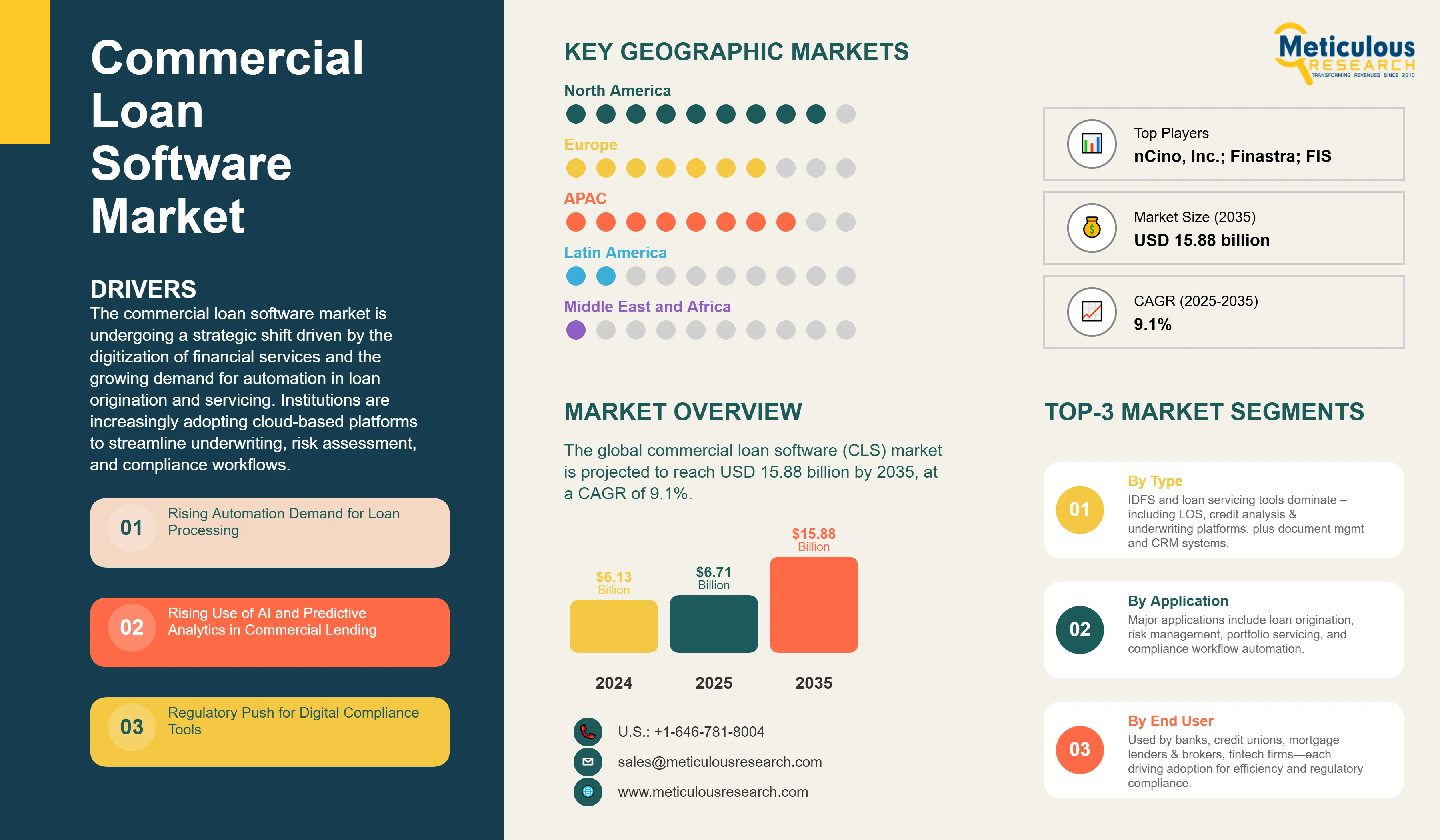

The global commercial loan software (CLS) market is valued at USD 6.13 billion in 2024. This market is projected to reach USD 15.88 billion by 2035 from USD 6.71 billion in 2025, at a CAGR of 9.1%. The commercial loan software market is undergoing a strategic shift driven by the digitization of financial services and the growing demand for automation in loan origination and servicing. Institutions are increasingly adopting cloud-based platforms to streamline underwriting, risk assessment, and compliance workflows.

In 2024, over 68% of mid-sized banks in North America reported transitioning to digital loan processing systems, citing operational efficiency and regulatory alignment. The rise of embedded finance and API-driven integrations is also reshaping how lenders interact with borrowers and third-party platforms. With increasing pressure to reduce turnaround times and improve customer experience, software providers are investing in AI-powered credit scoring and predictive analytics. The market outlook remains positive, with demand expected to rise across regional banks, credit unions, and fintech lenders.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The competitive landscape is led by firms like FIS, Finastra, nCino, and Temenos, each offering modular platforms tailored to commercial lending workflows. nCino has gained traction among regional banks by integrating AI-based credit decisioning tools, while Finastra continues to expand its Fusion Loan IQ platform globally. Smaller players such as Lendisoft and CloudBnq are targeting niche segments like SME lending and community banks. Competitive differentiation is increasingly driven by user experience, integration capabilities, and regulatory compliance features.

Recent Developments

- In August 2025, HyperVerge Launches AI-Driven Loan Origination System Focused on Fraud Detection. HyperVerge’s loan origination platform integrates customizable AI decision engines and real-time analytics dashboards. The system strengthens risk management through advanced machine learning-based fraud detection, helping lenders speed up underwriting while reducing fraudulent activities.

- Finflux by M2P Fintech Launches New AI-Driven Loan Origination Software

- Launched in August 2025, Finflux is a configurable loan origination system designed for microfinance, retail, and SME lending markets.

- The platform offers extensive third-party integrations, business rules engines, automated customer notifications, and AI-powered decision-making tools.

- It aims to accelerate lending operations, improve credit risk assessment, and broaden access to underbanked segments.

Key Market Drivers

Rising Automation Demand for Loan Processing:

- Automation in loan origination, underwriting, and servicing is growing quickly. This aims to cut costs, boost compliance, and speed up decision-making.

- Surveys from 2024 show that a large majority of big banks, over 70% of those with assets above USD 10 billion, are automating key loan workflows.

- Regulatory bodies like the OCC and FDIC stress the importance of digital transformation for transparency and managing risk.

- Software providers are reacting with customizable rule engines and real-time dashboards to support audits and flexible workflows.

Growth in SME Lending:

- Borrowing by SMEs through digital platforms has increased sharply, especially in Asia-Pacific, with loan applications rising by about 28% in 2024.

- This trend is pushing software vendors to create flexible repayment options, multi-channel onboarding, and better credit scoring solutions designed for SMEs.

- Fintechs and neo-banks are aggressively using these platforms to provide quick, unsecured loans with little paperwork. This is increasing competition and driving innovation.

Rising Use of AI and Predictive Analytics:

- AI and predictive analytics are being used widely to enhance credit assessments, improve early warning systems, and detect fraud in commercial lending.

- A report from 2024 showed that banks using AI achieved almost 20% lower default rates and 25% better performance in loan origination.

- AI models that consider borrower behavior and macroeconomic data allow for real-time risk scoring and early alerts. These models are increasingly being integrated into loan origination systems.

Table: Key Factors Impacting Global Commercial Loan Software Market (2025–2035)

Base CAGR: 9.1%

|

Category

|

Key Factor

|

Short-Term Impact (2025–2028)

|

Long-Term Impact (2029–2035)

|

Estimated CAGR Impact

|

|

Drivers

|

1. Rising Automation Demand Accelerates Loan Processing

|

Increased use of automation tools in loan workflows

|

Seamless, fully automated loan lifecycle with real-time compliance

|

▲ +2.8%

|

| |

2. Growth in SME Lending

|

Cloud platform adoption growth among SMEs

|

Standardization of dynamic credit scoring in SME lending

|

▲ +2.3%

|

| |

3. Rising Use of AI and Predictive Analytics in Commercial Lending

|

Enhanced credit risk models and fraud alerts

|

AI-driven holistic risk management and portfolio optimization

|

▲ +2.0%

|

|

Restraints

|

1. Legacy System Integration Challenges

|

Integration delays and technical complexity

|

Legacy system modernization enables smoother platform adoption

|

▼ −1.8%

|

| |

2. Increasing Data Privacy and Cybersecurity Risks

|

Heightened security concerns slow cloud migrations

|

Mature security frameworks reduce risks and enable adoption

|

▼ −1.5%

|

|

Opportunities

|

1. Expansion of Fintech and Alternative Lending Platforms

|

Increased competitive fintech-driven innovation

|

Collaborative fintech-traditional lender ecosystems

|

▲ +1.8%

|

| |

2. AI-Driven Predictive Analytics and Automated Decision-Making Capabilities

|

Early AI-powered loan decision pilots

|

Full automation of credit decisions with predictive accuracy

|

▲ +1.5%

|

|

Trends

|

1. Rise of Low-Code/No-Code Platforms for Rapid Customization

|

Adoption of no-code solutions improving deployment speed

|

Wide adoption of low-code platforms across lending software vendors

|

▲ +1.5%

|

| |

2. Growing Emphasis on ESG Scoring and Sustainable Lending Practices

|

ESG modules integrated into lending platforms

|

ESG lending becomes core to credit evaluation

|

▲ +1.3%

|

|

Challenges

|

1. Managing Diverse Regulatory Requirements Across Multiple Jurisdictions

|

Complex regulatory navigation delays rollout

|

Harmonized AI-driven compliance frameworks reduce complexity

|

▼ −1.9%

|

| |

2. Ensuring Data Quality, Lineage, and Ethical Use Across Complex Lending Ecosystems

|

Initial data governance investment

|

Mature data ethics and lineage systems underpin lending decisions

|

▼ −1.7%

|

Regional Analysis

North America Leads with Strong Cloud Migration, AI Adoption, and Regulatory Support for Lending Software Transformation

North America remains the leading market for commercial loan software in 2025. This regional dominance is driven by aggressive digital transformation among regional and national banks. In 2024, over 60% of U.S. banks adopted cloud-based lending platforms, with AI integration rising by 35% year-over-year. Regulatory clarity from agencies like the OCC and CFPB has encouraged innovation, while fintech partnerships have accelerated deployment. The FDIC and OCC have issued guidelines supporting digital compliance tools, prompting vendors to enhance audit and reporting features. Fintechs like Kabbage and BlueVine continue to disrupt the SME lending space with fast, digital-first solutions. Canada is also seeing growth, particularly in SME lending, with credit unions adopting modular platforms to improve member services.

Asia-Pacific Experiences Rapid Expansion of Digital Lending Fueled by Fintech Innovation and SME Growth

Asia-Pacific will continue to expand at a 10.9% CAGR through 2035. This region is emerging as a high-growth region for commercial loan software, fueled by fintech innovation and rising SME demand. In 2024, digital commercial loan applications in India and Southeast Asia grew by 40%, driven by mobile-first platforms and embedded finance models. Governments in China, India, and Indonesia are promoting digital lending through policy incentives and infrastructure investments. Local banks are partnering with software vendors to offer multilingual, mobile-compatible platforms tailored to regional needs.

China Accelerates Digital Lending Growth Backed by Government Initiatives and Expanding Fintech Ecosystem

China’s commercial loan software market is expected to grow at a CAGR of 11.5% from 2025 to 2035. China’s commercial lending sector is rapidly digitizing, with fintechs and state-owned banks adopting cloud-native platforms. In 2024, digital loan origination in China rose by 38%, supported by government-backed initiatives like the Digital Finance Development Plan. AI and big data analytics are widely used to assess borrower creditworthiness, especially among SMEs.

The People's Bank of China actively promotes open banking standards and API integration, facilitating seamless data exchange across multiple platforms and encouraging interoperability between traditional banks and emerging fintech providers. Local vendors such as Ping An Technology and Tencent Cloud are expanding their lending suites to support regional banks and rural cooperatives. Additionally, government's strategic emphasis on supporting micro, small, and medium enterprises (MSMEs) through enhanced lending frameworks creates substantial opportunities for commercial loan software providers.

Germany Modernizes Commercial Lending Systems to Meet EU Compliance and Support SME and Green Financing

Germany’s commercial lending market is undergoing modernization, driven by EU-wide mandates on digital compliance and risk management. In 2024, over 55% of German banks upgraded their loan origination platforms to meet Basel III and GDPR requirements. The rise of SME financing and green lending initiatives is also influencing platform design, with vendors offering ESG scoring and sustainability-linked loan modules. Partnerships between banks and fintechs help accelerate deployment across regional institutions. Germany's emphasis on data security, privacy protection, and operational resilience creates demand for enterprise-grade commercial loan software platforms supporting both domestic and international banking operations.

Segmental Analysis

Loan Origination Software Leads Commercial Loan Software Market in 2025 with Automation, AI-driven Credit Decisioning, and Enhanced Digital Onboarding

Loan origination software accounts for the largest share of around 30% of the commercial loan software market in 2025, driven by demand for faster credit decisioning and reduced manual processing. Loan origination is a critical application driving commercial loan software market expansion, as financial institutions prioritize automation and AI integration to accelerate approval processes while improving risk evaluation accuracy and borrower satisfaction. In 2024, usage of digital origination platforms rose by 32% globally, with banks reporting a 20% reduction in processing time. These platforms offer automated document verification, borrower profiling, and real-time risk scoring. Vendors are also integrating e-signature and mobile onboarding features to improve borrower experience.

Solutions Segment Dominates Overall Commercial Loan Software Market in 2025

On the basis of component, the solutions component dominate the commercial loan software market, capturing the revenue share of more than 70% in 2025. This is mainly attributed to the demand mandated by enterprises for platforms capable of managing complete loan lifecycles from origination through servicing. These integrated solution suites encompass loan origination systems (LOS), credit risk assessment tools, automated underwriting platforms, and loan servicing modules, incorporating AI and machine learning algorithms to streamline workflows and ensure regulatory compliance. Financial institutions prefer modular solution architectures offering scalability, cloud compatibility, and seamless integration with existing core banking systems and partner ecosystems. Additionally, the growing complexity of commercial lending operations, coupled with evolving regulatory landscapes, drives the continued market expansion in this segment.

Report Specifications:

|

Report Attribute

|

Details

|

|

Market size (2025)

|

USD 6.71 billion

|

|

Revenue forecast in 2035

|

USD 15.88 billion

|

|

CAGR (2025-2035)

|

9.1%

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 – 2035

|

|

Report coverage

|

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints

|

|

Segments covered

|

Component (Software, Services), Deployment (Cloud, On-Premise, Hybrid), Application (Loan Origination, Risk Management, Portfolio Management, Compliance Management), Geography

|

|

Regional scope

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

|

Key companies profiled

|

nCino, Inc.; Finastra; Temenos AG; FIS (Fidelity National Information Services); Oracle Corporation; Newgen Software Technologies; Ellie Mae (ICE Mortgage Technology); Blend Labs, Inc.; Black Knight, Inc.; Sageworks (Abrigo); M2P Fintech; FinBox; HyperVerge; AllCloud; Q2 Holdings, Inc.

|

|

Customization

|

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available

|

|

Pricing Details

|

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models

|

Market Segmentation

- By Component

- By Deployment Mode

- Cloud-based

- On-Premises

- Hybrid

- By Application

- Loan Origination

- Risk Management

- Portfolio Management

- Compliance Management

- Others

- By Organization Size

- Large Enterprises

- Small and Medium Enterprises

Key Questions Answered in the Report: