Enterprise Mobility Management Enables Secure, Scalable Operations in Hybrid Work Environments

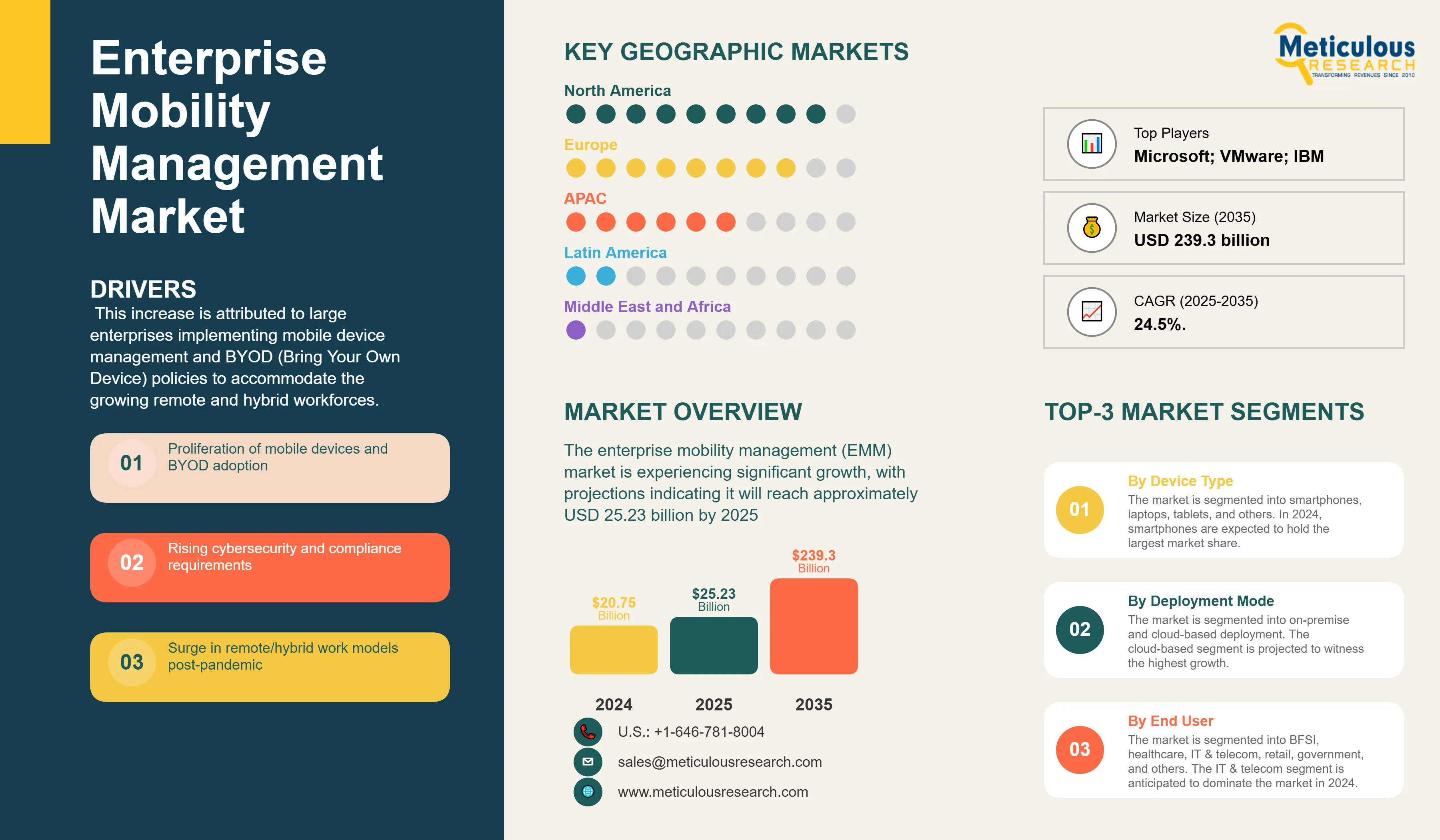

The enterprise mobility management (EMM) market is experiencing significant growth, with projections indicating it will reach approximately USD 25.23 billion by 2025, an increase from around USD 20.75 billion in 2024, reflecting a strong compound annual growth rate (CAGR) of 24.5%.

This increase is attributed to large enterprises implementing mobile device management and BYOD (Bring Your Own Device) policies to accommodate the growing remote and hybrid workforces. Cloud-native EMM solutions that provide real-time device security and application management are fundamental to this growth. North America currently dominates the enterprise mobility management (EMM) market in terms of revenue, driven by its mature IT infrastructure and early adoption of mobility solutions across industries. Meanwhile, the Asia-Pacific region is projected to record the highest growth rate, supported by government-led digital transformation initiatives and increasing corporate investment in mobile security solutions. Furthermore, rising regulatory compliance demands—such as GDPR in Europe and HIPAA in the United States—coupled with the growing complexity of mobile endpoint management, are compelling enterprises to accelerate EMM adoption to secure sensitive data, ensure regulatory alignment, and enhance workforce productivity.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The EMM industry is highly competitive, with prominent providers like Microsoft (Intune), VMware (Workspace ONE), IBM, Cisco, and Citrix dominating commercial and government deployments. Microsoft Intune is the market leader in AI-powered compliance automation, whereas VMware's Workspace ONE prioritises zero-trust security in the face of growing ransomware threats. Emerging players concentrate on AI-powered threat intelligence and context-aware security. Partnerships between EMM providers and telecom carriers accelerate adoption in regulated industries such as healthcare and banking. The pace of scalable, consistent AI integration and cloud compatibility has become increasingly important in determining vendor viability.

Recent Developments

Microsoft Advances Compliance Automation in Intune

In February 2025, Microsoft increased the compliance automation of its Intune platform, enabling real-time patching and fully automated device provisioning. This has resulted in a 30% reduction in onboarding time, which mostly benefits regulated sectors.

VMware Integrates AI-Driven Zero-Trust Security

In April 2025, VMware added AI-powered zero-trust endpoint security to Workspace ONE to meet the growing threat landscape in mobile-first businesses. Additionally, the company recorded a 59% decrease in successful ransomware incidents compared to the previous year.

Key Market Drivers

- Expansion of Remote and Hybrid Workforces: Remote and hybrid work adoption has significantly increased in recent years, with 22.9% of U.S. employees working from home in early 2024, and about 34.8% of professionals in management and technical roles doing so as of November 2023 (Bureau of Labor Statistics). To support this shift, 82% of organizations plan to implement or enhance mobile device management tools by 2024, aiming to maintain flexibility while managing risk.

- Growing Adoption of BYOD Policies with Real-Time Security Needs: By 2024, 59% of enterprises had adopted Bring‑Your‑Own‑Device (BYOD) policies, intensifying the demand for robust mobile threat defense solutions and strict access policy enforcement to protect sensitive corporate data. With rising security threats and regulatory mandates, organizations are increasingly deploying MDM and MCM tools to manage compliance, enforce encryption, and restrict unauthorized access—all essential for safeguarding corporate assets in a mobile-first environment.

- Shift Towards Unified Endpoint Management (UEM) and Cloud-Native Solutions: As organizations transition from fundamental MDM solutions, they are increasingly looking for UEM platforms capable of managing a diverse range of device types, including IoT devices and laptops. Cloud-based EMM/UEM solutions significantly decrease deployment time and reduce operational costs, making them attractive for distributed workforces and intricate IT environments.

- Intensifying Regulatory Compliance in Sensitive Sectors: Increased regulation within healthcare, finance, and government necessitates the swift adoption of EMM to guarantee data privacy and compliance with regulations. A 2024 IDC report highlights that over 62% of enterprises in healthcare and 58% in banking have integrated EMM platforms primarily to comply with data protection regulations and manage security risks stemming from employee‑owned devices. Regulatory pressures are expected to accelerate double‑digit EMM market growth through 2027, particularly in sectors where compliance is non‑negotiable.

Key Market Restraints

- Integration Complexity and Fragmented Infrastructure: The proliferation of multiple vendors and the absence of standardized interoperability present significant challenges for enterprises in adopting Enterprise Mobility Management (EMM) solutions. These issues notably slow adoption rates, especially among small and medium-sized businesses, thereby constraining market growth. The complexity of integration results in extended rollout periods and increased expenses, prompting the industry to seek consolidation and collaborative development of standards.

- Talent Gaps and Cultural Resistance: Although technology has improved, full adoption of EMM is still limited by cultural barriers within companies. According to a 2024 (ISC)² Cybersecurity Workforce Study, the global cybersecurity workforce shortage reached approximately 3.5 million professionals, with mobile security and endpoint management expertise among the most critical gaps. Users often perceive EMM as intrusive surveillance, fearing excessive monitoring of personal devices and activities, especially under BYOD policies. This can lead to reluctance in embracing required security protocols.

- Total Cost of Ownership Concerns: Subscription and ongoing integration expenses can sometimes surpass initial licensing costs, especially in organizations with constrained IT resources or insufficient cloud migration strategies, resulting in budget overruns and postponed ROI realization. According to a 2023 industry survey by Gartner, the average total implementation cost for mid-sized enterprises ranged between $150,000 and $500,000, including all associated expenses. Small and medium-sized businesses may incur lower costs but face higher per-device expenses due to lack of scale.

Table: Key Factors Impacting Global AI in Social Media Market (2025–2035)

Base CAGR: 24.5%

|

Category

|

Key Factor

|

Short-Term Impact (2025–2028)

|

Long-Term Impact (2029–2035)

|

Estimated CAGR Impact

|

|

Drivers

|

1. Proliferation of Generative AI Remote/Hybrid Workforce Growth Content Creation

|

Enhanced remote collaboration

|

Seamless AI-driven workforce scaling

|

▲ +5.8%

|

| |

2. BYOD and Real-Time Security

|

Increased device flexibility

|

Mature secure BYOD ecosystems

|

▲ +4.5%

|

| |

3. Real-Time Automated Moderation and Trust Building

|

Faster threat detection

|

Robust, AI-powered trust layers

|

▲ +3.9%

|

|

Restraints

|

1. Integration and Data Privacy

|

Complex system integrations

|

Strict privacy framework adoption

|

▼ −2.1%

|

| |

2. Total Cost of Ownership

|

High initial deployment costs

|

Lower costs via optimized licensing

|

▼ −2.5%

|

|

Opportunities

|

1. Adoption of AI-driven security and analytics tools

|

Improved real-time risk insights

|

Holistic AI security platforms

|

▲ +4.1%

|

| |

2. Increased demand for unified endpoint management (UEM)

|

Consolidated endpoint control

|

Standardized UEM adoption

|

▲ +3.6%

|

|

Trends

|

1. Shift to cloud-based and SaaS-delivered EMM platforms

|

Rapid solution deployments

|

Predominant cloud-native EMM usage

|

▲ +2.9%

|

|

Challenges

|

1. Privacy concerns for employee device monitoring

|

Employee data sharing hesitation

|

Mature privacy-preserving solutions

|

▼ −1.6%

|

Regional Analysis

EMM Adoption Driven by Security, Hybrid Work, and Regulatory Standards in North America

North America continues to dominate the market, with EMM revenues expected to reach USD 8.09 billion in 2025 and grow at a projected CAGR of 21% until 2035. The dominance of this region is established on advanced enterprise mobility maturity throughout the U.S. and Canada, widespread adoption in regulated industries such as healthcare, banking, and government, along with progressively rigorous compliance requirements (HIPAA, CCPA, and others). Over 70% of Fortune 500 companies currently utilize unified endpoint management (UEM) to oversee both mobile and IoT assets. Cloud-native Enterprise Mobility Management (EMM) solutions are demonstrating superior performance compared to on-premise alternatives, offering reduced implementation times and significant cost savings. Between 2024 and 2025, managed mobility contracts grew by 19%, driven largely by demand from utility and public sector organizations. In complex and decentralized environments, strategic partnerships between telecom carriers and software providers are enhancing deployment efficiency and streamlining integration processes.

Government and Industry Accelerate EMM, Led by China, India, and South Korea

The EMM market in Asia-Pacific is expected to reach USD 5.80 billion in 2025, expanding at a CAGR of 24%, making it the fastest-growing region in the world. China has launched multiple government programs, such as the “Digital China” initiative, which emphasizes secure mobile and IoT infrastructure across the public and private sectors. Investments in cloud-based EMM platforms have surged by over 25% in 2024, particularly within government agencies and large enterprises.

India’s Digital India program is aggressively promoting secure mobile environments to support its expanding IT and services sectors. With over 30% growth in managed mobility contracts in 2024, Indian enterprises are increasingly adopting cloud-native EMM solutions to comply with data privacy regulations and facilitate remote work.

South Korea continues to invest heavily in mobile security and unified endpoint management through its Smart Korea initiative, aiming to bolster cybersecurity resilience. South Korean organizations report a 22% increase in EMM deployment across telecom, manufacturing, and finance sectors, supported by partnerships between telecom carriers and software providers.

Country-level Analysis

Compliance and Cloud Adoption Propel U.S. Enterprise Mobility Management Market

The U.S. leads all countries with EMM revenue of USD 6.01 billion in 2025, accounting for 25-30% of the global market and heading toward USD 65.6 billion by 2035 at 21% CAGR. Federal and state agencies are increasingly deploying platforms such as ServiceNow and Appian to digitize government workflows and benefits processing. Meanwhile, private sector adoption is accelerating across finance, healthcare, and logistics industries. Heightened regulatory pressures, particularly around the California Consumer Privacy Act (CCPA) and zero-trust security frameworks, have driven substantial new investments in AI-powered policy automation and advanced endpoint monitoring solutions. The U.S. continues to be a dominant force in scaling managed services, with this segment expanding at twice the rate of software licensing, as organizations address critical skills shortages and escalating cyber threats.

Manufacturing and Urban Modernization Anchor EMM Uptake in China

In 2024, China's EMM market achieved a value of USD 1.38 billion, with a projected compound annual growth rate of 24.2% anticipated through 2035. Thorough government digitalization strategies, proactive smart city implementations in leading urban areas, and ongoing investments from manufacturers have rendered EMM indispensable in logistics, automotive, and public works industries. Additionally, the introduction of localized compliance regulations concerning cybersecurity law is driving an increased demand for policy-based device management. Also, the collaborative alliances with national telecom operators and cloud service providers facilitate large-scale deployment, as local vendors experience an increase in contracts for tailored industry solutions.

Germany: Data Privacy Underpins Rapid Market Expansion

Germany is anticipated to achieve USD 10.6 billion in EMM revenues by 2035, with a compound annual growth rate (CAGR) of 22%. EMM is a key component of operational change, driven by Industry 4.0 initiatives in the automotive and manufacturing sectors. Germany's GDPR-aligned compliance landscape emphasizes security and audit trail features. This makes enterprise MDM/MAM deployment possible for both frontline and back-office workers. Although the government funds several trial programs to test real-time logistics tracking and secure field service management, the banking industry was pioneer in adopting EMM services owing to regulations.

Segmental Analysis

Enterprise Mobility Software Drives Market Leadership with Security and Device Management Advantages

In 2024, the software segment possessed the largest market share, exceeding 70-80%. Enterprise mobility software plays a critical role in enhancing the security of employees’ mobile devices, safeguarding sensitive corporate data. Key benefits include granular control over content access, the ability to update content across multiple devices simultaneously, and robust protection against data breaches. These capabilities are driving positive market momentum. Furthermore, the market is expected to expand significantly, fueled by the increasing availability of diverse EMM software portfolios and continuous advancements in technology.

Cloud-Based EMM Platforms Dominate with Scalable Security and Cost-Efficient Deployments

In 2024, the cloud-based segment maintained a revenue share of over 40-45%, thereby dominating the market. The cloud segment is witnessing significant growth due to its numerous advantages, such as centralized data security and enhanced flexibility across various EMM functions, including mobile device security, device provisioning, and application management. Cloud deployment enables organizations to eliminate expenses related to dedicated hardware and software infrastructure. Additionally, cloud-based enterprise mobility management solutions offer secure data storage and automated backups, ensuring data integrity and availability. As a result, data remains protected against user-related issues, and systems can automatically resume operations with minimal downtime.

Report Specifications:

|

Report Attribute

|

Details

|

|

Market size (2025)

|

USD 25.23 billion

|

|

Revenue forecast in 2035

|

USD 226.2 billion

|

|

CAGR (2025-2035)

|

24.5%

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 – 2035

|

|

Report coverage

|

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints

|

|

Segments covered

|

Component (Software, Services), Deployment Mode (Cloud-based, On-premises, Hybrid), Organization Size, End-User Industry, Geography

|

|

Regional scope

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

|

Key companies profiled

|

Microsoft; VMware; IBM; Citrix; Blackberry; Ivanti; SOTI; Cisco Systems; MobileIron (Ivanti); SAP SE; JAMF; Sophos; Hexnode (Mitsogo); Zoho (ManageEngine); Snow Software; Matrix42; Scalefusion; 42Gears; Codeproof Technologies; Baramundi Software

|

|

Customization

|

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available

|

|

Pricing Details

|

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models

|

Market Segmentation

- By Component

- By Deployment Mode

- Cloud-based

- On-Premises

- Hybrid

- By Organization Size

- Small and Medium Enterprises

- Large Enterprises

- Others

- By End-Use Industry

- Retail

- Healthcare

- IT & Telecom

- BFSI

- Manufacturing

- Transportation and Logistics

- Government

- Others

Key Questions Answered in the Report: