Resources

About Us

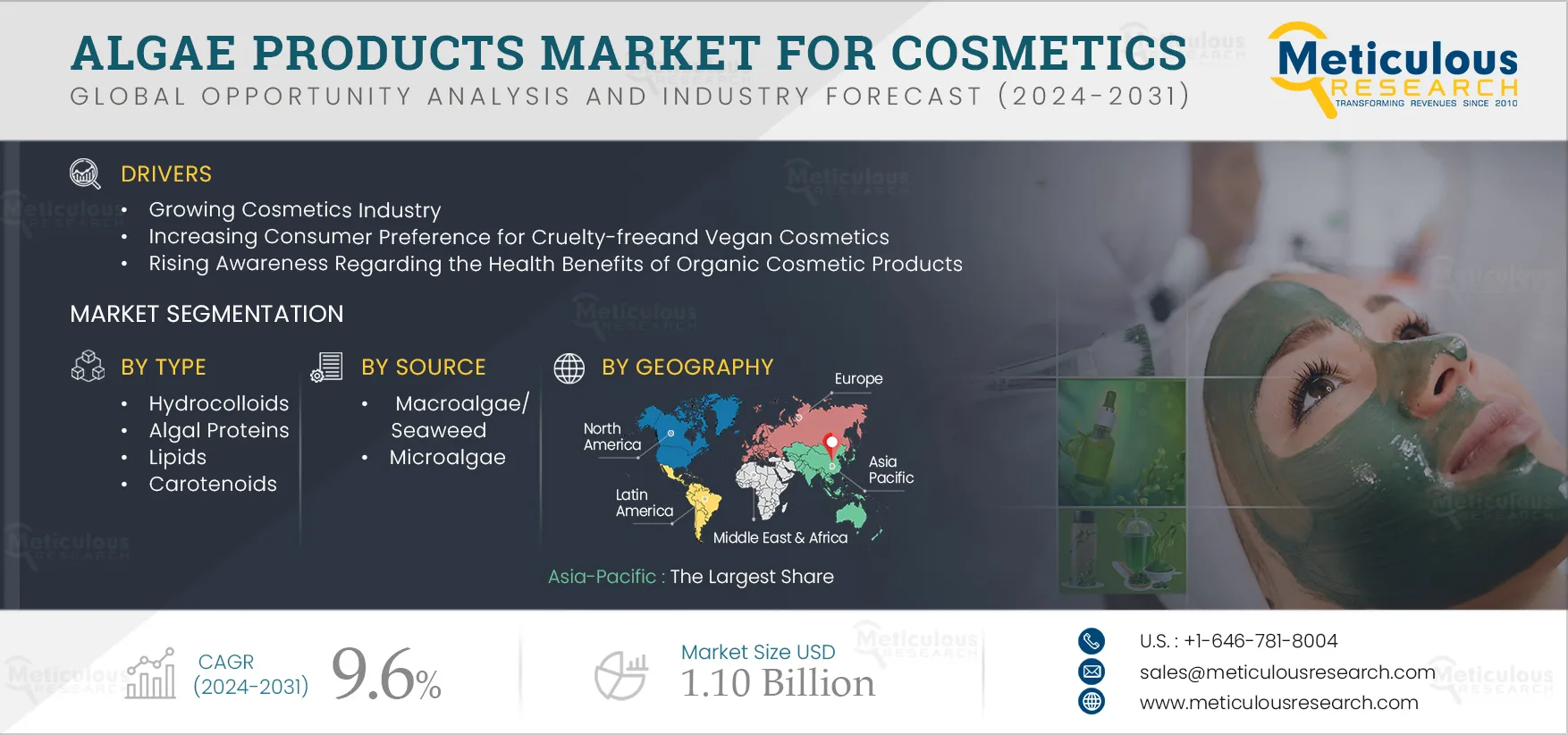

Algae Products Market for Cosmetics by Type (Hydrocolloids, Lipids, Carotenoids), Source (Seaweed, Microalgae {Chlorella, Spirulina}), Form (Dry, Liquid), Application (Skin Care {Moisturizers}, Hair Care Products), and Geography - Global Forecast to 2031

Report ID: MRCHM - 104608 Pages: 360 Feb-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe Algae Products Market for Cosmetics is projected to reach $1.10 billion by 2031, at a CAGR of 9.6% during the forecast period 2024–2031. In terms of volume, the algae products market for cosmetics is projected to reach 86,911.6 tons by 2031, at a CAGR of 11.2% during the forecast period 2024–2031. The growth of the algae products market for cosmetics is driven by the growing cosmetics industry, increasing consumer preference for cruelty-free and vegan cosmetics, and rising awareness regarding the health benefits of organic cosmetic products. However, the complexities in algae production and the lack of R&D activities in underdeveloped countries restrain the growth of this market.

Furthermore, the growing demand for personalized cosmetic products is expected to generate growth opportunities for the stakeholders in this market. However, the risk of algae contamination is a major challenge impacting the growth of the algae products market for cosmetics.

Moreover, the rising adoption of eco-friendly packaging and sustainable practices in the cosmetics industry is a prominent trend in the algae products market for cosmetics.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments of leading market participants during the last 3-4 years. The key players profiled in the algae products market for cosmetics research report are Algatechnologies Ltd. (a part of Solabia Group) (Israel), BASF SE (Germany), BDI BioLife Science GmbH (Austria), Bluetec Naturals Co., Ltd (China), Cargill, Incorporated (U.S.), DIC Corporation (Japan), Seagrass Tech Private Limited (India), Tianjin Norland Biotech Co., Ltd. (China), COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A (Spain), W Hydrocolloids, Inc. (Philippines), SNAP Natural & Alginate Products Pvt. Ltd. (India), AlgoSource (France), Algamo s.r.o. (Czech Republic), Zhejiang Binmei Biotechnology Co., Ltd. (China), Algalimento SL (Spain), and Shaivaa Algaetech LLP (India).

Click here to: Get Free Sample Pages of this Report

The global cosmetics industry produces and distributes an extensive range of products, including skin care & makeup products, fragrances, hair care products, and toiletries. Currently, this industry is dominated by a small number of multinational companies and brands, the majority of which originated in the early 20th century; however, there are numerous companies engaged in the distribution and sale of cosmetics, ranging from small businesses to large enterprises.

Rising awareness about skin care routines, consumers’ increasing purchasing power, and self-care and wellness trends are some of the major factors driving the demand for cosmetics and personal care products globally. In the last few years, the demand for cosmetic products has surged in almost every region across the globe. For instance, in 2022, the cosmetic and personal care products market in Europe was valued at €88 billion, an increase of 10% compared to €80 billion in 2021 (source: Cosmetics Europe).

Moreover, in the last few years, consumers’ preference for organic and natural cosmetics has increased globally, mainly due to growing awareness and concerns over the harmful effects of synthetic chemicals present in traditional cosmetics. Consumers are now more inclined toward products that are made from natural ingredients and are free from harmful additives. This change in consumer behavior has led to a surge in the demand for organic and natural cosmetics, and many companies are now focusing on developing and marketing such products to cater to this growing market. Moreover, the Centre for the Promotion of Imports from Developing Countries (CBI) predicts that the market for natural and organic beauty products will reach $22 billion by 2024. This growth is driven by the increasing demand for sustainably produced cosmetic ingredients and rising awareness regarding the health benefits associated with natural and organic cosmetic ingredients.

Nowadays, the use of algae products in the manufacture of cosmetics and skin care products is increasing. Algae is rich in vitamins, minerals, and antioxidants, making it highly beneficial for the skin. Products ranging from algae-based moisturizers to algae-infused face masks are gaining popularity for their ability to hydrate, nourish, and rejuvenate the skin. With consumers becoming more conscious of the ingredients they use on their skin, the demand for algae products in the cosmetics industry is expected to continue rising in the future.

Therefore, the growing cosmetics industry and the shift in consumer preference toward natural cosmetic products are expected to support the growth of the algae products market for cosmetics.

Based on type, the algae products market for cosmetics is mainly segmented into hydrocolloids, lipids, carotenoids, and algal proteins. In 2024, the hydrocolloids segment is expected to account for the largest share of the global algae products for cosmetics. The large market share of this segment can be attributed to several factors, including the increasing adoption of carrageenan, alginate, and agar in cosmetic products. Carrageenan, derived from algae, is widely used in skin care formulations as a binding, thickening, and gelling agent. Additionally, this natural ingredient serves as an alternative to synthetic materials such as Polyethylene Glycol (PEG) and carbomer, which are commonly used as thickening agents in cosmetic products but are known to be harmful.

However, the carotenoids segment is projected to register the highest CAGR during the forecast period 2024–2031. The high growth of this segment is driven by the increasing adoption of beta carotene, astaxanthin, and lutein in cosmetic products. Furthermore, the rising demand for sunscreen lotions has driven the utilization of algae-derived beta carotene (which is known for its effectiveness in skin care formulations) in the manufacture of sunscreen lotion products, as it helps protect the skin from UVA-light-induced damage. Moreover, cosmetic products containing beta carotene are known to reduce oxidative damage to the skin and enhance its appearance.

Based on source, the algae products market for cosmetics is segmented into macroalgae/seaweed and microalgae. In 2024, the macroalgae/seaweed segment is expected to account for the larger share of the global algae products for cosmetics. The large market share of this segment can be attributed to the abundant availability of seaweed as a raw material for the cosmetics and personal care industries, the increasing production of seaweed, and the growing awareness regarding the health benefits associated with seaweed products. Furthermore, the active components derived from seaweed serve various purposes, acting as antioxidants, antibacterial & whitening agents, and anti-aging and anti-acne solutions, driving their adoption in the formulation of skin care products. Moreover, this segment is also projected to register the higher CAGR during the forecast period 2024–2031.

Based on form, the algae products market for cosmetics is segmented into dry and liquid. In 2024, the dry segment is expected to account for the larger share of the global algae products for cosmetics. The large market share of this segment is attributed to the longer shelf-life and ease of transportation and storage of dry algae products compared to liquid algae products and the increasing use of algae powder for product formulation in the cosmetics industry. Moreover, this segment is also projected to register the higher CAGR during the forecast period 2024–2031.

Based on application, the algae products market for cosmetics is segmented into skin care products, hair care products, and other cosmetic applications. In 2024, the skin care products segment is expected to account for the largest share of the algae products market for cosmetics. The large market share of this segment can be attributed to the rising consumer preference for natural and organic skin care products, the benefits of algae in improving the skin, increasing skin health concerns, and technological advancements in the cosmetics industry. Additionally, this segment is projected to register the highest CAGR during the forecast period 2024–2031 due to the increasing demand for multi-functional skin care products and the growing personal grooming trend.

Based on geography, the algae products market for cosmetics is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the algae products market for cosmetics. Asia-Pacific's large market share is attributed to the increasing demand for natural ingredients from the region’s rapidly growing cosmetics industry and rising awareness among consumers regarding the benefits of using cosmetics with natural ingredients. In addition, the presence of a large number of stakeholders engaged in providing algae products for cosmetics manufacturing and the abundant availability of raw materials due to favorable climatic conditions for algae production are further expected to drive the growth of this market. Moreover, government initiatives aimed at promoting the cultivation and usage of algae in the cosmetics and personal care industries are expected to boost the algae products market for cosmetics in this region.

However, Europe is slated to register the highest CAGR during the forecast period 2024–2031. The high growth of this market is mainly driven by the rapidly growing cosmetics industry in the region, rising health & wellness trends, the growing demand for natural and vegan cosmetic products, and the growing demand for algae products from the cosmetics industry in the region.

|

Particulars |

Details |

|

No. of Pages |

360 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2022 |

|

CAGR |

9.6% |

|

Market Size (Value) |

$1.10 Billion by 2031 |

|

Market Size (Volume) |

86,911.6 Tons by 2031 |

|

Segments Covered |

By Type

By Source

By Form

By Application

|

|

Regions/Countries Covered |

North America (U.S., Canada), Europe (France, Germany, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Chile, Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

Algatechnologies Ltd. (a part of Solabia Group) (Israel), BASF SE (Germany), BDI BioLife Science GmbH (Austria), Bluetec Naturals Co., Ltd (China), Cargill, Incorporated (U.S.), DIC Corporation (Japan), Seagrass Tech Private Limited (India), Tianjin Norland Biotech Co., Ltd. (China), COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A (Spain), W Hydrocolloids, Inc. (Philippines), SNAP Natural & Alginate Products Pvt. Ltd. (India), AlgoSource (France), Algamo s.r.o. (Czech Republic), Zhejiang Binmei Biotechnology Co., Ltd. (China), Algalimento SL (Spain), and Shaivaa Algaetech LLP (India) |

Algae are a class of photosynthetic organisms mainly found in marine and freshwater habitats. They are used in several industries for various purposes. Algae-based ingredients are becoming increasingly popular in the cosmetics industry due to their nutrient-rich nature and diverse applications. Algal products are used in the cosmetics industry as antioxidants, thickening agents, and moisturizing agents to enhance skin health and protect the skin against abrasions and tanning. Carotenoids, lipids, hydrocolloids, and algae proteins are the major algal products widely used in the cosmetics industry. Algae extracts used in cosmetic formulations are primarily derived from seaweed, chlorella, spirulina, Dunaliella salina, and Haematococcus pluvialis.

The algae products market for cosmetics report provides information on revenues from the sale of all types of algae products, such as hydrocolloids, carotenoids, lipids, and algae protein, to cosmetics manufacturers. The algae products market for cosmetics study provides valuable insights, market sizes, and forecasts in terms of both value and volume by type and country/region. However, the study provides insights, market sizes, and forecasts only in terms of value based on source, form, and application.

The algae products market for cosmetics is projected to reach $1.10 billion by 2031, at a CAGR of 9.6% during the forecast period.

Based on form, the dry segment is expected to witness the fastest growth during the forecast period.

o Growing cosmetics industry

o Increasing consumer preference for cruelty-free and vegan cosmetics

o Rising awareness regarding the health benefits of organic cosmetic products

o Complexities in algae production

o Lack of R&D activities in underdeveloped countries

The key players operating in the algae products market for cosmetics are Algatechnologies Ltd. (a part of Solabia Group) (Israel), BASF SE (Germany), BDI BioLife Science GmbH (Austria), Bluetec Naturals Co., Ltd (China), Cargill, Incorporated (U.S.), DIC Corporation (Japan), Seagrass Tech Private Limited (India), Tianjin Norland Biotech Co., Ltd. (China), COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A (Spain), W Hydrocolloids, Inc. (Philippines), SNAP Natural & Alginate Products Pvt. Ltd. (India), AlgoSource (France), Algamo s.r.o. (Czech Republic), Zhejiang Binmei Biotechnology Co., Ltd. (China), Algalimento SL (Spain), and Shaivaa Algaetech LLP (India).

Asia-Pacific is expected to account for the largest market share, mainly due to the increasing demand for natural ingredients from the region’s rapidly growing cosmetics industry and rising awareness among consumers regarding the benefits of using cosmetics with natural ingredients. In addition, the presence of a large number of stakeholders engaged in providing algae products for cosmetics manufacturing and the region’s abundant availability of raw materials due to favorable climatic conditions for algae production are further expected to drive the growth of this market. Moreover, government initiatives aimed at promoting the cultivation and usage of algae in the cosmetics and personal care industries are expected to boost the algae products market for cosmetics in Asia-Pacific.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews With Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Algae Products Market for Cosmetics, by Type

3.2.2. Algae Products Market for Cosmetics, by Source

3.2.3. Algae Products Market for Cosmetics, by Form

3.2.4. Algae Products Market for Cosmetics, by Application

3.3. Algae Products Market for Cosmetics—Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Growing Cosmetics Industry Supporting Market Growth

4.2.2. Increasing Consumer Preference for Cruelty-Free and Vegan Cosmetics Driving the Demand for Algae Products

4.2.3. Rising Awareness Regarding the Health Benefits of Organic Cosmetic Products Boosting the Adoption of Algae Products

4.2.4. Complexities In Algae Production Restraining Market Growth

4.2.5. Lack of R&D Activities in Underdeveloped Countries Limiting the Growth of the Algae Products Market for Cosmetics

4.2.6. Growing Demand for Personalized Cosmetic Products Generating Market Growth Opportunities

4.2.7. Risk of Algae Contamination to Remain a Major Challenge for Market Growth

4.3. Key Trends

4.3.1. Rising Adoption of Eco-Friendly Packaging and Sustainable Practices in the Cosmetics Industry

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitutes

4.4.4. Threat of New Entrants

4.4.5. Degree of Competition

4.5. Pricing Analysis

4.5.1. Hydrocolloids

4.5.1.1. Carrageenan

4.5.1.2. Alginate

4.5.1.3. Agar

4.5.1.4. Other Hydrocolloids

4.5.2. Algal Proteins

4.5.3. Lipids

4.5.4. Carotenoids

4.5.4.1. Beta Carotene

4.5.4.2. Astaxanthin

4.5.4.3. Lutein

4.5.4.4. Other Carotenoids

5. Algae Products Market for Cosmetics—by Type

5.1. Overview

5.2. Hydrocolloids

5.2.1. Carrageenan

5.2.2. Alginate

5.2.3. Agar

5.2.4. Other Hydrocolloids

5.3. Algal Proteins

5.4. Lipids

5.5. Carotenoids

5.5.1. Beta Carotene

5.5.2. Astaxanthin

5.5.3. Lutein

5.5.4. Other Carotenoids

6. Algae Products Market for Cosmetics—by Source

6.1. Overview

6.2. Macroalgae/Seaweed

6.2.1. Red Seaweed

6.2.2. Brown Seaweed

6.2.3. Green Seaweed

6.3. Microalgae

6.3.1. Spirulina

6.3.2. Chlorella

6.3.3. Haematococcus Pluvialis

6.3.4. Dunaliella Salina

6.3.5. Nannochloropsis

6.3.6. Other Microalgae

7. Algae Products Market for Cosmetics—by Form

7.1. Overview

7.2. Dry

7.3. Liquid

8. Algae Products Market for Cosmetics—by Application

8.1. Overview

8.2. Skin Care

8.2.1. Anti-aging Products

8.2.2. Moisturizers

8.2.3. Sunscreen/UV-Protection Products

8.2.4. Other Skin Care Products

8.3. Hair Care

8.3.1. Hair Conditioners & Shampoos

8.3.2. Other Hair Care Products

8.4. Other Cosmetic Applications

9. Algae Products Market for Cosmetics–by Geography

9.1. Overview

9.2. Asia-Pacific

9.2.1. China

9.2.2. Japan

9.2.3. India

9.2.4. Australia

9.2.5. South Korea

9.2.6. Rest of Asia-Pacific

9.3. North America

9.3.1. U.S.

9.3.2. Canada

9.4. Europe

9.4.1. France

9.4.2. Germany

9.4.3. U.K.

9.4.4. Italy

9.4.5. Spain

9.4.6. Rest of Europe

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Chile

9.5.5. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

11. Company Profiles

11.1. Algatechnologies Ltd. (A Part of Solabia Group)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.2. BASF SE

11.2.1. Company Overview

11.2.2. Financial Overview

11.2.3. Swot Analysis: BASF SE

11.2.4. Product Portfolio

11.2.5. Strategic Developments

11.3. BDI BioLife Science GmbH

11.3.1. Company Overview

11.3.2. Product Portfolio

11.3.3. Strategic Developments

11.4. Bluetec Naturals Co., Ltd

11.4.1. Company Overview

11.4.2. Product Portfolio

11.5. Cargill, Incorporated

11.5.1. Company Overview

11.5.2. Financial Overview

11.5.3. Swot Analysis: Cargill, Incorporated

11.5.4. Product Portfolio

11.6. DIC Corporation

11.6.1. Company Overview

11.6.2. Financial Overview

11.6.3. Swot Analysis: DIC Corporation

11.6.4. Product Portfolio

11.6.5. Strategic Developments

11.7. Seagrass Tech Private Limited

11.7.1. Company Overview

11.7.2. Product Portfolio

11.8. Tianjin Norland Biotech Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Portfolio

11.9. SNAP Natural & Alginate Products Pvt. Ltd.

11.9.1. Company Overview

11.9.2. Product Portfolio

11.10. COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A

11.10.1. Company Overview

11.10.2. Product Portfolio

11.11. W Hydrocolloids, Inc.

11.11.1. Company Overview

11.11.2. Product Portfolio

11.11.3. Strategic Developments

11.12. AlgoSource

11.12.1. Company Overview

11.12.2. Product Portfolio

11.13. Algamo s.r.o.

11.13.1. Company Overview

11.13.2. Product Portfolio

11.14. Zhejiang Binmei Biotechnology Co., Ltd.

11.14.1. Company Overview

11.14.2. Product Portfolio

11.15. Algalimento SL

11.15.1. Company Overview

11.15.2. Product Portfolio

11.16. Shaivaa Algaetech LLP

11.16.1. Company Overview

11.16.2. Product Portfolio

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Average Selling Prices of Algae Hydrocolloids for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 2 Average Selling Prices of Algae Carrageenan for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 3 Average Selling Prices of Algae Alginate for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 4 Average Selling Prices of Algae Agar for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 5 Average Selling Prices of Other Algae Hydrocolloids for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 6 Average Selling Prices of Algal Proteins for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 7 Average Selling Prices of Algae Lipids for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 8 Average Selling Prices of Algae Carotenoids for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 9 Average Selling Prices of Algae Beta Carotene for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 10 Average Selling Prices of Algae Astaxanthin for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 11 Average Selling Prices of Algae Lutein for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 12 Average Selling Prices of Other Algae Carotenoids for Cosmetics, by Country/Region, 2022–2031 (USD/Ton)

Table 13 Global Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 14 Global Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 15 Global Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 16 Global Algae Hydrocolloids Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 18 Global Algae Hydrocolloids Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 19 Global Algae Carrageenan Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 20 Global Algae Carrageenan Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 21 Global Algae Alginate Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Algae Alginate Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 23 Global Algae Agar Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Algae Agar Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 25 Global Other Algae Hydrocolloids Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 26 Global Other Algae Hydrocolloids Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 27 Protein Content in Microalgae Species

Table 28 A Comparison of Protein Content Between Spirulina and Other Foods

Table 29 Global Algal Proteins Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 30 Global Algal Proteins Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 31 Lipid Content in Different Marine and Freshwater Microalgae

Table 32 Global Algae Lipids Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 33 Global Algae Lipids Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 34 Global Algae Carotenoids Market, by Type, 2022–2031 (USD Million)

Table 35 Global Algae Carotenoids Market, by Country/Region, 2022–2031 (USD Million)

Table 36 Global Algae Carotenoids Market, by Type, 2022–2031 (Tons)

Table 37 Global Algae Carotenoids Market, by Country/Region, 2022–2031 (Tons)

Table 38 Global Algae Beta Carotene Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 39 Global Algae Beta Carotene Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 40 Global Algae Astaxanthin Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 41 Global Algae Astaxanthin Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 42 Global Algae Lutein Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 43 Global Algae Lutein Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 44 Global Other Algae Carotenoids Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 45 Global Other Algae Carotenoids Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 46 Global Algae Products Market for Cosmetics, by Source, 2022—2031 (USD Million)

Table 47 Global Macroalgae/Seaweed Products Market for Cosmetics, by Type, 2022—2031 (USD Million)

Table 48 Global Macroalgae/Seaweed Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 49 Global Red Seaweed Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 50 Global Brown Seaweed Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 51 Global Green Seaweed Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 52 Global Microalgae Products Market for Cosmetics, by Type, 2022—2031 (USD Million)

Table 53 Global Microalgae Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 54 Global Spirulina Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 55 Global Chlorella Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 56 Global Haematococcus Pluvialis Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 57 Global Dunaliella Salina Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 58 Global Nannochloropsis Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 59 Global Other Microalgae Products Market for Cosmetics, by Country/Region, 2022—2031 (USD Million)

Table 60 Algae Products Market for Cosmetics, by Form, 2022—2031 (USD Million)

Table 61 Dry Algae Products Market for Cosmetics, by Country/Region, 2021—2031 (USD Million)

Table 62 Liquid Algae Products Market for Cosmetics, by Country/Region, 2021—2031 (USD Million)

Table 63 Global Algae Products Market for Cosmetics, by Application, 2022—2031 (USD Million)

Table 64 Global Algae Products Market for Skin Care, by Product Type, 2022—2031 (USD Million)

Table 65 Global Algae Products Market for Skin Care, by Country/Region, 2022—2031 (USD Million)

Table 66 Global Algae Products Market for Anti-aging Products, by Country/Region, 2022—2031 (USD Million)

Table 67 Global Algae Products Market for Moisturizers, by Country/Region, 2022—2031 (USD Million)

Table 68 Global Algae Products Market for Sunscreen/UV-Protection Products, by Country/Region, 2022—2031 (USD Million)

Table 69 Global Algae Products Market for Other Skin Care Products, by Country/Region, 2022—2031 (USD Million)

Table 70 Global Algae Products Market for Hair Care, by Product Type, 2022—2031 (USD Million)

Table 71 Global Algae Products Market for Hair Care, by Country/Region, 2022—2031 (USD Million)

Table 72 Global Algae Products Market for Hair Conditioners & Shampoos, by Country/Region, 2022—2031 (USD Million)

Table 73 Global Algae Products Market for Other Hair Care Products, by Country/Region, 2022—2031 (USD Million)

Table 74 Global Algae Products Market for Other Cosmetic Applications, by Type, 2022—2031 (USD Million)

Table 75 Global Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 76 Global Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 77 Asia-Pacific: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 78 Asia-Pacific: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 79 Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 80 Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 81 Asia-Pacific: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 82 Asia-Pacific: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 83 Asia-Pacific: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 84 Asia-Pacific: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 85 Asia-Pacific: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 86 Asia-Pacific: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 87 Asia-Pacific: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 88 Asia-Pacific: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 89 Asia-Pacific: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 90 Asia-Pacific: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 91 Asia-Pacific: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 92 China: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 93 China: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 94 China: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 95 China: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 96 China: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 97 China: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 98 China: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 99 China: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 100 China: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 101 China: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 102 China: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 103 China: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 104 China: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 105 Japan: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 106 Japan: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 107 Japan: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 108 Japan: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 109 Japan: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 110 Japan: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 111 Japan: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 112 Japan: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 113 Japan: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 114 Japan: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 115 Japan: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 116 Japan: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 117 Japan: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 118 India: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 119 India: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 120 India: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 121 India: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 122 India: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 123 India: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 124 India: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 125 India: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 126 India: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 127 India: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 128 India: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 129 India: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 130 India: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 131 Australia: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 132 Australia: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 133 Australia: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 134 Australia: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 135 Australia: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 136 Australia: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 137 Australia: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 138 Australia: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 139 Australia: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 140 Australia: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 141 Australia: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 142 Australia: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 143 Australia: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 144 South Korea: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 145 South Korea: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 146 South Korea: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 147 South Korea: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 148 South Korea: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 149 South Korea: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 150 South Korea: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 151 South Korea: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 152 South Korea: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 153 South Korea: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 154 South Korea: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 155 South Korea: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 156 South Korea: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 157 Rest of Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 158 Rest of Asia-Pacific: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 159 Rest of Asia-Pacific: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 160 Rest of Asia-Pacific: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 161 Rest of Asia-Pacific: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 162 Rest of Asia-Pacific: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 163 Rest of Asia-Pacific: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 164 Rest of Asia-Pacific: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 165 Rest of Asia-Pacific: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 166 Rest of Asia-Pacific: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 167 Rest of Asia-Pacific: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 168 Rest of Asia-Pacific: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 169 Rest of Asia-Pacific: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 170 North America: Algae Products Market for Cosmetics, by Country, 2022–2031 (USD Million)

Table 171 North America: Algae Products Market for Cosmetics, by Country, 2022–2031 (Tons)

Table 172 North America: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 173 North America: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 174 North America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 175 North America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 176 North America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 177 North America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 178 North America: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 179 North America: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 180 North America: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 181 North America: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 182 North America: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 183 North America: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 184 North America: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 185 U.S.: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 186 U.S.: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 187 U.S.: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 188 U.S.: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 189 U.S.: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 190 U.S.: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 191 U.S.: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 192 U.S.: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 193 U.S.: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 194 U.S.: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 195 U.S.: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 196 U.S.: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 197 U.S.: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 198 Canada: Algae Products Market for Cosmetics, by Type, 2021–2030 (USD Million)

Table 199 Canada: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 200 Canada: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 201 Canada: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 202 Canada: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 203 Canada: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 204 Canada: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 205 Canada: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 206 Canada: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 207 Canada: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 208 Canada: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 209 Canada: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 210 Canada: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 211 Europe: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 212 Europe: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 213 Europe: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 214 Europe: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 215 Europe: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 216 Europe: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 217 Europe: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 218 Europe: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 219 Europe: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 220 Europe: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 221 Europe: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 222 Europe: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 223 Europe: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 224 Europe: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 225 Europe: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 226 France: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 227 France: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 228 France: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 229 France: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 230 France: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 231 France: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 232 France: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 233 France: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 234 France: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 235 France: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 236 France: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 237 France: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 238 France: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 239 Germany: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 240 Germany: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 241 Germany: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 242 Germany: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 243 Germany: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 244 Germany: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 245 Germany: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 246 Germany: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 247 Germany: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 248 Germany: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 249 Germany: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 250 Germany: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 251 Germany: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 252 U.K.: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 253 U.K.: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 254 U.K.: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 255 U.K.: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 256 U.K.: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 257 U.K.: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 258 U.K.: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 259 U.K.: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 260 U.K.: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 261 U.K.: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 262 U.K.: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 263 U.K.: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 264 U.K.: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 265 Italy: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 266 Italy: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 267 Italy: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 268 Italy: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 269 Italy: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 270 Italy: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 271 Italy: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 272 Italy: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 273 Italy: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 274 Italy: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 275 Italy: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 276 Italy: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 277 Italy: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 278 Spain: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 279 Spain: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 280 Spain: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 281 Spain: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 282 Spain: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 283 Spain: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 284 Spain: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 285 Spain: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 286 Spain: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 287 Spain: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 288 Spain: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 289 Spain: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 290 Spain: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 291 Rest of Europe: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 292 Rest of Europe: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 293 Rest of Europe: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 294 Rest of Europe: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 295 Rest of Europe: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 296 Rest of Europe: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 297 Rest of Europe: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 298 Rest of Europe: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 299 Rest of Europe: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 300 Rest of Europe: Algae Products Market for Cosmetics, by Form, 2022–2031 (USD Million)

Table 301 Rest of Europe: Algae Products Market for Cosmetics, by Application, 2022–2031 (USD Million)

Table 302 Rest of Europe: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 303 Rest of Europe: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 304 Latin America: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (USD Million)

Table 305 Latin America: Algae Products Market for Cosmetics, by Country/Region, 2022–2031 (Tons)

Table 306 Latin America: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 307 Latin America: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 308 Latin America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 309 Latin America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 310 Latin America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 311 Latin America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 312 Latin America: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 313 Latin America: Macroalgae/Seaweed Market, by Type, 2022–2031 (USD Million)

Table 314 Latin America: Microalgae Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 315 Latin America: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 316 Latin America: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 317 Latin America: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 318 Latin America: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 319 Brazil: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 320 Brazil: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 321 Brazil: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 322 Brazil: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 323 Brazil: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 324 Brazil: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 325 Brazil: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 326 Brazil: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 327 Brazil: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 328 Brazil: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 329 Brazil: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 330 Brazil: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 331 Brazil: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 332 Mexico: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 333 Mexico: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 334 Mexico: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 335 Mexico: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 336 Mexico: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 337 Mexico: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 338 Mexico: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 339 Mexico: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 340 Mexico: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 341 Mexico: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 342 Mexico: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 343 Mexico: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 344 Mexico: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 345 Argentina: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 346 Argentina: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 347 Argentina: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 348 Argentina: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 349 Argentina: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 350 Argentina: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 351 Argentina: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 352 Argentina: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 353 Argentina: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 354 Argentina: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 355 Argentina: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 356 Argentina: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 357 Argentina: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 358 Chile: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 359 Chile: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 360 Chile: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 361 Chile: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 362 Chile: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 363 Chile: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 364 Chile: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 365 Chile: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 366 Chile: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 367 Chile: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 368 Chile: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 369 Chile: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 370 Chile: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 371 Rest of Latin America: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 372 Rest of Latin America: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 373 Rest of Latin America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 374 Rest of Latin America: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 375 Rest of Latin America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 376 Rest of Latin America: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 377 Rest of Latin America: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 378 Rest of Latin America: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 379 Rest of Latin America: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 380 Rest of Latin America: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 381 Rest of Latin America: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 382 Rest of Latin America: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 383 Rest of Latin America: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 384 Middle East & Africa: Algae Products Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 385 Middle East & Africa: Algae Products Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 386 Middle East & Africa: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 387 Middle East & Africa: Algae Hydrocolloids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 388 Middle East & Africa: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 389 Middle East & Africa: Algae Carotenoids Market for Cosmetics, by Type, 2022–2031 (Tons)

Table 390 Middle East & Africa: Algae Products Market for Cosmetics, by Source, 2022–2031 (USD Million)

Table 391 Middle East & Africa: Macroalgae/Seaweed Market for Cosmetics, by Type, 2022–2031 (USD Million)

Table 392 Middle East & Africa: Microalgae Market, by Type, 2022–2031 (USD Million)

Table 393 Middle East & Africa: Algae Products Market, by Form, 2022–2031 (USD Million)

Table 394 Middle East & Africa: Algae Products Market, by Application, 2022–2031 (USD Million)

Table 395 Middle East & Africa: Algae Products Market for Skin Care, by Product Type, 2022–2031 (USD Million)

Table 396 Middle East & Africa: Algae Products Market for Hair Care, by Product Type, 2022–2031 (USD Million)

Table 397 Recent Developments, by Company (2020–2024)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2024, the Algae Hydrocolloids Segment is Expected to Dominate the Market

Figure 8 In 2024, the Macroalgae/Seaweed Segment is Expected to Dominate the Market

Figure 9 In 2024, the Dry Segment is Expected to Dominate the Market

Figure 10 In 2024, the Skin Care Segment is Expected to Dominate the Market

Figure 11 Asia-Pacific Dominates the Overall Algae Products Market for Cosmetics, While Europe Leads in Growth

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Porter’s Five Forces Analysis: Global Algae Products Market for Cosmetics

Figure 14 Global Algae Products Market for Cosmetics, by Type, 2024 Vs. 2031 (USD Million)

Figure 15 Global Algae Products Market for Cosmetics, by Type, 2024 Vs. 2031 (Tons)

Figure 16 Global Algae Products Market for Cosmetics, by Source, 2024 Vs. 2031 (USD Million)

Figure 17 Global Algae Products Market for Cosmetics, by Form, 2024 Vs. 2031 (USD Million)

Figure 18 Global Algae Products Market for Cosmetics, by Application, 2024 Vs. 2031 (USD Million)

Figure 19 Global Algae Products Market for Cosmetics, by Region, 2024 Vs. 2031 (USD Million)

Figure 20 Global Algae Products Market for Cosmetics, by Region, 2024 Vs. 2031 (Tons)

Figure 21 Asia-Pacific: Algae Products Market for Cosmetics Snapshot (2024)

Figure 22 North America: Algae Products Market for Cosmetics Snapshot (2024)

Figure 23 Europe: Algae Products Market for Cosmetics Snapshot (2024)

Figure 24 Latin America: Algae Products Market for Cosmetics Snapshot (2024)

Figure 25 Middle East & Africa: Algae Products Market for Cosmetics Snapshot (2024)

Figure 26 Key Growth Strategies Adopted by Leading Players (2020–2024)

Figure 27 Global Algae Products Market for Cosmetics Competitive Benchmarking, by Type

Figure 28 Competitive Dashboard: Global Algae Products Market for Cosmetics

Figure 29 BASF SE: Financial Overview (2022)

Figure 30 Cargill, Incorporated: Financial Overview (2023)

Figure 31 DIC Corporation: Financial Overview (2022)

Published Date: Dec-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates