Resources

About Us

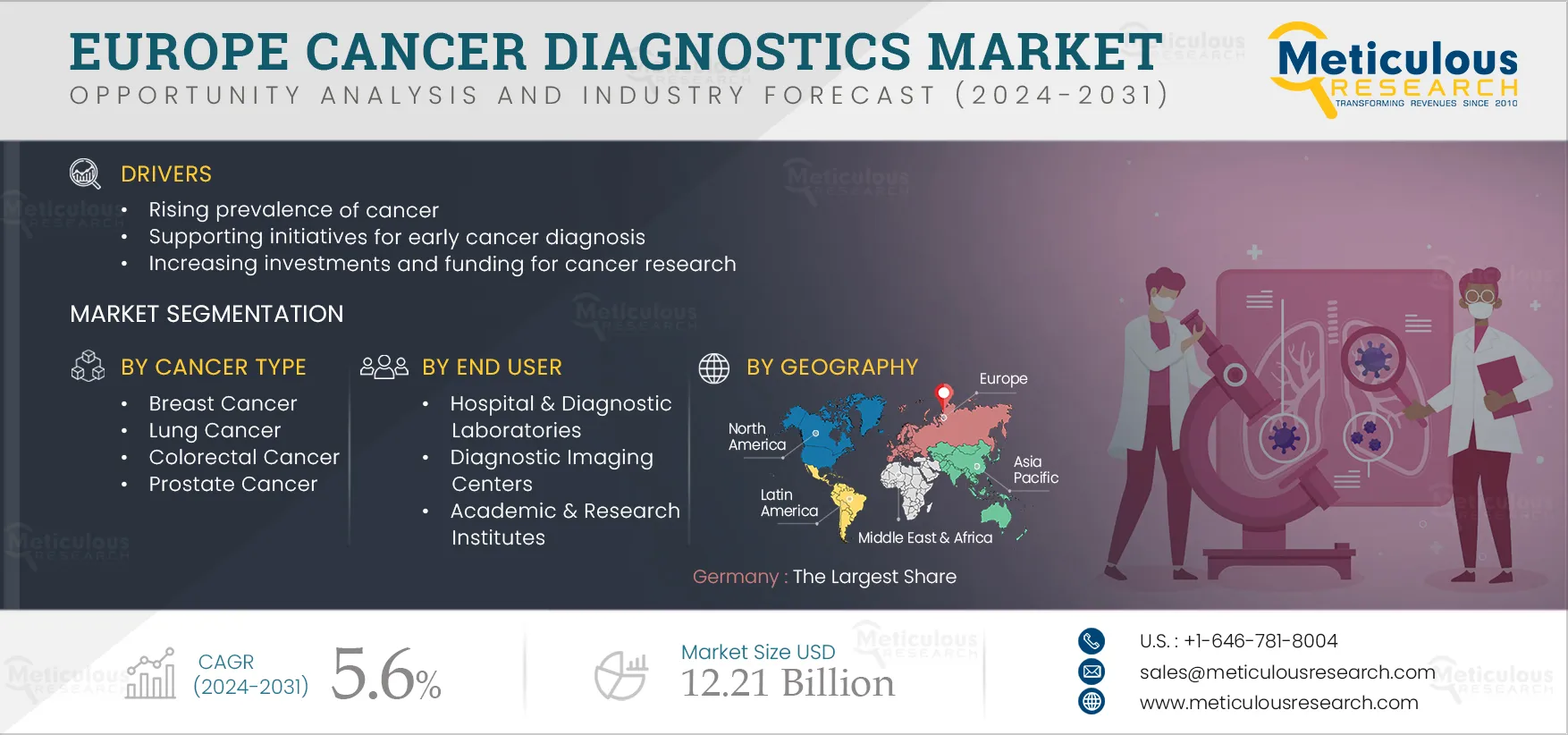

Europe Cancer Diagnostics Market by Product (IVD [Microarray, Immunoassay, PCR, Sequencing], Imaging [CT, MRI, Mammography, Ultrasound]) Cancer Type (Breast, Lung, Colon, Prostate), End User (Hospital, Imaging Center, Pharmaceutical) - Forecast to 2031

Report ID: MRHC - 1041104 Pages: 209 Feb-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Europe cancer diagnostics market is driven by the rising prevalence of cancer, supporting initiatives for early cancer diagnosis, increasing investments and funding for cancer research, rising awareness about cancer, and advancements in cancer diagnostics technology. However, the high cost of imaging systems restrains the growth of this market.

Furthermore, supporting initiatives toward precision diagnostics for cancer are expected to generate growth opportunities for the players operating in the Europe cancer diagnostics market. However, the lack of skilled professionals and insufficiencies in the national implementation of cancer screening programs are major challenges impacting the market growth.

Click here to: Get Free Sample Pages of this Report

The burden of cancer is growing in Europe. According to GLOBOCAN 2020, cancer incidence is expected to increase from 4.4 million in 2020 to 5.1 million in 2035. Early detection is extremely important in reducing mortality, improving patients’ chances of survival, and saving on treatment costs. Various methods are used to detect cancer. The demand for cancer testing in Europe is expected to grow significantly in the coming years. Traditional cancer therapies generally involve treatment approaches that are non-partial toward cancer cells and can result in several serious side effects.

Quick and reliable sequencing of multiple genes simultaneously is possible using advanced profiling technologies such as next-generation sequencing (NGS). The use of advanced profiling technologies, such as NGS and PCR, is gaining traction in the treatment of cancer due to their high accuracy and declining testing costs. Furthermore, NGS has helped develop precision medicine, which involves tailoring treatments based on disease-causing molecular changes in a person's body. While NGS is used in various scenarios, oncologists use it to sequence their patients' biopsy samples to determine the right medicines that can target the genetic abnormalities driving tumor growth. Thus, the growing adoption of NGS and sequencing technologies for cancer diagnosis is further expected to drive market growth.

Biomarker testing provides insights into abnormalities in the DNA of the tumor or tissue and levels of specific proteins present in the tumor. Biomarker testing may show whether the cancer is more likely to grow and spread, whether certain cancer treatments are likely (or unlikely) to be helpful, whether the cancer treatment is working or not, and look for possible signs of cancer reoccurrence.

The growing adoption of NGS across the European region is further expected to aid in the adoption of precise cancer testing for better clinical outcomes. Several initiatives are being taken in this regard.

In 2021, Germany removed the prior authorization requirement for sequencing analysis by public health insurers. This resulted in better access to diagnostic approaches for the entire population. Also in 2021, Illumina, Inc. (U.S.), a leader in next-generation sequencing technology, announced an agreement with the Institute of Medical Genetics and Applied Genomics at the University Hospital of Tübingen (Germany) to assess whole-genome sequencing (WGS) as a first-line diagnostic test for patients with genetic diseases and familial cancer syndromes. Such initiatives of adopting sequencing technologies for precision testing for cancer in Europe are further expected to generate significant opportunities for the players operating in the Europe cancer diagnostics market.

The large market share of the In Vitro Diagnostics segment is attributed to factors such as the technological advancements in IVD, the commercial availability of a diverse range of IVD reagents & consumables for the diagnosis of cancer, and the recurring use of IVD consumables.

IVD consumables are critical components in cancer diagnostics, allowing for reliable and precise examination of patient samples. They assist healthcare providers in obtaining vital information regarding genetic abnormalities, tumor markers, and other diagnostic indicators to monitor disease development, guide treatment decisions, and assess therapy responses in cancer patients.

The large market share of the Breast Cancer segment is attributed to the increase in breast cancer cases, government initiatives promoting breast cancer awareness regarding diagnosis and treatment, increasing healthcare expenditure, and inclusion of certain advanced technologies such as NGS in the reimbursement have propelled the demand for cancer diagnostics for breast cancer.

According to the GLOBOCAN, new breast cancer cases are estimated to increase from 557,532 in 2022 to 581,443 by 2030 in Europe. The mortality rate for this disease is estimated to increase from 144,439 in 2022 to 156,264 by 2030.

The large market share of the Hospitals & Diagnostic Laboratories segment is attributed to factors such as increasing cancer cases, higher purchasing power of hospitals and diagnostic laboratories, well-equipped operating & diagnostic rooms, the presence of highly skilled healthcare professionals, ease in accessibility, better health coverage for hospital-based healthcare services from various private & group insurance plans, and the increasing number of hospitals and expansion of diagnostic laboratories.

Hospitals & diagnostic laboratories are the primary sources for patients to receive diagnoses and treatments for cancer. Thus, the inclination of patients is more toward hospitals & diagnostic laboratories. The clinical demand for mutation detection within multiple genes from a single tumor sample requires diagnostic laboratories to provide rapid, highly sensitive, high-throughput, accurate & parallel testing. Therefore, to meet this demand, many hospitals & diagnostic laboratories have adopted advanced technologies such as Immunohistochemistry (IHC), fluorescence in situ hybridization (FISH), Polymerase Chain Reaction (PCR), and Next-generation sequencing (NGS) as a standardized method for cancer diagnosis.

In 2024, Germany is expected to account for the largest share of the Europe cancer diagnostics market. Germany’s large share can be attributed to the high cancer incidence, the high adoption of advanced technologies, established healthcare systems, rising healthcare expenditures, increasing investments and funding for cancer research, initiatives to raise awareness about cancer diagnosis, and the presence of major market players in the region.

Due to the high incidence of cancer in Germany, there is a need to create awareness regarding its early diagnosis and treatment. These factors have led the German Federal Ministry of Education and Research (BMBF) and various stakeholders active in the field of cancer research to launch a joint initiative, namely the National Decade Against Cancer 2019–2029, to promote preventive measures, diagnostics, and therapies for cancer. Furthermore, the All.Can Germany initiative and DKTK – German Cancer Consortium are among the key notable projects of cancer care in the country.

The report includes a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments in leading industry market players over the past years. The key players operating in the Europe cancer diagnostics market include F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), QIAGEN N.V. (Netherlands), Abbott Laboratories (U.S.), Illumina, Inc. (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V (Netherlands), FUJIFILM Holdings Corporation (Japan), Canon Medical Systems Corporation (a subsidiary of Canon Inc.) (Japan), and Hologic, Inc. (U.S.).

|

Particular |

Details |

|

Page No |

209 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

5.6% |

|

Market Size (Value) |

$12.21 billion by 2031 |

|

Segments Covered |

By Product

By Cancer Type

By End User

|

|

Countries Covered |

Europe (Germany, France, U.K., Spain, Italy, Switzerland, Netherlands, Rest of Europe) |

|

Key Companies |

F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), QIAGEN N.V. (Netherlands), Abbott Laboratories (U.S.), Illumina, Inc. (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V (Netherlands), FUJIFILM Holdings Corporation (Japan), Canon Medical Systems Corporation (a subsidiary of Canon Inc.) (Japan), and Hologic, Inc. (U.S.). |

The Europe cancer diagnostics market covers the market sizes & forecasts of offering, including product, cancer type, and end user. The Europe cancer diagnostics market studied in this report involves the value analysis of various segments and sub-segments of the Europe cancer diagnostics market at country levels.

The Europe cancer diagnostics market is projected to reach $12.21 billion by 2031, at a CAGR of 5.6% during the forecast period.

In 2024, the In Vitro Diagnostics segment is expected to account for the largest share of the Europe cancer diagnostics market.

The Breast Cancer segment is projected to create more traction in the Europe cancer diagnostics market.

The Europe cancer diagnostics market is driven by the rising prevalence of cancer, supporting initiatives for early cancer diagnosis, and increasing investments and funding for cancer research. Furthermore, supporting initiatives toward precision diagnostics for cancer are expected to generate growth opportunities for the players operating in the Europe cancer diagnostics market.

The key players operating in the Europe cancer diagnostics market are F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), QIAGEN N.V. (Netherlands), Abbott Laboratories (U.S.), Laboratory Corporation of America Holdings (U.S.), Illumina, Inc. (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V (Netherlands), FUJIFILM Holdings Corporation (Japan), and Canon Medical Systems Corporation (a subsidiary of Canon Inc.) (Japan).

France, Germany, and the U.K. are projected to offer significant growth opportunities for the vendors in this market due to factors such as increasing cancer incidence, supporting government initiatives, rising healthcare expenditure, growing demand for precision oncology, and growing R&D investments for cancer.

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates