer shelf life, ability to provide long-term release of nutrients, and high efficiency in all climatic conditions over its counterparts further support the growth of this market.

Based on application, the global specialty fertilizers market is segmented into fertigation, soil application, and foliar spray. In 2024, the fertigation segment is expected to account for the largest share of 43.5% of the global specialty fertilizers market. The large market share of this segment is attributed to the high use of drip irrigation in crop production, increasing preference for drip irrigation, high availability of water-soluble and liquid fertilizers, rising automation in irrigation methods, and rising precision agricultural practices.

However, the foliar spray segment is projected to register the highest CAGR of 9.5% during the forecast period of 2024–2031. The growth of this segment is driven by the increasing product launches by manufacturers suitable for foliar application, growing farmer preference for foliar spray due to its ability to offer more precise nutrient delivery to plants and rapid nutrient absorption with easy and uniform application, and growing advancement in spraying technologies.

Based on crop type, the specialty fertilizers market is mainly segmented into cereals & grains, fruits & vegetables, oilseeds & pulses, and other crops. In 2024, the cereals & grains segment is expected to account for the larger share of 50.7% of the global specialty fertilizers market. The large market share of this segment is mainly attributed to factors such as the rising demand for food grains due to the growing population, high area under cereals and grains production such as wheat, maize, rice, and barley, and increasing industrial application of cereals and grains.

However, the fruits & vegetables segment is projected to register the highest CAGR of 10.3% during the forecast period of 2024–2031. The growth of this segment is driven by the increasing area of fruit and vegetable cultivation and the growing demand for chemical-free organic fruits and vegetables.

Based on geography, the global specialty fertilizers market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of 57.4% of the global specialty fertilizers market, followed by Europe and North America. Asia-Pacific specialty fertilizer market is estimated to be worth USD 14.48 billion in 2024. The large share of this market is mainly attributed to the presence of major specialty fertilizers suppliers in the region, a huge area under agriculture production, rising demand for high-yield crop products, and the growing support from various organizations & governments to enhance crop cultivation.

However, Latin America is slated to register the highest CAGR of 10.5% during the forecast period of 2024–2031, mainly due to the rapidly growing population, a huge agricultural area, rising demand for specialized agriculture input products, rising government support for the agricultural sector, increasing adoption of advanced agricultural techniques, and rising focus of various manufactures in the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the specialty fertilizers market are Nutrien Ltd. (Canada), Coromandel International Limited (India), Haifa Group (Israel), Yara International ASA (Norway), ICL Group Ltd. (Israel), EuroChem Group AG (Switzerland), Kingenta Ecological Engineering Group Co., Ltd (China), The Mosaic Company (U.S.), Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) (India), Sociedad Química y Minera de Chile S.A. (Chile), and Kugler Company (U.S.).

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value) |

USD 46.83 Billion by 2031 |

|

Market Size (Volume) |

38,680.6 KT by 2031 |

|

Segments Covered |

By Type

By Form

By Mode of Application

By Crop Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, Spain, Italy, U.K., Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Nutrien Ltd. (Canada), Coromandel International Limited (India), Haifa Group (Israel), Yara International ASA (Norway), ICL Group Ltd. (Israel), EuroChem Group AG (Switzerland), Kingenta Ecological Engineering Group Co., Ltd (China), The Mosaic Company (U.S.), Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) (India), Sociedad Química y Minera de Chile S.A. (Chile), and Kugler Company (U.S.) |

Specialty fertilizers are sources of nutrients that are applied in special conditions of soil and plants for special action in plants to achieve higher efficiency. These fertilizers are innovated with the help of different technologies to achieve optimum crop yield and quality. Specialty fertilizer significantly reduces possible nutrient losses and increases uptake by plants through gradual nutrient release.

The specialty fertilizer is different from general fertilizer as the NPK rate is adjusted according to the crop requirement, and the application of these fertilizers varies accordingly. Different technologies are used for the manufacturing of these fertilizers, such as coating with different materials, nanotechnology, and liquefaction.

There is no universal definition or category of specialty fertilizers. The International Fertilizer Association (IFA) included controlled-release fertilizers (CRFs), slow-release fertilizers (SRFs), sulfur-coated urea (SCU), stabilized nitrogen fertilizers (SNFs), WSFs, liquid NPKs, and chelated micronutrients and boron in their assessment study of the global market for special products. In this study, all these types of specialty fertilizers are covered. The stakeholders in this market are raw material suppliers, manufacturers, distributors, dealers, and end-users of specialty fertilizers.

The specialty fertilizers market study provides valuable insights such as market size and forecast in terms of both value and volume by type, country/region, and in terms of value for segmentation based on formulation, application, and crop type.

The global specialty fertilizers market is projected to reach $46.83 billion by 2031, at a CAGR of 9.2% during the forecast period.

Specialty NPK fertilizers segment is expected to hold a major share during the forecast period of 2024–2031.

Foliar spray segment is expected to witness the fastest growth during the forecast period of 2024–2031.

The declining availability of arable land and the rising demand for food, growing environmental concerns, and favorable government policies and regulations are factors supporting growth of this market. Moreover, rising adoption of precision farming technologies creates opportunity for players operating in this market.

The key players operating in the specialty fertilizers market are Nutrien Ltd. (Canada), Coromandel International Limited (India), Haifa Group (Israel), Yara International ASA (Norway), ICL Group Ltd. (Israel), EuroChem Group AG (Switzerland), Kingenta Ecological Engineering Group Co., Ltd (China), The Mosaic Company (U.S.), Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) (India), Sociedad Química y Minera de Chile S.A. (Chile), and Kugler Company (U.S.).

Latin America is slated to register the highest CAGR of 10.5% during the forecast period of 2024–2031, mainly due to the rapidly growing population, a huge agricultural area, rising demand for specialized agriculture input products, rising government support for the agricultural sector, increasing adoption of advanced agricultural techniques, and rising focus of various manufactures in the region.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Jun-2022

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates