Resources

About Us

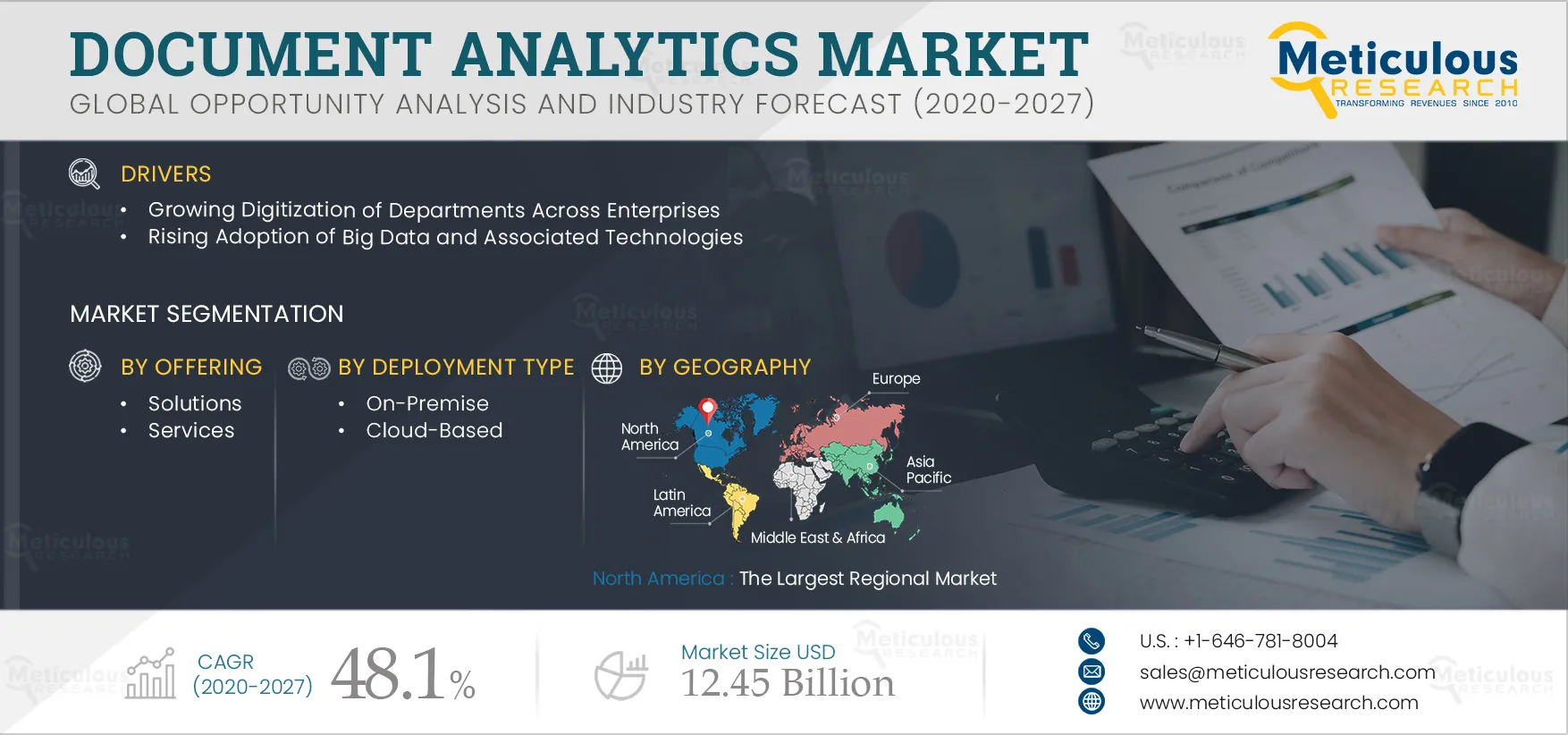

Document Analytics Market by Product Type (Solution and Services), Deployment Type, Industry Vertical (BFSI, Government, Healthcare, Retail and ecommerce, Manufacturing, Transportation), Organization Size, and Region - Global Forecast to 2027

Report ID: MRICT - 104444 Pages: 145 Mar-2021 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Document Analytics Market is expected to reach $12.45 billion by 2027, at a CAGR of 48.1% during the forecast period of 2020 to 2027. The growth of this market is attributed to the growing initiatives to digitize content across enterprises, coupled with the increasing adoption of cloud-based document analysis solutions. In addition, the integration of advanced technologies, such as AI and ML with document analysis solutions and the increasing need to improve customer experience, offers significant growth opportunities for the document analytics market. However, addressing governance and compliance requirements obstructs the growth of this market up to some extent.

Impact of COVID-19 on Document Analytics Market

In the first quarter of 2020, the world was hit by a COVID-19 pandemic. The outbreak was declared as the global pandemic by WHO, as it has spread in many countries across the globe and raised the number of cases multi-folds in few weeks. The COVID-19 pandemic has adversely hit many economies around the globe. The combat measures like complete lockdown and quarantine to fight against COVID-19 have a strong adverse impact on many businesses globally, including the document analytics market.

Demand for digital transformation, increased investments in analytics, growing demand for remote services & location data, and increasing need for real-time information to track and monitor the COVID-19 spread create opportunities for the document analytics market's growth. Furthermore, post-COVID-19, enterprises will automate as much as possible to reduce dependence on the human workforce and cut costs. Automated data extraction using document analysis solutions will enable organizations to process large volumes of semi-structured and unstructured documents with low-touch processing, greater accuracy, and faster turnaround times, thus helping deal with volume fluctuations.

Adopting automation products in general, and document analysis products specifically, will intensify considerably, particularly in sectors that handle considerable documents such as banking, insurance, and healthcare. The sectors are already leading the way to adopt document analysis solutions and entice other sectors, such as manufacturing and government agencies, to teach document analytics. Post-COVID 19, these industries will seek to accelerate low-touch processing and faster turnaround times through automated data extraction.

So, it is expected that 2020 would be a tough time for the growth of the document analytics market and will negatively impact 2020. Although the COVID-19 has affected the document analysis globally, businesses are expected to make a strong comeback in the post-COVID-19 business environment. Positive government initiatives to uplift different sectors affected by COVID-19 are also expected to help businesses recover faster and support the strong recovery of the document analytics market.

Growing initiatives to digitize content across enterprises drives the growth of the market

Content Digitization is the process in which various content in different forms and formats are transformed into digital format. Enterprises across the world are going in for content digitization as it eases workloads, organizes data, reduces latencies, and helps in the business's smooth functioning. The banking, financial services, and insurance sector is continuously experiencing the emergence of advanced technological solutions to increase efficiency. However, the market players operating in this sector are challenged with enormous data that varies from the financial statement, invoices, legal contracts, emails, and receipts. Analyzing these documents is of utmost importance to the players operating in the BFSI sector.

The BFSI companies across the globe are experiencing continuous growth in their customer base, which is increasing the documentation size. To categorize the data, the BFSI sector players utilize or deploy natural language processing (NLP) to ensure customer and enterprise data in document mining applications. The consciousness related to the advantages of document analysis software among the BFSI sector players is stimulating the document analytics market's growth. Furthermore, government agencies handle individuals, departments, processes, and agencies' secured and private data. The volume of data generated in government agencies is enormous and in an unstructured format that accurately captures, classify, and extract to streamline government process. Hence enterprises are taking initiatives to digitize content as it helps streamline business processes and keep all data and information in an organized manner. Thus, with the increase in content digitization, the demand for document analysis to manage that data is also expected to grow multifold.

Key Findings in the Global Document analysis market Study:

Document analysis solution to witness the largest share through 2027

Based on product type, the solutions segment is expected to command the largest share of the overall document analytics market in 2020. Rising initiatives to digitize content across enterprises to manage large data and improve the quality for analysis is one of the key factors fueling investments in the document analysis solution market. However, the services segment is expected to grow at the fastest CAGR during the forecast period. As the market will gradually move towards its maturity over the next few years, demand for services such as installation, consultation, training, maintenance, and support are expected to grow in numbers. Owing to this, document analytics services are expected to grow faster over the forecast period.

In 2020, the BFSI segment to dominate the document analytics market

Based on industry vertical, the BFSI segment is expected to command the largest share of the overall document analytics market in 2020. The companies in this vertical deal with complex documents, such as invoices, receipts, legal contracts, emails, and financial statements. Data extraction in different formats, such as PDFs, images, excels sheets, and others, is very difficult to do manually. As a result, the BFSI vertical is anticipated to hold the largest share in the document analytics market. Besides, the manufacturing sector is expected to grow with the fastest growth rate over the next few years. Manufacturing organizations control several departments and components of the supply chain, and structuring physical documents for all such departments is a tedious and error-prone process. Due to this, the manufacturing sector has started to incorporate documents analytics to reduce latency and proper organization of unstructured data.

North America: The largest regional market

Geographically, North America is expected to command the largest share of the document analytics market in 2020. In the developed economies of North America, such as the U.S. and Canada, there is a high focus on innovations obtained from Research and Development (R&D) and technology. Also, companies' indispensable requirement to transform their traditional business operations into digital, coupled with the rapid adoption of mobile devices, IoT solutions, and cloud technology, has led to the increased adoption of document analysis solutions in this region. Furthermore, many document analysis solutions and services providers in North America are expected to drive growth significantly. However, the growing significance of analytical tools such as document analytics coupled with the development of connectivity infrastructure provides new opportunities for organizations in Asia-Pacific to incorporate document analytics. Consequently, Asia-Pacific is projected to grow with the fastest growth over the forecast period.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by the leading market participants in the document analytics market over the last four years. The key players profiled in the document analytics market are ABBYY (U.S.), Kofax Inc. (U.S.), WorkFusion (U.S.), Automation Anywhere (U.S.), AntWorks PTE. LTD. (Singapore), Hyland Software, Inc. (U.S.), Celaton (U.K.), Extract Systems (U.S.), HyperScience (U.S.), Parascript, LLC (U.S.), Infrrd (U.S.), IBM Corporation (U.S.), Datamatics Global Services Ltd (India), OpenText Corporation (Canada), and HCL Technologies (India), among others.

Scope of the report:

Market by Product Type

Market by Deployment Type

Market by Industry Vertical

Market by Organization Size

Market by Geography

Key questions answered in the report-

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for The Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Deployment Mode

3.4. Market Analysis, by Organization Size

3.5. Market Analysis, by Vertical

3.6. Market Analysis, by Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Growing Digitization of Departments Across Enterprises

4.2.2. Rising Adoption of Big Data and Associated Technologies

4.3. Restraints

4.3.1. Legal and Data Privacy Issues

4.4. Opportunities

4.4.1. Integration of Ai & Ml with Document Analytics

4.4.2. Increasing Need to Improve Customer Experience

4.5. Challenges

4.5.1. High Cost of Implementation

4.6. Trends

4.6.1. Increasing Adoption of Cloud-Based Document Analytics Solutions

4.7. Impact of Covid-19 on the Document Analytics Market

5. Document Analytics Market, by Offering

5.1. Introduction

5.2. Solutions

5.3. Services

5.3.1. Professional Services

5.3.2. Managed Services

6. Document Analytics Market, by Deployment Mode

6.1. Introduction

6.2. On-Premise

6.3. Cloud-Based

7. Document Analytics Market, by Vertical

7.1. Introduction

7.2. BFSI

7.3. Healthcare and Life Sciences

7.4. Government

7.5. Retail and E-Commerce

7.6. Manufacturing

7.7. Transportation & Logistics

7.8. Other Verticals

8. Document Analytics Market, by Organization Size

8.1. Introduction

8.2. Large Enterprises

8.3. Small & Medium-Sized Enterprises

9. Document Analytics Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Rest of Asia-Pacific

9.5. Latin America

9.6. Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Market Ranking by Key Players

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

11.1. Abbyy

11.2. Kofax Inc.

11.3. WorkFusion, Inc.

11.4. Automation Anywhere

11.5. AntWorks Pte. Ltd.

11.6. Hyperscience

11.7. Celaton

11.8. Extract Systems

11.9. Parascript, Llc

11.10. Infrrd, Inc.

11.11. Hyland Software, Inc.

11.12. OpenText Corporation

11.13. Datamatics Global Services Ltd

11.14. HCL Technologies

11.15. IBM Corporation

12. Appendix

12.1. Questionnaire

12.1.1. Available Customization

List of Table

Table 1 Impact Assessment of Covid-19 On Document Analytics Market (USD Billion)

Table 2 Global Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 3 Global Document Analytics Solutions Market Size, by Country/Region, 2018–2027 (USD Million)

Table 4 Global Document Analytics Services Market Size, by Type, 2018–2027

Table 5 Global Document Analytics Services Market Size, by Country/Region, 2018–2027 (USD Million)

Table 6 Global Document Analytics Professional Services Market Size,

Table 7 Global Document Analytics Managed Services Market Size, by Country/Region, 2018–2027 (USD Million)

Table 8 Global Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 9 Global On-Premise Document Analytics Market Size, by Country/Region, 2018–2027 (USD Million)

Table 10 Global Cloud-Based Document Analytics Market Size, by Country/Region,

Table 11 Global Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 12 Global Document Analytics Market Size for BFSI, by Country/Region, 2018–2027 (USD Million)

Table 13 Global Document Analytics Market Size for Healthcare & Life Sciences,

Table 14 Global Document Analytics Market Size for Government, by Country/Region, 2018–2027 (USD Million)

Table 15 Global Document Analytics Market Size for Retail & E-Commerce,

Table 16 Global Document Analytics Market Size for Manufacturing, by Country/Region, 2018–2027 (USD Million)

Table 17 Global Document Analytics Market Size for Transportation, by Country/Region, 2018–2027 (USD Million)

Table 18 Global Document Analytics Market Size for Other Verticals, by Country/Region, 2018–2027 (USD Million)

Table 19 Global Document Analytics Market Size, by Organization Size, 2018–2027

Table 20 Global Document Analytics Market Size for Large Enterprises,

Table 21 Global Document Analytics Market Size for Small & Medium Enterprises,

Table 22 North America: Document Analytics Market Size, by Country, 2018–2027

Table 23 North America: Document Analytics Market Size, by Offering, 2018–2027

Table 24 North America: Document Analytics Services Market Size, by Type, 2018–2027

Table 25 North America: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 26 North America: Document Analytics Market Size, by Vertical, 2018–2027

Table 27 North America: Document Analytics Market Size, by Organization Size,

Table 28 U.S.: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 29 U.S.: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 30 U.S.: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 31 U.S.: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 32 U.S.: Document Analytics Market Size, by Organization Size, 2018–2027

Table 33 Canada: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 34 Canada: Document Analytics Services Market Size, by Type, 2018–2027

Table 35 Canada: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 36 Canada: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 37 Canada: Document Analytics Market Size, by Organization Size, 2018–2027

Table 38 Europe: Document Analytics Market Size, by Country/Region, 2018–2027

Table 39 Europe: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 40 Europe: Document Analytics Services Market Size, by Type, 2018–2027

Table 41 Europe: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 42 Europe: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 43 Europe: Document Analytics Market Size, by Organization Size, 2018–2027

Table 44 Germany: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 45 Germany: Document Analytics Services Market Size, by Type, 2018–2027

Table 46 Germany: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 47 Germany: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 48 Germany: Document Analytics Market Size, by Organization Size, 2018–2027

Table 49 U.K: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 50 U.K: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 51 U.K: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 52 U.K: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 53 U.K: Document Analytics Market Size, by Organization Size, 2018–2027

Table 54 France: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 55 France: Document Analytics Services Market Size, by Type, 2018–2027

Table 56 France: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 57 France: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 58 France: Document Analytics Market Size, by Organization Size, 2018–2027

Table 59 Italy: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 60 Italy: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 61 Italy: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 62 Italy: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 63 Italy: Document Analytics Market Size, by Organization Size, 2018–2027

Table 64 Spain: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 65 Spain: Document Analytics Services Market Size, by Type, 2018–2027

Table 66 Spain: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 67 Spain: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 68 Spain: Document Analytics Market Size, by Organization Size, 2018–2027

Table 69 RoE: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 70 RoE: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 71 RoE: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 72 RoE: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 73 RoE: Document Analytics Market Size

Table 74 Asia-Pacific: Document Analytics Market Size, by Country, 2018–2027

Table 75 Asia-Pacific: Document Analytics Market Size, by Offering, 2018–2027

Table 76 Asia-Pacific: Document Analytics Services Market Size, by Type, 2018–2027

Table 77 Asia-Pacific: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 78 Asia-Pacific: Document Analytics Market Size, by Vertical, 2018–2027

Table 79 Asia-Pacific: Document Analytics Market Size, by Organization Size, 2018–2027 (USD Million)

Table 80 Japan: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 81 Japan: Document Analytics Services Market Size, by Type, 2018–2027

Table 82 Japan: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 83 Japan: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 84 Japan: Document Analytics Market Size, by Organization Size, 2018–2027

Table 85 China: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 86 China: Document Analytics Services Market Size, by Type, 2018–2027

Table 87 China: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 88 China: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 89 China: Document Analytics Market Size, by Organization Size, 2018–2027

Table 90 India: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 91 India: Document Analytics Services Market Size, by Type, 2018–2027

Table 92 India: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 93 India: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 94 India: Document Analytics Market Size, by Organization Size, 2018–2027

Table 95 RoAPAC: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 96 RoAPAC: Document Analytics Services Market Size, by Type, 2018–2027

Table 97 RoAPAC: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 98 RoAPAC: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 99 RoAPAC: Document Analytics Market Size, by Organization Size, 2018–2027

Table 100 Latin America: Document Analytics Market Size, by Offering, 2018–2027

Table 101 Latin America: Document Analytics Services Market Size, by Type, 2018–2027

Table 102 Latin America: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 103 Latin America: Document Analytics Market Size, by Vertical, 2018–2027

Table 104 Latin America: Document Analytics Market Size, by Organization Size, 2018–2027 (USD Million)

Table 105 MEA: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 106 MEA: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 107 MEA: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 108 MEA: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 109 MEA: Document Analytics Market Size, by Organization Size, 2018–2027

Table 110 Recent Developments by Major Players During 2017–2020

Table 111 Market Ranking by Key Players

List of Figure

Figure 1 Research Process

Figure 2 Key Secondary Resources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Key Insights

Figure 8 Document Analytics Market, by Offering, 2020 Vs. 2027 (USD Million)

Figure 9 Document Analytics Market, by Deployment Mode, 2020 Vs. 2027 (USD Million)

Figure 10 Document Analytics Market, by Organization Size, 2020 Vs. 2027 (USD Million)

Figure 11 Manufacturing Segment Is Expected to Grow at The Highest CAGR

Figure 12 Geographic Snapshot: Document Analytics Market

Figure 13 Market Dynamics

Figure 14 Number of Data Breaches and Records Exposed, 2010-2019

Figure 15 Impact Assessment of Covid-19 On The Document Analytics Market (Market Growth)

Figure 16 Global Document Analytics Market Size, by Offering, 2020–2027 (USD Million)

Figure 17 Global Document Analytics Market Size, by Deployment Mode, 2020–2027 (USD Million)

Figure 18 Global Document Analytics Market Size, by Vertical, 2020–2027 (USD Million)

Figure 19 Global Document Analytics Market Size, by Organization Size, 2020–2027 (USD Million)

Figure 20 Global Document Analytics Market Size, by Geography, 2020–2027 (USD Million)

Figure 21 Geographic Snapshot: North American Document Analytics Market

Figure 22 Geographic Snapshot: European Document Analytics Market

Figure 23 Geographic Snapshot: Asia-Pacific Document Analytics Market

Figure 25 Growth Strategies Adopted by The Key Players

Figure 26 Document Analytics Market: Competitive Benchmarking

Figure 27 OpenText Corporation: Financial Overview, (2017-2019)

Figure 28 Datamatics Global Services Ltd.: Financial Overview, (2017-2019)

Figure 29 HCL Technologies: Financial Overview, (2017-2019)

Figure 30 IBM Corporation: Financial Overview, (2017-2019)

Figure 35 Verisk Analytics Inc.: Financial Overview (2017–2019)

Figure 36 Hexaware Technologies Limited: Financial Overview (2017–2019)

Figure 37 Salesforce.Com Inc.: Financial Overview (2017–2019)

Figure 38 Guidewire Software, Inc.: Financial Overview (2017–2019)

Figure 39 RELX Plc (LexisNexis Risk Solutions): Financial Overview (2017–2019)

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates