Resources

About Us

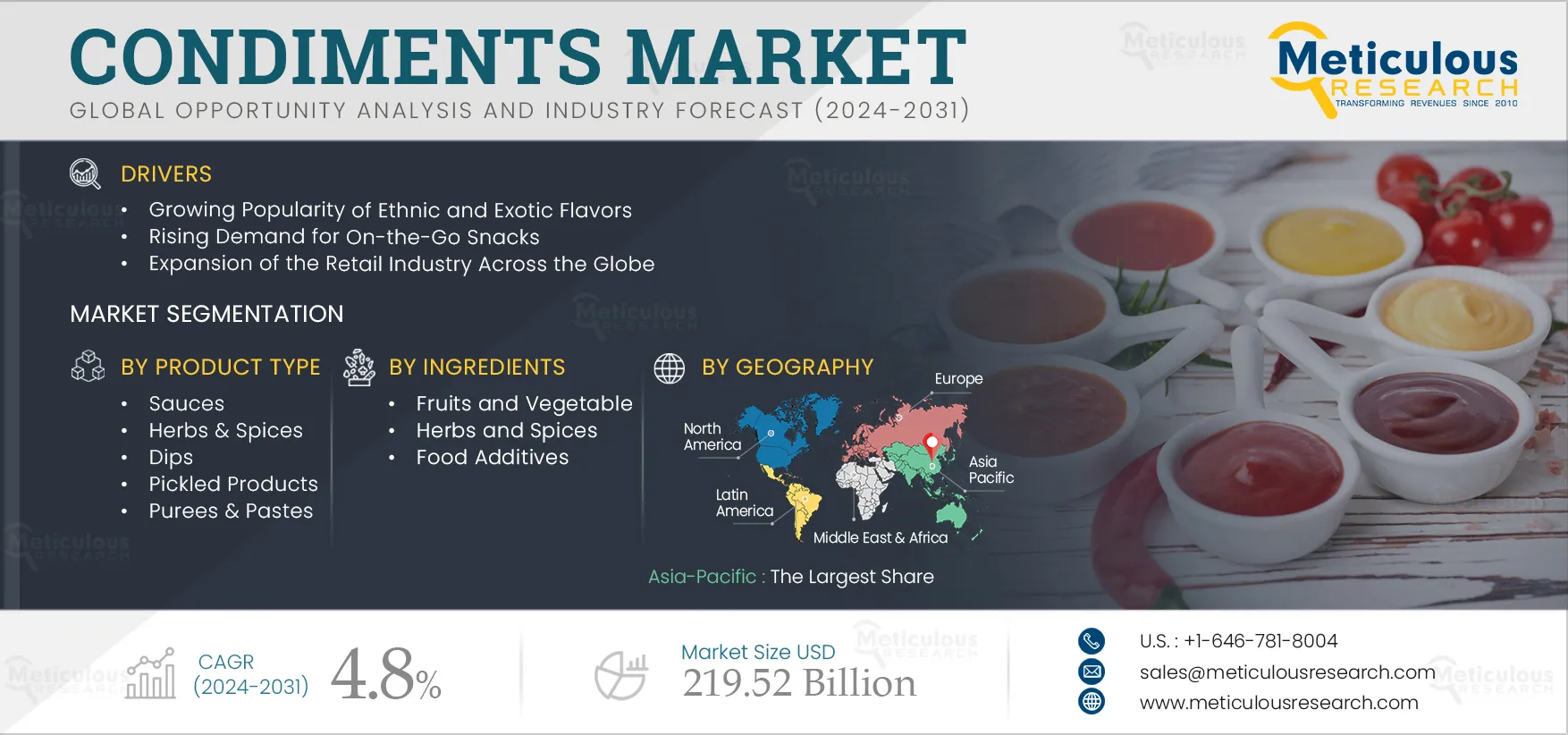

Condiments Market Size, Share, Forecast, & Trends Analysis by Product Type (Sauces {Cooking, Table}, Herbs & Spices, Dips, Purees), Ingredient, Category (Organic), Distribution Channel (B2B, B2C {Supermarkets & Hypermarkets, Online}) - Global Forecast to 2032

Report ID: MRFB - 104783 Pages: 220 Jan-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Condiments Market is expected to reach $219.52 billion by 2032, at a CAGR of 4.8% from 2025 to 2032. The growth of this market can be attributed to several factors, including the growing popularity of ethnic & exotic flavors, rising demand for on-the-go snacks, and expansion of the retail industry across the globe. Moreover, the rise in e-commerce is expected to offer growth opportunities for the players operating in this market. Additionally, the growing popularity of plant-based & vegan food products and the growing demand for natural & organic products are key trends in the condiments market. However, the presence of artificial preservatives and additives is expected to hinder market growth to a certain extent.

Consumers are increasingly interested in trying new and exotic flavors from different cultures, which is driving the demand for condiments that can help them achieve these flavors. The increasing globalization of food and technology has made it easier for consumers to access and learn about different cuisines and flavors from around the world. Further, changing demographics and consumer preferences are also contributing to the demand for ethnic and exotic flavors. The exploration of food outside of the conventional gamut is leading to the growth in the demand for foreign cuisine and exotic ingredients, where people are ready to play around with foreign recipes at home as well.

For example, the growing Hispanic and Asian populations in the U.S. are driving the demand for flavors that are popular in these cultures. Also, the growing popularity of Chinese, Japanese, Thai, Indian, and other ethnic food variants is increasing in the market. The increasing consumer preference towards global cuisines has led to the exploration of a new variety of cuisines. In February 2024, Desai Foods Private Limited (India)’s brand Mother’s Recipe launched its new category of “Exotic Global Sauces” under the brand ‘Recipe’ - available in Red Chili, Green Chili, Garlic Chilli, Soya bean, Chilli Vinegar & Sriracha Sauce. Therefore, the growing popularity of ethnic and exotic flavors further boosts the demand for condiments.

Consumer demand for snacks has grown substantially over the past several decades, driven by the need for quick nutrition and satiety in busy schedules. According to the ‘State of Snacking’ report by Mondelēz International in 2024, approximately 67% of consumers seek portion-controlled snacks, and 7 in 10 prefer a smaller portion of an indulgent snack over a larger portion of a low-fat or low-sugar alternative. Snacks are increasingly seen as part of healthy diets due to their controlled portions. Convenient and portable packaging provides a quick energy boost during hectic workdays.

The trend toward healthy eating is transforming the snack industry, pushing companies to offer a variety of healthy snack options, including gluten-free, natural, and plant-based products. Sauces, dressings, and condiments are integral to this trend, as they enhance flavor, taste, and texture, appealing to all age groups. This growing interest in healthy and flavorful snacks is expected to continue, boosting the consumption of on-the-go snack products and driving the growth of the condiments market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Nowadays, consumers are inclined towards plant-based and vegan foods due to their health benefits, environmental concerns, and growing awareness of the negative impact of animal products. The growing trend of millennials adopting flexitarian and meat-free diets signals a change in purchasing habits that significantly shift from earlier generations. This trend has led to an increase in the demand for condiments that are free from animal products, such as vegan mayonnaise, vegan ranch dressing, and vegan cheese sauces.

In March 2025, Niúke Foods LLC (U.S.) launched a range of plant-based condiments, including eight varieties of chickpea vegan mayonnaise, under the VMAYO brand. The flavors available are Basil, Beet, Carrot, Coleslaw, Garlic, Merquen, Original, and Sriracha, each made from a blend of sunflower oil, chickpeas, beans, and other ingredients and spices based on the variety. Therefore, the growing popularity of plant-based and vegan food products is expected to support the growth of the condiments market.

As consumers become more health-conscious and environmentally aware, they increasingly seek food products that align with their values and preferences. Condiments, a crucial aspect of food preparation worldwide, add flavor and taste to a wide range of dishes. This shift has led to a rise in demand for condiments made with natural and organic ingredients, such as organic ketchup, mustard, and mayonnaise. Consumers are opting for condiments free from high-fructose corn syrup, artificial colors, and artificial flavors, preferring products made with natural ingredients.

The demand for organic foods is steadily increasing, primarily due to their perceived health benefits and safer profile compared to conventional foods. According to FiBL, organic food sales reached USD 142.3 billion (EUR 135 billion) in 2022. Consequently, the growing demand for natural and organic food products is driving the increased demand for condiments made with such ingredients.

In recent years, e-commerce has significantly impacted the food industry, particularly the condiments market. As more consumers turn to online shopping for their food needs, this segment has seen substantial growth. E-commerce platforms enable consumers to conveniently purchase condiments from home, saving time and effort. These platforms offer hassle-free delivery, user-friendly websites and apps, and an extensive selection of products from various brands and regions, enhancing accessibility and availability.

The increasing pace of modern lifestyles has driven individuals to prefer online retail channels for quick doorstep delivery. Additionally, e-commerce platforms are providing personalized products, subscription-based services, and improved customer experiences. Factors such as growing urbanization, rising disposable incomes, and an increasing working population further boost the demand for premium food products. Consequently, these trends are expected to support the continued growth of the condiments market through e-commerce channels.

Based on product type, the condiments market is segmented into sauces, herbs & spices, dips, pickled products, purees & pastes, and other product types. In 2025, the sauces segment is expected to account for the largest share of 46.1% of the condiments market. The large market share of this segment can be attributed to increasing demand from the food service industry and household use, increasing consumer preference for ethnic, authentic, and umami flavors, and growing adoption of innovative sauces, such as gluten-free, natural, and organic.

However, the dips segment is projected to register the highest CAGR during the forecast period of 2025–2032. The high growth of this segment is mainly driven by the increased demand for artisanal and gourmet products and growing popularity of ready-to-eat food & spicy & flavorful options.

Based on ingredients, the condiments market is segmented into fruits & vegetables, herbs & spices, food additives, and others. In 2025, the fruits & vegetables segment is expected to account for the largest share of the condiments market. The large market share of this segment can be attributed to factors such as the growing demand for natural & organic ingredients and the high demand for products like sauces, purees, and pastes.

Based on category, the condiments market is segmented into conventional and organic. In 2025, the conventional segment is expected to account for the larger share of the condiments market. The large market share of this segment can be attributed to the wider availability of products and, low cost & longer shelf life compared to organic condiments. These often contain additives, preservatives, and artificial flavors to enhance taste, texture, and shelf life.

The organic segment is projected to register a higher CAGR during the forecast period due to the growing number of health-conscious consumers, rising interest in organic food products and sustainability, and increased consumer concern about the potential health concerns related to synthetic or artificial food additives and other genetically modified ingredients.

Based on distribution channel, the condiments market is segmented into business-to-business (B2B) and business-to-consumer (B2C). In 2025, the business-to-consumer (B2C) is expected to account for the larger share of the condiments market. The large market share of this segment can be attributed to factors such as rising demand for various types of sauces, dressings, and other condiments from the end consumers backed by rising cooking enthusiasts trying innovative international dishes at home. In addition, well-established supermarkets and hypermarket chains and growing consumer preferences for online sales are supporting growth in this segment. Moreover, this segment is projected to register a higher CAGR during the forecast period.

Furthermore, the business-to-consumer (B2C) segment is divided into supermarkets & hypermarkets, convenience stores, specialty stores, online stores, and other B2C distribution channels. In 2025, the supermarkets & hypermarkets segment is expected to account for the largest share of the condiments market for the B2C distribution channel. The large market share of this segment is attributed to the growing number of supermarkets in developing countries, such as China & India, consumers’ preference for shopping from supermarkets and hypermarkets due to easy access and availability at low prices, and the increasing consumer spending on sauces, dressings & condiments products.

However, the online stores segment is expected to witness significant growth during the forecast period. The rapid growth of this segment is mainly attributed to the rising internet penetration, growing preference for consumer convenience, availability of greater discounts compared to modern trade, and greater product selection experience.

Based on geography, the condiments market is divided into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of 42.1% of the condiments market, followed by North America, Europe, Latin America, and the Middle East & Africa. The large share of this market is mainly attributed to the rising demand for ready-to-use packaged sauces, dressings, and condiments with changing lifestyles, rising disposable incomes, rapid urbanization & industrialization, rising number of working women, and increasing demand for global cuisines. Furthermore, the expansion of the food service industry and growing E-commerce penetration are expected to boost the demand for condiments in this region.

However, Europe is projected to register the highest CAGR during the forecast period. The fast growth of this region is mainly driven by the growing popularity of exotic & ethnic flavors, evolving consumer preferences, increasing health-conscious consumers, and growing demand for plant-based & vegan food products.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the condiments market are Conagra Brands, Inc. (U.S.), McCormick & Company Inc. (U.S.), The Kraft Heinz Company (U.S.), Kikkoman Corporation (Japan), Sweet Baby Ray’s (U.S.), Unilever Plc (U.K.), Nestlé S.A. (Switzerland), PepsiCo Inc. (U.S.), Campbell Soup Company (U.S.), General Mills, Inc. (U.S.), Lee Kum Kee Company Limited (China), Daiya Foods Inc. (Canada), and Dr. August Oetker Nahrungsmittel KG (Germany), among others.

|

Particulars |

Details |

|

Number of Pages |

220 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.8% |

|

Market Size (Value) |

$219.52 Billion by 2032 |

|

Segments Covered |

By Product Type

By Ingredient

By Category

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (U.K., Germany, France, Spain, Italy, Netherlands, Russia, Poland, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (South Africa, Saudi Arabia, United Arab Emirates, and Rest of Middle East & Africa) |

|

Key Companies |

Conagra Brands, Inc. (U.S.), McCormick & Company Inc. (U.S.), The Kraft Heinz Company (U.S.), Kikkoman Corporation (Japan), Sweet Baby Ray’s (U.S.), Unilever Plc (U.K.), Nestlé S.A. (Switzerland), PepsiCo Inc. (U.S.), Campbell Soup Company (U.S.), General Mills, Inc. (U.S.), Lee Kum Kee Company Limited (China), Daiya Foods Inc. (Canada), and Dr. August Oetker Nahrungsmittel KG (Germany) |

Condiments include sauces, dressings, dips, herbs & spices, and spreads that are added to food to enhance its flavor or texture. Condiments are typically used to complement the taste of the food and can be salty, sweet, tangy, or spicy in flavor.

This market study primarily provides a detailed market assessment and valuable insights for condiments, including product type, ingredients, category, distribution channel, and various countries across the different regions.

The condiments market is projected to reach $219.52 billion by 2032, at a CAGR of 4.8% during the forecast period 2025–2032.

The sauces segment is expected to hold the major share of the market in 2025.

The business-to-consumer (B2C) segment is projected to record a higher growth rate during the forecast period 2025–2032.

The key players operating in the condiments market are Conagra Brands, Inc. (U.S.), McCormick & Company Inc. (U.S.), The Kraft Heinz Company (U.S.), Kikkoman Corporation (Japan), Sweet Baby Ray’s (U.S.), Unilever Plc (U.K.), Nestlé S.A. (Switzerland), PepsiCo Inc. (U.S.), Campbell Soup Company (U.S.), General Mills, Inc. (U.S.), Lee Kum Kee Company Limited (China), Daiya Foods Inc. (Canada), and Dr. August Oetker Nahrungsmittel KG (Germany).

The Asia-Pacific region is projected to register the highest CAGR during the forecast period.

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates