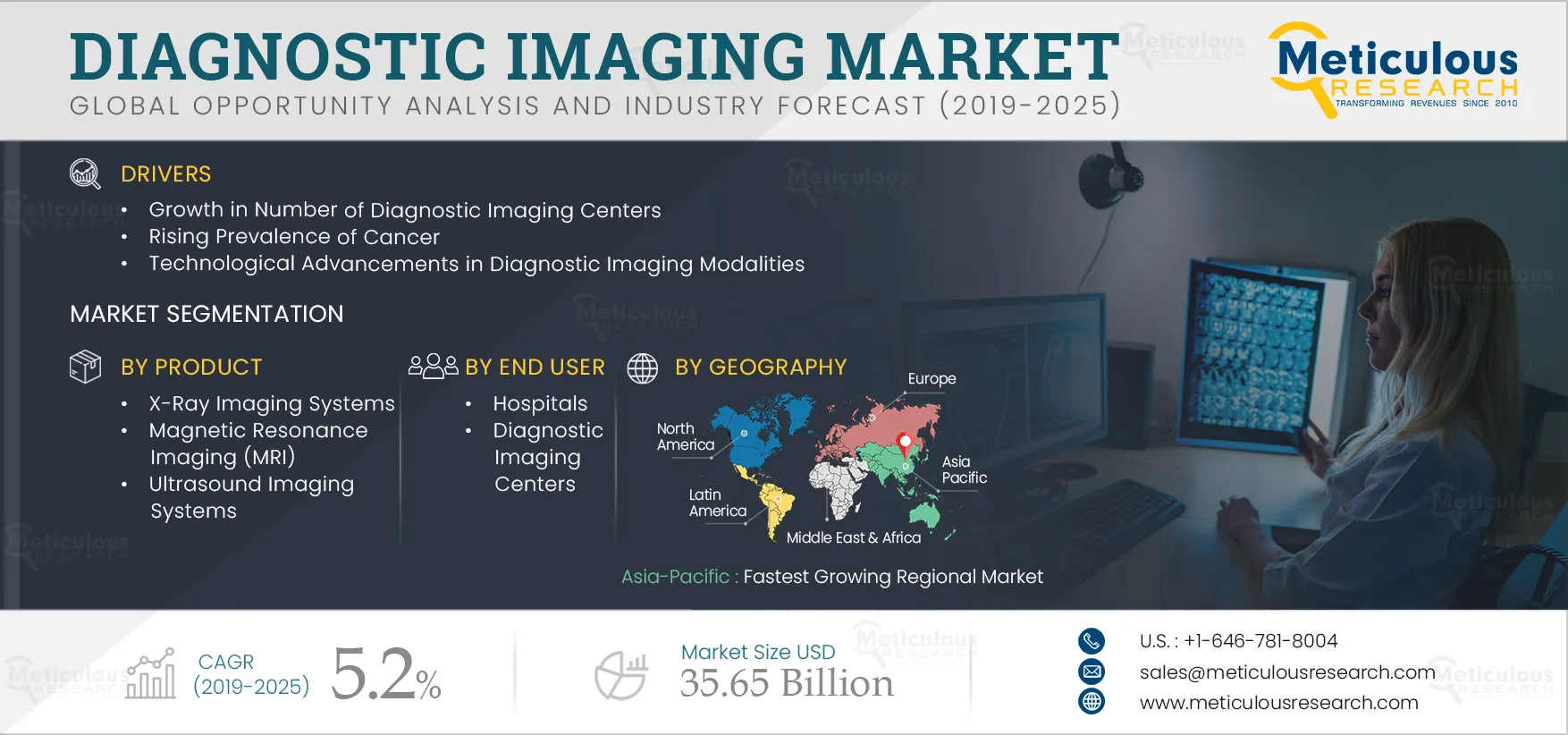

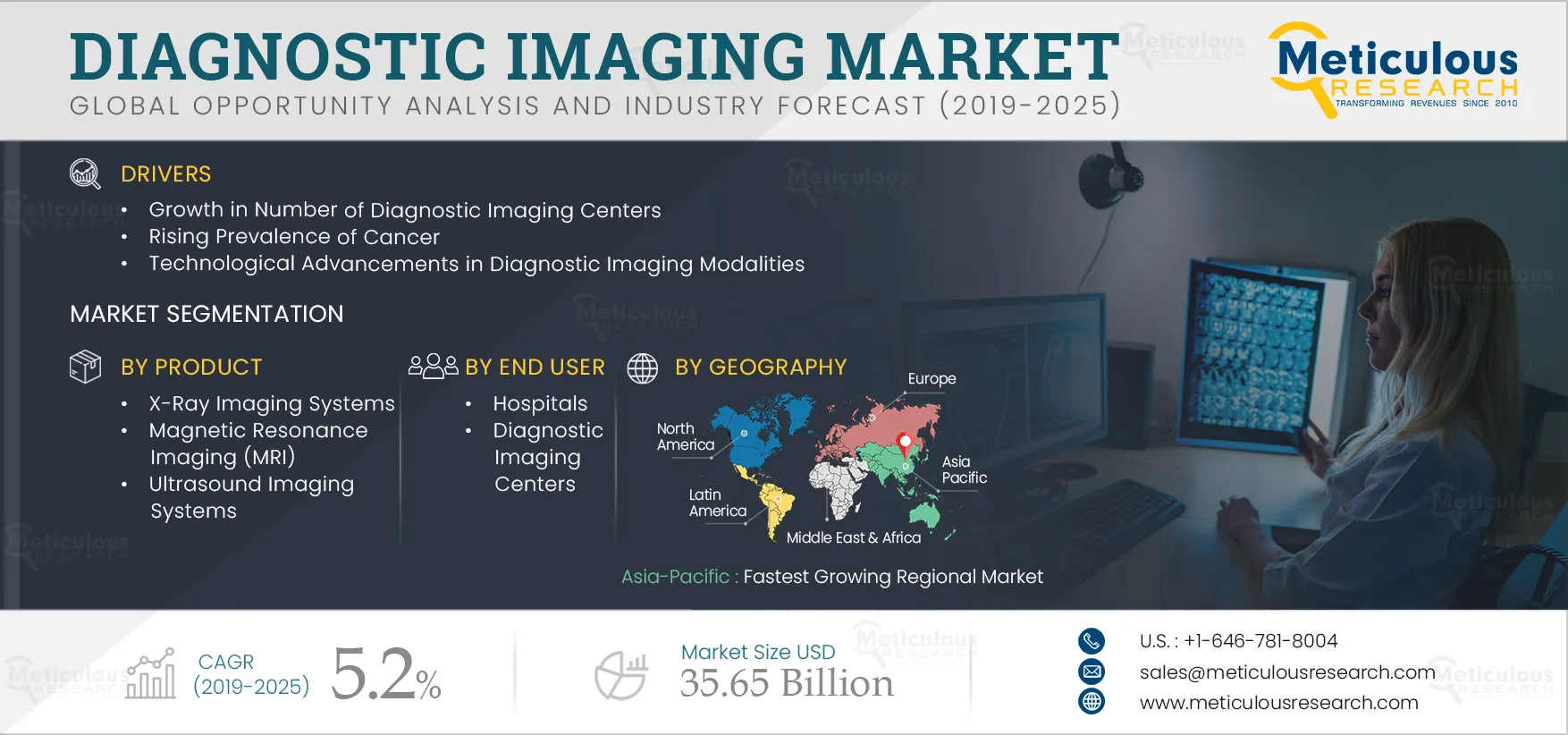

The Diagnostic Imaging Market will increase at a CAGR of 5.2% from 2019 to 2025 to reach $35.65 billion by 2025. Factors such as growing prevalence of chronic diseases, increasing geriatric population, technological advancements in imaging modalities, growing number of hospitals and diagnostic imaging centers, and improving healthcare infrastructure are expected to drive the growth of diagnostic imaging market. Moreover, emerging economies, growing medical tourism, and development of multi-modality imaging systems offer significant growth opportunities for market players during the forecast period.

Increasing geriatric population fuels the growth of the global diagnostic imaging market

The aging population is a global concern and its share in total population is growing in most of the countries. This increase is attributed to decline in fertility rate and improvement in quality of healthcare leading to greater survival rates.

According to World Bank, the global elderly population increased from 530 million in 2010 to 655 million in 2017, representing a growth of 24%. According to a report published by United Nations in 2017, the global population aged 60 years or over is expected to reach 2.1 billion by 2050. Also, the number of persons aged 80 years or above is projected to increase threefold between 2017 and 2050, rising from 137 million to 425 million, globally.

Growing aging population is linked with the rising prevalence of chronic diseases which in turn is likely to increase the number of hospital admissions. Further, aging often leads to problem of falls - which is one of the most common causes of injury and hospital admissions in the geriatric population. According to CDC, in 2015, medical cost associated with the falls in the U.S. exceeded USD 50 billion. In a year, in the U.S., at least 300,000 older people are hospitalized for hip fractures. Thus, increasing elderly population and rising prevalence of chronic diseases along with high fall rates will lead to growth in demand for diagnostic imaging.

Click here to Download Sample Report Now!!

Key Findings in the global diagnostic imaging market study:

X-ray imaging dominates the global diagnostic imaging market, by product

The diagnostic imaging market study provides detailed insights on X-ray imaging systems, computed tomography (CT) scanners, ultrasound imaging systems, magnetic resonance imaging (MRI) systems, and nuclear imaging systems. X-ray imaging systems lead the diagnostic imaging market owing to its low cost, and the ability of X-rays to produce accurate images that provide a clear idea of the musculoskeletal system. The growth of this segment is supported by the increasing demand for mobile X-ray systems, growth in the number of hospitals and diagnostic centers especially in emerging countries, advances in digital technology, painless and non-invasive procedures, and low price of x-rays as compared to other modalities.

Hospitals lead the global diagnostic imaging market, by end user

Based on the end user, the market is segmented into hospitals, diagnostic imaging centers, and others (including pharmaceutical & biotechnology companies, academic & research centers, sports academies, and CROs). Currently, hospitals comprise the largest share however, adoption of imaging systems by the diagnostic centers is expected to grow at the highest CAGR during the forecast period. Factors such as increasing number of private imaging centers fueled by the rising demand for diagnostic imaging procedures is expected to drive the growth of this end user segment.

Asia-Pacific: Fastest Growing Regional Market

The diagnostic imaging market is dominated by North America. However, Asia-Pacific region is expected to register the highest growth during the forecast period. Increasing number of hospitals and diagnostic centers, favorable government policies and initiatives, increasing healthcare expenditure, improving infrastructure, aging population, and growing focus of key players in this region are the key factors expected to fuel growth of this market in APAC.

Key Players

The key players in the global diagnostic imaging market are GE Healthcare (U.S.), Siemens Healthineers (Germany), Koninklijke Philips N.V. (The Netherlands), Canon Medical Systems Corporation (Japan), Hitachi Ltd. (Japan), Carestream Health, Inc. (U.S.), Esaote S.p.A (Italy), Hologic, Inc. (U.S.), Fujifilm Corporation (Japan), Samsung Medison (South Korea), and Shimadzu Corporation (Japan), among others.

Future Outlook

Utilization of 3D, 4D technologies, multi-modality imaging systems, and integration of Artificial Intelligence (AI) in imaging modalities are some of the emerging trends in diagnostic imaging field. The growing application of AI and machine learning to the field of medical imaging is expected to bring a myriad of benefits, including augmentation and improvements in diagnosis. Moreover, AI will be an asset to the radiologists when it comes to workflow and diagnostic efficiency, as well as a vital tool that fosters a paradigm shift in predictive healthcare.

Key questions answered in the report:

Hospitals accounted for the largest share of the global diagnostic imaging market

- What factors contribute to the frequent usage of diagnostic imaging in hospitals?

- Which region is expected to experience the fastest growth in the usage of diagnostic imaging in hospitals, diagnostic imaging centres, and other end users?

- How does the penetration of diagnostic imaging in hospitals differ from other end users such as diagnostic imaging centres?

Diagnostic Imaging market favours both larger and local manufacturers that compete in multiple segments

- What are the top competitors in this market and what strategies do they employ to gain shares?

- What is driving growth and which market segments have the most potential for revenue expansion over the forecast period?

- What strategies should new companies looking to enter in this market use to compete effectively?

- What are the major drivers, restraints, opportunities, and challenges in the diagnostic imaging market?

- Who are the major players in various countries and what share of the market do they hold?

- What are the geographical trends and high growth regions/ countries?

Recent partnerships, acquisitions, and expansions have taken place in the global diagnostic imaging market

- What companies have recently merged/acquired and how will these unions affect the competitive landscape of the diagnostic imaging market?

- What companies have created partnerships and how will these partnerships promote a competitive advantage?

- Who are the major players in the global diagnostic imaging market and what share of the market do they hold?

- What are the local emerging players in the global diagnostic imaging market and how do they compete with the global players?