Resources

About Us

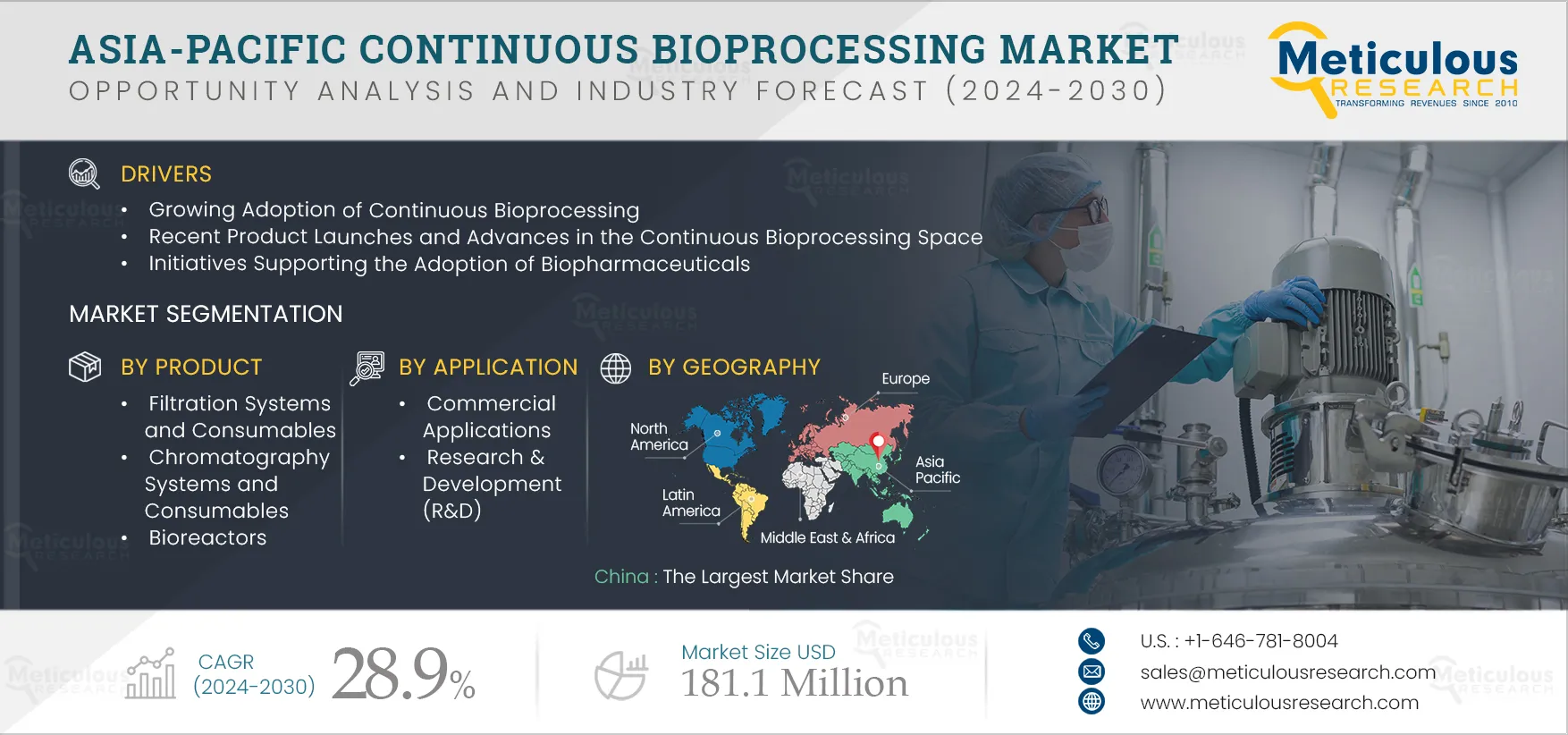

Asia-Pacific Continuous Bioprocessing Market by Product (Filtration, Chromatography, Centrifuges, Consumables), Application (Commercial {Vaccines, Monoclonal Antibodies}, R&D), End User (Pharmaceuticals, Biotechnology, CROs) - Forecast to 2032

Report ID: MRHC - 104999 Pages: 145 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Continuous Bioprocessing Market is expected to grow at a CAGR of 28.9% from 2025 to 2032 to reach $181.1 million by 2032. Continuous manufacturing is an emerging trend spanning various industries. From automotive to paper, businesses are embracing continuous manufacturing to enhance efficiency and bolster profits. The shift from batch to continuous manufacturing is gaining traction in the biopharmaceuticals sector due to the surge in demand for intricate therapies and heightened market competition. Continuous bioprocessing is increasingly being adopted due to its agility, flexibility, efficiency, and robustness. This approach streamlines processes by minimizing steps, utilizing compact facilities and equipment, and enhancing product quality to facilitate real-time release.

The growth of the continuous bioprocessing market in Asia-Pacific is attributed to the gradual adoption of continuous manufacturing, rising manufacturing and research-related outsourcing of biopharmaceuticals, expansions in CDMOs, and initiatives supporting the adoption of biopharmaceuticals. Furthermore, the shift towards bioprocessing 4.0 and the rising adoption of personalized medicines are expected to provide significant market growth opportunities.

However, the limitations of continuous bioprocessing may restrain the growth of this market. Additionally, manufacturers’ hesitation to shift from batch manufacturing to continuous manufacturing poses challenges to the market players.

Click here to: Get Free Sample Pages of this Report

The current push of biotech R&D towards establishing a biotherapeutic landscape and improving the regulatory landscape for the development and approval of biosimilars supported companies to expand biopharma capacity:

In December 2020, Alvotech (Iceland) and Fuji Pharma, a Japanese pharmaceutical company, extended their partnership to commercialize four biosimilars in Japan.

Support Initiatives for CDMOs Boosts R&D Development in the Asia-Pacific Continuous Bioprocessing Market

The demand for innovative manufacturing methods like continuous processing is rising due to the increasing R&D and bioproduction. For instance,

In 2025, the Filtration Systems and Consumables Segment is Expected to Account for the Largest Share of the Asia-Pacific Continuous Bioprocessing Market

In 2025, the filtration systems and consumables segment is estimated to account for the largest share of the Asia-Pacific continuous bioprocessing market. Filtration stands as a preferred purification method in the biopharmaceutical sector. The surge in advanced filtration systems and consumables, such as disposable or single-use systems, combined with the filters' reusability across various bioprocessing steps, contributes to the significant market share of this segment.

In 2025, the Commercial Application Segment is Expected to Account for the Largest Share of the Asia-Pacific Continuous Bioprocessing Market

In 2025, the commercial applications segment is estimated to account for the largest share of the Asia-Pacific continuous bioprocessing market. Growing initiatives supporting the adoption of biopharmaceuticals, rising biopharmaceutical manufacturing outsourcing, growing investments in constructing facilities compatible with continuous bioprocessing for the commercial manufacture of biopharmaceuticals, and accelerated developments in personalized therapies drive the adoption of continuous bioprocessing for commercial application.

In 2025, the Pharmaceutical and Biotechnology Companies Segment is Expected to Account for the Largest Share of Asia-Pacific Continuous Bioprocessing Market

In 2025, the pharmaceutical and biotechnology companies segment is estimated to account for the largest share of the Asia-Pacific continuous bioprocessing market. The large share of this segment is attributed to factors such as the transition of pharma and biopharma manufacturers from batch to continuous processing, regulatory authorities' increasing emphasis on continuous bioprocessing, and the rising investments directed toward the integration of continuous processing technologies.

China to Account for the Largest Market Share in 2025

In 2025, China is estimated to dominate the Asia-Pacific continuous bioprocessing market. Though China has the largest adoption, China’s biopharma sector faces multiple challenges in quality management, including a lack of experience and talent, a rapidly changing regulatory environment, as well as cultural issues in management. These factors are projected to hinder the growth of this market to a certain extent.

Key Players

The report includes a competitive landscape based on the key growth strategies adopted by leading market players in the past four years. The key players profiled in Asia-Pacific continuous bioprocessing market study are 3M Company (U.S.), Cytiva (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Sartorius AG (Germany), Repligen Corporation (U.S.), Eppendorf AG (Germany), Applikon Biotechnology (Netherlands), Pall Corporation (U.S.), Solida Biotech GmBH (Germany), Electrolab Biotech Limited (U.K.), Biowest (France), and Bionet (U.S.).

Scope of the Report:

Asia-Pacific Continuous Bioprocessing Market Assessment, by Product

Asia-Pacific Continuous Bioprocessing Market Assessment, by Application

Asia-Pacific Continuous Bioprocessing Market Assessment, by End User

Asia-Pacific Continuous Bioprocessing Market Assessment, by Country

Key questions answered in the report:

This report covers the market sizes & forecasts for various products, applications, end user, and geography. It also involves the value analysis of various segments and sub-segments of continuous bioprocessing at the country level.

Asia-Pacific continuous bioprocessing market is projected to reach $181.1 million by 2032, at a CAGR of 28.9% during the forecast period of 2025–2032.

Based on product, in 2025, the filtration systems and consumables segment is estimated to account for the largest share of the Asia-Pacific continuous bioprocessing market.

The growth of this market is attributed to factors such as the gradual adoption of continuous manufacturing, rising manufacturing and research-related outsourcing of biopharmaceuticals, expansions in CDMOs, and initiatives supporting the adoption of biopharmaceuticals. Furthermore, the shift towards bioprocessing 4.0 and the rising adoption of personalized medicines are expected to provide significant market growth opportunities.

The limitations of continuous bioprocessing may restrain the growth of this market.

The key players operating in the Asia-Pacific continuous bioprocessing market are 3M Company (U.S.), Cytiva (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Sartorius AG (Germany), Repligen Corporation (U.S.), Eppendorf AG (Germany), Applikon Biotechnology (Netherlands), Pall Corporation (U.S.), Solida Biotech GmBH (Germany), Electrolab Biotech Limited (U.K.), Biowest (France), and Bionet (U.S.).

The market in China is projected to register the highest growth rate during the forecast period and offer significant growth opportunities for the players operating in this market. Rising government initiatives aimed at promoting the adoption of biosimilars, expansion of CDMOs, and government initiatives for biopharma production are key factors driving the market’s growth in China.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates