Resources

About Us

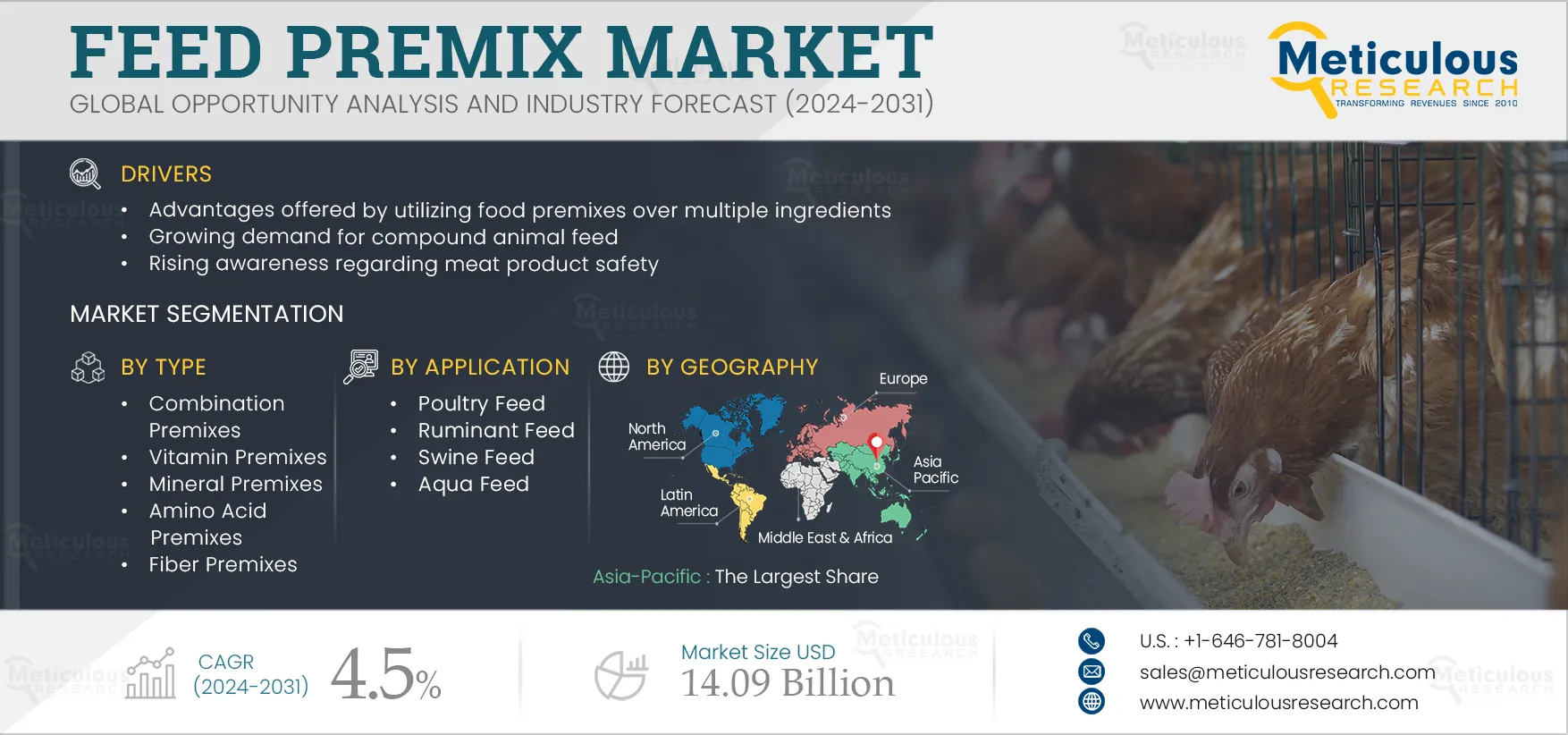

Feed Premix Market by Type (Combination Premixes, Vitamin Premix, Mineral Premix, Amino Acid Premix, Nucleotide Premix, Nutraceutical Premix), Form (Powder and Liquid), Application (Ruminant Feed, Swine Feed, Aqua Feed) - Global Forecast to 2031

Report ID: MRFB - 104132 Pages: 200 May-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is driven by the advantages offered by utilizing food premixes over multiple ingredients, the growing demand for compound animal feed, and the rising awareness regarding meat product safety. However, stringent regulatory frameworks and storage & handling issues may restrain market growth.

Furthermore, the rising demand from emerging economies is expected to create market growth opportunities. Additionally, the increasing adoption of animal-derived protein and the integration of functional ingredients are prominent trends in the feed premix market.

Nutrient premixes and feed systems blend a number of ingredients to make products with specific nutritional or physical characteristics. Premixes provide a convenient way to add a nutrient package that appeals to a specific target consumer. Premixing multiple nutrient ingredients into a single ingredient streamlines production processes and eliminates potential batching or incorporation errors that could result in a nutrient deficit, regulatory issues, and product recalls.

Premixes play a crucial role in modern manufacturing, enabling companies to streamline operations and enhance efficiency. By consolidating multiple ingredients into one, they offer consistent quality and eliminate the risk of errors during production, which may otherwise lead to nutrient deficiencies and costly recalls. In addition to simplifying the manufacturing process, premixes enhance consistency by providing precise proportions of nutrients and facilitating the addition of functional ingredients to animal feed at the right time and in the correct form. This process results in cost & time savings, reduces inventory, and prevents wastage. The use of premixes helps ensure safety and quality by reducing equipment and labor costs, as well as testing expenses. They also contribute to product differentiation and improve nutrient homogeneity.

These benefits have prompted feed manufacturers to increasingly incorporate premixes in the production of compound animal feed, driving the growth of this market.

Click here to: Get Free Sample Pages of this Report

In recent years, ensuring the safety of meat products has become a top priority. Numerous studies continually investigate the relationship between meat consumption and health issues, reflecting ongoing concerns. The International Agency for Research on Cancer (IARC) has classified processed meat as a carcinogen and red meat as a probable carcinogen, indicating a likely link to cancer. Concerns surrounding meat safety extend to various pathogenic and parasitic contaminants found in meat products, such as salmonella, listeria, and E. coli. Additionally, disease outbreaks in livestock, including swine flu and foot-and-mouth disease, have raised further concerns about meat quality and safety. For instance, in January 2011, a significant meat quality issue emerged in Germany due to the presence of cancer-causing dioxin in meat products. This event prompted swift action from authorities to implement stringent food safety measures.

In response, countries such as South Korea and Slovakia imposed bans on pork imports from Germany, citing health risks. These events expedited the adoption of supplements like feed premixes as a safer alternative to enhance protein and other essential nutrients in animal diets. Feed premixes, especially those enriched with antioxidants, minerals, enzymes, and vitamins, offer balanced nutrition to animals, protecting them from diseases. They also enhance the digestibility of feed nutrients and elevate the nutritional profile of meat. Therefore, the mounting concerns regarding meat safety, coupled with the rising focus on enhancing animal health, welfare, and performance in both the livestock and aquaculture sectors, are driving the growth of the global feed premixes market.

Rapid population growth has driven the demand for animal protein, particularly from sources like poultry, swine, and aquaculture. Meeting this rising demand requires efficient and sustainable methods to enhance animal health and productivity. Feed premixes, which are blends of essential nutrients, vitamins, minerals, and additives, play a crucial role in ensuring optimal nutrition for livestock and aquaculture.

These premixes are formulated to meet the specific dietary needs of different animal species and production stages. Feed premixes promote growth, improve feed efficiency, and enhance overall animal health. As farmers and producers increasingly recognize the significance of quality nutrition in maximizing yields and profitability, the demand for feed premixes continues to increase.

Furthermore, as consumers become more discerning about the quality and safety of animal-derived products, there is a growing preference for naturally sourced and sustainably produced feeds. Feed premixes, formulated with carefully selected ingredients, including natural additives and supplements, align with these consumer preferences, contributing to their increased demand.

The integration of functional ingredients in feed premixes is a rising trend in this market. This trend is driven by a growing emphasis on enhancing animal health, welfare, and performance in both the livestock and aquaculture sectors. Functional ingredients, such as probiotics, prebiotics, enzymes, antioxidants, and herbal extracts, offer various benefits in animal production. These benefits include improving digestion, boosting immunity, and mitigating the negative effects of stressors.

As producers seek alternatives to conventional additives like antibiotics and growth promoters, functional ingredients are gaining traction as they promote sustainable and responsible farming practices while maintaining optimal animal productivity. This shift is further fueled by consumer demands for ethically sourced and naturally fortified animal products. These factors are driving the adoption of feed premixes enriched with functional ingredients.

Emerging economies, particularly in Southeast Asia, Latin America, and Africa, are driving the growth of the feed premixes market and hold immense potential for future growth. This growth is primarily attributed to the increased utilization of nutrient premixes in the production of animal and pet feed. Feed premixes are used as supplements along with concentrate feed to ensure animals receive a well-rounded, nutritional diet. The feed premix market in these economies is driven by the rising demand for compound feed and feed additives. With technological advancements and heightened awareness among dairy farmers, emerging markets are witnessing a surge in localized premix products and services.

According to the FAO report on “World Agriculture: Towards 2015/2030,” developing countries in the Asia-Pacific region are projected to experience an annual growth rate of 2.4% in meat consumption until 2030. This surge in demand has spurred the growth of commercial livestock farming activities and increased the need for high-quality feed concentrates and premixes to enhance the weight and quality of meat-producing animals. Therefore, the rising demand for high-quality feed concentrates and premixes from developing countries is expected to offer significant opportunities for various stakeholders in the feed premixes market.

Based on type, the feed premix market is segmented into combination premixes, vitamin premixes, mineral premixes, amino acids premixes, nucleotide premixes, fiber premixes, nutraceutical premixes, and other premixes. In 2024, the combination premixes segment is expected to account for the largest share of 31.1% of the feed premix market. This segment’s large market share can be attributed to the rising demand for compound feed, driven by the increasing need for vitamin and mineral-enriched foods to meet the nutritional needs of animals and growing consumer awareness regarding essential pet nutrition.

Based on form, the feed premix market is segmented into powder and liquid. In 2024, the powder segment is expected to account for the larger share of 92.7% of the feed premix market. This segment’s large market share is mainly attributed to the advantages offered by powdered premixes over liquid premixes, such as better homogeneity, ease of handling & transport, and better stability. Moreover, the powder segment is projected to register a higher growth rate of 4.7% during the forecast period of 2024–2031.

Based on application, the feed premix market is segmented into poultry feed, ruminant feed, swine feed, aquafeed, and other feed applications. In 2024, the poultry feed segment is expected to account for the largest share of 46.0% of the feed premix market. This segment’s large market share is mainly attributed to the growing demand for poultry feed due to rising poultry meat consumption and poultry farming, especially in developing regions like Asia-Pacific and South America. However, the aquafeed segment is projected to register the highest growth rate of 5.4% during the forecast period of 2024–2031. This growth is driven by the increasing emphasis on balanced commercial diets aimed at promoting optimal fish growth and health, along with the rising global demand for fish & fish products and the growth of the aquaculture industry.

In 2024, Asia-Pacific is expected to account for the largest share of 36.6% of the feed premix market, followed by North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific’s significant market share can be attributed to the growth in the compound animal feed industry, rapid economic growth, increasing demand for pet food supplementation in emerging and developing countries, including India, China, Indonesia, and Thailand, and rising investments from major players in the region.

Moreover, the market in Asia-Pacific is projected to register the highest growth rate of 5.5% during the forecast period. The growth of this regional market is driven by shifting consumption patterns, the industrialization of the livestock sector, instances of counterfeit meat and other products, and regulations banning the use of antibiotics as growth promoters.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the feed premix market are DSM-Firmenich AG (Switzerland), BASF SE (Germany), Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), Nutreco N.V. (Netherlands), InVivo Group (France), Jubilant Pharmova Limited (India), Koninklijke Coöperatie Agrifirm U.A. (Netherlands), Dansk Landbrugs Grovvareselskab a.m.b.a. (Denmark), Phibro Animal Health Corporation (U.S.), Purina Animal Nutrition LLC (U.S.), Burkmann Industries Inc. (U.S.), Danish Agro a.m.b.a. (Denmark), and De Heus Voeders B.V. (Netherlands).

|

Particulars |

Details |

|

Number of Pages |

~200 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

4.5% |

|

Market Size (Value) |

USD 14.09 billion |

|

Segments Covered |

By Type

By Form

By Application

|

|

Countries Covered |

Asia-Pacific (China, India, Japan, Australia, Vietnam, Philippines, Indonesia, Thailand, Malaysia, South Korea, Myanmar, Taiwan, and Rest of Asia-Pacific), North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

DSM-Firmenich AG (Switzerland), BASF SE (Germany), Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), Nutreco N.V. (Netherlands), InVivo Group (France), Jubilant Pharmova Limited (India), Koninklijke Coöperatie Agrifirm U.A. (Netherlands), Dansk Landbrugs Grovvareselskab a.m.b.a. (Denmark), Phibro Animal Health Corporation (U.S.), Purina Animal Nutrition LLC (U.S.), Burkmann Industries Inc. (U.S.), Danish Agro a.m.b.a. (Denmark), and De Heus Voeders B.V. (Netherlands). |

The Feed Premix Market is defined by its efficiency and consistency, as it simplifies production by using premixes instead of multiple individual ingredients.

The Feed Premix Market was valued at $9.97 Billion in 2023 and is expected to reach $14.09 Billion by 2031.

The Feed Premix Market is forecasted to grow at a CAGR of 4.5% from 2024 to 2031.

The Feed Premix Market size is expected to be $14.09 Billion by 2031.

Key companies in the Feed Premix Market include DSM-Firmenich AG, BASF SE, Cargill, Nutreco, InVivo Group, and others.

The Feed Premix Market trend includes increasing adoption of functional ingredients and rising demand for animal-derived protein.

Drivers include the benefits of premixes over multiple ingredients, rising demand for compound feed, and heightened meat product safety awareness.

Segments include type (combination, vitamin, mineral premixes), form (powder, liquid), and application (poultry, aquafeed).

The global outlook on the Feed Premix Market is positive, with significant growth opportunities in emerging economies and a rising focus on animal health.

The Feed Premix Market is expected to grow from $10.32 billion in 2024 to $14.09 billion by 2031, driven by increasing demand and advancements.

The Feed Premix Market is projected to grow at a CAGR of 4.5% during the forecast period from 2024 to 2031.

Asia-Pacific holds the highest market share in the Feed Premix Market, driven by rapid growth and high demand for compound feed.

Published Date: Jul-2024

Published Date: Jan-2024

Published Date: Jun-2023

Published Date: Feb-2023

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates