1. Introduction

1.1 Market Definition

1.2 Currency & Limitations

1.2.1 Currency

1.2.2 Limitation

2. Research Methodology

2.1 Research Approach

2.2 Process of Data Collection & Validation

2.2.1 Secondary Research

2.2.2 Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3 Market Sizing and Forecast

2.3.1 Market Size Estimation Approach

2.3.2 Growth Forecast Approach

2.4 Assumptions for the Study

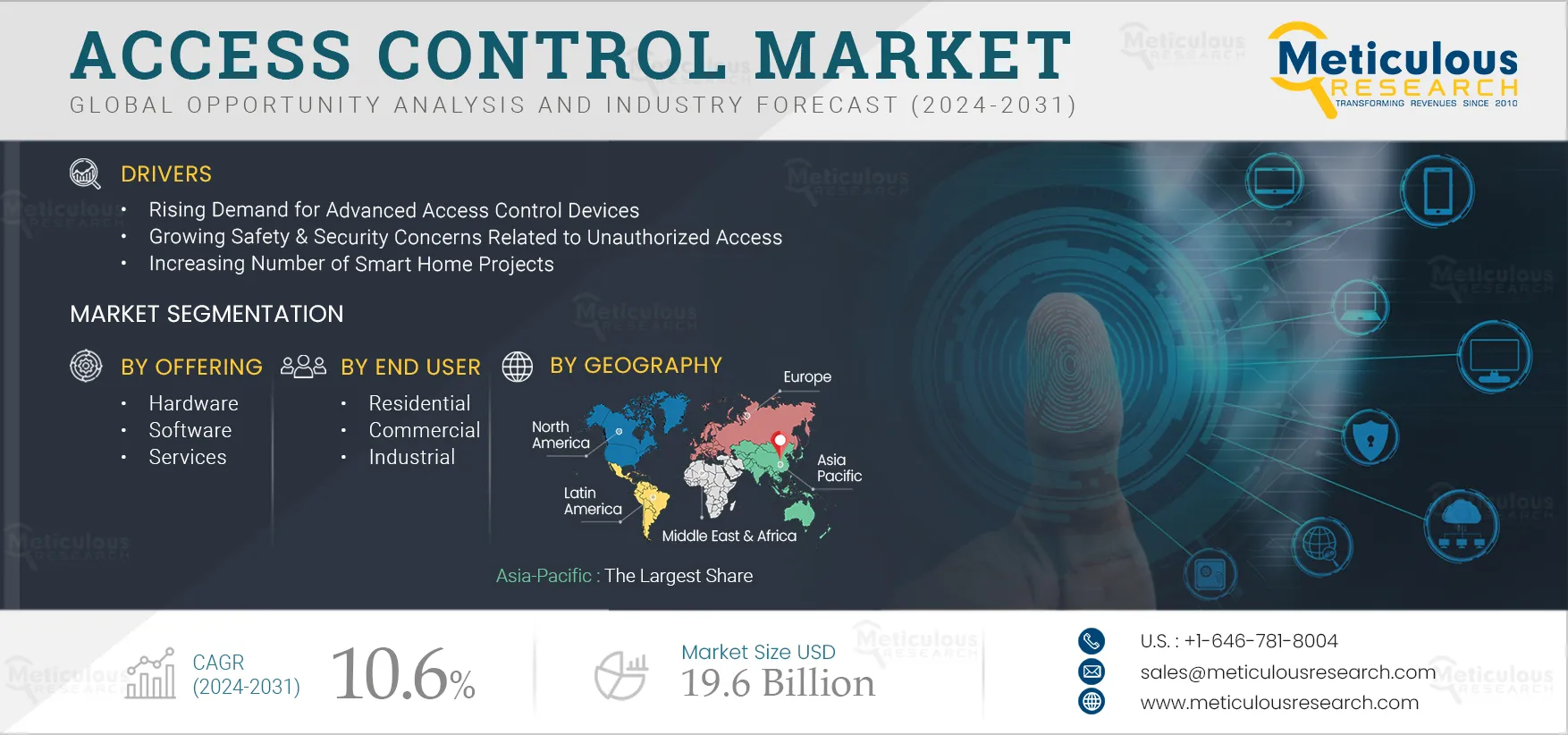

3. Executive Summary

3.1 Market Overview

3.2 Market Analysis, by Offering

3.3 Market Analysis, by End User

3.4 Market Analysis, by Geography

3.5 Competitive Analysis

4. Market Insights

4.1 Overview

4.2 Factors Affecting Market Growth

4.2.1 Drivers

4.2.1.1 Increasing Demand for Advanced Access Control Devices

4.2.1.2 Growing Safety & Security Concerns

4.2.1.3 Increasing Smart Home Projects

4.2.2 Restraints

4.2.2.1 High Initial Cost Deploying Access Control Systems

4.2.3 Opportunities

4.2.3.1 Inclination Towards Cloud-based Access Control Systems

4.2.3.2 Growing Use of Wireless Access Controls

4.2.4 Challenges

4.2.4.1 Low Awareness of Advanced Security Solutions in Developing Countries

4.2.4.2 Safety & Security Issues

4.3 Trends

4.3.1 Increasing Adoption of Access Control as a Service (ACaaS)

4.3.2 Growing Use of Smartphones for Access Controls

4.3.3 Rising Incorporation of Contactless Biometric Access Control Devices

4.4 Case Studies

4.5 Porter's Five Force Analysis

5. Access Control Market Assessment, by Offering

5.1 Overview

5.2 Hardware

5.2.1 Biometric Devices

5.2.1.1 Fingerprint Recognition

5.2.1.2 Face Recognition

5.2.1.3 Iris Recognition

5.2.1.4 Voice Recognition

5.2.2 Cards

5.2.2.1 Smart Cards

5.2.2.2 Proximity Cards

5.2.2.3 Card Readers

5.2.3 Electronic Locks and Doors

5.2.4 Controllers

5.2.5 Hybrid Devices

5.3 Software

5.3.1 Cloud-based Deployments

5.3.2 On-premise Deployments

5.4 Services

5.4.1 Consulting Services

5.4.2 Deployment & Integration Services

5.4.3 Maintainance & Support Services

6. Access Control Market Assessment, by End User

6.1 Overview

6.2 Residential

6.3 Commercial

6.3.1 Retail

6.3.2 BFSI

6.3.3 IT & Telecom

6.3.4 Hospitality

6.3.5 Education

6.3.6 Government

6.3.7 Healthcare

6.3.8 Transportation & Logistics

6.4 Industrial

6.4.1 Pharmaceutical

6.4.2 Military & Defense

6.4.3 Aerospace

6.4.4 Manufacturing

6.4.5 Mining and Construction

6.4.6 Energy and Utilities

6.4.7 Other Industrial End Users

7. Access Control Market Assessment, by Geography

7.1 Overview

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Asia-Pacific

7.3.1 China

7.3.2 Japan

7.3.3 India

7.3.4 South Korea

7.3.5 Rest of Asia-Pacific

7.4 Europe

7.4.1 Germany

7.4.2 U.K.

7.4.3 Italy

7.4.4 France

7.4.5 Spain

7.4.6 Rest of Europe

7.5 Latin America

7.6 Middle East & Africa

8. Competitive Analysis

8.1 Overview

8.2 Key Growth Strategies

8.3 Competitive Benchmarking

8.4 Competitive Dashboard

8.4.1 Industry Leaders

8.4.1.1 Market Ranking by Key Player

8.4.2 Market Differentiators

8.4.3 Vanguards

8.4.4 Emerging Companies

9. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

9.1 Johnson Controls International plc

9.2 Honeywell International Inc.

9.3 Identiv, Inc.

9.4 Suprema Inc.

9.5 Bosch Sicherheitssysteme GmbH

9.6 Genetec Inc.

9.7 NEC Corporation

9.8 Assa Abloy

9.9 dormakaba International Holding AG

9.10 Allegion plc

9.11 Nedap N.V.

9.12 Thales

9.13 IDEMIA

9.14 Axis Communications AB

9.15 Dahua Technology Co., Ltd

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

10. Appendix

10.1 Questionnaire

10.2 Available Customization

List of Tables

Table 1 Currency Conversion Rate (2018-2022)

Table 2 Global Access Control Market, by Country/Region, 2021-2030 (USD Million)

Table 3 Global Access Control Market, by Offering, 2021-2030 (USD Million)

Table 4 Global Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 5 Global Access Control Hardware Market, by Country/Region, 2021-2030 (USD Million)

Table 6 Global Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 7 Global Biometric Devices Market, by Country/Region, 2021-2030 (USD Million)

Table 8 Global Access Control Biometric Devices Market for Fingerprint Recognition, Country/Region, 2021-2030 (USD Million)

Table 9 Global Access Control Biometric Devices Market for Face Recognition, Country/Region, 2021-2030 (USD Million)

Table 10 Global Access Control Biometric Devices Market for Iris Recognition, Country/Region, 2021-2030 (USD Million)

Table 11 Global Access Control Biometric Devices Market for Voice Recognition, Country/Region, 2021-2030 (USD Million)

Table 12 Global Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 13 Global Access Control Cards Market, by Country/Region, 2021-2030 (USD Million)

Table 14 Global Access Control Smart Cards Market, by Country/Region, 2021-2030 (USD Million)

Table 15 Global Access Control Proximity Cards Market, by Country/Region, 2021-2030 (USD Million)

Table 16 Global Access Control Card Readers Market, by Country/Region, 2021-2030 (USD Million)

Table 17 Global Access Control Market for Electronic Locks and Doors, by Country/Region, 2021-2030 (USD Million)

Table 18 Global Access Control Market for Controllers, by Country/Region, 2021-2030 (USD Million)

Table 19 Global Access Control Market for Hybrid Devices, by Country/Region, 2021-2030 (USD Million)

Table 20 Global Access Control Software Market, by Country/Region, 2021-2030 (USD Million)

Table 21 Global Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 22 Global Cloud-based Access Control Software Market, by Country/Region, 2021-2030 (USD Million)

Table 23 Global On-premise Access Control Software Market, by Country/Region, 2021-2030 (USD Million)

Table 24 Global Access Control Services Market, by Country/Region, 2021-2030 (USD Million)

Table 25 Global Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 26 Global Access Control Consulting Services Market, by Country/Region, 2021-2030 (USD Million)

Table 27 Global Access Control Deployment & Integration Services Market, by Country/Region, 2021-2030 (USD Million)

Table 28 Global Access Control Maintainance & Support Services Market, by Country/Region, 2021-2030 (USD Million)

Table 29 Global Access Control Market, by End User, 2021-2030 (USD Million)

Table 30 Global Access Control Market for Residential Users, by Country/Region, 2021-2030 (USD Million)

Table 31 Global Access Control Market for Commerical Users, by Country/Region, 2021-2030 (USD Million)

Table 32 Global Access Control Market for Commerical Users, by Type, 2021-2030 (USD Million)

Table 33 Global Access Control Market for Retail, by Country/Region, 2021-2030 (USD Million)

Table 34 Global Access Control Market for BFSI, by Country/Region, 2021-2030 (USD Million)

Table 35 Global Access Control Market for IT & Telecom, by Country/Region, 2021-2030 (USD Million)

Table 36 Global Access Control Market for Hospitality, by Country/Region, 2021-2030 (USD Million)

Table 37 Global Access Control Market for Education, by Country/Region, 2021-2030 (USD Million)

Table 38 Global Access Control Market for Government, by Country/Region, 2021-2030 (USD Million)

Table 39 Global Access Control Market for Healthcare, by Country/Region, 2021-2030 (USD Million)

Table 40 Global Access Control Market for Transportation & Logistics, by Country/Region, 2021-2030 (USD Million)

Table 41 Global Access Control Market for Industrial End User, by Country/Region, 2021-2030 (USD Million)

Table 42 Global Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 43 Global Access Control Market for Pharmaceutical, by Country/Region, 2021-2030 (USD Million)

Table 44 Global Access Control Market for Military & Defense, by Country/Region, 2021-2030 (USD Million)

Table 45 Global Access Control Market for Aerospace, by Country/Region, 2021-2030 (USD Million)

Table 46 Global Access Control Market for Manufacturing, by Country/Region, 2021-2030 (USD Million)

Table 47 Global Access Control Market for Mining and Construction, by Country/Region, 2021-2030 (USD Million)

Table 48 Global Access Control Market for Energy and Utilities, by Country/Region, 2021-2030 (USD Million)

Table 49 Global Access Control Market for Other Industrial End Users, by Country/Region, 2021-2030 (USD Million)

Table 50 North America: Access Control Market, by Country, 2021-2030 (USD Million)

Table 51 North America: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 52 North America: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 53 North America: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 54 North America: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 55 North America: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 56 North America: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 57 North America: Access Control Market, by End User, 2021-2030 (USD Million)

Table 58 North America: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 59 North America: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 60 U.S.: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 61 U.S.: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 62 U.S.: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 63 U.S.: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 64 U.S.: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 65 U.S.: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 66 U.S.: Access Control Market, by End User, 2021-2030 (USD Million)

Table 67 U.S.: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 68 U.S.: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 69 Canada: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 70 Canada: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 71 Canada: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 72 Canada: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 73 Canada: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 74 Canada: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 75 Canada: Access Control Market, by End User, 2021-2030 (USD Million)

Table 76 Canada: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 77 Canada: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 78 Asia-Pacific: Access Control Market, by Country/Region, 2021-2030 (USD Million)

Table 79 Asia-Pacific: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 80 Asia-Pacific: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 81 Asia-Pacific: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 82 Asia-Pacific: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 83 Asia-Pacific: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 84 Asia-Pacific: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 85 Asia-Pacific: Access Control Market, by End User, 2021-2030 (USD Million)

Table 86 Asia-Pacific: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 87 Asia-Pacific: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 88 China: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 89 China: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 90 China: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 91 China: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 92 China: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 93 China: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 94 China: Access Control Market, by End User, 2021-2030 (USD Million)

Table 95 China: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 96 China: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 97 Japan: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 98 Japan: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 99 Japan: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 100 Japan: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 101 Japan: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 102 Japan: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 103 Japan: Access Control Market, by End User, 2021-2030 (USD Million)

Table 104 Japan: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 105 Japan: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 106 India: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 107 India: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 108 India: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 109 India: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 110 India: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 111 India: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 112 India: Access Control Market, by End User, 2021-2030 (USD Million)

Table 113 India: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 114 India: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 115 South Korea: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 116 South Korea: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 117 South Korea: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 118 South Korea: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 119 South Korea: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 120 South Korea: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 121 South Korea: Access Control Market, by End User, 2021-2030 (USD Million)

Table 122 South Korea: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 123 South Korea: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 124 Rest of Asia-Pacific: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 125 Rest of Asia-Pacific: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 126 Rest of Asia-Pacific: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 127 Rest of Asia-Pacific: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 128 Rest of Asia-Pacific: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 129 Rest of Asia-Pacific: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 130 Rest of Asia-Pacific: Access Control Market, by End User, 2021-2030 (USD Million)

Table 131 Rest of Asia-Pacific: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 132 Rest of Asia-Pacific: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 133 Europe: Access Control Market, by Country/Region, 2021-2030 (USD Million)

Table 134 Europe: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 135 Europe: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 136 Europe: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 137 Europe: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 138 Europe: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 139 Europe: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 140 Europe: Access Control Market, by End User, 2021-2030 (USD Million)

Table 141 Europe: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 142 Europe: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 143 Germany: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 144 Germany: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 145 Germany: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 146 Germany: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 147 Germany: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 148 Germany: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 149 Germany: Access Control Market, by End User, 2021-2030 (USD Million)

Table 150 Germany: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 151 Germany: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 152 U.K.: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 153 U.K.: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 154 U.K.: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 155 U.K.: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 156 U.K.: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 157 U.K.: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 158 U.K.: Access Control Market, by End User, 2021-2030 (USD Million)

Table 159 U.K.: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 160 U.K.: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 161 Italy: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 162 Italy: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 163 Italy: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 164 Italy: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 165 Italy: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 166 Italy: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 167 Italy: Access Control Market, by End User, 2021-2030 (USD Million)

Table 168 Italy: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 169 Italy: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 170 France: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 171 France: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 172 France: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 173 France: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 174 France: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 175 France: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 176 France: Access Control Market, by End User, 2021-2030 (USD Million)

Table 177 France: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 178 France: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 179 Spain: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 180 Spain: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 181 Spain: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 182 Spain: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 183 Spain: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 184 Spain: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 185 Spain: Access Control Market, by End User, 2021-2030 (USD Million)

Table 186 Spain: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 187 Spain: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 188 Rest of Europe: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 189 Rest of Europe: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 190 Rest of Europe: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 191 Rest of Europe: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 192 Rest of Europe: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 193 Rest of Europe: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 194 Rest of Europe: Access Control Market, by End User, 2021-2030 (USD Million)

Table 195 Rest of Europe: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 196 Rest of Europe: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 197 Latin America: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 198 Latin America: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 199 Latin America: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 200 Latin America: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 201 Latin America: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 202 Latin America: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 203 Latin America: Access Control Market, by End User, 2021-2030 (USD Million)

Table 204 Latin America: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 205 Latin America: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 206 Middle East & Africa: Access Control Market, by Offering, 2021-2030 (USD Million)

Table 207 Middle East & Africa: Access Control Hardware Market, by Type, 2021-2030 (USD Million)

Table 208 Middle East & Africa: Access Control Biometric Devices Market, by Type, 2021-2030 (USD Million)

Table 209 Middle East & Africa: Access Control Cards Market, by Type, 2021-2030 (USD Million)

Table 210 Middle East & Africa: Access Control Software Market, by Type, 2021-2030 (USD Million)

Table 211 Middle East & Africa: Access Control Services Market, by Type, 2021-2030 (USD Million)

Table 212 Middle East & Africa: Access Control Market, by End User, 2021-2030 (USD Million)

Table 213 Middle East & Africa: Access Control Market for Commercial End User, by Type, 2021-2030 (USD Million)

Table 214 Middle East & Africa: Access Control Market for Industrial End User, by Type, 2021-2030 (USD Million)

Table 215 Recent Key Developments, by Company, 2020–2023

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown Of Primary Interviews (Supply Side & Demand Side)

Figure 8 Market Sizing And Growth Forecast Approach

Figure 9 Key Insights

Figure 10 Global Access Control Market, by Offering, 2023 VS. 2030 (USD Million)

Figure 11 Global Access Control Market, by End User, 2023 VS. 2030 (USD Million)

Figure 12 Geographic Snapshot: Global Access Control Market

Figure 13 Factors Affecting the Market Growth

Figure 14 Porter’s Five Force Analysis: Access Control Market

Figure 15 Global Access Control Market, by Offering, 2023 VS. 2030 (USD Million)

Figure 16 Global Access Control Market, by End User, 2023 VS. 2030 (USD Million)

Figure 17 Global Access Control Market, by Geography, 2023-2030 (USD Million)

Figure 18 North America: Access Control Market Market Snapshot

Figure 19 Asia-Pacific: Access Control Market Snapshot

Figure 20 Europe: Access Control Market Snapshot

Figure 21 Key Growth Strategies Adopted by Key Players (2020-2023)

Figure 22 Competitive Dashboard

Figure 23 Vendor Market Positioning Analysis (2020–2023)

Figure 24 Johnson Controls International plc: Financial Overview

Figure 25 Honeywell International Inc.: Financial Overview

Figure 26 Identiv, Inc.: Financial Overview

Figure 27 Robert Bosch GmbH: Financial Overview

Figure 28 NEC Corporation: Financial Overview

Figure 29 Assa Abloy: Financial Overview

Figure 30 dormakaba International Holding AG: Financial Overview

Figure 31 Allegion plc: Financial Overview

Figure 32 Nedap N.V.: Financial Overview

Figure 33 Thales: Financial Overview

Figure 34 IDEMIA: Financial Overview

Figure 35 Axis Communications AB: Financial Overview

Figure 36 Dahua Technology Co., Ltd: Financial Overview