Resources

About Us

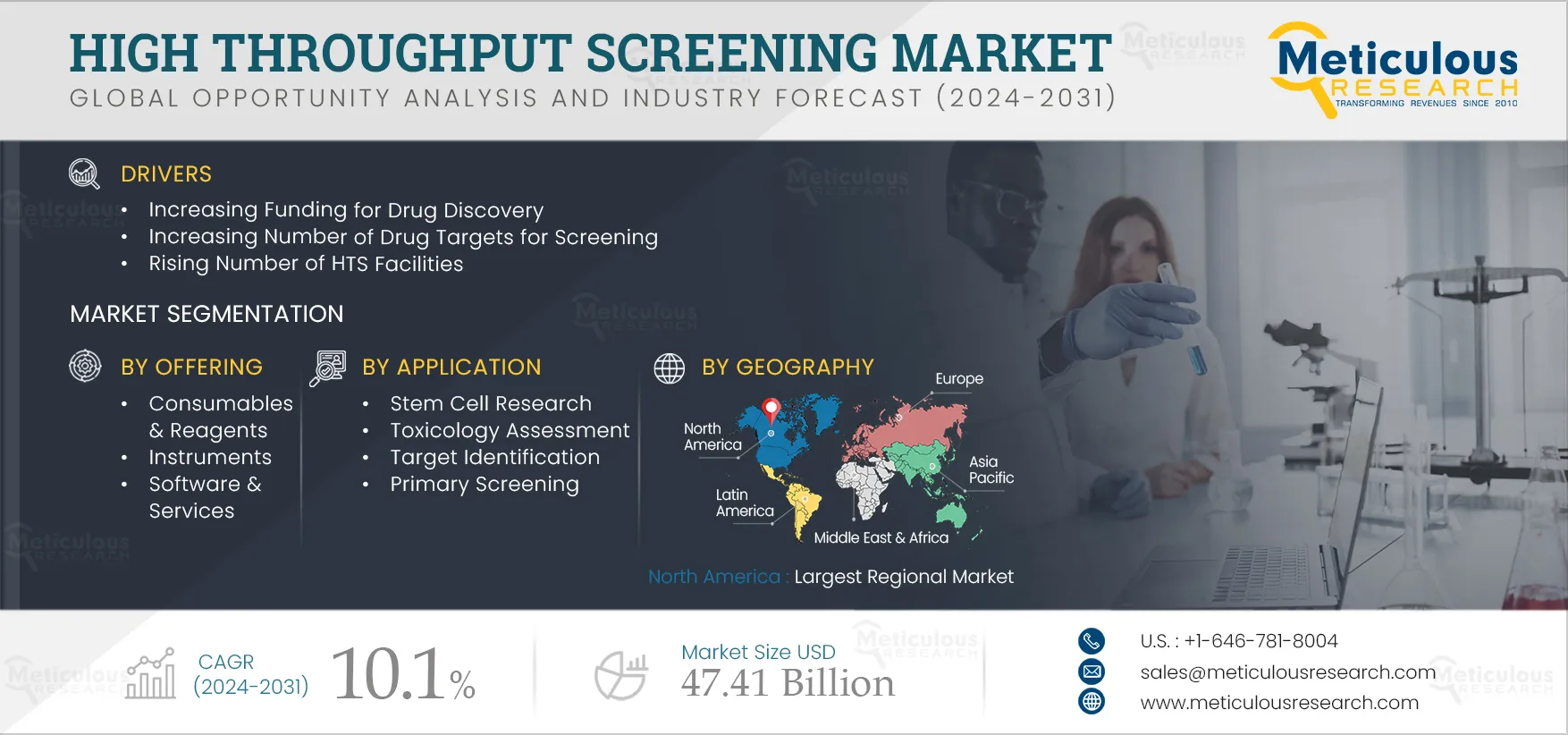

High Throughput Screening Market by Technology (Cell-based Assays [2D, 3D], Label-free, Lab-on-chip), Offering (Reagents, Liquid Handling, Readers, Sample Prep), Application (Target Identification, Toxicology, Stem Cell), End User - Global Forecast to 2031

Report ID: MRHC - 10443 Pages: 250 Mar-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportHigh throughput screening (HTS) or high-throughput experimentation (HTE) is used to carry out many reactions simultaneously in parallel synthesis. HTS assays are specifically useful for efficient and rapid screening of compounds to find the ideal reactants for the reaction. High-throughput screening methods frequently use automated systems such as computer programs, robotic plating systems, and automated data collection/analysis for the identification of potential reactants. HTS has transformed the drug discovery process and is used by research laboratories, pharmaceutical companies, academic institutions, and other end users to identify new potential drug candidates.

Pharmaceutical and biotechnology companies allocate significant resources to drug discovery. For instance, in 2022, the R&D spending of F Merck KGaA (Germany) increased by 10.6% from 2021. The rise in the company’s R&D expenditure was attributed to the increased focus on the cardiovascular drug portfolio. Similarly, Pfizer (U.S.) increased R&D expenditure in 2022 by 10% from 2021. High throughput screening is majorly used for the detection of compounds known as hits with biological or pharmacological activity. The hits are considered as a starting point for drug discovery & development.

Along with the pharmaceutical & biotechnology companies, government agencies across the globe are also allocating funding for drug discovery, which, in turn, is expected to drive the growth of the high throughput screening market. For instance, according to the National Venture Capital Association, venture capital investments and funding for biotech and pharmaceutical companies in the U.S. reached USD 30.7 billion in 2022 from USD 18.7 billion in 2019. Following are some of the recent investments/funding for drug discovery:

Click here to: Get Free Sample Pages of this Report

High throughput analysis is a crucial technique frequently used in the early stages of drug discovery to select small subsets of vast chemical libraries that regulate the activity of a biological target. To discover the most promising compounds rapidly, effectively, and affordably, HTS needs scalable, high-quality assays. Multiplex assays analyze several targets in a single well with small amounts of sample, dramatically increasing the data points gathered in HTS. Multiplex assays enable simultaneous measurement of many analytes, giving researchers more information from a single assay. They can reduce a researcher's workload while speeding up and scaling up biomarker profiling.

Multiplexing and high-throughput capabilities combined in high-throughput multiplex assays allow for the collection of more meaningful data and the improvement of early drug discovery decision-making without compromising test performance or data quality.

Performing HTS assay in multiplexed format increases the speed and efficiency of the drug discovery process as more than one piece of information can be obtained from each assay performed. A multiplexed format also lowers costs and variability as assays are completed using the same parameters. The lowering variability of the assay results also decreases the potential incidences of obtaining false positive results, thus increasing the accuracy of the drug discovery process.

Additionally, the key players are launching the multiplexed HTS assay. For instance, in February 2022, Bruker Corporation (U.S.) launched a High-Throughput Multiplex HTS on the Sierra SPR Platform. The microfluidic system of the Bruker Sierra SPR-32 Pro provides a unique 8x4 array for parallel readout of 32 measurement sensor spots per injection at exceptional robustness. This configuration offers high throughput while maintaining flexibility for the development of both biologics and small-molecule drug candidates.

Based on offerings, the high throughput screening market is segmented into consumables & reagents, instruments, and software & services. The software & services segment is expected to register the highest CAGR during the forecast period. The high CAGR of the segment is attributed to the increasing adoption of software for the data analysis obtained through the HTS. Additionally, HTS leverages the automation in instruments such as liquid handling systems, which require data processing software.

Based on technologies, the high throughput screening market is segmented into cell-based assays, ultra-high throughput screening, label-free technology, and lab-on-chip. In 2024, the cell-based assays segment is expected to account for the largest share of the high throughput screening market. The use of cell-based assays in drug-discovery screening applications and biomedical research to quantify off-target interactions, cytotoxicity, and biochemical mechanisms is attributed to the largest share of the segment. The benefits associated with high throughput cell-based assays, such as physiological relevance, generation of more data, and the ability to simultaneously measure compound characteristics, are also supporting the segment's large share.

Based on applications, the high throughput screening market is segmented into stem cell research, toxicology assessment, target identification, and primary screening. In 2024, the target identification segment is expected to account for the largest share of the high throughput screening market. The large share of the segment is attributed to the increased adoption of high throughput products for the efficient, cost-effective, and accurate identification of targets in the early stage of drug discovery. Additionally, increasing drug failure rate during clinical trials due to drug toxicity and lack of drug efficacy is increasing the demand for target identification. Additionally, HTS is also used in cases where the structure information of the target molecule is not known, thus providing the flexibility of target identification from a large number of molecules.

Based on end users, the high throughput screening market is segmented into pharmaceutical and biotechnology industry, academics and research institutes, and contract research organizations. In 2024, the pharmaceutical & biotechnology industry segment is expected to account for the largest share of the high throughput screening market. The large market share of this segment is attributed to the need to develop new therapies owing to increasing disease prevalence and increased spending on pharmaceutical R&D. For instance, global pharmaceutical R&D expenditure is expected to reach USD 213 billion in 2026 from USD 179 billion in 2020 (Source: International Federation of Pharmaceutical Manufacturers & Associations (IFPMA)). Additionally, pharmaceutical & biotechnology companies' shift from traditional screening methods to HTS is contributing to the large share of the segment.

In 2024, North America is expected to account for the largest share of the high throughput screening market. North America's significant market share is attributed to several factors, including substantial R&D investments by pharmaceutical and biotechnology companies for drug and biomarker development, a growing prevalence of chronic diseases, increased healthcare expenditure, the presence of key market players in the region, and government initiatives supporting research and development. The surge in R&D spending by pharmaceutical companies is anticipated to drive the demand for high throughput screening, driving the market. According to the European Federation of Pharmaceutical Industries and Associations (Belgium), in the U.S., the pharmaceutical R&D expenditure annual growth rate was 15.6% from 2018-2022 compared to 13.6% from 2013-2017.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years 2020–2024. The key players operating in the global high throughput screening market are Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Revvity Inc. (U.S.), Tecan Group Ltd. (Switzerland), Axxam S.p.A. (Italy), Charles River Laboratories International, Inc. (U.S.), Hamilton Company (U.S.), Promega Corporation (U.S.), and Aurora Biomed Inc. (Canada).

|

Particulars |

Details |

|

Number of Pages |

~250 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

10.1% |

|

Estimated Market Size (Value) |

$47.41 billion by 2031 |

|

Segments Covered |

By Product

By Offerings

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, and RoE), Asia-Pacific (China, Japan, India, and RoAPAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Revvity Inc. (U.S.), Tecan Group Ltd. (Switzerland), Axxam S.p.A. (Italy), Charles River Laboratories International, Inc. (U.S.), Hamilton Company (U.S.), Promega Corporation (U.S.), and Aurora Biomed Inc. (Canada). |

The global high throughput screening market covers the study of various technologies and offerings in HTS for multiple applications used across end users. This report also involves the analysis of various segments of high throughput screening at the regional and country levels.

The High Throughput Screening Market is projected to reach $47.41 billion by 2031 at a CAGR of 10.1% from 2024 to 2031.

Among all the offerings studied in this report, in 2024, the consumables & reagents segment is expected to account for the largest share of the high throughput screening market. The wide availability of reagents and kits and their recurrent use at various stages in drug discovery are supporting the large share of consumables & reagents in the market.

Among all the applications studied in this report, in 2024, the target identification segment is expected to account for the largest share of the high throughput screening market. The large share of the segment is attributed to the increased adoption of high throughput products for the efficient, cost-effective, and accurate identification of targets in the early stage of drug discovery.

The growth of this market can be attributed to various factors, such as the increasing adoption of innovative approaches for R&D in pharmaceutical and biotechnology companies, increasing funding for drug discovery, increasing number of drug targets for screening, and the rising number of HTS facilities.

Furthermore, the expansion of the biotechnology sector in countries like Singapore and India and technological advancements in HTS are expected to offer market growth opportunities.

The key players operating in the global HTS market are Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KGaA (Germany), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Revvity Inc. (U.S.), Tecan Group Ltd. (Switzerland), Axxam S.p.A. (Italy), Charles River Laboratories International, Inc. (U.S.), Hamilton Company (U.S.), Promega Corporation (U.S.), and Aurora Biomed Inc. (Canada).

The countries in Asia-Pacific are projected to offer significant growth opportunities for the vendors in this market. China and India are boosting their investment in research and development in the healthcare sector. Chinese pharmaceutical & biopharmaceutical companies are actively seeking new products and technologies through drug discovery and development to meet the rising medical demand for innovative products from the large patient population in the country. Moreover, significantly growing pharmaceutical research outsourcing from the country is positively impacting the high throughput screening market. Additionally, the rising drug discovery market and collaboration of key companies with domestic companies for drug discovery in South Korea are offering opportunities for market growth.

Published Date: Jan-2024

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates