Resources

About Us

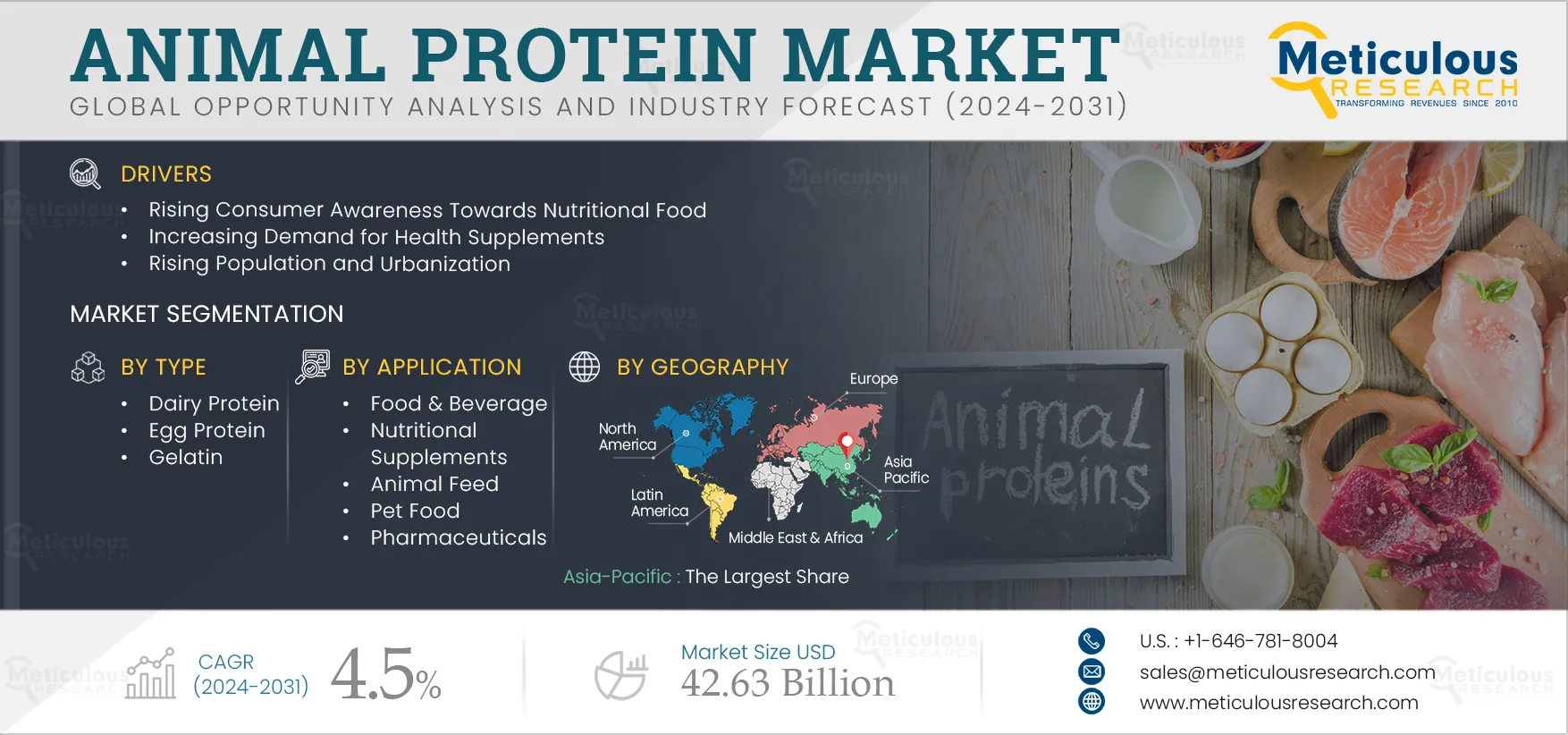

Animal Protein Market Size, Share, Forecast, & Trends Analysis by Type (Dairy Protein {Milk, Whey Protein}, Egg Protein), Form (Liquid), Application (Food & Beverage {Bakery and Confectionery, Dairy}, Animal Feed, Pharmaceuticals) - Global Forecast to 2032

Report ID: MRFB - 1041141 Pages: 430 Aug-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the rising consumer awareness towards nutritional food, increasing demand for health supplements, rising population and urbanization, and rising need for protein-rich diets. Moreover, the growing emerging economies and technological development in the dairy industry are expected to offer growth opportunities for the players operating in this market.

Additionally, the increasing health and wellness and sustainable and ethical sourcing are major trends in the global animal protein market.

However, the growing demand for alternative proteins and rising milk allergies and lactose intolerance are expected to hinder the marker growth to a certain extent. Furthermore, the increasing consumer awareness about the benefits of vegan diet poses a challenge to market expansion.

In recent years, the rise of nutritional foods has played a key role in healthy habits due to growing consumer concern about health and the perception that diet directly affects health. According to the NIH-funded study, a healthy eating diet is directly proportional to overall health improvement and reduces the prevalence of heart diseases, strokes, and type 2 diabetes. Therefore, healthy eating, especially the protein diet trend, is gaining traction and evoking population interest, significantly driving the development of healthful food formulation. In healthy food formulations, animal protein ingredients are emerging as a vital ingredient in the food processing industry. For instance, dairy ingredients support basic food formulations, such as calcium enrichment, fat reduction, and sodium reduction. The enrichment of calcium content in yogurt, dairy beverages, cheese spread, and other food products is done by milk minerals concentrate. Further, whey protein stimulates fat globules, making low-fat content-based yogurts, cheese, desserts, and ice cream. Thus, the increasing consumer awareness regarding nutritional food is driving the animal protein ingredients market.

Click here to: Get a Free Sample Copy of this Report

Click here to: Get a Free Sample Copy of this Report

Over the past decade, rapid changes in diets and lifestyles have occurred due to industrialization, urbanization, economic development, and globalization. These changes have significantly impacted the health and nutritional status of populations, particularly in developing countries. As incomes rise, there is a growing demand for greater food variety. This scenario has led to an increased demand for major protein supplement ingredients such as whey ingredients, including demineralized whey powder, whey protein concentrate (WPC), sweet whey powder (SWP), whey protein isolate (WPI), and whey protein hydrolysate (WPH), with varying protein concentrations. Compared to plant-based protein supplements, these whey-derived ingredients have gained popularity due to their nutritional value and health benefits. Consequently, the changes in consumption patterns and considerable population growth have resulted in an increased demand for milk protein-based supplements in numerous developing countries.

Nowadays, there is increasing focus on health and wellness among consumers due to the increasing prevalence of health concerns, hectic lifestyles, changing health awareness, consumer expectations, and the impact of COVID-19 pandemic. Consumers are becoming more aware of the connection between diet and health, leading to a surge in demand for healthier and more nutritious food options. Protein, being an essential nutrient that plays a vital role in maintaining good health, including muscle repair, weight management, and satiety. As a result, consumers are seeking high-quality animal protein sources to meet their daily nutritional needs, which has led to an increase in the consumption of animal proteins such as dairy protein. In response to this growing demand, many food manufacturers are reformulating their products to include higher protein content while reducing saturated fats, sodium, and sugar. Additionally, the trend of incorporating functional ingredients, such as omega-3 fatty acids and probiotics, in animal protein products has gained momentum as consumers seek additional health benefits. Thus, the increasing health and wellness trend has driven innovation and growth in the animal protein market, as food companies strive to cater to consumer demand for healthier and more nutritious products.

Consumers are increasingly concerned about the environmental impact and ethical considerations related to animal protein production. Furthermore, consumers are increasingly demanding transparency in the food supply chain, and they want to know that the products they purchase are produced in an ethical and sustainable manner. This has led to a rise in the demand for products that have been sourced sustainably and ethically. Animal proteins are highly nutritious and form a key part of a balanced, healthy diet. Sustainable sourcing practices help to reduce the environmental impact of animal protein production. This includes reducing greenhouse gas emissions, conserving water resources, and by improving nutritional quality of milk, meat, fish, and eggs while minimizing food loss and waste.

Moreover, according to the United Nations, the global population is projected to reach 9.7 billion by 2050. Simultaneously, there is growing demand for healthier, balanced, and nutrient-dense diets due to shifting consumer expectations and health consciousness, in addition to the population growth. Although a growing variety of plant-based alternatives may contribute to addressing this demand, they remain inaccessible and unaffordable for many around the world compared to animal proteins. Consequently, demand for animal-source foods is still expected to rise, as numerous populations need to increase their animal protein intake to achieve balanced and healthy nutrition.

Emerging economies, particularly Asia-Pacific, Latin America, and Middle East and Africa, are boosting the growth of animal protein market and hold huge potential for future growth. Countries like China, India, South Africa, Argentina, and Brazil are expected to be the fastest growing markets. As these economies develop and urbanize, there is a growing demand for animal protein, driven by rising incomes and changing dietary preferences. Emerging economies, such as those in Asia and Africa, present significant growth opportunities for animal protein producers, as they have large populations and a growing middle class. Additionally, improvements in infrastructure and the expansion of retail and foodservice sectors in these regions are making it easier to access and distribute animal protein products. As a result, many animal protein companies are investing in these emerging markets, establishing production facilities and distribution networks to meet the growing demand for animal protein. This trend is expected to continue in the coming years, as emerging economies play an increasingly important role in the global animal protein market.

Based on type, the global animal protein market is segmented into dairy protein, egg protein, gelatin, and other animal proteins. In 2025, the dairy protein segment is expected to account for the largest share of 52.1% of the animal protein market. The large market share of this segment can be attributed to the increasing awareness about the health benefits of dairy proteins, rising demand for infant formula and nutritional supplements. Furthermore, dairy proteins offer a complete amino acid profile, making it ideal for manufacturers looking to create protein-rich products. Its consumption is rapidly increasing in protein bars, meal replacement powder, high protein clinical formulation, and dietetic products.

However, the egg protein segment is projected to witness the highest growth rate of 4.5% during the forecast period of 2025–2032. This growth is driven by its functional and nutritional benefits, increasing demand for sports nutrition, rising popularity of high-protein diets, increasing fitness activities and healthier lifestyles. Further, egg protein functions as an emulsifier, texturizer, thickening agent, foaming agent, and gelling agent, increasing their application in the food & beverages.

Based on form, the global animal protein market is segmented into solid and liquid. In 2025, the solid segment is expected to account for a larger share of the animal protein market. The large market share can be attributed to the higher demand with ease in handling & transport, cost effectiveness, and competence to maintain the stability of the ingredient. This segment is also expected to grow at a higher CAGR during the forecast period due to its stability during processing and storage, making them ideal for use in various food manufacturing applications.

Based on application, the global animal protein market is segmented into food & beverage, nutritional supplements, animal feed, pet food, pharmaceuticals, and other applications. In 2025, the food & beverage segment is expected to account for the largest share of the animal protein market. The large market share of this segment can be attributed to the growing awareness and demand for protein-rich food products, changing consumer preferences, and increasing demand for healthy and functional ingredient-based processed food products. Furthermore, the growing consumer demand for healthy and premium food & beverage products is expected to support the growth of this market.

However, the nutritional supplements segment market is expected to witness rapid growth during the forecast period due to the rising sports and fitness activities; growing popularity for sports nutrition; increasing demand for protein supplementation; and increasing consciousness regarding the benefits of a balanced and nutrient-rich diet.

Based on geography, the global animal protein market is divided into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of 63.8% of the animal protein market, followed by North America, Europe, Latin America, and the Middle East & Africa. The large share of this market is mainly attributed to the growing health consciousness among consumers, growing food & beverage industry, rapid urbanization, and increasing awareness regarding the importance of protein-rich diets. Furthermore, this region is projected to register the highest CAGR of 4.6% during the forecast period due to the rising technological advancements in China and India’s food & beverage industry and regional population growth.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the global animal protein market are Kerry Group plc (Ireland), Arla Foods amba (Denmark), Fonterra Co-Operative Group Limited (New Zealand), Royal FrieslandCampina N.V. (Netherlands), Groupe Lactalis S.A. (France), AMCO Proteins (U.S.), Glanbia plc (Ireland), Hilmar Cheese Company, Inc. (U.S.), Kewpie Corporation (Japan), Darling Ingredients Inc. (U.S.), Savencia Fromage & Dairy (France), Nitta Gelatin Inc. (U.S.), Agropur Cooperative (Canada), and Essentia Protein Solutions (Denmark).

|

Particulars |

Details |

|

Number of Pages |

430 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.5% |

|

Market Size (Value) |

$42.63 Billion by 2032 |

|

Segments Covered |

By Type

By Form

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Russia, Netherlands, Poland, Belgium, Austria, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, Thailand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (United Arab Emirates, South Africa, Saudi Arabia, and Rest of Middle East & Africa). |

|

Key Companies |

Kerry Group plc (Ireland), Arla Foods amba (Denmark), Fonterra Co-Operative Group Limited (New Zealand), Royal FrieslandCampina N.V. (Netherlands), Groupe Lactalis S.A. (France), AMCO Proteins (U.S.), Glanbia plc (Ireland), Hilmar Cheese Company, Inc. (U.S.), Kewpie Corporation (Japan), Darling Ingredients Inc. (U.S.), Savencia Fromage & Dairy (France), Nitta Gelatin Inc. (U.S.), Agropur Cooperative (Canada), and Essentia Protein Solutions (Denmark). |

Animal proteins are primarily obtained from sources such as milk, eggs, meat, and fish, and are widely used in various applications such as food & beverage, nutritional supplements, animal feed, pet food, and personal care products. Animal proteins are complete proteins, they contain all the essential amino acids that are needed in diet. Animal protein ingredients are the major and versatile constituent of food products. Apart from the nutritive value, the physicochemical and behavioral properties of these proteins during processing play a significant role in determining the end quality of food. Common animal protein ingredients used for processing in the food industry include dairy proteins, egg proteins, and gelatin.

The animal protein market is projected to reach $42.63 billion by 2032, at a CAGR of 4.5% during the forecast period 2025–2032.

Based on type, the dairy protein segment is expected to hold the major share of the market in 2025.

Based on application, the nutritional supplements segment is projected to record a higher growth rate during the forecast period 2025–2032.

The key players operating in the global animal protein market are Kerry Group plc (Ireland), Arla Foods amba (Denmark), Fonterra Co-Operative Group Limited (New Zealand), Royal FrieslandCampina N.V. (Netherlands), Groupe Lactalis S.A. (France), AMCO Proteins (U.S.), Glanbia plc (Ireland), Hilmar Cheese Company, Inc. (U.S.), Kewpie Corporation (Japan), Darling Ingredients Inc. (U.S.), Savencia Fromage & Dairy (France), Nitta Gelatin Inc. (U.S.), Agropur Cooperative (Canada), and Essentia Protein Solutions (Denmark).

The Asia-Pacific region is projected to register the highest CAGR of 4.6% during the forecast period. The fast growth of this region is mainly attributed to the rising technological advancements in China and India’s food & beverage industry and regional population growth.

Published Date: Feb-2025

Published Date: Jan-2024

Published Date: Jan-2024

Published Date: Jun-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates