1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

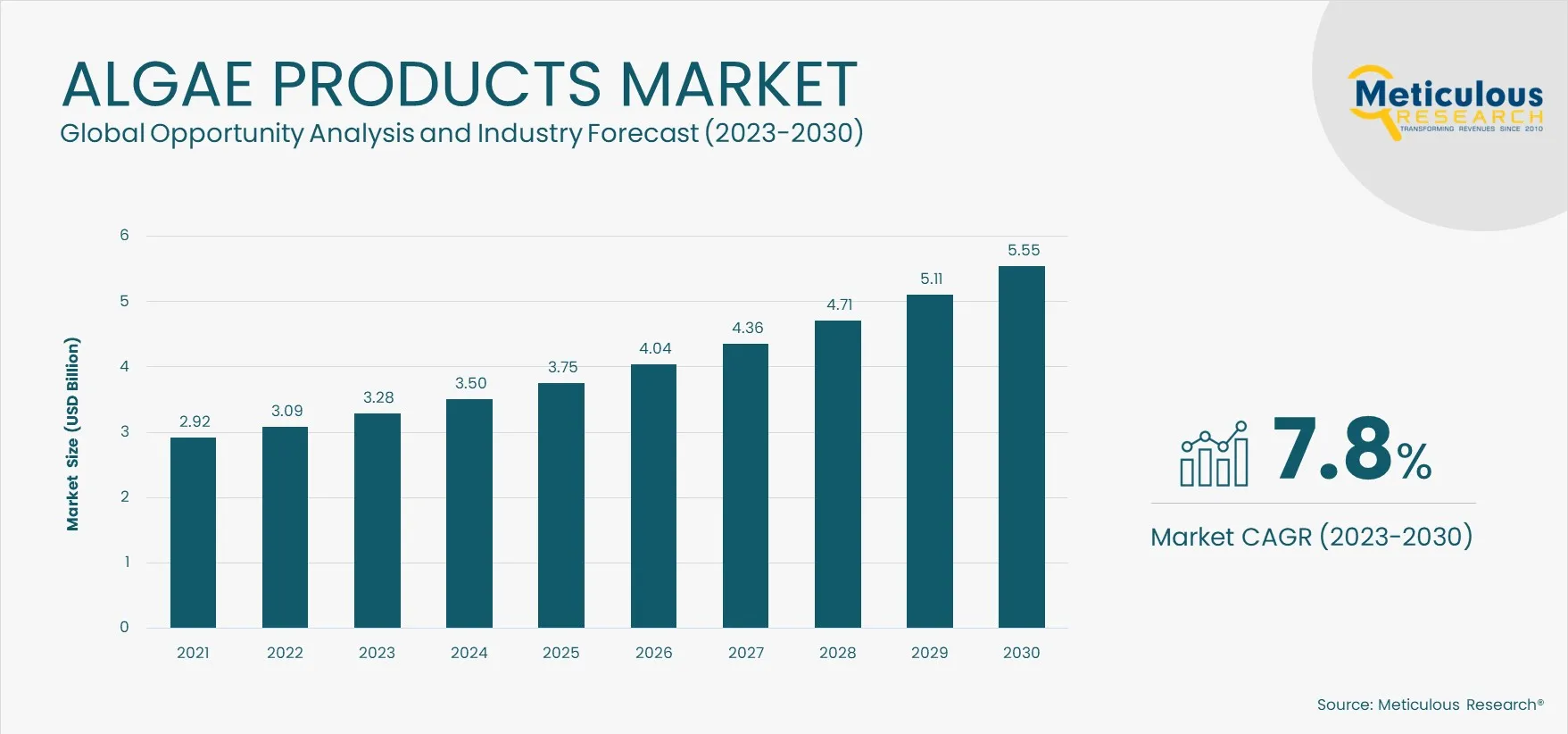

3. Executive Summary

3.1. Overview

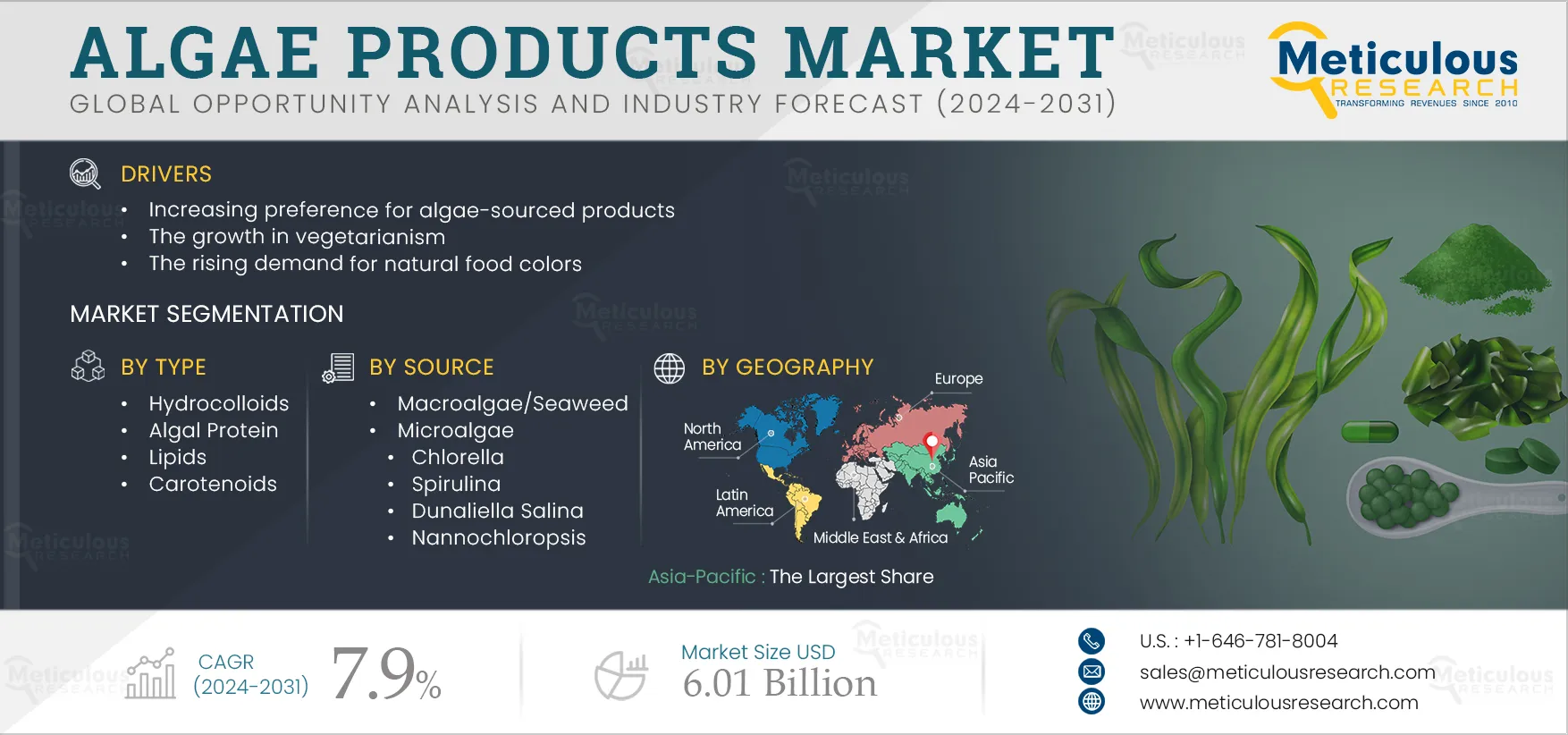

3.2. Segment Analysis

3.2.1. Algae Products Market, by Type

3.2.2. Algae Products Market, by Source

3.2.3. Algae Products Market, by Form

3.2.4. Algae Products Market, by Application

3.3. Algae Products Market, by Regional Analysis

3.4. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Consumers’ Increasing Preference for Algae-Sourced Products Driving Market Growth

4.2.2. Growth in Vegetarianism Sustaining the Demand for Algae Products

4.2.3. Rising Demand for Natural Food Colors Increasing the Utilization of Algae Products

4.2.4. Rapid Growth of the Nutraceuticals Industry Driving the Demand for Algae Products

4.2.5. Complexities in Algae Production Restraining Market Growth

4.2.6. Low Awareness Limiting the Adoption of Algae Products

4.2.7. Growing Demand for Biofuels Expected to Generate Growth Opportunities for Market Players

4.2.8. Risk of Algae Contamination Expected to Remain a Major Challenge in Market Expansion

4.3. Key Market Trends

4.3.1. Increasing Adoption of Self-Grooming Products

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitutes

4.4.4. Threat of New Entrants

4.4.5. Degree of Competition

4.5. Pricing Analysis

4.5.1. Hydrocolloids

4.5.1.1. Carrageenan

4.5.1.2. Alginate

4.5.1.3. Agar

4.5.1.4. Other Hydrocolloids

4.5.2. Algal Proteins

4.5.3. Lipids

4.5.4. Carotenoids

4.5.4.1. Astaxanthin

4.5.4.2. Beta Carotene

4.5.4.3. Lutein

4.5.4.4. Other Carotenoids

5. Algae Products Market Assessment—by Type

5.1. Overview

5.2. Hydrocolloids in Algae

5.2.1. Carrageenan

5.2.2. Alginate

5.2.3. Agar

5.2.4. Other Hydrocolloids

5.3. Algal Proteins

5.4. Lipids

5.5. Carotenoids

5.5.1. Beta Carotene

5.5.2. Astaxanthin

5.5.3. Lutein

5.5.4. Other Carotenoids

6. Algae Products Market Assessment—by Source

6.1. Overview

6.2. Macroalgae/Seaweed

6.2.1. Red Seaweed

6.2.2. Brown Seaweed

6.2.3. Green Seaweed

6.3. Microalgae

6.3.1. Spirulina

6.3.2. Chlorella

6.3.3. Dunaliella Salina

6.3.4. Haematococcus Pluvialis

6.3.5. Nannochloropsis

6.3.6. Other Microalgae Sources

7. Algae Products Market Assessment—by Form

7.1. Overview

7.2. Dry

7.3. Liquid

8. Algae Products Market Assessment—by Application

8.1. Overview

8.2. Food & Beverage

8.2.1. Food

8.2.1.1. Dairy

8.2.1.2. Bakery & Confectionary

8.2.1.3. Other Food Products

8.2.2. Beverages

8.3. Nutraceuticals

8.4. Cosmetics

8.4.1. Skin Care

8.4.2. Hair Care

8.4.3. Other Cosmetic Products

8.5. Animal Feed

8.6. Other Applications

9. Algae Products Market Assessment–by Geography

9.1. Overview

9.2. Asia-Pacific

9.2.1. China

9.2.2. Japan

9.2.3. India

9.2.4. South Korea

9.2.5. Australia

9.2.6. Rest of Asia-Pacific

9.3. North America

9.3.1. U.S.

9.3.2. Canada

9.4. Europe

9.4.1. Germany

9.4.2. France

9.4.3. U.K.

9.4.4. Italy

9.4.5. Spain

9.4.6. Rest of Europe

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Chile

9.5.5. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

11. Company Profiles

11.1. Algatechnologies Ltd. (A Part of Solabia Group)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.3. Strategic Developments

11.2. BASF SE

11.2.1. Company Overview

11.2.2. Financial Overview

11.2.3. Swot Analysis: BASF SE

11.2.4. Product Portfolio

11.2.5. Strategic Developments

11.3. BDI BioLife Science GmbH

11.3.1. Company Overview

11.3.2. Product Portfolio

11.3.3. Strategic Developments

11.4. Bluetec Naturals Co., Ltd

11.4.1. Company Overview

11.4.2. Product Portfolio

11.5. Cargill, Incorporated

11.5.1. Company Overview

11.5.2. Financial Overview

11.5.3. Swot Analysis: Cargill, Incorporated

11.5.4. Product Portfolio

11.6. Cyanotech Corporation

11.6.1. Company Overview

11.6.2. Financial Overview

11.6.3. Swot Analysis: Cyanotech Corporation

11.6.4. Product Portfolio

11.6.5. Strategic Developments

11.7. DIC Corporation

11.7.1. Company Overview

11.7.2. Financial Overview

11.7.3. Swot Analysis: DIC Corporation

11.7.4. Product Portfolio

11.7.5. Strategic Developments

11.8. Lyxia Corporation (a subsidiary of Shenzhen Qianhai Xiaozao Technology Co., Ltd.)

11.8.1. Company Overview

11.8.2. Product Portfolio

11.8.3. Strategic Developments

11.9. Seagrass Tech Private Limited

11.9.1. Company Overview

11.9.2. Product Portfolio

11.10. Tianjin Norland Biotech Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Portfolio

11.11. Ingredion Incorporated

11.11.1. Company Overview

11.11.2. Financial Overview

11.11.3. Swot Analysis: Ingredion Incorporated

11.11.4. Product Portfolio

11.11.5. Strategic Developments

11.12. SNAP Natural & Alginate Products Pvt. Ltd

11.12.1. Company Overview

11.12.2. Product Portfolio

11.13. COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A

11.13.1. Company Overview

11.13.2. Product Portfolio

11.14. HISPANAGAR S.A.

11.14.1. Company Overview

11.14.2. Product Portfolio

11.15. W Hydrocolloids, Inc.

11.15.1. Company Overview

11.15.2. Product Portfolio

11.15.3. Strategic Developments

11.16. Harsha Enterprises

11.16.1. Company Overview

11.16.2. Product Portfolio

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Limitations of Open Cultivation Systems

Table 2 Products Containing Algal Extracts and Their Functions

Table 3 Average Selling Prices of Algae Hydrocolloids, by Country/Region, 2021–2030 (USD/Ton)

Table 4 Average Selling Prices of Algae Carrageenan, by Country/Region, 2021–2030 (USD/Ton)

Table 5 Average Selling Prices of Algae Alginate, by Country/Region, 2021–2030 (USD/Ton)

Table 6 Average Selling Prices of Algae Agar, by Country/Region, 2021–2030 (USD/Ton)

Table 7 Average Selling Prices of Other Algae Hydrocolloids, by Country/Region, 2021–2030 (USD/Ton)

Table 8 Average Selling Prices of Algal Proteins, by Country/Region, 2021–2030 (USD/Ton)

Table 9 Average Selling Prices of Algae Lipids, by Country/Region, 2021–2030 (USD/Ton)

Table 10 Average Selling Prices of Algae Carotenoids, by Country/Region, 2021–2030 (USD/Ton)

Table 11 Average Selling Prices of Algae Astaxanthin, by Country/Region, 2021–2030 (USD/Ton)

Table 12 Average Selling Prices of Algae Beta Carotene, by Country/Region, 2021–2030 (USD/Ton)

Table 13 Average Selling Prices of Algae Lutein, by Country/Region, 2021–2030 (USD/Ton)

Table 14 Average Selling Prices of Other Algae Carotenoids, by Country/Region, 2021–2030 (USD/Ton)

Table 15 Global Algae Products Market, by Type, 2021–2030 (USD Million)

Table 16 Global Algae Products Market, by Type, 2021–2030 (Tons)

Table 17 Global Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 18 Global Algae Hydrocolloids Market, by Country/Region, 2021–2030 (USD Million)

Table 19 Global Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 20 Global Algae Hydrocolloids Market, by Country/Region, 2021–2030 (Tons)

Table 21 Global Algae Carrageenan Market, by Country/Region, 2021–2030 (USD Million)

Table 22 Global Algae Carrageenan Market, by Country/Region, 2021–2030 (Tons)

Table 23 Global Algae Alginate Market, by Country/Region, 2021–2030 (USD Million)

Table 24 Global Algae Alginate Market, by Country/Region, 2021–2030 (Tons)

Table 25 Global Algae Agar Market, by Country/Region, 2021–2030 (USD Million)

Table 26 Global Algae Agar Market, by Country/Region, 2021–2030 (Tons)

Table 27 Global Other Algae Hydrocolloids Market, by Country/Region, 2021–2030 (USD Million)

Table 28 Global Other Algae Hydrocolloids Market, by Country/Region, 2021–2030 (Tons)

Table 29 Protein Content in Microalgae Species

Table 30 A Comparison of Protein Content Between Spirulina and Other Foods

Table 31 Global Algal Protein Market, by Country/Region, 2021–2030 (USD Million)

Table 32 Global Algal Protein Market, by Country/Region, 2021–2030 (Tons)

Table 33 Lipid Content in Different Marine and Freshwater Microalgae

Table 34 Global Algae Lipids Market, by Country/Region, 2021–2030 (USD Million)

Table 35 Global Algae Lipids Market, by Country/Region, 2021–2030 (Tons)

Table 36 Global Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 37 Global Algae Carotenoids Market, by Country/Region, 2021–2030 (USD Million)

Table 38 Global Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 39 Global Algae Carotenoids Market, by Country/Region, 2021–2030 (Tons)

Table 40 Global Algae Beta Carotene Market, by Country/Region, 2021–2030 (USD Million)

Table 41 Global Algae Beta Carotene Market, by Country/Region, 2021–2030 (Tons)

Table 42 Global Algae Astaxanthin Market, by Country/Region, 2021–2030 (USD Million)

Table 43 Global Algae Astaxanthin Market, by Country/Region, 2021–2030 (Tons)

Table 44 Global Algae Lutein Market, by Country/Region, 2021–2030 (USD Million)

Table 45 Global Algae Lutein Market, by Country/Region, 2021–2030 (Tons)

Table 46 Global Other Algae Carotenoids Market, by Country/Region, 2021–2030 (USD Million)

Table 47 Global Other Algae Carotenoids Market, by Country/Region, 2021–2030 (Tons)

Table 48 Algae Products Market, by Source, 2021—2030 (USD Million)

Table 49 Macroalgae/Seaweed Products Market, by Type, 2021—2030 (USD Million)

Table 50 Macroalgae/Seaweed Products Market, by Country/Region, 2021—2030 (USD Million)

Table 51 Red Seaweed Products Market, by Country/Region, 2021—2030 (USD Million)

Table 52 Brown Seaweed Products Market, by Country/Region, 2021—2030 (USD Million)

Table 53 Green Seaweed Products Market, by Country/Region, 2021—2030 (USD Million)

Table 54 Microalgae Products Market, by Type, 2021—2030 (USD Million)

Table 55 Microalgae Products Market, by Country/Region, 2021—2030 (USD Million)

Table 56 Spirulina Products Market, by Country/Region, 2021—2030 (USD Million)

Table 57 Chlorella Products Market, by Country/Region, 2021—2030 (USD Million)

Table 58 Dunaliella Salina Products Market, by Country/Region, 2021—2030 (USD Million)

Table 59 Haematococcus Pluvialis Products Market, by Country/Region, 2021—2030 (USD Million)

Table 60 Nannochloropsis Products Market, by Country/Region, 2021—2030 (USD Million)

Table 61 Other Microalgae Sources Products Market, by Country/Region, 2021—2030 (USD Million)

Table 62 Algae Products Market, by Form, 2021—2030 (USD Million)

Table 63 Dry Algae Products Market, by Country/Region, 2021—2030 (USD Million)

Table 64 Liquid Algae Products Market, by Country/Region, 2021—2030 (USD Million)

Table 65 Algae Products Market, by Application, 2021—2030 (USD Million)

Table 66 Global Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 67 Global Algae Products Market for Food & Beverage, by Country/Region, 2021–2030 (USD Million)

Table 68 Global Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 69 Global Algae Products Market for Food, by Country/Region, 2021–2030 (USD Million)

Table 70 Global Algae Products Market for Dairy, by Country/Region, 2021–2030 (USD Million)

Table 71 Global Algae Products Market for Bakery & Confectionary, by Country/Region, 2021–2030 (USD Million)

Table 72 Global Algae Products Market for Other Food Products, by Country/Region, 2021–2030 (USD Million)

Table 73 Global Algae Products Market for Beverages, by Country/Region, 2021–2030 (USD Million)

Table 74 Global Algae Products Market for Nutraceuticals, by Country/Region, 2021–2030 (USD Million)

Table 75 Global Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 76 Global Algae Products Market for Cosmetics, by Country/Region, 2021–2030 (USD Million)

Table 77 Global Algae Products Market for Skin Care, by Country/Region, 2021–2030 (USD Million)

Table 78 Global Algae Products Market for Hair Care, by Country/Region, 2021–2030 (USD Million)

Table 79 Global Algae Products Market for Other Cosmetic Products, by Country/Region, 2021–2030 (USD Million)

Table 80 Global Algae Products Market for Animal Feed, by Country/Region, 2021–2030 (USD Million)

Table 81 Global Algae Products Market for Other Applications, by Country/Region, 2021–2030 (USD Million)

Table 82 Global Algae Products Market, by Region, 2021–2030 (USD Million)

Table 83 Global Algae Products Market, by Region, 2021–2030 (Tons)

Table 84 Asia-Pacific: Algae Products Market, by Country/Region, 2021–2030 (USD Million)

Table 85 Asia-Pacific: Algae Products Market, by Country/Region, 2021–2030 (Tons)

Table 86 Asia-Pacific: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 87 Asia-Pacific: Algae Products Market, by Type, 2021–2030 (Tons)

Table 88 Asia-Pacific: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 89 Asia-Pacific: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 90 Asia-Pacific: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 91 Asia-Pacific: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 92 Asia-Pacific: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 93 Asia-Pacific: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 94 Asia-Pacific: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 95 Asia-Pacific: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 96 Asia-Pacific: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 97 Asia-Pacific: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 98 Asia-Pacific: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 99 Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 100 China: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 101 China: Algae Products Market, by Type, 2021–2030 (Tons)

Table 102 China: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 103 China: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 104 China: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 105 China: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 106 China: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 107 China: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 108 China: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 109 China: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 110 China: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 111 China: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 112 China: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 113 China: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 114 Japan: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 115 Japan: Algae Products Market, by Type, 2021–2030 (Tons)

Table 116 Japan: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 117 Japan: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 118 Japan: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 119 Japan: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 120 Japan: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 121 Japan: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 122 Japan: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 123 Japan: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 124 Japan: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 125 Japan: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 126 Japan: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 127 Japan: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 128 India: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 129 India: Algae Products Market, by Type, 2021–2030 (Tons)

Table 130 India: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 131 India: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 132 India: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 133 India: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 134 India: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 135 India: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 136 India: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 137 India: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 138 India: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 139 India: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 140 India: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 141 India: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 142 South Korea: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 143 South Korea: Algae Products Market, by Type, 2021–2030 (Tons)

Table 144 South Korea: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 145 South Korea: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 146 South Korea: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 147 South Korea: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 148 South Korea: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 149 South Korea: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 150 South Korea: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 151 South Korea: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 152 South Korea: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 153 South Korea: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 154 South Korea: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 155 South Korea: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 156 Australia: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 157 Australia: Algae Products Market, by Type, 2021–2030 (Tons)

Table 158 Australia: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 159 Australia: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 160 Australia: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 161 Australia: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 162 Australia: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 163 Australia: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 164 Australia: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 165 Australia: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 166 Australia: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 167 Australia: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 168 Australia: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 169 Australia: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 170 Rest of Asia-Pacific: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 171 Rest of Asia-Pacific: Algae Products Market, by Type, 2021–2030 (Tons)

Table 172 Rest of Asia-Pacific: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 173 Rest of Asia-Pacific: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 174 Rest of Asia-Pacific: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 175 Rest of Asia-Pacific: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 176 Rest of Asia-Pacific: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 177 Rest of Asia-Pacific: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 178 Rest of Asia-Pacific: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 179 Rest of Asia-Pacific: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 180 Rest of Asia-Pacific: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 181 Rest of Asia-Pacific: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 182 Rest of Asia-Pacific: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 183 Rest of Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 184 North America: Algae Products Market, by Country, 2021–2030 (USD Million)

Table 185 North America: Algae Products Market, by Country, 2021–2030 (Tons)

Table 186 North America: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 187 North America: Algae Products Market, by Type, 2021–2030 (Tons)

Table 188 North America: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 189 North America: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 190 North America: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 191 North America: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 192 North America: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 193 North America: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 194 North America: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 195 North America: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 196 North America: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 197 North America: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 198 North America: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 199 North America: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 200 U.S.: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 201 U.S.: Algae Products Market, by Type, 2021–2030 (Tons)

Table 202 U.S.: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 203 U.S.: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 204 U.S.: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 205 U.S.: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 206 U.S.: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 207 U.S.: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 208 U.S.: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 209 U.S.: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 210 U.S.: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 211 U.S.: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 212 U.S.: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 213 U.S.: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 214 Canada: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 215 Canada: Algae Products Market, by Type, 2021–2030 (Tons)

Table 216 Canada: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 217 Canada: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 218 Canada: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 219 Canada: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 220 Canada: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 221 Canada: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 222 Canada: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 223 Canada: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 224 Canada: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 225 Canada: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 226 Canada: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 227 Canada: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 228 Europe: Algae Products Market, by Country/Region, 2021–2030 (USD Million)

Table 229 Europe: Algae Products Market, by Country/Region, 2021–2030 (Tons)

Table 230 Europe: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 231 Europe: Algae Products Market, by Type, 2021–2030 (Tons)

Table 232 Europe: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 233 Europe: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 234 Europe: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 235 Europe: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 236 Europe: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 237 Europe: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 238 Europe: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 239 Europe: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 240 Europe: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 241 Europe: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 242 Europe: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 243 Europe: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 244 Germany: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 245 Germany: Algae Products Market, by Type, 2021–2030 (Tons)

Table 246 Germany: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 247 Germany: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 248 Germany: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 249 Germany: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 250 Germany: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 251 Germany: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 252 Germany: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 253 Germany: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 254 Germany: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 255 Germany: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 256 Germany: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 257 Germany: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 258 France: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 259 France: Algae Products Market, by Type, 2021–2030 (Tons)

Table 260 France: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 261 France: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 262 France: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 263 France: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 264 France: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 265 France: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 266 France: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 267 France: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 268 France: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 269 France: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 270 France: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 271 France: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 272 U.K.: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 273 U.K.: Algae Products Market, by Type, 2021–2030 (Tons)

Table 274 U.K.: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 275 U.K.: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 276 U.K.: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 277 U.K.: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 278 U.K.: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 279 U.K.: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 280 U.K.: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 281 U.K.: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 282 U.K.: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 283 U.K.: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 284 U.K.: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 285 U.K.: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 286 Italy: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 287 Italy: Algae Products Market, by Type, 2021–2030 (Tons)

Table 288 Italy: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 289 Italy: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 290 Italy: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 291 Italy: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 292 Italy: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 293 Italy: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 294 Italy: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 295 Italy: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 296 Italy: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 297 Italy: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 298 Italy: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 299 Italy: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 300 Spain: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 301 Spain: Algae Products Market, by Type, 2021–2030 (Tons)

Table 302 Spain: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 303 Spain: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 304 Spain: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 305 Spain: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 306 Spain: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 307 Spain: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 308 Spain: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 309 Spain: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 310 Spain: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 311 Spain: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 312 Spain: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 313 Spain: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 314 Rest of Europe: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 315 Rest of Europe: Algae Products Market, by Type, 2021–2030 (Tons)

Table 316 Rest of Europe: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 317 Rest of Europe: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 318 Rest of Europe: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 319 Rest of Europe: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 320 Rest of Europe: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 321 Rest of Europe: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 322 Rest of Europe: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 323 Rest of Europe: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 324 Rest of Europe: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 325 Rest of Europe: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 326 Rest of Europe: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 327 Rest of Europe: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 328 Latin America: Algae Products Market, by Country/Region, 2021–2030 (USD Million)

Table 329 Latin America: Algae Products Market, by Country/Region, 2021–2030 (Tons)

Table 330 Latin America: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 331 Latin America: Algae Products Market, by Type, 2021–2030 (Tons)

Table 332 Latin America: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 333 Latin America: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 334 Latin America: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 335 Latin America: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 336 Latin America: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 337 Latin America: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 338 Latin America: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 339 Latin America: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 340 Latin America: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 341 Latin America: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 342 Latin America: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 343 Latin America: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 344 Brazil: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 345 Brazil: Algae Products Market, by Type, 2021–2030 (Tons)

Table 346 Brazil: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 347 Brazil: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 348 Brazil: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 349 Brazil: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 350 Brazil: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 351 Brazil: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 352 Brazil: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 353 Brazil: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 354 Brazil: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 355 Brazil: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 356 Brazil: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 357 Brazil: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 358 Mexico: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 359 Mexico: Algae Products Market, by Type, 2021–2030 (Tons)

Table 360 Mexico: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 361 Mexico: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 362 Mexico: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 363 Mexico: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 364 Mexico: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 365 Mexico: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 366 Mexico: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 367 Mexico: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 368 Mexico: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 369 Mexico: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 370 Mexico: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 371 Mexico: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 372 Argentina: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 373 Argentina: Algae Products Market, by Type, 2021–2030 (Tons)

Table 374 Argentina: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 375 Argentina: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 376 Argentina: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 377 Argentina: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 378 Argentina: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 379 Argentina: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 380 Argentina: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 381 Argentina: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 382 Argentina: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 383 Argentina: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 384 Argentina: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 385 Argentina: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 386 Chile: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 387 Chile: Algae Products Market, by Type, 2021–2030 (Tons)

Table 388 Chile: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 389 Chile: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 390 Chile: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 391 Chile: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 392 Chile: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 393 Chile: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 394 Chile: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 395 Chile: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 396 Chile: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 397 Chile: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 398 Chile: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 399 Chile: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 400 Rest of Latin America: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 401 Rest of Latin America: Algae Products Market, by Type, 2021–2030 (Tons)

Table 402 Rest of Latin America: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 403 Rest of Latin America: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 404 Rest of Latin America: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 405 Rest of Latin America: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 406 Rest of Latin America: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 407 Rest of Latin America: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 408 Rest of Latin America: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 409 Rest of Latin America: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 410 Rest of Latin America: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 411 Rest of Latin America: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 412 Rest of Latin America: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 413 Rest of Latin America: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 414 Middle East & Africa: Algae Products Market, by Type, 2021–2030 (USD Million)

Table 415 Middle East & Africa: Algae Products Market, by Type, 2021–2030 (Tons)

Table 416 Middle East & Africa: Algae Hydrocolloids Market, by Type, 2021–2030 (USD Million)

Table 417 Middle East & Africa: Algae Hydrocolloids Market, by Type, 2021–2030 (Tons)

Table 418 Middle East & Africa: Algae Carotenoids Market, by Type, 2021–2030 (USD Million)

Table 419 Middle East & Africa: Algae Carotenoids Market, by Type, 2021–2030 (Tons)

Table 420 Middle East & Africa: Algae Products Market, by Source, 2021–2030 (USD Million)

Table 421 Middle East & Africa: Macroalgae/Seaweed Market, by Type, 2021–2030 (USD Million)

Table 422 Middle East & Africa: Microalgae Market, by Type, 2021–2030 (USD Million)

Table 423 Middle East & Africa: Algae Products Market, by Form, 2021–2030 (USD Million)

Table 424 Middle East & Africa: Algae Products Market, by Application, 2021–2030 (USD Million)

Table 425 Middle East & Africa: Algae Products Market for Food & Beverage, by Type, 2021–2030 (USD Million)

Table 426 Middle East & Africa: Algae Products Market for Food, by Type, 2021–2030 (USD Million)

Table 427 Middle East & Africa: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 428 Recent Developments, by Company (2020–2023)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2023, the Algae Hydrocolloids Segment Is Expected to Dominate the Market

Figure 8 In 2023, the Macroalgae/Seaweed Segment Is Expected to Dominate the Market

Figure 9 In 2023, the Dry Algae Products Segment Is Expected to Dominate the Market

Figure 10 In 2023, the Food & Beverage Segment Is Expected to Dominate the Market

Figure 11 In 2023, Asia-Pacific Is Expected to Dominate the Algae Products Market

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Porter’s Five Forces Analysis: Global Algae Products Market

Figure 14 Global Algae Products Market, by Type, 2023 Vs. 2030 (USD Million)

Figure 15 Global Algae Products Market, by Type, 2023 Vs. 2030 (Tons)

Figure 16 Global Algae Products Market, by Source, 2023 Vs. 2030 (USD Million)

Figure 17 Global Algae Products Market, by Form, 2023 Vs. 2030 (USD Million)

Figure 18 Global Algae Products Market, by Application, 2023 Vs. 2030 (USD Million)

Figure 19 Global Algae Products Market, by Region, 2023 (%)

Figure 20 Asia-Pacific: Algae Products Market Snapshot (2023)

Figure 21 North America: Algae Products Market Snapshot (2023)

Figure 22 Europe: Algae Products Market Snapshot (2023)

Figure 23 Latin America: Algae Products Market Snapshot (2023)

Figure 24 Middle East & Africa: Algae Products Market Snapshot (2023)

Figure 25 Key Growth Strategies Adopted by Leading Players (2020–2023)

Figure 26 Global Algae Products Market Competitive Benchmarking, by Type

Figure 27 Global Algae Products Market Competitive Benchmarking, by Application

Figure 28 Competitive Dashboard: Global Algae Products Market

Figure 29 BASF SE: Financial Overview (2022)

Figure 30 Cargill, Incorporated: Financial Overview (2023)

Figure 31 Cyanotech Corporation: Financial Overview (2023)

Figure 32 DIC Corporation: Financial Overview (2022)

Figure 33 Ingredion Incorporated: Financial Overview (2022)