Resources

About Us

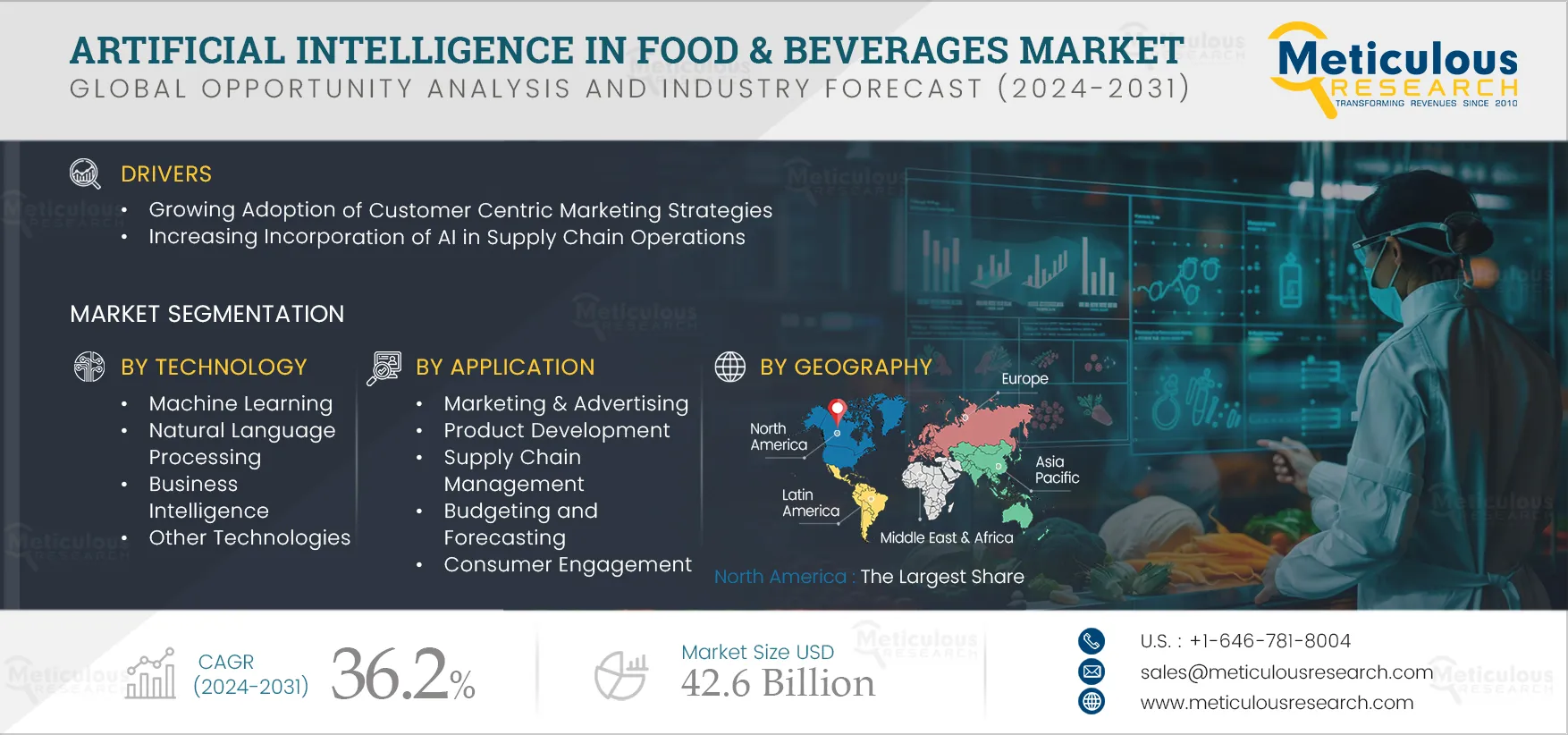

Artificial Intelligence in Food & Beverage Market Size, Share, Forecast, & Trends Analysis by Offering (Solution, Services), Technology (Business Intelligence, ML, Others), Organization Size, Application (Marketing & Advertising, Supply Chain Management, Others), End User (Food Manufacturers, Beverage Producers, Others) & Geography—Global Forecasts to 2032

Report ID: MRICT - 1041304 Pages: 250 Aug-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the AI in food & beverage market is driven by the growing adoption of customer-centric marketing strategies and the increasing incorporation of AI in supply chain operations. Furthermore, the increasing use of AI in product development and the rising need for greater visibility & transparency in supply chain processes are expected to generate growth opportunities for the stakeholders in this market.

Customer-centric marketing is one of the most important strategies for food & beverage businesses. By focusing on the needs and preferences of consumers, food & beverage businesses can build stronger relationships with them. A major advantage of AI in the F&B sector is improved customer experiences. AI technology enables businesses to understand and meet consumer demands effectively, resulting in customer satisfaction. By analyzing customer data and preferences, businesses can provide personalized recommendations through targeted marketing campaigns. This tailored approach enhances customer satisfaction and loyalty. Artificial intelligence is transforming the ways in which businesses can understand their customers. AI allows businesses to collect and analyze vast quantities of qualitative and quantitative data related to customer preferences and behaviors.

Several food & beverage businesses are leveraging AI to provide recommendations to consumers. For instance, in August 2024, IHOP Restaurants LLC (U.S.), a restaurant chain, partnered with Google Cloud to use its AI technology to enhance the online ordering experience. Under this partnership, IHOP will deploy an AI-powered food-ordering recommendation engine across its U.S. stores. Implementing a customer-centric AI strategy across all customer touchpoints is essential for creating seamless, personalized experiences and gaining a competitive edge for food & beverage businesses, which is driving the growth of this market.

One significant advantage of AI is its ability to capture, manage, and analyze detailed data throughout the supply chain. When integrated with blockchain technology and connected enterprise systems, AI enables real-time monitoring and traceability of products, ensuring transparency and preventing fraud. This data-driven approach enhances supply chain visibility, streamlines operations, and reduces the risk of contamination or recalls. AI can determine the fastest and most efficient methods for transporting temperature-controlled products, monitor temperature for quality assurance, and suggest alternative uses for products that do not meet specific temperature requirements.

Customer experience and satisfaction are largely influenced by the complexity of returns processes, delivery times & accuracy, and visibility into stock levels. These factors can be optimized by leveraging AI capabilities. The food & beverage businesses in this market are focused on expanding AI-supported features in their supply chain management solutions. AI algorithms analyze vast amounts of data to optimize the supply chain. AI predicts demand fluctuations, streamlines inventory management, and minimizes waste, which ultimately maximizes efficiency. Food & beverage businesses are incorporating AI in their supply chain for demand forecasting, optimizing inventory management to ensure consistent stocking of appropriate food and beverage products at optimal times, and minimizing stockouts and overstock situations.

One of the most significant challenges in managing a food & beverage supply chain is the lack of visibility. Disruptions can occur at any point, from raw material sourcing to final product delivery, and identifying these issues in real time is crucial. Such challenges can impact the profitability of the food & beverage business. Modern-day businesses have realized the importance of collecting and sharing supply chain information with partners, suppliers, and customers. By increasing supply chain transparency, companies can connect with customers, build trust, and gain better visibility into all stages of their supply chains to drive process improvements and react faster and more effectively when problems occur.

There are numerous advantages to supply chain transparency, from building trust between suppliers, companies, and customers to gaining real-time insights to sharing relevant information with customers. Artificial intelligence (AI) technologies are helping organizations take proactive approaches toward supply chain transparency. AI technologies improve supply chain visibility with advanced analytics, real-time tracking, predictive maintenance, & blockchain. Therefore, to overcome visibility & transparency challenges, the companies are integrating AI in their in-supply chain processes, which is expected to provide opportunities for the market stakeholders.

Based on offering, the market is segmented into solutions and services. In 2025, the solutions segment is expected to account for the larger share of the market. The large market share of this segment is attributed to various factors such as the growing implementation of AI-powered marketing solutions to automated marketing processes in F&B industries, predictive analysis, the growing popularity of AI-powered tools to optimize marketing campaigns, analyze customer data for targeted promotions, rising need to integrate AI-based solutions in F&B product innovation by analyzing trends, consumer preferences, and feedback, increasing integration of business intelligence to analyze consumer behavior, and growing demand for customer-driven marketing and advertisement.

Moreover, the solutions segment is also projected to register the highest CAGR during the forecast period.

Based on technology, the market is segmented into machine learning, natural language processing, business intelligence, and other technologies. In 2025, the business intelligence segment is expected to account for the largest share of the market. Artificial intelligence in the food and beverage industry significantly enhances business intelligence technology by providing advanced data analytics, predictive insights, and automation capabilities. AI algorithms analyze historical sales data, market trends, and consumer behavior to forecast demand, helping businesses manage inventory and reduce waste. Such factors help to drive the growth of the market during the forecast period.

However, the machine learning segment is projected to register the highest CAGR during the forecast period. Artificial intelligence in the food and beverage industry significantly aids the development and application of machine learning (ML) technologies. AI systems monitor and analyze data from various stages of food production, such as ingredient quality, cooking temperatures, and packaging processes. This data is crucial for training ML models to predict and maintain consistent product quality. Also, AI systems equipped with sensors can monitor the performance and health of machinery used in food production. In such cases, machine learning algorithms can analyze data to predict various factors in food & beverage production processes, such as maintenance, preventing breakdowns, and reducing downtime. These benefits drive the growth of this segment.

Based on organization size, the market is segmented into large enterprises and small & medium-sized enterprises. In 2025, the large enterprises segment is expected to account for the larger share of the market. The large market share of this segment is attributed to the increasing adoption to enable personalized customer experience at scale, the growing use of AI in marketing solutions for data-driven decision-making and optimizing marketing campaigns in food & beverages industries, and the rising need to streamline processes, optimize costs, and prevent human error.

However, the small & medium-sized enterprise segment is expected to register the highest CAGR during the forecast period due to the growing need to streamline the marketing process without significant resource investment, the increasing adoption of chatbots and virtual assistance to enhance customer support and improve customer satisfaction in food & beverages industries, and the rising adoption for automated targeting, lead generation, and social media management.

Based on application, the market is segmented into marketing & advertising, product development, supply chain management, budgeting and forecasting, consumer engagement, shelf management, procurement, quality management, resource management, operation management, and other applications. In 2025, the marketing & advertising segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the rising implementation of AI algorithms to understand audience preference, content creation and optimization, advertising recommendation, and social media management.

AI analyzes customer data to understand customers' preferences, purchase history, and behavior patterns. This enables businesses to create highly personalized marketing campaigns tailored to individual customers, increasing the likelihood of engagement and conversion.

However, the supply chain management segment is expected to register the highest CAGR during the forecast period due to several factors, as AI helps to optimize delivery routes for efficiency, reducing fuel consumption and delivery times. Also, it helps to evaluate and rank suppliers based on various criteria such as price, quality, reliability, and sustainability, helping companies make better sourcing decisions.

Moreover, in the food & beverages industries, end-to-end tracking and resource optimization is crucial. With the help of these technologies, visibility into every stage of the supply chain, from raw materials to finished products, allows for better coordination and decision-making.

Based on end user, the market is segmented into food manufacturers, beverage producers, food service providers, retailers, and hospitality. In 2025, the food manufacturers segment is expected to account for the largest share of the market. AI-powered vision systems can inspect products on the production line for defects, ensuring that only high-quality products reach consumers. Also, AI algorithms analyze products to maintain consistency in shape, size, and appearance, which is crucial for brand reputation. Also, AI optimizes energy consumption in manufacturing processes, reducing costs and environmental impact. Such factors help to drive the growth of the market during the forecast period.

However, the hospitality segment is expected to register the highest CAGR during the forecast period due to various factors such as increased demand for personalized customer experiences, high operational efficiency, enhancement in food safety and quality control, and automated food preparation. AI-powered robots can perform repetitive tasks which helps to increase efficiency and reduce labor costs.

In 2025, North America is expected to account for the largest share of the market. North America’s large market share is mainly attributed to various factors as organizations in North America have swiftly used AI to increase efficiency, productivity, and consumer experiences. The growing use of AI in the food & beverages industry to enhance operational efficiency, improving product quality, and new opportunities for innovations are some of the other drivers for the growth of this regional segment.

Additionally, various key players in this market are undertaking initiatives for the development of the market. For instance, in May 2022, Ai Palette (Singapore) expanded its business in the U.S. to help consumer packaged goods (CPG) companies better identify consumer preferences and market trends and speed up the product development process.

AI-powered robots and automated systems streamline food preparation, packaging, and distribution processes. This reduces labor costs and increases production speed, allowing companies to scale operations more effectively.

However, the Asia-Pacific region is projected to register the highest CAGR during the forecast period. The growth of this region is driven by the growing adoption of operational efficiency, increasing disposable income, increasing government initiatives for the adoption of smart devices, and significant growth opportunities in emerging countries of Asia-Pacific.

Additionally, key players in this market are focusing on various initiatives in the development of the market. For instance, in June 2024, LabelBlind (India), a digital food labeling company, launched FoLSol-AI, a cutting-edge artificial intelligence (AI)-powered solution for food label validations and regulatory compliance in the food and beverage sector. In April 2024, Nestlé S.A., a Swiss multinational food and beverage company, expanded its AI model developed by its Indian unit in global markets. The model uses ML algorithms to analyze consumer data and trends to inform product development and marketing strategies.

AI systems monitor food quality and safety in real time, detecting contaminants and ensuring compliance with health standards. This is especially important in an Asia-Pacific region with varying regulatory standards. Also, AI accelerates research and development by simulating food formulations and predicting consumer acceptance, shortening the time-to-market for new products.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the market are Prognolite (Switzerland), Tastry (U.S.), ThroughPut Inc. (U.S.), Ai Palette (Singapore), Oracle Corporation (U.S.), GEP (U.S), Elisa IndustrIQ (Finland), Coupa Software Inc. (U.S.), PIPA LLC (U.S.), Gastrograph.ai (Analytical Flavor Systems, Inc.) (U.S.)

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

36.2% |

|

Market Size (Value) |

USD 42.6 Billion by 2032 |

|

Segments Covered |

By Offering

By Technology

By Organization Size

By Application

By End User

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Sweden, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Australia & New Zealand, Indonesia, Rest of Asia-Pacific), North America (U.S., Canada), Latin America, and the Middle East & Africa |

|

Key Companies |

Prognolite (Switzerland), Tastry (U.S.), ThroughPut Inc. (U.S.), Ai Palette (Singapore), Oracle Corporation (U.S.), GEP (U.S), Elisa IndustrIQ (Finland), Coupa Software Inc. (U.S.), PIPA LLC (U.S.), Gastrograph.ai (Analytical Flavor Systems, Inc.) (U.S.), Company 11, Company 12, and Company 13. |

The artificial intelligence in food & beverage market study focuses on market assessment and opportunity analysis through the sales of AI in food & beverage solutions and services across different regions and countries. This study is also focused on competitive analysis for AI in food & beverage based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The artificial intelligence in food & beverage market is expected to reach $42.6 billion by 2032, at a CAGR of 36.2% from 2025 to 2032.

In 2025, the solution segment is expected to hold the largest share of the artificial intelligence in food & beverage market.

The food manufacturers segment is expected to register the highest CAGR during the forecast period.

The growth of the artificial intelligence in food & beverage market is driven by the growing adoption of customer-centric marketing strategies and the increasing incorporation of AI in supply chain operations. Furthermore, the increasing use of AI in product development and the rising need for greater visibility & transparency in supply chain processes are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the artificial intelligence in food & beverage market are Prognolite (Switzerland), Tastry (U.S.), ThroughPut Inc. (U.S.), Ai Palette (Singapore), Oracle Corporation (U.S.), GEP (U.S), Elisa IndustrIQ (Finland), Coupa Software Inc. (U.S.), PIPA LLC (U.S.), Gastrograph.ai (Analytical Flavor Systems, Inc.) (U.S.), Company 11, Company 12, and Company 13.

Asia-Pacific is expected to record the highest CAGR during the forecast period.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates