Resources

About Us

Cancer/Tumor Profiling Market Size, Share, Forecast, & Trends Analysis by Biomarker Type (Genetic, Protein) Technology (NGS, PCR, ISH) Cancer Type (Breast, Prostate) Application (Clinical, Research) End User (Pharma, Academic) - Global Forecast to 2031

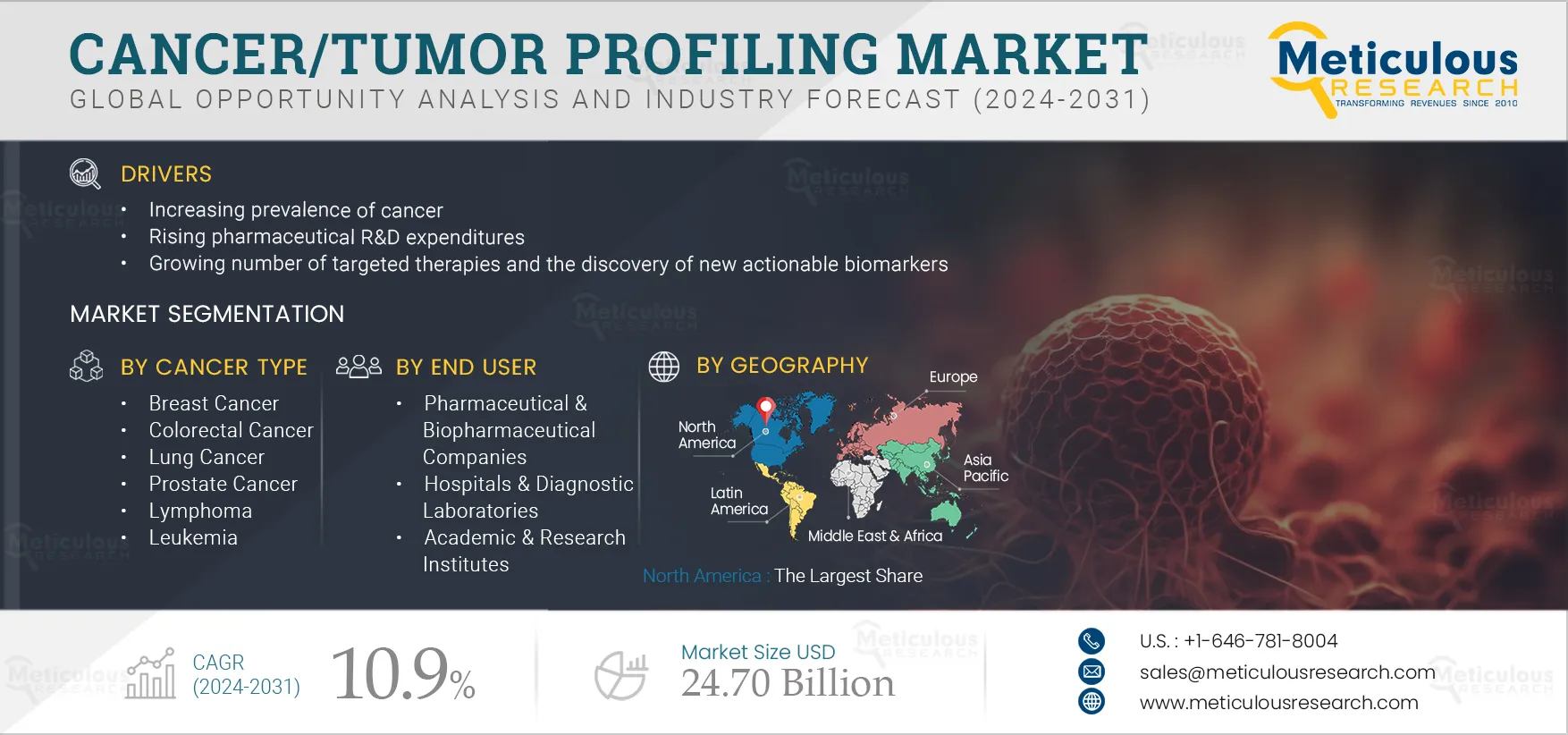

Report ID: MRHC - 104947 Pages: 270 Jul-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe Cancer/Tumor Profiling Market is projected to reach $24.70 billion by 2031 at a CAGR of 10.9% from 2024 to 2031. The rise in cancer cases, the growing research of novel molecules, and the increasing number of genomic research projects have increased the demand for cancer/tumor profiling. The emergence of tumor profiling has removed the restraints of traditional cancer/tumor classification approaches, which rely on the morphology of the cancerous cells and the surrounding tissues. Today, cancer/tumor profiling is accepted as the standard technique for classifying tumors, with the guidelines associated with the European Society for Molecular Oncology (ESMO) and the College of American Pathologists (CAP).

The profiling of tumors with advanced technologies such as ISH, NGS, IHC, and PCR has successfully analyzed the genes, amplicons, and gene regions with familiar involvement with tumors. This approach, also known as targeted treatment, delivers high sensitivity for detecting tumor subclones or rare mutations, providing increased visibility regarding important mutations acting as drivers of cancer.

The growth of the cancer/tumor profiling market is attributed to the increasing prevalence of cancer, the rising pharmaceutical R&D expenditures, the growing number of targeted therapies and the discovery of new actionable biomarkers, increasing investments in cancer research, the declining costs of NGS-based profiling, and advancements in multi-omics tumor profiling. However, the high capital investments required for NGS setups and long turnaround times restrain the growth of this market.

Additionally, the increasing focus on developing personalized medicines and the rising awareness and adoption of targeted therapies are expected to generate market growth opportunities. However, the lack of genetic experts for interpreting results, the non-availability of in-house tumor profiling technologies, and the high number of false biomarker discoveries are major challenges for the stakeholders in the cancer/tumor profiling market.

Cancer research has benefited from the advancement in omics technologies from genomics to transcriptomics and from a wide variety of resources obtained from multiple omics datasets originating from the patients. Multi-omics approaches offer a unique opportunity to identify cancer patients' clinical and molecular features. In transcriptomics and genomics, there is an unmet need to distinguish between inconsistency in related biological procedures, like differences in variability or post-translational changes in the expression profiles due to the role of mRNA transcripts in the development of cancer.

Recent advancements in proteomics have facilitated the emergence of proteogenomic approaches. These approaches seamlessly integrate genomic data with proteomics data, including insights into post-translational modifications such as acetylation and protein phosphorylation. These developments in multi-omics tumor profiling and cancer research are expected to drive the growth of the cancer/tumor profiling market.

Click here to: Get Free Sample Pages of this Report

The burden of cancer is growing globally. According to GLOBOCAN 2020, cancer incidence is expected to increase from 19.3 million in 2020 to 30.2 million in 2040. Moreover, the mortality due to cancer is estimated to increase from 9.9 million in 2020 to 16.3 million in 2040. Nearly 70% of the total deaths due to cancer occur in low and middle-income countries. Early detection is extremely important in reducing mortality, improving patients’ chances of survival, and saving on treatment costs. Various methods are used to detect cancer. The demand for cancer/tumor profiling for cancer diagnosis is expected to grow significantly in the coming years.

During the last decade, genomics and proteomics approaches have become effective and crucial tools in the clinical research of biological pathways involved in cancer pathogen replication, host response, and disease progression. Genomics and proteomics are important for discovering and understanding host-pathogen interactions. They offer the opportunity to improve personalized treatments and disease prevention in advanced cancer cases. Genomics primarily aims to sequence, assemble, and analyze the functions and structures of genomes. At the same time, proteomics helps in the large–scale study of the complete set of proteins within an organism. Such developments in genomics and proteomics are expected to drive the cancer/tumor profiling market.

Personalized/precision medicine uses an individual’s genomic information to offer targeted treatment. The synthesis of genes can rapidly sequence large sections of a person’s genome and aid in the formulation of precision medicine, in turn generating cost-effective alternatives to existing therapies and allowing for novel treatments. Personalized medicine analyzes molecules, individual genes, and networks and translates them into an overall output for the systems of the human body. These medicines can tailor therapies with the best responses and highest safety margins, ensuring better patient care. Moreover, precision medicines help cure diseases and enhance the chances of saving people undergoing treatments for life-threatening diseases. Furthermore, cancer treatment and diagnosis are also advancing significantly with the increased adoption of advanced technologies such as PCR, NGS, FISH, and ISH in precision medicine.

New targeted cancer treatments that use genomic data to provide patient-specific treatments are known as precision oncology. This rapidly developing field has already become a part of mainstream clinical practices. It involves the molecular profiling of cancer cells to identify targetable alterations, also known as biomarkers. Quick and reliable sequencing of multiple genes at once is possible with next–generation sequencing (NGS) technology. Furthermore, personalized medicine contributes to advancements in new therapies for cancer treatment, the development of new methods for disease detection, and the development of preventive medicines. Thus, the increasing inclination toward personalized medicine-based diagnosis and treatment is expected to create opportunities for market growth.

Based on biomarker type, the cancer/tumor profiling market is segmented into genetic biomarkers and protein biomarkers. In 2024, The genetic biomarkers segment is expected to account for the largest share of 72.0% of the cancer/tumor profiling market. The large market share of this segment is attributed to the benefits offered by genetic biomarkers, including their reliability in identifying drug-resistant cancer cells, assisting in identifying genetic patterns responsible for future cancer recurrence, and their increased use for the early detection of cancer.

Based on technology, the cancer/tumor profiling market is segmented into next-generation sequencing (NGS), polymerase chain reaction (PCR), in situ hybridization (ISH), immunohistochemistry (IHC), and other technologies. In 2024, the next-generation sequencing (NGS) segment is expected to account for the largest share of the cancer/tumor profiling market. The large market share of this segment is attributed to the benefits offered by NGS, such as high-throughput production, efficient instrument runs, and cost-effectiveness compared to traditional first-generation sequencing methods. Additionally, NGS is highly preferred for large-scale genomic profiling and transcriptomic sequencing.

Based on Cancer Type, the cancer/tumor profiling market is segmented into breast cancer, colorectal cancer, lung cancer, prostate cancer, lymphoma, leukemia, cervical cancer, and other cancer types. In 2024, The breast cancer segment is expected to account for the largest share of the cancer/tumor profiling market. The large market share of this segment is attributed to the rising incidence of breast cancer cases and the increasing adoption of tumor profiling for breast cancer.

Based on application, the cancer/tumor profiling market is segmented into clinical applications and research applications. In 2024, the research applications segment is expected to account for the largest share of the cancer/tumor profiling market. The large market share of this segment is attributed to the decreasing cost of sequencing procedures, the rising research and development efforts by pharmaceutical and biopharmaceutical companies in drug and biomarker discovery, the high sensitivity and throughput offered by advanced profiling technology, and the expanding applications of cancer/tumor profiling in various clinical and research areas.

Based on End User, the cancer/tumor profiling market is segmented into pharmaceutical & biopharmaceutical companies, hospitals & diagnostic laboratories, academic & research institutes, and contract research organizations (CROs). In 2024, the pharmaceutical & biopharmaceutical companies segment is expected to account for the largest share of 40.9% of the cancer/tumor profiling market. The large market share of this segment is attributed to the declining costs of sequencing, the increase in research and development activities by pharmaceutical and biopharmaceutical companies, and the extensive utilization of advanced profiling solutions for cancer studies.

In 2024, North America is expected to account for the largest share of 42.7% of the cancer/tumor profiling market. North America’s significant market share can be attributed to the high prevalence of cancer, substantial healthcare expenditure, widespread adoption of advanced molecular technologies, and substantial investment in pharmaceutical R&D.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years (2021–2024). The key players operating in the global cancer/tumor profiling market are Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (U.S.), NanoString Technologies, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Agendia Inc. (U.S.), Personalis, Inc. (U.S.), Exact Sciences Corporation (U.S.), and Tempus Labs, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

270 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

10.9% |

|

Estimated Market Size (Value) |

$24.70 billion by 2031 |

|

Segments Covered |

By Biomarker Type

By Technology

By Application

By Cancer Type

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, India, and Rest of Asia-Pacific), Latin America and Middle East & Africa |

|

Key Companies |

The key players operating in the global cancer/tumor profiling market are Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (U.S.), NanoString Technologies, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Agendia Inc. (U.S.), Personalis, Inc. (U.S.), Exact Sciences Corporation (U.S.), and Tempus Labs, Inc. (U.S.). |

The global cancer/tumor profiling market report covers the qualitative analysis and market sizing of biomarker type, cancer type, technology, application, and end user. This report involves the analysis of various segments of cancer/tumor profiling at the regional and country level. The report also provides insights on factors impacting market growth, factor analysis, case studies, regulatory analysis, pricing analysis, and Porter’s five forces analysis.

The cancer/tumor profiling market is projected to reach $24.70 billion by 2031, at a CAGR of 10.9% during the forecast period.

Among the biomarkers covered in this report, the genetic biomarkers segment is expected to account for the largest share of the market in 2024.

Among the technologies covered in this report, the next-generation sequencing (NGS) segment is expected to account for the largest share of the market in 2024. The large market share of this segment is attributed to the higher sensitivity of this technique compared to call variants, low sequencing costs compared to other sequencing technologies, and the availability of low-cost sequencers.

Among the cancer types covered in the report, the breast cancer segment is expected to account for the largest share of the market in 2024. The increase in breast cancer cases, government initiatives promoting breast cancer treatment, increasing healthcare expenditure, and reimbursement for certain profiling technologies such as NGS drive the demand for cancer/tumor profiling for breast cancer.

Among the applications covered in this report, the research applications segment is expected to hold the largest share of the market in 2024. The large market share of this segment is attributed to the rising incidence of cancer, the growing demand for precision medicine, the increased discovery of biomarkers, and the availability of cost-effective advanced profiling technologies like NGS and PCR within research protocols.

Among the end users covered in this report, the pharmaceutical & biopharmaceutical companies segment is expected to hold the largest share of the market in 2024. The large market share of this segment is attributed to rising research efforts in biomarker discovery, the growing demand for precision medicine, and the increasing number of cancer studies aimed at advancing cancer treatment.

The growth of the cancer/tumor profiling market is attributed to the increasing prevalence of cancer, the rising pharmaceutical R&D expenditures, the growing number of targeted therapies and the discovery of new actionable biomarkers, increasing investments in cancer research, the declining costs of NGS-based profiling, and advancements in multi-omics tumor profiling.

Furthermore, the increasing focus on developing personalized medicines and the rising awareness and adoption of targeted therapies are expected to generate market growth opportunities.

The key players profiled in the cancer/tumor profiling market study are Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (U.S.), NanoString Technologies, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Agendia Inc. (U.S.), Personalis, Inc. (U.S.), Exact Sciences Corporation (U.S.), and Tempus Labs, Inc. (U.S.).

Emerging economies such as China and India are projected to offer significant growth opportunities to the market players due to rising investments in the healthcare sector and increasing genomic projects in these countries.

Published Date: Feb-2024

Published Date: May-2023

Published Date: Nov-2022

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates