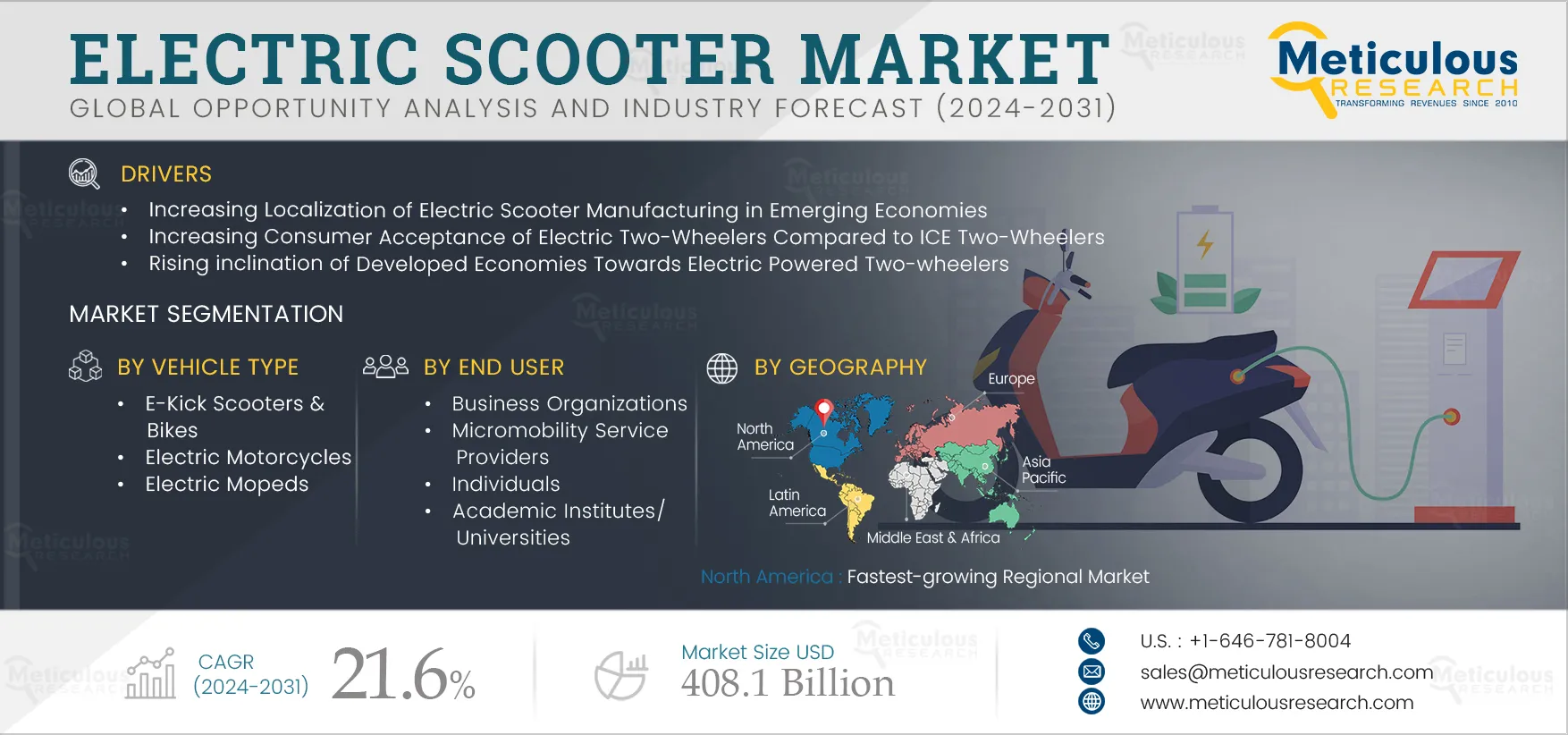

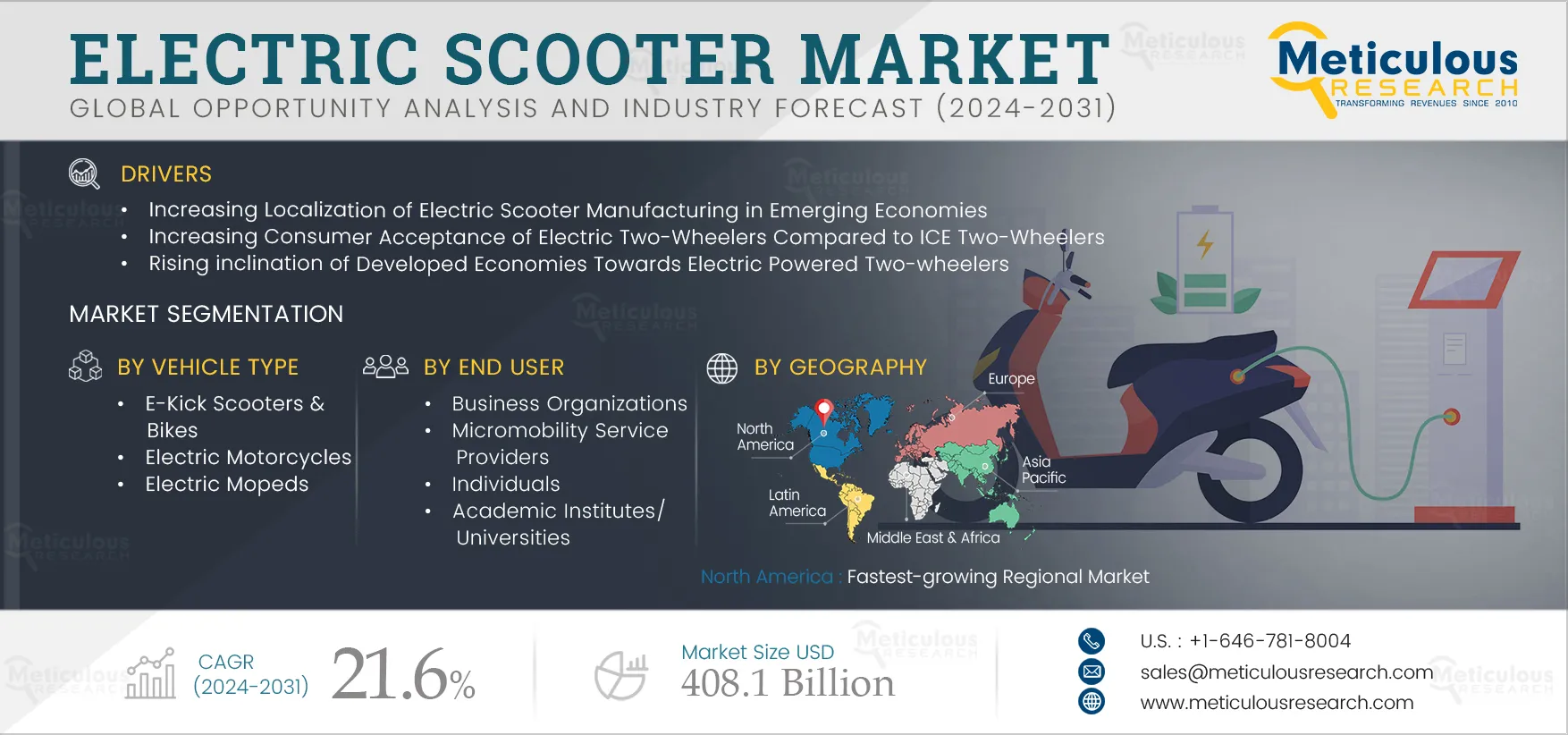

Electric Scooter Market Size & Forecast

The Electric Scooter Market is expected to reach $408.1 billion by 2031, at a CAGR of 21.6% from 2024 to 2031. By volume, this market is expected to reach 298.5 million units by 2031 at a CAGR of 18.1% during the forecast period 2024 to 2031. The growth of the global electric Scooter market is driven by the increasing localization of electric scooter manufacturing in emerging economies, the increasing consumer acceptance of electric two-wheelers compared to ICE two-wheelers, and the rising inclination of developed economies toward electric-powered two-wheelers. However, the growing reliability issues among consumers due to increasing incidents of accidents involving electric two-wheelers and inadequate investment by legacy two-wheeler manufacturers toward electric Scooter restrain the growth of this market.

The rise in government initiatives to mitigate traffic congestion and pollution is expected to generate market growth opportunities. However, the lack of charging infrastructure poses a major challenge for the market’s growth.

Increasing Consumer Acceptance of Electric Two-Wheelers Compared to ICE Two-Wheelers to Support the Market Growth

The EV Scooter market is experiencing a boost in consumer acceptance, attributed to the compelling combination of lower total cost of ownership (TCO) and superior performance dynamics compared to traditional Internal Combustion Engine (ICE) two-wheelers. This shift is propelled by the decreasing cost of electric vehicle components, advancements in battery technology, and supportive government incentives. Additionally, the range of electric two-wheelers is no longer a constraint owing to substantial advancements in battery technology. The present energy density of lithium-iron-phosphate (LFP) and nickel-manganese-cobalt (NMC) batteries stands at approximately 180 and 250 Wh/kg, respectively, enabling a range of 80 to 120 kms per charge. The expenses associated with batteries, traditionally constituting around 35% of the two-wheeler's bill of materials (BoM) value, are decreasing notably due to manufacturers achieving economies of scale, production efficiencies, and a broader transition to lower-cost lithium-iron-phosphate (LFP) batteries.

Electric two-wheelers are benefitting from regulatory measures such as consumer subsidies, accounting for up to 25% of their costs, rising fuel prices, and the ongoing reduction of conventional fossil fuel subsidies in various nations. In countries such as Indonesia, the total cost of ownership (TCO) for locally assembled electric two-wheelers has now reached a breakeven point. It is anticipated to further decrease as the electric vehicle industry continues to advance.

Hence, factors such as lower maintenance costs, minimal fuel expenses, and longer product lifespans contribute significantly to reduced TCO. Simultaneously, electric Scooter showcase superior performance dynamics as compared to ICE vehicles, with instant acceleration and reduced environmental impact, positioning them as attractive alternatives in the evolving landscape of personal transportation.

Click here to: Get Free Sample Pages of this Report

Key Findings in the Global Electric Scooter Market Study:

The Electric Motorcycles Segment is Projected to Register the Highest Growth Rate During Forecast Period

Based on vehicle type, the global electric Scooter market is segmented into electric motorcycles, electric mopeds, and e-kick Scooter & bikes. The electric motorcycles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to increasing government policies aimed at promoting electric mobility, growing awareness regarding the need to reduce greenhouse gas emissions and environmental pollution, rising demand for electric motorcycles among consumers, increasing gasoline prices, and stringent emission norms.

The 3.6 kW to 7.2 kW Segment Projected to Register the Highest Growth Rate During Forecast Period

Based on power output, the global electric Scooter market is segmented into less than 3.6 kW, 3.6 kW to 7.2 kW, and 20 kW to 100 kW. The 3.6 kW to 7.2 kW segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing adoption of electric Scooter in emerging economies, favorable incentives and tax benefits, and increasing initiatives by key players in the electric two-wheeler segment.

The Lithium-ion Polymer Battery Segment Projected to Register the Highest Growth Rate During Forecast Period

Based on battery technology, the global electric Scooter market is segmented into sealed lead-acid battery, lithium-ion battery, and lithium-ion polymer battery. The lithium-ion polymer battery segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising adoption of lithium-ion polymer batteries due to their superior performance. These batteries provide a higher power-to-weight ratio, faster charging capabilities, and increased cycle life compared to traditional lithium-ion batteries, contributing to enhanced efficiency and range for electric two-wheelers.

The Hub Motor Segment Projected to Register the Highest Growth Rate During Forecast Period

Based on motor type, the global electric Scooter market is segmented into hub motors and mid-drive motors. The hub motors segment is expected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to government initiatives aimed at promoting the adoption of electric vehicles and the growing adoption of electric two-wheelers.

The Business Organization Segment Projected to Register the Highest Growth Rate During Forecast Period

Based on end user, the global electric Scooter market is segmented into government institutions, academic institutes/universities, business organizations, micro-mobility service providers, individuals, and other end users. The business organizations segment is expected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to government initiatives aimed at promoting EV adoption and reducing road congestion.

North America: Fastest-growing Regional Market

Based on geography, the global electric Scooter market is segmented into Asia–Pacific, Europe, North America, Latin America, and Middle East & Africa. The market in North America is projected to register the highest growth rate during the forecast period. The growth of this regional market can be attributed to rapid urbanization, increasing environmental consciousness, and the need for flexible and sustainable transportation options. Cities across the U.S. and Canada have embraced electric Scooter as a viable solution to address the challenges of traffic congestion and the last-mile commute.

Electric Scooter Market: Competitive Analysis

The key players operating in the global electric Scooter market are Fuji-Ta Bicycle Co., Ltd. (China), Trek Bicycle Corporation (U.S.), Yamaha Motor Co., Ltd. (Japan), Yadea Group Holdings Ltd. (China), Riese & Müller GmbH (Germany), Leon Cycles (Germany), Niu Technologies (China), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Magnum Bikes (U.S.), Pedego Electric Bikes (U.S.), Aventon Bikes (U.S.), Govecs AG (Germany), Zhejiang Minimotors Bike Co Ltd (China), Zero Motorcycle Inc. (U.S.), Gogoro Inc. (Taiwan), Ather Energy Pvt. Ltd (India), Energica Motor Company (Italy), Revolt Motors (India), Hero MotoCorp Ltd. (India), and Rad Power Bikes Inc. (U.S.).

Electric Scooter Market Report Summary:

|

Particular

|

Details

|

|

Number of Pages

|

262

|

|

Format

|

PDF

|

|

Forecast Period

|

2024–2031

|

|

Base Year

|

2023

|

|

CAGR (Value)

|

21.6%

|

|

Estimated Market Size (Value)

|

$408.1 billion by 2031

|

|

Segments Covered

|

By Vehicle Type

- E-Kick Scooter & Bikes

- Electric Motorcycles

- Electric Mopeds

By Power Output

- Less Than 3.6 kW

- 3.6 Kw to 7.2 kW

- 20 Kw to 100 kW

By Battery Technology

- Lithium-Ion Battery

- Sealed Lead-Acid Battery

- Lithium-Ion Polymer Battery

By Motor Type

- Hub Motors

- Gearless Hub Motors

- Geared Hub Motors

- Mid-Drive Motors

By Charging Type

- Connector Charging

- Wireless Charging

By End User

- Business Organizations

- Micromobility Service Providers

- Individuals

- Academic Institutes/Universities

- Government Institutions

- Other End Users

By Geography

- Asia-Pacific

- China

- India

- Thailand

- Japan

- South Korea

- Singapore

- Rest of Asia-Pacific

- Europe

- Germany

- France

- Netherlands

- Italy

- Spain

- U.K.

- Switzerland

- Sweden

- Norway

- Denmark

- Rest of Europe

- North America

- Latin America

- Middle East & Africa

|

|

Countries Covered

|

North America (U.S., Canada), Europe (Germany, France, Netherlands, Italy, Spain, U.K., Switzerland, Sweden, Norway, Denmark, Rest of Europe), Asia-Pacific (China, India, Thailand, Japan, South Korea, Singapore, Rest of Asia-Pacific), Latin America, and Middle East & Africa

|

|

Key Companies

|

Fuji-Ta Bicycle Co., Ltd. (China), Trek Bicycle Corporation (U.S.), Yamaha Motor Co., Ltd. (Japan), Yadea Group Holdings Ltd. (China), Riese & Müller GmbH (Germany), Leon Cycles (Germany), Niu Technologies (China), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Magnum Bikes (U.S.), Pedego Electric Bikes (U.S.), Aventon Bikes (U.S.), Govecs AG (Germany), Zhejiang Minimotors Bike Co Ltd (China), Zero Motorcycle Inc. (U.S.), Gogoro Inc. (Taiwan), Ather Energy Pvt. Ltd (India), Energica Motor Company (Italy), Revolt Motors (India), Hero MotoCorp Ltd. (India), and Rad Power Bikes Inc. (U.S.)

|

Key questions answered in the report: