Resources

About Us

Beverage Shelves Market Size & Forecast 2025–2035 | Global Trends, Smart Shelving Adoption, Retail Expansion & Regional Analysis

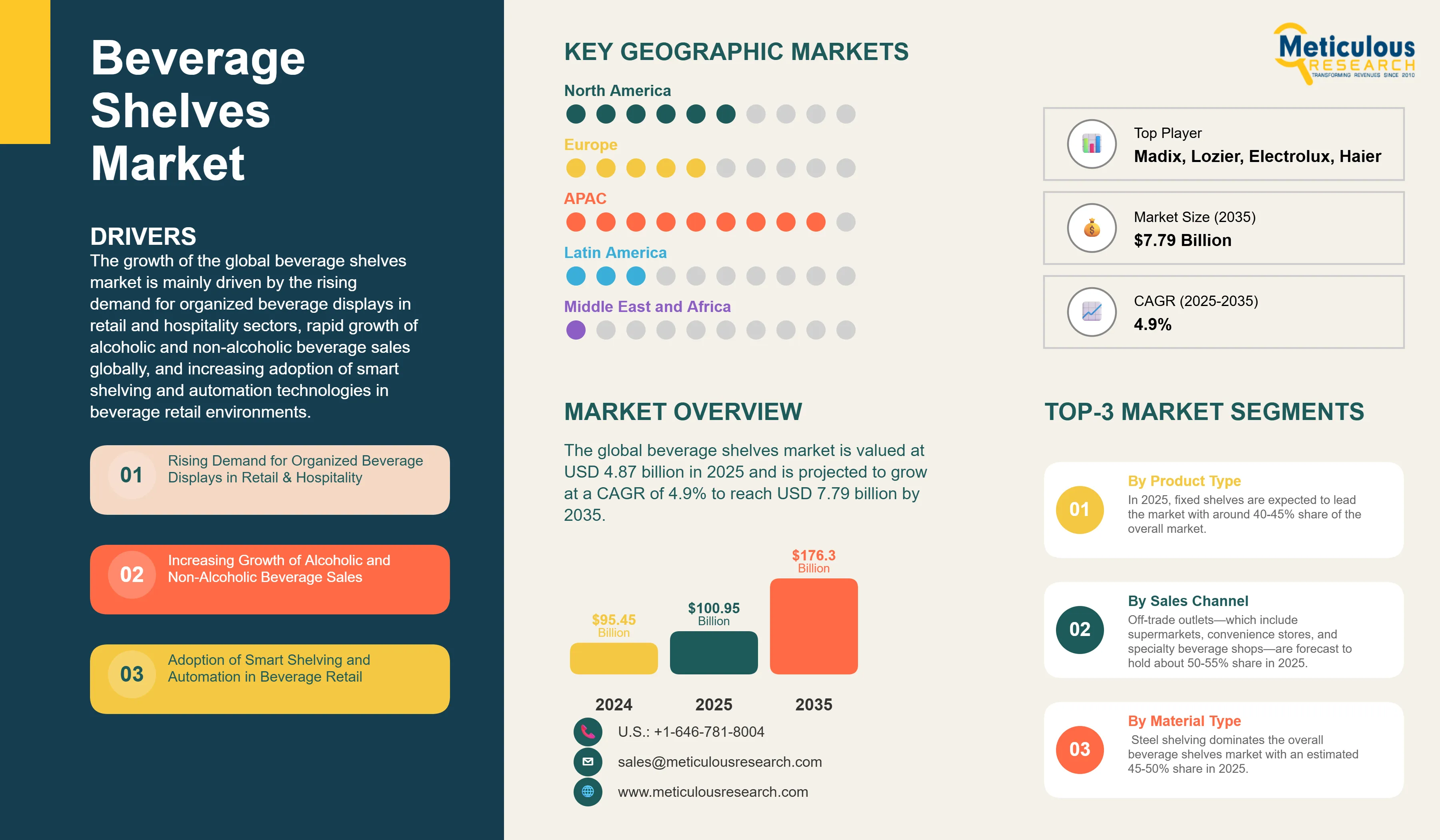

Report ID: MRFB - 1041533 Pages: 180 Jun-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the global beverage shelves market is mainly driven by the rising demand for organized beverage displays in retail and hospitality sectors, rapid growth of alcoholic and non-alcoholic beverage sales globally, and increasing adoption of smart shelving and automation technologies in beverage retail environments.

Moreover, the expansion of e-commerce and the consequent need for optimized shelf storage in warehouses has accelerated the growth of this market across the globe. Additionally, regulatory and safety compliance requirements, particularly for alcoholic beverage shelving, are driving demand for specialized display solutions.

However, the high cost of smart shelving technologies is expected to hamper the adoption, especially by some smaller retailers to some extent. Additionally, factors such as various complexities in shelf compliance and labeling requirements for alcoholic products and the difficulty in managing diverse beverage sizes, packaging formats, and weight distributions further restrains the growth of this market to some extent.

Despite existing challenges, the beverage shelving market offers significant growth opportunities in many regions across the globe. These opportunities for growth are emerging through the development of advanced solutions such as gravity-fed and refrigerated shelving systems, which enhance product preservation and visibility. Rapid retail expansion in many emerging markets is further driving demand for innovative and scalable shelving technologies. Additionally, the integration of AI and advanced analytics into shelf management is also broadening the use of shelves for different applications.

In line with broader industry trends, the focus on energy-efficient refrigerated shelving technologies and reduced carbon footprint through optimized material usage is increasing. Manufacturers are also developing sustainable materials and implementing sustainable manufacturing processes to meet evolving environmental demands.

Market Drivers

Rising Demand for Organized Beverage Displays in Retail & Hospitality

According to industry trends reported in recent retail research, a significant portion of retailers have increased their investment in visual merchandising and display solutions to enhance the in-store customer experience. This trend is particularly evident in the beverage sector, where demand for organized and attractive beverage displays is rising across supermarkets, specialty stores, bars, restaurants, and other hospitality venues.

Beverage shelves often represent a substantial portion of retail display space in these outlets, typically ranging from around 20% to 30%, depending on the store format and product mix. Given the high sales value of beverages, these shelves play a crucial role in revenue generation. Research and case studies in retail merchandising indicate that well-designed shelving systems can notably improve product visibility and positively influence sales conversion rates when compared to traditional storage and display methods. Enhancements in shelf organization, lighting, and ergonomics contribute to better shopper engagement and purchasing decisions, thereby maximizing sales and optimizing space utilization in high-traffic areas.

The use of gravity feed shelving systems alongside temperature-controlled display units is increasingly recognized for its effectiveness in keeping beverages fresh and ensuring smooth product rotation. These shelving solutions not only help maintain product quality but also typically deliver a return on investment within 18 to 24 months by reducing waste and increasing sales velocity.

Recent trends indicate growing interest from the hospitality sector—including hotels, restaurants, and entertainment venues—for custom-designed beverage shelving that balances practical functionality with visual appeal. Such tailored shelving solutions not only improve the customer experience but also strengthen brand image and positioning in competitive markets.

Increasing Growth of Alcoholic and Non-Alcoholic Beverage Sales

The global beverage industry is continuing its growth trajectory, with the International Wine and Spirit Research (IWSR) forecasting an annual growth rate of around 2.3% through 2025. This steady expansion is driving a demand for specialized beverage shelving solutions capable of accommodating a wide variety of products—from craft beers and premium wines to energy drinks and functional beverages.

The trend toward premiumization in alcoholic beverages is fueling the need for sophisticated display shelving that highlights the value and uniqueness of high-end products. For example, wine storage and display shelves now often include specialized features such as temperature control, UV protection, and vibration reduction to help preserve product quality and enhance the customer experience.

Meanwhile, non-alcoholic beverage segments—like functional drinks, cold-pressed juices, and craft sodas—are growing rapidly and require versatile shelving solutions that can easily adjust to different package sizes and presentation styles. Alongside this growth, the increasing number of health-conscious consumers has fueled demand for refrigerated shelving that keeps products fresh while making them visually appealing on the shelf.

Adoption of Smart Shelving and Automation in Beverage Retail

The integration of IoT-enabled smart shelving systems with real-time inventory tracking is transforming the way beverage retailers operate. Recent industry studies have shown that businesses adopting smart shelves experience significant improvements—inventory accuracy increases by around 25 to 35%, while out-of-stock situations drop by 20 to 30%.

Modern beverage shelving increasingly features sensor-based weight detection and automated replenishment alerts, allowing retailers to maintain optimal stock levels without manual oversight. These technologies not only help reduce labor costs but also increase customer satisfaction by ensuring popular products are always available.

In addition, the use of digital price tags and interactive product displays linked with smart shelves is reshaping the shopping experience. Customers benefit from up-to-date pricing and detailed product information, while retailers gain the flexibility to implement dynamic pricing and manage promotions in real time.

Beyond inventory management, smart shelving systems are leveraging advanced analytics and machine learning to forecast demand, fine-tune product placement, and boost operational efficiency. These innovations enable beverage retailers to respond quicker to changing consumer preferences and optimize shelf space for maximum impact.

As the retail landscape becomes increasingly digital, smart shelves are proving to be a crucial tool in bridging offline and online channels—offering seamless, engaging, and efficient shopping experiences that drive sales and build customer loyalty.

Market Segmentation Analysis

By Product Type

The beverage shelves market is broadly categorized into fixed shelves, mobile shelves, gravity feed shelves, and refrigerated or temperature -controlled shelving units. In 2025, fixed shelves are expected to lead the market with around 40-45% share of the overall market. Their popularity stems from being cost- effective, durable, and versatile enough to suit many retail formats and beverages varieties.

However, refrigerated and temperature-controlled shelving is anticipated to grow at the fastest CAGR between 2025 and2035. This growth is largely driven by increasing consumer demand for premium beverage preservation, the expanding craft beverage sector requiring precise temperature control, and retailers' focus on maintaining product freshness and quality.

By Technology

Technologically, the overall beverage shelves market is primarily segmented into conventional shelving, smart shelving with IoT capabilities, automated shelving including robotic systems, and sensors or weight-based inventory management systems. Conventional shelving is expected to hold the largest share in 2025 with around 55-60% share of the overall market- thanks to its lower upfront costs and widespread use in traditional retail.

At the same time, smart and IoT-enabled shelving solutions are predicted to register the fastest CAGR, driven by their benefits in real-time inventory tracking, boosting operational efficiency, lowering labor costs, and enhancing the shopping experience through updated product information and pricing.

By Material Type

Material-wise, steel shelving dominates the overall beverage shelves market with an estimated 45-50% share in 2025, valued for its strength, durability, and cost advantages, especially when handling heavy beverage loads.

That said, shelving made from specialty materials designed for hygienic use and cold storage is expected to grow at the fastest CAGR over the next decade. This reflects rising consumer and retailer emphasis on cleanliness, food safety standards, and the rising use of refrigerated storage that demands more advanced materials.

By Sales Channel

Looking at sales channels, off-trade outlets—which include supermarkets, convenience stores, and specialty beverage shops—are forecast to hold about 50-55% share of the market in 2025. Their extensive reach into consumer markets makes them the largest adopters of beverage shelving solutions.

Meanwhile, the online distribution and e-commerce channel is set to grow rapidly as it scales to accommodate booming online beverage sales. This growth is supported by increasingly efficient warehouse shelving solutions and automated fulfillment technologies specifically designed for beverage inventory management.

Regional Analysis

Geographically, the Asia-Pacific region is poised to be the largest market in 2025, with an estimated 35-40% share of global beverage shelves market. This growth is driven by rapid retail expansion, rising beverage consumption, the proliferation of modern retail formats, and greater adoption of advanced retail technologies.

The Asia-Pacific region is also expected to grow at the fastest CAGR through 2035. Factors such as the expanding organized retail sector's need for professional display solutions, rising disposable incomes, a growing hospitality industry, government-backed retail modernization initiatives, and increasing awareness around food safety and hygiene standards all contribute to the growth of beverage shelves market in this region.

North America remains a mature, innovation-focused market that emphasizes smart shelving technologies, sustainability, and regulatory compliance. Here, upgrading existing retail infrastructure and growing premium beverage segments underpin steady market growth.

In Europe, demand for sustainable and energy-efficient shelving is particularly strong, driven by strict environmental regulations and consumer preferences for eco-friendly materials. This is encouraging the adoption of sustainable shelving designs and circular economy principles across the region's retail sector.

Key Players Operating in the Global Beverage Shelves Market

The key players in the global beverage shelves market include Trion Industries Inc., Madix Inc., Lozier Corporation, Gondella NV, Hussmann Corporation, Artitalia Group, Metalware Corporation, Shelving Inc., Borgen Systems AS, Dexion, Tegometall International AG, Uniweb Inc., Spacesaver Corporation, CAEM Srl, LA Darling, Donracks, Storflex, Guangzhou Huicheng Shelf Co., Ltd., Handy Store Fixtures, Kider SA, Metalfrio Solutions SA, True Manufacturing Co. Inc., Electrolux AB, Haier Group Corporation, and Dover Corporation among others.

|

Particulars |

Details |

|

Number of Pages |

180 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.9% |

|

Market Size 2024 |

USD 4.42 billion |

|

Market Size 2025 |

USD 4.87 billion |

|

Market Size 2035 |

USD 7.79 billion |

|

Segments Covered |

By Product Type, Technology, Material Type, Beverage Type, Sales Channel, and End Use |

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The beverage shelves market is projected to reach USD 7.79 billion by 2035 from USD 4.87 billion in 2025, at a CAGR of 4.9% during the forecast period.

In 2025, the fixed shelves segment is projected to hold the major share of the beverage shelves market, while the refrigerated & temperature-controlled shelving units segment is slated to record the highest growth rate.

Key factors driving the growth include rising demand for organized beverage displays in retail and hospitality sectors, increasing growth of alcoholic and non-alcoholic beverage sales, adoption of smart shelving and automation technologies, expansion of e-commerce and optimized warehouse storage, and regulatory compliance requirements for alcoholic beverage shelving.

Asia-Pacific leads the market with the highest share and is projected to record the highest growth rate during the forecast period, offering significant opportunities for beverage shelving vendors.

Major opportunities include development of gravity feed and refrigerated shelves for beverage preservation, growth in emerging markets and untapped retail channels, integration of artificial intelligence and analytics in shelf management, modularity and customization in shelf design, and emerging trends in self-vending and automated shelving solutions.

Key trends include demand for sustainable and eco-friendly shelf materials, advances in refrigerated and smart display shelving, integration of IoT and sensor-based inventory management systems, temperature-controlled shelving for premium beverages, and focus on energy-efficient refrigerated shelving technologies.

The smart shelving systems and IoT-enabled shelves segment is anticipated to record the highest growth rate during the forecast period, driven by real-time inventory tracking capabilities, improved operational efficiency, and enhanced customer experience through dynamic product information display.

Published Date: Jan-2025

Published Date: Dec-2024

Published Date: Jun-2024

Published Date: Mar-2024

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates